Top 10 Power Generation Technologies Market by Generation (Steam Turbine, Micro Turbine, Gas Turbine, Gas Engine, Micro CHP, Nuclear Power Reactor, Small Wind, Diesel Generator and Gas Generator, and Concentrating Solar Power) - Global Forecast to 2021

[193 Pages Report] The top 10 power generation technologies market is expected to grow from an estimated USD 64.15 Billion in 2016 to USD 85.40 Billion by 2021. Factors such as increase in electricity consumption and subsequent investment in power generation capacity and modernization of existing power generation systems are driving the market worldwide.

Objectives of the study

- To define and segment the top 10 power generation technologies market with respect to region

- To estimate the market size, in terms of value, of the top 10 power generation technologies market

- To identify factors driving or inhibiting the growth of the market, and their present and future impact on the market

- To identify the drivers, restraints, opportunities, and challenges of the top 10 power generation technologies market

- To analyze the major stakeholders in the top 10 power generation technologies market and provide details regarding the competitive landscape for key market leaders

- To study the industry trends and forecast the top 10 power generation technologies market for major regions, namely, Europe and Asia-Pacific, among others

- To strategically identify and profile global as well as local players in the power generation technologies market and comprehensively analyze their market ranking

- To analyze competitive developments such as new product launches, mergers & acquisitions, expansions, and supply contracts in the power generation technologies market

The years considered for the study are as follows:

- Historical Year: 2014

- Base Year: 2015

- Estimated Year: 2016

- Projected Year: 2021

- Forecast Period: From 2016 to 2021

For company profiles in the report, 2015 has been used as the base year. Wherever recent (2015) data was unavailable, the previous years (2014) data has been included.

Research Methodology

This research study involved the extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg, Businessweek, and Factiva) to identify and collect information useful for this technical, market-oriented, and commercial study of the top 10 power generation technologies market. The points mentioned below explain the research methodology applied in this report.

* Core competencies of the companies are captured in terms of their key developments, SWOT analysis, and the key strategies adopted by them to sustain their position in the market.

- Analysis of country-wise electricity generation and consumption for the past 10 years

- Analysis of region-wise capital expenditure in the transmission and distribution network for past five years

- Country-wise analysis of investments in power grids

- Analysis of market trends of the top 10 power generation technologies market across regions

- The overall market sizes have been finalized by triangulating the supply-side data, including product developments, supply chain, and global annual sales of the top 10 power generation technologies market

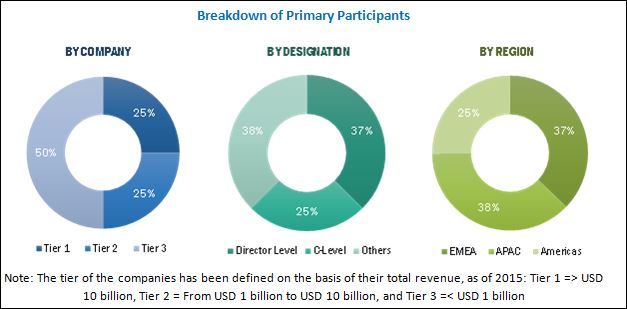

After arriving at the overall top 10 power generation technologies market size, the total market has been split into several segments and subsegments. The figure given below shows the breakdown of the primaries on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

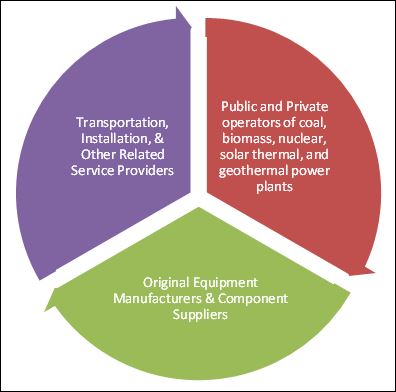

Market Ecosystem

The top 10 power generation technologies market starts with the manufacturing of equipment such as engines and turbines, among others. General Electric Company (U.S.), and Siemens AG (Germany), among others, are the leading equipment and service providers. The final stage covers application in end-use industries such as public and private operators of coal, biomass, nuclear, solar thermal, and geothermal power plants, among others.

Stakeholders

The stakeholders included in this report are as follows:

- Generator manufacturers

- Generator component suppliers

- Government and research organizations

- Institutional investors/shareholders

- Consulting companies of the energy and power and industrial sectors

- Generator set assemblers

- Utilities, oil & gas, manufacturing, and other processing industries

- Gas engine manufacturing companies

- Manufacturers associations

- Public and private operators of natural gas power plants

- State and national regulatory authorities

- Suppliers of parts and components to the gas engines industry

- Gas turbine manufacturers

- Distribution consultancies

- Power grid infrastructure companies

- Power plant project developers

- Micro CHP equipment manufacturers

- Micro CHP unit manufacturers

- Micro CHP unit distributors and suppliers

- Smart grid players

- Utilities such as hotels, hospitals, care homes, office buildings, and retail stores, among others

- Micro turbine manufacturers

- Supplier of parts and components to the micro turbine industry

- Supplier of parts and components to the nuclear power plant industry

- Wind turbine service companies

- Small wind turbine manufacturers

- Wind farm developers and investors

- Steam turbine manufacturers

- Public and private operators of coal, biomass, nuclear, solar thermal, and geothermal power plants

- Suppliers of parts and components to the steam turbine industry

- Concentrating solar power developers, suppliers, constructors, EPC, operators, and designers

The study answers several questions for stakeholders, primarily, which market segments to focus on in the next two to five years to prioritize efforts and investments.

Scope of the report

- Steam Turbines

- Micro Turbines

- Gas Turbines

- Gas Engines

- Micro CHP

- Nuclear Power Reactors

- Small Wind

- Diesel Generators

- Gas Generators

- Concentrating Solar Power

- Asia-Pacific

- Europe

- Other Regions*

Power Generation Technologies

By Region

*Other regions varies from product to product

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players

The top 10 power generation technologies market is expected to grow from an estimated USD 64.15 Billion in 2016 to USD 85.40 Billion by 2021. Factors such as increase in electricity consumption and subsequent investment in power generation capacity, and modernization of existing power generation infrastructure are driving the market worldwide.

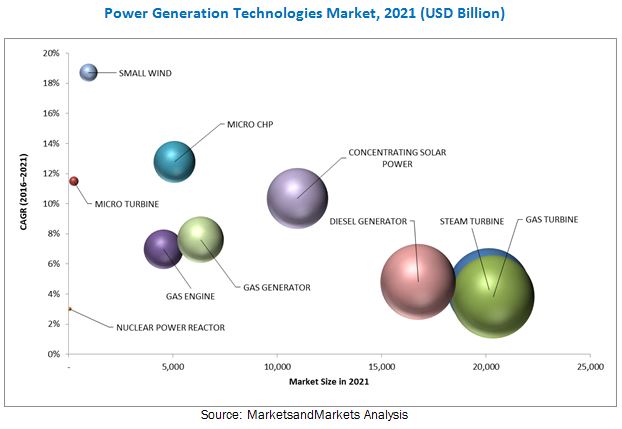

The report segments the top 10 power generation technologies market into steam turbines, micro turbines, gas turbines, gas engines, micro CHP, nuclear power reactors, small wind, diesel and gas generators, and concentrating solar power.

In terms of the top 10 power generation technologies market, by technology, the small wind market is expected to grow at the fastest pace during the forecast period. Developing countries such as the U.S. and Canada offer high growth opportunities to the small wind market. Factors such as encouraging environment policies, plummeting cost of wind energy generation, and increasing standardization would impart growth in the small wind market.

Following the small wind market, the micro CHP market is expected to grow at the second fastest pace during the forecast period. Developing countries such as the U.S. and Canada offer high growth opportunities to the micro CHP market. Factors such as reduction in carbon footprint, progressive government support, and autonomous heat and electricity generation at a reduced cost would lead to growth in the micro CHP market.

The micro turbine market is expected to grow at a decent pace during the forecast period owing to factors such as increase in energy demand, high reliability, focus on generating clean energy, and easy availability of fuel. The North American micro turbine market is projected to dominate with a share of around 50% in 2016.

The concentrating solar power market is expected to grow at a good pace during the forecast period. Factors such as growing environmental concerns over carbon emissions and efforts to reduce air pollution, policy support from governments to enable adoption of renewable technologies, and the ability to supply dispatchable power would necessitate market growth.

The gas generator sales market is expected to grow at a good pace during the forecast period. Factors such as growing demand for uninterrupted and reliable power supply, growth healthcare infrastructure, rising demand for data centers and IT facilities, and rapid urbanization in developing countries would spur the demand for gas generators.

The top 10 power generation technologies market can be directly linked to the ever-growing demand for reliable electric power. However, factors such as supply security, infrastructure concerns, and price disparity across regional markets could restrain market growth. On the other hand, rising urban population, industrialization, and a growing trend of distributed power generation represent promising growth opportunities for the market.

Some of the leading players in the top 10 power generation technologies market include Siemens AG (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Alstom S.A. (France), Ansaldo Energia S.p.A (Italy), Caterpillar, Inc. (U.S.), Cummins, Inc. (U.S.) , among others. Contracts & agreements was the most common strategy adopted by the top players in the market, constituting more than fifty% of the total development share. This was followed by new product launches, mergers & acquisitions, and expansions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Steam Turbine

1.2.2 Micro Turbine

1.2.3 Gas Turbine

1.2.4 Gas Engine

1.2.5 Micro CHP

1.2.6 Nuclear Power Reactor

1.2.7 Small Wind

1.2.8 Diesel Generators

1.2.9 Gas Generators

1.2.10 Concentrating Solar Power

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Market Breakdown & Data Triangulation

2.3 Research Assumptions

2.3.1 Assumptions

3 Executive Summary & Premium Insights (Page No. - 28)

3.1 Introduction

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Top 10 Power Generation Technologies Market (Page No. - 36)

4.1 Introduction

4.2 Steam Turbine

4.2.1 Market Dynamics

4.2.1.1 Drivers

4.2.1.1.1 Increasing Electricity Consumption

4.2.1.1.2 Rising Thermal Power Capacity Additions

4.2.1.1.3 Increase in Combined Cycle and Cogeneration Operations

4.2.1.2 Restraints

4.2.1.2.1 Regulatory Policy Restrictions on Fossil Fuel-Fired Power Plants

4.2.1.3 Opportunity

4.2.1.3.1 Replacement/Upgradation of Aged Power Generation Infrastructure

4.2.1.4 Challenges

4.2.1.4.1 Boiler Efficiency and Steam Quality

4.2.2 Steam Turbine Market

4.2.2.1 Asia-Pacific

4.2.2.2 Europe

4.2.2.3 The Americas

4.2.2.4 Middle East & Africa

4.3 Micro Turbine

4.3.1 Market Dynamics

4.3.1.1 Drivers

4.3.1.1.1 Increase in Energy Demand

4.3.1.1.2 High Reliability

4.3.1.1.3 Focus on Generating Clean Energy

4.3.1.1.4 Easy Availability of Fuel

4.3.1.2 Restraints

4.3.1.2.1 Low Electrical Efficiency

4.3.1.3 Opportunities

4.3.1.3.1 Fluctuating Weather Conditions

4.3.1.3.2 Unreliable Grid Conditions

4.3.1.3.3 Urbanization and Industrialization

4.3.1.4 Challenges

4.3.1.4.1 Electrical Grid Modernization and Network Upgradation

4.3.1.4.2 Competition From Existing Distributed Generation Technologies

4.3.2 Micro Turbine Market

4.3.2.1 North America

4.3.2.2 Europe

4.3.2.3 Asia-Pacific

4.3.2.4 The Rest of the World

4.4 Gas Turbines

4.4.1 Market Dynamics

4.4.1.1 Drivers

4.4.1.1.1 Lower Carbon Dioxide Emissions

4.4.1.2 Restraints

4.4.1.2.1 Supply Security and Infrastructure Concerns

4.4.1.3 Opportunities

4.4.1.3.1 Growing Trend of Distributed Power Generation

4.4.1.4 Challenges

4.4.1.4.1 Limited Natural Gas Reserves

4.4.2 Gas Turbines Market

4.4.2.1 Asia-Pacific

4.4.2.2 Europe

4.4.2.3 North America

4.4.2.4 Middle East & Africa

4.4.2.5 Latin America

4.5 Gas Engines

4.5.1 Market Dynamics

4.5.1.1 Drivers

4.5.1.1.1 Drop in Natural Gas Prices

4.5.1.1.2 Clean and Efficient Power Generation Technology

4.5.1.1.3 Rising Environmental Concerns

4.5.1.2 Restraints

4.5.1.2.1 Price Disparity Across Regional Markets

4.5.1.2.2 Supply Security and Infrastructure Concerns

4.5.1.3 Opportunities

4.5.1.3.1 Shifting Towards Gas-Fired Power Plants

4.5.1.3.2 Growing Trend of Distributed Power Generation

4.5.1.4 Challenges

4.5.1.4.1 Limited Natural Gas Reserves

4.5.2 Gas Engines Market

4.5.2.1 Europe

4.5.2.2 North America

4.5.2.3 Asia-Pacific

4.5.2.4 Middle East & Africa

4.5.2.5 South America

4.6 Micro-CHP

4.6.1 Market Dynamics

4.6.1.1 Drivers

4.6.1.1.1 Autonomous Heat and Electricity Generation

4.6.1.1.2 Progressive Government Support

4.6.1.1.3 Reduction in Carbon Footprint

4.6.1.2 Restraints

4.6.1.2.1 High Price of Micro-CHP Units

4.6.1.2.2 Consumer Utility and Assistance

4.6.1.2.3 Infrastructural Hurdles

4.6.1.3 Opportunities

4.6.1.3.1 Absolute Substitute of Heating Boilers

4.6.1.3.2 Residential/Commercial Construction Market

4.6.1.4 Challenges

4.6.1.4.1 Low Price of Natural Gas in Europe and Other Regions

4.6.2 Micro CHP Market

4.6.2.1 Asia-Pacific

4.6.2.2 Europe

4.6.2.3 North America

4.7 Nuclear Power Reactors

4.7.1 Market Dynamics

4.7.1.1 Drivers

4.7.1.1.1 Cleaner Generation of Electricity

4.7.1.1.2 Increasing Energy Demand

4.7.1.1.3 Security of Supply

4.7.1.2 Restraints

4.7.1.2.1 Costlier Nuclear Power Plants

4.7.1.2.2 Environmental Concerns and Efficiency of the Nuclear Power Plants

4.7.2 Nuclear Power Reactor Market

4.7.2.1 The Americas

4.7.2.2 Asia-Pacific

4.7.2.3 Europe

4.7.2.4 The Rest of World

4.8 Small Wind

4.8.1 Market Dynamics

4.8.1.1 Drivers

4.8.1.1.1 Encouraging Environmental Policies

4.8.1.1.2 Plummeting Cost of Wind Energy Generation

4.8.1.1.3 Increasing Standardization

4.8.1.2 Restraints

4.8.1.2.1 Localized Regulatory Hurdles

4.8.1.2.2 High Capital Investment

4.8.2 Small Wind Market

4.8.2.1 The Americas

4.8.2.2 Europe

4.8.2.3 Asia-Pacific

4.9 Diesel and Gas Generators

4.9.1 Market Dynamics

4.9.1.1 Drivers

4.9.1.1.1 Growing Demand for Uninterrupted and Reliable Power Supply

4.9.1.1.2 Growth of Healthcare Infrastructure

4.9.1.1.3 Rising Demand for Data Centres and It Facilities

4.9.1.1.4 Rapid Urbanization in Developing Countries

4.9.1.2 Restraints

4.9.1.2.1 Limited Power Generation Capacity

4.9.1.2.2 High Maintenance and Operating Costs

4.9.1.2.3 Rise in T&D Expenditure

4.9.1.3 Opportunities

4.9.1.3.1 Rural and Remote Area Electrification in Developing Countries

4.9.1.3.2 Bi-Fuel Generators and Inverter Generators

4.9.1.4 Challenges

4.9.1.4.1 Rise in Captive Power Plants

4.9.1.4.2 Stringent Government Regulations

4.9.2 Diesel and Gas Generator Market

4.9.2.1 Asia-Pacific

4.9.2.2 North America

4.9.2.3 Europe

4.9.2.4 Middle East & Africa

4.9.2.5 South America

4.10 Concentrating Solar Power

4.10.1 Market Dynamics

4.10.1.1 Drivers

4.10.1.1.1 Growing Environmental Concerns Over Carbon Emissions and Efforts to Reduce Air Pollution

4.10.1.1.2 Policy Support From Governments to Enable Adoption of Renewable Technologies

4.10.1.1.3 Ability to Supply Dispatchable Power

4.10.1.2 Restraints

4.10.1.2.1 Higher Cost of Generation Compared to Other Renewable Technologies

4.10.1.3 Opportunities

4.10.1.3.1 Application in Hybrid Power Plants

4.10.1.3.2 Mining Industry Investing in Renewables

4.10.1.3.3 Applications in Desalination and Enhanced Oil Recovery

4.10.1.4 Challenges

4.10.1.4.1 Land and Water Requirements

4.10.1.4.2 Technical Challenges

4.10.2 Concentrating Solar Power Market

4.10.2.1 North America

4.10.2.2 Latin America

4.10.2.3 Europe

4.10.2.4 Asia-Pacific

4.10.2.5 Middle East & Africa

5 Competitive Landscape (Page No. - 99)

5.1 Overview

5.2 Market Ranking, 2015

5.3 Competitive Situation & Trends

5.4 Contracts & Agreements

5.5 New Product Launches

5.6 Expansions

5.7 Mergers & Acquisitions

5.8 Others (Joint Ventures, Partnerships, Collaborations, and Strategic Alliances)

6 Company Profiles (Page No. - 110)

6.1 Introduction

6.2 Siemens AG

6.2.1 Business Overview

6.2.2 Products Offered

6.2.3 Developments, 20112017

6.3 Mitsubishi Heavy Industries, Ltd

6.3.1 Business Overview

6.3.2 Products Offered

6.3.3 Developments, 20072016

6.4 Alstom S.A.

6.4.1 Business Overview

6.4.2 Products Offered

6.4.3 Developments, 20122015

6.5 Ansaldo Energia S.P.A.

6.5.1 Business Overview

6.5.2 Products Offered

6.5.3 Developments, 20132016

6.6 Caterpillar Inc.

6.6.1 Business Overview

6.6.2 Products Offered

6.6.3 Developments, 20112016

6.7 Cummins Inc.

6.7.1 Business Overview

6.7.2 Products Offered

6.7.3 Developments, 20122016

6.8 Yanmar Co., Ltd.

6.8.1 Business Overview

6.8.2 Products Offered

6.8.3 Developments, 20132016

6.9 General Electric Company

6.9.1 Business Overview

6.9.2 Products Offered

6.9.3 Developments, 20122017

6.10 Mitsubishi Hitachi Power Systems, Ltd

6.10.1 Business Overview

6.10.2 Products Offered

6.10.3 Developments, 20132016

6.11 Shanghai Electric Group Co. Ltd

6.11.1 Business Overview

6.11.2 Products Offered

6.11.3 Developments, 2013

6.12 Dongfang Electric Corporation Limited

6.12.1 Business Overview

6.12.2 Products Offered

6.12.3 Developments, 20132015

6.13 Harbin Electric International Company Limited

6.13.1 Business Overview

6.13.2 Products Offered

6.13.3 Developments, 20122016

6.14 Abengoa Solar, S.A.

6.14.1 Business Overview

6.14.2 Products Offered

6.14.3 Developments, 20142016

6.15 Capstone Turbine Corporation

6.15.1 Business Overview

6.15.2 Products Offered

6.15.3 Developments, 20152016

6.16 Northern Power Systems

6.16.1 Business Overview

6.16.2 Products Offered

6.16.3 Developments, 20102014

6.17 Wind Energy Solutions

6.17.1 Business Overview

6.17.2 Products Offered

6.17.3 Developments, 2014

6.18 Bdr Thermea Group

6.18.1 Business Overview

6.18.2 Products Offered

6.18.3 Developments, 20102014

6.19 Viessmann Group

6.19.1 Business Overview

6.19.2 Products Offered

6.19.3 Developments, 20122015

6.20 Flexenergy, Inc

6.20.1 Business Overview

6.21 Kingspan Group

6.21.1 Business Overview

6.22 Xzeres Wind Corporation

6.22.1 Business Overview

6.23 Bergey Windpower

6.23.1 Business Overview

6.24 Brightsource Energy, Inc

6.24.1 Business Overview

6.25 Acwa Power

6.25.1 Business Overview

6.26 Esolar Inc

6.26.1 Business Overview

6.27 Solarreserve, LLC

6.27.1 Business Overview

6.28 Honda Motor Co. Ltd

6.28.1 Business Overview

6.29 Vaillant Group

6.29.1 Business Overview

6.30 Ceres Power Holdings PLC

6.30.1 Business Overview

6.31 Doosan Heavy Industries & Construction

6.31.1 Business Overview

6.32 Micro Turbine Technology Bv

6.32.1 Business Overview

6.33 Wilson Solarpower Corporation

6.33.1 Business Overview

6.34 Areva Sa

6.34.1 Business Overview

7 Appendix (Page No. - 187)

7.1 Insights of Industry Experts

7.4 Available Customizations

7.5 Complete Syndicated Reports

7.6 Author Details

List of Tables (66 Tables)

Table 1 Steam Turbine Market Size, By Region, 20142021 (USD Million)

Table 2 Asia-Pacific: Steam Turbine Market Size, By Country, 20142021 (USD Million)

Table 3 Europe: Steam Turbine Market Size, By Country, 20142021 (USD Million)

Table 4 The Americas: Steam Turbine Market Size, By Country, 20142021 (USD Million)

Table 5 Middle East & Africa: Steam Turbine Market Size, By Country, 20142021 (USD Million)

Table 6 Micro Turbine Market Size, By Region, 20142021 (USD Million)

Table 7 Micro Turbine Market Size, By Application, 20142021 (USD Million)

Table 8 Micro Turbine Market Size, By End-User, 20142021 (USD Million)

Table 9 Micro Turbine Market Size, By Power Rating, 20142021 (USD Million)

Table 10 North America: Micro Turbine Market Size, By Country, 20142021 (USD Million)

Table 11 Europe: Micro Turbine Market Size, By Country, 20142021 (USD Million)

Table 12 Asia-Pacific: Micro Turbine Market Size, By Country, 20142021 (USD Million)

Table 13 The Rest of the World: Micro Turbine Market Size, By Country, 20142021 (USD Million)

Table 14 Gas Turbine Market Size, By Region, 20142021 (USD Million)

Table 15 Asia-Pacific: Gas Turbine Market Size, By Country, 20142021 (USD Million)

Table 16 Europe: Gas Turbine Market Size, By Country, 20142021 (USD Million)

Table 17 North America: Gas Turbine Market Size, By Country, 20142021 (USD Million)

Table 18 Middle East & Africa: Gas Turbine Market Size, By Country, 20142021 (USD Million)

Table 19 Latin America: Gas Turbine Market Size, By Country, 20142021 (USD Million)

Table 20 Gas Engine Market Size, By Region, 20142021 (USD Million)

Table 21 Gas Engine Market Size, By Fuel, 20142021 (USD Million)

Table 22 Europe: Gas Engine Market Size, By Country, 20142021 (USD Million)

Table 23 North America: Gas Engine Market Size, By Country, 20142021 (USD Million)

Table 24 Asia-Pacific: Gas Engine Market Size, By Country, 20142021 (USD Million)

Table 25 Middle East & Africa: Gas Engine Market Size, By Country, 20142021 (USD Million)

Table 26 South America: Gas Engine Market Size, By Country, 20142021 (USD Million)

Table 27 Micro CHP Market Size, By Region, 20142021 (Units)

Table 28 Micro CHP Market Size, By Region, 20142021 (USD Million)

Table 29 Asia-Pacific: Micro CHP Market Size, By Country, 20142021 (Units)

Table 30 Asia-Pacific: Micro CHP Market Size, By Country, 20142021 (USD Million)

Table 31 Europe: Micro CHP Market Size, By Country, 20142021 (Units)

Table 32 Europe: Micro CHP Market Size, By Country, 20142021 (USD Million)

Table 33 North America: Micro CHP Market Size, By Country, 20142021 (Units)

Table 34 North America: Micro CHP Market Size, By Country, 20142021 (USD Million)

Table 35 Nuclear Power Reactor Market Size, By Region, 20142021 (USD Million)

Table 36 The Americas: Nuclear Power Reactor Market Size, By Type, 20142021 (USD Million)

Table 37 Asia-Pacific: Nuclear Power Reactor Market Size, By Country, 20142021 (USD Million)

Table 38 Europe: Nuclear Power Reactor Market Size, By Country, 20142021 (USD Million)

Table 39 The Rest of the World: Nuclear Power Reactor Market Size, By Country, 20142021 (USD Million)

Table 40 Small Wind Market Size, By Region, 20142021 (USD Million)

Table 41 North America: Small Wind Market Size, By Country, 20142021 (USD Million)

Table 42 Europe: Small Wind Market Size, By Country, 20142021 (USD Million)

Table 43 Asia-Pacific: Small Wind Market Size, By Country, 20142021 (USD Million)

Table 44 Generator Sales Market Size, By Region, 20142021 (USD Million)

Table 45 Asia-Pacific: Diesel Generator Market Size, By Country, 20142021 (USD Million)

Table 46 Asia-Pacific: Gas Generator Market Size, By Country, 20142021 (USD Million)

Table 47 North America: Diesel Generator Market Size, By Country, 20142021 (USD Million)

Table 48 North America: Gas Generator Market Size, By Country, 20142021 (USD Million)

Table 49 Europe: Diesel Generator Market Size, By Country, 20142021 (USD Million)

Table 50 Europe: Gas Generator Market Size, By Country, 20142021 (USD Million)

Table 51 Middle East & Africa: Diesel Generator Market Size, By Country, 20142021 (USD Million)

Table 52 Middle East & Africa: Gas Generator Market Size, By Country, 20142021 (USD Million)

Table 53 South America: Diesel Generator Market Size, By Country, 20142021 (USD Million)

Table 54 South America: Gas Generator Market Size, By Country, 20142021 (USD Million)

Table 55 Concentrating Solar Power Market Size, By Region, 20142021 (USD Million)

Table 56 North America: Concentrating Solar Power Market Size, By Country, 20142021 (USD Million)

Table 57 Latin America: Concentrating Solar Power Market Size, By Country, 20142021 (USD Million)

Table 58 Europe: Concentrating Solar Power Market Size, By Country, 20142021 (USD Million)

Table 59 Asia-Pacific: Concentrating Solar Power Market Size, By Country, 20142021 (USD Million)

Table 60 Middle East & Africa: Concentrating Solar Power Market Size, By Country, 20142021 (USD Million)

Table 61 Technologies Adopted Contracts & Agreements as the Key Growth Strategy

Table 62 Contracts & Agreements

Table 63 New Product Launches

Table 64 Expansions

Table 65 Mergers & Acquisitions

Table 66 Others (Joint Ventures, Partnerships, Collaborations, and Strategic Alliances)

List of Figures (41 Figures)

Figure 1 Markets Covered: Top 10 Power Generation Technologies Market

Figure 2 Top 10 Power Generation Technologies Market: Research Design

Figure 3 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Estimation Approach & Data Triangulation Methodology

Figure 5 Market Size for Power Generation , 2015 (USD Million)

Figure 6 Attractive Market Opportunities in the Generator Sales Market

Figure 7 Attractive Market Opportunities in the Concentrating Solar Power Market

Figure 8 Attractive Market Opportunities in the Gas Engine Market

Figure 9 Attractive Market Opportunities in the Micro Turbine Market

Figure 10 Attractive Market Opportunities in the Steam Turbine Market

Figure 11 Attractive Market Opportunities in the Gas Turbine Market

Figure 12 Attractive Market Opportunities in the Micro CHP Market

Figure 13 Attractive Market Opportunities in the Small Wind Market

Figure 14 Attractive Market Opportunities in the Nuclear Power Reactor Market

Figure 15 Top 10 Power Generation Technologies Market By Region, 2015 (USD Million)

Figure 16 Top 10 Power Generation Technologies Market Developments (20122016)

Figure 17 Top 10 Power Generation Technologies Market Share By Region, 2015

Figure 18 Top 10 Power Generation Technologies Market Dynamics: Steam Turbines

Figure 19 Top 10 Power Generation Technologies Market Dynamics: Micro Turbines

Figure 20 Top 10 Power Generation Technologies Market Dynamics: Gas Turbines

Figure 21 Top 10 Power Generation Technologies Market Dynamics: Gas Engines

Figure 22 Top 10 Power Generation Technologies Market Dynamics: Micro-CHP

Figure 23 Top 10 Power Generation Technologies Market Dynamics: Nuclear Power Reactors

Figure 24 Top 10 Power Generation Technologies Market Dynamics: Small Wind

Figure 25 Top 10 Power Generation Technologies Market Dynamics: Diesel and Gas Generators

Figure 26 Top 10 Power Generation Technologies Market Dynamics: Concentrating Solar Power

Figure 27 Top 10 Power Generation Technologies Market Evaluation Framework, 20122016

Figure 28 Battle for Top 10 Power Generation Technologies Market Share: Contracts & Agreements Was the Key Strategy, 2012-2016

Figure 29 Siemens AG: Company Snapshot

Figure 30 Mitsubishi Heavy Industries, Ltd.: Company Snapshot

Figure 31 Alstom Sa : Company Snapshot

Figure 32 Ansaldo Energia: Company Snapshot

Figure 33 Caterpillar Inc: Company Snapshot

Figure 34 Cummins Inc: Company Snapshot

Figure 35 Yanmar Co : Company Snapshot

Figure 36 General Electric: Company Snapshot

Figure 37 Shanghai Electric Group Co. Ltd : Company Snapshot

Figure 38 Dongfang Electric Corporation Limited: Company Snapshot

Figure 39 Abengoa Solar, S.A : Company Snapshot

Figure 40 Capstone Turbine Corporation : Company Snapshot

Figure 41 Northern Power Systems : Company Snapshot

Growth opportunities and latent adjacency in Top 10 Power Generation Technologies Market