Transradial Access Market by Product (Catheters, Guidewires, Sheath and Sheath Introducers), Application (Administration of Medicine and Administration of fluids), End User (Hospitals, Clinics & Ambulatory Centres) - Global Forecast 2022

[142 Pages Report] The global transradial access market is projected to reach USD 2.18 Billion by 2022 from USD 1.44 Billion in 2016, at a CAGR of 7.5% during the forecast period. Base year considered for the report is 2016 and the forecast period is 2017–2022.

Objectives of the Study:

- To define, describe, and forecast the global transradial access market by product, application, end user, and region

- To provide detailed information about key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of market segments for North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze the market structure, profile key players of the global transradial access market, and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, expansions, acquisitions, and product launches & approvals in the market

Research Methodology

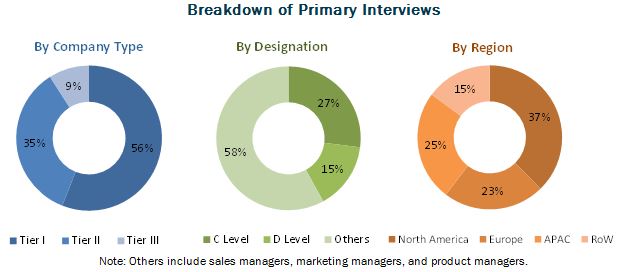

Top-down and bottom-up approaches were used to validate the size of the global transradial access market and estimate the size of other dependent submarkets. Various secondary sources such as World Health Organization (WHO), Central Intelligence Agency (CIA), Centers for Disease Control and Prevention (CDC), European Renal Care Providers Association (ERCPA), Society for Cardiovascular Angiography and Interventions (SCAI), American Heart Association (AHA), Canadian Association of Interventional Cardiology (CAIC), Asian Pacific Society of Interventional Cardiology (APSIC), American College of Cardiology, directories, industry journals, databases, and annual reports of companies have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global transradial access market are Becton, Dickinson and Company (US) and Terumo Corporation (Japan).

Target Audience:

- Suppliers and distributors of transradial access devices

- Research institutes

- Vendors/service providers

Scope of the Report:

The research report categorizes the transradial access market into the following segments and subsegments:

By Product

- Catheters

- Guidewires

- Sheaths & Sheath Introducers

- Accessories

By Application

- Drug Administration

- Fluid & Nutrition Administration

- Blood Transfusion

- Diagnostics & Testing

By End User

- Hospitals

- Clinics & Ambulatory Care Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe (RoE)

-

APAC

- China

- Japan

- India

- RoAPAC

-

Rest of the World

- LATAM

- MEA

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The transradial access market is projected to reach USD 2.18 Billion by 2022 from USD 1.52 Billion in 2017, at a CAGR of 7.5%. The increasing prevalence of obesity, growing preference for interventional procedures using radial artery access, technological advancements, rising prevalence of lifestyle diseases, and increasing number of chemotherapy procedures globally are factors expected to drive the market.

By product, transradial access market is segmented into catheters, guidewires, sheaths and sheath introducers, and accessories (needles and cannulas). Catheters market is expected to grow with highest growth rate owing to factors such as the increasing incidence of lifestyle-related diseases such as CVD, obesity, and diabetes and the growing number of interventional and angiography procedures.

On the basis of application, the transradial access market is segmented as drug administration, fluid and nutrition administration, blood transfusion, and diagnostics & testing. Drug administration market is estimated to grow with highest CAGR owing to factors such as high usage of radial access devices for drug administration for treatment of infections and cancer.

The transradial access market is segmented on the basis of end users into hospitals, clinics and ambulatory care centers, and other end users (nursing homes, laboratories, diagnostic & imaging centers, and Home Healthcare agencies). The hospitals segment is expected to grow with highest growth rate owing to the large number of transradial procedures performed in hospital settings.

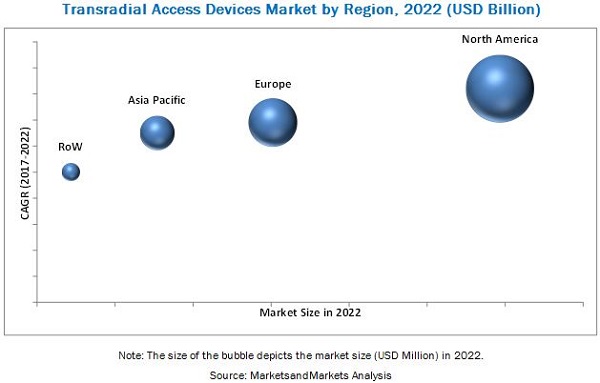

By geography, transradial access market is segmented as North America, Europe, Asia Pacific and RoW. North America, market is likely to grow with highest growth rate owing to factors such as growing prevalence of CVDs, rising number of conferences and workshops, the large number of cancer patients, and increase in research and clinical trials for vascular access devices

Factors such as a dearth of skilled professionals and the risks associated with radial access devices are anticipated to limit the growth of the market to a certain extent.

The prominent players in the Transradial Access Market include Becton, Dickinson and Company (US) and Terumo Corporation (Japan), Teleflex Incorporated (US), Smiths Group Plc (UK), Edward Lifesciences Corporation (US), Medtronic (Ireland), Merit Medical System, Inc. (US), Boston Scientific (US), NIPRO Medical Corporation (US), AngioDynamics (US), Ameco Medical Industries (Egypt), and OSCOR Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Breakdown of Primary

2.1.2.2 Key Data From Primary Sources

2.2 Market Size Estimation Methodology

2.3 Market Data Validation and Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Transradial Access Devices: Market Overview

4.2 Market, By Product (2017)

4.3 Market, By Application, 2017 vs 2022

4.4 Geographical Snapshot of the Transradial Access Market

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Preference for Interventional Procedures Using Radial Artery Access

5.2.1.2 Growing Prevalence of Lifestyle Diseases

5.2.1.3 Rising Prevalence of Obesity

5.2.1.4 Increasing Number of Chemotherapy Procedures

5.2.1.5 Growing Use of Radial Access Devices in Pediatric Patients

5.2.2 Restraints

5.2.2.1 High Costs Involved in the Placement and Maintenance of Vascular Access Devices

5.2.2.2 Product Recalls and Failures

5.2.3 Opportunities

5.2.3.1 Technological Advancements

5.2.3.2 Emerging Markets

5.2.4 Challenges

5.2.4.1 Dearth of Highly Skilled Professionals

5.2.4.2 Risks Associated With Radial Access Devices

6 Transradial Access Market, By Product (Page No. - 37)

6.1 Introduction

6.2 Catheters

6.3 Guidewires

6.4 Sheaths and Sheath Introducers

6.5 Accessories

7 Transradial Access Market, By Application (Page No. - 44)

7.1 Introduction

7.2 Drug Administration

7.3 Fluid and Nutrition Administration

7.4 Blood Transfusion

7.5 Diagnostics and Testing

8 Transradial Access Market, By End User (Page No. - 51)

8.1 Introduction

8.2 Hospitals

8.3 Clinics and Ambulatory Care Centers

8.4 Other End Users

9 Transradial Access Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Incidence of Cancer

9.2.1.2 Rising Burden of CVDS

9.2.1.3 Increasing Number of Conferences, Symposia, and Workshops

9.2.2 Canada

9.2.2.1 Increasing Incidence of CVDS

9.2.2.2 Increase in Cancer Incidence

9.3 Europe

9.3.1 Increasing Focus of Market Players in Europe

9.3.2 Rising Geriatric Population

9.3.3 Increasing Prevalence of End-Stage Renal Disease (ESRD)

9.3.4 Growing Prevalence of Cancer in Germany, France, and Italy

9.3.5 Uk

9.3.5.1 Rising Prevalence of CVDS With Growth in the Obese Population

9.3.5.2 Growing Prevalence of Cancer in the UK

9.3.6 Germany

9.3.6.1 Increase in the Prevalence of Target Diseases Coupled With Strengthening of the Healthcare Infrastructure to Propel Market Growth

9.3.6.2 Increasing Number of Research Studies on Vascular Access Devices in Germany

9.3.7 France

9.3.7.1 Growth in the Geriatric Population

9.3.8 RoE

9.3.8.1 Improving Healthcare Infrastructure in Russia

9.3.8.2 Increasing Incidence of Cancer in the RoE

9.3.8.3 Growth in the Healthcare Sector & Rising Medical Tourism in Turkey

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Increasing Prevalence of Chronic Kidney Disease in Japan

9.4.1.2 Rapid Growth in the Geriatric Population

9.4.2 China

9.4.2.1 Favorable Government Initiatives

9.4.2.2 Increasing Focus of Market Players on China

9.4.3 India

9.4.3.1 Increasing Incidence of Cancer

9.4.3.2 High Burden of CVDS in India

9.4.4 Rest of APAC

9.4.4.1 High Diabetes Prevalence and Rising Incidence of CVDS in Pacific Countries

9.5 Rest of the World

9.5.1 Latin America

9.5.1.1 High Prevalence of Obesity in Latin America

9.5.2 Middle East & Africa

9.5.2.1 Increasing Geriatric Population & Rise in Age-Related Disorders in the Middle East

9.5.2.2 Strengthening of the Healthcare Infrastructure in the Middle East

9.5.2.3 Rising Prevalence of Cancer in Africa

10 Competitive Landscape (Page No. - 99)

10.1 Introduction

10.2 Comparative Assessment of Key Players in the Transradial Access Market

10.3 Market Share Analysis

10.3.1 Introduction

10.3.2 Becton, Dickinson and Company

10.3.3 Terumo Corporation

10.4 Competitive Situation and Trends

10.4.1 Product Launches and Approvals

10.4.2 Acquisitions

10.4.3 Expansions

10.4.4 Agreements and Collaborations

11 Company Profiles (Page No. - 107)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Becton, Dickinson and Company

11.2 Terumo Corporation

11.3 Teleflex Incorporated

11.4 Smiths Medical

11.5 Medtronic

11.6 Edward Lifesciences Corporation

11.7 Merit Medical Systems

11.8 Boston Scientific Corporation

11.9 Nipro Medical Corporation

11.10 Angiodynamics, Inc.

11.11 Ameco Medical

11.12 Oscor Inc.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 135)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (78 Tables)

Table 1 Market, By Product, 2015–2022 (USD Million)

Table 2 Market, By Country, 2015–2022 (USD Million)

Table 3 Market for Catheters, By Country, 2015–2022 (USD Million)

Table 4 Market for Guidewires, By Country, 2015–2022 (USD Million)

Table 5 Market for Sheaths and Sheath Introducers, By Country, 2015–2022 (USD Million)

Table 6 Market for Accessories, By Country, 2015–2022 (USD Million)

Table 7 Market, By Application, 2015–2022 (USD Million)

Table 8 Market, By Country, 2015–2022 (USD Million)

Table 9 Market for Drug Administration, By Country, 2015–2022 (USD Million)

Table 10 Market for Fluid and Nutrition Administration, By Country, 2015–2022 (USD Million)

Table 11 Market for Blood Transfusion, By Country, 2015–2022 (USD Million)

Table 12 Market for Diagnostics and Testing, By Country, 2015–2022 (USD Million)

Table 13 Market, By End User, 2015–2022 (USD Million)

Table 14 Transradial Access Market, By Country, 2015–2022 (USD Million)

Table 15 Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 16 Market for Clinics and Ambulatory Care Centers, By Country, 2015–2022 (USD Million)

Table 17 Market for Other End Users, By Country, 2015–2022 (USD Million)

Table 18 Market, By Region, 2015–2022 (USD Million)

Table 19 Market, By Country/Region, 2015–2022 (USD Million)

Table 20 North America: Transradial Access Market, By Country, 2015–2022 (USD Million)

Table 21 North America: Market, By Product, 2015–2022 (USD Million)

Table 22 North America: Market, By Application, 2015–2022 (USD Million)

Table 23 North America: Market, By End User, 2015–2022 (USD Million)

Table 24 Indicative List of Recent Events in the Us

Table 25 US: Market, By Product, 2015–2022 (USD Million)

Table 26 US: Market, By Application, 2015–2022 (USD Million)

Table 27 US: Market, By End User, 2015–2022 (USD Million)

Table 28 Canada: Market, By Product, 2015–2022 (USD Million)

Table 29 Canada: Market, By Application, 2015–2022 (USD Million)

Table 30 Canada: Market, By End User, 2015–2022 (USD Million)

Table 31 Geriatric Population in European Countries (As A Percentage of the Total Population)

Table 32 Europe: Market, By Country, 2015–2022 (USD Million)

Table 33 Europe: Market, By Product, 2015–2022 (USD Million)

Table 34 Europe: Market, By Application, 2015–2022 (USD Million)

Table 35 Europe: Market, By End User, 2015–2022 (USD Million)

Table 36 UK: Market, By Product, 2015–2022 (USD Million)

Table 37 UK: Market, By Application, 2015–2022 (USD Million)

Table 38 UK: Market, By End User, 2015–2022 (USD Million)

Table 39 Germany: Market, By Product, 2015–2022 (USD Million)

Table 40 Germany: Transradial Access Market, By Application, 2015–2022 (USD Million)

Table 41 Germany: Market, By End User, 2015–2022 (USD Million)

Table 42 France: Market, By Product, 2015–2022 (USD Million)

Table 43 France: Market, By Application, 2015–2022 (USD Million)

Table 44 France: Market, By End User, 2015–2022 (USD Million)

Table 45 RoE: Market, By Product, 2015–2022 (USD Million)

Table 46 RoE: Market, By Application, 2015–2022 (USD Million)

Table 47 RoE: Market, By End User, 2015–2022 (USD Million)

Table 48 Asia Pacific: Market, By Country, 2015–2022 (USD Million)

Table 49 Asia Pacific: Market, By Product, 2015–2022 (USD Million)

Table 50 Asia Pacific: Market, By Application, 2015–2022 (USD Million)

Table 51 Asia Pacific: Market, By End User, 2015–2022 (USD Million)

Table 52 Japan: Market, By Product, 2015–2022 (USD Million)

Table 53 Japan: Market, By Application, 2015–2022 (USD Million)

Table 54 Japan: Market, By End User, 2015–2022 (USD Million)

Table 55 China: Market, By Product, 2015–2022 (USD Million)

Table 56 China: Market, By Application, 2015–2022 (USD Million)

Table 57 China: Market, By End User, 2015–2022 (USD Million)

Table 58 India: Market, By Product, 2015–2022 (USD Million)

Table 59 India: Market, By Application, 2015–2022 (USD Million)

Table 60 India: Market, By End User, 2015–2022 (USD Million)

Table 61 Number of Diabetes Cases in RoAPAC Countries, 2000 vs 2030

Table 62 RoAPAC: Transradial Access Market, By Product, 2015–2022 (USD Million)

Table 63 RoAPAC: Market, By Application, 2015–2022 (USD Million)

Table 64 RoAPAC: Market, By End User, 2015–2022 (USD Million)

Table 65 RoW: Market, By Region, 2015–2022 (USD Million)

Table 66 RoW: Market, By Product, 2015–2022 (USD Million)

Table 67 RoW: Market, By Application, 2015–2022 (USD Million)

Table 68 RoW: Transradial Access Market, By End User, 2015–2022 (USD Million)

Table 69 Latin America: Market, By Product, 2015–2022 (USD Million)

Table 70 Latin America: Market, By Application, 2015–2022 (USD Million)

Table 71 Latin America: Market, By End User, 2015–2022 (USD Million)

Table 72 Middle East & Africa: Market, By Product, 2015–2022 (USD Million)

Table 73 Middle East & Africa: Market, By Application, 2015–2022 (USD Million)

Table 74 Middle East & Africa: Market, By End User, 2015–2022 (USD Million)

Table 75 Product Launches and Approvals (201-2018)

Table 76 Acquisitions, By Company (2014–2018)

Table 77 Expansions, By Company (2014–2018)

Table 78 Agreements, Collaborations, and Partnerships, By Company (2014–2018)

List of Figures (45 Figures)

Figure 1 Transradial Access Market Segmentation

Figure 2 Transradial Access Market: Research Methodology Steps

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Transradial Access Market Analysis, By Product (2017–2022)

Figure 9 Transradial Access Market, By Application, 2017 vs 2022

Figure 10 Transradial Access Market, By End User, 2017 vs 2022

Figure 11 North America to Witness Highest Growth During the Forecast Period

Figure 12 Increasing Number of Interventional Procedures and Growing Prevalence of Lifestyle Diseases—The Key Growth Drivers of the Transradial Access Market

Figure 13 Catheters to Account for the Largest Market Share in 2017

Figure 14 Drug Administration to Dominate the Transradial Access Market, By Application

Figure 15 US to Register the Highest CAGR in the Forecast Period

Figure 16 Transradial Access Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Catheters to Continue to Dominate the Transradial Access Market By 2022

Figure 18 Drug Administration Application Segment Dominated the Transradial Access Market in 2017

Figure 19 Hospitals Dominated the Transradial Access Market in 2017

Figure 20 Transradial Access Market, By Region, 2017 vs 2022 (USD Million)

Figure 21 Rising Prevalence of Cancer—A Major Factor Driving Market Growth in North America

Figure 22 North America: Transradial Access Market Snapshot

Figure 23 Europe: Number of New Cancer Cases, By Country

Figure 24 Europe: Transradial Access Market Snapshot

Figure 25 UK: Cancer Cases, By Type (2016)

Figure 26 Number of New Cancer Cases, By Type

Figure 27 Asia Pacific: Transradial Access Market Snapshot

Figure 28 RoW: Transradial Access Market Snapshot

Figure 29 Key Developments By Leading Players in the Transradial Access Market (2014-2018)

Figure 30 Market Share Analysis, By Key Player, 2016

Figure 31 Product Development Was the Key Growth Strategy Adopted By Market Players in the Transradial Access Market

Figure 32 Product Launches and Approvals, By Company (2014-2018)

Figure 33 Acquisitions, By Company (2014–2018)

Figure 34 Expansions, By Company (2014–2018)

Figure 35 Agreements and Collaborations, By Company (2014–2018)

Figure 36 Becton, Dickinson and Company: Company Snapshot (2017)

Figure 37 Terumo Corporation: Company Snapshot (2016)

Figure 38 Teleflex Incorporated Company Snapshot (2016)

Figure 39 Smiths Group PLC: Company Snapshot (2017)

Figure 40 Medtronic: Company Snapshot (2017)

Figure 41 Edward Lifesciences Corporation: Company Snapshot (2016)

Figure 42 Merit Medical Systems: Company Snapshot (2016)

Figure 43 Boston Scientific Corporation: Company Snapshot (2016)

Figure 44 Nipro Medical Corporation Company Snapshot (2017)

Figure 45 Angiodynamics Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Transradial Access Market