Unidirectional Tapes (UD) Market by Fiber (Glass, Carbon), Resin (Thermoplastic, Thermoset), End-use Industry (Aerospace & Defense, Automotive, Sports & Leisure) and Region (North America, Europe, Asia Pacific) - Global Forecasts to 2026

Updated on : August 25, 2025

Unidirectional Tapes Market

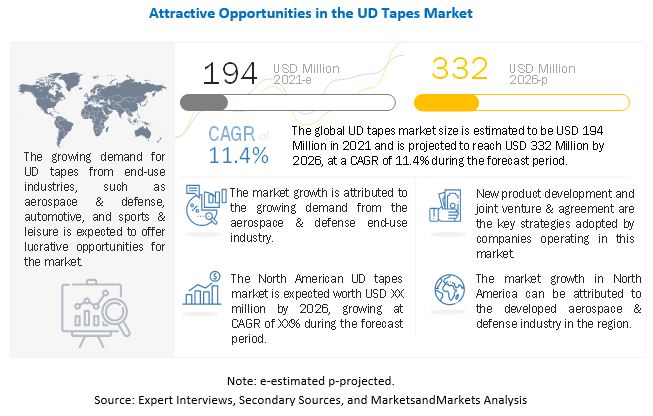

The global unidirectional tapes market was valued at USD 194 million in 2021 and is projected to reach USD 332 million by 2026, growing at 11.4% cagr from 2021 to 2026. The global market is growing due to the rise in the demand for high-performance materials.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on UD Tapes Market

The novel coronavirus pandemic had created ripples across the global aerospace industry, affecting the global supply chains, which move materials and components rapidly across borders and fabrication facilities. This had resulted in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers. These factors have affected the world’s biggest commercial aircraft providers, Boeing and Airbus, and their constellation of suppliers. Boeing did not have any orders in January 2020. Airbus also had zero orders in February 2020. The loss of the aerospace & defense industry had directly affected the UD tapes market as it is a major end-use industry of UD tapes.

Unidirectional Tapes Market Dynamics

Driver: Increase in the use of UD tapes in primary & secondary aircraft structures

Vehicle weight reduction and increased fuel efficiency are the major factors driving the use of UD tapes in the aerospace & defense industry. The greater strength-to-weight capability of UD tapes allows for more efficient structural and aerodynamic designs. UD tapes offer high fatigue tolerance and improve the strength of structural components, thereby enabling the manufacturing of bigger passenger windows and lower cabin altitude than conventional jetliners.

The rise in air passenger traffic across the globe has contributed to an increase in aircraft production. The demand for new aircraft is expected to gradually shift from developed to emerging markets, such as APAC, South America, and Africa. In the commercial aerospace sector, North America is expected to witness the highest commercial aircraft deliveries, followed by Europe, APAC, South America, and the Middle East.

Carbon fiber-based UD tapes are mostly preferred in aircraft due to their high strength and stiffness. Unidirectional tapes can also be silt easily without losing its strength, which is not possible in the case of woven tapes and fabrics. The major applications of UD tapes are fixed wing fuselage, drive shafts, wing spars, wing skins, cargo floor panels, fan blades, tail booms, rib stiffeners, conduit, brackets, and others. There has been a paradigm shift in aircraft design by Boeing and Airbus, with composites now being considered for primary structures of all wide-bodied aircraft. Owing to the increasing use of composites in aircraft manufacturing, the demand for UD tapes is rapidly increasing.

Restraint: Issues related to recyclability

Globally, companies are trying to reduce the effect of global warming and explore the potential of UD tapes to reduce greenhouse gas emissions. However, the difficulty of recycling glass fiber is a stumbling block, especially in the construction and automotive sectors, where the pressure to recycle is high.

The European Composites Industry Association (EUCIA) states that glass-fiber reinforced plastic and carbon fiber reinforced thermoplastic are recyclable and compliant with the European Union (EU) legislation and with the stringent regulations of the US. Currently, recycling facilities for composites exist only in Germany; hence, for companies in other countries, it is prohibitively expensive and not environment-friendly as it involves significant expenses to transport the products for recycling.

Opportunity: Increasing use of UD tapes in new applications

UD tapes are emerging as a class of materials that possess superior properties. These materials have very high stiffness, lower weight, high abrasion, and wear resistance. The use of these materials is increasing in medical, construction & infrastructure, and other industries. In the medical industry, the use of UD tapes is increasing in the manufacturing of prosthetic parts, such as wheelchair frame, artificial limbs, and exoskeleton construction for limbs. The use of UD tapes is also increasing rapidly in localized reinforcement, repairs, and seam taping of concrete parts in the construction industry. These tapes are also used for the manufacturing of tubular products through the filament winding process in the pipe & tank industry.

Challenge: High manufacturing and processing costs of UD tapes

The high cost of UD tapes has posed as a hurdle to its expansion into structural applications of various industries. The real potential of UD tapes has not yet been realized owing to the R&D costs, high manufacturing costs, and increased cycle times. Many new applications of UD tapes have been discovered, but due to high-cost constraints, commercialization in these applications is yet to begin. The high R&D, manufacturing, and processing costs are a major challenge for the key players to manufacture cost-effective products in the market.

Glass fiber is estimated to account for the largest share of the UD tapes market during the forecast period

Glass fiber segment is estimated to account for the largest share of the UD tapes market during the forecast period. Glass fiber UD tapes are easy to process and manufacture as compared to carbon fiber, which are very difficult to process. Glass fiber-based UD tapes are preferable over carbon fiber UD tapes as they provide a quick and affordable way to build parts & molds and make repairs. Government regulations such as CAFÉ Standards in the US and carbon emission targets in Europe are putting pressure on automotive OEMs to incorporate lightweight materials to reduce the overall vehicle weight. Such factors are the key drivers for the glass fiber UD tapes market.

Thermoplastic UD tapes to be the fastest-growing resin segment of the UD tapes market during the forecast period.

Thermoplastic UD tapes is expected to be the largest segment, by resin, during the forecast period. Thermoplastic UD tapes are used in a large number of industries, including aerospace & defense and sports & leisure. These are widely used in the aerospace & defense industry due to their toughness, high strength, moisture absorption resistance, high performance properties, and ability to survive under high temperature conditions.

The aerospace & defense segment is estimated to be the fastest-growing end-use industry of the UD tapes market during the forecast period.

Based on end-use industry, the aerospace & defense segment is estimated to account for the largest share of the UD tapes market during the forecast period. UD tapes are used in aircraft seat frames as they help reduce the weight of aircraft seats by 30% in comparison to traditional aluminum frame seats. They are also used in lightweight sandwich panels for ultralight aircraft. According to Airbus, there will be a global increase in the aircraft demand; for 28,200 new built freighters and passenger aircraft between 2012 and 2031. This increased aircraft demand includes the demand from the developing markets, such as APAC, South America, and Africa. This will drive the demand for UD tapes in the aerospace & defense industry.

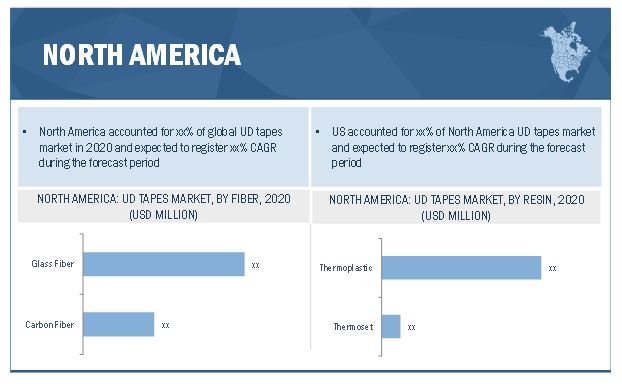

North America to account for the largest share of the global UD tapes market during the forecast period.

The North America UD tapes market is expected to witness strong growth in the next five years. The demand for lightweight, fuel-efficient aircraft is increasing, which will drive the demand for UD tapes in the aerospace & defense industry. The launch of new aircraft such as Boeing 777x and China’s indigenously build aircraft Comac C919 is also expected to drive the demand for UD tapes in the near future. UD tapes are also used in lightweight sandwich panels for ultralight aircraft. These factors will drive the demand for UD tapes.

To know about the assumptions considered for the study, download the pdf brochure

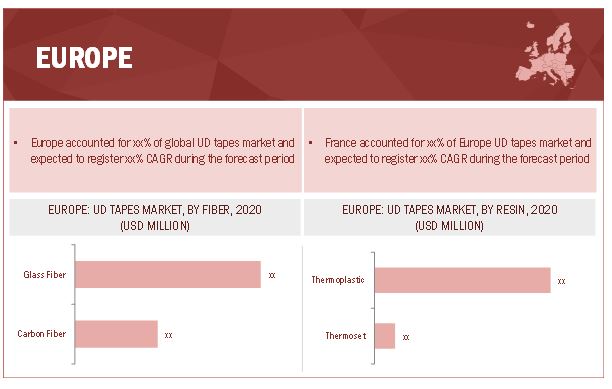

Europe to account for the second-largest share of the global UD tapes during the forecast period.

Europe is the second-largest market for UD tapes. The growth of end-use industries is driving the UD tapes market in the region. France accounted for the maximum market share in terms of value in 2020. France provides the lowest business setup costs in terms of facility costs, utility costs, transport, and corporate taxes. Germany is the leading automotive market in terms of production and sales in Europe. OEMs are constantly challenged by government regulations to increase fuel efficiency and decrease carbon emissions by using lightweight materials such as UD tapes. This has turned the focus of automotive OEMs to use carbon and glass fiber UD tapes for structural parts of passenger cars and high-utility vehicles. Thus, the UD tapes manufacturers stand a good chance to penetrate the automotive sector in Germany.

Unidirectional Tapes Market Players

Evonik Industries (Germany), SABIC (Saudi Arabia), Toray Industries, Inc. (Japan), Hexcel Corporation (US), SGL Group (Germany), and Teijin Limited (Japan) are some of the players operating in the global market.

Unidirectional Tapes Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) and Volume (Ton) |

|

Segments |

Fiber, Resin, and End-Use Industry |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Toray Industries, Inc. (Japan), SABIC (Saudi Arabia), Evonik Industries (Germany), Hexcel Corporation (US), SGL Group (Germany), Teijin Limited (Japan) |

This research report categorizes the UD tapes market based on fiber, resin, end-use industry, and region.

Based on fiber, the UD tapes market has been segmented as follows:

- Glass fiber

- Carbon fiber

Based on resin, the UD tapes market has been segmented as follows:

- Thermoplastic

- Thermoset

Based on end-use industries, the UD tapes market has been segmented as follows:

- Aerospace & Defense

- Automotive

- Sports & Leisure

- Others (industrial, electrical & electronics, wind energy, marine, construction, and pipe & tank)

Based on the region, the UD tapes market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2020, Hexcel Corporation collaborated with Madshus, a leading innovator in the field of cross-country skiing. The company provides Madshus with three different Hi Tape products based on specific design parameters of various cross-country ski types. Hexcel’s new HiTape dry carbon-based UD tapes improve the performance, manufacturing efficiency, and surface finish of Madshus’ skis.

- In August 2019, Toray Advanced Composites and BASF signed a manufacturing and supply agreement focused on the production of continuous fiber-reinforced thermoplastic (CFRT) UD tapes for the automotive and industrial markets.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of UD tapes?

Yes the report covers the new applications of UD tapes

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the UD tapes market in terms of new applications, production, and sales?

The market has various large, medium, and small scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, Japan, France, China, and Germany are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 UD TAPES MARKET SEGMENTATION

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DESIGN

FIGURE 3 UD TAPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 4 UD TAPES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 UD TAPES MARKET SIZE ESTIMATION, BY REGION

FIGURE 6 UD TAPES MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST

FIGURE 7 METHODOLOGY FOR “SUPPLY-SIDE” SIZING OF UD TAPES MARKET

2.3.2 DEMAND-SIDE FORECAST

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 UD TAPES MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

TABLE 1 UD TAPES MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 NORTH AMERICAN UD TAPES MARKET TO REGISTER HIGHEST CAGR

FIGURE 10 AEROSPACE & DEFENSE INDUSTRY TO DOMINATE UD TAPES MARKET

FIGURE 11 GLASS FIBER-BASED UD TAPES ACCOUNTED FOR LARGER MARKET SHARE

FIGURE 12 THERMOPLASTIC SEGMENT TO LEAD OVERALL UD TAPES MARKET

FIGURE 13 NORTH AMERICA IS LARGEST UD TAPES MARKET

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN UD TAPES MARKET

FIGURE 14 HIGH DEMAND FROM AEROSPACE & DEFENSE INDUSTRY TO DRIVE THE MARKET

4.2 NORTH AMERICA UD TAPES MARKET, BY RESIN AND END-USE INDUSTRY, 2020

FIGURE 15 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE

4.3 UD TAPES MARKET, BY FIBER

FIGURE 16 GLASS FIBER IS LARGER SEGMENT OF THE MARKET

4.4 UD TAPES MARKET, BY END-USE INDUSTRY

FIGURE 17 AUTOMOTIVE TO BE LARGEST END-USE INDUSTRY

4.5 UD TAPES MARKET, BY KEY COUNTRIES

FIGURE 18 US TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 43)

5.1 VALUE CHAIN OVERVIEW

5.1.1 VALUE CHAIN ANALYSIS

5.1.1.1 Raw Material

5.1.1.2 Manufacturing Process

5.1.1.3 Final Product

FIGURE 19 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING PROCESS

5.1.2 DISRUPTION IN VALUE CHAIN DUE TO COVID–19

5.1.2.1 Action plan against such crisis vulnerability

5.2 SUPPLY CHAIN CRISES

5.3 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE UD TAPES MARKET

5.3.1 DRIVERS

5.3.1.1 Increase in use of UD tapes in primary & secondary aircraft structures

5.3.1.2 Increasing demand for manufacturing lightweight vehicles

5.3.1.3 Initiatives by governments of China and India

5.3.1.4 Replacement of old/aging aircraft and modernization of existing aircraft

5.3.2 RESTRAINTS

5.3.2.1 Issues related to recyclability

5.3.2.2 High processing and manufacturing costs of carbon fiber

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing use of UD tapes in new applications

5.3.3.2 Emergence of aircraft manufacturers in Asia Pacific and South America

5.3.3.3 Increasing demand for passenger aircraft in developing regions

5.3.4 CHALLENGES

5.3.4.1 High manufacturing and processing costs of UD tapes

5.3.4.2 Market chain recovery from COVID-19 impact

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: UD TAPES MARKET

TABLE 2 UD TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 COVID-19 IMPACT ANALYSIS

5.5.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.5.2 ECONOMIC IMPACT OF COVID-19 – SCENARIO ASSESSMENT

FIGURE 23 FACTORS IMPACTING ECONOMIES OF SELECT G20 COUNTRIES IN 2020

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 PUBLICATION TRENDS

FIGURE 24 PUBLICATION TRENDS, 2017–2021

5.6.3 INSIGHT

5.6.4 JURISDICTION ANALYSIS

FIGURE 25 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2017–2021

5.6.5 TOP APPLICANTS

5.7 PRICING ANALYSIS

FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN UD TAPES MARKET, BY REGION

5.7.1 PRICING ASSUMPTIONS

5.8 GLOBAL SCENARIOS

5.8.1 CHINA

5.8.1.1 Economic Meltdown

5.8.1.2 Australia-China trade war

5.8.1.3 Environmental commitments

5.8.2 EUROPE

5.8.2.1 Manpower issues in UK

5.9 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.9.1 INTRODUCTION

5.9.2 TRENDS AND FORECAST OF GDP

TABLE 3 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE

5.9.3 TRENDS OF GLOBAL AUTOMOTIVE INDUSTRY

FIGURE 27 GLOBAL AUTOMOTIVE INDUSTRY PRODUCTION, 2019–2021

5.9.4 TRENDS OF REGIONAL AUTOMOTIVE INDUSTRY

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION, 2019–2021

5.9.5 GROWTH TRENDS IN AEROSPACE INDUSTRY

5.9.5.1 Growth Indicators of Aerospace Industry, 2020–2040

TABLE 5 GROWTH INDICATORS OF AEROSPACE INDUSTRY, 2020–2040

FIGURE 28 WORLD FLEET PRODUCTION FORECAST, 2020–2040

TABLE 6 NUMBER OF AIRCRAFT REQUIRED, BY REGION

TABLE 7 NUMBER OF GLOBAL FREIGHTERS

TABLE 8 INDICATORS ENCOURAGING AEROSPACE INDUSTRY

5.10 YCC SHIFT: TRENDS AND DISRUPTIONS IMPACTING CONSUMERS

5.10.1 IMPACT OF MEGATRENDS AND TECHNOLOGY DISRUPTION ON FUTURE REVENUE POCKETS OF MAJOR COMPANIES

5.10.1.1 Aerospace

5.10.1.1.1 Continued technological advancement

5.10.1.1.2 Unmanned aircraft systems (UAS)

5.10.1.1.3 In-flight entertainment & connectivity

5.10.1.1.4 Strong replacement demand

5.10.1.1.5 Decline in fuel prices

5.10.1.1.6 Increasing focus on enhancing safety and efficiency

5.10.1.2 Automotive & Transportation

5.10.1.2.1 Electric Vehicles

5.10.1.2.2 Shared mobility

5.10.1.2.3 Innovation in batteries to power electric vehicles

5.10.1.2.4 Revolutionary transformation in autonomous driving

5.11 TARIFF AND REGULATIONS

5.12 CASE STUDY ANALYSIS: UD TAPES

6 UNIDIRECTIONAL TAPES MARKET, BY RESIN (Page No. - 70)

6.1 INTRODUCTION

FIGURE 29 THERMOPLASTIC RESIN SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

TABLE 9 UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (USD MILLION)

TABLE 10 UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (TON)

6.2 THERMOSET UD TAPES

6.2.1 THERMOSET BASED UD TAPES ARE MORE BRITTLE AND CHEAPER COMPARED TO THERMOPLASTIC-BASED UD TAPES

6.2.2 EPOXY

6.2.2.1 Excellent mechanical properties of epoxy driving its demand

6.2.3 OTHERS

TABLE 11 THERMOSET UD TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 12 THERMOSET UD TAPES MARKET SIZE, BY REGION, 2018–2026 (TON)

6.3 THERMOPLASTIC UD TAPES

6.3.1 NORTH AMERICA IS LARGEST AND FASTEST-GROWING MARKET FOR THERMOPLASTIC UD TAPES

6.3.2 POLYETHER ETHER KETONE (PEEK)

6.3.2.1 PEEK is most widely used thermoplastic resin carbon fiber-based UD tapes

6.3.3 POLYAMIDE

6.3.3.1 Superior chemical properties of PA driving the demand

6.3.4 OTHERS

TABLE 13 THERMOPLASTIC UD TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 14 THERMOPLASTIC UD TAPES MARKET SIZE, BY REGION, 2018–2026 (TON)

7 UNIDIRECTIONAL TAPES MARKET, BY FIBER (Page No. - 76)

7.1 INTRODUCTION

FIGURE 30 CARBON FIBER SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (USD MILLION)

TABLE 16 UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (TON)

7.2 GLASS FIBER

7.2.1 GLASS FIBER PROVIDES QUICK AND AFFORDABLE WAY TO BUILD PARTS & MOLDS AND MAKE REPAIRS

TABLE 17 GLASS FIBER UD TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 18 GLASS FIBER UD TAPES MARKET SIZE, BY REGION, 2018–2026 (TON)

7.3 CARBON FIBER

7.3.1 CARBON FIBER-BASED UD TAPES PROVIDE MORE DURABILITY OF PRODUCTS

TABLE 19 CARBON FIBER UD TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 20 CARBON FIBER UD TAPES MARKET SIZE, BY REGION, 2018–2026 (TON)

8 UNIDIRECTIONAL TAPES MARKET, BY END-USE INDUSTRY (Page No. - 82)

8.1 INTRODUCTION

FIGURE 31 AEROSPACE & DEFENSE SEGMENT TO REGISTER THE HIGHEST CAGR

TABLE 21 UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (TON)

TABLE 22 UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

8.2 AEROSPACE & DEFENSE

8.2.1 EXCELLENT STRENGTH-TO-WEIGHT CAPABILITY OF UD TAPES LEADING TO THEIR INCREASING DEMAND

TABLE 23 UD TAPES MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2018–2026 (TON)

TABLE 24 UD TAPES MARKET SIZE IN AEROSPACE & DEFENSE, BY REGION, 2018–2026 (USD MILLION)

8.2.2 COVID-19 IMPACT ON AEROSPACE MARKET

8.3 AUTOMOTIVE

8.3.1 GROWING FOCUS ON LIGHTWEIGHT VEHICLES TO BOOST DEMAND FOR UD TAPES

TABLE 25 UD TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2026 (TON)

TABLE 26 UD TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2026 (USD MILLION)

8.3.2 COVID-19 IMPACT ON AUTOMOTIVE MARKET

8.4 SPORTS & LEISURE

8.4.1 SMALL TOW CARBON FIBERS WITH HIGHER PERFORMANCE GRADES USED SPORTS & LEISURE INDUSTRY

TABLE 27 UD TAPES MARKET SIZE IN SPORTS & LEISURE, BY REGION, 2018–2026 (TON)

TABLE 28 UD TAPES MARKET SIZE IN SPORTS & LEISURE, BY REGION, 2018–2026 (USD MILLION)

8.5 OTHERS

TABLE 29 UD TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2026 (TON)

TABLE 30 UD TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2026 (USD MILLION)

9 UNIDIRECTIONAL TAPES MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 32 NORTH AMERICA TO REGISTER HIGHEST CAGR IN UD TAPES MARKET

TABLE 31 UD TAPES MARKET SIZE, BY REGION, 2018–2026 (TON)

TABLE 32 UD TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: UD TAPES MARKET SNAPSHOT

TABLE 33 NORTH AMERICA: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (TON)

TABLE 34 NORTH AMERICA: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (TON)

TABLE 36 NORTH AMERICA: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (TON)

TABLE 38 NORTH AMERICA: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (TON)

TABLE 40 NORTH AMERICA: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of major UD tapes producers in the country

9.2.2 CANADA

9.2.2.1 Aerospace & defense - a major industry of Canada

9.3 EUROPE

FIGURE 34 EUROPE: UD TAPES MARKET SNAPSHOT

TABLE 41 EUROPE: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (TON)

TABLE 42 EUROPE: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (USD MILLION)

TABLE 43 EUROPE: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (TON)

TABLE 44 EUROPE: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (USD MILLION)

TABLE 45 EUROPE: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (TON)

TABLE 46 EUROPE: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 47 EUROPE: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (TON)

TABLE 48 EUROPE: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Second-largest UD tapes market in Europe

9.3.2 FRANCE

9.3.2.1 Largest consumer of UD tapes in the region

9.3.3 UK

9.3.3.1 High demand for fuel-efficient and lightweight vehicles propelling the market

9.3.4 ITALY

9.3.4.1 Country’s sporting goods industry to create demand for UD tapes

9.3.5 SPAIN

9.3.5.1 High focus on increasing the use of UD tapes

9.3.6 RUSSIA

9.3.6.1 High focus on use of UD tapes in aerospace industry to drive the market

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: UD TAPES MARKET SNAPSHOT

TABLE 49 ASIA PACIFIC: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (TON)

TABLE 50 ASIA PACIFIC: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (USD MILLION)

TABLE 51 ASIA PACIFIC: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (TON)

TABLE 52 ASIA PACIFIC: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (TON)

TABLE 54 ASIA PACIFIC: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 55 ASIA PACIFIC UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (TON)

TABLE 56 ASIA PACIFIC: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Demand for new airplanes to replace older ones to influence the market

9.4.2 CHINA

9.4.2.1 China witnessing growth in aircraft manufacturing and maintenance

9.4.3 SOUTH KOREA

9.4.3.1 Demand for UD tapes in both commercial and general aviation

9.4.4 TAIWAN

9.4.4.1 Growing sporting goods industry spurring the market growth

9.4.5 REST OF ASIA PACIFIC

9.5 MIDDLE EAST & AFRICA

FIGURE 36 AEROSPACE & DEFENSE TO BE FASTEST-GROWING END USER OF UD TAPES IN MIDDLE EAST & AFRICA

TABLE 57 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (TON)

TABLE 58 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (TON)

TABLE 60 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (TON)

TABLE 62 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (TON)

TABLE 64 MIDDLE EAST & AFRICA: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.5.1 ISRAEL

9.5.1.1 Presence of OEMs boosting the market

9.5.2 UAE

9.5.2.1 Investment by leading players to fuel the market

9.5.3 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

FIGURE 37 AEROSPACE & DEFENSE TO BE FASTEST-GROWING END-USE INDUSTRY OF UD TAPES IN SOUTH AMERICA

TABLE 65 SOUTH AMERICA: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (TON)

TABLE 66 SOUTH AMERICA: UD TAPES MARKET SIZE, BY RESIN, 2018–2026 (USD MILLION)

TABLE 67 SOUTH AMERICA: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (TON)

TABLE 68 SOUTH AMERICA: UD TAPES MARKET SIZE, BY FIBER, 2018–2026 (USD MILLION)

TABLE 69 SOUTH AMERICA: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (TON)

TABLE 70 SOUTH AMERICA: UD TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 71 SOUTH AMERICA: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (TON)

TABLE 72 SOUTH AMERICA: UD TAPES MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Brazil- one of the only five commercial jet manufacturers globally

9.6.2 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 118)

10.1 OVERVIEW

FIGURE 38 COMPANIES ADOPTED COLLABORATION/AGREEMENT AND NEW PRODUCT LAUNCH AS KEY GROWTH STRATEGIES BETWEEN 2017 AND 2020

10.2 MARKET SHARE ANALYSIS

TABLE 73 UD TAPES MARKET: DEGREE OF COMPETITION

FIGURE 39 UD TAPES MARKET: MARKET SHARE ANALYSIS FOR 2020

10.2.1 MARKET RANKING ANALYSIS

FIGURE 40 RANKING OF KEY PLAYERS

10.3 COMPANY REVENUE ANALYSIS

FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES DURING THE PAST FIVE YEARS

10.4 COMPANY EVALUATION QUADRANT, 2020

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 PARTICIPANTS

FIGURE 42 UD TAPES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 SME MATRIX, 2020

10.5.1 PROGRESSIVE COMPANIES

10.5.2 DYNAMIC COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 RESPONSIVE COMPANIES

FIGURE 43 UD TAPES MARKET: EMERGING COMPANIES’ COMPETITIVE LEADERSHIP MAPPING, 2020

10.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 44 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN UD TAPES MARKET

10.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 45 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN UD TAPES MARKET

10.8 COMPETITIVE SCENARIO

10.8.1 MARKET EVALUATION FRAMEWORK

TABLE 74 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 75 MOST FOLLOWED STRATEGY

TABLE 76 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

10.8.2 MARKET EVALUATION MATRIX

TABLE 77 COMPANY PRODUCT FOOTPRINT

TABLE 78 COMPANY REGION FOOTPRINT

TABLE 79 COMPANY INDUSTRY FOOTPRINT

10.9 STRATEGIC DEVELOPMENTS

TABLE 80 NEW PRODUCT LAUNCH, 2017–2021

TABLE 81 DEALS, 2017–2021

TABLE 82 OTHERS, 2017–2021

11 COMPANY PROFILES (Page No. - 133)

11.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

11.1.1 EVONIK INDUSTRIES

TABLE 83 EVONIK INDUSTRIES: BUSINESS OVERVIEW

FIGURE 46 EVONIK INDUSTRIES: COMPANY SNAPSHOT

11.1.2 SABIC

TABLE 84 SABIC: BUSINESS OVERVIEW

FIGURE 47 SABIC: COMPANY SNAPSHOT

11.1.3 TORAY INDUSTRIES, INC.

TABLE 85 TORAY INDUSTRIES, INC: BUSINESS OVERVIEW

FIGURE 48 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

11.1.4 HEXCEL CORPORATION

TABLE 86 HEXCEL CORPORATION: BUSINESS OVERVIEW

FIGURE 49 HEXCEL CORPORATION: COMPANY SNAPSHOT

11.1.5 SGL GROUP

TABLE 87 SGL GROUP: BUSINESS OVERVIEW

FIGURE 50 SGL GROUP: COMPANY SNAPSHOT

11.1.6 TEIJIN LIMITED

TABLE 88 TENJIN LIMITED: BUSINESS OVERVIEW

FIGURE 51 TEIJIN LIMITED: COMPANY SNAPSHOT

11.1.7 SOLVAY SA

TABLE 89 SOLVAY SA: BUSINESS OVERVIEW

FIGURE 52 SOLVAY SA: COMPANY SNAPSHOT

11.1.8 BASF SE

TABLE 90 BASF SE: BUSINESS OVERVIEW

FIGURE 53 BASF: COMPANY SNAPSHOT

11.1.9 BARRDAY

TABLE 91 BARRDAY: BUSINESS OVERVIEW

11.1.10 CELANESE CORPORATION

TABLE 92 CELANESE CORPORATION: BUSINESS OVERVIEW

FIGURE 54 CELANESE CORPORATION: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER COMPANIES

11.2.1 CRISTEX

TABLE 93 CRISTEX: BUSINESS OVERVIEW

11.2.2 VICTREX

TABLE 94 VICTREX: BUSINESS OVERVIEW

11.2.3 TCR COMPOSITES

TABLE 95 TCR COMPOSITES: BUSINESS OVERVIEW

11.2.4 SIGMATEX

TABLE 96 SIGMATEX: BUSINESS OVERVIEW

11.2.5 EUROCARBON

TABLE 97 EUROCARBON: BUSINESS OVERVIEW

11.2.6 PRF COMPOSITE MATERIALS

TABLE 98 PRF COMPOSITE MATERIALS: BUSINESS OVERVIEW

11.2.7 OXEON AB

TABLE 99 OXEON AB: BUSINESS OVERVIEW

11.2.8 AXIOM MATERIALS

TABLE 100 AXIOM MATERIALS: BUSINESS OVERVIEW

11.2.9 SHELDAHL

TABLE 101 SHELDAHL: BUSINESS OVERVIEW

12 ADJACENT & RELATED MARKETS (Page No. - 164)

12.1 INTRODUCTION

12.1.1 LIMITATIONS

12.2 AUTOMOTIVE COMPOSITES MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE

TABLE 102 AUTOMOTIVE COMPOSITES MARKET SIZE, BY FIBER TYPE, 2015–2022 (USD MILLION)

TABLE 103 AUTOMOTIVE COMPOSITES MARKET SIZE, BY FIBER TYPE, 2015–2022 (KILOTON)

12.2.3.1 Carbon Fiber Automotive Composites

12.2.3.2 Glass Fiber Automotive Composites

12.2.3.3 Other Fiber-based Automotive Composites

12.2.4 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE

TABLE 104 AUTOMOTIVE COMPOSITES MARKET SIZE, BY RESIN TYPE, 2015–2022 (USD MILLION)

TABLE 105 AUTOMOTIVE COMPOSITES MARKET SIZE, BY RESIN TYPE, 2015–2022 (KILOTON)

12.2.4.1 Thermoset Automotive Composites

12.2.4.1.1 Polyester Resin

12.2.4.1.2 Vinyl Ester Resin

12.2.4.1.3 Epoxy resin

12.2.4.1.4 Others

12.2.4.2 Thermoplastic Automotive Composites

12.2.4.2.1 Polypropylene (PP)

12.2.4.2.2 Polyamide (PA)

12.2.4.2.3 Polyphenylene Sulfide (PPS)

12.2.4.2.4 Others

12.2.5 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS

TABLE 106 AUTOMOTIVE COMPOSITES MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (USD MILLION)

TABLE 107 AUTOMOTIVE COMPOSITES MARKET SIZE, BY MANUFACTURING PROCESS, 2015–2022 (KILOTON)

12.2.5.1 Compression Molded Automotive Composites

12.2.5.2 Injection Molded Automotive Composites

12.2.5.3 Resin Transfer Molded Automotive Composites

12.2.5.4 Other Processes

12.2.5.4.1 Filament Winding Process

12.2.5.4.2 Continuous Process

12.2.5.4.3 Manual Process

12.2.6 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION

TABLE 108 AUTOMOTIVE COMPOSITES MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 109 AUTOMOTIVE COMPOSITES MARKET SIZE, BY APPLICATION, 2015–2022 (KILOTON)

12.2.6.1 Exterior

12.2.6.2 Interior

12.2.6.3 Powertrain

12.2.6.4 Chassis

12.2.7 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE

TABLE 110 AUTOMOTIVE COMPOSITES MARKET SIZE, BY VEHICLE TYPE, 2015–2022 (USD MILLION)

TABLE 111 AUTOMOTIVE COMPOSITES MARKET SIZE, BY VEHICLE TYPE, 2015–2022 (KILOTON)

12.3 NON-ELECTRIC VEHICLES

12.4 ELECTRIC VEHICLES

12.4.1 AUTOMOTIVE COMPOSITES MARKET, BY REGION

TABLE 112 AUTOMOTIVE COMPOSITES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 113 AUTOMOTIVE COMPOSITES MARKET SIZE, BY REGION, 2015–2022 (KILOTON)

12.4.1.1 Europe

12.4.1.2 North America

12.4.1.3 Asia Pacific

12.4.1.4 Latin America

12.4.1.5 Middle East & Africa

13 APPENDIX (Page No. - 177)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

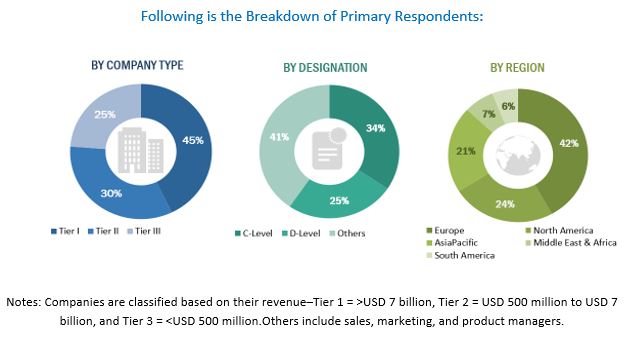

The study involved four major activities in estimating the current market size of UD tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the UD tapes market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The UD tapes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the aerospace & defense, automotive, sports & leisure, and other industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the UD tapes market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The UD tape industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall size of the UD tapes market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the unidirectional (UD) tapes market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market based on resin, fiber, and end-use industry

- To analyze and forecast the market based on key regions, such as North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product launch and expansion

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Unidirectional Tapes (UD) Market