Unmanned Traffic Management Market by Type ((Persistent, Non-Persistent), Component (Solutions, Software, Services), Application (Aviation, Homeland Security, Agriculture, Logistics & Transportation), End-User, and Region - Global Forecast to 2030

Updated on : Nov 25, 2024

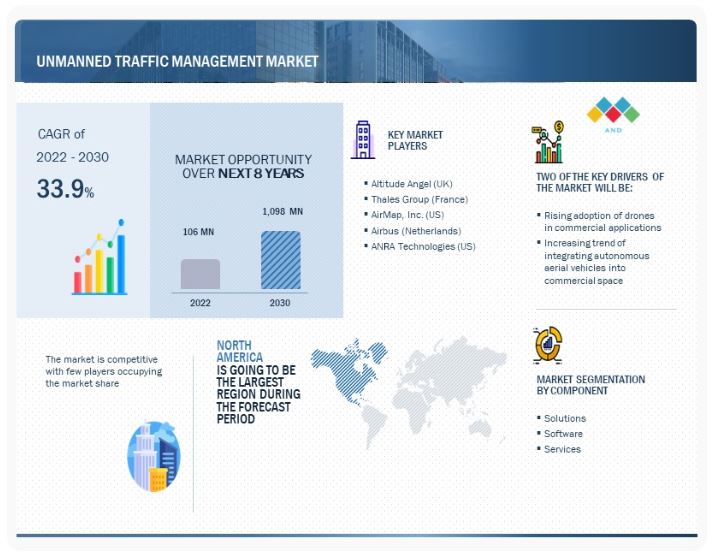

[288 Pages Report] The Unmanned Traffic Management Market size is anticipated to reach USD 1,098 million by 2030, growing at a CAGR of 33.9% from USD 106 million in 2022.

The development of advanced HMI technologies is important for enabling the easy and intuitive control of drones by pilots and other users. There are several different approaches to HMI in drones, including the use of traditional controls such as joysticks and keyboards, as well as more advanced technologies such as voice control and gestures. In addition to traditional HMI technologies, the use of virtual reality (VR) and augmented reality (AR) is also being explored as a way to enable users to interact with drones in real time. This could allow for the real-time visualization of data from drones and the ability to control drones through intuitive gestures and movements. Overall, the development of advanced HMI technologies is an important aspect of UTM systems, as it allows for the easy and intuitive control of drones by pilots and other users and enables a wide range of applications.

Unmanned Traffic Management (UTM) Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Unmanned Traffic Management (UTM) Market Dynamics

Driver: Growing understanding of digitalization and its role within aviation industry

The new concept of the remote virtual tower has been introduced in the UTM Market. Remote virtual towers allow controllers to perform all functions of a control tower from anywhere in the world. These towers ensure streamlined access, reduced delays, and increased safety margins compared to non-towered airports. Airports and air navigation service providers (ANSPs) are considering the possibilities of advancements in visual observation aided by the introduction of ICAO’s Procedures for Air Navigation Services (PANS) ATM amendments. These amendments state that visual observation shall be achieved through direct out-of-the-window observation or indirect observation utilizing a visual surveillance system specifically approved for the purpose by the appropriate ATS authority. This would undoubtedly encourage several countries to implement remote and digital towers. These towers occupy a smaller footprint, cost less, are technically effective, and are often more resilient and secure in comparison to a conventional control tower. In addition, they can provide aerodrome control services for more than one aerodrome, where dedicated local air traffic services are not considered sustainable or cost effective. Disruption and change are often adopted without any real enthusiasm and implementing new things such as software into processes takes time because it impacts a lot of people, from the ground handler to the airport manager, but also the service providers. The aviation industry has been slow to adopt technologies such as IoT and AI etc. compared to other industries, however, digitalization can lead to major benefits at different levels. By digitalizing their processes, airliners and airports can enhance the efficiency of their operations management by improving employee productivity, reduce costs by saving time and money both on and off the ground and therefore improve the customer experience

Restraints: Government regulations

While innovation in technologies is required to support the UTM concept, the largest hurdle to full drone deployment in most countries remains regulation. Drones are allowed in the United States for recreational and commercial use, subject to FAA and local regulations. International regulations and standards require that any new system, procedure, or operation that has an impact on the safety of ATM operations shall be subject to a risk assessment and mitigation process to support its safe introduction and operation. The flying of drones in the airspace of different countries primarily depends on obtaining approval from the respective governments and the regulations formulated by them to ensure proper air traffic management, sufficient data support, effective controller training, and social adaptability drones by the population in those countries.

Governments of different countries across the world are making efforts to enhance their capabilities by developing new technologies for drones or carrying out advancements in the existing technologies used in drones. However, these technologies need to comply with country-wise drone regulations and be capable of controlling drones in a regulated environment. Thus, huge investments are required for the R&D and procurement of drones based on advanced technologies. Suppose the cost incurred in the development of drone infrastructure outweighs the benefits offered by drones. In that case, it will become difficult for governments of different countries to make changes in their existing policies to enable the use of drones in various applications. The cost of developing the drone infrastructure, along with political issues to obtain the required approvals for the development of drone ecosystems, acts as an uncertainty to the growth of this market.

Opportunities: UAS service suppliers

A UAS Service Supplier (USS) will be responsible for managing a UTM system's essential functioning (USS). Although the USS's function is still being developed, they will be commercial organizations under the authority and supervision of a government organisation, such as the FAA. All other stakeholders, including drone operators, hobbyists, air traffic control, law enforcement, and the general public, would converge at the USS to get situational awareness surrounding unmanned aircraft. Additionally, USS will offer commercial drone operators essential data such as geo-fencing, real-time aircraft tracking, conflict advisors, UAS identification, and airspace authorization. The ideal USS will provide an independent, highly automated and scalable system that will manage and monitor drone flights, as well as factor in inputs from external sources such as terrain, weather, and air traffic control, making this data available to all commercial drone operators or service providers. In addition, the USS will send notifications to external stakeholders such as public safety and state agencies..

Challenges: Interaction of UTM and ATM

Drones can perform a wide range of functions and are available in several sizes and shapes. UAS operate at altitudes from close to the surface to the edge of the space and range in weight from a few grams to several tonnes. While a few UAS can fly at very high speeds, some can only do it at very low speeds, and a few can remain in the air for days. Drones are being taken into consideration independently from aircraft that can operate under instrument flight regulations (IFR) and can fly in a controlled airspace. Aircraft are capable of interacting with air navigation service providers (ANSPs) in a manner similar to traditional manned aircraft (i.e., on an IFR flight plan), which are certified by a regulator and flown with a licensed pilot directly involved with flight operations and are referred to as remotely piloted aircraft systems (RPAS). The experience of RPAS operations and their interaction with the ATM system indicates that currently, RPAS are unable to comply with many standards, routine ATM procedures. This has not prevented RPAS operations but has limited their integration due to special activity airspace, altitude reservations, or other airspace separations. Thus, RPAS operators are now seeking greater freedom of access to airspace, and this will increasingly interact with the wider ATM system.

Smaller UAS known as drones frequently fly at lower altitudes than RPAS. A large numbers of drones flying in or near controlled airspace daily could make it difficult for ANSPs to maintain separation of UAS from manned and other unmanned aircraft in the non-segregated airspace. The effectiveness and safety of ATMs could be affected by this. For instance, local ANSPs express safety concerns about drone operations at low altitudes close to airports. Speed, maneuverability, climb rate, performance traits, and avionic system equipage may be significantly different from conventional aircraft, necessitating future adjustments to ATM regulations and procedures. A key factor in safely integrating unmanned technology in non-segregated airspace is the ability for a drone to perform in a predictable manner and that there shall always be a pilot in command of the operation. However, it is assumed that, in the future, there will be a higher degree of automation. Should that be the case, the control of UAS, the interaction of UAS with other users of the airspace, and the interaction of UAS with present or future air traffic management systems, by means of non-human entities should also demonstrate equivalence with all the rules and safety thresholds established for flying, certifying, and equipping aircraft..

Software segment of the unmanned traffic management market is projected to witness the largest market share during forecast period.

Based on component, the unmanned traffic management market has been segmented into solutions, software, and services. The software segment is estimated to lead the market. Based on software type, the unmanned traffic management component market is segmented into flight planning, fleet operation & management, data capture, and others, which include computer vision and navigation, and software development kits (SDKs). These software for drones enable the user to control the flight from devices such as smartphones, tablets, or controllers. Being present on the site helps the drone pilot to make improvements in the flight path or flight pattern. Commercial drones are bound to a specific operational range, due to which a controller, mobile, or tablet can be easily used to control their operation. A majority of drone software are cloud-based and provide ease of access from any device. This enables users to view videos and pictures in real time. Application software is practical for drones that are used in remote areas or places where carrying a desktop station is not possible; for instance, surveying a hazardous material accident, water sampling using drones, or using drones in archaeology or wildlife photography.

Commercial segment of the unmanned traffic management market is projected to witness the largest market share during the forecast period.

Based on end-user, the unmanned traffic management market has been classified into commercial and government & law. Consumer drones have become popular among prosumers and hobbyists, vloggers, and videographers worldwide. This is because these drones are cost-effective and offer high-resolution wide-angle photography. The need for UTM has become more critical to ensure the safe and secure use of airspace. UTM provides a platform for commercial drone operators to plan and authorize their flights, considering airspace restrictions, weather conditions, and other factors. It also provides a way for drones to be remotely identified and for their operators to be authenticated. This is important for ensuring the safety of other airspace users, such as users of manned aircraft, and for complying with regulations.

Based on type, the Persistent segment is estimated to lead the unmanned traffic management market from 2022 to 2030.

Based on type, the unmanned traffic management market has been segmented into persistent UTM and non-persistent UTM. The persistent UTM segment is estimated to lead the market as it can provide a high level of safety and security for drone operations. Persistent UTM refers to a system that provides continuous and long-term monitoring, control, and management of drone flights. A persistent UTM system would typically include a wide range of capabilities such as flight planning, communication, navigation, surveillance, and separation assurance, which are provided through a network of ground-based and airborne systems. These capabilities allow for the continuous monitoring and control of drone flights, enabling the safe and efficient operation of drones in the airspace.

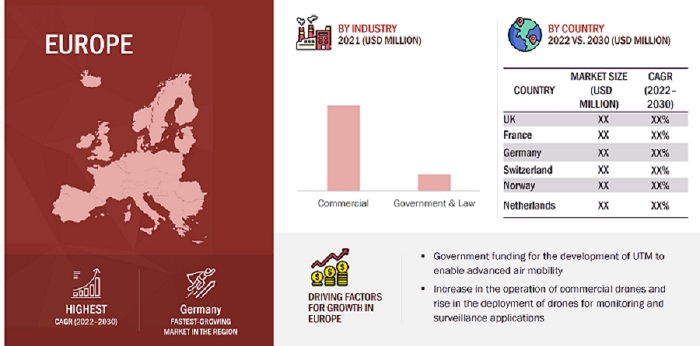

The Europe market is projected to contribute the highest CAGR from 2022 to 2030 in the unmanned traffic management market

The UTM market in Europe is projected to grow at highest CAGR from 2022 to 2030 owing to the increasing demand for drones for various applications in the region. As the geopolitical situation in this region is unstable, a number of countries in Europe are focusing on increasing their defensive capabilities. The prevailing trend of the procurement of drones by emerging economies such as the UK, Germany, and France is expected to drive the growth of the UTM market in Europe in the coming years.

Over the past few years, countries in the European region have been focused on the development of new and advanced technologies for use in UAV payloads, UAV ground control stations (GCS), and UAV data links. The European Commission is working toward amending the existing rules regarding UAVs. The European Aviation Safety Agency (EASA) has formulated regulations for drones that weigh above 150 kilograms. With the recent focus on the air traffic management of drones, the European Commission has introduced an initiative known as U-Space, which is described as an efficient framework for all individuals and businesses to operate UAS at low altitudes. U-Space helps automate operations of UAS that fly over long distances. In addition, SESAR Joint Undertaking, a European public-private partnership, funded a project known as CLear Air Situation for uaS (CLASS), which is spearheaded by Airbus Defense and Space. Such developments undertaken in the field of UTM are projected to drive the growth of the unmanned traffic management industry in the European region.

Unmanned Traffic Management (UTM) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

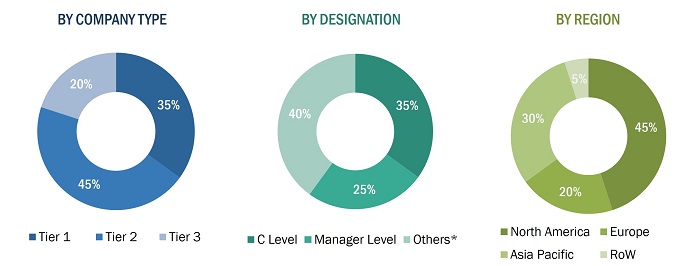

The break-up of the profile of primary participants in the unmanned traffic management market:

- By Company Type: Tier 1 – 35%, Tier 2 – 45%, and Tier 3 – 20%

- By Designation: C Level – 35%, Director Level – 25%, and Others – 40%

- By Region: North America – 45%, Europe – 20%, Asia Pacific – 30%, ROW-5%

Top Unmanned Traffic Management Companies - Key Market Players

The Unmanned Traffic Management Companies are mainly resorted to government funding, and R&D expenditure to drive their growth. They also entered new markets by launching technologically advanced and cost-effective software, and services. Altitude Angel (UK). Thales Group (France), AirMap, Inc. (US), Airbus (Netherlands), and ANRA Technologies (US) are a few of the leading players in the market who adopted this strategy. An increase in the demand for advanced unmanned traffic management services and the growth of emerging markets has encouraged companies to adopt this strategy to enter new regions.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 106 Million in 2022 |

|

Projected Market Size |

USD 1,098 Million by 2030 |

|

Growth Rate |

33.9% |

|

Market size available for years |

2019-2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By component, By type, By end-user, and By application |

|

Geographies covered |

North America, Europe, Asia Pacific, ROW |

|

Companies covered |

Altitude Angel (UK). Thales Group (France), AirMap, Inc. (US), Airbus (Netherlands), and ANRA Technologies (US) are some of the major players of unmanned traffic management market. (25 Companies) |

Unmanned Traffic Management (UTM) Market Highlights

The study categorizes the unmanned traffic management market based on component, type, end-user, and application and region.

|

Aspect |

Details |

|

By Component |

|

|

By Type |

|

|

By Application |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In December 2022, Altitude Angel announced a partnership with SAAB Group on Digital Tower technology. With the formal partnership agreement in place, Altitude Angel will begin integrating its GuardianUTM services into the r-TWR digital tower solution offered by Saab, allowing ANSPs and appropriate stakeholders to digitally authorize and manage uncrewed flights in conjunction with crewed flights, directly communicating authorization, clearance, and in-flight instructions to provide the enhanced situational awareness of drone operations.

- In December 2022, OneSky announced that Supernal has signed on to be a member of the OneSky Future of Flight program. OneSky and Supernal will work together to combine the power of OneSky’s airspace situational awareness, operations planning and simulation, and UTM/PSU solutions with Supernal’s expertise in eVTOL platform manufacturing and operations.

- In November 2022, ANRA Technologies won a contract to demonstrate the ability to collect, aggregate, and retransmit Broadcast Remote ID (B-RID) messages. ANRA will convert these B-RID messages to Network Remote ID (N-RID) messages that can be shared in the Unmanned Aircraft Systems (UAS) Service Supplier (USS) Network. This FAA-funded project will test and validate advanced air traffic management functions for UAS to safely operate in conformance with the FAA Remote Identification Final Rule requiring the remote identification of uncrewed aircraft in the United States airspace.

- In November 2022, Raytheon Intelligence & Space, a Raytheon Technologies business, in collaboration with the Virginia Tech Mid-Atlantic Aviation Partnership, or MAAP, and the Lone Star UAS Center of Excellence & Innovation has been selected by the Federal Aviation Administration (FAA) to participate in the Uncrewed Aircraft Systems Traffic Management (UTM) field test. As a part of this effort, the team will conduct UTM flight tests in complex environments.

- In December 2021, DroneUp, LLC, the drone flight services innovator and aviation technology provider, announced it has acquired AirMap, Inc., the digital airspace and automation company serving the global aerospace economy.

Frequently Asked Questions (FAQ):

Which are the major companies in the unmanned traffic management market? What are their major strategies to strengthen their market presence?

Some of the key players in the unmanned traffic management market are Altitude Angel (UK). Thales Group (France), AirMap, Inc. (US), Airbus (Netherlands), and ANRA Technologies (US), and among others, are the key players in unmanned traffic management market. Major strategies include new product launches, new service launches, contracts, partnerships, agreements, collaborations, and expansions. Contracts were the key strategy adopted by leading players to achieve growth in the sensors and actuators market.

What are the drivers and opportunities for the unmanned traffic management market?

The use of unmanned aerial vehicles (UAVs) is growing rapidly across several commercial application domains including real-time monitoring, providing wireless coverage, remote sensing, search and rescue, delivery of goods, security and surveillance, precision agriculture, and infrastructure inspection. With increase in number of drones, the interplay between manned and unmanned systems needs to be managed. Unmanned traffic management will play this crucial of managing airspace along with interplay between manned and unmanned systems. A UAS Service Supplier (USS) will be responsible for managing a UTM system's essential functioning (USS). Although the USS's function is still being developed, they will be commercial organizations under the authority and supervision of a government organization, such as the FAA. All other stakeholders, including drone operators, hobbyists, air traffic control, law enforcement, and the general public, would converge at the USS to get situational awareness surrounding unmanned aircraft.

Which region is expected to grow at the highest rate in the next coming years?

The market in Europe is projected to grow at the highest CAGR of from 2022 to 2030, showcasing strong need of unmanned traffic management in the region. The governments of various European countries are investing in drones to increase business opportunities with countries across the world. As a result, drone manufacturers such as senseFly and Parrot are involved in the R&D of drones, resulting in the development of lighter, faster, and more versatile drones. This, in turn, leads to the increased use of UAVs in the civil and commercial sectors resulting in the need for more controlled and monitored airspace and thus the demand for UTM.

Which segment of unmanned traffic management is expected to have highest CAGR in the coming years?

The service segment is estimated to have highest CAGR in the forecast year from 2022 to 2030. The Unmanned traffic management (UTM) services enable the safe and efficient operation of drones in the airspace. UTM services provide functions such as flight planning and authorization, remote identification, real-time tracking and monitoring, data analytics and reporting, and communication with other systems. The services segment of the unmanned traffic management market has been subdivided into security services, flight services, and information services. Drone operators or companies deploying drones for specific applications can avail of these services.

Which are the key technology trends prevailing in the unmanned traffic management market?

Blockchain is one of the key technology trends prevailing in the unmanned traffic management market. Instead of keeping track of all transactions in a central location, blockchain utilizes a distributed record and provides several benefits over centralized forms of record keeping while operating without a single point of failure and supports complete transparency of data. UAS traffic management (UTM) is another potential use case for blockchain. The end goal of UTM would be to create a system that does not require constant human monitoring and surveillance and can still ensure the authenticity, safety, security, and control of the drones in the low-altitude airspace.

This technology can potentially deliver a framework that can be used by various stakeholders in the commercial drone ecosystem and can be leveraged to offer services that could lead to the creation of “Highways in the sky” that ensures the safe integration of small UAS into the national airspace system. From a traffic management point of view, blockchain can enable having a decentralized system of UAS service supplier systems. The use of a blockchain-enabled remote identification system would protect drone user information and any confidential information about the nature and objective of the drone missions. Ultimately, the goal of the solution would be to develop an independent, self-directed, and scalable system that will manage and monitor end-to-end drone operations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of drones in commercial applications- Growing development of sensors and remote sensing technology- Increasing trend of integrating autonomous aerial vehicles into commercial space- Growing understanding of digitalization and its role within aviation industryRESTRAINTS- Government regulations- High initial infrastructure costOPPORTUNITIES- Simultaneous localization and mapping- UAS service suppliers- Drone tracking & remote identificationCHALLENGES- Interaction of UTM and ATM- Expensive and time-consuming BVLOS operation certification- Need for preventing collision between UAS and manned aircraft

-

5.3 UNMANNED TRAFFIC MANAGEMENT MARKET ECOSYSTEMPARTICIPANTSSERVICE AND SUPPORTING INFRASTRUCTURE PROVIDERSSOFTWARE PROVIDERSMISCELLANEOUS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR UTM MARKET

- 5.5 ANALYSIS OF RECESSION IMPACT ON UTM MARKET

-

5.6 TECHNOLOGY ANALYSISANTI-UAV DEFENSE SYSTEMSBLOCKCHAIN TECHNOLOGY TO PROTECT CONFIDENTIAL INFORMATIONARTIFICIAL INTELLIGENCE FOR DRONE MONITORING, CONTROLLING, AND TRACKINGINTERNET OF THINGS FOR DRONE TRACKING

- 5.7 VALUE CHAIN ANALYSIS OF UNMANNED TRAFFIC MANAGEMENT MARKET

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 KEY CONFERENCES AND EVENTS, 2023

- 5.11 TRADE DATA ANALYSIS

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- US- CanadaEUROPE- UK- Germany- France

- 5.13 OPERATIONAL DATA

-

5.14 PRICING ANALYSISAVERAGE SELLING PRICE OF UTM OFFERED BY KEY PLAYERS, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 UTM DEVELOPMENT AND IMPLEMENTATION BY NASA

- 6.3 FAA UTM DEVELOPMENT AND IMPLEMENTATION

- 6.4 STAGES OF UTM RESEARCH, DEVELOPMENT, TESTING, AND IMPLEMENTATION

-

6.5 EMERGING TECHNOLOGY TRENDSADS-B ENHANCE CONTROLSOFTWARE-DEFINED NETWORKINGAUGMENTED REALITY5G-ENABLING HIGH-RESOLUTION VIDEOSREMOTE IDENTIFICATIONSENSE-AND-AVOIDAUTONOMOUS OPERATIONINTEGRATION WITH EXISTING AIRSPACE SYSTEMSHUMAN-MACHINE INTERFACE

-

6.6 USE CASE ANALYSISUTM SYSTEMS FOR DELIVERY OF MEDICAL SUPPLIES IN REMOTE AREASAERIAL PHOTOGRAPHY AND SURVEILLANCEPACKAGE DELIVERY BY DRONES USING UTM SYSTEMSAGRICULTURAL MONITORING BY DRONES USING UTM SYSTEMSEMERGENCY RESPONSE BY DRONES USING UTM SYSTEMS

- 6.7 IMPACT OF MEGATRENDS

-

6.8 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 SOLUTIONSONBOARD SOLUTIONS- Sensors- EquipmentONGROUND- Communication infrastructure- Navigation infrastructure- Surveillance infrastructure

-

7.3 SOFTWAREFLIGHT PLANNING, FLEET OPERATION & MANAGEMENT- Reduced cost of operation offered by this software to drive adoptionDATA CAPTURE- Ability to track and monitor drone traffic to boost marketOTHERS

-

7.4 SERVICESSECURITY SERVICES- Increasing need to detect and prevent cyberattacks on drones to propel marketFLIGHT SERVICES- Rising need for safe and secure operation of drones in airspace to boost marketINFORMATION SERVICES- Growing requirement for supplementary information for efficient drone operation to drive market

- 8.1 INTRODUCTION

-

8.2 COMMERCIALRISING APPLICATIONS OF DRONES IN COMMERCIAL SECTOR TO BOOST MARKET

-

8.3 GOVERNMENT & LAWINCREASING USE OF DRONES IN BORDER SECURITY OPERATIONS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 PERSISTENTHIGHER LEVEL OF RELIABILITY AND PREDICTABILITY TO DRIVE MARKET

-

9.3 NON-PERSISTENTQUICK IMPLEMENTATION AND COST-EFFECTIVENESS TO BOOST MARKET

- 10.1 INTRODUCTION

-

10.2 AVIATIONINCREASING SAFETY AND EFFICIENT OPERATION OF DRONES NEAR AIRPORTS TO DRIVE MARKET

-

10.3 HOMELAND SECURITYGROWING USAGE OF DRONES IN SURVEILLANCE ACTIVITIES TO BOOST MARKET

-

10.4 AGRICULTUREHIGH-QUALITY DRONE DATA TO ENSURE PRODUCTIVITY OF FARMERS TO PROPEL MARKET

-

10.5 LOGISTICS AND TRANSPORTATIONRISING BENEFITS OF DRONE DELIVERY TO ACCELERATE MARKET

- 10.6 OTHERS

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICAPESTLE ANALYSISUS- Innovations and changes in regulations related to UTM to fuel marketCANADA- Canadian government’s initiative of national RPAS Traffic Management to drive market

-

11.4 EUROPEPESTLE ANALYSISUK- Exponential growth in adoption of drones for commercial applications to fuel marketFRANCE- Commencement of UTM testing to boost marketGERMANY- Launch of country-wide digital platform for UAVs to drive marketSWITZERLAND- Growing development in UTM to propel marketNORWAY- Increasing government initiatives to propel tech economy to boost safe adoption of dronesNETHERLANDS- Launch of Dutch Drone Delta consortium to propel development of UTM

-

11.5 ASIA PACIFICPESTLE ANALYSISCHINA- Increasing applicability of unmanned aerial vehicles to drive marketINDIA- Rising government initiatives on UAS traffic management policies to boost marketJAPAN- Growing procurement of UAVs to propel marketAUSTRALIA- Increasing beyond visual line of sight trials for medical delivery to accelerate marketSOUTH KOREA- Increasing integration of drones in commercial airspace to boost market

-

11.6 ROWPESTLE ANALYSISMIDDLE EAST AND AFRICA- Growing focus of aviation authorities in Africa on developing UTM systems to drive marketLATIN AMERICA- Increasing investments by authorities to develop UTM to boost market

- 12.1 INTRODUCTION

- 12.2 COMPANY OVERVIEW

- 12.3 RANKING ANALYSIS OF KEY PLAYERS IN UNMANNED TRAFFIC MANAGEMENT MARKET, 2021

- 12.4 REVENUE ANALYSIS, 2021

- 12.5 MARKET SHARE ANALYSIS, 2021

-

12.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE COMPANIESPARTICIPANTS

-

12.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

12.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES AND DEVELOPMENTDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSALTITUDE ANGEL- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAIRMAP, INC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAIRBUS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewANRA TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLEONARDO S.P.A- Business overview- Products/Services/Solutions offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developmentsDJI- Business overview- Products/Services/Solutions offered- Recent developmentsALPHABET INC.- Business overview- Products/Services/Solutions offered- Recent developmentsUNIFLY- Business overview- Products/Services/Solutions offered- Recent developmentsFREQUENTIS AG- Business overview- Products/Solutions/Services offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsONESKY- Business overview- Products/Services/Solutions offered- Recent developmentsPRECISIONHAWK, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments

-

13.3 OTHER PLAYERSALOFT TECHNOLOGIES, INC.DRONEDEPLOY INC.NOVA SYSTEMSSENSEFLY LTDAIRSPACE LINK INCEMESENTPIX4DESRIAVISION, INC.SKYDIO, INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNMANNED TRAFFIC MANAGEMENT MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 UTM MARKET ECOSYSTEM

- TABLE 4 UNMANNED TRAFFIC MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE COMPONENTS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE COMPONENTS

- TABLE 7 UTM MARKET: CONFERENCES AND EVENTS

- TABLE 8 IMPORT AND EXPORT STATISTICS FOR UAVS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 DRONE REGULATIONS AND APPROVALS FOR COMMERCIAL SECTOR, BY COUNTRY

- TABLE 15 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

- TABLE 16 CANADA: RULES AND GUIDELINES FOR OPERATION OF DRONES

- TABLE 17 UK: RULES AND GUIDELINES BY CAA FOR OPERATION OF DRONES

- TABLE 18 GERMANY: RULES AND GUIDELINES FOR OPERATION OF DRONES

- TABLE 19 FRANCE: RULES AND GUIDELINES FOR OPERATION OF DRONES

- TABLE 20 UAV REGULATIONS, BY COUNTRY

- TABLE 21 AVERAGE SELLING PRICE OF UTM OFFERED BY KEY PLAYERS FOR TOP THREE COMPONENTS (USD)

- TABLE 22 AVERAGE SELLING PRICE OF UTM COMPONENTS, 2021–2022

- TABLE 23 TENTATIVE KEY ACTIVITIES ASSOCIATED WITH UTM SYSTEMS

- TABLE 24 DELIVERY OF MEDICAL SUPPLIES

- TABLE 25 AERIAL PHOTOGRAPHY AND SURVEILLANCE

- TABLE 26 PACKAGE DELIVERY BY DRONES USING UTM SYSTEMS

- TABLE 27 AGRICULTURAL MONITORING BY DRONES USING UTM SYSTEMS

- TABLE 28 EMERGENCY RESPONSE BY DRONES USING UTM SYSTEMS

- TABLE 29 PATENTS RELATED TO MILITARY DRONES GRANTED BETWEEN MAY 2019 AND SEPTEMBER 2022

- TABLE 30 UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 31 UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 32 UNMANNED TRAFFIC MANAGEMENT MARKET, BY SOLUTION TYPE, 2019–2021 (USD MILLION)

- TABLE 33 UNMANNED TRAFFIC MANAGEMENT MARKET, BY SOLUTION TYPE, 2022–2030 (USD MILLION)

- TABLE 34 UNMANNED TRAFFIC MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019–2021 (USD MILLION)

- TABLE 35 UNMANNED TRAFFIC MANAGEMENT MARKET, BY SOFTWARE TYPE, 2022–2030 (USD MILLION)

- TABLE 36 UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 37 UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 38 UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 39 UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 40 UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 41 UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 42 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 43 UNMANNED TRAFFIC MANAGEMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 44 UNMANNED TRAFFIC MANAGEMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 55 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 56 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 57 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 58 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 59 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 60 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 61 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 62 US: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 63 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 64 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 65 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 66 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 67 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 68 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 69 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 70 CANADA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 71 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 72 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 73 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 74 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 75 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 76 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 77 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 78 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 79 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 80 EUROPE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 81 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 82 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 83 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 84 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 85 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 86 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 87 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 88 UK: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 89 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 90 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 91 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 92 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 93 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 94 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 95 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 96 FRANCE: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 97 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 98 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 99 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 100 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 101 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 102 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 103 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 104 GERMANY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 105 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 106 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 107 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 108 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 109 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 110 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 111 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 112 SWITZERLAND: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 113 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 114 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 115 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 116 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 117 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 118 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 119 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 120 NORWAY: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 121 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 122 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 123 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 124 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 125 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 126 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 127 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 128 NETHERLANDS: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 132 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 139 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 140 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 141 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 142 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 143 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 144 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 145 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 146 CHINA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 147 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 148 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 149 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 150 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 151 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 152 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 153 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 154 INDIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 155 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 156 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 157 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 158 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 159 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 160 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 161 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 162 JAPAN: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 163 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 164 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 165 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 166 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 167 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 168 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 169 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 170 AUSTRALIA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 171 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 172 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 173 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 174 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 175 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 176 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 177 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 178 SOUTH KOREA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 179 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 180 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 181 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 182 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 183 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 184 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 185 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 186 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 187 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 188 ROW: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 189 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 190 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 191 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 192 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 193 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 194 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 195 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 196 MIDDLE EAST AND AFRICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 198 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2019–2021 (USD MILLION)

- TABLE 200 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY END-USER, 2022–2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 202 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 204 LATIN AMERICA: UNMANNED TRAFFIC MANAGEMENT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 205 KEY DEVELOPMENTS BY LEADING PLAYERS IN UNMANNED TRAFFIC MANAGEMENT MARKET (2019–2021)

- TABLE 206 UNMANNED TRAFFIC MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 207 UNMANNED TRAFFIC MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 208 UNMANNED TRAFFIC MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 209 UNMANNED TRAFFIC MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [MAJOR PLAYERS]

- TABLE 210 UNMANNED TRAFFIC MANAGEMENT (UTM) MARKET: PRODUCT LAUNCHES, JUNE 2021–DECEMBER 2022

- TABLE 211 UNMANNED TRAFFIC MANAGEMENT (UTM) MARKET: DEALS, MARCH 2019–DECEMBER 2022

- TABLE 212 UNMANNED TRAFFIC MANAGEMENT (UTM) MARKET: OTHERS, NOVEMBER 2019–DECEMBER 2022

- TABLE 213 ALTITUDE ANGEL: BUSINESS OVERVIEW

- TABLE 214 ALTITUDE ANGEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 ALTITUDE ANGEL: DEALS

- TABLE 216 ALTITUDE ANGEL: OTHERS

- TABLE 217 THALES GROUP: BUSINESS OVERVIEW

- TABLE 218 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 THALES GROUP.: DEALS

- TABLE 220 THALES GROUP: OTHERS

- TABLE 221 AIRMAP, INC: BUSINESS OVERVIEW

- TABLE 222 AIRMAP, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 AIRMAP, INC: DEALS

- TABLE 224 AIRBUS: BUSINESS OVERVIEW

- TABLE 225 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 AIRBUS: PRODUCT LAUNCHES

- TABLE 227 AIRBUS: DEALS

- TABLE 228 AIRBUS: OTHERS

- TABLE 229 ANRA TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 230 ANRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 ANRA TECHNOLOGIES.: DEALS

- TABLE 232 ANRA TECHNOLOGIES: OTHERS

- TABLE 233 LEONARDO S.P.A.: BUSINESS OVERVIEW

- TABLE 234 LEONARDO S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 236 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 238 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 239 DJI: BUSINESS OVERVIEW

- TABLE 240 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 ALPHABET INC.: BUSINESS OVERVIEW

- TABLE 242 ALPHABET, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 ALPHABET, INC.: PRODUCT LAUNCHES

- TABLE 244 ALPHABET, INC.: DEALS

- TABLE 245 ALPHABET, INC.: OTHERS

- TABLE 246 UNIFLY: BUSINESS OVERVIEW

- TABLE 247 UNIFLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 UNIFLY: PRODUCT LAUNCHES

- TABLE 249 UNIFLY: DEALS

- TABLE 250 UNIFLY: OTHERS

- TABLE 251 FREQUENTIS AG: BUSINESS OVERVIEW

- TABLE 252 FREQUENTIS AG: PRODUCTS

- TABLE 253 FREQUENTIS AG: DEALS

- TABLE 254 FREQUENTIS AG: OTHERS

- TABLE 255 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 256 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS

- TABLE 257 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 258 ONESKY: BUSINESS OVERVIEW

- TABLE 259 ONESKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 ONESKY: DEALS

- TABLE 261 ONESKY: OTHERS

- TABLE 262 PRECISIONHAWK, INC.: BUSINESS OVERVIEW

- TABLE 263 PRECISIONHAWK, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 264 PRECISIONHAWK, INC.: DEALS

- TABLE 265 PRECISIONHAWK, INC: OTHERS

- TABLE 266 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 267 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 268 RAYTHEON TECHNOLOGIES CORPORATION.: DEALS

- TABLE 269 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- TABLE 270 ALOFT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 271 DRONEDEPLOY INC.: COMPANY OVERVIEW

- TABLE 272 NOVA SYSTEMS: COMPANY OVERVIEW

- TABLE 273 SENSEFLY LTD: COMPANY OVERVIEW

- TABLE 274 AIRSPACE LINK INC: COMPANY OVERVIEW

- TABLE 275 EMESENT: COMPANY OVERVIEW

- TABLE 276 PIX4D.: COMPANY OVERVIEW

- TABLE 277 ESRI.: COMPANY OVERVIEW

- TABLE 278 AVISION, INC.: COMPANY OVERVIEW

- TABLE 279 SKYDIO, INC.: COMPANY OVERVIEW

- FIGURE 1 UNMANNED TRAFFIC MANAGEMENT MARKET SEGMENTATION

- FIGURE 2 UNMANNED TRAFFIC MANAGEMENT MARKET TO GROW AT LOWER RATE COMPARED TO PREVIOUS ESTIMATES

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 RESEARCH DESIGN

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 9 SERVICE SEGMENT TO WITNESS HIGHEST CAGR IN UNMANNED TRAFFIC MANAGEMENT FROM 2022 TO 2030

- FIGURE 10 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGER SHARE OF UNMANNED TRAFFIC MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 11 PERSISTENT SEGMENT TO ACCOUNT FOR LARGER SHARE OF UNMANNED TRAFFIC MANAGEMENT MARKET IN 2030

- FIGURE 12 LOGISTICS AND TRANSPORTATION SEGMENT TO WITNESS HIGHEST CAGR IN UNMANNED TRAFFIC MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO HOLD MAJOR MARKET SHARE FROM 2022 TO 2030

- FIGURE 14 INNOVATIONS AND CHANGES IN REGULATIONS RELATED TO UTM IN VARIOUS COUNTRIES TO FUEL MARKET

- FIGURE 15 ONGROUND SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2030

- FIGURE 16 FLIGHT PLANNING, FLEET OPERATION & MANAGEMENT SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 17 AVIATION APPLICATIONS HELD LARGEST MARKET SHARE IN 2022

- FIGURE 18 UNMANNED TRAFFIC MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 DECREASING PRICE OF DRONE COMPONENTS (IN USD)

- FIGURE 20 UNMANNED TRAFFIC MANAGEMENT MARKET ECOSYSTEM MAP

- FIGURE 21 REVENUE SHIFT IN UTM MARKET

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 UNMANNED TRAFFIC MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 COMPONENTS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP 3 COMPONENT

- FIGURE 26 UNITS OF ENTERPRISE DRONES SHIPPED, 2014–2021 (THOUSAND)

- FIGURE 27 AVERAGE SELLING PRICE OF UTM OFFERED BY KEY PLAYERS FOR TOP THREE COMPONENTS

- FIGURE 28 UAS TRAFFIC MANAGEMENT DEVELOPMENT BY NASA

- FIGURE 29 FAA UTM DEVELOPMENT AND IMPLEMENTATION

- FIGURE 30 SERVICES SEGMENT TO WITNESS HIGHEST CAGR IN UNMANNED TRAFFIC MANAGEMENT MARKET FROM 2022 TO 2030

- FIGURE 31 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGER SIZE OF UNMANNED TRAFFIC MANAGEMENT MARKET IN 2030

- FIGURE 32 PERSISTENT SEGMENT TO ACCOUNT FOR LARGER SIZE OF UNMANNED TRAFFIC MANAGEMENT MARKET FROM 2022 TO 2030

- FIGURE 33 AVIATION SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF UNMANNED TRAFFIC MANAGEMENT MARKET FROM 2022 TO 2030

- FIGURE 34 NORTH AMERICA HELD LARGEST SHARE OF UNMANNED TRAFFIC MANAGEMENT MARKET IN 2022

- FIGURE 35 NORTH AMERICA: UTM MARKET SNAPSHOT

- FIGURE 36 EUROPE: UTM MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: UNMANNED TRAFFIC MANAGEMENT MARKET SNAPSHOT

- FIGURE 38 RANKING OF KEY PLAYERS IN UNMANNED TRAFFIC MANAGEMENT MARKET, 2021

- FIGURE 39 REVENUE ANALYSIS FOR KEY COMPANIES IN UNMANNED TRAFFIC MANAGEMENT MARKET, 2021

- FIGURE 40 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN UNMANNED TRAFFIC MANAGEMENT MARKET, 2021

- FIGURE 41 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 42 UNMANNED TRAFFIC MANAGEMENT MARKET (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 43 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 44 AIRBUS: COMPANY SNAPSHOT

- FIGURE 45 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 47 ALPHABET, INC.: COMPANY SNAPSHOT

- FIGURE 48 FREQUENTIS AG: COMPANY SNAPSHOT

- FIGURE 49 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 50 RAYTHEON TECHNOLOGIES CORPORATION.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the unmanned traffic management Market. Exhaustive secondary research was done to collect information on the unmanned traffic management market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the unmanned traffic management Market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated on the basis of performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study include financial statements of companies offering UTM services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the unmanned traffic management market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the unmanned traffic management market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

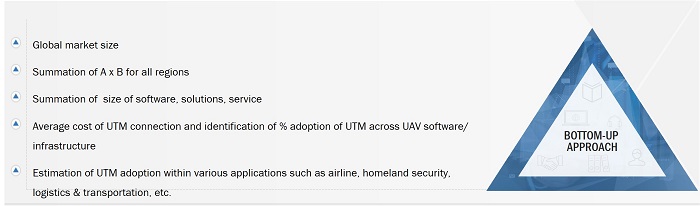

Market Size Estimation

The bottom-up approach has been employed to arrive at the overall size of the unmanned traffic management market. The estimation of UTM adoption within various applications such as airline, homeland security, logistics & transportation, etc. is done. The average cost of UTM connection and identification of percentage adoption of UTM across UAV software/solution is derived, which is summated for all the regions. Triangulation is done by determining the revenue of the key players and their shares in the market. Calculations based on revenues of the key players identified in the market led to estimating the size of the unmanned traffic management market.

Unmanned Traffic Management Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure explained below has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the unmanned traffic management (UTM) market based on component, type, end-user, and application

- To forecast the size of different segments of the market with respect to four key regions, namely, North America, Europe, Asia Pacific, and RoW, along with their key countries

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify technology trends currently prevailing in the unmanned traffic management market

- To provide an overview of the tariff and regulatory landscape with respect to UAVs across different regions

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the key market trends

- To profile the leading market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying the key growth strategies, such as acquisitions, new product launches, contracts, and partnerships, adopted by the leading market players

- To identify detailed financial positions, key products, and unique selling points of the leading companies in the market

- To provide a detailed competitive landscape of the market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the unmanned traffic management Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the unmanned traffic management Market

The Impact of Drone Traffic Management on the Unmanned Traffic Management Market

The implementation of DTM has a significant impact on the unmanned traffic management market. Here are a few ways in which DTM is influencing the market:

- Increased demand for UTM solutions: As the number of drones in the airspace continues to increase, the demand for UTM solutions is also growing. DTM is an essential component of any UTM solution, and its implementation is driving the need for more comprehensive UTM systems.

- Improved safety: DTM helps improve safety in the airspace by reducing the risk of collisions between drones and other aircraft. This increased safety is driving the adoption of UTM systems, as governments and businesses seek to manage drone operations more effectively.

- New business opportunities: The implementation of DTM is creating new business opportunities for companies that provide UTM solutions. As the demand for UTM solutions increases, companies that provide software and hardware solutions for DTM and UTM are well-positioned to benefit.

- Regulatory compliance: Many countries are implementing regulations that require the use of UTM systems for drone operations. DTM is a critical component of these systems, and its implementation is driving the need for regulatory compliance.

Growth Opportunities and Key Challenges for Drone Traffic Management in the Future

Growth Opportunities:

- Increased adoption of autonomous drones: Autonomous drones are becoming more common, and they require sophisticated DTM systems to manage their operations. As more businesses adopt autonomous drone technology, the demand for advanced DTM solutions is expected to grow.

- Emergence of new technologies: The development of new technologies, such as artificial intelligence and machine learning, is expected to improve the capabilities of DTM systems. These technologies can help improve airspace management, reduce the risk of collisions, and enhance communication between drones and ground control.

- Expansion of drone operations: The expansion of drone operations in various industries, including delivery, agriculture, and construction, is expected to drive the growth of the DTM market. As the number of drones in the airspace increases, the need for advanced DTM solutions will also grow.

Key Challenges:

- Integration with existing air traffic management systems: DTM solutions must be integrated with existing air traffic management systems to ensure the safe and efficient management of the airspace. This integration can be challenging, as DTM systems must be compatible with various legacy systems and protocols.

- Cybersecurity risks: As DTM systems become more advanced, they may become more vulnerable to cybersecurity threats. These threats could potentially compromise the safety and security of the airspace, and companies must invest in robust cybersecurity measures to mitigate these risks.

- Regulatory compliance: Compliance with regulations is a significant challenge for companies operating in the DTM market. Regulations vary by jurisdiction, and companies must ensure that their DTM solutions meet all relevant standards and requirements.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Unmanned Traffic Management Market

The objective is to understand the status and probable evolution of UTM.

My company is working on Drone aerial traffic regulations and I would be interested in having your market study.

Determining the best end to end UTM solution for my operations and a low cost UTM solution for BVLOS operations.