Valve Positioner Market Size, Share & Trends

Valve Positioner Market by Type (Pneumatic Positioners, Electro-pneumatic Positioners, Digital Positioners), Actuation (Single Acting Positioners, Double Acting Positioners), Industry (Oil & Gas, Energy & Power) and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global valve positioner market is projected to grow from USD 2.07 billion in 2025 to USD 2.56 billion by 2030, at a CAGR of 4.4%. The rising adoption of automation and demand for precise flow control are major factors driving the valve positioner market. Technological advancements, including the shift toward digital valve positioners and their integration with IoT and AI, further enhance their performance and expand applications.

KEY TAKEAWAYS

-

BY TYPEDigital valve positioners excel through accuracy, diagnostics, easy integration, and predictive maintenance, enabling smarter control and optimized industrial operations.

-

BY ACTUATIONSingle-acting actuators stand out with straightforward design, dependable performance, low energy use, and automatic fail-return, ensuring safe and economical automation.

-

BY INDUSTRYThe oil & gas industry drives innovation through complex operations, stringent safety standards, and advanced process optimization, supporting efficient and resilient energy production, which helps the adoption of valve positioners.

-

BY REGIONThe Asia Pacific region leads the valve positioner market due to extensive automation adoption, a strong energy & power demand, oil refineries base, and supportive government initiatives.

-

COMPETITIVE LANDSCAPEMajor market players have pursued both organic and inorganic strategies, including partnerships and investments. For example, Emerson Electric Co. and ABB have undertaken R&D activities to develop advanced valve positioners with improved precision, diagnostics, and integration capabilities.

Valve positioners are critical components in industrial automation, ensuring precise control of valve movements by regulating actuator positioning based on control signals. They are widely used across the oil & gas, chemicals, power generation, water treatment, and manufacturing industries. As industries increasingly focus on process optimization, energy efficiency, and digital transformation, the valve positioner industry is poised for steady growth, driven by advancements in smart, digital, and networked positioning technologies and expanding applications across diverse industrial processes.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on end users arises from evolving customer demands and market disruptions. This highlights how the revenue composition of valve positioner suppliers is likely to shift over the next 4–5 years, transitioning from traditional analog and pneumatic solutions to digital, smart, and IIoT-enabled positioners while also opening opportunities in new industrial applications, process segments, and geographies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing significance of monitoring and control in process industries for optimized output

-

Rising focus of industry players on reducing energy costs and improving efficiency

Level

-

Rapid pace of technological change

Level

-

Increasing focus on remote operations and decentralized plants

-

Greater emphasis of industry players on offering improved customer services

Level

-

Risk of unplanned downtime due to use of oversized valves

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing significance of monitoring and control in process industries for optimized output

The growing emphasis on precise monitoring and control in process industries is driving demand for valve positioners, which ensure accurate valve operation, enhance process stability, and support compliance with safety and environmental standards. Modern smart positioners offer diagnostics and remote monitoring, enabling predictive maintenance and reduced downtime. By improving operational visibility and automation, they help industries optimize output and efficiency.

Restraint: Rapid pace of technological change

The rapid pace of technological change in the valve positioner market creates adoption challenges, as companies hesitate to invest amid concerns of quick obsolescence. Integration with smart systems, IIoT platforms, and AI-driven controls adds cost and complexity, particularly for small and mid-sized manufacturers. Lack of standardization and interoperability further slows adoption, with many businesses adopting a cautious approach.

Opportunity: Increasing focus on remote operation & decentralized plants

The shift toward remote operation and decentralized plant setups is driving demand for smart valve positioners, enabling precise control, real-time monitoring, and remote diagnostics. Integration with SCADA and cloud systems supports predictive maintenance and reduced downtime. As industries prioritize efficiency and safety, intelligent valve positioners are becoming essential for modern automated operations.

Challenge: Risk of unplanned downtime due to use of oversized valves

Positioner overshoot and oversized valves hinder precise control, causing pressure fluctuations, energy inefficiency, and increased wear on valve components. These issues can lead to unplanned downtime and higher operational costs. Proper valve sizing and advanced positioner tuning are critical to maintaining process stability and extending equipment life.

Valve Positioner Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cloud-based valve monitoring services using Azbil Smart Valve Positioners to analyze control valve operating conditions at Mitsubishi Chemical Corporation | Improved plant reliability | Early detection of valve issues | Enhanced maintenance efficiency | Reduced downtime |

|

Implementation of Siemens PS2 digital valve positioner on feedwater and startup valves in a power plant to replace analog I/P and pneumatic input positioners | Achieved precise and repeatable control | Improved reliability | Ensured positive feedback indication to the control room |

|

Replacement of analog valve positioners with Azbil SVP3000 Alphaplus digital positioners, integrated with the CommPad smart communicator for monitoring and maintenance | Simplified auto-setup |Improved maintenance efficiency | Reduced inspection workload | Minimized risks of sudden valve malfunctions affecting production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The valve positioner market ecosystem involves mapping and analyzing the interconnected relationships among key stakeholders, including raw material suppliers, manufacturers, distributors, end-use industries, and regulator bodies. Distributors act as a vital link between valve positioner manufacturers and industrial end users, ensuring smooth product availability and technical support. By streamlining the supply chain, distributors help improve delivery timelines, reduce operational disruptions, and enhance overall efficiency. This interconnected network not only supports market growth but also drives higher profitability by aligning product development, distribution, and end-user requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Valve Positioner Market, by Type

Digital valve positioners are expected to hold the largest market share in 2025, driven by the growing demand for automation, accuracy, and operational efficiency across industries. Digital valve positioners are widely adopted for their ability to provide precise valve control, real-time monitoring, and advanced diagnostics, which are critical in sectors such as oil & gas, energy & power, and chemical processing. The increasing shift toward smart plants and Industry 4.0 further accelerates their adoption, as these positioners seamlessly integrate with distributed control systems (DCS) and enable predictive maintenance. This makes smart digital valve positioners dominant in the market.

Valve Positioner Market, by Actuation

Single-acting valve positioners are expected to lead the market in 2025 due to their energy efficiency, reliability, and low maintenance needs. Their design reduces air consumption and operating costs, making them ideal for the oil & gas, water treatment, and power industries. These advantages position single-acting systems as the dominant actuation type in the valve positioner market.

Valve Positioner Market, by Industry

The oil & gas industry is expected to dominate the valve positioner market in 2025, driven by the need for precise flow control, safety, and reliability in exploration, refining, and distribution processes. Digital valve positioners enable real-time monitoring and predictive maintenance, reducing downtime and enhancing operational efficiency. Their critical role in optimizing complex processes makes oil & gas the leading industry segment for valve positioner adoption.

REGION

Asia Pacific to hold largest market share during forecast period

The Asia Pacific region is expected to dominate the valve positioner market in 2024, fueled by large-scale infrastructure development, increasing manufacturing output, and government initiatives promoting industrial automation. The region’s strong base of local manufacturers and expanding export-oriented industries further accelerate demand. With rising focus on energy efficiency and modernization of process industries, Asia Pacific is set to lead the global valve positioner market.

Valve Positioner Market: COMPANY EVALUATION MATRIX

In the valve positioner market, Emerson Electric Co. and ABB (Stars) stand out as leading players due to their strong global presence and extensive product offerings. This dominance allows them to achieve widespread adoption across industries such as oil & gas, power generation, and chemicals. Their emphasis on advanced digital technologies, automation solutions, and integration capabilities positions them at the forefront of market growth and industry innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.98 Billion |

| Market Forecast in 2030 (Value) | USD 2.56 Billion |

| Growth Rate | CAGR of 4.4% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type: Digital, Electro-pneumatic, Pneumatic By Actuation: Single Acting, Double Acting By Industry: Oil & Gas, Metals & Mining, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Chemicals, Pharmaceuticals, Pulp & Paper, Other Industries |

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: Valve Positioner Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key regional players, including market share, revenue, product portfolio, and strategic initiatives | • Facilitated competitive benchmarking and informed strategy development |

| Regional Market Entry Strategy | Country- or region-specific go-to-market strategy including barriers, regulations, and competitive landscape | • Minimized entry risk and accelerates market adoption |

| Local Risk & Opportunity Assessment | Identification of regional risks, barriers, and untapped opportunities by market or sector | • Enabled proactive risk mitigation and strategic investments |

RECENT DEVELOPMENTS

- June 2025 : Flowserve Corporation (US) and Chart Industries announced a USD 19-billion all-stock merger to form a global leader in industrial process technologies. The merger aims to integrate Flowserve's flow control expertise with Chart's cryogenic and thermal capabilities. This strategic move will enhance their combined presence in high-growth markets, including valve positioners.

- August 2024 : Azbil Corporation (Japan) established a new production base in Hung Yên Province, Vietnam, to strengthen its global manufacturing and procurement systems. The move enhances production capacity, reduces costs, and diversifies risk beyond China and Thailand. It supports Azbil Corporation's long-term growth strategy and stable supply for automation products, including valve positioners.

- October 2023 : Emerson Electric (US) acquired National Instruments Corp. (US) to broaden its global footprint in automation and test equipment. The acquisition enhanced Emerson’s expertise in data-driven diagnostics and intelligent monitoring, while offering notable advantages to the valve positioner market through advanced control systems, predictive maintenance capabilities, and improved performance analytics.

- August 2023 : Emerson Electric Co. (US) enhanced its factory automation portfolio through the acquisition of Afag Holding AG (Switzerland), a company specializing in electric linear motion and handling solutions. This deal improved the integration of electric motion with pneumatic systems, leading to greater actuation accuracy and energy efficiency. Additionally, it bolstered Emerson's position in the valve positioner market by providing better control precision and optimizing flow automation for improved energy efficiency.

Table of Contents

Methodology

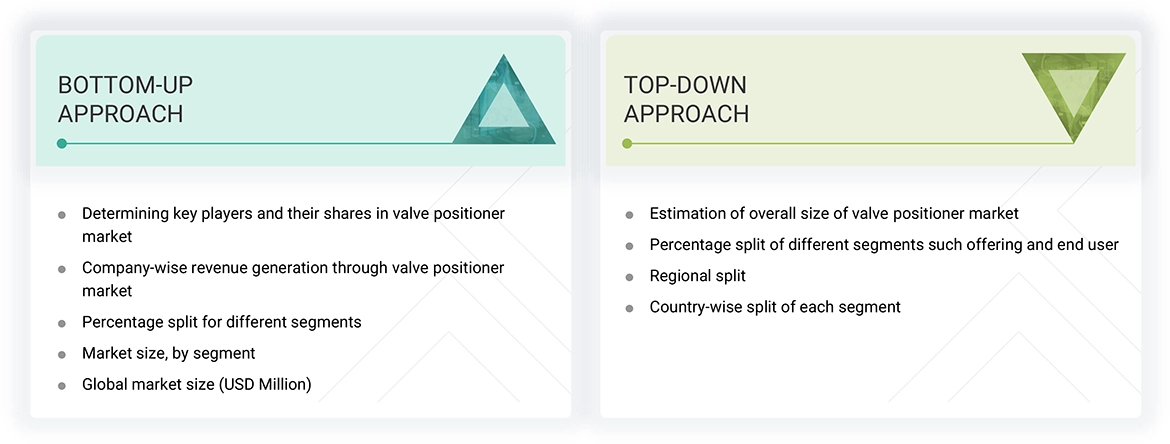

The study involved four major activities in estimating the current size of the valve positioner market. Exhaustive secondary research has been conducted to gather information on the market, adjacent markets, and the overall valve positioner landscape. These findings, assumptions, and projections were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the valve positioner market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

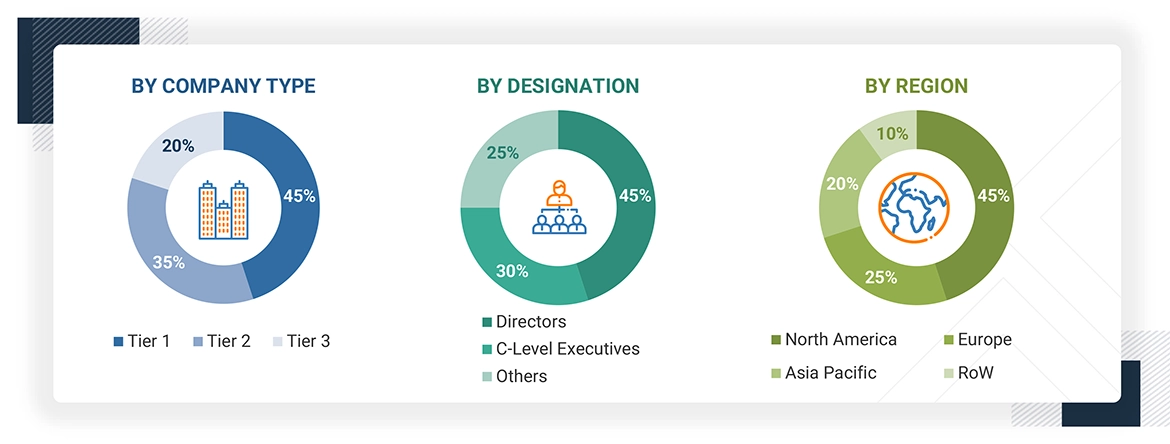

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the valve positioner market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include sales and product managers and project engineers. The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the valve positioner market. These methods have also been used extensively to estimate the size of various subsegments on the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Valve Positioner Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the valve positioner market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

A valve positioner is an accessory used to enhance the precision and operation of a control valve. It enables the efficient operation of a control valve by allowing it to position itself correctly with respect to the signal it receives. Valve positioners are widely used in several industries, such as oil & gas, energy & power, water & wastewater treatment, pharmaceuticals, and chemicals.

Key Stakeholders

- Valve positioner manufacturer

- Valve Positioner Distributors

- Control Valve Suppliers

- Control Valve Accessory Suppliers

- Companies in Valve Automation, Flow Control, and Monitoring

- System Integrators

- Research Organizations and Consulting Companies

- Original Device Manufacturers (ODMs)

- Valve Positioner-related Technology Solution Providers

- Assembly, Testing, and Packaging Vendors

- Organizations, Forums, Alliances, and Associations Related to the Valve Positioner Industry

Report Objectives

- To define, describe, and forecast the valve positioner market, in terms of value, by type, actuation, and industry.

- To evaluate the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To offer a detailed overview of the value chain of the valve positioner market.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the valve positioner market

- To assess opportunities in the market for stakeholders by identifying high-growth segments of the valve positioner market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To understand competitive strategies, such as product launches, expansions, mergers, and acquisitions, adopted by key market players in the valve positioner market.

Available customizations:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the total CAGR expected to be recorded for the valve positioner market during the forecast period?

The global valve positioner market is expected to record a CAGR of 4.4% during the forecast period.

What are the driving factors for the valve Ppsitioner market?

The valve positioner market is driven by the growing demand for precise flow control in industries like oil & gas, chemicals, and water treatment. As plants focus more on automation, efficiency, and safety, the need for accurate valve operation continues to rise.

What is the impact of AI on the valve positioner market?

AI positively impacts the valve positioner market by enabling smart and more predictive control systems. With AI, valve positioners can detect early signs of failure, optimize flow performance, and reduce unplanned downtime. It also supports real-time data analysis, improving system efficiency and maintenance planning.

Which are the significant players operating in the valve positioner market?

Emerson Electric Co. (US), ABB (Switzerland), Siemens (Germany), Flowswerve Corporation (US), and Schneider Electric (France) are some of the major companies operating in the Valve Positioner Market.

Which region is anticipated to offer lucrative growth for the valve positioner market by 2030?

During the projected period, the Asia Pacific is expected to offer lucrative opportunities in the valve positioner market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Valve Positioner Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Valve Positioner Market