Concentrating Solar Power Market by Technology (Solar Power Tower, Linear Concentrating System, Dish Stirling), Operation Type (Stand-alone, Storage), Capacity (<50 MW, 50-99 MW, 100 MW & Above), End User (Utilities, EOR), Region - Global Forecast to 2027

[266 Pages Report] The global concentrating solar power market size is estimated to be USD 6.0 billion in 2022 and is projected to reach USD 19.9 billion by 2027; it is projected to grow at a CAGR of 26.9% during the forecast period. The key drivers for the concentrating solar power market include environmental concerns over carbon emissions and efforts to reduce air pollution, support from governments to enable the adoption of renewable technologies, and the integrability of CSP systems with thermal storage systems.

To know about the assumptions considered for the study, Request for Free Sample Report

Concentrating Solar Power Market Dynamics

Driver: Support from governments to enable adoption of renewable technologies

There are various types of renewable energy sources, such as solar, wind, hydroelectric, biomass, geothermal, tidal, and wave energy. Governments of multiple countries are incentivizing renewable energy generation in the form of tax credits, grants, and loan programs, which have encouraged investors and project developers to shift toward renewable power generation. Such favorable initiatives have also facilitated the maturity of these technologies on a commercial scale. Some of the key policies to support solar deployment are mentioned below:

- Renewable electricity standards and solar set-asides

- Feed-in tariffs

- Auctions/tendering processes

- Net metering

- Interconnection standards

- Solar investment and production tax credits

- Approaches to support private investment

The Government of India has set a target of installing 175 GW of renewable energy capacity by 2022; this includes 60 GW from wind, 10 GW from biopower, 100 GW from solar, and 5 GW from small hydropower. Similarly, the Spanish government raised its renewable energy target to 74% by 2030, and the government also aims to add 157 GW of renewable energy capacity. According to the IEA, CSP generation increased by an estimated 34% in 2019. This can be achieved through continuous policy support to CSP projects across the Middle East and Africa, Asia Pacific, and North America and hence is expected to increase the installation of concentrating solar power technologies, which will drive the market growth

Restraint: Higher cost of generation compared to other renewable technologies

Concentrating solar power is a highly capital-intensive technology. The components used in solar towers include heliostat fields, power blocks, receiver fields, thermal energy storage, and tower. The key components used in parabolic troughs include solar fields, thermal energy storage systems, power blocks, and heat transfer fluid systems. The Levelized Cost of Energy (LCOE) of concentrating solar power plants is dominated by the initial investment costs, which accounts for approximately four-fifths of the total cost. According to the IRENA, in parabolic trough technology, the solar field is the most expensive component, which accounts for 3549% of the total installed costs of the projects. The heat transfer fluid accounts for 811% of the total costs in the projects examined. This result in the biggest restraint for concentrating solar power market.

Opportunities: Use of CSP in desalination and enhanced oil recovery processes

It is difficult for humans to drink saline water, but saline water can be converted into water suitable for human consumption through a process called desalination. The process is being widely used across the world for obtaining potable water. Enhanced oil recovery (EOR), also known as tertiary recovery, is the process of extracting oil that has not been retrieved through secondary or primary oil recovery techniques. The integration of CSP with EOR and desalination help to address the water shortage and even extend the lives of oil fields in the MENA (Middle East and North Africa) region.

According to the Emirates Solar Industry Association (ESIA), the domestic oil consumption of Saudi Arabia will exceed exports by 2026. CSP can facilitate power generation even in remote locations and integration with EOR. According to Helioscsp, this technology is estimated to produce 20% of oil production by 2030, which will help to extend the lives of oil fields. In the Middle East and North Africa region, 5% of the population survive on less than 1% of the freshwater being supplied. Hence, access to freshwater is the priority of governments in the region, which makes desalination an attractive solution. Therefore, integrating CSP with desalination help to reduce costs and ensure an ample supply of safe water. Governments in the Middle East and Pacific regions, such as the government of Australia, are undertaking concrete steps to provide clean water by sanctioning various desalination projects. The Ashalim project of Israel uses parabolic trough technology with molten salt thermal energy storage. The scope of this project is solar energy generation and large-scale water desalination. The project is under development and will be operational by 2025. With more such projects in the pipeline, the market for concentrating solar power is expected to grow significantly during the forecast period.

Challenges: Solar PV is cheaper than CSP

Photovoltaics is the process of converting light (photons) to electricity (voltage). A photovoltaic system is made up of different components, such as PV modules, one or more batteries, a charge regulator or controller, inverter, wiring, and mounting hardware or a framework. Although CSP is more efficient in terms of energy saving, PV is cheaper than CSP; hence energy investors are more inclined to use PV. According to the Solar Energy Industries Association, the US installed 3.6 GW of solar PV capacity in Q1 2020 to reach up to 81.4 GW of total installed capacityenough to power 15.7 million American homes. The cost of installing solar PV has dropped by more than 70% over the last few decades. This will lead the PV industry to expand into new markets and result in the installation of thousands of systems worldwide, this is a major challenge for the big players in the concentrating solar power market.

Solar Power Towers segment, by technology, is expected to be the largest market during forecast period

By technology, the concentrating solar power market has been segmented into solar power towers, linear concentrating systems, and dish Stirling technology. Solar power towers segment is expected to be the largest segment during the forecast period. The market for the solar power towers segment is driven by the higher efficiency of the steam cycle and the potential to reach high temperatures for power generation operations.

By operation type, storage segment is expected to be the most significant contributor to the concentrating solar power market during the forecast period

By operation type, the concentrating solar power market has been segmented into stand-alone, and storage. Storage segment is expected to be the largest segment during the forecast period. The market for the storage segment is driven by the need to generate continuous power during the night and the ability to operate the plant for a longer time.

Utilities segment, by end user, is expected to be the largest market during forecast period

By end user, the concentrating solar power market has been segmented into utilities, enhanced oil recovery (EOR), and others. Utilities segment is expected to be the largest segment during the forecast period. The utilities segment is driven by the increasing energy demand and the ability to store energy for future use

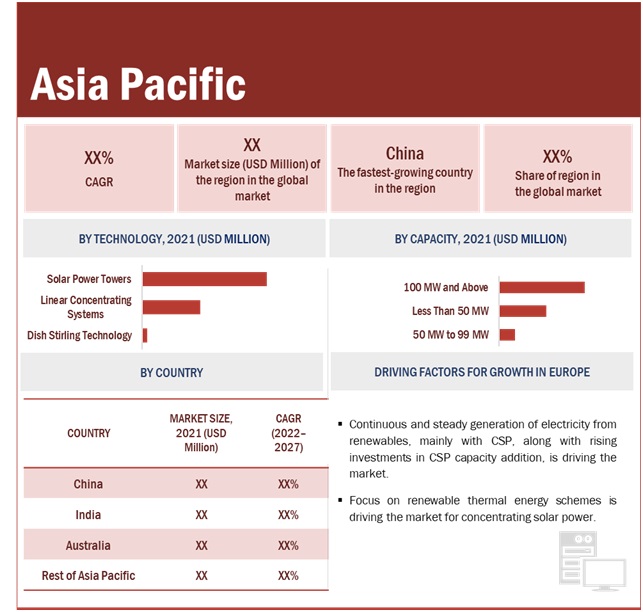

Asia Pacific: The largest and fastest concentrating solar power market

Asia Pacific is expected to dominate the concentrating solar power market between 20222027, followed by Middle East & Africa. The CSP market growth in Asia Pacific, and Middle East & Africa is expected to be backed by the growing demand for continuous generation of electricity and increasing support from governments to adopt renewable technologies in key countries such as China, India, Morocco, the UAE, and Saudi Arabia.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

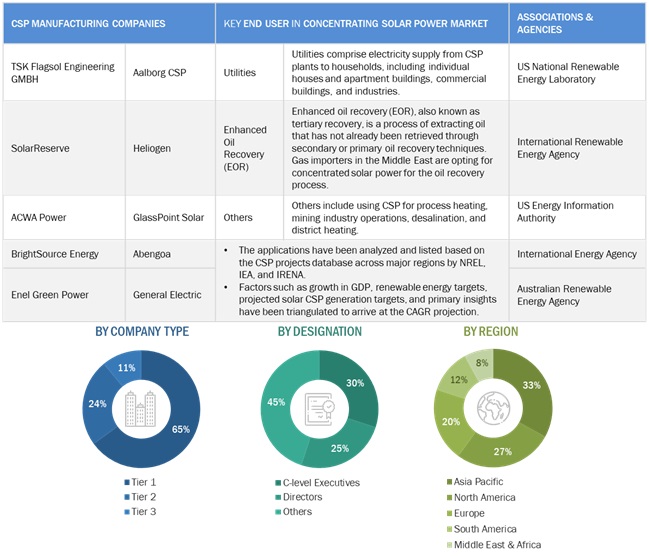

The concentrating solar power market is dominated by a few major players that have a wide regional presence. The major players in the CSP market are Abengoa (Spain), BrightSource Energy (US), ACWA Power (Saudi Arabia), SolarReserve (US), and Aalborg CSP (Denmark). Between 2018 and 2022, the companies adopted growth strategies such as deals to capture a larger share of the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20202027 |

|

Base year considered |

2021 |

|

Forecast period |

20222027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Concentrating solar power market by technology, operation type, capacity, end user, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Abengoa (Spain), BrightSource Energy (US), ACWA Power (Saudi Arabia), SolarReserve (US), Aalborg CSP (Denmark), General Electric (US), Heliogen (US), Torresol Energy (Spain), Solastor (Australia), Enel Green Power (Italy), GlassPoint Solar (US), Atlantica Yield (Italy), Alsolen (Switzerland), TSK Flagsol Engineering GmbH (Germany), Cobra Energia (Spain), Frenell GmbH (Taiwan), Acciona Energy (Spain), Soltigua (Italy), Archimede Solar Energy (Italy), and Chiyoda Corporation (Japan) |

This research report categorizes the concentrating solar power market by technology, operation type, capacity, end user, and region

On the basis of by technology:

- Solar Power Towers

- Linear Concentrating Systems

- Dish Stirling Technology

On the basis of operation type:

- Stand-alone

- Storage

On the basis of capacity:

- Less than 50 MW

- 50 MW to 100 MW

- 100 MW and Above

On the basis of end user:

- Utilities

- Enhanced Oil Recovery (EOR)

- Others

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2022, Abengoa has completed the construction of three 200 MW parabolic trough plants as part of phase IV of the Mohammed bid Rashid Al Maktoum Solar Park mega-project outside Dubai. The company worked under a contract with the phase IV EPC contractor Shanghai Electric Group and oversaw the technology, design, engineering, and construction of the parabolic trough plants.

- In June 2021, ACWA made an offtake contract with Eskom Holdings SOC Ltd and secured about USD 800 million in funding to build the largest concentrated solar power plant in South Africa. Redstone CSP is designed to have a generation capacity of 100 MW and is set to enter commercial operations in the fourth quarter of 2023. The CSP plant will have a 12-hour thermal energy storage system so that it will be able to meet the power demand of nearly 200,000 homes 24/7.

- In April 2019, BrightSource Energy partnered with General Electric for the ASHALIM project, a 121 MW capacity solar field that became operational in 2019. GE was responsible for the engineering, procurement, and construction (EPC) of the solar power station, with BrightSource providing the advanced solar field technology.

- In February 2019, Aalborg CSP signed an agreement with Shanghai Electric Group to supply no-leaks steam generation systems to the Dubai 700 MW CSP project

Frequently Asked Questions (FAQ):

What is the current size of the concentrating solar power market?

The current market size of concentrating solar power market is 3.5 billion in 2021.

What are the major drivers for concentrating solar power market?

The growth of the concentrating solar power market can be attributed to environmental concerns over carbon emissions and efforts to reduce air pollution, support from governments to enable the adoption of renewable technologies, and the integrability of CSP systems with thermal storage systems

Which is the fastest-growing region during the forecasted period in concentrating solar power market?

Asia Pacific is the fastest growing region in the concentrating solar power market between 20222027, followed by Middle East & Africa. The concentrating solar power market growth in Asia Pacific, and Middle East & Africa is expected to be backed by the growing demand for continuous generation of electricity and increasing support from governments to adopt renewable technologies in key countries such as China, India, Morocco, the UAE, and Saudi Arabia

Which is the fastest-growing segment, by technology during the forecasted period in concentrating solar power market?

The solar power towers segment is expected to be the largest segment during the forecast period. The market for the solar power towers segment is driven by the higher efficiency of the steam cycle and the potential to reach high temperatures for power generation operations .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY CAPACITY: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY OPERATION TYPE: INCLUSIONS AND EXCLUSIONS

1.3.4 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION: MARKET

2.3 STUDY SCOPE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.4.3 DEMAND-SIDE ANALYSIS

FIGURE 4 ESTIMATING MARKET SIZE THROUGH YEAR-ON-YEAR CAPACITY ADDITION OF CONCENTRATING SOLAR POWER TECHNOLOGY ACROSS COUNTRIES

2.4.3.1 Assumptions for demand-side analysis

2.4.3.2 Demand-side calculation

2.4.3.3 Capex cost projection

FIGURE 5 GLOBAL AVERAGE CAPEX COST OF CSP TECHNOLOGIES INTEGRATED WITH STORAGE, 20202027 (USD/KW)

FIGURE 6 GLOBAL AVERAGE CAPEX COST OF CSP TECHNOLOGY INTEGRATED WITH STAND-ALONE OPERATION TYPE, 20202027 (USD/KW)

2.4.4 SUPPLY-SIDE ANALYSIS

2.4.4.1 Supply-side assumptions

2.4.4.2 Supply-side calculation

2.4.5 GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 54)

TABLE 1 MARKET OVERVIEW

FIGURE 7 MIDDLE EAST & AFRICA DOMINATED MARKET IN 2021

FIGURE 8 SOLAR POWER TOWERS EXPECTED TO HOLD LARGEST MARKET SHARE, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 9 UTILITIES EXPECTED TO LEAD MARKET, BY END USER, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS IN MARKET

FIGURE 10 STAGNANT GROWTH OF RENEWABLE SECTOR EXPECTED TO DRIVE MARKET FROM 20222027

4.2 MARKET, BY REGION

FIGURE 11 SOUTH AMERICA TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 12 SOLAR POWER TOWERS DOMINATED MARKET, BY TECHNOLOGY, IN 2021

4.4 MARKET, BY OPERATION TYPE

FIGURE 13 CONCENTRATING SOLAR POWER STORAGE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.5 MARKET, BY CAPACITY

FIGURE 14 100 MW AND ABOVE HELD LARGEST SHARE OF MARKET IN 2021

4.6 MARKET, BY END USER

FIGURE 15 UTILITIES HELD LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing environmental concerns over carbon emissions and efforts to reduce air pollution

FIGURE 17 SOURCES OF CARBON DIOXIDE EMISSION IN US, 2020

5.2.1.2 Support from governments to enable adoption of renewable technologies

5.2.1.3 Effective integration of CSP systems with thermal storage systems

TABLE 2 CSP TOWER PROJECTS WITH STORAGE DURING FORECAST PERIOD

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of generation compared with other renewable technologies

TABLE 3 GLOBAL LCOE RANGE FOR RENEWABLE TECHNOLOGIES, 2021

FIGURE 18 TOTAL GLOBAL LCOE RANGE FOR RENEWABLE TECHNOLOGIES, 2010 2021

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of CSP in hybrid power plants

5.2.3.2 Use of CSP in desalination and enhanced oil recovery processes

5.2.4 CHALLENGES

5.2.4.1 Technical complexities of CSP plants

5.2.4.2 Solar PV is cheaper than CSP

FIGURE 19 GLOBAL ANNUAL SOLAR PV CAPACITY, IN GW, 2021

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 CONCENTRATING SOLAR POWER: VALUE CHAIN

5.3.1 RESEARCH AND PROJECT DEVELOPMENT

5.3.2 RAW MATERIAL SOURCING

5.3.3 COMPONENTS SUPPLY

5.3.4 PLANT ENGINEERING

5.3.5 OPERATION

5.3.6 DISTRIBUTION

5.4 TECHNOLOGY ANALYSIS

5.4.1 TEMPERATURE AND EFFICIENCY LIMITATIONS

5.4.2 NREL SUNSHOT INITIATIVE

5.4.3 MICRO-CSP

5.5 CASE STUDY ANALYSIS

5.5.1 CRESCENT DUNES USES SOLAR POWER TOWER CSP FOR UTILITIES

TABLE 4 CRESCENT DUNES PROJECT STATISTICS

5.5.2 SUPCON DELINGHA 50MW MOLTEN SALT TOWER CSP USES SOLAR POWER TOWER CSP FOR UTILITIES

TABLE 5 SUPCON DELINGHA PROJECT STATISTICS

5.6 PRICING ANALYSIS

5.6.1 INDICATIVE PRICING ANALYSIS TREND

5.6.1.1 Break-up of installed cost of CSP

FIGURE 21 TOTAL INSTALLED COST BREAKDOWN FOR PARABOLIC TROUGH, 2020

FIGURE 22 TOTAL INSTALLED COST BREAKDOWN FOR POWER TOWER, 2020

6 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY (Page No. - 76)

6.1 INTRODUCTION

FIGURE 23 MARKET, BY TECHNOLOGY, 2021

TABLE 6 MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 7 MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

6.2 SOLAR POWER TOWERS

6.2.1 POTENTIAL TO REACH HIGH TEMPERATURES THAN OTHER TECHNOLOGIES

TABLE 8 SOLAR POWER TOWERS: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 9 SOLAR POWER TOWERS: MARKET, BY REGION, 20202027 (USD MILLION)

6.3 LINEAR CONCENTRATING SYSTEMS

6.3.1 LESS CAPITAL EXPENDITURE THAN OTHER TECHNOLOGIES

6.3.2 PARABOLIC TROUGH

6.3.2.1 Ability to generate very high temperatures at low cost

6.3.3 LINEAR FRESNEL REFLECTORS

6.3.3.1 Greater surface area per receiver allows more mobility to track sun

TABLE 10 LINEAR CONCENTRATING SYSTEMS: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 11 LINEAR CONCENTRATING SYSTEMS: MARKET, BY REGION, 20202027 (USD MILLION)

6.4 DISH STIRLING TECHNOLOGY

6.4.1 REDUCED HEAT LOSS DURING POWER GENERATION

TABLE 12 DISH STIRLING TECHNOLOGY: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 13 DISH STIRLING TECHNOLOGY: MARKET, BY REGION, 20202027 (USD MILLION)

7 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 24 MARKET SHARE, BY OPERATION TYPE, 2021

TABLE 14 MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 15 MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

7.2 STAND-ALONE

7.2.1 LOW CAPITAL EXPENDITURE TO DRIVE MARKET

TABLE 16 STAND-ALONE: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 17 STAND-ALONE: MARKET, BY REGION, 20202027 (USD MILLION)

7.3 STORAGE

7.3.1 NEED FOR POWER GENERATION DURING NIGHTTIME IS DRIVING MARKET

TABLE 18 STORAGE: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 19 STORAGE: MARKET, BY REGION, 20202027 (USD MILLION)

8 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY (Page No. - 88)

8.1 INTRODUCTION

FIGURE 25 MARKET, BY CAPACITY, 2021

TABLE 20 MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 21 MARKET, BY CAPACITY, 20202027 (USD MILLION)

8.2 LESS THAN 50 MW

8.2.1 NEEDED FOR SMALL-SCALE RENEWABLE UTILITY POWER GENERATION

TABLE 22 LESS THAN 50 MW: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 23 LESS THAN 50 MW: MARKET, BY REGION, 20202027 (USD MILLION)

8.3 50 MW TO 99 MW

8.3.1 INCREASED UTILITY-SCALE POWER GENERATION WITH THERMAL STORAGE

TABLE 24 50 MW TO 99 MW: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 25 50 MW TO 99 MW: MARKET, BY REGION, 20202027 (USD MILLION)

8.4 100 MW AND ABOVE

8.4.1 NEED TO INSTALL CSP TECHNOLOGY TO MEET RENEWABLE ENERGY GENERATION DEMAND

TABLE 26 100 MW AND ABOVE: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 27 100 MW AND ABOVE: MARKET, BY REGION, 20202027 (USD MILLION)

9 CONCENTRATING SOLAR POWER MARKET, BY END USER (Page No. - 94)

9.1 INTRODUCTION

FIGURE 26 MARKET SHARE, BY END USER, 2021

TABLE 28 MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 29 MARKET, BY END USER, 20202027 (USD MILLION)

9.2 UTILITIES

9.2.1 INCREASING ENERGY DEMAND AND ABILITY TO STORE ENERGY FOR FUTURE USE

TABLE 30 UTILITIES: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 31 UTILITIES: MARKET, BY REGION, 20202027 (USD MILLION)

9.3 ENHANCED OIL RECOVERY (EOR)

9.3.1 NEED TO BOOST OIL PRODUCTION AND EXTEND LIFE OF OIL FIELDS

TABLE 32 ENHANCED OIL RECOVERY (EOR): MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 33 ENHANCED OIL RECOVERY (EOR): MARKET, BY REGION, 20202027 (USD MILLION)

9.4 OTHERS

9.4.1 GROWING NEED FOR OFF-GRID POWER SUPPLY USING RENEWABLE POWER SOURCES

TABLE 34 OTHERS: MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 35 OTHERS: MARKET, BY REGION, 20202027 (USD MILLION)

10 CONCENTRATING SOLAR POWER MARKET, BY REGION (Page No. - 100)

10.1 INTRODUCTION

FIGURE 27 MARKET IN SOUTH AMERICA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 28 MARKET SHARE (VALUE), BY REGION, 2021

TABLE 36 GLOBAL MARKET, BY REGION, 20162019 (IN MW)

TABLE 37 GLOBAL MARKET, BY REGION, 20202027 (IN MW)

TABLE 38 GLOBAL MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 39 GLOBAL MARKET, BY REGION, 20202027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 BY TECHNOLOGY

TABLE 40 NORTH AMERICA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.2.2 BY OPERATION TYPE

TABLE 42 NORTH AMERICA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.2.3 BY CAPACITY

TABLE 44 NORTH AMERICA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.2.4 BY END USER

TABLE 46 NORTH AMERICA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY END USER, 20202027 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 48 NORTH AMERICA: MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY COUNTRY, 20202027 (USD MILLION)

10.2.5.1 US

10.2.5.1.1 Planned CSP power generation targets to drive market

10.2.5.1.2 By technology

TABLE 50 US: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 51 US: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.2.5.1.3 By operation type

TABLE 52 US: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 53 US: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.2.5.1.4 By capacity

TABLE 54 US: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 55 US: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.2.5.1.5 By end user

TABLE 56 US: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 57 US: MARKET, BY END USER, 20202027 (USD MILLION)

10.2.5.2 Mexico

10.2.5.2.1 Potential of using CSP for numerous mini-grid applications

10.2.5.2.2 By technology

TABLE 58 MEXICO: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 59 MEXICO: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.2.5.2.3 By operation type

TABLE 60 MEXICO: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 61 MEXICO: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.2.5.2.4 By capacity

TABLE 62 MEXICO: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 63 MEXICO: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.2.5.2.5 By end user

TABLE 64 MEXICO: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 65 MEXICO: MARKET, BY END USER, 20202027 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT, 2021

10.3.1 BY TECHNOLOGY

TABLE 66 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.3.2 BY OPERATION TYPE

TABLE 68 ASIA PACIFIC: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.3.3 BY CAPACITY

TABLE 70 ASIA PACIFIC: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.3.4 BY END USER

TABLE 72 ASIA PACIFIC: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY END USER, 20202027 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 74 ASIA PACIFIC: MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY COUNTRY, 20202027 (USD MILLION)

10.3.5.1 China

10.3.5.1.1 Increasing investments in CSP for power grid stabilization

10.3.5.1.2 By technology

TABLE 76 CHINA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 77 CHINA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.3.5.1.3 By operation type

TABLE 78 CHINA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 79 CHINA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.3.5.1.4 By capacity

TABLE 80 CHINA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 81 CHINA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.3.5.1.5 By end user

TABLE 82 CHINA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 83 CHINA: MARKET, BY END USER, 20202027 (USD MILLION)

10.3.5.2 India

10.3.5.2.1 Potential to integrate CSP with desalination plants

10.3.5.2.2 By technology

TABLE 84 INDIA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 85 INDIA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.3.5.2.3 By operation type

TABLE 86 INDIA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 87 INDIA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.3.5.2.4 By capacity

TABLE 88 INDIA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 89 INDIA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.3.5.2.5 By end user

TABLE 90 INDIA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 91 INDIA: MARKET, BY END USER, 20202027 (USD MILLION)

10.3.5.3 Australia

10.3.5.3.1 CSP to provide power grid balance and flexibility

10.3.5.3.2 By technology

TABLE 92 AUSTRALIA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 93 AUSTRALIA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.3.5.3.3 By operation type

TABLE 94 AUSTRALIA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 95 AUSTRALIA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.3.5.3.4 By capacity

TABLE 96 AUSTRALIA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 97 AUSTRALIA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.3.5.3.5 By end user

TABLE 98 AUSTRALIA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 99 AUSTRALIA: MARKET, BY END USER, 20202027 (USD MILLION)

10.3.5.4 Rest of Asia Pacific

10.3.5.4.1 By technology

TABLE 100 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.3.5.4.2 By operation type

TABLE 102 REST OF ASIA PACIFIC: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 103 REST OF ASIA PACIFIC: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.3.5.4.3 By capacity

TABLE 104 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.3.5.4.4 By end user

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 107 REST OF ASIA PACIFIC: MARKET, BY END USER, 20202027 (USD MILLION)

10.4 EUROPE

10.4.1 BY TECHNOLOGY

TABLE 108 EUROPE: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.4.2 BY OPERATION TYPE

TABLE 110 EUROPE: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.4.3 BY CAPACITY

TABLE 112 EUROPE: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.4.4 BY END USER

TABLE 114 EUROPE: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY END USER, 20202027 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 116 EUROPE: MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 20202027 (USD MILLION)

10.4.5.1 Cyprus

10.4.5.1.1 CSP targets and suitable solar irradiation levels boosting market growth

10.4.5.1.2 By technology

TABLE 118 CYPRUS: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 119 CYPRUS: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.4.5.1.3 By operation type

TABLE 120 CYPRUS: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 121 CYPRUS: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.4.5.1.4 By capacity

TABLE 122 CYPRUS: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 123 CYPRUS: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.4.5.1.5 By end user

TABLE 124 CYPRUS: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 125 CYPRUS: MARKET, BY END USER, 20202027 (USD MILLION)

10.4.5.2 Spain

10.4.5.2.1 Multitude of CSP deployments favoring market growth

10.4.5.2.2 By technology

TABLE 126 SPAIN: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 127 SPAIN: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.4.5.2.3 By operation type

TABLE 128 SPAIN: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 129 SPAIN: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.4.5.2.4 By capacity

TABLE 130 SPAIN: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 131 SPAIN: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.4.5.2.5 By end user

TABLE 132 SPAIN: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 133 SPAIN: MARKET, BY END USER, 20202027 (USD MILLION)

10.4.5.3 Greece

10.4.5.3.1 Need to reduce energy imports and presence of favorable radiation levels

10.4.5.3.2 By technology

TABLE 134 GREECE: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 135 GREECE: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.4.5.3.3 By operation type

TABLE 136 GREECE: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 137 GREECE: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.4.5.3.4 By capacity

TABLE 138 GREECE: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 139 GREECE: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.4.5.3.5 By end user

TABLE 140 GREECE: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 141 GREECE: MARKET, BY END USER, 20202027 (USD MILLION)

10.4.5.4 Rest of Europe

10.4.5.4.1 By technology

TABLE 142 REST OF EUROPE: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.4.5.4.2 By operation type

TABLE 144 REST OF EUROPE: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.4.5.4.3 By capacity

TABLE 146 REST OF EUROPE: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.4.5.4.4 By end user

TABLE 148 REST OF EUROPE: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET, BY END USER, 20202027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

FIGURE 30 MIDDLE EAST & AFRICA: MARKET SNAPSHOT, 2021

10.5.1 BY TECHNOLOGY

TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.5.2 BY OPERATION TYPE

TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.5.3 BY CAPACITY

TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.5.4 BY END USER

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY END USER, 20202027 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20202027 (USD MILLION)

10.5.5.1 Saudi Arabia

10.5.5.1.1 Potential to transit from oil dependence and use CSP for renewable power generation

10.5.5.1.2 By technology

TABLE 160 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 161 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.5.5.1.3 By operation type

TABLE 162 SAUDI ARABIA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 163 SAUDI ARABIA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.5.5.1.4 By capacity

TABLE 164 SAUDI ARABIA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 165 SAUDI ARABIA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.5.5.1.5 By end user

TABLE 166 SAUDI ARABIA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 167 SAUDI ARABIA: MARKET, BY END USER, 20202027 (USD MILLION)

10.5.5.2 UAE

10.5.5.2.1 Potential for CSP to supply power for district cooling systems

10.5.5.2.2 By technology

TABLE 168 UAE: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 169 UAE: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.5.5.2.3 By operation type

TABLE 170 UAE: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 171 UAE: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.5.5.2.4 By capacity

TABLE 172 UAE: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 173 UAE: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.5.5.2.5 By end user

TABLE 174 UAE: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 175 UAE: MARKET, BY END USER, 20202027 (USD MILLION)

10.5.5.3 South Africa

10.5.5.3.1 Potential of CSP and mining hybridization

10.5.5.3.2 By technology

TABLE 176 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 177 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.5.5.3.3 By operation type

TABLE 178 SOUTH AFRICA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 179 SOUTH AFRICA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.5.5.3.4 By capacity

TABLE 180 SOUTH AFRICA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 181 SOUTH AFRICA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.5.5.3.5 By end user

TABLE 182 SOUTH AFRICA: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 183 SOUTH AFRICA: MARKET, BY END USER, 20202027 (USD MILLION)

10.5.5.4 Morocco

10.5.5.4.1 Growing number of CSP projects and supportive legislation driving market

10.5.5.4.2 By technology

TABLE 184 MOROCCO: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 185 MOROCCO: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.5.5.4.3 By operation type

TABLE 186 MOROCCO: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 187 MOROCCO: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.5.5.4.4 By capacity

TABLE 188 MOROCCO: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 189 MOROCCO: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.5.5.4.5 By end user

TABLE 190 MOROCCO: MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 191 MOROCCO: MARKET, BY END USER, 20202027 (USD MILLION)

10.5.5.5 Rest of Middle East & Africa

10.5.5.5.1 By technology

TABLE 192 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.5.5.5.2 By operation type

TABLE 194 REST OF MIDDLE EAST & AFRICA: MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST & AFRICA: MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.5.5.5.3 By capacity

TABLE 196 REST OF MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.5.5.5.4 By end user

TABLE 198 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST & AFRICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20202027 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY TECHNOLOGY

TABLE 200 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 201 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.6.2 BY OPERATION TYPE

TABLE 202 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 203 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.6.3 BY CAPACITY

TABLE 204 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 205 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.6.4 BY END USER

TABLE 206 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 207 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20202027 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 208 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 209 SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY COUNTRY, 20202027 (USD MILLION)

10.6.5.1 Brazil

10.6.5.1.1 Availability of large suitable land area for CSP and supportive renewable energy policies

10.6.5.1.2 By technology

TABLE 210 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 211 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.6.5.1.3 By operation type

TABLE 212 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 213 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.6.5.1.4 By capacity

TABLE 214 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 215 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.6.5.1.5 By end user

TABLE 216 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 217 BRAZIL: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20202027 (USD MILLION)

10.6.5.2 Chile

10.6.5.2.1 Potential to supply components such as thermal energy storage molten salts

10.6.5.2.2 By technology

TABLE 218 CHILE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 219 CHILE: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.6.5.2.3 By operation type

TABLE 220 CHILE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 221 CHILE: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.6.5.2.4 By capacity

TABLE 222 CHILE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 223 CHILE: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.6.5.2.5 By end user

TABLE 224 CHILE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 225 CHILE: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20202027 (USD MILLION)

10.6.5.3 Rest of South America

10.6.5.3.1 By technology

TABLE 226 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 227 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 20202027 (USD MILLION)

10.6.5.3.2 By operation type

TABLE 228 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20162019 (USD MILLION)

TABLE 229 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 20202027 (USD MILLION)

10.6.5.3.3 By capacity

TABLE 230 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20162019 (USD MILLION)

TABLE 231 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 20202027 (USD MILLION)

10.6.5.3.4 By end user

TABLE 232 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20162019 (USD MILLION)

TABLE 233 REST OF SOUTH AMERICA: CONCENTRATING SOLAR POWER MARKET, BY END USER, 20202027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 185)

11.1 KEY PLAYERS STRATEGIES

TABLE 234 OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, 20182022

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 235 CONCENTRATING SOLAR POWER MARKET: DEGREE OF COMPETITION

FIGURE 31 CONCENTRATING SOLAR POWER MARKET SHARE ANALYSIS, 2021

11.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 32 TOP PLAYERS IN CONCENTRATING SOLAR POWER MARKET FROM 2017 TO 2021

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 PERVASIVE PLAYERS

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 33 CONCENTRATING SOLAR POWER MARKET (GLOBAL) KEY COMPANY EVALUATION MATRIX, 2021

11.5 CONCENTRATING SOLAR POWER MARKET: COMPANY FOOTPRINT

TABLE 236 TECHNOLOGY: COMPANY FOOTPRINT

TABLE 237 OPERATION TYPE: COMPANY FOOTPRINT

TABLE 238 CAPACITY: COMPANY FOOTPRINT

TABLE 239 REGION: COMPANY FOOTPRINT

TABLE 240 COMPANY FOOTPRINT

11.6 COMPETITIVE SCENARIO

TABLE 241 CONCENTRATING SOLAR POWER MARKET: DEALS, JANUARY 2018MARCH 2022

12 COMPANY PROFILES (Page No. - 198)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 GENERAL ELECTRIC

TABLE 242 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 34 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 243 GENERAL ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 244 GENERAL ELECTRIC: DEALS

12.1.2 ABENGOA

TABLE 245 ABENGOA: BUSINESS OVERVIEW

FIGURE 35 ABENGOA: COMPANY SNAPSHOT, 2021

TABLE 246 ABENGOA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 247 ABENGOA: DEALS

12.1.3 BRIGHTSOURCE ENERGY

TABLE 249 BRIGHTSOURCE ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 250 BRIGHTSOURCE ENERGY: DEALS

12.1.4 ACWA POWER

TABLE 251 ACWA POWER: BUSINESS OVERVIEW

TABLE 252 ACWA POWER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 253 ACWA POWER: DEALS

12.1.5 GLASSPOINT SOLAR

TABLE 254 GLASSPOINT SOLAR: BUSINESS OVERVIEW

TABLE 255 GLASSPOINT SOLAR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 256 GLASSPOINT SOLAR: DEALS

12.1.6 ENEL GREEN POWER

TABLE 257 ENEL GREEN POWER: BUSINESS OVERVIEW

TABLE 258 ENEL GREEN POWER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.7 SOLARRESERVE

TABLE 259 SOLARRESERVE: BUSINESS OVERVIEW

TABLE 260 SOLARRESERVE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 261 SOLARRESERVE: DEALS

TABLE 262 SOLARRESERVE: OTHERS

12.1.8 AALBORG CSP

TABLE 263 AALBORG CSP: BUSINESS OVERVIEW

TABLE 264 AALBORG CSP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 265 AALBORG CSP: DEALS

12.1.9 TSK FLAGSOL ENGINEERING GMBH

TABLE 266 TSK FLAGSOL ENGINEERING GMBH: BUSINESS OVERVIEW

TABLE 267 TSK FLAGSOL ENGINEERING GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 268 TSK FLAGSOL ENGINEERING GMBH: DEALS

12.1.10 ALSOLEN

TABLE 269 ALSOLEN: BUSINESS OVERVIEW

TABLE 270 ALSOLEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.11 ARCHIMEDE SOLAR ENERGY

TABLE 271 ARCHIMEDE SOLAR ENERGY: BUSINESS OVERVIEW

TABLE 272 ARCHIMEDE SOLAR ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.12 ACCIONA ENERGY

TABLE 273 ACCIONA ENERGY: BUSINESS OVERVIEW

TABLE 274 ACCIONA ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.13 COBRA ENERGIA

TABLE 275 COBRA ENERGIA: BUSINESS OVERVIEW

TABLE 276 COBRA ENERGIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.14 FRENELL GMBH

TABLE 277 FRENELL GMBH: BUSINESS OVERVIEW

TABLE 278 FRENELL GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 279 FRENELL GMBH: OTHERS

12.2 OTHER PLAYERS

12.2.1 SOLTIGUA

12.2.2 ATLANTICA YIELD

12.2.3 CHIYODA CORPORATION

12.2.4 SOLASTOR

12.2.5 TORRESOL ENERGY

12.2.6 HELIOGEN

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 227)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

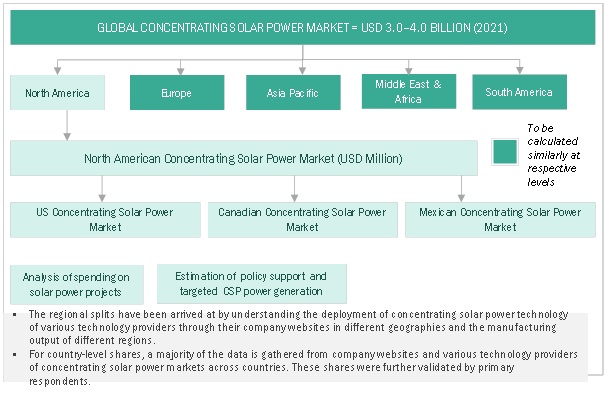

The study involved major activities in estimating the current size of the concentrating solar power market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the concentrating solar power market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the concentrating solar power market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The concentrating solar power market `comprises several stakeholders such as concentrating solar power manufacturers, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for concentrating solar powers in, utilities, enhanced oil recovery, and other end users. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the concentrating solar power market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industrys value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Concentrating solar power Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the concentrating solar power (CSP) market based on technology, capacity, operation type, and end user, in terms of value

- To provide detailed information on the drivers, restraints, opportunities, and challenges influencing the market's growth

- To provide information about value chain analysis, technology analysis, and case study analysis

- To strategically analyze the CSP market with respect to individual growth trends, future expansions, and the contribution of each segment to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape of the market

- To forecast the market size for five main regions, namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies*

- To track and analyze competitive developments, such as contracts and agreements, investments and expansions, and product developments, in the CSP market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Concentrating Solar Power Market

Interested in finding out the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the Concentrating Solar Power Market in next forecast period.