TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 AIR TRAFFIC MANAGEMENT: MARKETS COVERED

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 51)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

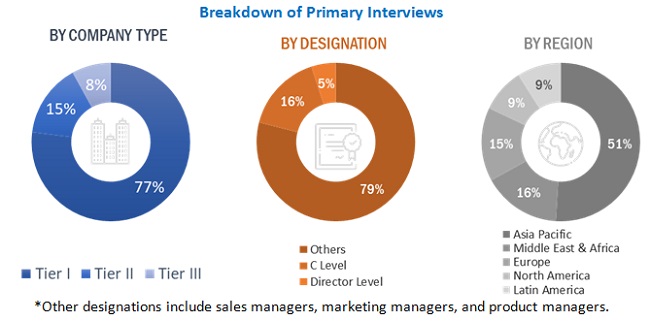

2.1.2.3 Breakdown of primaries

2.1.3 DEMAND-SIDE INDICATORS

2.1.4 SUPPLY-SIDE ANALYSIS

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

TABLE 2 AIR TRAFFIC MANAGEMENT: SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

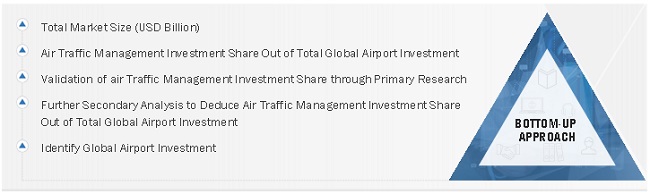

2.3.1 BOTTOM-UP APPROACH

TABLE 3 AIR TRAFFIC MANAGEMENT: MARKET ESTIMATION PROCEDURE

2.3.1.1 Regional air traffic management market

2.3.1.2 Market size estimation of ATM market, by end use

2.3.1.3 Market size estimation of air traffic management market, by investment type

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 7 AIR TRAFFIC SERVICES PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 HARDWARE SEGMENT TO HAVE LARGEST MARKET SHARE IN 2022

FIGURE 9 COMMERCIAL END USE TO BE AT FOREFRONT OF AIR TRAFFIC MANAGEMENT MARKET

FIGURE 10 AUTOMATION APPLICATION TO DOMINATE ATM MARKET

FIGURE 11 ASIA PACIFIC ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 ATTRACTIVE OPPORTUNITIES IN AIR TRAFFIC MANAGEMENT MARKET, 2022–2027

FIGURE 12 MODERNIZATION OF EXISTING AIRPORTS AND CONSTRUCTION OF NEW AIRPORTS TO DRIVE MARKET

4.2 AIR TRAFFIC MANAGEMENT MARKET, BY APPLICATION

FIGURE 13 COMMUNICATION SEGMENT TO LEAD AIR TRAFFIC MANAGEMENT MARKET DURING FORECAST PERIOD

4.3 AIR TRAFFIC MANAGEMENT MARKET, BY INVESTMENT TYPE

FIGURE 14 MODERNIZATION & UPGRADATION TO COMMAND HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 AIR TRAFFIC MANAGEMENT MARKET, BY COMMERCIAL END USE

FIGURE 15 CLASS C COMMERCIAL AIRPORTS TO GROW FASTEST DURING FORECAST PERIOD

4.5 AIR TRAFFIC MANAGEMENT MARKET, BY COUNTRY

FIGURE 16 INDIA AND AUSTRALIA PROJECTED TO WITNESS HIGHEST CAGR (2022-2027)

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS OF AIR TRAFFIC MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Launch of SESAR 3 joint undertaking to modernize European air traffic management

5.2.1.2 Global focus on improving air safety

5.2.1.3 Modernization of air traffic management infrastructure

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory norms associated with aircraft operation

5.2.2.2 High costs of air traffic management equipment

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in unmanned traffic management

5.2.3.2 Growing role of digitalization in aviation

5.2.4 CHALLENGES

5.2.4.1 Risk of cyber threat due to ADS–B in air traffic management

5.2.4.2 Limited availability of skilled personnel

5.2.4.3 Upgrading existing aircraft with advanced air traffic management sytems

5.3 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: AIR TRAFFIC MANAGEMENT

5.4 OPERATIONAL DATA

TABLE 4 NEWLY CONSTRUCTED AND UPGRADED AIRPORTS

5.5 TECHNOLOGY ANALYSIS

5.5.1 SPACE-BASED ADS-B IN AIR TRAFFIC MANAGEMENT

5.5.2 HOLOGRAPHIC RADAR

5.6 AIR TRAFFIC MANAGEMENT MARKET ECOSYSTEM

FIGURE 19 ATM MARKET ECOSYSTEM MAP

TABLE 5 AIR TRAFFIC MANAGEMENT MARKET ECOSYSTEM

5.7 DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIR TRAFFIC MANAGEMENT MARKET

FIGURE 20 REVENUE SHIFT IN ATM MARKET

5.8 AVERAGE SELLING PRICE

TABLE 6 AVERAGE SELLING PRICE: AIR TRAFFIC MANAGEMENT EQUIPMENT (USD THOUSAND)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 AIR TRAFFIC MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 ATM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION REGULATIONS

5.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 13 AIR TRAFFIC MANAGEMENT MARKET: CONFERENCES & EVENTS

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.12.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 15 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 INDUSTRY TRENDS (Page No. - 91)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 5G ADOPTION IN AIR TRAFFIC MANAGEMENT

6.2.2 HOLOGRAPHIC RADAR

6.2.3 TIME BASED SEPARATION (TBS) AND ENHANCED TIME BASED SEPARATION (ETBS)

6.2.4 TRAJECTORY BASED OPERATIONS (TBO) TECHNOLOGY

6.2.5 AI AND ML IN AIR TRAFFIC MANAGEMENT

6.2.6 ADS-B AND ADS-C STREAMLINING SURVEILLANCE TECHNOLOGIES

6.2.7 TERMINAL MANEUVERING AREA (TMA) USING RNP BASED OPERATIONS

6.2.8 VOICE OVER INTERNET PROTOCOL (VOIP) SYSTEMS IN ATM

6.2.9 INTERNET OF THINGS (IOT) IN ATM

6.2.10 AIRPORT SAFETY NETS

6.2.11 REMOTE TOWER SYSTEMS

6.2.12 GROUND BASED AUGMENTATION SYSTEMS (GBAS)

6.2.13 IMPROVED OPERATIONS MANAGEMENT

6.2.14 INTEGRATING UNMANNED AERIAL VEHICLE (UAV) MOVEMENTS INTO ATC

6.2.15 AIRSPACE OPERATION AS OPEN ARCHITECTURE IOT SYSTEM

TABLE 16 IOT INFRASTRUCTURE FOR ATM

6.2.16 USE OF IOT CONCEPTS IN MANAGEMENT AND OPERATION OF INDIVIDUAL DEVICES

6.2.17 AMAN/DMAN INTEGRATION TOOLS

6.3 USE CASES: AIR TRAFFIC MANAGEMENT

6.3.1 FLIGHT DECK INTERVAL MANAGEMENT TECHNOLOGY BY NASA

TABLE 17 MANAGEMENT OF AIRCRAFT ARRIVAL AT BUSY AIRPORTS USING TECHNOLOGY

6.3.2 USE OF AI AND BLOCKCHAIN TECHNOLOGY FOR AIR TRAFFIC MANAGEMENT

TABLE 18 AI-POWERED PLATFORM TO OPTIMIZE AIR TRAFFIC MANAGEMENT

6.3.3 SESAR 3 JOINT UNDERTAKING

TABLE 19 SESAR 3 JOINT UNDERTAKING

6.4 PATENT ANALYSIS

TABLE 20 PATENTS RELATED TO AIR TRAFFIC MANAGEMENT MARKET GRANTED BETWEEN 2019 AND 2022

6.5 IMPACT OF MEGATRENDS

7 AIR TRAFFIC MANAGEMENT, BY AIRSPACE (Page No. - 104)

7.1 INTRODUCTION

FIGURE 24 AIR TRAFFIC SERVICES TO LEAD AIRSPACE SEGMENT DURING FORECAST PERIOD

TABLE 21 AIR TRAFFIC MANAGEMENT MARKET SIZE, BY AIRSPACE, 2018–2021 (USD MILLION)

TABLE 22 ATM MARKET SIZE, BY AIRSPACE, 2022–2027 (USD MILLION)

7.2 AIR TRAFFIC SERVICES (ATS)

7.2.1 AIR TRAFFIC CONTROL (ATC)

7.2.1.1 Major share of ATM systems used in ATC towers

7.2.2 FLIGHT INFORMATION SERVICES (FIS)

7.2.2.1 FIS providing information to air traffic

7.2.3 ALERTING SERVICES

7.2.3.1 Search & rescue of aircraft carried out by alerting services

7.3 AIR TRAFFIC FLOW MANAGEMENT (ATFM)

7.3.1 MAINTAINING BALANCE OF AIR AND GROUND AIRCRAFT TRAFFIC USING ATFM

7.4 AIRSPACE MANAGEMENT (ASM)

7.4.1 ASM EMPLOYED TO DESIGN AVAILABLE AIRSPACE EFFICIENTLY

7.5 AERONAUTICAL INFORMATION MANAGEMENT (AIM)

7.5.1 GENERATION OF INTEGRAL DIGITAL DATA THROUGH AIM

8 AIR TRAFFIC MANAGEMENT MARKET, BY APPLICATION (Page No. - 109)

8.1 INTRODUCTION

FIGURE 25 AUTOMATION SUBSEGMENT PROJECTED TO GROW AT HIGHEST CAGR

TABLE 23 ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 ATM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 COMMUNICATION

8.2.1 CONTROLLER TO PILOT DATA LINK COMMUNICATION (CPDLC)

8.2.1.1 Traffic connection with ground-based ATM systems through CPDLC

8.2.2 VERY HIGH FREQUENCY (VHF) COMMUNICATION

8.2.2.1 Line of sight communication between ATC and aircraft

8.2.3 AUTOMATIC TERMINAL INFORMATION SYSTEM (ATIS)

8.2.3.1 Transmission of meteorological and operational information to pilots

8.2.4 VOICE COMMUNICATION CONTROL SYSTEM (VCCS)

8.2.4.1 Essential hardware for communication

8.3 NAVIGATION

8.3.1 VHF OMNIDIRECTIONAL RANGE (VOR)

8.3.1.1 Increasing commercial and general aviation traffic to drive demand for VOR

8.3.2 DOPPLER VERY HIGH FREQUENCY OMNI RANGE (DVOR)

8.3.2.1 Ground-based navigation systems for safer landing and approach at airports

8.3.3 DISTANCE MEASURING EQUIPMENT (DME)

8.3.3.1 Range determination hardware for safe navigation

8.3.4 TACTICAL AIR NAVIGATION SYSTEM (TACAN)

8.3.4.1 Highly precise military navigation system

8.3.5 NON-DIRECTIONAL BEACON (NDB)

8.3.5.1 Essential ATM hardware for aircraft landing

8.3.6 GLOBAL NAVIGATION SATELLITE SYSTEM (GNSS)

8.3.6.1 GNSS to be key element of CNS/ATM

8.3.7 GLOBAL POSITIONING SYSTEM (GPS)

8.3.7.1 GPS to play prime role during landings

8.3.8 PRECISION AREA NAVIGATION (PRNAV)

8.3.8.1 PRNAV to define routes in terminal airspace

8.3.9 INSTRUMENT LANDING SYSTEM (ILS)

8.3.9.1 Increased reliability of aircraft landing

8.3.10 ADVANCED SURFACE MOVEMENT GUIDANCE & CONTROL SYSTEM (A-SMGCS)

8.3.10.1 Improved guidance and surveillance for aircraft control

8.4 SURVEILLANCE

8.4.1 AUTOMATIC DEPENDENT SURVEILLANCE-BROADCAST (ADS-B)

8.4.1.1 Demand for GPS-based modern systems to boost use of ADS-B

8.4.2 AIR TRAFFIC CONTROL RADAR BEACON SYSTEM (ATCRBS)

8.4.2.1 Rotating ground antennas to fetch important aircraft data using ATCRBS

8.4.3 PRIMARY SURVEILLANCE RADAR (PSR)

8.4.3.1 Essential radar systems determined at every airport for ATM using PSR

8.4.4 SECONDARY SURVEILLANCE RADAR (SSR)

8.4.4.1 Enables direct exchange of data between aircraft for collision avoidance

8.4.5 HOLOGRAPHIC RADAR

8.4.5.1 Widely used to detect illegal drones

8.5 AUTOMATION

8.5.1 ARRIVAL AND DEPARTURE DATA MANAGER

8.5.1.1 Sharing of electronic data between stakeholders

8.5.2 ELECTRONIC FLIGHT STRIP (EFS)

8.5.2.1 Digitally presents important information about flights in tabular form

8.5.3 ITOWER SIMULATION SYSTEM

8.5.3.1 ATC simulation system for training new recruits and route planning

8.5.4 SURVEILLANCE DATA PROCESSING SYSTEM (SDPS)

8.5.4.1 Takes inputs from radar, ADS-B, and MLAT systems for better efficiency

8.5.5 FLIGHT DATA PROCESSING SYSTEM (FDPS)

8.5.5.1 Regarded as most important software algorithm in ATM

8.5.6 OBSTACLE SURFACE PLANNER

8.5.6.1 Helps in prevention of air and ground aircraft accidents

8.5.7 NETWORK SOLUTIONS

8.5.7.1 Likely to replace traditional ATC networks

8.5.8 SAFETY NET AND DECISION SUPPORT (SNET)

8.5.8.1 Provides advance air traffic alerts for airport operations

8.5.9 CONTROL & MONITORING DISPLAY (CMD)

8.5.9.1 Assists in close monitoring of air traffic

9 AIR TRAFFIC MANAGEMENT, BY OFFERING (Page No. - 121)

9.1 INTRODUCTION

FIGURE 26 HARDWARE SUBSEGMENT TO COMMAND FASTEST GROWTH IN AIR TRAFFIC MANAGEMENT MARKET

TABLE 25 ATM MARKET SIZE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 26 ATM MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

9.2 HARDWARE

9.2.1 RADAR

9.2.1.1 Radar upgrades in French military

9.2.2 SENSORS

9.2.2.1 Increasing use of automated sensor recording, monitoring, and evaluation system

9.2.3 MODULATORS AND DEMODULATORS

9.2.3.1 Help enhance signal strength

9.2.4 ANTENNAS

9.2.4.1 Use of radio frequencies to receive and transmit information

9.2.5 CAMERAS

9.2.5.1 HD cameras used in remote digital towers to monitor out of line of sight areas

9.2.6 DISPLAYS

9.2.6.1 Enable reading in low light conditions

9.2.7 ENCODERS AND DECODERS

9.2.7.1 Widely used to analyze ADS-B messages

9.2.8 AMPLIFIERS

9.2.8.1 Usage in surveillance systems on rise

9.2.9 OTHER DEVICES

9.3 SOFTWARE AND SOLUTIONS

9.3.1 DATABASE MANAGEMENT SYSTEMS

9.3.1.1 Wide-scale usage to increase automation

9.3.2 RADAR DATA COMPRESSOR UNITS

9.3.2.1 Used to upgrade primary and secondary surveillance radar

9.3.3 INCIDENT MANAGEMENT

9.3.3.1 Vital for operations in incident management

9.3.4 DATA LINK SERVERS

9.3.4.1 Help link ground stations to aircraft

9.3.5 COMMUNICATIONS RECORDING AND MANAGEMENT

9.3.5.1 Secure and record important conversations between aircraft and ATC

9.3.6 PLATFORM AND SUITE

9.3.6.1 Ease in operational overview in aircraft

9.3.7 CAPACITY AND DEMAND MANAGEMENT

9.3.7.1 Assist in quality management of flight data

10 AIR TRAFFIC MANAGEMENT MARKET, BY AIRPORT SIZE (Page No. - 128)

10.1 INTRODUCTION

FIGURE 27 MEDIUM AIRPORTS EXPECTED TO LEAD AIR TRAFFIC MANAGEMENT MARKET (USD MILLION)

TABLE 27 ATM MARKET SIZE, BY AIRPORT SIZE, 2018–2021(USD MILLION)

TABLE 28 ATM MARKET SIZE, BY AIRPORT SIZE, 2022–2027(USD MILLION)

10.2 LARGE

10.2.1 REQUIRE ADVANCED CONTROL TOWERS TO HANDLE OPERATIONS SMOOTHLY

10.3 MEDIUM

10.3.1 AIRPORTS WITH SEASONAL AIR TRAFFIC TO BENEFIT FROM REMOTE TOWERS

10.4 SMALL

10.4.1 REMOTE AIR TRAFFIC CONTROL UNITS TO HELP SMALL AIRPORTS REMAIN PROFITABLE

11 AIR TRAFFIC MANAGEMENT MARKET, BY INVESTMENT TYPE (Page No. - 132)

11.1 INTRODUCTION

FIGURE 28 ATM MARKET, BY INVESTMENT TYPE, 2020- 2027 (USD MILLION)

TABLE 29 MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 30 MARKET SIZE, BY INVESTMENT TYPE, 2022–2027(USD MILLION)

11.2 NEW INSTALLATION

11.2.1 CHINA, INDIA, AND MIDDLE EASTERN COUNTRIES HAVE HIGH GREENFIELD AIRPORT CAPEX INVESTMENTS

11.3 MODERNIZATION & UPGRADATION

11.3.1 SATELLITE-BASED NAVIGATION AND MODERN ATM EQUIPMENT DRIVE BROWNFIELD INVESTMENTS

12 AIR TRAFFIC MANAGEMENT, BY END USE (Page No. - 136)

12.1 INTRODUCTION

FIGURE 29 AIR TRAFFIC MANAGEMENT MARKET SIZE, BY END USE, 2020-2027 (USD MILLION)

TABLE 31 MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 32 MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

12.2 COMMERCIAL

12.2.1 REGULAR UPGRADES TO BOOST COMMERCIAL ATM MARKET

12.3 MILITARY

12.3.1 MILITARY REQUIREMENT FOR PRECISE ATM SYSTEMS

13 AIR TRAFFIC MANAGEMENT MARKET, BY SERVICE (Page No. - 139)

13.1 INTRODUCTION

13.1.1 MACHINE LEARNING AND CLOUD COMPUTING TO ENHANCE ATM-AS-A-SERVICE ARCHITECTURE

13.2 MAINTENANCE SERVICES

13.2.1 MAINTENANCE SERVICES TO VITAL FOR ATM INFRASTRUCTURE

13.3 SUPPORT SERVICES

13.3.1 REQUIRED FOR INSTALLATION OF ATM SYSTEMS

14 REGIONAL ANALYSIS (Page No. - 141)

14.1 INTRODUCTION

TABLE 33 AIR TRAFFIC MANAGEMENT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

14.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA: ATM MARKET SNAPSHOT

14.2.2 NORTH AMERICA: AIR PASSENGER MOVEMENT

FIGURE 31 NORTH AMERICA: AIR PASSENGER MOVEMENT

TABLE 35 NORTH AMERICA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.2.3 US

14.2.3.1 NextGen program for modernization of existing ATM systems to drive market growth

TABLE 45 US: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 46 US: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 47 US: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 50 US: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.2.4 CANADA

14.2.4.1 Multi-Fleet Air Traffic Management Avionics Project to fuel market growth

TABLE 51 CANADA: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 55 CANADA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 56 CANADA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3 EUROPE

14.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE: AIR TRAFFIC MANAGEMENT MARKET SNAPSHOT

14.3.2 EUROPE: AIR PASSENGER MOVEMENT

FIGURE 33 EUROPE: AIR PASSENGER MOVEMENT

TABLE 57 EUROPE: ATM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY OFFERINGS, 2018–2021 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY OFFERINGS, 2022–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.3 UK

14.3.3.1 Airport congestion to lead to modernization of ATM systems

TABLE 67 UK: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 68 UK: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 69 UK: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 70 UK: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 71 UK: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 72 UK: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.4 FRANCE

14.3.4.1 Modernization and expansion of existing airports

TABLE 73 FRANCE: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 FRANCE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 FRANCE: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 76 FRANCE: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 77 FRANCE: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 78 FRANCE: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.5 SWEDEN

14.3.5.1 Increasing adoption of remote air traffic services raises demand for ATM solutions

TABLE 79 SWEDEN: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 80 SWEDEN: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 81 SWEDEN: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 82 SWEDEN: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 83 SWEDEN: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 84 SWEDEN: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.6 GERMANY

14.3.6.1 Implementation of remote control towers at airports

TABLE 85 GERMANY: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 GERMANY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 GERMANY: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 88 GERMANY: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 90 GERMANY: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.7 ITALY

14.3.7.1 Digital transformation of air traffic control to speed up market growth

TABLE 91 ITALY: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 ITALY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 ITALY: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 94 ITALY: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 95 ITALY: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 96 ITALY: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.8 SPAIN

14.3.8.1 Need for digitization of air traffic management

TABLE 97 SPAIN: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 SPAIN: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 SPAIN: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 100 SPAIN: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 101 SPAIN: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 102 SPAIN: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.3.9 REST OF EUROPE

14.3.9.1 Increase in domestic and international air passenger traffic

TABLE 103 REST OF EUROPE: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4 ASIA PACIFIC

14.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: AIR TRAFFIC MANAGEMENT MARKET SNAPSHOT

14.4.2 ASIA PACIFIC: AIR PASSENGER MOVEMENT

FIGURE 35 ASIA PACIFIC: AIR PASSENGER MOVEMENT

TABLE 109 ASIA PACIFIC: ATM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4.3 CHINA

14.4.3.1 Upcoming greenfield airport projects to boost ATM growth

TABLE 119 CHINA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 124 CHINA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4.4 INDIA

14.4.4.1 Government focus on increasing regional connectivity to propel market growth

TABLE 125 INDIA: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 INDIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 INDIA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 128 INDIA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 129 INDIA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 130 INDIA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4.5 SOUTH KOREA

14.4.5.1 Need to upgrade ILS and DME at airports

TABLE 131 SOUTH KOREA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 133 SOUTH KOREA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 134 SOUTH KOREA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 135 SOUTH KOREA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 136 SOUTH KOREA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4.6 AUSTRALIA

14.4.6.1 Increase in air travel to aid market growth

TABLE 137 AUSTRALIA: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 138 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 AUSTRALIA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 140 AUSTRALIA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 141 AUSTRALIA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 142 AUSTRALIA: ATM MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4.7 NEW ZEALAND

14.4.7.1 Wide-scale adoption of remote tower technology

TABLE 143 NEW ZEALAND: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 NEW ZEALAND: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 146 NEW ZEALAND: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 147 NEW ZEALAND: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 148 NEW ZEALAND: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.4.8 REST OF ASIA PACIFIC

14.4.8.1 Focus on airport upgrades and modernization

TABLE 149 REST OF ASIA PACIFIC: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.5 MIDDLE EAST & AFRICA

14.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

14.5.2 AIR PASSENGER MOVEMENT: MIDDLE EAST & AFRICA

FIGURE 36 MIDDLE EAST & AFRICA: AIR PASSENGER MOVEMENT

TABLE 155 MIDDLE EAST & AFRICA: ATM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET SIZE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.5.3 UAE

14.5.3.1 Increasing tourism to drive demand for air traffic management and airport modernization

TABLE 165 UAE: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 166 UAE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 167 UAE: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 168 UAE: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 169 UAE: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 170 UAE: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.5.4 SAUDI ARABIA

14.5.4.1 Relaunch of airport privatization plans to encourage market growth

TABLE 171 SAUDI ARABIA: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 SAUDI ARABIA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 174 SAUDI ARABIA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 175 SAUDI ARABIA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 176 SAUDI ARABIA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.5.5 SOUTH AFRICA

14.5.5.1 Modernization of airports and increasing tourism traffic to support market growth

TABLE 177 SOUTH AFRICA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 179 SOUTH AFRICA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 180 SOUTH AFRICA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 181 SOUTH AFRICA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 182 SOUTH AFRICA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.5.6 REST OF MIDDLE EAST & AFRICA

14.5.6.1 Use of advanced automated air traffic management

TABLE 183 REST OF MIDDLE EAST & AFRICA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 184 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 185 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 186 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 188 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.6 LATIN AMERICA

14.6.1 PESTLE ANALYSIS: LATIN AMERICA

14.6.2 LATIN AMERICA: AIR PASSENGER MOVEMENT

FIGURE 37 LATIN AMERICA: AIR PASSENGER MOVEMENT

TABLE 189 LATIN AMERICA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.6.3 BRAZIL

14.6.3.1 Modernization of airports and increased tourism traffic

TABLE 199 BRAZIL: ATM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 200 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 201 BRAZIL: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 202 BRAZIL: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 203 BRAZIL: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 204 BRAZIL: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.6.4 MEXICO

14.6.4.1 Presence of several mid-sized airports to elevate demand for ATM solutions

TABLE 205 MEXICO: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 206 MEXICO: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 207 MEXICO: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 208 MEXICO: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 209 MEXICO: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 210 MEXICO: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.6.5 ARGENTINA

14.6.5.1 Modernization of air control centers projected to increase market growth

TABLE 211 ARGENTINA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 212 ARGENTINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 213 ARGENTINA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 214 ARGENTINA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 215 ARGENTINA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 216 ARGENTINA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

14.6.6 REST OF LATIN AMERICA

14.6.6.1 Reduction of costs in Colombian air traffic control to fuel market for ATM

TABLE 217 REST OF LATIN AMERICA: AIR TRAFFIC MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 218 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 219 REST OF LATIN AMERICA: MARKET SIZE, BY INVESTMENT TYPE, 2018–2021 (USD MILLION)

TABLE 220 REST OF LATIN AMERICA: MARKET SIZE, BY INVESTMENT TYPE, 2022–2027 (USD MILLION)

TABLE 221 REST OF LATIN AMERICA: MARKET SIZE, BY END USE, 2018–2021 (USD MILLION)

TABLE 222 REST OF LATIN AMERICA: MARKET SIZE, BY END USE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 213)

15.1 INTRODUCTION

15.2 COMPETITIVE OVERVIEW

15.2.1 KEY DEVELOPMENTS OF LEADING PLAYERS IN AIR TRAFFIC MANAGEMENT MARKET (2018-2021)

TABLE 223 KEY DEVELOPMENTS OF LEADING PLAYERS: ATM MARKET

15.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 38 RANKING ANALYSIS OF TOP FIVE PLAYERS IN ATM MARKET, 2021

15.4 REVENUE ANALYSIS, 2019-2021

FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES

15.5 MARKET SHARE ANALYSIS, 2021

FIGURE 40 MARKET SHARE ANALYSIS OF KEY COMPANIES

TABLE 224 AIR TRAFFIC MANAGEMENT MARKET: DEGREE OF COMPETITION

15.6 COMPANY EVALUATION QUADRANT

15.6.1 STARS

15.6.2 EMERGING LEADERS

15.6.3 PERVASIVE PLAYERS

15.6.4 PARTICIPANT COMPANIES

FIGURE 41 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

15.6.5 COMPETITIVE BENCHMARKING

TABLE 225 AIR TRAFFIC MANAGEMENT MARKET: COMPETITIVE BENCHMARKING

15.7 COMPETITIVE SCENARIO

15.7.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 226 ATM MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, APRIL 2020–OCTOBER 2021

15.7.2 DEALS

TABLE 227 AIR TRAFFIC MANAGEMENT MARKET: DEALS, JANUARY 2019–MAY 2022

16 COMPANY PROFILES (Page No. - 224)

16.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats)*

16.2 KEY PLAYERS

16.2.1 THALES GROUP

TABLE 228 THALES GROUP: BUSINESS OVERVIEW

FIGURE 42 THALES GROUP: COMPANY SNAPSHOT

TABLE 229 THALES GROUP: PRODUCTS

TABLE 230 THALES GROUP: PRODUCT LAUNCHES

TABLE 231 THALES GROUP: DEALS

16.2.2 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 232 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 233 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS

TABLE 234 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

16.2.3 L3HARRIS TECHNOLOGIES, INC.

TABLE 235 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 44 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 236 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS

TABLE 237 L3HARRIS TECHNOLOGIES, INC.: DEALS

16.2.4 INDRA SISTEMAS, S.A.

TABLE 238 INDRA SISTEMAS, S.A.: BUSINESS OVERVIEW

FIGURE 45 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

TABLE 239 INDRA SISTEMAS, S.A.: PRODUCTS

TABLE 240 INDRA SISTEMAS, S.A.: DEALS

16.2.5 SAAB AB

TABLE 241 SAAB AB: BUSINESS OVERVIEW

FIGURE 46 SAAB AB: COMPANY SNAPSHOT

TABLE 242 SAAB AB: PRODUCTS

TABLE 243 SAAB AB: DEALS

TABLE 244 SAAB AB: OTHERS

16.2.6 NORTHROP GRUMMAN CORPORATION

TABLE 245 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 47 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 246 NORTHROP GRUMMAN CORPORATION: PRODUCTS

TABLE 247 NORTHROP GRUMMAN CORPORATION: DEALS

16.2.7 SITA GROUP

TABLE 248 SITA GROUP: BUSINESS OVERVIEW

TABLE 249 SITA GROUP: PRODUCTS

TABLE 250 SITA GROUP: DEALS

16.2.8 BAE SYSTEMS PLC

TABLE 251 BAE SYSTEMS PLC: BUSINESS OVERVIEW

FIGURE 48 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 252 BAE SYSTEMS PLC: PRODUCTS

TABLE 253 BAE SYSTEMS PLC: DEALS

16.2.9 FREQUENTIS AG

TABLE 254 FREQUENTIS AG: BUSINESS OVERVIEW

FIGURE 49 FREQUENTIS AG: COMPANY SNAPSHOT

TABLE 255 FREQUENTIS AG: PRODUCTS

TABLE 256 FREQUENTIS AG: DEALS

16.2.10 HONEYWELL INTERNATIONAL, INC.

TABLE 257 HONEYWELL INTERNATIONAL, INC.: BUSINESS OVERVIEW

FIGURE 50 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

TABLE 258 HONEYWELL INTERNATIONAL, INC.: PRODUCTS

TABLE 259 HONEYWELL INTERNATIONAL, INC.: DEALS

16.2.11 ADVANCED NAVIGATION AND POSITIONING CORPORATION

TABLE 260 ADVANCED NAVIGATION AND POSITIONING CORPORATION: BUSINESS OVERVIEW

TABLE 261 ADVANCED NAVIGATION AND POSITIONING CORPORATION: PRODUCTS

16.2.12 LOCKHEED MARTIN CORPORATION

TABLE 262 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 51 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 263 LOCKHEED MARTIN CORPORATION: PRODUCTS

TABLE 264 LOCKHEED MARTIN CORPORATION: DEALS

16.2.13 INTELCAN TECHNOSYSTEMS INC.

TABLE 265 INTELCAN TECHNOSYSTEMS INC.: BUSINESS OVERVIEW

TABLE 266 INTELCAN TECHNOSYSTEMS INC.: PRODUCTS

TABLE 267 INTELCAN TECHNOSYSTEMS INC.: DEALS

16.2.14 AMADEUS IT GROUP, S.A.

TABLE 268 AMADEUS IT GROUP, S.A.: BUSINESS OVERVIEW

FIGURE 52 AMADEUS IT GROUP, S.A.: COMPANY SNAPSHOT

TABLE 269 AMADEUS IT GROUP, S.A.: PRODUCTS

TABLE 270 AMADEUS IT GROUP, S.A.: DEALS

16.2.15 LEONARDO SPA

TABLE 271 LEONARDO SPA: BUSINESS OVERVIEW

FIGURE 53 LEONARDO SPA: COMPANY SNAPSHOT

TABLE 272 LEONARDO SPA: PRODUCTS

TABLE 273 LEONARDO SPA: PRODUCT LAUNCHES

16.3 OTHER PLAYERS

16.3.1 ADACEL TECHNOLOGIES, LTD.

TABLE 274 ADACEL TECHNOLOGIES, LTD.: BUSINESS OVERVIEW

FIGURE 54 ADACEL TECHNOLOGIES, LTD.: COMPANY SNAPSHOT

TABLE 275 ADACEL TECHNOLOGIES, LTD.: PRODUCTS

TABLE 276 ADACEL TECHNOLOGIES, LTD.: PRODUCT LAUNCHES

TABLE 277 ADACEL TECHNOLOGIES, LTD.: DEALS

16.3.2 ACAMS AIRPORT TOWER SOLUTIONS

TABLE 278 ACAMS AIRPORT TOWER SOLUTIONS: BUSINESS OVERVIEW

TABLE 279 ACAMS AIRPORT TOWER SOLUTIONS: PRODUCTS

TABLE 280 ACAMS AIRPORT TOWER SOLUTIONS: DEALS

16.3.3 SKYSOFT-ATM

TABLE 281 SKYSOFT-ATM: BUSINESS OVERVIEW

TABLE 282 SKYSOFT-ATM: PRODUCTS

TABLE 283 SKYSOFT-ATM: DEALS

16.3.4 AQUILA AIR TRAFFIC MANAGEMENT SERVICES LIMITED

TABLE 284 AQUILA AIR TRAFFIC MANAGEMENT SERVICES LIMITED: BUSINESS OVERVIEW

TABLE 285 AQUILA AIR TRAFFIC MANAGEMENT SERVICES LIMITED: PRODUCTS

TABLE 286 AQUILA AIR TRAFFIC MANAGEMENT SERVICES LIMITED: DEALS

16.3.5 LEIDOS HOLDINGS, INC.

TABLE 287 LEIDOS HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 55 LEIDOS HOLDINGS, INC.: COMPANY SNAPSHOT

TABLE 288 LEIDOS HOLDINGS, INC.: PRODUCTS

TABLE 289 LEIDOS HOLDINGS, INC.: DEALS

16.3.6 NAV CANADA

TABLE 290 NAV CANADA: COMPANY OVERVIEW

16.3.7 ALTYS TECHNOLOGIES

TABLE 291 ALTYS TECHNOLOGIES: COMPANY OVERVIEW

16.3.8 SAIPHER ATC

TABLE 292 SAIPHER ATC: COMPANY OVERVIEW

16.3.9 CYRRUS LIMITED

TABLE 293 CYRRUS LIMITED: COMPANY OVERVIEW

16.3.10 IDS AIRNAV

TABLE 294 IDS AIRNAV: COMPANY OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 282)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Traffic Management Market

I am interested in Value analysis for air transport system in africa

Good Morning, We are looking for a safe supplier of an ATM system. And we would like some suggestions from the key players on the market. Best Regards, Aguinaldo Madureira

Hi! I'd like to know the size of our ATC market, on which way we are now, and what problems are faced by different ATC markets in other countries. Thank you!