UV Stabilizers Market

UV Stabilizers Market by Type (HALS, UV Absorbers, and Quenchers), Application (Personal Care, Cosmetics & Sunscreens, Automotive, Packaging, Agriculture, Building & Construction, Adhesives & Sealants), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The UV Stabilizers market is estimated to grow from USD 2.53 billion in 2024 to USD 3.72 billion by 2030, at a CAGR of 6.76% between 2025 to 2030. This growth is fueled by the rising demand for durable plastic automotive, packaging and construction applications requiring enhanced UV resistance and longer lifespan. An UV stabilizer is a chemical additive that protects materials such as plastics, coatings, polymers and textiles from ultraviolet (UV) degradation. UV light breaks down chemical bonds in a material, leading to its discoloration, cracking, brittleness, and loss of mechanical strength, thereby impacting its aesthetic properties and functionalities. UV stabilizers prevent these kinds of damage by reflecting, absorbing, or neutralizing UV radiation, thereby extending lifespan of UV-exposed products. UV stabilizers comprise of HALS, UV absorbers, and quenchers

KEY TAKEAWAYS

-

BY TYPEUV absorbers hold the second-largest share of the global UV stabilizers market, in terms of value, in 2023. This is driven by their superior performance in protecting materials against degradation caused by UV radiation. Their performance in extreme climatic conditions and compatibility with a broad spectrum of polymers render them a preferable option for manufacturers looking for long-term durability and protection of the product. With increasing demand for UV-resistant materials worldwide, particularly in areas of high sun exposure, UV absorbers are likely to remain dominant in the stabilizers market.

-

BY APPLICATONAgriculture was the second-fastest growing application in the global market for UV stabilizers, by value, over the forecast period. The growth is primarily driven by the growing use of plastic films, nets, greenhouse coverings, and irrigation components, which need UV stabilization to resist long exposure to sunlight and retain functional performance in outdoor conditions. As modern farming practices expand, particularly in emerging economies and regions with high solar intensity, the need for durable, UV-resistant agricultural materials has become more critical. UV stabilizers help extend the service life of these products, reduce replacement frequency, and improve crop yield efficiency, making them an essential input in the push for more sustainable and high-output agriculture.

-

BY REGIONNorth America, the second largest region in the global UV stabilizers market is driven by its established production base, rigorous environmental and safety standards, and dominant presence of major end-use industries such as automotive, packaging, and building & construction. The region's regulatory authorities impose stringent standards on product durability and environmental sustainability, leading manufacturers to invest in UV stabilization technologies to guarantee longevity and sustainability. The growing emphasis of countries on innovation and R&D, as well as the presence of major global players, further supports the regions’ role in driving market trends and product performance

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, SONGWON Industrial Co., Ltd. expanded its reach in Italy by forming an exclusive distribution agreement with Krahn Italia S.p.A. for its coating’s portfolio, which includes UV absorbers and HALS products.

The UV stabilizers market is projected to grow steadily. This growth is led by the rising demand for UV stabilizers that provide long-term protection against polymer degradation, color fading, and surface cracking caused by UV exposure. Major end-use applications such as automotive and building & construction are fueling market growth because they demand high-performance UV stabilizers with the ability to prolong product lifespan and protect against material degradation due to sunlight exposure. Industries are increasingly adopting advanced UV stabilizers to adhere to rigorous safety standards and improve equipment efficiency in extreme climatic conditions. Increased investments in infrastructure development, urbanization, and machinery modernization are also driving demand. Increasing emphasis on UV-resistant materials, environmental sustainability, and equipment longevity is also encouraging companies to move towards premium-grade UV stabilizers, further boosting market growth in key manufacturing centers worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends, including digital transformation and renewables, will impact a company's revenue stream. The driving factor for the market is the end-use industries such as packaging, automotive coatings, flooring & decking, furniture, agricultural films, and adhesives & sealants. The end-use industries lead to the growing demand for UV stabilizers. These end-use industries use UV stabilizers in applications such as food packaging films, exterior plastic parts & tires of vehicles, greenhouses, mulch and silage films, flooring & decking applications, balconies & fences, electronics & outdoor furniture, personal care products, and printing inks. These stabilizers help protect their materials from the harmful effects of UV radiation, improve durability, reduce the need for frequent replacement, prevent loss of strength, improve food safety, maintain the appearance of adhesives & sealants, and reduce failures. These megatrends are expected to drive growth and increase the revenue of the UV stabilizers market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand from packaging industry

-

Growing demand from the construction industry

Level

-

Fluctuations in raw materials prices

-

High production costs

Level

-

Increasing use of nanocomposites in UV stabilizers

-

Growing agriculture film industry

Level

-

Stringent government regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand from packaging industry

UV stabilizers can impart retention properties to packaging materials to maintain their quality and durability during exposure to sunlight and harsh environmental conditions. The long-term durability of packaging materials is the major factor driving the UV stabilizers market. UV stabilizers are used in the packaging of food and beverages and other consumer products, cosmetics, and pharmaceuticals. The growth in the global packaging market is mainly driven by the food & beverage, retail, and healthcare industries. UV radiation can adversely affect the plastic packaging of food and beverages, pharmaceutical products, household, cosmetics, and personal care products, leading to color fading of food, accelerated oxidation of oils and fats, and loss of vitamin content in fruit juices and milk. UV stabilizers are added to plastic packaging to protect the package and its contents from the damaging effects of ultraviolet and infrared radiation from sunlight. The use of polyethylene terephthalate (PET) packaging is increasing in the food & beverage industry. The demand for barrier PET bottles that offer protection against UV light is rising. UV light is harmful to many nutrients in a product, including vitamins, lipids, and fatty acids. There is a high demand for safer and cleaner packaging products; as a result, innovations and R&D activities are increasing in the food packaging industry, further driving the demand for UV stabilizers

Restraint: High production costs

The cost of UV stabilizers varies in accordance with the type, thickness, applications, environment for use, performance required, and level of compatibility with other components where they are used. The UV stabilizers market is capital-intensive, and the downtime involved with implementing and attaching UV stabilizer materials to the existing components also causes significant losses to the end-use industries. The R&D cost, in terms of labor and materials, is high. The materials used to manufacture UV stabilizers are highly volatile and specific to the applications and should meet the quality and government standards while delivering optimum coating solutions that have short- and long-term benefits. The setting up of a UV stabilizer manufacturing plant requires huge capital investments, proficient machinery, an adequate supply of raw materials, and rigorous R&D during the manufacturing process to deliver a quality product. The manufacturers have to upscale their production capacity to sustain a steady cash flow, leading to economies of scale. Thus, it is difficult for emerging manufacturers to access such technology and skilled labor with high capital investment to manufacture environment-friendly, efficient, and effective additive compounds, such as UV stabilizers, at a very competitive price.

Opportunity: Increasing use of nanocomposites in UV stabilizers

Nanotechnology plays a major role in the UV stabilizers market. Nanocomposite materials can enhance the properties of coating systems by improving the UV stability and scratch-resistance of the coated product. The nano-sized oxides, such as TiO2, ZnO2, and CeO2, are used as inorganic UVAs to increase the longevity of coated substrates. Nano-size ZnO2 is a good broadband UVA, while CeO2 shows high efficiency in the UV-B region. These nano-based composites are used in both solvent-borne and waterborne coating systems; thus, they are easy to use in UV stabilizers. Conventional UVAs are organic stabilizers that tend to degrade easily; thus, nano-based inorganic UVAs offer the additional advantage of greater long-term protection. However, the selection of nanoparticles is based on various parameters that include chemical composition, size, shape, structure, and surface chemistry, as they have the drawback of reducing the transparency of the coating film. This drawback can be overcome by reducing the size of the nanocomposite compounds, as the smaller the particle size, the greater the transparency. Though implementing nanocomposites in UV stabilizers is still under research with limited use in industrial applications, it still creates an opportunity to enhance the quality, stability, resistivity, and performance of different UV stabilizers.

Challenge: Stringent government regulations

The growing demand for UV-resistant coated plastic, polymer, and wood products has increased the production of UV stabilizers for flooring & decking, furniture, packaging, and automotive coating applications globally. However, government organizations set various regulations and standards to regulate the level of petrochemicals and other materials used to synthesize UV stabilizers. They also govern the number of UV stabilizers used in various end-use applications. For instance, the Environmental Protection Agency (EPA) Toxic Substances Control Act (TSCA) Inventory (1983) provides and regulates the yearly data of the total production and import volume of benzophenone type of UVA, along with the level of toxicity of the compound in the chemical industry. Other standards set by organizations, such as the Code of Federal Regulations (CFR), state UV stabilizers' limit in polymers used in direct or indirect contact with manufacturing, packaging, processing, transportation, or holding of food and beverages, and medical drugs or components. Also, there are various regulations regarding the use of UV stabilizers in personal care products, such as sunscreens and moisturizers. Thus, stringent government regulations against the use or content limits of UV stabilizers in industrial and commercial applications are a challenge for UV stabilizer manufacturers.

UV Stabilizers Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses UV stabilizers in polyethylene and polypropylene compounds to prevent degradation in automotive components, films, and fibers exposed to sunlight. | Enhances weather resistance, extends product lifespan, and maintains color stability and mechanical integrity under prolonged UV radiation. |

|

Integrates UV absorbers and HALS in flexible packaging films, pipes, and building materials to protect polymers from UV-induced oxidation. | Ensures long-term durability, reduces maintenance costs, and prevents yellowing or brittleness, preserving material aesthetics and performance. |

|

Uses UV stabilizers in plastic housings for consumer electronics and outdoor appliances to prevent discoloration and surface cracking. | Maintains product appearance, enhances heat and light stability, and improves longevity of devices used under UV exposure. |

|

Uses UV stabilizers in coatings, interiors, and plastic trims to protect surfaces from fading and degradation caused by sunlight. | Improves vehicle aesthetics, extends component lifespan, and ensures better resistance to UV-induced wear and cracking. |

|

Employs UV stabilizers in display panels, casings, and optical films to prevent yellowing and maintain optical clarity. | Ensures consistent display quality, prevents optical distortion, and extends product life in UV-exposed devices. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of UV stabilizers. These companies have been in business for a while and have broad product portfolios, cutting-edge technologies, and wide international sales and marketing networks. The prominent companies in this market include BASF SE (Germany), Rianlon Corporation (China), Suqian Unitech Corp., Ltd. (China), Syensqo SA/NV (Belgium), SONGWON Industrial Co., Ltd. (South Korea), ADEKA Corporation (Japan), SABO S.p.A. (Italy), Arkema (France), Clariant AG (Switzerland), Everlight Chemical Industrial Corporation (Taiwan), and SI Group, Inc. (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

UV Stabilizers Market, By Type

The HALS segment accounted for the largest market share in the UV stabilizers market. This dominance is led by the better performance and a wide range of applications of HALS. HALS are highly renowned for their ability to provide long-term protection against UV radiation-induced degradation of polymers, thus being highly effective in extending the life and appearance of plastic products. In contrast to conventional UV absorbers that only block UV radiation, HALS act by scavenging free radicals formed during photo-degradation, providing continuous and effective stabilization. The versatility of HALS enables them to be applied across a variety of industries, such as automotive, construction, agriculture, and packaging. In automotive applications, HALS are critical in enhancing the exterior components' durability and aesthetic appeal when exposed to sunlight. In construction, they are applied in siding, pipes, and roofing materials to provide long-term performance in outdoor conditions. The packaging sector also benefits from HALS, especially in food and consumer products, where product appearance and integrity need to be maintained when exposed to light.

UV Stabilizers Market, By Application

The automotive segment held the largest market share in the global UV stabilizers market. This growth is mainly fueled by the growing applications of high-performance coatings and plastics on vehicle exteriors and interiors, which need proper protection from extended UV exposure. Being exposed to sunlight for long periods, UV radiation can lead to fading, discoloration, surface cracking, and material degradation. For maintaining visual appeal and structural integrity, manufacturers predominantly rely on UV stabilizers, especially HALS and UV absorbers. The demand for UV stabilizers in the automotive industry is also driven by increasing consumer expectations for durable vehicle parts and the increased use of lightweight materials to enhance fuel efficiency. Plastics and composites used in components like bumpers, dashboards, trims, and exterior panels are exposed to harsh weather conditions without affecting performance or appearance. UV stabilizers are essential to ensuring these materials meet durability and warranty requirements.

REGION

Asia Pacific is expected to be the largest market for UV stabilizers during the forecast period

Asia Pacific is anticipated to be the largest market for UV stabilizers over the forecast period due to its robust economic growth, rising industrial production, and growing polymer manufacturing capacities. It is also driven by rapid infrastructure development and growing investments in key industries such as automotive, packaging, and agriculture. The large-scale manufacturing facility in the region, supported by government incentives and foreign direct investment, has positioned it as a key center for chemical and material production, such as UV stabilizers. The emerging local markets and export-oriented production, especially in emerging markets such as China, India, and Japan, have caused demand for high-performance, advanced UV stabilizers to jump sharply. Besides economic factors, the market is also supported by favorable climatic conditions in the region, which boost demand for UV protection. Strong sunlight and greater exposure to UV radiation across most of the Asia Pacific market increase the risk of degradation in plastics and paints, prompting higher consumption of stabilizers. This inherent driver of demand provides UV stabilizer producers with a broad margin of expansion in the domestic market. With increasing emphasis on quality, sustainability, and material durability, Asia Pacific is likely to continue its leadership in the global UV stabilizers market during the forecast period.

UV Stabilizers Market: COMPANY EVALUATION MATRIX

In the Adhesive Tapes Market matrix, BASF SE (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. ADEKA Corporation (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While BASF SE dominates with scale, ADEKA Corporation shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 2.53 BN |

| Revenue Forecast in 2030 | USD 3.72 BN |

| Growth Rate | CAGR of 6.76% from 2025-2030 |

| Actual data | 2020−2030 |

| Base year | 2024 |

| Forecast period | 2025−2030 |

| Units considered | Value (USD Billion) and Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Type (HALS, UV Absorber, Quenchers ), Application (Personal Care, Cosmetcs & Sunscreens, Automotive, Packaing, Agriculture, Building & Construction, Adhesives & Sealants and Other Applications) and Region |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: UV Stabilizers Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based UV Stabilizers Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by application sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across the industry • Highlight untapped customer clusters for market entry |

| Asia Pacific-based UV Stabilizers Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the applications | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- 7/1/2023 12:00:00 AM : SONGWON Industrial Co., Ltd. expanded its reach in Italy by forming an exclusive distribution agreement with Krahn Italia S.p.A. for its coating’s portfolio, which includes UV absorbers and HALS products

- 12/1/2022 12:00:00 AM : Everlight Chemical Industrial Corporation launched the Eversorb CP Series, a line of composite formula light stabilizers designed with carbon fiber-reinforced polymer (CFRP) materials.

- 11/1/2022 12:00:00 AM : SABO S.p.A. acquired TAA and derivatives business and production sites in Marl, Germany, and Liaoyang, China from Evonik Industries AG.

- 3/1/2022 12:00:00 AM : BASF SE increased its production capacity for HALS at its sites in Italy and Germany to cater to the growing demand for sustainable plastic materials.

Table of Contents

Methodology

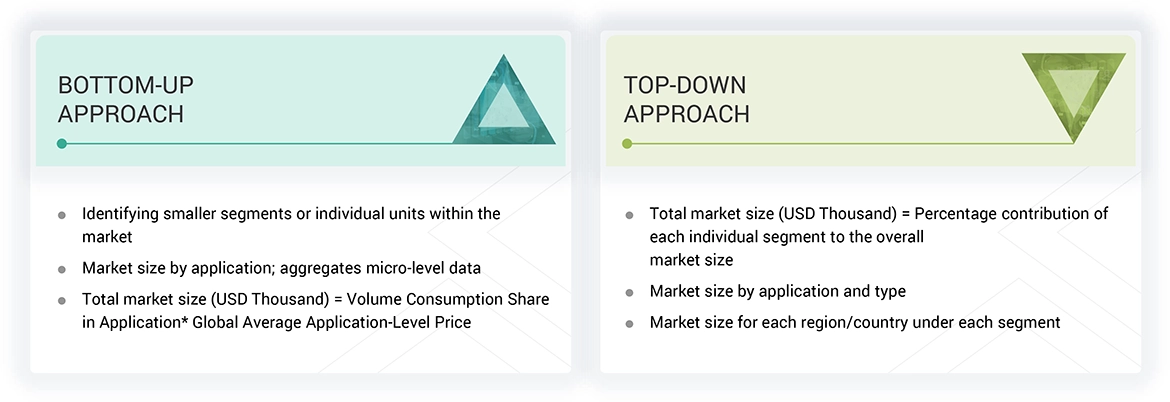

The study involved four major activities in estimating the market size for UV stabilizers. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

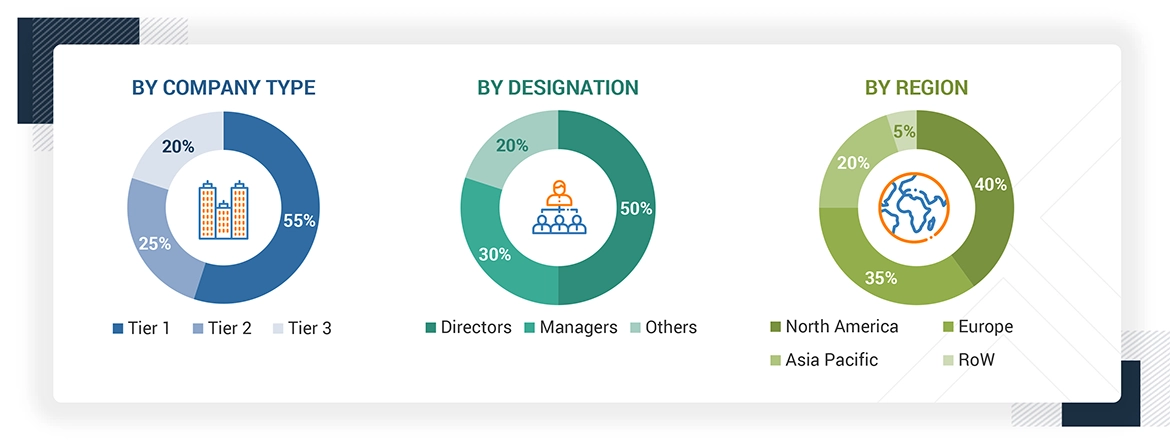

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The UV stabilizers market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Key opinion leaders in various applications for the UV stabilizers market characterize the demand side of this market. Advancements in technology and diverse application industries characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| BASF SE | Senior Manager | |

| Rianlon Corporation | Innovation Manager | |

| Suqian Unitech Corp., Ltd. | Vice-President | |

| Syensqo SA/NV | Production Supervisor | |

| SONGWON Industrial Co., Ltd. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the UV stabilizers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

UV Stabilizers Market: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the UV stabilizers industry.

Market Definition

According to the Plastics Industry Association, “An UV stabilizer is a chemical additive that protects materials such as plastics, coatings, polymers and textiles from ultraviolet (UV) degradation. UV light breaks down chemical bonds in a material, leading to its discoloration, cracking, brittleness, and loss of mechanical strength, thereby impacting its aesthetic properties and functionalities. UV stabilizers prevent these kinds of damage by reflecting, absorbing, or neutralizing UV radiation, thereby extending lifespan of UV-exposed products. UV stabilizers comprise of HALS, UV absorbers, and quenchers.”

Stakeholders

- UV Stabilizer Manufacturers

- UV Stabilizer Distributors

- Raw Material Suppliers

- Government and Research Organizations

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the UV stabilizers market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, segment, and project the size of the global UV stabilizers market based on type and application

- To project the market size for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, with their key countries

- To analyze the micromarkets1 concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze R&D and competitive developments such as expansions, product launches, collaborations, investments, partnerships, agreements, developments, collaborations, and mergers & acquisitions in the UV stabilizers market

Key Questions Addressed by the Report

Who are the major players in the UV stabilizers market?

BASF SE (Germany), Rianlon Corporation (China), Suqian Unitech Corp., Ltd. (China), Syensqo SA/NV (Belgium), SONGWON Industrial Co., Ltd. (South Korea), ADEKA Corporation (Japan), SABO S.p.A. (Italy), Arkema (France), Clariant AG (Switzerland), Everlight Chemical Industrial Corporation (Taiwan), and SI Group, Inc. (US).

What are the drivers and opportunities for the UV stabilizers market?

Key drivers include increasing demand from the packaging and construction industries, and rising demand in Asia Pacific and North America. Opportunities include the growing use of nanocomposites in UV stabilizers and the expanding agricultural films industry.

Which strategies are the key players focusing on in the UV stabilizers market?

Major strategies include product launches, partnerships, mergers & acquisitions, agreements, and expansions aimed at enhancing global presence.

What is the expected growth rate of the UV stabilizers market between 2025 and 2030?

The UV stabilizers market is projected to grow at a CAGR of 6.76% in terms of value during the forecast period (2025–2030).

Which major factors are expected to restrain the growth of the UV stabilizers market during the forecast period?

Fluctuations in raw material prices and high production costs are anticipated to limit market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UV Stabilizers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in UV Stabilizers Market