UV Curing System Market Size, Share & Industry Trends

UV Curing System Market by System Type (Spot Curing, Flood Curing, Conveyor/Inline), Mercury Lamp Curing, UV LED Curing, Hybrid Curing, 3D Printing, Coating, Ink, Adhesive, Industrial Manufacturing, Packaging Industry – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

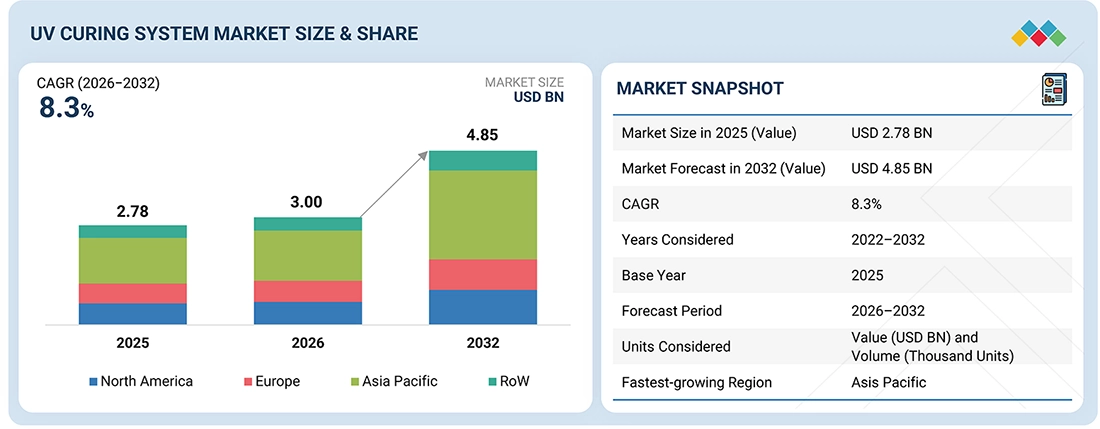

The global UV curing system market is expected to increase from USD 3.00 billion in 2026 to USD 4.85 billion by 2032, representing a compound annual growth rate (CAGR) of 8.3% during the forecast period. Market expansion is driven by the rising demand for high-speed, energy-efficient, and environmentally sustainable curing solutions that allow for instant processing and reduced volatile organic compound (VOC) emissions. The growing integration of UV curing systems into automated production lines, along with advancements in UV LED technology, hybrid curing methods, and enhanced system efficiency, is improving process control, throughput, and product quality. Additionally, the increasing focus on lightweight materials, miniaturized components, and high-precision manufacturing is further accelerating the global adoption of UV curing systems.

KEY TAKEAWAYS

-

By RegionAsia Pacific is projected to witness the highest CAGR of 10.0% in the UV curing system market during the forecast period.

-

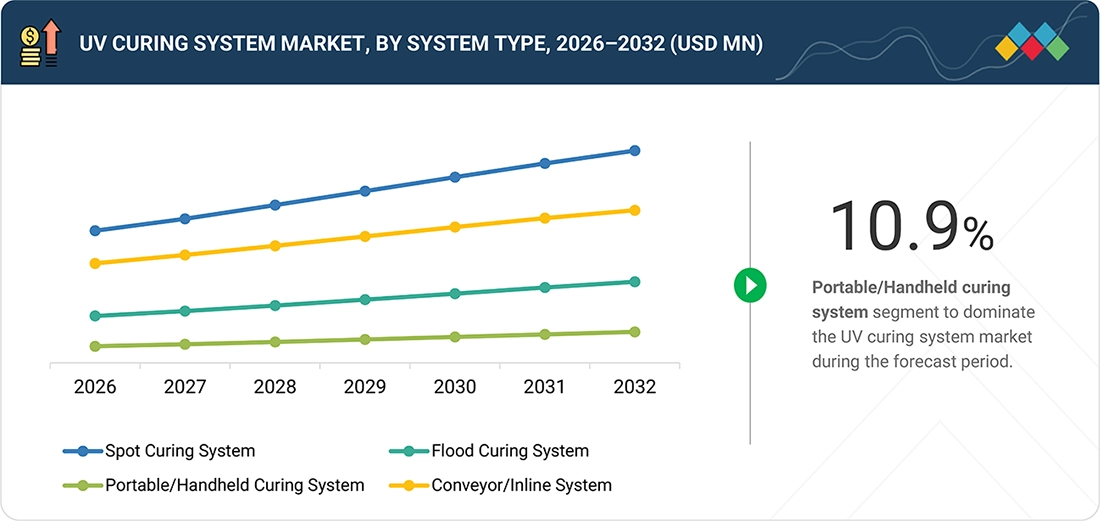

By System TypeBy system type, the spot curing system segment is projected to account for the largest share of the UV curing system market during the forecast period.

-

By TechnologyBy technology, the UV LED curing segment is projected to account for the largest share of the UV curing system market during the forecast period.

-

By Pressure TypeBy pressure type, the medium segment is projected to account for the largest market in the UV curing system market during the forecast period.

-

By ComponentBy component, the hardware segment is projected to account for the largest market size of the UV curing system market during the forecast period.

-

By ApplicationBy application, the adhesives segment is estimated to lead the UV curing system market in 2026.

-

By VerticalBy vertical, the electronics segment is projected to account for the largest share of the UV curing system market during the forecast period.

-

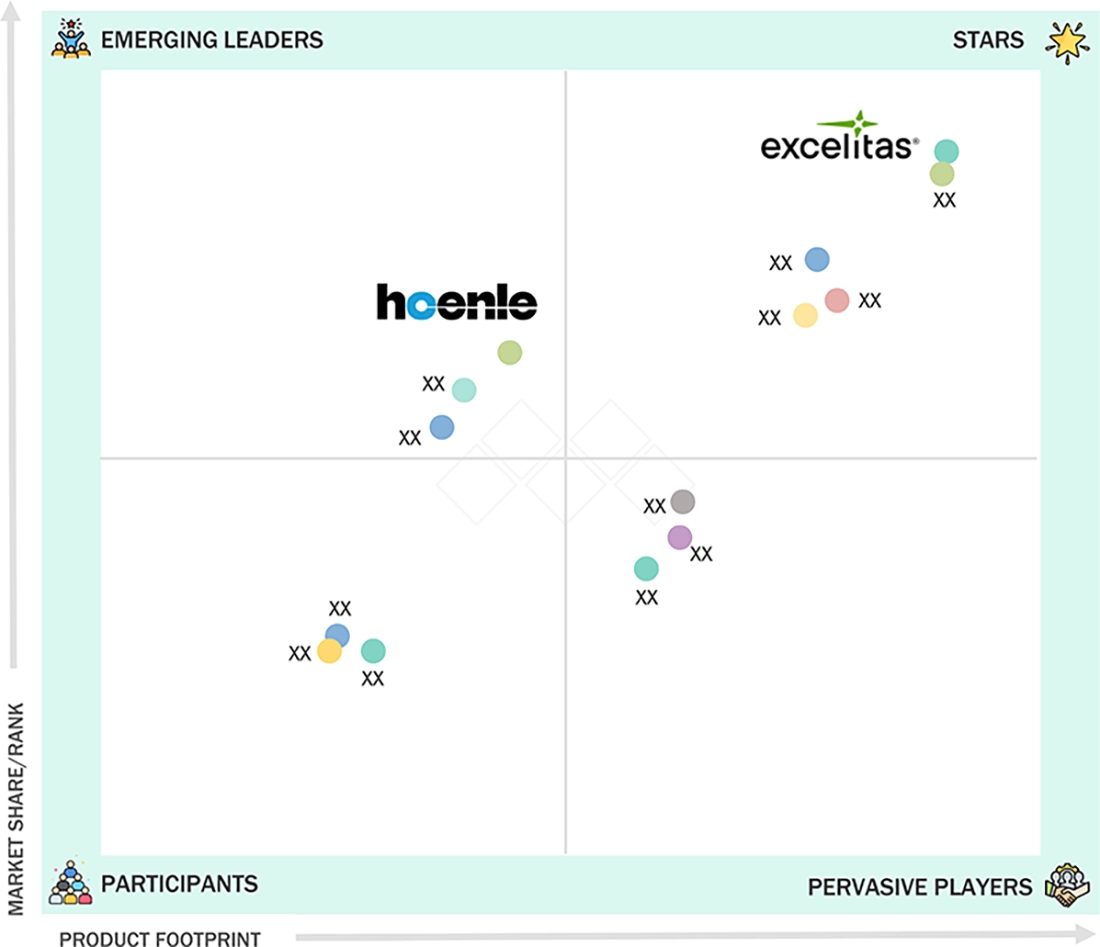

Competitive Landscape - Key PlayersExcelitas Technologies Corp., Nordson Corporation, IST METZ GmbH, BW Converting, and Dymax Corporation, among others, were identified as some of the star players in the UV curing system market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsOmniCure Technologies and UVITEC, among others, have distinguished themselves among startups/SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

UV curing systems are advanced processing solutions designed to rapidly cure, bond, or harden inks, coatings, adhesives, and resins using ultraviolet radiation. Unlike conventional thermal curing, these systems initiate photochemical reactions that enable instant curing at low temperatures, improving productivity and energy efficiency. They are widely utilized across printing, electronics, automotive, medical devices, packaging, and industrial manufacturing to enhance surface quality and process consistency. UV curing systems employ technologies, such as UV LED, mercury vapor, and hybrid curing, to support diverse material requirements and production speeds. With increasing emphasis on sustainable manufacturing, reduced VOC emissions, and automated production lines, the UV curing system market is witnessing strong growth. Ongoing advancements in LED efficiency, wavelength control, and system integration are further improving curing precision, operational flexibility, and overall manufacturing performance across multiple end-use industries.

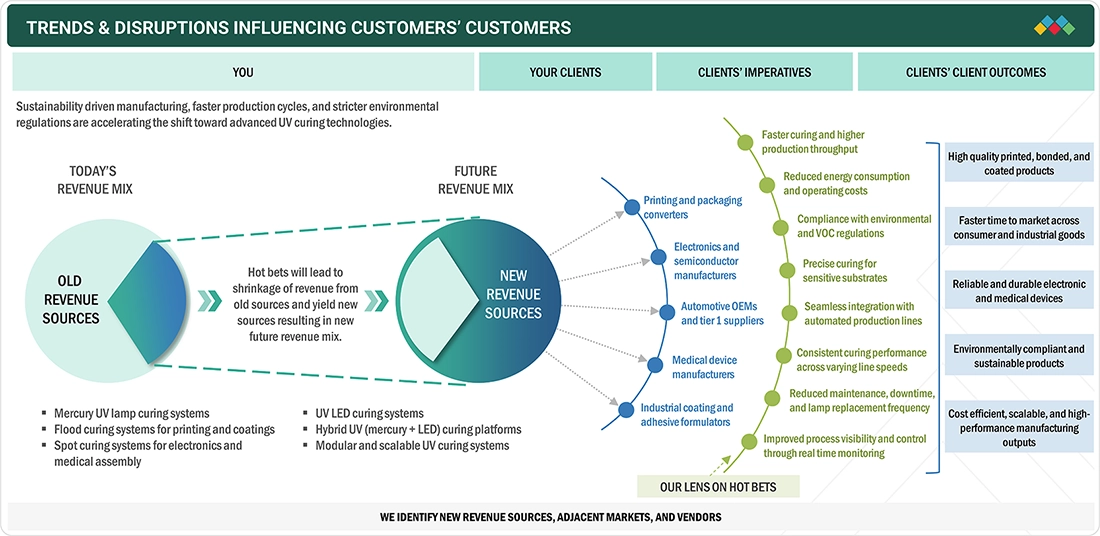

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the UV curing system market is shaped by growing emphasis on high-speed manufacturing, sustainability mandates, and advancements in curing technologies. Over the next 4 to 5 years, product portfolios are expected to evolve from conventional mercury lamp systems toward UV LED and hybrid curing solutions with higher efficiency and longer lifecycles, integrated with automated production lines and real-time process monitoring. Two key trends driving this transition include rapid adoption of UV LED systems for energy savings and thermal control, and increasing use of hybrid curing to support diverse substrates and formulations. These innovations are enabling faster curing, improved process consistency, reduced operating costs, and lower environmental impact across printing, electronics, automotive, packaging, and medical manufacturing. The shift toward compact, modular systems with digital controls and smart diagnostics is also enhancing throughput, regulatory compliance, and scalability in high-volume industrial environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing emphasis on high-speed, eco-friendly curing

-

Rising demand for precision curing in electronics manufacturing

Level

-

Requirement for high initial investments

-

Curing depth and material compatibility issues

Level

-

Rising manufacturing automation and smart factory integration

Level

-

Risks associated with UV mercury lamps

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing emphasis on high-speed, eco-friendly curing

The growing emphasis on high-speed and eco-friendly curing is driving the adoption of UV curing systems across industries. These systems enable near instant curing of inks, coatings, and adhesives, significantly reducing cycle times and boosting throughput. Lower energy consumption and reduced environmental impact compared to thermal or solvent based methods make UV curing ideal for high volume applications, such as printing, packaging, electronics, automotive, and industrial coatings.

Restraint: Requirement for high initial investments

High initial investment remains a key restraint for UV curing system adoption, especially among small and medium manufacturers. These systems require significant upfront spending on UV lamps or LED modules, power supplies, cooling, control units, and safety enclosures. Additional costs for system integration, customization, compliance, maintenance, and operator training further raise total ownership costs, limiting adoption in cost-sensitive and emerging markets.

Opportunity: Rising manufacturing automation and smart factory integration

Rising manufacturing automation and smart factory adoption present strong growth opportunities for the UV curing system market. UV curing systems offer fast curing speeds, compact designs, and precise process control, enabling seamless integration into automated production lines. Advanced UV LED systems support programmable control, instant on off operation, and stable performance, allowing synchronization with robotics, conveyors, and monitoring systems while improving consistency, reducing downtime, and enabling data-driven manufacturing.

Challenge: Risks associated with UV mercury lamps

Risks associated with UV mercury lamps present a key challenge for the UV curing system market. Mercury is a hazardous substance, posing health, environmental, and safety risks during handling, breakage, and disposal. Stricter environmental regulations and hazardous waste directives are increasing compliance costs, safety requirements, and operational complexity, pressuring manufacturers and end users to transition away from mercury-based curing technologies.

UV CURING SYSTEM MARKET SIZE, SHARE & INDUSTRY TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provide UV LED and conventional UV curing systems for adhesives, coatings, and electronic assembly applications | Solutions to support spot, flood, and conveyor-based curing across industrial and medical manufacturing lines | High precision curing with low heat output and long system lifespan |

|

Offer integrated UV curing solutions used in automated dispensing, coating, and bonding processes across electronics, automotive, and packaging industries | Systems designed for seamless integration into high-speed production lines | Improved production efficiency and consistent curing quality |

|

Develop high-intensity UV and LED curing systems for printing, coatings, and industrial surface finishing applications | Known for large-scale curing platforms and customized line integration | High throughput curing with excellent process reliability |

|

Supply UV curing systems for printing, packaging, and converting applications, including LED and hybrid solutions optimized for web and sheet-fed processes | Energy efficient curing with reduced operating costs |

|

Specialize in UV curing systems for medical devices, electronics, and precision assembly, focusing on spot curing and localized bonding applications | Fast curing with high accuracy for small and sensitive components |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The UV curing system ecosystem comprises manufacturers, system integrators, distributors, and end users working together to enable efficient curing across industrial applications. Manufacturers develop UV LED, mercury, and hybrid curing systems for inks, coatings, and adhesives. System integrators embed these solutions into automated production lines using conveyors, robotics, and control software. Distributors support market access through product supply, technical assistance, training, and after-sales services. End users across packaging, electronics, automotive, and industrial manufacturing adopt UV curing systems to enhance throughput, ensure consistent quality, reduce energy consumption, and meet sustainability and regulatory requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

UV Curing System Market, By System Type

The spot curing system segment is projected to account for the largest share during the forecast period due to its high precision, compact design, and suitability for localized curing in electronics, medical devices, and automotive assemblies.

UV Curing System Market, By Technology

The UV LED curing segment is projected to lead the market during the forecast period due to its high energy efficiency, long operating life, instant on-off capability, and low heat emission.

UV Curing System Market, By Pressure Type

The medium segment is projected to lead the market during the forecast period due to the high curing intensity, broad wavelength output, and proven reliability of medium-pressure systems across printing, coatings, and industrial applications.

UV Curing System Market, By Component

The hardware segment is estimated to lead the market in 2026 as UV curing systems are capital-intensive and require core components, such as lamps or LED modules, power supplies, controllers, reflectors, and cooling units.

UV Curing System Market, By Application

The adhesives segment is projected to account for the largest market during the forecast period due to their extensive use in electronics assembly, medical devices, automotive components, and packaging. UV-cured adhesives offer rapid bonding, high strength, precise application, and minimal thermal impact.

UV Curing System Market, By Vertical

The electronics segment is projected to account for the largest market size during the forecast period due to the extensive use of UV curing in PCB assembly, semiconductor packaging, display manufacturing, and optical components.

REGION

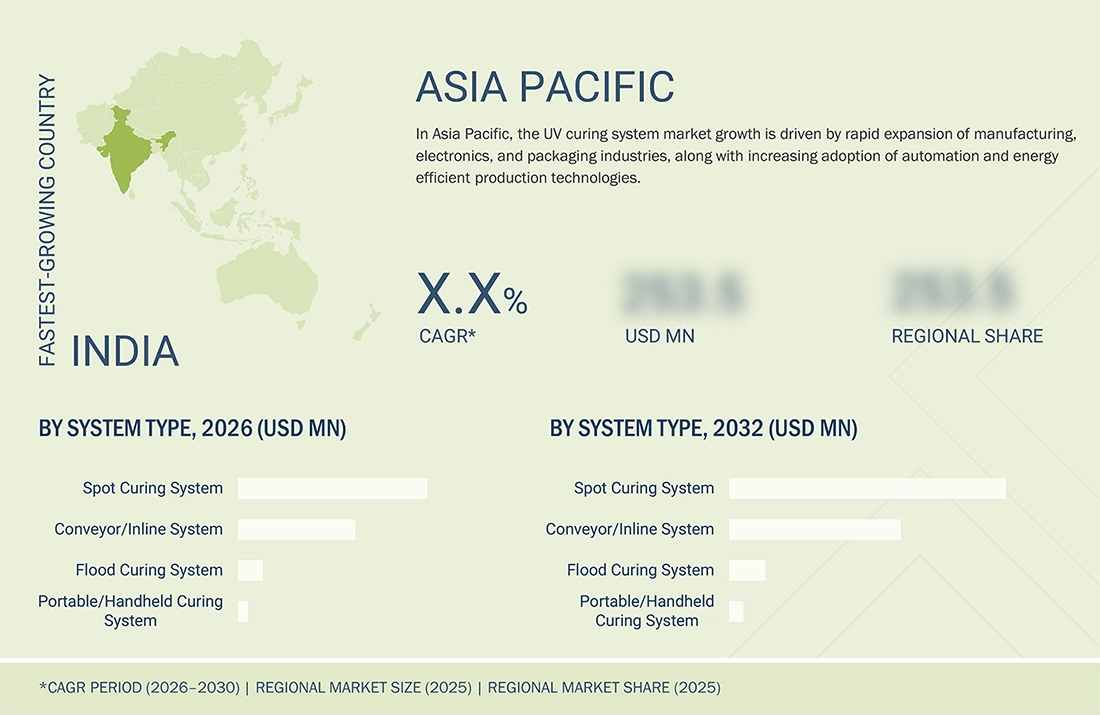

Asia Pacific is projected to be fastest-growing segment in the UV curing system market during the forecast period

Asia Pacific is expected to witness the highest CAGR in the UV curing system market during the forecast period due to rapid growth in the manufacturing, packaging, electronics, and automotive industries across the region. Rising investments in industrial automation, expanding printing and converting capacity, and increasing adoption of energy-efficient and sustainable curing technologies are accelerating demand. Additionally, strong presence of contract manufacturers and favorable government initiatives further support market growth.

UV CURING SYSTEM MARKET SIZE, SHARE & INDUSTRY TRENDS: COMPANY EVALUATION MATRIX

In the UV curing system market matrix, Excelitas Technologies Corp (Star) leads with its strong global footprint and comprehensive portfolios spanning UV LED, mercury, and hybrid curing systems. Its advanced spot, flood, and integrated line curing solutions, combined with high reliability, application expertise, and seamless automation compatibility, strengthen its dominance across electronics, medical devices, printing, packaging, and industrial manufacturing. Continuous innovation in energy-efficient UV LED platforms, digital controls, and smart curing solutions reinforces their leadership positions. On the other hand, Hoenle Group (Emerging Leader) is gaining momentum through its expanding range of high-performance UV and LED curing systems, particularly in industrial coatings, printing, and specialized manufacturing applications, supported by strong technological capabilities and growing international presence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Excelitas Technologies Corp. (US)

- Nordson Corporation (US)

- IST METZ GmbH & Co. KG. (Germany)

- BW Converting (US)

- Dymax (US)

- Hoenle AG (Germany)

- Hanovia (US)

- American Ultraviolet (US)

- GEW Limited (UK)

- FUJIFILM Europe GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.78 Billion |

| Market Forecast in 2032 (Value) | USD 4.85 Billion |

| Growth Rate | CAGR of 8.3% from 2026–2032 |

| Years Considered | 2022–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD Billion) and Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

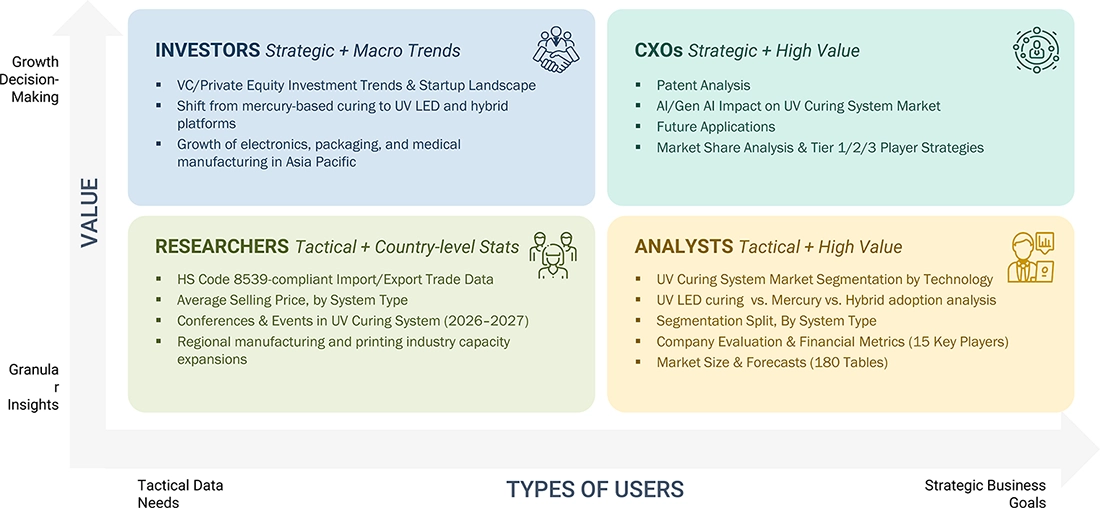

WHAT IS IN IT FOR YOU: UV CURING SYSTEM MARKET SIZE, SHARE & INDUSTRY TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| UV Curing System Manufacturer/OEM |

|

Identify technology gaps and innovation opportunities in energy efficient and high performance UV curing platforms |

| System Integrator/Automation Solution Provider |

|

Gain insights into application specific integration trends and automation driven adoption patterns by region |

| Regulatory/Environmental Compliance Body |

|

Support regulatory alignment and compliance planning with evolving environmental and safety standards |

| Industrial/Commercial End User |

|

|

RECENT DEVELOPMENTS

- September 2025 : Excelitas Technologies Corp. launched the Phoseon Nexus II UV LED curing platform for flexographic printing, offering higher reliability, stronger performance in high-temperature environments, and an optional high-airflow cooling model.

- January 2024 : IST Metz GmbH & Co. KG launched a next-generation UV LED curing module developed for B2-format digital and packaging printing. It would provide high energy output, better thermal management, and improved curing uniformity, supporting high-speed printing applications.

- October 2021 : Dymax launched the new Dymax BlueWave QX4 V2.0 LED system offering high-intensity spot-curing technology, a compact size, and excellent curing versatility to create an efficient and user-friendly experience.

Table of Contents

Methodology

This study involves the usage of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource to identify and collect information useful for this technical, market-oriented, and commercial study of the UV curing system market. Primary sources include several industry experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, and technology developers. In-depth interviews have been conducted with key industry participants, subject matter experts (SMEs), C-level executives of key companies operating in the UV curing system market, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the UV curing system market.

Secondary Research

In the secondary research, various secondary sources are used for identifying and collecting information relevant to this study on the UV curing system market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications & articles by recognized authors, directories, and databases.

The global size of the UV curing system market is obtained from the secondary data made available through paid and unpaid sources. It is determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research is used to gather key information about the supply chain, the monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It identifies and analyzes the industry trends and key developments undertaken from market and technology perspectives.

Primary Research

In the primary research process, various primary sources were interviewed to obtain the qualitative and quantitative information related to the market across four main regions—Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and some other related key executives from major companies and organizations operating in the UV curing system market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research was conducted to identify various market segments, industry trends, key players, competitive landscape, market dynamics, and key strategies adopted by market players. Most of the primary interviews were conducted with the supply side of the market. This primary data was collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

The top-down and bottom-up approaches have been used extensively in the market engineering process. Several data triangulation methods helped to forecast and estimate market segments and subsegments in the report. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players of the UV curing system market. The revenues of those key players are determined through primary and secondary research. The revenues are identified geographically and market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were conducted to gain insights into the key players and the UV curing system market. All the market shares are estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs & analysis by experts at MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then split into several segments and sub-segments. The data triangulation procedure has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Study Objectives

- To describe and forecast the UV curing system market, in terms of value, segmented by technology, type, pressure type, application, vertical, and region

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the emerging applications/use cases and standards in the UV curing system market

- To analyze the manufacturers of UV curing systems, their strategies, and new production plans to understand the ecosystem/supply chain consisting of material & component suppliers and manufacturers

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape of the market

- To analyze competitive developments in the UV curing system market, such as collaborations, partnerships, acquisitions, and product launches & developments

- To strategically profile key players and comprehensively analyze their market share analysis & ranking core competencies2

Report Scope

The report covers the demand- and supply-side segmentation of the UV curing system market. The supply-side market segmentation includes the pressure type, technology, and type, whereas the demand-side market segmentation includes application, industry and region. The following figure represents an overview of the micromarkets covered in the report.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown of the UV curing system market for North America, Europe, APAC, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UV Curing System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in UV Curing System Market

josue

May, 2022

I would like to have access to this report for an anlysis in the university.

Kaushal

Oct, 2019

Looking for market share of traditional (thermal) cure system compared to UV-LED based cure system..

Vonn

May, 2019

I would like to refer this report for a University project report on UV Curable materials. I would need to interact with the author of the report to be able to do this..