UV Curable Coatings Market by Composition (Monomers, Oligomers), Type (Wood Coatings, Plastic Coatings, Over Print Varnish, Display Coatings), End Use Industry (Industrial Coatings, Electronics, Graphic Arts), Region - Global Forecast to 2025

UV Curable Coatings Market

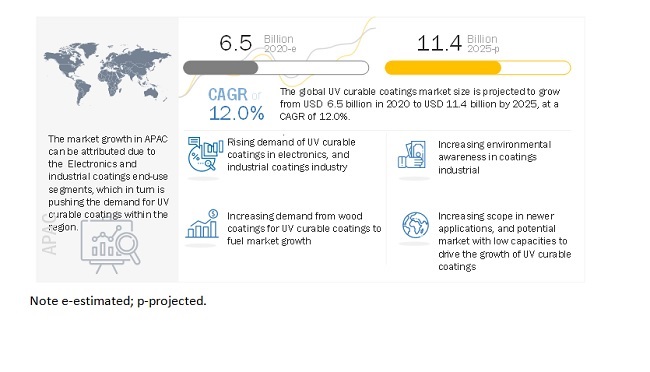

The global UV curable coatings market was valued at USD 6.5 billion in 2020 and is projected to reach USD 11.4 billion by 2025, growing at 12.0% cagr during the forecast period. Increasing environment regulations and norms, especially in Europe and North America, have resulted in the growing popularity of green coatings in the coating industry. However, owing to COVID-19, the sales from electronics, and industrial coatings induatries has declined, resulting in reduced demand for UV curable coatings.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global UV curable coatings market

UV curable coatings are used across the industrial, electronics, and graphics art sectors, where the impact of COVID-19 has been high. Lockdowns imposed in various countries have impacted various sectors, which has played a major role in the decline of the UV coatings market. Delayed upcoming projects have also affected the growth of the UV coatings market in 2020. Most advertising has switched to a digital mode; thus, UV coatings would take some time to regain their market. However, it is expected that the market will start recovering from 2021 due to the increasing demand from end-use industries. The lockdown delayed upcoming projects, which also affected the growth of the UV curable coatings market in 2020.

To know about the assumptions considered for the study, download the pdf brochure

Increasing environmental awareness in coatings industry

The Green coatings are the new riding wave in the coating industry. The coatings that are environment friendly and help reduce pollution during any of its stages are known as green coatings. These coatings are usually expensive in comparison to the other paints and coatings available in the market; however, at the same time, they are advantageous and show higher/comparable performance properties than the conventional toxic paints. Increasing environment regulations and norms, especially in Europe and North America, have resulted in the growing popularity of green coatings in the coating industry.. This has resulted in an increasing demand for UV curable coatings.

High cost of UV curable coatings and lack of awareness about these coatings

In a competitive market, it is difficult to reach out with a new product with its market price higher than the existing ones. A similar market scenario persists for UV curable coatings market, as UV curable coatings are very expensive as compared to others that are already available in the market. Due to the stringent emission rules and regulations, UV curable coatings have gained wide acceptance in regions, such as Europe and North America, but it is still struggling in various countries in the APAC and MEA regions, which is majorly due to non-compliance of emission standards and lack of awareness. This has led to the holding back of investments by major market players due to poor anticipated demand, and the local manufacturers are restricted by high CAPEX involved in changing the equipment. These factors may impact the UV curable coatings market, eventually.

Increasing demand for UV curable coatings in newer applications

UV curable coatings are also being utilized out of the factories and in the field applications that are a direct result of numerous improvements in UV curing equipment and technological transformations in the industry. In the field curing, the major applications are concrete floor coating, wood floor coating, vinyl floor coating, countertops coating, tubs, and coating. All of these applications are in the phase of development, with effective commercialization expected in the coming years. Additionally, UV technology is also expected to be recognized as one of the leading technologies for metal coatings application in the future, from its current limited footprint in this segment. The metal coatings market includes several industries, including automotive, protective, coil, and can. Hence, a significant demand for UV curable coatings is expected, as a direct result of increased applications and also because of awareness in developing economies.

Cracking defects on UV curable coatings products

UV coatings render a glossy finish, provide high clarity, and are abrasion-resistant, environment-friendly, quick-dry, versatile, and inexpensive. These properties have increased their demand in the market. The major challenge with UV coated paper, however, is the cracking that usually occurs when the paper is folded or scored. Due to the glossy and silky nature of the printed paper, it becomes difficult to apply other treatments. For instance, ink application in the form of writing or rubber stamping can be difficult. Such surfaces do not allow adhesives or any other forms of imprinting. If a particular section of the paper needs to be written on, it must be ensured that it is not UV coated. Else, the section could form cracks when folded or scored.

Monomers to account for the largest market share, in terms of volume

Monomers accounts for the largest share of the overall market. The monomers are non-flammable materials with low volatility and also have low odor. Monomers generally can have one to as many as six UV curable groups, and the number of functional groups will determine the properties the monomer will bring to the UV formulation. These monomers are low viscous materials, most commonly esters of acrylic acid, and simple multifunctional or monofunctional polyols. Monomers are usually selected based on acrylic functional groups attached to it. However, due to pandemic COVID-19, the sales of UV curable coatings decreased due to disturbance in supply chain. This demand would surge with recovery in the electronics, industrial coatings, and graphic arts industries.

Wood coatings accounted for the largest share in terms of value and volume

The wood coatings based UV curable coatings accounted for 43%, in terms of volume, of the overall market in 2019. Wood coatings type is the largest segment in the UV curable coatings market since coated wood enhances the aesthetic appeal and also provides surface protection. Wood coatings find extensive use in residential and non-residential applications. However, because of COVID-19, the demand for UV curable coatings is reduced from wood coatings. The wood coatings segment is at the forefront with the highest consumption of UV curable coatings globally owing to the rapidly increasing applications of these coatings in the wood & furniture industry. China is the largest consumer of wood coatings. Subsequently, certain European countries such as Germany and Sweden consumed a considerable share of UV wood coatings in 2019. There is a huge decline in demand in the APAC region due to a complete and partial lockdown in the region.

APAC held the largest market share in the UV curable coatings market

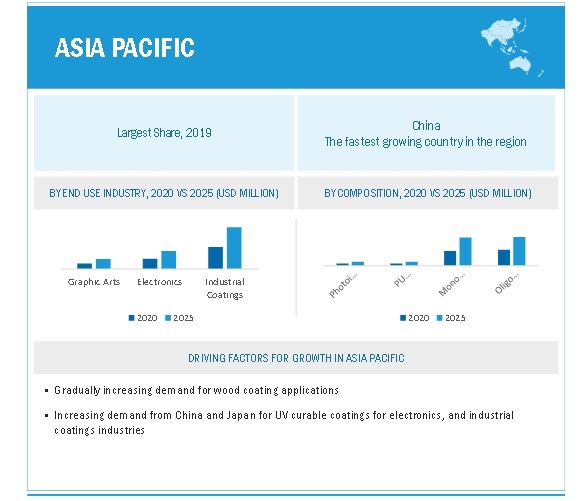

The APAC is the biggest and the fastest growing market for UV curable coatings, consuming almost half of the total global volume in 2019. Electronics and industrial coatings end-use segments are driving the demand for high performance coatings, which in turn is pushing the demand for UV curable coatings within the region. APAC is the most promising market for coatings and is anticipated to be the same in the near future. The significance of APAC in the chemical industry cannot be undervalued. Its large developing middle-class population derives the demand for the industry and has led to continued industrialization and a rise in the manufacturing sector of the region.

UV Coatings Market Players

The key players in the global UV curable coatings market are:

- Royal DSM N.V. (Netherlands)

- PPG Industries Inc. (US)

- Akzo Nobel N.V. (Netherlands)

- BASF SE (Germany)

- The Sherwin-Williams Company (US)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the composites industry. The study includes an in-depth competitive analysis of these key players in the UV curable coatings market, with their company profiles, recent developments, and key market strategies.

UV Curable Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 6.5 Billion |

|

Revenue Forecast in 2025 |

USD 11.4 Billion |

|

CAGR |

12.0% |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Composition, Type, End use industry and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Royal DSM N.V. (Netherlands), PPG Industries Inc. (US), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), and The Sherwin-Williams Company (US) are some of the key players in the UV coatings market. Axalta Coatings System (US), Dymax Corporation (US), Eternal Chemical Co. Ltd. (Taiwan), DIC Corporation (Japan), and Croda International Plc (UK) |

This research report categorizes the UV curable coatings market based on composition, type, end use industry, and region.

By Composition:

- Oligomers

- Monomers

- Photoinitiators

- PU Dispersions

- Others

By Type:

- Wood Coatings

- Plastic Coatings

- Over Print Varnish

- Display Coatings

- Conformal Coatings

- Paper Coatings

By End use industry:

- Industrial Coatings

- Electronics

- Graphic Arts

By Region:

- North America

- Europe

- APAC

- Rest of the World (ROW)

Recent Developments

- In September 2020, AkzoNobel acquired Stahl Performance Powder Coatings and its range of products for heat-sensitive substrates. The acquisition accelerated AkzoNobel’s low curing technology that the company expects would open up new market opportunities.

- In February 2020, Hexagon Purus received the first contract from a major US hydrogen fuel supplier to provide hydrogen transport modules in the US. The purchased transport modules are composed of Hexagon’s proprietary, lightweight, Type 4, 500 bar pressure vessels.

- In September 2020, Dymax Corporation opened a new adhesive production facility in Wiesbaden, Germany, in addition to its production sites in the US and Asia. The investment in production facilities and additional quality control systems enables the company to respond with even greater speed and precision to serve the needs of its customers in medical technology, automotive, electronics, and aerospace industries.

- In April 2020, DSM-AGI started production of UV-curable resins at its brand-new, highly automated manufacturing facility in Taiwan. Furthermore, DSM-AGI strengthened its sales, logistics, technical service, and regulatory support to customers in Europe and the US through the integration with DSM Coatings Resins.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the UV curable coatings market?

The increasing environmental awareness in industrial coatings, growing electronics market, and increasing demand for wood coatings

Which is the largest country-level market for UV curbale coatings?

China is the largest UV curable coatings market due to Electronics and industrial coatings end-use segments are driving the demand for high performance coatings, which in turn is pushing the demand for UV curable coatings within the region

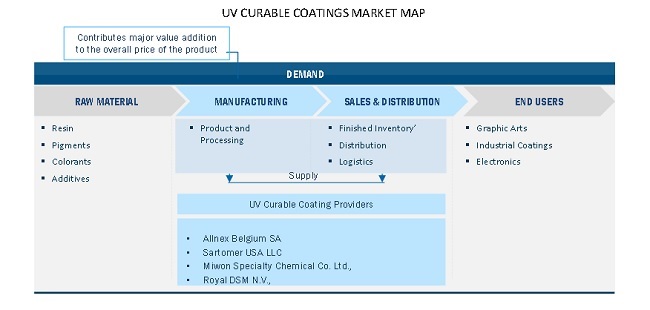

What are the factors contributing to the final price of UV curable coatings?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of UV curbale coatings.

What are the challenges in the UV curable coatings market?

Cracking defects on UV curable coatings products is the major challenge in the UV curable coatings market.

Which type of UV curbale coatings holds the largest market share?

Wood coatings hold the largest share since coated wood enhances the aesthetic appeal and also provides surface protection.

How is the UV curable coatings market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business especially in the UV curable coatings market.

Who are the major manufacturers?

Royal DSM N.V. (Netherlands), PPG Industries Inc. (US), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), The Sherwin-Williams Company (US), Axalta Coatings System (US), Dymax Corporation (US), Eternal Chemical Co. Ltd. (Taiwan), DIC Corporation (Japan), and Croda International Plc (UK).

What are the composition types for UV curbale coatings?

Monomers, oligomers, PU dispersions, photoinitiators, and others are the composition material types for UV curbale coatings .

What are the major end use industries for UV curbale coatings?

The major end use industries are electronics, industrial coatings, and graphic arts.

What is the biggest restraint in the UV curable coatings market?

High cost of UV curbale coatings and lack of awareness about these coatings are affecting the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SCOPE

FIGURE 1 UV CURABLE COATINGS MARKET SEGMENTATION

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 UNIT CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 UV CURABLE COATINGS MARKET: RESEARCH METHODOLOGY

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.3 MARKET SIZE ESTIMATION

2.3.1 APPROACH 1

FIGURE 3 MARKET NUMBER ESTIMATION

2.3.2 APPROACH 2

FIGURE 4 MARKET NUMBER ESTIMATION

2.4 DATA TRIANGULATION

FIGURE 5 UV CURABLE COATINGS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.5.1 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 6 OLIGOMERS SEGMENT DOMINATES UV CURABLE COATINGS MARKET

FIGURE 7 WOOD COATINGS ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 8 INDUSTRIAL COATINGS TO LEAD OVERALL MARKET BETWEEN 2020 AND 2025

FIGURE 9 APAC DOMINATES UV CURABLE COATINGS MARKET

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE OPPORTUNITIES IN UV CURABLE COATINGS MARKET

FIGURE 10 HIGH DEMAND FROM INDUSTRIAL COATINGS SEGMENT TO DRIVE MARKET

4.2 UV CURABLE COATINGS MARKET, BY END-USE INDUSTRY AND REGION

FIGURE 11 APAC AND INDUSTRIAL COATINGS TO BE LARGEST UV CURABLE COATINGS MARKETS

4.3 UV CURABLE COATINGS MARKET, BY COMPOSITION

FIGURE 12 MONOMERS DOMINATE OVERALL UV CURABLE COATINGS MARKET

4.4 UV CURABLE COATINGS MARKET, BY TYPE

FIGURE 13 WOOD COATINGS TO BE LARGEST CONSUMER OF UV CURABLE COATINGS

4.5 UV CURABLE COATINGS MARKET, KEY COUNTRIES

FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN UV CURABLE COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing environmental awareness in coatings industry

FIGURE 16 US GREENHOUSE GAS EMISSIONS, BY SECTOR

5.2.1.2 Growing electronics market to increase UV coatings demand

5.2.1.3 Increasing demand for industrial wood coatings

5.2.2 RESTRAINTS

5.2.2.1 High cost of UV coatings and lack of awareness about these coatings

5.2.2.2 Decrease in demand for UV curable coatings due to COVID-19 pandemic

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing scope in newer applications

5.2.3.2 Potential markets with low capacities

5.2.4 CHALLENGES

5.2.4.1 Cracking defects on UV curable coating products

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 UV CURABLE COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

5.5 MARKET PATENT ANALYSIS

5.5.1 METHODOLOGY

5.5.2 DOCUMENT TYPE

FIGURE 18 PATENT PUBLICATION TRENDS: 2014-2020

FIGURE 19 PATENT JURISDICTION ANALYSIS FOR UV COATINGS, 2019

5.5.3 TOP APPLICANTS OF PATENTS

FIGURE 20 TOP APPLICANTS OF UV COATING PATENTS

5.6 TECHNOLOGY ANALYSIS

5.7 COVID-19 IMPACT ANALYSIS

5.8 PRICING ANALYSIS

5.9 REGULATORY FRAMEWORK

5.10 RAW MATERIAL ANALYSIS

5.10.1 UV CURABLE RESINS

5.10.1.1 Monomers

5.10.1.2 Oligomers

TABLE 1 OLIGOMERS: TYPES & PERFORMANCE EFFECTS

5.10.1.3 Photoinitiators

5.10.1.4 PU (Polyurethane) Dispersions

6 UV CURABLE COATINGS MARKET, BY COMPOSITION (Page No. - 48)

6.1 INTRODUCTION

FIGURE 21 OLIGOMER UV CURABLE COATINGS TO DOMINATE MARKET (USD MILLION)

TABLE 2 UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018–2025 (USD MILLION)

TABLE 3 UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018–2025 (KILOTON)

6.2 MONOMERS

TABLE 4 MONOMERS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 MONOMERS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.3 OLIGOMERS

FIGURE 22 APAC DOMINATED OLIGOMER-BASED UV CURABLE COATINGS MARKET

TABLE 6 OLIGOMERS IN UV CURABLE COATINGS MARKET SIZE, BY REGION,2018–2025 (USD MILLION)

TABLE 7 OLIGOMERS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.4 PHOTOINITIATORS

TABLE 8 PHOTOINITIATORS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 PHOTOINITIATORS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.5 PU DISPERSIONS

TABLE 10 PU DISPERSIONS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 PU DISPERSIONS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

6.6 OTHERS

TABLE 12 OTHER COMPOSITIONS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 OTHER COMPOSITIONS IN UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7 UV CURABLE COATINGS MARKET, BY TYPE (Page No. - 56)

7.1 INTRODUCTION

FIGURE 23 WOOD COATINGS TO BE LARGEST TYPE OF UV CURABLE COATINGS

TABLE 14 UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 15 UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

7.2 WOOD COATINGS

FIGURE 24 APAC DOMINATED IN WOOD UV CURABLE COATINGS MARKET

TABLE 16 WOOD UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 WOOD UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.3 PLASTIC COATINGS

TABLE 18 PLASTIC UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 PLASTIC UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.4 OVER PRINT VARNISH

TABLE 20 OVER PRINT VARNISH UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 OVER PRINT VARNISH UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.5 DISPLAY COATINGS

TABLE 22 DISPLAY UV CURABLE COATINGS MARKET SIZE, BY REGION,2018–2025 (USD MILLION)

TABLE 23 DISPLAY UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.6 CONFORMAL COATINGS

TABLE 24 CONFORMAL UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 CONFORMAL UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

7.7 PAPER COATINGS

TABLE 26 PAPER UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 PAPER UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

8 UV CURABLE COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 64)

8.1 INTRODUCTION

FIGURE 25 INDUSTRIAL COATINGS TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD (USD MILLION)

TABLE 28 UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 29 UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

8.2 INDUSTRIAL COATINGS

FIGURE 26 APAC DOMINATES IN INDUSTRIAL COATINGS END-USE INDUSTRY (USD MILLION)

TABLE 30 UV CURABLE COATINGS MARKET SIZE IN INDUSTRIAL COATINGS, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 UV CURABLE COATINGS MARKET SIZE IN INDUSTRIAL COATINGS, BY REGION, 2018–2025 (KILOTON)

8.3 ELECTRONICS

TABLE 32 UV CURABLE COATINGS MARKET SIZE IN ELECTRONICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 UV CURABLE COATINGS MARKET SIZE IN ELECTRONICS, BY REGION, 2018–2025 (KILOTON)

8.4 GRAPHIC ARTS

TABLE 34 UV CURABLE COATINGS MARKET SIZE IN GRAPHIC ARTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 UV CURABLE COATINGS MARKET SIZE IN GRAPHIC ARTS, BY REGION, 2018–2025 (KILOTON)

9 UV CURABLE COATINGS MARKET, BY REGION (Page No. - 70)

9.1 INTRODUCTION

FIGURE 27 CHINA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

9.1.1 UV CURABLE COATINGS MARKET SIZE, BY REGION

TABLE 36 UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 37 UV CURABLE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: UV CURABLE COATINGS MARKET SNAPSHOT

9.2.1 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION

TABLE 38 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018-2025 (USD MILLION)

TABLE 39 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018-2025 (KILOTON)

9.2.2 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY

TABLE 40 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 41 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.3 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY TYPE

TABLE 42 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 43 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

9.2.4 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY

TABLE 44 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 45 NORTH AMERICA: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

9.2.4.1 US

9.2.4.1.1 US: UV curable coatings market size, by end-use industry

TABLE 46 US: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 47 US: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.4.2 Canada

9.2.4.2.1 Canada: UV curable coatings market size, by end-use industry

TABLE 48 CANADA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 49 CANADA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3 EUROPE

FIGURE 29 EUROPE: UV CURABLE COATINGS MARKET SNAPSHOT

9.3.1 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION

TABLE 50 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018-2025 (USD MILLION)

TABLE 51 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018-2025 (KILOTON)

9.3.2 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY

TABLE 52 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.3 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY TYPE

TABLE 54 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 55 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY TYPE,2018-2025 (KILOTON)

9.3.4 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY

TABLE 56 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY,2018-2025 (USD MILLION)

TABLE 57 EUROPE: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

9.3.4.1 Belgium

9.3.4.1.1 Belgium: UV curable coatings market size, by end-use industry

TABLE 58 BELGIUM: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 59 BELGIUM: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.4.2 Germany

9.3.4.2.1 Germany: UV curable coatings market size, by end-use industry

TABLE 60 GERMANY: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 61 GERMANY: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.4.3 UK

9.3.4.3.1 UK: UV curable coatings market size, by end-use industry

TABLE 62 UK: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 63 UK: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.4.4 Italy

9.3.4.4.1 Italy: UV curable coatings market size, by end-use industry

TABLE 64 ITALY: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 65 ITALY: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.4.5 Sweden

9.3.4.5.1 Sweden: UV curable coatings market size, by end-use industry

TABLE 66 SWEDEN: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 67 SWEDEN: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.4.6 Rest of Europe

9.3.4.6.1 Rest of Europe: UV curable coatings market size, by end-use industry

TABLE 68 REST OF EUROPE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 69 REST OF EUROPE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.4 APAC

FIGURE 30 APAC: UV CURABLE COATINGS MARKET SNAPSHOT

9.4.1 APAC: UV CURABLE COATINGS MARKET, BY COMPOSITION

TABLE 70 APAC: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018–2025 (USD MILLION)

TABLE 71 APAC: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018–2025 (KILOTON)

9.4.2 APAC: UV CURABLE COATINGS MARKET, BY END-USE INDUSTRY

TABLE 72 APAC: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 73 APAC: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.3 APAC: UV CURABLE COATINGS MARKET, BY TYPE

TABLE 74 APAC: UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 APAC: UV CURABLE COATINGS MARKET SIZE, BY TYPE,2018–2025 (KILOTON)

9.4.4 APAC: UV CURABLE COATINGS MARKET, BY COUNTRY

TABLE 76 APAC: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY,2018–2025 (USD MILLION)

TABLE 77 APAC: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

9.4.4.1 China

9.4.4.1.1 China: UV curable coatings market, by end-use industry

TABLE 78 CHINA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY 2018–2025 (USD MILLION)

TABLE 79 CHINA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.4.2 Japan

9.4.4.2.1 Japan: UV curable coatings market, by end-use industry

TABLE 80 JAPAN: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY 2018–2025 (USD MILLION)

TABLE 81 JAPAN: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.4.3 India

9.4.4.3.1 India: UV curable coatings market, by end-use industry

TABLE 82 INDIA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY 2018–2025 (USD MILLION)

TABLE 83 INDIA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.4.4 South Korea

9.4.4.4.1 South Korea: UV curable coatings market, by end-use industry

TABLE 84 SOUTH KOREA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY 2018–2025 (USD MILLION)

TABLE 85 SOUTH KOREA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.4.4.5 Rest of APAC

9.4.4.5.1 Rest of APAC: UV curable coatings market, by end-use industry

TABLE 86 REST OF APAC: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY 2018–2025 (USD MILLION)

TABLE 87 REST OF APAC: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5 ROW

9.5.1 ROW: UV CURABLE COATINGS MARKET, BY COMPOSITION

TABLE 88 ROW: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018–2025 (USD MILLION)

TABLE 89 ROW: UV CURABLE COATINGS MARKET SIZE, BY COMPOSITION, 2018–2025 (KILOTON)

9.5.2 ROW: UV CURABLE COATINGS MARKET, BY END-USE INDUSTRY

TABLE 90 ROW: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 91 ROW: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.3 ROW: UV CURABLE COATINGS MARKET, BY TYPE

TABLE 92 ROW: UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 ROW: UV CURABLE COATINGS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

9.5.4 ROW: UV CURABLE COATINGS MARKET, BY COUNTRY

TABLE 94 ROW: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 ROW: UV CURABLE COATINGS MARKET SIZE, BY COUNTRY,2018–2025 (KILOTON)

9.5.4.1 UAE

9.5.4.1.1 UAE: UV curable coatings market, by end-use industry

TABLE 96 UAE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 97 UAE: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.4.2 Saudi Arabia

9.5.4.2.1 Saudi Arabia: UV curable coatings market, by end-use industry

TABLE 98 SAUDI ARABIA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 99 SAUDI ARABIA: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

9.5.4.3 Others in RoW

9.5.4.3.1 Others in RoW: UV curable coatings market, by end-use industry

TABLE 100 OTHERS IN ROW: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 101 OTHERS IN ROW: UV CURABLE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 100)

10.1 INTRODUCTION

FIGURE 31 NEW PRODUCT LAUNCH/DEVELOPMENT AND EXPANSION ARE THE KEY GROWTH STRATEGIES ADOPTED BETWEEN 2015 AND 2020

10.2 MARKET SHARE ANALYSIS

FIGURE 32 PPG INDUSTRIES INC. LED THE UV COATINGS MARKET IN 2019

10.3 MARKET EVALUATION FRAMEWORK

10.3.1 NEW PRODUCT LAUNCH/NEW PRODUCT DEVELOPMENT

TABLE 102 NEW PRODUCT LAUNCHES/NEW PRODUCT DEVELOPMENTS, 2015–2020

10.3.2 ACQUISITION

TABLE 103 ACQUISITIONS, 2015-2020

10.3.3 EXPANSION

TABLE 104 EXPANSIONS, 2015-2020

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 105 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019

10.5 COMPANY EVALUATION MATRIX

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 PARTICIPANTS

10.5.4 EMERGING LEADERS

FIGURE 33 UV COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 34 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 35 BUSINESS STRATEGY EXCELLENCE

11 COMPANY PROFILE (Page No. - 110)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition, and MNM View)*

11.1 ROYAL DSM N.V.

FIGURE 36 ROYAL DSM N.V. BUSINESS OVERVIEW

FIGURE 37 ROYAL DSM N.V.: SWOT ANALYSIS

11.2 PPG INDUSTRIES INC.

FIGURE 38 PPG INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 39 PPG INDUSTRIES INC.: SWOT ANALYSIS

11.3 AKZONOBEL N.V.

FIGURE 40 AKZONOBEL N.V.: BUSINESS OVERVIEW

FIGURE 41 AKZONOBEL N.V.: SWOT ANALYSIS

11.4 BASF SE

FIGURE 42 BASF SE: BUSINESS OVERVIEW

FIGURE 43 BASF SE: SWOT ANALYSIS

11.5 THE SHERWIN-WILLIAMS COMPANY

FIGURE 44 THE SHERWIN-WILLIAMS COMPANY: BUSINESS OVERVIEW

FIGURE 45 THE SHERWIN-WILLIAMS COMPANY: SWOT ANALYSIS

11.6 PHICHEM MATERIAL CO., LTD.

11.7 HUIZHOU CHANGRUNFA PAINT CO., LTD

11.8 AXALTA COATINGS SYSTEMS

FIGURE 46 AXALTA COATINGS SYSTEMS: BUSINESS OVERVIEW

11.9 DYMAX CORPORATION

11.10 ETERNAL MATERIALS CO. LTD.

FIGURE 47 ETERNAL MATERIALS CO. LTD.: BUSINESS OVERVIEW

11.11 DIC CORPORATION

FIGURE 48 DIC CORPORATION: BUSINESS OVERVIEW

11.12 CRODA INTERNATIONAL PLC

FIGURE 49 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

11.13 OTHER COMPANIES

11.13.1 ALLNEX NETHERLANDS B.V.

11.13.2 JAINCO INDUSTRY CHEMICALS

11.13.3 THE DOW CHEMICAL COMPANY

11.13.4 ACTEGA COATINGS & SEALANTS

11.13.5 ASHLAND INC.

11.13.6 BRILLIANT COATINGS SOLUTIONS

11.13.7 SOLTECH LTD.

11.13.8 DEUTSCHE DRUCKFARBEN

11.13.9 TEKNOS GROUP

11.13.10 AVM COATINGS AND CHEMICALS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition, and MNM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 139)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved two major activities in estimating the current size of the UV curable coatings market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The UV curable coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is primarily characterized by the development of the electonics, industrial coatings, and grpahic arts end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Notes: Tiers of companies are selected based on their ownership and revenues in 2019.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the UV curable coatings market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall UV curable coatings market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the fuel tank, and transportation tank applications.

Report Objectives

- To define, describe, and forecast the size of the UV curable coatings market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on by composition, type, and end use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC UV curable coatings market

- Further breakdown of Rest of Europe UV curable coatings market

- Further breakdown of Rest of RoW UV curable coatings market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in UV Curable Coatings Market