Two Part Adhesive Market by Resin Type (Polyurethane, Epoxy, MMA, Silicone, Others), by Application (Automotive, Construction, Electronics, Aerospace & Others) & by Region (North America, Europe, Asia-Pacific & Others) - Global Forecast to 2020

[141 Pages Report] The global two part adhesive market (20152020) is estimated to reach USD 6.23 Billion by 2020 at a CAGR of 6.5%. The report covers the two part adhesive market by resin type, such as polyurethane, epoxy, MMA, silicone, and others; by application, such as automotive, construction, electronic, aerospace, and others; and by region, namely, North America, Europe, Asia-Pacific, and RoW. Base year considered for the study is 2014 while the forecast period is between 2015 and 2020. The two part adhesive market is driven by rise in demand of adhesives in bonding different plastics, composites, and different lightweight materials in the automotive, construction, & aviation industry.

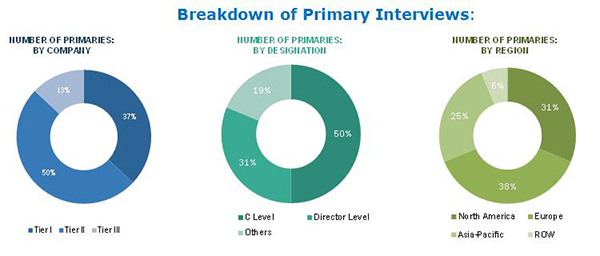

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets in the overall two part adhesive market. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, The Adhesive and Sealant Council (ASC), Association of European Adhesives and Sealants (FEICA), Adhesive & Sealant Portal, British Adhesives and Sealants Association, Adhesives and Sealants Manufacturers Association of Canada, China National Adhesives Industry Association, The European Adhesive Tape Industry Network, Japan Adhesive Industry Association (JAIA), China Adhesives and Tape Industry Association (CATIA), Taiwan Synthetic Resins & Adhesives Industry Association (TSRAIA), Korea Adhesive Industry Association (KAIA), and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the two part adhesive market.

To know about the assumptions considered for the study, download the pdf brochure

Two part adhesive are manufactured from various raw materials such as resins, binders, additives, wax, tackifier, and other ingredients. The raw material available in the market are supplied by major companies such as Dow Chemical Company (U.S.), Eastman Chemical Company (U.S.), Evonik Industries (Germany), Exxonmobil Chemical (U.S.) and others to the two part adhesive manufacturers such as H.B. Fuller (U.S.), 3M Company (U.S.), and Henkel AG & Company (Germany) and others.

Key Target Audience:

- Manufacturers of adhesive resins, adhesives raw materials, and other feedstock chemical manufacturers

- Traders, distributors, and suppliers of two part adhesive

- Regional manufacturers associations and general two part adhesive associations

- Government and regional agencies and research organizations

- Investment research firms

Scope of the Report:

This research report categorizes the global two part adhesive market on the basis of resin type, application, and region.

On the basis of Resin Type:

- Polyurethane

- Epoxy

- MMA

- Silicone

- Others

On the basis of Application:

- Automotive

- Construction

- Electronics

- Aviation

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- RoW

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players.

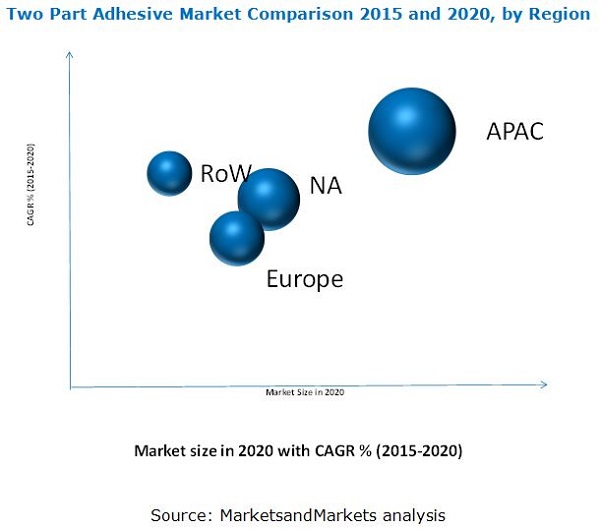

The two part adhesive market size is estimated to reach USD 6.23 Billion by 2020, at a CAGR of 6.5%. The market is driven by rising use of adhesive in the vehicles for weight reduction. As the automotive industry uses lightweight materials such as plastics, composites, and aluminum, which ultimately demand better adhesive material for bonding. So, it is a prime factor for the growth of two component adhesive, globally. Among all regions considered, Asia-Pacific and RoW are estimated to witness a strong growth in the next five years. Also, the demand across these regions is reinforced by the emerging markets, namely, China, Brazil, and India.

According to applications, different types of adhesive based on different resins are generally used in the various industry. These have distinct properties as per the application requirements. These are classified based on their chemistries, namely, polyurethane, epoxy, MMA, silicone, among others. Furthermore, the others segment constitute of acrylic, polyimide and rubber based adhesives. Polyurethane adhesive is the current dominant type of adhesive in the two part adhesive market. Two part adhesive are used in various applications. Automotive, construction, and electronics, aerospace are the main application segments considered in the report. Automotive application witnessed the largest share of total adhesive, in terms of volume, and is also the highest growing application between 2015 and 2020.

The drivers of the industry are growing demand of two part adhesive from automotive, construction and aerospace market. In automotive welds, fasteners, rivets, screws, gaskets, and joints are replaced with two component adhesives. The restraining factors are identified as volatility in raw material prices, government regulations and recessionary effect on the end-use industries.

Price and availability of raw materials are key factors for adhesive manufacturers for determining the cost structure of their products. Raw materials used by the adhesive industry include resins, inorganic chemicals, and refined petroleum products. Most of these raw materials are petroleum-based derivatives and are vulnerable to the fluctuations in commodity prices.

However, H.B. Fuller (U.S.), 3M Company (U.S.), and Henkel AG & Company (Germany) are the leading companies and with an excellent foothold in the U.S. and China. These companies are expected to account for a significant market share in the coming future. Entering into related industries and targeting new markets will enable the two part adhesive manufacturers to overcome the effects of volatile economy, leading to diversified business portfolio and increase in its revenue. Other major manufacturers of two component adhesive are Sika AG (Switzerland), BASF SE (Germany), Dow Chemical Company (U.S.), Bostik (France), and Master Bond Inc., (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insight

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Reserach Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in Two Part Adhesive Market

4.2 Two Part Adhesive Market, By Resin Types, (2015-2020)

4.3 Two Part Adhesive Market Growth, By Region, (2015-2020)

4.4 Two Part Adhesive Market, By Application, (2015-2020)

4.5 Two Part Adhesive Market Share in Asia-Pacific, By Country and By Application

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.1.1 Two Part Adhesive

5.1.2 Major Advantages of Two Part Adhesive

5.1.3 Disadvantages of Two Part Adhesive

5.2 Market Segmentation

5.2.1 By Resin Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Construction, Transportation, and Consumer Applications to Drive the Adhesives Market

5.3.1.2 High Demand for Adhesives From Asia-Pacific

5.3.1.3 Technological Advances in End-Use Industries

5.3.2 Restraints

5.3.2.1 Volatility in Raw Material Prices

5.3.2.2 Recessionary Effect on the End-Use Industries

5.3.3 Opportunities

5.3.3.1 Growing Demand for Low Voc, Green and Sustainable Adhesives

5.3.3.2 Increasing Demand for Lightweight and Low Carbon-Emitting Vehicles

5.3.4 Challenges

5.3.4.1 Stringent and Time-Consuming Regulatory Policies

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Degree of Competition

7 Two Part Adhesive Market, By Resin Type (Page No. - 48)

7.1 Introduction

7.2 Polyurethane Adhesives

7.3 Epoxy Adhesives

7.4 Mma Adhesives

7.5 Silicone Adhesives

7.6 Others

8 Two Part Adhesive Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Construction

8.3 Automotive

8.4 Electronics

8.5 Aviation

8.6 Others

9 Two Part Adhesive Market, By Region (Page No. - 68)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 U.K.

9.3.5 Others

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Others

9.5 RoW

9.5.1 Russia

9.5.2 Brazil

9.5.3 Others

10 Competitive Landscape (Page No. - 109)

10.1 Overview

10.2 Competitive Situation and Trends

10.3 New Product Launches

10.4 Mergers & Acquisitions

10.5 Investments & Expansions

10.6 Partnerships, Contracts & Agreements

11 Company Profiles (Page No. - 115)

11.1 Introduction

11.2 3M Company

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Brand and Their Applications

11.2.4 Recent Developments

11.2.5 MnM View

11.3 H.B. Fuller Company

11.3.1 Business Overview

11.3.2 Brand and Their Applications

11.3.3 Recent Developments

11.3.4 MnM View

11.4 Henkel AG & Company

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 MnM View

11.5 BASF SE

11.5.1 Business Overview

11.5.2 Products and Their Applications

11.5.3 Recent Developments

11.5.4 MnM View

11.6 Huntsman Corporation

11.6.1 Company Overview

11.6.2 Products& Their Applications

11.6.3 Recent Development

11.6.4 MnM View

11.7 DOW Chemical Company

11.7.1 Company Overview

11.7.2 Product and Their Applications

11.7.3 Recent Developments

11.7.4 MnM View

11.8 Sika AG

11.8.1 Business Overview

11.8.2 Products and Their Applications

11.8.3 Recent Development

11.8.4 MnM View

11.9 Bostik

11.9.1 Business Overview

11.9.2 Products and Their Applications

11.9.3 Recent Developments

11.9.4 MnM View

11.10 Aster Bond Inc.

11.10.1 Company Overview

11.10.2 Products and Their Application

11.10.3 Recent Developments

11.10.4 MnM View

12 Appendix (Page No. - 138)

12.1 Discussion Guide

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (105 Tables)

Table 1 Impact of Two Part Adhesive Market: Drivers (20152020)

Table 2 Impact of Two Part Adhesive Market: Restraints (2015-2020)

Table 3 Impact of Two Part Adhesive Market: Opportunities (2015-2020)

Table 4 Impact of Two Part Adhesive Market: Challenges (20152020)

Table 5 Two Part Adhesive Market Size, By Resin Type, 20132020 (USD Million)

Table 6 Two Part Adhesive Market Size, By Resin Type, 20132020 (Kiloton)

Table 7 Two Part Adhesive Market Size By Polyurethane Resin Type, By Region, 20132020 (USD Million)

Table 8 Two Part Adhesive Market Size By Polyurethane Resin Type, By Region, 20132020 (Kiloton)

Table 9 Two Part Adhesive Market Size By Epoxy Resin Type, By Region, 20132020 (USD Million)

Table 10 Two Part Adhesive Market Size By Epoxy Resin Type, By Region, 20132020 (Kiloton)

Table 11 Two Part Adhesive Market Size By Mma Resin Type, By Region, 20132020 (USD Million)

Table 12 Two Part Adhesive Market Size By Mma Resin Type, By Region, 20132020 (Kiloton)

Table 13 Two Part Adhesive Market Size By Silicone Resin Type, By Region, 20132020 (USD Million)

Table 14 Two Part Adhesive Market Size By Silicone Resin Type, By Region, 20132020 (Kiloton)

Table 15 Two Part Adhesive Market Size By Others Resin Type, By Region, 20132020 (USD Million)

Table 16 Two Part Adhesive Market Size By Others Resin Type, By Region, 20132020 (Kiloton)

Table 17 Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 18 Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 19 Two Part Adhesive Market Size in Construction Application, By Region, 20132020 (USD Million)

Table 20 Two Part Adhesive Market Size in Construction Application, By Region, 20132020 (Kiloton)

Table 21 Two Part Adhesive Market Size in Automotive Application, By Region, 20132020 (USD Million)

Table 22 Two Part Adhesive Market Size in Automotive Application, By Region, 20132020 (Kiloton)

Table 23 Two Part Adhesive Market Size in Electronics Application, By Region, 20132020 (USD Million)

Table 24 Two Part Adhesive Market Size in Electronics Application, By Region, 20132020 (Kiloton)

Table 25 Two Part Adhesive Market Size in Aviation Application, By Region, 20132020 (USD Million)

Table 26 Two Part Adhesive Market Size in Aviation Application, By Region, 20132020 (Kiloton)

Table 27 Two Part Adhesive Market Size in Other Applications, By Region, 20132020 (USD Million)

Table 28 Two Part Adhesive Market Size in Other Applications, By Region, 20132020 (Kiloton)

Table 29 Two Part Adhesive Market Size, By Region, 20132020 (USD Million)

Table 30 Two Part Adhesive Market Size, By Region, 20132020 (Kiloton)

Table 31 North America: Two Part Adhesive Market Size, By Country, 20132020 (USD Million)

Table 32 North America: Two Part Adhesive Market Size, By Country, 20132020 (Kiloton)

Table 33 North America: Two Part Adhesive Market Size, By Resin Type, 20132020 (USD Million)

Table 34 North America: Market Size, By Resin Type, 20132020 (Kiloton)

Table 35 North America: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 36 North America: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 37 U.S.: Two Part Adhesive Market Size 20132020 (USD Million and Kiloton)

Table 38 U.S.: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 39 U.S.: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 40 Canada: Two Part Adhesive Market Size 20132020 (USD Million and Kiloton)

Table 41 Canada: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 42 Canada: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 43 Mexico: Two Part Adhesive Market Size 20132020 (USD Million and Kiloton)

Table 44 Mexico: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 45 Mexico: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 46 Europe: Two Part Adhesive Market Size, By Country, 20132020 (USD Million)

Table 47 Europe: Two Part Adhesive Market Size, By Country, 20132020 (Kiloton)

Table 48 Europe: Two Part Adhesive Market Size, By Resin Type, 20132020 (USD Million)

Table 49 Europe: Two Part Adhesive Market Size, By Resin Type, 20132020 (Kiloton)

Table 50 Europe: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 51 Europe: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 52 Germany: Two Part Adhesive Market Size 20132020 (USD Million and Kiloton)

Table 53 Germany: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 54 Germany: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 55 France: Two Part Adhesive Market Size 20132020 (USD Million & Kiloton)

Table 56 France: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 57 France: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 58 Italy: Two Part Adhesive Market Size 20132020 (USD Million Kiloton)

Table 59 Italy: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 60 Italy: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 61 U.K.: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 62 U.K.: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 63 U.K.: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 64 Others: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 65 Others: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 66 Others: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 67 Asia-Pacific: Two Part Adhesive Market Size, By Country, 20132020 (USD Million)

Table 68 Asia-Pacific: Two Part Adhesive Market Size, By Country, 20132020 (Kiloton)

Table 69 Asia-Pacific: Two Part Adhesive Market Size, By Resin Type, 20132020 (USD Million)

Table 70 Asia-Pacific: Two Part Adhesive Market Size, By Resin Type, 20132020 (Kiloton)

Table 71 Asia-Pacific: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 72 Asia-Pacific: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 73 China: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 74 China: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 75 China: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 76 Japan: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 77 Japan: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 78 Japan: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 79 South Korea: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 80 South Korea: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 81 South Korea: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 82 India: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 83 India: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 84 India: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 85 Others: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 86 Others: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 87 Others: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 88 RoW: Two Part Adhesive Market Size, By Country, 20132020 (USD Million)

Table 89 RoW: Two Part Adhesive Market Size, By Country, 20132020 (Kiloton)

Table 90 RoW: Two Part Adhesive Market Size, By Resin Type, 20132020 (USD Million)

Table 91 RoW: Two Part Adhesive Market Size, By Resin Type, 20132020 (Kiloton)

Table 92 RoW: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 93 RoW: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 94 Russia: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 95 Russia: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 96 Russia: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 97 Brazil: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 98 Brazil: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 99 Brazil: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 100 Others: Two Part Adhesive Market Size (USD Million and Kiloton), 2013-2020

Table 101 Others: Two Part Adhesive Market Size, By Application, 20132020 (USD Million)

Table 102 Others: Two Part Adhesive Market Size, By Application, 20132020 (Kiloton)

Table 103 New Product Launches, 20112015

Table 104 Mergers & Acquisitions, 20112015

Table 105 Investments & Expansions, 20102015

List of Figures (44 Figures)

Figure 1 Two Part Adhesive: Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology: Data Triangulation

Figure 4 Automotive Application Segment Will Remain Dominant During the Forecast Period

Figure 5 Polyurethane Adhesives to Register the Highest Growth Between 2015 and 2020

Figure 6 Asia-Pacific Accounted for the Largest Market Share in 2015

Figure 7 Two Part Adhesive Market Expected to Register High Growth Due to Growing Demand From Emerging Nations

Figure 8 Polyurethane-Based Adhesive to Register the Fastest Growth Between 2015 and 2020

Figure 9 Asia-Pacific is Expected to Register Highest CAGRs

Figure 10 Market for Automotive Application to Register the Highest Growth

Figure 11 China Dominates Over All Application in the Two Part Adhesive Market

Figure 12 APAC and RoW to Remain in Growth Phase

Figure 13 Two Part Adhesive Market Segmentation, By Resin Type

Figure 14 Two Part Adhesive Market Segmentation, By Application

Figure 15 Two Part Adhesive Market Segmentation, By Region

Figure 16 Drivers, Restraints, Opportunities, and Challenges of Two Part Adhesive Market

Figure 17 Fluctuations in Price of Crude Oil Between 2011 and 2014

Figure 18 Two Part Adhesive Market: Value-Chain Analysis

Figure 19 Polyurethane to Dominate the Two Part Adhesive Market, By Resin Type, 2015 vs 2020 (Kiloton)

Figure 20 Two Part Adhesive Market, By Application, 2015 vs 2020 (Kiloton)

Figure 21 Regional Snapshot (20152020): India and China are Emerging as Preferred Location for the Two Part Adhesive Market

Figure 22 Asia-Pacific: Favorable Destination for Adhesive By Resin Type

Figure 23 Asia-Pacific to Generate Future Growth for Adhesive Applications

Figure 24 Two Part Adhesive Market in North America Snapshot

Figure 25 U.S. Dominated Two Part Adhesive Market in North America

Figure 26 Germany to Dominate Two Part Adhesive Market in Europe Till 2020

Figure 27 Two Part Adhesive Market in Asia-Pacific Snapshot

Figure 28 China Dominates Two Part Adhesive Market in Asia-Pacific

Figure 29 RoW: Automotive Adhesives Market Size, By Country, 20132020 (Kiloton)

Figure 30 Companies Adopted Merger & Acqusition as the Key Growth Strategy Between 2011 and 2015

Figure 31 Battle for Market Share: Merger Acquisition and Partnership Was the Key Strategy

Figure 32 Regional Revenue Mix of Top 5 Market Players

Figure 33 3M Company: Company Snapshot

Figure 34 3M Company: SWOT Analysis

Figure 35 H.B. Fuller: Company Snapshot

Figure 36 H.B. Fuller: SWOT Analysis

Figure 37 Henkel AG & Company: Company Snapshot

Figure 38 Henkel AG & Company SWOT Analysis

Figure 39 BASF SE: Company Snapshot

Figure 40 BASF SE: SWOT Analysis

Figure 41 Huntsman Corporation: Company Snapshot

Figure 42 Huntsman Corporation: SWOT Analysis

Figure 43 DOW Chemical Company: Company Snapshot

Figure 44 Sika AG: Company Snapshot

Growth opportunities and latent adjacency in Two Part Adhesive Market