The research study involved four major activities in estimating the size of the UV disinfection equipment market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

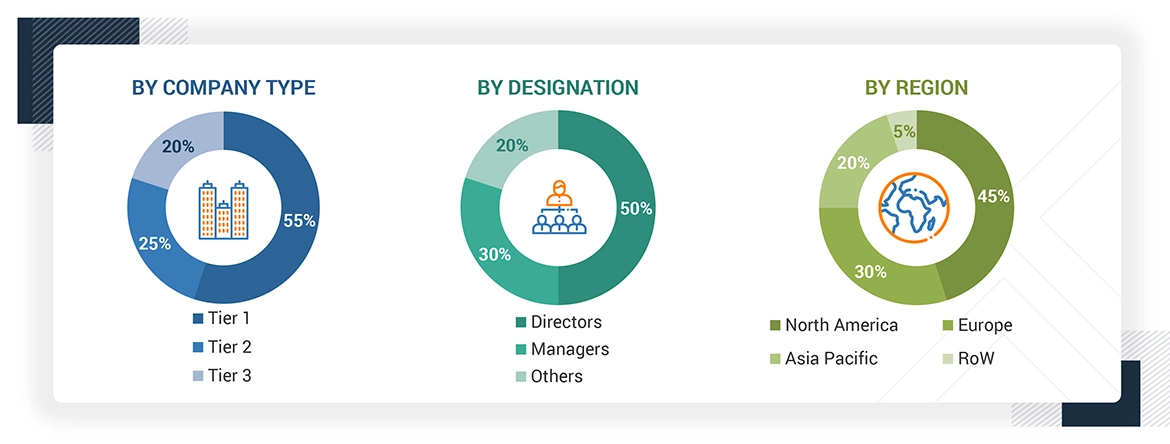

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the UV disinfection equipment market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the UV disinfection equipment market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the UV disinfection equipment market.

-

Major companies that provide UV Disinfection Equipment systems were identified. This included analyzing company product portfolios and presence across various regions.

-

The segment-specific revenues of the companies, particularly those related to UV Disinfection Equipment, were determined.

-

These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

-

Using this consolidated data, the global market size for UV Disinfection Equipment was obtained.

The top-down approach has been used to estimate and validate the total size of the UV disinfection equipment market.

-

Identified top-line investments and spending in the ecosystem and major market developments to consider segment-level splits

-

Estimated the overall UV disinfection equipment market size, then segmented the global market by allocating shares based on the segments considered

-

Distributed the segment-level markets into regions and countries by aligning regional UV Disinfection activity with economic indicators, UV Disinfection Equipment manufacturing presence, and regional development initiatives

UV Disinfection Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the UV disinfection equipment market.

Market Definition

The UV disinfection equipment involves the development, deployment, and integration of ultraviolet (UV) technology-based systems designed to inactivate or eliminate harmful microorganisms in water, air, and surface treatment applications. These systems are widely used across municipal, industrial, commercial, and residential sectors to ensure hygiene, safety, and regulatory compliance. The market focuses on delivering chemical-free, environmentally friendly disinfection solutions that enhance operational efficiency and public health outcomes. UV disinfection equipment utilizes a range of technologies, including low-pressure and medium-pressure UV lamps, quartz sleeves, ballasts, sensors, and advanced control panels, often integrated with IoT platforms, real-time monitoring, and data analytics. These components work together to provide targeted and effective disinfection by damaging the DNA of microorganisms, rendering them harmless. The UV disinfection industry offers diverse solutions tailored to drinking water treatment, wastewater management, air purification, and surface sterilization. Modern systems enable automation, remote monitoring, and predictive maintenance to reduce human intervention and operational costs. They are capable of detecting lamp performance, tracking UV intensity, and ensuring consistent dosage, thereby preventing microbial contamination and ensuring safe, clean environments across various applications.

Key Stakeholders

-

Raw material and manufacturing equipment suppliers

-

Component manufacturers

-

Original equipment manufacturers (OEMS)

-

Original design manufacturers (ODMS)

-

ODM and OEM technology solution providers

-

Technology, service, and solution providers

-

Suppliers and distributors

-

Government and other regulatory bodies

-

Technology investors

-

Research institutes and organizations

Report Objectives

-

To define, describe, segment, and forecast the UV disinfection equipment market by component, power rating, application, and end user in terms of value

-

To assess and forecast the market for various segments, with respect to four main regions: North America, Europe, Asia Pacific, and RoW, in terms of value

-

To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the UV disinfection equipment market

-

To offer a detailed overview of the UV disinfection equipment market’s value chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis.

-

To understand industry trends, patents, innovations, and trade data (export and import data) related to UV disinfection equipment

-

To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To identify the key players and comprehensively analyze their market share and core competencies

-

To assess opportunities for stakeholders and provide a detailed competitive landscape of the market

-

To investigate competitive developments, such as product launches/developments, collaborations, agreements, partnerships, acquisitions, and research & development (R&D), carried out by players in the UV disinfection equipment market

-

To profile key players in the UV disinfection equipment market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

-

Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

-

Detailed analysis and profiling of additional market players (up to five)

Kyungkwan

Sep, 2022

I want a Sample Report of the global disinfection equipment market .