Construction Adhesives Market by Resin Type (Acrylic, PVA, PU, Epoxy), Technology (Waterborne, Reactive, Solventborne), End Use Sector (Residential, Non-residential, Infrastructure), and Region - Global Forecast to 2022

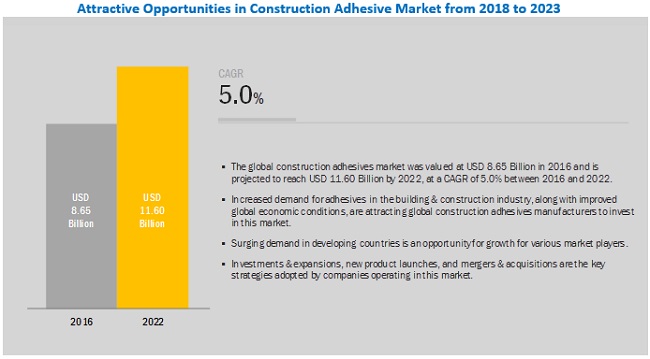

[184 Pages Report] The construction adhesives market was valued at USD 8.65 Billion in 2016 and is projected to reach USD 11.60 Billion by 2022, at a CAGR of 5.0% during the forecast period. In this study, 2016 has been considered as the base year and the forecast period for estimating the market size is from 2017 to 2022.

Based on end-use sector, residential is estimated to be the largest segment of the construction adhesives market in 2017, in terms of volume, followed by the infrastructure segment. The rising demand for new and innovative products and the need for research & development in construction adhesives have driven companies to adopt organic and inorganic growth strategies to increase their market shares.

Based on resin type, the PU segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment can be attributed to its significant contributions to the adhesive bonding technology, making available several different feedstock materials for the manufacturing of adhesives that exhibit a broad spectrum of performance characteristics. Based on their varied compositions, PU adhesives are used in a wide range of applications in the construction industry.

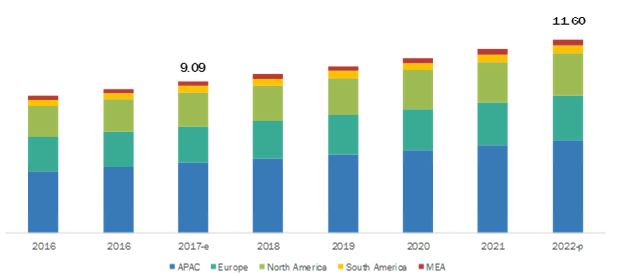

APAC is expected to account for the largest market share during the forecast period.

APAC is expected to account for the largest market share during the forecast period.

The rising demand from the non-residential and residential sectors, governments incentive for affordable housing to boost construction activities, and ongoing infrastructural projects have been the major factors driving the rapid expansion of the construction adhesives market. The demand for adhesives has increased in the APAC countries such as India, China, Indonesia, Vietnam, Malaysia, and Thailand corresponding to the emerging end-use activities such as new construction works, repairs, maintenance, and renovation of floors, roofs, wall coverings, beams, and airport construction, among others.

The demand for adhesives has increased in countries such as Brazil, Qatar, Colombia, and the UAE due to the increase in end-use activities such as the expansion of a logistic terminals, development, and expansion of new manufacturing facilities, car assembling plants, multi-storied towers, oil pipelines, and water treatment plants.

Market Dynamics

Driver

Increased demand for construction adhesives in the residential housing and infrastructure markets

Construction adhesives are used in various applications such as carpet laying, tile installation, wallpapers, and exterior insulation systems in the construction industry. These applications have spurred the growth of the construction adhesives market.The pace of expansion in the global construction industry steadied in 2016. However, the increasing investments in infrastructure development such as airports, bridges, dams, and metro stations are driving the demand for adhesives in flooring, expansion joints, panels, and other applications. Also, the increase in middle-class population has resulted in a rise in demand for houses. This is expected to drive the construction adhesive market growth.

Increasing demand for permanent, non-slum houses across India and other developing countries such as Brazil, China, Indonesia, and Vietnam are primarily driven by the growth in population, urbanization and increasing income in these countries is increasing demand for construction adhesives. For instance, the government of India has reportedly worked out the details of the two new subsidy schemes under the Prime Minister Awas Yojana (PMAY). The governments two new subsidy slabs aim at fueling the real estate sector and achieving housing for all by 2022. As against the current limit of 15 years, these schemes will apply to loans with a tenure of 20 years. Through this, more number of economically weaker section (EWS)/ low income group (LIG) families would now come under the ambit of PMAY schemes. This will increase the formal credit flow to rural areas, which is expected to be utilized not only for constructing new houses but also for converting the existing kutcha houses to pucca ones. These government initiatives are thus expected to drive the construction adhesives demand. Also, the Union Ministry has sought USD 2.88 billion (INR 185 billion) to develop seven cities around the Delhi-Mumbai Industrial Corridor (DMIC) that will crisscross six states. The USD 90 billion DMIC project, comprising Uttar Pradesh, Haryana, Rajasthan, Gujarat, Maharashtra, and Madhya Pradesh, is being developed in collaboration with Japan as a manufacturing and trading hub. The industrial hubs and eco-friendly cities along the Delhi Mumbai Industrial Corridor (DMIC) are expected to double employment opportunities, triple industrial production, and increase exports by four folds over the next decade. This will largely drive the construction adhesives market in the country as well as the whole of APAC region.

Restraint

Environmental regulations in North American and European countries

With the increase in environmental concerns and regulatory policies, manufacturers of North America and Europe are shifting toward the eco-friendly construction adhesives products for various applications. For instance, Henkels OSI Green Series provides environmentally-friendly caulks, sealants, and adhesives for the green building process. Also, Franklin International manufactures environment-friendly construction adhesives under the brand name Titebond GREENchoice. In North America, Europe, and parts of APAC the environmental protection regulations have become more restrictive and solventborne construction adhesives have been banned in many countries. In major parts of the world, construction adhesives with less than 10% VOCs are now required.

Europe and North America are strictly regulated by environmental laws regarding the production of chemical and petro-based products. Agencies such as Epoxy Resin Committee (ERC), European Commission (EC), and other regulatory bodies are governing the manufacturing of solventborne products in these regions. These regulations are restraining the growth of the construction adhesives market. The companies are not able to shift their entire focus on manufacturing green and environment-friendly products which is also hampering their business revenue.

Opportunities

Growing demand for low-VOC, green, and sustainable adhesives

The rising trend of using environmentally-friendly or green products in various applications is driving the demand for green adhesives or those with low VOCs. Stringent regulations implemented by USEPA (United States Environmental Protection Agency), Europes REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have forced the manufacturers to produce environmentally-friendly adhesives with low VOC levels. The shift toward a more sustainable product portfolio has provided the industry a significant growth opportunity.

The major players manufacture environmentally-friendly construction adhesives. These green adhesive solutions are made from renewable, recycled, remanufactured, or biodegradable materials; the use of these environmentally-friendly products also benefits the health of the occupants.

Challenge

Established infrastructure in developed countries

The developed countries such as the US, Germany, the UK, Japan, and the other Western European countries have established infrastructure for public, commercial, and transport sectors. The developed infrastructure in these countries provides low scope for new construction activities. Moreover, infrastructures are built to sustain for a longer period, thus providing low opportunities for growth of the construction adhesives market. It is projected that in the next five years the demand for construction adhesives will witness moderate growth, mainly because of the increased activity in the construction sector.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Construction Adhesive Market, By Resin Type (Acrylic, PVA, PU, Epoxy, Others), By Technology (Waterborne, Reactive, Solventborne, Others), By End-Use Sector (Residential, Non-Residential, Infrastructure), By Application (Countertop & Drywall Lamination, Flooring, Roofing, Manufactured Housing, Panels, Concrete, Joint Cement) |

|

Geographies covered |

North America, Europe, APAC, MEA, and South America |

|

Companies covered |

Henkel (Germany), 3M (US), Bostik (France), Sika (Switzerland), H.B. Fuller (US), BASF (Germany), Dow Chemical (US), DAP Products (US), Franklin International (US), Illinois Tool Works (US), Avery Dennison (US) and other 11 players. |

This research report categorizes the Construction Adhesive market based on application and region.

On the basis of application, the Construction Adhesive market has been segmented as follows:

Construction Adhesives Market, By Resin Type:

- Acrylic

- PVA

- PU

- Epoxy

- Others

- Waterborne

- Reactive

- Solventborne

- Others

Construction Adhesives Market, By End-Use Sector:

- Residential

- Non-Residential

- Infrastructure

Construction Adhesives Market, By Application:

- Countertop & Drywall Lamination Flooring

- Roofing

- Manufactured Housing

- Panels

- Concrete

- Joint Cement

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Key Market Players

Henkel (Germany), 3M (US), Bostik (France), Sika (Switzerland), H.B. Fuller (US), BASF (Germany), Dow Chemical (US), DAP Products (US), Franklin International (US), Illinois Tool Works (US), Avery Dennison (US), etc., are the key players in the global construction adhesive market. Diverse product portfolios strategically positioned R&D centers, adoption of varied development strategies, and technological advancements are some of the factors that have helped companies strengthen their position in the construction adhesives market. These players have been adopting various organic and inorganic strategies to grow in the market.

Major strategies identified in the global market include the following:

- Expansions

- New product launches

- Acquisitions

- Agreements

Key Questions Addressed by the Report

- Who are the major market players in the Construction Adhesive market?

- What are the regional growth trends and the largest revenue-generating regions for the Construction Adhesives market?

- Which are the significant regions for different industries that are projected to witness remarkable growth for the Construction Adhesive market?

- What are the major types of Construction Adhesive that are projected to gain maximum market revenue and share during the forecast period?

- Which is the major application where Construction Adhesive are used that will be accounting for most of the revenue over the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of The Study

1.2 Market Definition

1.3 Scope of The Study

1.3.1 Years Considered for The Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in The Construction Adhesives Market

4.2 Construction Adhesive Market Size, By Resin Type

4.3 Construction Adhesives Market Size, Developed Vs Developing Countries

4.4 Construction Adhesive Market, By End Use Sector and Key Countries

4.5 Construction Adhesives Market, By Technology

4.6 Construction Adhesive Market Attractiveness

5 Market Overview

5.1 Introduction

5.2 Criteria for Adhesives Selection

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Demand for Construction Adhesives in The Residential Housing and Infrastructure Industries

5.3.1.2 Rising Demand from The Asian and MEA Countries

5.3.1.3 Construction Adhesives Provide Safety and Ease of Application

5.3.2 Restraints

5.3.2.1 Environmental Regulations in The North American and European Countries

5.3.3 Opportunities

5.3.3.1 Growing Demand for Low-VOC, Green, and Sustainable Adhesives

5.3.3.2 Economic Growth and Rising Government Expenditure on Infrastructure Development

5.3.4 Challenges

5.3.4.1 Established Infrastructure in The Developed Countries

5.3.4.2 Changing Regulations and Industry Standards

5.4 Porters Five Forces Analysis

5.4.1 Threat of Substitutes

5.4.2 Bargaining Power of Buyers

5.4.3 Threat of New Entrants

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Macroeconomic Indicators

5.5.1 Trends and Forecast of GDP

5.5.2 Trends and Forecast of Construction Industry

6 Construction Adhesives Market, By Resin Type

6.1 Introduction

6.2 Acrylic Adhesive

6.2.1 Anaerobic Acrylic Adhesives

6.2.2 Cyanoacrylates Adhesives

6.2.3 Reactive Acrylic

6.3 Polyurethane (PU)

6.3.1 Reactive Adhesives

6.3.1.1 One-Component Adhesives

6.3.1.2 Two-Component Adhesives

6.3.2 Non-Reactive

6.4 Polyvinyl Acetate (PVA)

6.5 Epoxy

6.6 Others

6.6.1 Styrenic Block

6.6.2 Ethylene Vinyl Acetate (EVA)

6.6.3 Silicone

6.6.4 Polyisobutylene

7 Construction Adhesive Market, By Technology

7.1 Introduction

7.2 Waterborne Technology

7.2.1 Natural Waterborne Adhesive

7.2.2 Synthetic Waterborne Adhesive

7.3 Reactive Technology

7.3.1 One-Component

7.3.2 Two-Component

7.4 Solvent Borne Technology

7.5 Other Technologies

8 Construction Adhesives Market, By End-Use Sector

8.1 Introduction

8.2 Residential

8.3 Non-Residential (Commercial & Industrial)

8.4 Infrastructure

9 Construction Adhesives Market, By Application

9.1 Introduction

9.2 Countertop & Drywall Lamination

9.3 Flooring

9.4 Roofing

9.5 Manufactured Housing

9.6 Panels

9.7 Concrete

9.8 Joint Cement

*Can be Provided as A Part of Customization

10 Construction Adhesive Market, By Region

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.2 Japan

10.2.3 India

10.2.4 Indonesia

10.2.5 South Korea

10.2.6 Thailand

10.2.7 Malaysia

10.2.8 Rest of APAC

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 Russia

10.3.6 Spain

10.3.7 Turkey

10.3.8 Rest of Europe

10.4 North America

10.4.1 US

10.4.2 Canada

10.4.3 Mexico

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Colombia

10.5.4 Rest of South America

10.6 MEA

10.6.1 Saudi Arabia

10.6.2 UAE

10.6.3 Qatar

10.6.4 Rest of MEA

11 Competitive Landscape

11.1 Introduction

11.2 Market Ranking of Key Players

11.3 Competitive Scenario

11.3.1 New Product Launches/Developments

11.3.2 Acquisitions

11.3.3 Expansions

12 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Henkel

12.2 3M

12.3 Bostik

12.4 Sika

12.5 H.B. Fuller

12.6 BASF

12.7 DOW

12.8 DAP Products

12.9 Franklin International

12.1 Illinois Tool Works

12.11 Avery Dennison

12.12 Other Players

12.12.1 Mapei Spa

12.12.2 Ardex Gmbh

12.12.3 Laticrete International

12.12.4 Terraco

12.12.5 Saint-Gobain Weber

12.12.6 Fosroc

12.12.7 Custom Building Products

12.12.8 Construction Chemicals Pty

12.12.9 Flextile

12.12.10 Norcros Adhesives

12.12.11 Dural Industries

*Details Might Not be Captured in Case of Unlisted Companies

13 Appendix

13.1 Insights from Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: MarketsandMarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (138 Tables)

Table 1 Construction Adhesives Market Snapshot (2017 Vs 2022)

Table 2 Load Bearing Capabilities of Selected Adhesives

Table 3 Types of Adhesives and Their Uses

Table 4 Trends and Forecast of GDP, By Key Country, 20152022 (USD Billion)

Table 5 Contribution of Construction Industry to GDP of North America, 20142021 (USD Billion)

Table 6 Contribution of Construction Industry to GDP of Europe, 20142021 (USD Billion)

Table 7 Contribution of Construction Industry to GDP of Asia-Pacific, 20142021 (USD Billion)

Table 8 Contribution of Construction Industry to GDP of MEA, 20142021 (USD Billion)

Table 9 Construction Adhesives Market Size, By Resin Type, 20152022 (Kiloton)

Table 10 Market Size, By Resin Type, 20152022 (USD Million)

Table 11 Acrylic-Based Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 12 Acrylic-Based Market Size, By Region, 20152022 (USD Million)

Table 13 PU-Based Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 14 PU-Based Market, By Region, 20152022 (USD Million)

Table 15 PVA-Based Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 16 PVA-Based Market Size, By Region, 20152022 (USD Million)

Table 17 Epoxy-Based Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 18 Epoxy-Based Market Size, By Region, 20152022 (USD Million)

Table 19 Other Resins-Based Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 20 Other Resins-Based Market Size, By Region, 20152022 (USD Million)

Table 21 Construction Adhesives Market Size, By Technology, 20152022 (Kiloton)

Table 22 Market Size, By Technology, 20152022 (USD Million)

Table 23 Waterborne Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 24 Waterborne Market Size, By Region, 20152022 (USD Million)

Table 25 Reactive Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 26 Reactive Market Size, By Region, 20152022 (USD Million)

Table 27 Solventborne Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 28 Solventborne Market Size, By Region, 20152022 (USD Million)

Table 29 Other Technologies-Based Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 30 Other Technologies-Based Market Size, By Region, 20152022 (USD Million)

Table 31 Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 32 Market Size, By End-Use Sector, 20152022 (USD Million)

Table 33 Construction Adhesives Market Size in Residential Sector, By Region, 20152022 (Kiloton)

Table 34 Market Size in Residential Sector, By Region, 20152022 (USD Million)

Table 35 Construction Adhesives Market Size in Non-Residential Sector, By Region, 20152022 (Kiloton)

Table 36 Market Size in Non-Residential Sector, By Region, 20152022 (USD Million)

Table 37 Construction Adhesives Market Size in Infrastructure Sector, By Region, 20152022 (Kiloton)

Table 38 Market Size in Infrastructure Sector, By Region, 20152022 (USD Million)

Table 39 Construction Adhesives Market Size, By Region, 20152022 (Kiloton)

Table 40 Market Size, By Region, 20152022 (USD Million)

Table 41 APAC: Construction Adhesives Market Size, By Country, 20152022 (Kiloton)

Table 42 APAC: Market Size, By Country, 20152022 (USD Million)

Table 43 APAC: Market Size, By Resin Type, 20152022 (Kiloton)

Table 44 APAC: Market Size, By Resin Type, 20152022 (USD Million)

Table 45 APAC: Market Size, By Technology, 20152022 (Kiloton)

Table 46 APAC: Market Size, By Technology, 20152022 (USD Million)

Table 47 APAC: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 48 APAC: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 49 APAC: Market Size, By Application, 20152022 (Kiloton)

Table 50 APAC: Market Size, By Application, 20152022 (USD Million)

Table 51 China: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 52 China: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 53 Japan: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 54 Japan: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 55 India: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 56 India: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 57 Indonesia: Construction Adhesive Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 58 Indonesia: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 59 South Korea: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 60 South Korea: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 61 Thailand: Construction Adhesive Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 62 Thailand: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 63 Malaysia: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 64 Malaysia: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 65 Rest of APAC: Construction Adhesive Market Size, By End-Use Sector 20152022 (Kiloton)

Table 66 Rest of APAC: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 67 Europe: Construction Adhesives Market Size, By Country, 20152022 (Kiloton)

Table 68 Europe: Market Size, By Country, 20152022 (USD Million)

Table 69 Europe: Market Size, By Resin Type, 20152022 (Kiloton)

Table 70 Europe: Market Size, By Resin Type, 20152022 (USD Million)

Table 71 Europe: Market Size, By Technology, 20152022 (Kiloton)

Table 72 Europe: Market Size, By Technology, 20152022 (USD Million)

Table 73 Europe: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 74 Europe: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 75 Europe: Market Size, By Application, 20152022 (Kiloton)

Table 76 Europe: Market Size, By Application, 20152022 (USD Million)

Table 77 Germany: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 78 Germany: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 79 UK: Construction Adhesive Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 80 UK: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 81 France: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 82 France: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 83 Italy: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 84 Italy: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 85 Russia: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 86 Russia: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 87 Spain: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 88 Spain: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 89 Turkey: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 90 Turkey: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 91 Rest of Europe: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 92 Rest of Europe: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 93 North America: Construction Adhesives Market Size, By Country, 20152022 (Kiloton)

Table 94 North America: Market Size, By Country, 20152022 (USD Million)

Table 95 North America: Market Size, By Resin Type, 20152022 (Kiloton)

Table 96 North America: Market Size, By Resin Type, 20152022 (USD Million)

Table 97 North America: Market Size, By Technology, 20152022 (Kiloton)

Table 98 North America: Market Size, By Technology, 20152022 (USD Million)

Table 99 North America: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 100 North America: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 101 North America: Market Size, By Application, 20152022 (Kiloton)

Table 102 North America: Market Size, By Application, 20152022 (USD Million)

Table 103 US: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 104 US: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 105 Canada: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 106 Canada: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 107 Mexico: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 108 Mexico: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 109 South America: Construction Adhesive Market Size, By Country, 20152022 (Kiloton)

Table 110 South America: Market Size, By Country, 20152022 (USD Million)

Table 111 South America: Market Size, By Resin Type, 20152022 (Kiloton)

Table 112 South America: Market Size, By Resin Type, 20152022 (USD Million)

Table 113 South America: Market Size, By Technology, 20152022 (Kiloton)

Table 114 South America: Market Size, By Technology, 20152022 (USD Million)

Table 115 South America: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 116 South America: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 117 South America: Market Size, By Application, 20152022 (Kiloton)

Table 118 South America: Market Size, By Application, 20152022 (USD Million)

Table 119 Brazil: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 120 Brazil: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 121 Argentina: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 122 Argentina: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 123 Colombia: Construction Adhesive Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 124 Colombia: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 125 Rest of South America: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 126 Rest of South America: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 127 MEA: Construction Adhesives Market Size, By Country, 20152022 (Kiloton)

Table 128 MEA: Market Size, By Country, 20152022 (USD Million)

Table 129 MEA: Market Size, By Resin Type, 20152022 (Kiloton)

Table 130 MEA: Market Size, By Resin Type, 20152022 (USD Million)

Table 131 MEA: Market Size, By Technology, 20152022 (Kiloton)

Table 132 MEA: Market Size, By Technology, 20152022 (USD Million)

Table 133 MEA: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 134 MEA: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 135 MEA: Market Size, By Application, 20152022 (Kiloton)

Table 136 MEA: Market Size, By Application, 20152022 (USD Million)

Table 137 Saudi Arabia: Construction Adhesive Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 138 Saudi Arabia: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 139 UAE: Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 140 UAE: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 141 Qatar: Construction Adhesives Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 142 Qatar: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 143 Rest of MEA: Construction Adhesive Market Size, By End-Use Sector, 20152022 (Kiloton)

Table 144 Rest of MEA: Market Size, By End-Use Sector, 20152022 (USD Million)

Table 145 Market Ranking of Key Players, 2016

Table 146 New Product Launches/Developments, 20132017

Table 147 Acquisitions, 20132017

Table 148 Expansions, 20132017

List of Figures (37 Figures)

Figure 1 Construction Adhesives Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Construction Adhesives: Data Triangulation

Figure 5 PU to be The Fastest-Growing Resin Type Between 2017 and 2022

Figure 6 Waterborne to be The Fastest-Growing Technology for Construction Adhesives

Figure 7 Residential to be The Key End-Use Sector of Construction Adhesives Between 2017 and 2022

Figure 8 APAC to be The Largest and Fastest-Growing Market for Construction Adhesives

Figure 9 Emerging Economies to Offer Lucrative Growth Opportunities for Market Players Between 2017 and 2022

Figure 10 Acrylic-Based Construction Adhesives to Have The Largest Market Size

Figure 11 Demand for Construction Adhesives to be High in Developing Countries

Figure 12 Residential to be The Largest End-Use Sector of Construction Adhesives in 2017

Figure 13 Waterborne Technology to Register The Highest Growth During The Forecast Period

Figure 14 Indonesia to Register The Highest CAGR in The Construction Adhesives Market Between 2017 and 2022

Figure 15 Factors Governing The Construction Adhesives Market

Figure 16 Epoxy-Based Construction Adhesives to Dominate The Market

Figure 17 APAC to be The Largest Construction Adhesive Market in 2017

Figure 18 Construction Adhesives Market Size, By Technology and Region, 2017

Figure 19 Indonesia: An Emerging Market for Construction Adhesives

Figure 20 APAC Emerging as A High-Growth Potential Market for Epoxy and PU-Based Construction Adhesives

Figure 21 APAC to Lead The Construction Adhesive Market in All Major End-Use Sector

Figure 22 APAC Dominated The Construction Adhesives Market in 2016

Figure 23 APAC: Construction Adhesive Market Snapshot

Figure 24 Residential Sector to Drive The Construction Adhesives Market in Europe

Figure 25 Turkey to be The Fastest-Growing Country in The European Construction Adhesives Market

Figure 26 North America: Construction Adhesive Market Snapshot

Figure 27 Construction Adhesives Market in South America to Witness A Slow Growth

Figure 28 MEA: Construction Adhesive Market Snapshot

Figure 29 Companies Adopted New Product Launches as The Key Growth Strategy Between 2013 and 2017

Figure 30 Henkel: Company Snapshot

Figure 31 3M: Company Snapshot

Figure 32 Sika: Company Snapshot

Figure 33 H.B. Fuller: Company Snapshot

Figure 34 BASF: Company Snapshot

Figure 35 Dow: Company Snapshot

Figure 36 Illinois Tool Works: Company Snapshot

Figure 37 Avery Dennison: Company Snapshot

Growth opportunities and latent adjacency in Construction Adhesives Market

Market data for construction adhesive for the european region

General information on consumption of Construction Adhesives in North America

Market analysis and current market trends on epoxy resins market