Asia Pacific Generator Sales Market by Fuel Type (Diesel, Gas), Power Rating (<100kVA, 100-350kVA, 350-1000-2500kVA, 2500-5000kVA, >5000kVA), Application (Standby, Continuous, Peak Shaving), End-User, Country - Forecast to 2025

Asia Pacific Generator Sales Market

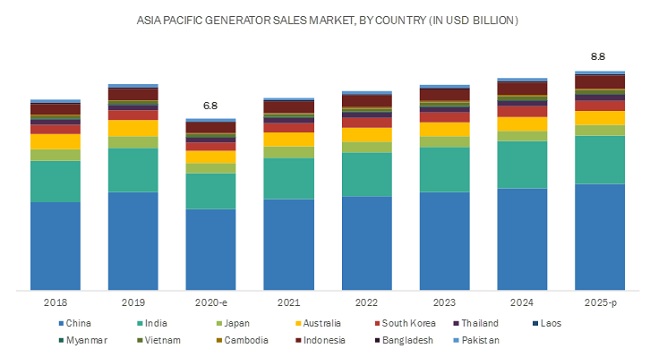

Asia Pacific Generator Sales Market is expected to grow at a CAGR of 5.1% during the forecast period (2020-2025)

Asia Pacific Generator Sales Market and Top Companies

Key market players profiled in the Asia Pacific generator sales market report includes:

- Wärtsilä (Finland)

- Rolls-Royce Holdings (UK)

- Cummins (US)

- Mitsubishi Heavy Industries (Japan)

- Caterpillar (US)

- Siemens (Germany)

- Generac (US)

- Atlas Copco (Sweden)

- Weichai Group (China)

- GE (US)

Wärtsilä (Finland) is a leading provider of technologies and solutions in the power and marine markets. The company operates through 2 business segments, namely, energy solutions and marine solutions, and offers generators under the marine business segment. The company through the marine business segment also offers other products/solutions, such as marine power solution; propulsion; exhaust gas cleaning systems; electrical solutions; seals and bearings; water & waste treatment, gas solutions; automation, navigation, and communication systems; fleet operation solutions; ship traffic control, simulators and training; and lifecycle solutions.

Rolls-Royce Holdings (UK) is a key provider of integrated power and propulsion systems. The company operates through 4 segments, namely, civil aerospace, power systems, defense, and ITP Aero. The power systems segment offers generator sets, high- and medium-speed reciprocating engines, distributed energy solutions, complete propulsion and drive systems, and fuel injection systems.

Cummins (US) designs, manufactures, distributes, and services diesel & natural gas generators, electric and hybrid engines. It also offers power system-related components, including filtration, turbochargers, fuel systems, controls systems, air handling systems, automated transmissions, electric power generation systems, batteries, electrified power systems, and hydrogen generation and fuel cell products. The company operates through 5 business segments, namely, engine, components, distribution, power systems, and new power.

Mitsubishi Heavy Industries (Japan) is a Japanese multinational engineering, electrical equipment, and electronics company. Under energy product portfolio, the company offers a wide range of diesel generator sets through its subsidiary companies, namely, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. and Mitsubishi Hitachi Power Systems.

Caterpillar (US) is the world’s leading manufacturer of mining and construction equipment, diesel and natural gas engines, diesel-electric locomotives, and industrial gas turbines. The company principally operates through three primary segments, i.e., construction industries, resource industries, and energy & transportation. It also provides financing and related services through the financial products segment.

Siemens (Germany) is a manufacturing and engineering company that focuses on the areas of electrification, automation, and digitalization in the process and manufacturing industries. The company operates through 8 business segments, namely, digital industries, smart infrastructure, gas and power, mobility, Siemens Healthiness, Siemens Gamesa Renewable Energy, Financial Services, and portfolio companies.

Generac (US) is one of the leading global designer and manufacturer of a wide range of energy technology solutions. The company offers several products and services, such as power generation equipment, energy storage systems, and other power products and services. The company operates through 3 business segments, namely, residential products, commercial & industrial products (C&I), and others segment. The others segment comprises of aftermarket service parts & product accessories.

Atlas Copco (Sweden) is a leading provider of air treatment systems and power tools. The company operates its business through 4 segments, namely, vacuum technique, industrial technique, power technique, and compressor technique. It offers generators through the power technique business segment.

Weichai Group (China) is a Chinese company specialized in the research and development, manufacturing, and sale of diesel engines. It offers its products under various brands, such as Weichai power, Shaanxi Automobile, Shaanxi Fast Gear, Hande Axle, and Ferretti Group. The company offers various products and services such as power trains, hydraulic parts, spark plugs, gears, and vehicles & engines. The company operates through 4 business segments, namely, powertrain, complete vehicles & machines & key components; other components; intelligent logistics; and others.

GE (US) is a high-tech industrial company that operates globally through 4 business segments, namely, aviation, healthcare, power, and renewable energy. It offers various products and services related to gas power, steam power, nuclear power, and hybrid power. It also offers various financial services, outage services, installation & commissioning, energy consulting services, power conversion marine services, and Environmental Control Solutions (ECS). Also, the company caters to various applications such as building and facilities power, Combined Heat Power (CHP), industrial power generation, and waste gas to power.

Asia Pacific Generator Sales Market and Applications

Applications in Asia Pacific Pacific Generator Sales Market are:

- Standby

- Prime & Continuous

- Peak Shaving

Standby – The demand for standby generators is driven owing to power outages in hospitals and data centers. Standby power generators are used in applications requiring a regular power supply to carry out operations. Their primary function is to supply emergency power for a limited duration during a power outage. They consist of an engine, an alternator, control panels, and possibly a fuel storage tank.

Prime & Continuous – Rising construction activities and technological advancements in the military sector, boost the growth of the prime & continuous generators. Prime power generators are accessible for a limited number of hours in non-variable load situations, whereas continuous power generators are used in applications at a constant 100% load for an unlimited number of hours.

Peak Shaving – The demand for peak shaving generators is driven due to increasing demand for continuous and reliable electricity during peak hours such as winters and summers. Peak shaving generally refers to leveling out peak use of electricity by industrial and commercial power consumers.

Asia Pacific Generator Sales Market and Top Fuel Types

Top fuel types in Asia Pacific Pacific Generator Sales Market are:

- Diesel

- Gas

Diesel – Ease of availability of diesel as fuel and the long-life span of diesel generator drive the adoption of diesel generators in the Asia Pacific countries. Diesel generators are preferred for emergency power supply in case of power cuts or in places where there is no connection with the power grid. Diesel generators have a long-running life, and the availability of diesel fuel is easy as compared to natural gas. Thus, these diesel generator sets are ideal for long-term (prime) operations with a load range of 70–80%.

Gas – Expanding gas distribution network in emerging economies to drive the growth of the gas segment during the forecast period. Natural gas can be used to power both emergency and portable generators and is regarded as one of the most affordable and effective fuels among non-renewable resources for power generation. Also, natural gas generators are cheaper and more environment-friendly compared to diesel generators.

Key Developments: Asia Pacific Generator Sales Market

- In November 2019, Siemens signed a contract with Hiep Phuoc Power, a utility company in Vietnam, to upgrade its steam power plant in Ho Chi Minh City, Vietnam. The scope of the contract includes three gas turbines, three generators, three heat recovery steam generators, and related electrical equipment.

- In June 2019, Wärtsilä launched a modular solution for use in power plants. The Wärtsilä Modular Block power plant solution is a pre-fabricated, modularly configured, and expandable enclosure for Wärtsilä medium-speed 34SG gas engine generators. Aside from the gas engine generator, the Wärtsilä Modular Block concept’s enclosure also incorporates engine-specific auxiliary units.

- In March 2019, Caterpillar launched Cat XQP30, a 50/60 Hz mobile diesel generator with a prime power rating of 30 kVA. The Cat XQP30 mobile generator includes features such as forklift pockets, dragging points, and a lifting arch for ease of transportation.

[173 Pages Report] The Asia Pacific generator sales market is projected to reach USD 8.8 billion by 2025 from an estimated USD 6.8 billion in 2020, at a CAGR of 5.1% during the forecast period. Increasing demand for uninterrupted and reliable power supply in several industries is driving the Asia Pacific generator sales industry.

By the end-user, the industrial segment is expected to make the most significant contribution to the Asia Pacific generator sales market during the forecast period.

Industrial generators are developed to ensure that there is a continuous supply of power in the event of power failure from the grid systems. The industrial segment includes utilities/power generation, oil & gas, and other industries. Other industries include mining, marine, chemical, military, and manufacturing industries.

Several large industries are in remote locations where the distribution supply is not present. In such situations, industries need gensets to provide prime power and require emergency backup solutions. Adoption of generators during the peak demand period to reduce the demand-supply gap in remote areas, drive the growth of utilities/power generation industry.

By application, the standby segment is expected to grow at the fastest rate during the forecast period.

Standby power generators are used in applications requiring a regular power supply to carry out operations. Their primary function is to supply emergency power for a limited duration during a power outage. Moreover, commercial buildings, such as the telecom industry, hospitals, data centers, and office buildings, require emergency power. Hospitals and data centers consume a large amount of energy and require generator sets that are reliable and ensure continuous power supply in the event of grid failure and power outages.

Also, in the Asia Pacific region, the use of standby diesel generators is high due to the availability of fuel and as it offers continuous power supply during peak hours. For instance, in 2019, Mitsubishi Heavy Industries Engine & Turbocharger Ltd. has delivered two MGS back up diesel generator sets for emergency use at Intercontinental Shanghai Wonderland, in the Songjiang District of Shanghai.

China is expected to be the largest market during the forecast period.

China, India, Japan, Australia, South Korea, Thailand, Laos, Myanmar, Vietnam, Cambodia, Indonesia, Bangladesh, and Pakistan are the major countries considered for the study of the Asia Pacific generator sales market. China is estimated to be the largest market from 2020 to 2025, driven by the development of industrial and real estate sectors in line with increased industrialization and urbanization in the country. According to the National Bureau of Statistics (NBS), the real state development in China mainly focused on the residential and commercial sectors, including office space in 2018. Hence, rising the demand for emergency generators in the market owing to increased power outages during peak hours and non-availability of the grid line, thereby making China one of the largest generator sales markets among all countries.

Key Market Players

The major players in the Asia Pacific generator sales market are Caterpillar (US), Cummins (US), Generac (US), Wärtsilä (Finland), Mitsubishi Heavy Industries (Japan), Rolls-Royce Holdings (UK), Yanmar (Japan), Siemens (Germany), Weichai Group (China), and Sterling & Wilson (India).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Fuel Type, Power Rating, End User, Application, Countries |

|

Geographies covered |

Asia Pacific |

|

Companies covered |

Wärtsilä (Finland), Rolls-Royce Holdings (UK), Cummins (US), Mitsubishi Heavy Industries, Ltd. (Japan), Caterpillar (US), Generac (US), Siemens (Germany), Atlas Copco (Sweden), Weichai Group (China), Wacker Neuson (Germany), Yanmar (Japan), Denyo (Japan), GE (US), ABB (Switzerland), and CG Power and Industrial Solutions (India) |

This research report categorizes the Asia Pacific generator sales market based on fuel type, power rating, end user, application, and region.

Based on fuel type:

- Diesel

- Gas

- Others (Note: Other include LPG, bio-fuel, coal gas, producer gas, and propane gas)

Based on the power rating:

- Below 100kVA

- 100–350 kVA

- 350–1,000 kVA

- 1,000-2,500 kVA

- 2,500-5,000 kVA

- Above 5,000 kVA

Based on the application:

- Standby

- Peak Shaving

- Prime & Continuous

Based on end-user:

- Residential

- Commercial

- IT & Telecom

- Healthcare

- Others (Others include data centers, hotels, shopping complexes, malls, and public infrastructure)

- Industrial

- Utilities/Power Generation

- Oil & Gas

- Others (Others include mining, marine, chemical, military, and manufacturing industries)

Based on the countries:

- China

- India

- Australia

- Japan

- Indonesia

- South Korea

- Thailand

- Laos

- Cambodia

- Myanmar

- Vietnam

- Pakistan

- Bangladesh

Recent Developments

- In November 2019, Siemens signed a contract with Hiep Phuoc Power to upgrade its steam power plant in Ho Chi Minh City, Vietnam. The scope of the contract includes three gas turbines, three generators, three heat recovery steam generators, and related electrical equipment.

- In June 2019, Wärtsilä launched a modular solution in power plants. The Wärtsilä Modular Block power plant solution includes pre-fabricated, modularly configured, and expandable enclosure for Wärtsilä medium-speed 34SG gas engine generators and incorporating engine-specific auxiliary units.

- In May 2019, Caterpillar launched Cat XQP30, a 50/60 Hz mobile diesel generator with a prime power rating of 30 kVA. It includes features such as forklift pockets, dragging points, and a lifting arch for ease of transportation.

Key Questions Addressed by the Report

- The report identifies and addresses the key segments of the Asia Pacific generator sales market, which will help manufacturers and service providers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights regarding the drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make more pivotal strategic decisions.

- The report addresses the market share analysis of key players in the Asia Pacific generator sales market. With the help of this, companies can enhance their revenues in their respective markets.

- The report provides insights about emerging geographies for generator sales, and hence, the entire market ecosystem can gain a competitive advantage.

Frequently Asked Questions (FAQ):

What are the revolutionary technology trends that could be witnessed over the next five years?

Increased focus on the development of green buildings, rising construction activities and technological advancements in military sector in the Asia Pacific region are the trends that could be witnessed in the next five years.

Which of these standby, prime & continuous, and peak shaving generators by application will dominate by 2025?

The standby segment, by application will dominate the Asia Pacific generator sales market by 2025, owing to high demand from the IT & healthcare sectors for uninterrupted and reliable power supply during power outage.

Which of the fuel type segments will have the maximum opportunity to grow during the forecast period?

The gas segment, by fuel type will have the maximum opportunity to grow during the forecast period, due to expanding gas distribution network in emerging economies.

How are the companies implementing organic and strategies to gain increased market share?

As a part of organic strategy, companies are emphasizing on new product launches to increase the marker share and as a part of inorganic strategies, companies are emphasizing on contracts & agreements to increase their share in the Asia Pacific generator sales market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 ASIA PACIFIC GENERATOR SALES MARKET, BY FUEL TYPE: INCLUSIONS VS. EXCLUSIONS

1.2.2 ASIA PACIFIC GENERATOR SALES MARKET, BY POWER RATING: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 SCOPE

2.3 MARKET SIZE ESTIMATION

2.3.1 IDEAL DEMAND-SIDE ANALYSIS

2.3.1.1 Regional analysis

2.3.1.2 Country analysis

2.3.1.3 Assumptions

2.3.1.4 Calculation

2.3.2 SUPPLY-SIDE ANALYSIS

2.3.2.1 Assumptions

2.3.2.2 Calculation

2.3.3 FORECAST

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 33)

3.1 SCENARIO ANALYSIS

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ASIA PACIFIC GENERATOR SALES MARKET

4.2 APAC GENERATOR SALES MARKET, BY APPLICATION

4.3 APAC GENERATOR SALES MARKET, BY POWER RATING

4.4 APAC GENERATOR SALES MARKET, BY END USER

4.5 APAC GENERATOR SALES MARKET, BY FUEL TYPE

4.6 APAC GENERATOR SALES MARKET, BY COUNTRY

4.7 CHINA GENERATOR SALES MARKET, BY FUEL TYPE & END USER, 2019

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Expanding manufacturing sector in Asia Pacific

5.2.1.2 Increasing demand for uninterrupted & reliable power supply in several industries

5.2.2 RESTRAINTS

5.2.2.1 Growing adoption of energy storage technologies and renewable energy sources

5.2.2.2 Significant investments in the upgradation of existing T&D infrastructure

5.2.2.3 Impact of COVID-19 on the power sector & generator sales market

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing requirement of hybrid generators, bi-fuel, and inverter generators

5.2.3.2 Electrification of rural areas in developing countries

5.2.3.3 Growing trend of distributed power generation

5.2.4 CHALLENGES

5.2.4.1 Stringent government regulations associated with generators

6 ASIA PACIFIC GENERATOR SALES MARKET, BY END USER (Page No. - 54)

6.1 INTRODUCTION

6.2 INDUSTRIAL

6.2.1 UTILITIES/POWER GENERATION

6.2.1.1 Adoption of generators during the peak demand period to reduce the demand–supply gap in remote areas to drive the growth of utilities/power generation segment

6.2.2 OIL & GAS

6.2.2.1 Installation of modern drilling machines for exploration & production activities to drive the demand for heavy-duty generator sets

6.2.3 OTHER INDUSTRIAL

6.3 COMMERCIAL

6.3.1 HEALTHCARE

6.3.1.1 Need for uninterrupted power supply in the healthcare sector to drive the demand for backup generators

6.3.2 IT & TELECOM

6.3.2.1 Increasing demand for generators in the IT & telecom sector for the successful commencement of business operations

6.3.3 OTHERS

6.4 RESIDENTIAL

6.4.1 EXPANDING REAL ESTATE SECTOR

7 ASIA PACIFIC GENERATOR SALES MARKET, BY POWER RATING (Page No. - 62)

7.1 INTRODUCTION

7.2 BELOW 100 KVA

7.2.1 INCREASING DEMAND FOR CONTINUOUS POWER SUPPLY FROM COMMERCIAL END USERS AND HOMEOWNERS

7.3 100–350 KVA

7.3.1 INCREASING INVESTMENTS IN CONSTRUCTION ACTIVITIES

7.4 350–1,000 KVA

7.4.1 INCREASING DEMAND IN THE OIL & GAS AND MINING INDUSTRIES

7.5 1,000–2,500 KVA

7.5.1 HIGH DEMAND IN THE CHEMICAL & COMMERCIAL SECTORS TO DRIVE THE GROWTH OF 1,000–2,500 KVA SEGMENT

7.6 2,500–5,000 KVA

7.6.1 HIGH DEMAND IN THE POWER GENERATION SECTOR TO DRIVE THE GROWTH OF 2,500–5,000 KVA SEGMENT

7.7 ABOVE 5,000 KVA

7.7.1 INCREASING DEMAND FOR UNINTERRUPTED POWER SUPPLY IN THE MARINE SECTOR

8 ASIA PACIFIC GENERATOR SALES MARKET, BY APPLICATION (Page No. - 71)

8.1 INTRODUCTION

8.2 STANDBY

8.2.1 POWER OUTAGES HAVE INCREASED THE DEMAND FOR STANDBY GENERATORS IN HOSPITALS AND DATA CENTERS

8.3 PRIME & CONTINUOUS

8.3.1 RISING CONSTRUCTION ACTIVITIES AND TECHNOLOGICAL ADVANCEMENTS IN THE MILITARY SECTOR TO BOOST THE GROWTH OF THE PRIME & CONTINUOUS GENERATOR SEGMENT

8.4 PEAK SHAVING

8.4.1 INCREASING DEMAND FOR PEAK SHAVING GENERATORS IN SUMMER AND WINTER SEASONS

9 ASIA PACIFIC GENERATOR SALES MARKET, BY FUEL TYPE (Page No. - 76)

9.1 INTRODUCTION

9.2 DIESEL

9.2.1 EASE OF AVAILABILITY OF DIESEL AS FUEL AND THE LONG-LIFE SPAN OF DIESEL GENERATOR DRIVE THEIR ADOPTION IN THE ASIA PACIFIC COUNTRIES

9.3 GAS

9.3.1 EXPANDING GAS DISTRIBUTION NETWORK IN EMERGING ECONOMIES TO DRIVE THE GROWTH OF THE SEGMENT DURING THE FORECAST PERIOD

9.4 OTHERS

10 ASIA PACIFIC GENERATOR SALES MARKET, BY COUNTRY (Page No. - 82)

10.1 INTRODUCTION

10.2 SCENARIO ANALYSIS

10.2.1 OPTIMISTIC SCENARIO

10.2.2 REALISTIC SCENARIO

10.2.3 PESSIMISTIC SCENARIO

10.3 CHINA

10.3.1 EXPANDING INDUSTRIAL AND REAL ESTATE SECTORS

10.3.2 BY END USER

10.3.3 BY POWER RATING

10.3.4 BY APPLICATION

10.3.5 BY FUEL TYPE

10.4 INDIA

10.4.1 HIGH FOCUS ON THE DEVELOPMENT OF GREEN BUILDINGS TO DRIVE THE GROWTH OF GENERATOR SALES MARKET IN INDIA

10.4.2 BY END USER

10.4.3 BY POWER RATING

10.4.4 BY APPLICATION

10.4.5 BY FUEL TYPE

10.5 AUSTRALIA

10.5.1 INCREASING DEMAND IN THE MINING AND CONSTRUCTION INDUSTRIES

10.5.2 BY END USER

10.5.3 BY POWER RATING

10.5.4 BY APPLICATION

10.5.5 BY FUEL TYPE

10.6 JAPAN

10.6.1 REPLACEMENT OF AGED POWER GENERATION INFRASTRUCTURE

10.6.2 BY END USER

10.6.3 BY POWER RATING

10.6.4 BY APPLICATION

10.6.5 BY FUEL TYPE

10.7 INDONESIA

10.7.1 INCREASING AGRICULTURAL ACTIVITIES AND EXPANDING PROCESSING INDUSTRY TO BOOST THE DEMAND FOR GENERATORS

10.7.2 BY END USER

10.7.3 BY POWER RATING

10.7.4 BY APPLICATION

10.7.5 BY FUEL TYPE

10.8 SOUTH KOREA

10.8.1 INCREASING MANUFACTURING OF ELECTRONICS AND SEMICONDUCTORS IN SOUTH KOREA TO DRIVE THE DEMAND FOR GENERATORS

10.8.2 BY END USER

10.8.3 BY POWER RATING

10.8.4 BY APPLICATION

10.8.5 BY FUEL TYPE

10.9 THAILAND

10.9.1 GROWING MANUFACTURING SECTOR DUE TO RAPID INDUSTRIALIZATION TO DRIVE THE GENERATOR SALES MARKET IN THAILAND

10.9.2 BY END USER

10.9.3 BY POWER RATING

10.9.4 BY APPLICATION

10.9.5 BY FUEL TYPE

10.10 VIETNAM

10.10.1 INCREASING INVESTMENTS IN THE HEALTHCARE INDUSTRY AND FREQUENT BLACKOUTS AND POWER OUTAGES TO DRIVE THE DEMAND FOR GENERATOR SETS IN VIETNAM

10.10.2 BY END USER

10.10.3 BY POWER RATING

10.10.4 BY APPLICATION

10.10.5 BY FUEL TYPE

10.11 PAKISTAN

10.11.1 LACK OF TRANSMISSION GRID NETWORK TO BOOST THE DEMAND FOR GENERATORS

10.11.2 BY END USER

10.11.3 BY POWER RATING

10.11.4 BY APPLICATION

10.11.5 BY FUEL TYPE

10.12 BANGLADESH

10.12.1 INFRASTRUCTURE DEVELOPMENT TO DRIVE THE DEMAND FOR GENERATORS

10.12.2 BY END USER

10.12.3 BY POWER RATING

10.12.4 BY APPLICATION

10.12.5 BY FUEL TYPE

10.13 CAMBODIA

10.13.1 RAPID ECONOMIC GROWTH AND TARIFF REDUCTION POLICY ARE DRIVING THE GROWTH OF GENERATOR SALES MARKET IN CAMBODIA

10.13.2 BY END USER

10.13.3 BY POWER RATING

10.13.4 BY APPLICATION

10.13.5 BY FUEL TYPE

10.14 MYANMAR

10.14.1 FAVORABLE GOVERNMENT INITIATIVES AND ECONOMIC REFORMS IN MYANMAR TO DRIVE THE GROWTH OF GENERATOR SALES MARKET

10.14.2 BY END USER

10.14.3 BY POWER RATING

10.14.4 BY APPLICATION

10.14.5 BY FUEL TYPE

10.15 LAOS

10.15.1 DEVELOPMENT OF GREEN BUILDINGS TO DRIVE GROWTH OF THE MARKET FOR GENERATOR SALES IN THE COUNTRY

10.15.2 BY END USER

10.15.3 BY POWER RATING

10.15.4 BY APPLICATION

10.15.5 BY FUEL TYPE

11 COMPETITIVE LANDSCAPE (Page No. - 116)

11.1 OVERVIEW

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC DIFFERENTIATORS

11.2.4 EMERGING COMPANIES

11.3 INDUSTRY CONCENTRATION, 2019

11.4 COMPETITIVE SCENARIO

11.4.1 NEW PRODUCT LAUNCHES

11.4.2 CONTRACTS & AGREEMENTS

12 COMPANY PROFILES (Page No. - 121)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 WÄRTSILÄ

12.2 ROLLS-ROYCE HOLDINGS

12.3 CUMMINS

12.4 MITSUBISHI HEAVY INDUSTRIES, LTD.

12.5 CATERPILLAR

12.6 GENERAC

12.7 SIEMENS

12.8 ATLAS COPCO

12.9 WEICHAI GROUP

12.10 WACKER NEUSON

12.11 YANMAR

12.12 DENYO

12.13 GE

12.14 ABB

12.15 CG POWER AND INDUSTRIAL SOLUTION

12.16 J.C. BAMFORD EXCAVATORS

12.17 KOHLER

12.18 STERLING & WILSON

12.19 SIAM TELEMACH

12.20 HUU TOAN CORPORATION

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 166)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

LIST OF TABLES (82 TABLES)

TABLE 1 ASIA PACIFIC GENERATOR SALES MARKET: PLAYERS/COMPANIES CONNECTED

TABLE 2 APAC GENERATOR SALES MARKET SNAPSHOT

TABLE 3 RENEWABLE ENERGY - TOTAL CUMULATIVE INSTALLED CAPACITY (MW) (2016–2019)

TABLE 4 T&D INFRASTRUCTURE EXPANSION PLANS

TABLE 5 APAC GENERATOR SALES MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 6 INDUSTRIAL: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 7 INDUSTRIAL: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 8 COMMERCIAL: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 COMMERCIAL: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 10 RESIDENTIAL: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 11 APAC GENERATOR SALES MARKET SIZE, BY POWER RATING, 2018–2025 (’000 UNITS)

TABLE 12 APAC GENERATOR SALES MARKET SIZE, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 13 BELOW 100 KVA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 100–300 KVA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 350–1,000 KVA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 1,000–2,500 KVA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 2,500–5,000 KVA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 ABOVE 5,000 KVA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 ASIA PACIFIC GENERATOR SALES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 20 STANDBY: APAC GENERATOR SALES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 PRIME & CONTINUOUS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 PEAK SHAVING: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 APAC GENERATOR SALES MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 24 DIESEL: ARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 GAS: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 OTHERS: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 OPTIMISTIC SCENARIO: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 REALISTIC SCENARIO: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 PESSIMISTIC SCENARIO: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 31 CHINA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 32 CHINA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 33 CHINA: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 34 INDIA: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 35 INDIA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 36 INDIA: APAC GENERATOR SALES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 37 INDIA: APAC GENERATOR SALES MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 38 AUSTRALIA: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 39 AUSTRALIA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 40 AUSTRALIA: APAC GENERATOR SALES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 41 AUSTRALIA: APAC GENERATOR SALES MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 42 JAPAN: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 43 JAPAN: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 44 JAPAN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 JAPAN: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 46 INDONESIA: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 47 INDONESIA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 48 INDONESIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 49 INDONESIA: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 50 SOUTH KOREA: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 51 SOUTH KOREA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 52 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 SOUTH KOREA: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 54 THAILAND: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 55 THAILAND: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 56 THAILAND: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 57 THAILAND: APAC GENERATOR SALES MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 58 VIETNAM: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 59 VIETNAM: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 60 VIETNAM: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 VIETNAM: APAC GENERATOR SALES MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 62 PAKISTAN: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 63 PAKISTAN: SALES MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 64 PAKISTAN: APAC GENERATOR SALES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 65 PAKISTAN: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 66 BANGLADESH: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 67 BANGLADESH: APAC GENERATOR SALES MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 68 BANGLADESH: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 BANGLADESH: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 70 CAMBODIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 71 CAMBODIA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 72 CAMBODIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 CAMBODIA: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 74 MYANMAR: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 75 MYANMAR: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

TABLE 76 MYANMAR: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 MYANMAR: APAC GENERATOR SALES MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 78 LAOS: APAC GENERATOR SALES MARKET, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 79 LAOS: MARKET, BY POWER RATING, 2018–2025 (USD THOUSAND)

TABLE 80 LAOS: MARKET, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 81 LAOS: MARKET SIZE, BY FUEL TYPE, 2018–2025 (USD THOUSAND)

TABLE 82 DEVELOPMENTS OF KEY PLAYERS IN THE MARKET, 2017–2019

LIST OF FIGURES (50 FIGURES)

FIGURE 1 ASIA PACIFIC GENERATOR SALES MARKET: RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY: ILLUSTRATION OF ASIA PACIFIC GENERATOR SALES COMPANY REVENUE ESTIMATION (2019)

FIGURE 3 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

FIGURE 4 DATA TRIANGULATION METHODOLOGY

FIGURE 5 SCENARIO ANALYSIS: APAC GENERATOR SALES MARKET, 2018–2025

FIGURE 6 CHINA DOMINATED THE MARKET IN 2019

FIGURE 7 GAS SEGMENT IS EXPECTED TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 8 300–1,000 KVA SEGMENT IS EXPECTED TO DOMINATE THE APAC GENERATOR SALES MARKET DURING THE FORECAST PERIOD

FIGURE 9 INDUSTRIAL SEGMENT IS EXPECTED TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 10 STANDBY GENERATORS SEGMENT IS EXPECTED TO LEAD THE APAC GENERATOR SALES MARKET DURING THE FORECAST PERIOD

FIGURE 11 INCREASING DEMAND FOR UNINTERRUPTED AND RELIABLE POWER SUPPLY TO DRIVE THE GROWTH OF GENERATOR SALES MARKET, 2020–2025

FIGURE 12 STANDBY GENERATORS SEGMENT DOMINATED THE MARKET, BY APPLICATION, IN 2019

FIGURE 13 350–1,000 KVA SEGMENT DOMINATED THE MARKET IN 2019

FIGURE 14 INDUSTRIAL SEGMENT IS EXPECTED TO DOMINATE THE MARKET BY 2025

FIGURE 15 DIESEL SEGMENT DOMINATED THE APAC GENERATOR SALES MARKET IN 2019

FIGURE 16 CAMBODIA IS EXPECTED TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 17 DIESEL AND INDUSTRIAL SEGMENTS DOMINATED THE CHINESE GENERATOR SALES MARKET IN 2019

FIGURE 18 APAC GENERATOR SALES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 19 NUMBER OF POWER OUTAGES IN ASIA PACIFIC, 2019

FIGURE 20 COVID-19 PROPAGATION: ASIA PACIFIC COUNTRIES

FIGURE 21 INDUSTRIAL IS EXPECTED TO BE THE LEADING SEGMENT OF THE APAC GENERATOR SALES MARKET DURING THE FORECAST PERIOD

FIGURE 22 2,500–5,000 KVA POWER RATING SEGMENT IS EXPECTED TO GROW AT A SIGNIFICANT RATE FROM 2020 TO 2025

FIGURE 23 STANDBY GENERATORS SEGMENT IS EXPECTED TO LEAD THE APAC GENERATOR SALES MARKET FROM 2020 TO 2025

FIGURE 24 DIESEL FUEL GENERATOR IS EXPECTED TO BE THE DOMINANT SEGMENT OF APAC GENERATOR SALES MARKET FROM 2020 TO 2025

FIGURE 25 CAMBODIA IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT, 2019

FIGURE 27 CRITERIA IMPACTING THE ECONOMY

FIGURE 28 KEY DEVELOPMENTS IN THE APAC GENERATOR SALES MARKET, 2017 TO NOVEMBER 2019

FIGURE 29 ASIA PACIFIC GENERATOR SALES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 30 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

FIGURE 31 WÄRTSILÄ: COMPANY SNAPSHOT

FIGURE 32 WÄRTSILÄ: SWOT ANALYSIS

FIGURE 33 ROLLS-ROYCE HOLDINGS: COMPANY SNAPSHOT

FIGURE 34 ROLLS-ROYCE HOLDINGS: SWOT ANALYSIS

FIGURE 35 CUMMINS: COMPANY SNAPSHOT

FIGURE 36 CUMMINS: SWOT ANALYSIS

FIGURE 37 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 38 MITSUBISHI HEAVY INDUSTRIES, LTD.: SWOT ANALYSIS

FIGURE 39 CATERPILLAR: COMPANY SNAPSHOT

FIGURE 40 CATERPILLAR: SWOT ANALYSIS

FIGURE 41 GENERAC: COMPANY SNAPSHOT

FIGURE 42 SIEMENS: COMPANY SNAPSHOT

FIGURE 43 ATLAS COPCO: COMPANY SNAPSHOT

FIGURE 44 WEICHAI GROUP: COMPANY SNAPSHOT

FIGURE 45 WACKER NEUSON: COMPANY SNAPSHOT

FIGURE 46 YANMAR: COMPANY SNAPSHOT

FIGURE 47 DENYO: COMPANY SNAPSHOT

FIGURE 48 GE: COMPANY SNAPSHOT

FIGURE 49 ABB: COMPANY SNAPSHOT

FIGURE 50 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY SNAPSHOT

This study involved four major activities in estimating the current size of the Asia Pacific generator sales market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to determine the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the Asia Pacific generator sales market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

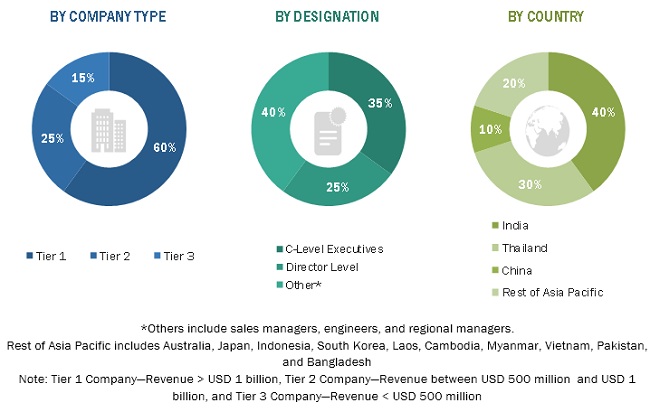

The Asia Pacific generator sales market comprises several stakeholders, such as end-product manufacturers, raw material providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as residential, commercial, and industrial. The supply-side is characterized by raw material providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents are given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the Asia Pacific generator sales market and its dependent submarkets. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market share has been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the end-use industries.

Report Objectives

- To define, describe, segment, and forecast the Asia Pacific generator sales market based on fuel type, end user, power rating, application, and countries.

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions of each segment to the market.

- To analyze opportunities in the market for stakeholders and describe the competitive landscape of the market

- To forecast the growth of the market with respect to countries such as China, India, Australia, Japan, Indonesia, South Korea, Thailand, Laos, Cambodia, Myanmar, Vietnam, Pakistan, and Bangladesh.

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments in the Asia Pacific generator sales market, such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the Asia Pacific generator sales market report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Asia Pacific Generator Sales Market