Carbon Fiber Tape Market by Form (Prepreg Tape, Dry Tape), Resin (Epoxy, Thermoplastic, Polyamide), Manufacturing Process (Hot Melt, Solvent Dip), End-use Industry (Aerospace, Marine, Pipe & Tank, Sporting Goods), and Region - Global Forecast to 2027

Updated on : August 25, 2025

Carbon Fiber Tape Market

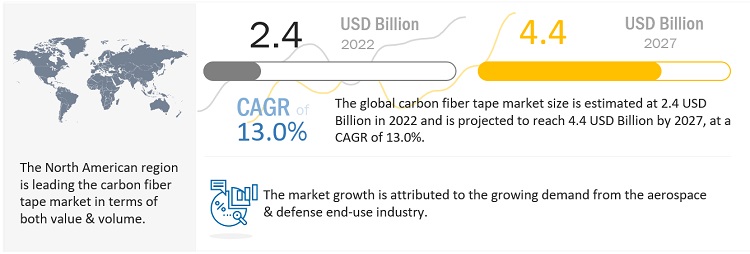

The global carbon fiber tape market was valued at USD 2.4 billion in 2022 and is projected to reach USD 4.4 billion by 2027, growing at 13.0% cagr from 2022 to 2027. Increasing use of carbon fiber tape in the aerospace and other end-use industries as a high-performance material is fueling the growth of the carbon fiber tape market across the globe.

Attractive Opportunities in the Carbon Fiber Tape Market

To know about the assumptions considered for the study, Request for Free Sample Report

Carbon Fiber Tape Market Dynamics

Drivers: Increase in the use of carbon fiber tapes in primary and secondary aircraft structures

The greater strength-to-weight capability and excellent fatigue resistance of carbon fiber tapes allow for more structurally efficient and aerodynamic aircraft designs. Carbon fiber tapes are mainly used for localized reinforcements, repairs, and rapidly building part thickness of carbon fiber composite parts in the primary and secondary structures of aircraft. Their major applications are fixed wing-fuselage, driveshafts, wing spars, wing skins, cargo floor panels, fan blades, tail booms, rib stiffeners, conduit, and brackets, among others. There has been a paradigm shift in aircraft design by Boeing and Airbus, with composites now being considered for primary structures of all wide-bodied aircraft. Now, the use of carbon fiber tapes is increasing in the new series of aircraft, such as Airbus A380, Boeing 777x, and Boeing 737 MAX. In the recently launched aircraft MS- 21 by Russian manufacturer, Irkut, carbon fiber tapes have been used for the manufacturing of its wing spars, wing skin, and six section panels for wing box. The 58%-60% of the carbon fiber content in this aircraft wing is made up of carbon fiber tapes. This scenario is expected to have a positive impact on the design of aircraft in the future.

Restraints: High processing and manufacturing cost of carbon fiber

Although the carbon fiber industry was cyclical in the past, the emerging applications of carbon fibers are driving the market at a high rate. However, the current global production capacity of carbon fibers is insufficient to meet the projected demand. A lot of research is going on across the world to cut the cost of carbon fiber for its mass production. For instance, the researchers in the Oak Ridge National Laboratory (ORNL), US, have demonstrated a carbon fiber production method that can reduce the cost of carbon fiber by 50%. It can also reduce the energy consumption for producing carbon fiber by more than 60%. In the automotive industry, carbon fiber is currently being used only in racing cars and other high-end sports cars. The reduction in the cost of carbon fiber is expected to lead to an increase in its use in various end-use industries.

Opportunities: Increasing penetration of carbon fiber tapes in new applications

Carbon fiber tapes are emerging as a class of materials that possess superior properties. These materials have very high stiffness, lower weight, high abrasion, and wear resistance. The use of these materials is increasing in the medical and construction & infrastructure, among other end-use industries. In the medical industry, the use of carbon fiber tapes is increasing in the manufacturing of prosthetic parts, such as artificial limbs and exoskeleton construction for limbs. Their use is also increasing rapidly in the localized reinforcement, repairs, and seam taping of concrete parts in the construction industry. These tapes are also used for the manufacturing of tubular products through the filament winding process in the pipe & tank industry.

Challenges: Transition of thermosetting resin to thermoplastic resin in prepreg carbon fiber tape

Thermosetting resin are dominating the market currently but are not eco-friendly. Thermoplastic resins can be recycled and have low cost of batch processing but still thermosetting resins are dominating the market due to the ease of fabrication. With the growing prices of carbon fiber and other raw materials due to inflation this would be a challenge to shift to more eco-friendly option viz. thermoplastic resins.

The epoxy resin segment accounted for a significant share of the carbon fiber prepreg tape market in terms of value and volume during the forecast period.

Epoxy resins holds the largest share in global carbon fiber tape market and have high demand because they have superior properties and fast-curing time compared to other thermoset resins, which makes it a preferred choice across end-use industries. Although in this segment of carbon fiber market thermoplastic resins are expected to grow with the highest CAGR due to its property of getting recycled.

Hot melt manufacturing process is expected to account for a major share of the carbon fiber prepreg tape market in terms of value and volume during the forecast period.

Hot melt manufacturing process results is a method commonly being used for the manufacturing of unidirectional carbon fiber tapes.Hot melt is a two-stage process where heat and pressure are used in order to let the fibers absorb the resins. It is also an eco-friendly process when compared to solvent dip process because it uses water-based and solvent-free adhesives.

The prepreg tape segment is expected to grow at the higher CAGR in terms of both value and volume during the forecast period.

Prepreg tapes are widely being used in aerospace, sporting goods and pipe & tanks industries for different applications. In aerospace industries carbon fiber prepreg tapes are used to manufacture wing spars, fuselage skins, and others. In commercial aircraft manufacturing units, hand lay up method has been replaced with automated tape laying method hence resulting in the boost in the demand of prepreg carbon fiber tapes.

To know about the assumptions considered for the study, download the pdf brochure

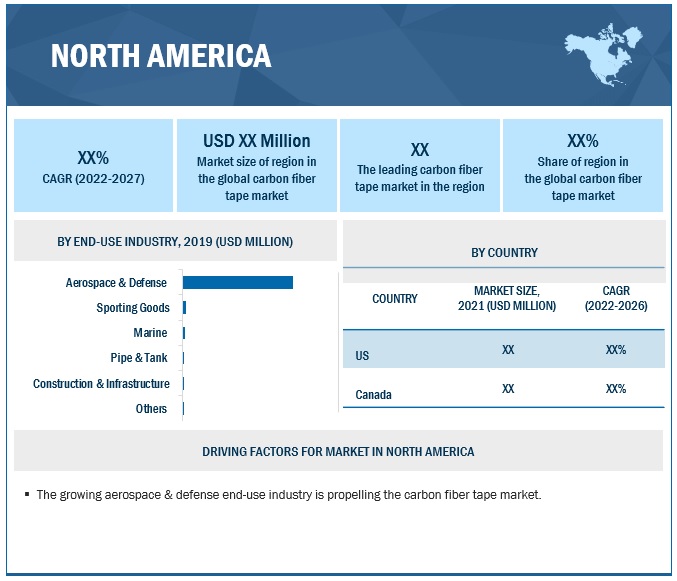

North America held the largest share in the carbon fiber tape market in 2021.

North America holds the largest share in the carbon fiber tape market, owing to the growing economy of the region, the presence of prominent players, and expanding aerospace & defense industry. In North American region, the US is largest market due to the huge demand coming from aerospace & defense sector. One of the leading player of aircraft manufacturing Boeing has its manufacturing units in US owing to the demand of carbon fiber tape in the country.

Increasing importance of carbon fiber tape in construction industry

Carbon fiber tapes are the best replacement for steel reinforcements. They protect concrete structures from rust as carbon fiber is less susceptible to corrosion. The use of carbon fiber tapes in the construction industry is increasing as they reduce the time and money costs for repairing structures. They are used in housing construction, bridge building, and the construction of treatment facilities, and utilities. Their superior properties make them the first choice for construction purposes. Carbon fiber tapes have a strength-weight ratio of 8-17 times, and the modulus of elasticity is 5-13 times higher than that of steel, aluminum, and titanium.

Carbon Fiber Tape Market Players

The key players in the global carbon fiber tape market are Mitsubishi Chemical Holdings (Japan), Evonik Industries (Germany), Toray Industries, Inc. (Japan), Hexcel Corporation (US), Teijin Limited (Japan), SGL Group (Germany), Royal DSM (Netherlands), SABIC (Saudi Arabia), and Solvay (Belgium).

Carbon Fiber Tape Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Form, Resin, Manufacturing Process, End-use Industry and Region |

|

Regions |

Europe, North America, Asia Pacific, MEA, and Latin America |

|

Companies |

Mitsubishi Chemical Holdings (Japan), Evonik Industries (Germany), Toray Industries, Inc. (Japan), Hexcel Corporation (US), Teijin Limited (Japan), SGL Group (Germany), Royal DSM (Netherlands), SABIC (Saudi Arabia), and Solvay (Belgium) |

This research report categorizes the carbon fiber tape market based on form, resin, manufacturing process, end-use industry, and region.

By Resin (Prepreg Tape):

- Epoxy

- Thermoplastic

- Bismaleimide

- Polyamide

- Others

By Form:

- Prepreg Tape

- Dry Tape

By Manufacturing Process (Prepreg Tape):

- Hot Melt

- Solvent Dip

By End-use Industry:

- Aerospace & Defense

- Marine

- Pipe & Tank

- Construction & Infrastructure

- Sporting Goods

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In September 2019, Solvay expanded its thermoplastic tape capacity with a new production line at its U.S. facility in Anaheim, California, underscoring its commitment to meeting strong demand growth from aerospace customers.

- In February 2019, Teijin acquired Renegade Materials Corporation, a supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This helped the company solidify its position as a leading provider of solutions for aerospace applications.

- In January 2020, Hexcel collaborated with Madshus, a leading innovator in the world of cross-country skiing. The company provides Madshus with three different Hi Tape products based on specific design parameters of different cross-country ski types. Hexcel’s new HiTape dry carbon tapes improve the performance, manufacturing efficiency, and surface finish of Madshus’ skis.

- In November 2021, Solvay and 9T Labs AG agreed to a partnership agreement where Solvay will focus on the development of carbon fiber-reinforced polyetheretherketone (CF/PEEK), CF-reinforced bio-based high performance polyamides and CF-reinforced polyphenylene sulfide (CF/PPS) composite materials. The partnership significantly expands the types of neat and carbon fiber-reinforced materials portfolio that 9T Labs currently offers to customers.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the carbon fiber tape market?

The properties of carbon fiber tape, increasing environmental awareness, and its upcoming new applications.

Which is the largest country-level market for carbon fiber tape?

US is the largest carbon fiber tape market due to high demand from aerospace industry.

What are the factors contributing to the final price of carbon fiber tape?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of carbon fiber tape.

What are the challenges in the carbon fiber tape market?

Development of low-cost production technology is the major challenge in the carbon fiber tape market, along with the transition of thermosetting resin to thermoplastic resin in prepreg carbon fiber tape. .

Which form of carbon fiber tape holds the largest market share?

Prepreg carbon fiber tape holds the largest share.

How is the carbon fiber tape market aligned?

The market is growing at a significant pace. It is a potential market and many manufacturers are planning business strategies to expand their business.

Who are the major manufacturers?

Mitsubishi Chemical Holdings (Japan), Evonik Industries (Germany), Toray Industries, Inc. (Japan), Hexcel Corporation (US), Teijin Limited (Japan), SGL Group (Germany), Royal DSM (Netherlands), SABIC (Saudi Arabia), and Solvay (Belgium).

What are the major applications for Carbon fiber tape?

The major applications for Carbon fiber tape are Aerospace, Sporting Goods and many more. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved two major activities in estimating the current size of the carbon fiber tape market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The carbon fiber tape market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is primarily characterized by the development of the aerospace, sporting goods, marine, pipe & tank, and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

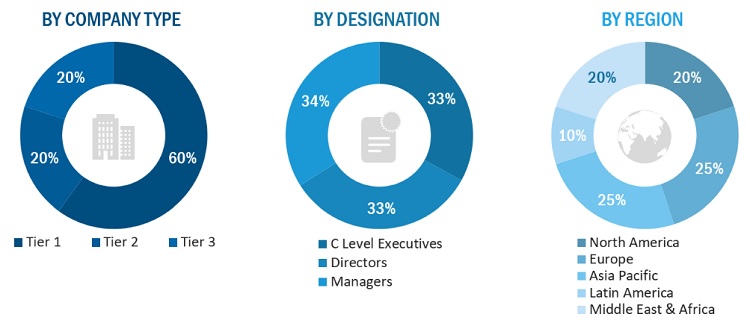

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the carbon fiber tape market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall carbon fiber tape market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive, consumer goods, sporting goods, and other end-use industries.

Report Objectives

- To define, describe, and forecast the size of the carbon fiber tape market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on form, resin, manufacturing process, and end-use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC carbon fiber tape market

- Further breakdown of Rest of European carbon fiber tape market

- Further breakdown of Rest of MEA carbon fiber tape market

- Further breakdown of Rest of Latin American carbon fiber tape market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Carbon Fiber Tape Market