Vapor Deposition Market by Technology (Chemical Vapor Deposition, Physical Vapor Deposition), by End-user Industry (Microelectronics, Cutting tools, Industrial & Energy, Medical, Decorative Coating) – Global Trends & Forecast to 2028

Vapor Deposition Market

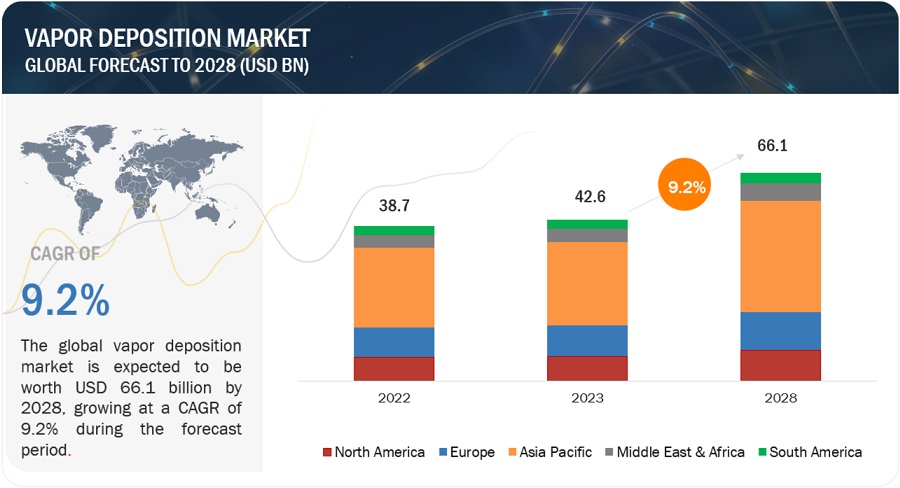

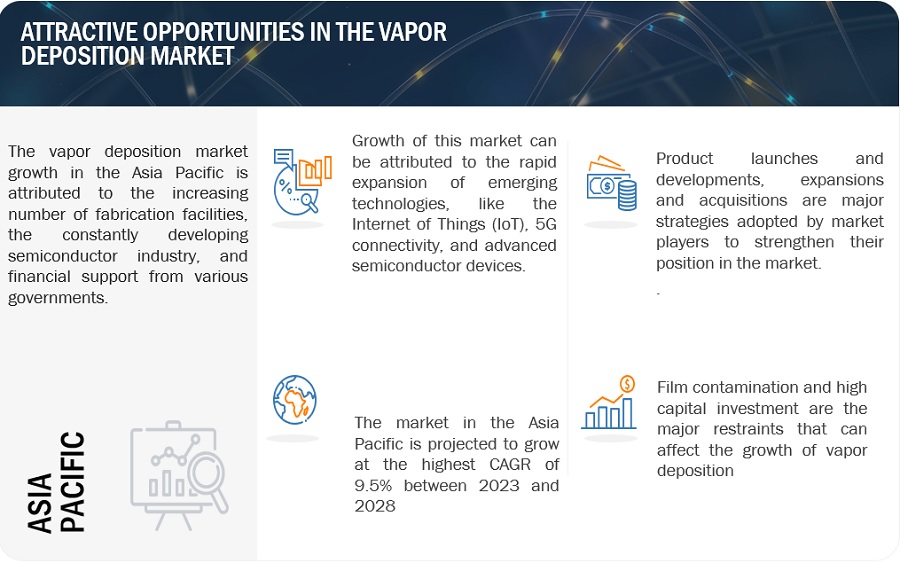

The global vapor deposition market is valued at USD 42.6 billion in 2023 and is projected to reach USD 66.1 billion by 2028, growing at 9.2% cagr during the forecast period. The vapor deposition industry is being driven by multiple factors, including the growth of the semiconductor and solar industries, the increasing demand for medical devices, the expanding LED device market, and environmental regulations related to Cr6. The growth of the semiconductor industry is set to be a significant driver for the vapor deposition market. As semiconductor technology advances, there is an escalating need for precise and efficient deposition processes to create thin film materials used in chip manufacturing. This demand is expected to surge in tandem with the expansion of the semiconductor sector. Additionally, the flourishing solar industry plays a pivotal role in propelling the vapor deposition market forward. The production of high-performance films is vital for enhancing the efficiency and durability of solar panels. Consequently, the vapor deposition industry stands to benefit from the increasing demand for these films within the solar sector. Another compelling driver is the rising requirement for medical devices and equipment. Vapor deposition techniques are indispensable in manufacturing medical tools and components with exceptional precision and biocompatibility. As healthcare technology continues to advance, so too will the demand for vapor deposition processes. These drivers collectively contribute to the robust and dynamic growth of the vapor deposition sector.

However, High capital investment, film contamination, technical difficulties, and process complexity are significant factors restraining the growth of vapor deposition technologies. The substantial financial resources required for setting up vapor deposition systems can deter potential investors and limit the widespread adoption of these processes. Additionally, the risk of film contamination poses a significant challenge, as any impurities can compromise the quality and functionality of deposited films. Technical complexities associated with vapor deposition techniques can also hinder their growth, as specialized knowledge and skills are often necessary for successful implementation

Attractive Opportunities in the Vapor Deposition Market

To know about the assumptions considered for the study, Request for Free Sample Report

Vapor Deposition Market Dynamics

Driver: Growth in semiconductor industry

In today’s rapidly evolving technological landscape, the growth of the semiconductor industry stands out as a key driving force for vapor deposition market. Semiconductors, often referred to as the "brains" of electronic devices, power everything from smartphones to advanced medical equipment. As this industry continues to expand, the demand for innovative manufacturing processes also intensifies. Among these processes, two crucial techniques have gained significant prominence: PVD and CVD.

The semiconductor industry is expected to grow in the medium-to-long term due to the continuous technological innovations amid an accelerating transition to a data-driven society backed by the spread of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and 5G. With technological advancements through R&D, companies from different industries are embedding ICs into their products to make them efficient and smart. With the ongoing trend of lightweight, fast, dense, and miniature electronic devices, a surge in demand for compact and complex ICs has been observed. As per data provided by the Semiconductor Industry Association, the global sales of semiconductors exhibited a substantial rise, climbing from USD 139.0 billion in 2008 to reach USD 557.4 billion by 2022. Furthermore, the World Semiconductor Trade Statistics (WSTS) Fall 2022 Semiconductor Industry Forecast projects a minor decline in worldwide semiconductor industry sales, with an anticipated value of USD 555.6 billion for 2023, followed by a subsequent increase to an estimated USD 602 billion in 2024.

The robust expansion of the semiconductor industry is poised to have a considerable impact on the growth of the vapor deposition market. Vapor deposition techniques play a pivotal role in the manufacturing processes of semiconductors. These methods involve the deposition of thin layers of material onto semiconductor wafers, enabling the creation of intricate electronic components and structures. As the semiconductor industry continues to grow, driven by factors such as technological advancements, increased demand for electronic devices, and the proliferation of applications like artificial intelligence, Internet of Things (IoT), and 5G technology, the demand for sophisticated vapor deposition technologies will also experience a corresponding upsurge.

The expanding semiconductor market requires advancements in vapor deposition techniques to ensure the deposition of precise, uniform, and high-quality thin films on semiconductor substrates. As semiconductor components become smaller, more complex, and powerful, the demand for sophisticated vapor deposition processes grows. This demand drives research and innovation in the vapor deposition industry, leading to improvements in deposition accuracy, efficiency, and scalability. As a result, the growth in the semiconductor market is fueling the growth of the vapor deposition market.

Restraints: High capital investment

Coating technologies like CVD and PVD play a significant role in enhancing the performance and durability of various products. However, these processes come with some challenges. Firstly, they are considered capital-intensive because they require substantial investment in specialized equipment. This equipment demands specific operational conditions, such as high temperatures and controlled vacuum environments. Due to the complexities involved, only a handful of major global companies dominate the market, leading to high manufacturing costs for CVD and PVD equipment. Consequently, the end-use industries that require these coatings face steep expenses.

Moreover, the coating process is not one-size-fits-all. It varies depending on factors like the material to be coated and the desired thickness of the coating. This diversity of applications necessitates different types of equipment, tailored to specific needs. This specialization further raises the initial capital investment required. As a result, many businesses are deterred from adopting these advanced technologies due to the financial constraints associated with acquiring and operating such equipment.

This financial hurdle encourages end-use industries to explore alternative coating methods that might not demand the same level of investment. While CVD and PVD technologies offer exceptional benefits in terms of coating quality and performance, the high capital costs and equipment diversity hinder their widespread adoption. End users might opt for less costly solutions, even if they do not offer the same level of sophistication. Balancing the need for superior coatings with the financial realities becomes a challenge, thereby restraining the growth of these advanced coating technologies.

Opportunity: Innovation in new technology will provide lucarative opportunity across various applications

R&D efforts in the field of CVD and PVD technologies contribute to enhancing the vapor deposition market by advancing substrate material properties across diverse industries. These endeavors focus on optimizing coating thickness and utilizing various precursor materials to elevate substrate characteristics. Research initiatives undertaken by universities and independent organizations globally aim to refine substrate properties through innovative precursor materials, while also streamlining the cost of processes for the benefit of end-use sectors.

Manufacturers of CVD and PVD equipment face the necessity of substantial investments to continually modernize their product lineup and cater to the evolving needs of end-use industries. Prominent players in the CVD and PVD market allocate substantial resources for annual R&D ventures to align their offerings with the dynamic demands of different industries.

Oerlikon Balzers, a major participant in this sector, stands out for its significant contributions. Notably, the introduction of the HiPIMS (High Power Impulse Magnetron Sputtering) technology has demonstrated high-rate PVD capabilities, allowing the deposition of thin films comprising metals, alloys, and ceramics. A recent milestone by Oerlikon Balzers involves the release of BALIQ TISINOS PRO in July 2023. This groundbreaking PVD coating substantially enhances precision machining for challenging materials, particularly targeting steels with a hardness of up to 70 HRC. The coating minimizes tool load, remarkably enhances wear resistance, extends tool longevity, and augments the overall quality of production output.

Additionally, AIXTRON also made significant strides in innovation. In September 2022, the company unveiled the G10-SiC 200 mm product solution, a next-generation CVD system tailored for silicon carbide (SiC) epitaxy. This high-temperature system is designed to facilitate large-scale SiC power device production on 150/200 mm wafers, signifying a significant advancement for the industry.

This continuous innovation through R&D initiatives is poised to create opportunities for the market players in various industrial applications.

Challenges:Lack of qualified workforce for applications

The vapor deposition market poses a significant challenge related to the need for a skilled and proficient workforce to effectively manage its complex and technologically advanced operations. Both CVD and PVD technologies are characterized by their intricate nature, demanding a high degree of precision and accuracy. These technologies find diverse applications across various industries, and their successful implementation hinges upon maintaining stringent quality standards for substrate materials. This is crucial not only to ensure the suitability of these materials for the final products but also to prevent unnecessary wastage of resources. The operational complexity of CVD and PVD equipment are such that they require the expertise of well-trained and highly skilled personnel. Regular operation, examination, and maintenance of these machines are essential to ensure their uninterrupted functionality and to prevent any unexpected breakdowns.

There is shortage of qualified professionals capable of handling these advanced machines in developing countries. This scarcity of skilled workforce is a major challenge for the market players and impedes the growth of the vapor deposition market.

Vapor Deposition Market Ecosystem

Based on technology, the Chemical Vapor Deposition (CVD) technology is expected to be the most significant contributor in the vapor deposition market during the forecast period.

CVD is a versatile and widely employed thin-film deposition technology in the vapor deposition industry. It involves the controlled deposition of solid materials onto a substrate surface through chemical reactions in a gaseous environment. In a typical CVD process, reactive gases are introduced into a vacuum chamber, where they undergo chemical reactions that result in the formation of a solid material on the substrate. This solid material can be a thin film, a coating, or even a three-dimensional structure, depending on the application and process parameters.

CVD offers several advantages. Firstly, it allows for precise control over the composition, thickness, and morphology of the deposited material. This level of control is crucial in industries such as microelectronics, where the properties of thin films are critical to device performance. Secondly, CVD can be used to deposit a wide range of materials, including semiconductors, metals, ceramics, and even diamond-like carbon. This versatility makes it suitable for various applications, ranging from integrated circuit manufacturing to production of protective coatings for cutting tools. CVD process finds extensive application across diverse industries, such as electronics, solar panels, and optics, including sunglasses, optical storage, and architectural glass. One of its highly versatile and cost-effective uses is in polymerization by CVD, where small molecules chemically combine to create extensive chain-like polymers. This method is instrumental in producing films for packaging materials, such as those used for potato chip bags. CVD coatings are favored for their exceptional hardness, fine-grained texture, and impermeability, making them indispensable in protecting surfaces against corrosion caused by various weather conditions. Moreover, CVD plays a crucial role in the manufacturing of high-performance automotive and aerospace components, particularly in applications where tribology, encompassing factors like lubricity and hardness, is of paramount importance, industrial applications, and transportation. Increasing usage of the technology in the various end-use industries, such as microelectronics, industrial & energy, and medical devices & equipment, is the key driver of CVD technology.

By end-use industry, the electronics and semiconductor segment is expected to be the most significant contributor in the vapor deposition market during the forecast period.

The vapor deposition market has emerged as a pivotal player in modern manufacturing processes, offering a diverse range of applications across various industries. Vapor deposition plays a critical role in the microelectronics and semiconductor industry, serving as a fundamental process for depositing thin films of materials onto semiconductor substrates. This technique enables the fabrication of advanced semiconductor devices, offering precise control over material composition, thickness, and properties. One primary application of vapor deposition in microelectronics is in the production of integrated circuits (ICs).

CVD allows for the growth of thin films of silicon dioxide (SiO2) and silicon nitride (Si3N4) as insulating layers, essential for isolating different components of an IC. PVD techniques, such as sputtering, deposit metals like copper (Cu) or aluminum (Al) to form interconnects that link various elements of the circuit. The precise deposition of these materials is crucial for ensuring the functionality and performance of the final IC. PVD and CVD are the backbone of the microelectronics and semiconductor industries, enabling the production of smaller, faster, and more energy-efficient electronic devices. As the demand for cutting-edge technology continues to grow, so does the importance of these vapor deposition techniques in meeting the ever-evolving requirements of these end-use industries.

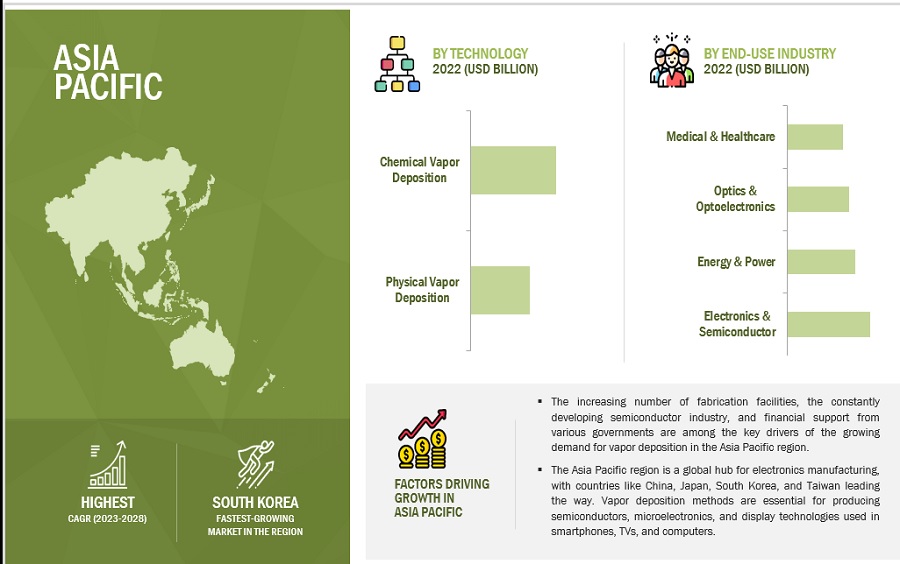

Asia Pacific is expected to be the largest market during the forecast period

The Asia Pacific region has emerged as a powerhouse in the global semiconductor and electronics manufacturing industry, and within this sector, Vapor deposition methods are essential for producing semiconductors, microelectronics, and display technologies used in smartphones, TVs, and computers. The Asia Pacific region has become the epicenter of semiconductor manufacturing, with countries like Taiwan, South Korea, and China leading the charge. The increasing number of fabrication facilities, the constantly developing semiconductor industry, and financial support from various governments are among the key drivers of the growing demand for vapor deposition in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Vapor Deposition Market Players

The major key players in the vapor deposition market include Applied Materials, Inc. (US), Tokyo Electron Limited. (Japan), Lam Research Corporation (US), OC Oerlikon Management AG (Switzerland), and IHI Corporation (Japan) ULVAC, Inc. (Japan), Veeco Instruments Inc. (US), and Voestalpine AG (Austria) and ASM International N.V. (Netherlands).

Vapor Deposition Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 42.6 billion |

|

Revenue Forecast in 2028 |

USD 66.1 billion |

|

CAGR |

9.2% |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion) |

|

Segments |

Technology, End-use Industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies |

The major players are Applied Materials, Inc. (US), Tokyo Electron Limited. (Japan), Lam Research Corporation (US), OC Oerlikon Management AG (Switzerland), and IHI Corporation (Japan) ULVAC, Inc. (Japan), Veeco Instruments Inc. (US), and Voestalpine AG (Austria) and ASM International N.V. (Netherlands). |

This research report categorizes the global vapor deposition market based on Technology, End-use Industry and Region

On the basis of Technology, the vapor deposition market has been categorized as follows:

-

PVD

- Magnetron Sputtering

- Electron Beam Evaporation

- Cathodic Arc Deposition

- Others

-

CVD

- Low Pressure CVD

- Atmospheric Pressure CVD

- Plasma Enhanced CVD

- Metal Organic CVD

- Others

On the basis of End-use Industry, the vapor deposition market has been categorized as follows:

- Electronics & Semiconductor

- Automotive

- Aerospace & Defense

- Energy & Power

- Medical & Healthcare

- Packaging

- Optic & Optoelectronics

- Cutting Tools & Wear Parts

- Others

On the basis of region, the vapor deposition market has been categorized as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2023, Applied Materials, Inc. has taken a initiative to establish a collaborative engineering hub in Bangalore, India. The primary focus of this initiative will be on advancing and commercializing cutting-edge technologies related to semiconductor manufacturing equipment.

- In June 2023, The Lam Research has launched its first bevel deposition solution designed to effectively tackle critical manufacturing hurdles in upcoming logic, 3D NAND, and advanced packaging applications. the Coronus DX applies an exclusive protective film layer on the edges of semiconductor wafers, mitigating the risks of defects and potential damage during intricate manufacturing stages. This robust safeguard significantly enhances yield rates and empowers chip manufacturers to adopt cutting-edge techniques for producing next-generation chips, all accomplished in a single step

- In July 2023, Tokyo Electron Technology Solutions, a subsidiary of Tokyo Electron Ltd. has completed its new development building at the Hosaka Office in Nirasaki City, Yamanashi Prefecture. The completion of the new developmental building will enhance TEL's technological advancement capabilities aligned with both market demands and customer requirements.

- In June 2022, Applied Materials had acquired Picosun Oy, a privately held semiconductor equipment company based in Espoo, Finland. The acquisition was valued at USD 450 million. The acquisition of Picosun will help Applied Materials to expand its portfolio of specialty semiconductor equipment and to meet the growing demand for these devices. Picosun's ALD technology is complementary to Applied Materials' existing portfolio of ALD equipment, and the acquisition will give Applied Materials a stronger position in the specialty semiconductor market.

- In May 2022, Tokyo Electron is building a new development facility at its Miyagi plant in Japan. The new building is scheduled to be completed in September 2024 and will house the company's research and development activities for its semiconductor manufacturing equipment.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the Vapor deposition Market?

The major driver influencing the growth of the vapor deposition market is growth in semiconductor industry

How is the Vapor deposition Market Segmented?

The vapor deposition market is segmented into technology and end-use industry.

What is the major challenge in the Vapor deposition Market?

Lack of qualified workforce is the major challenge that can affect the growth of vapor deposition.

How is the Vapor deposition Market segmented by technology?

By type, the vapor deposition market is segmented into Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD).

What are the major opportunities in the Vapor deposition Market?

Innovation in new technology is major opportunities in the Vapor deposition Market.

How is the Vapor deposition Market segmented by end-use industry?

By mode of supply, the vapor deposition market is segmented into Electronics and Semiconductor, Automotive, Aerospace & Defense, Energy & Power, Medical & Healthcare, Packaging, Optic & Optoelectronics, Cutting Tools & Wear Parts, Others.

Which region has the largest market for Vapor deposition?

Asia Pacific region has the largest market for vapor deposition. The shift in the manufacturing base of several end-user industries, increase in foreign investments, and rise in the number of new manufacturing establishments along with increasing production of LEDs and semiconductors for the applications in the consumer products is projected to boost the growth in Asia Pacific.

How is the market segmented based on region?

On the basis of region, the market is segmented into North America, Asia Pacific, Europe, South America, and Middle East and Africa.

Who are the major manufacturers of vapor depositions?

The major manufacturers of vapor depositions are Applied Materials, Inc. (US), Tokyo Electron Limited.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in semiconductor industry- Expansion of solar industry and demand for high-performance films- Increasing demand for medical devices- Growth of LED devices market- Environmental regulation regarding Cr6RESTRAINTS- High capital investment- Film contaminationOPPORTUNITIES- Increase in application areas due to technological innovations- Growing demand in developing economiesCHALLENGES- Lack of qualified workforce- Technical difficulties and process complexity

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.1 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTGLOBAL AUTOMOBILE PRODUCTION AND GROWTHINFLATION RATE, AVERAGE CONSUMER PRICE

- 6.2 VALUE CHAIN ANALYSIS

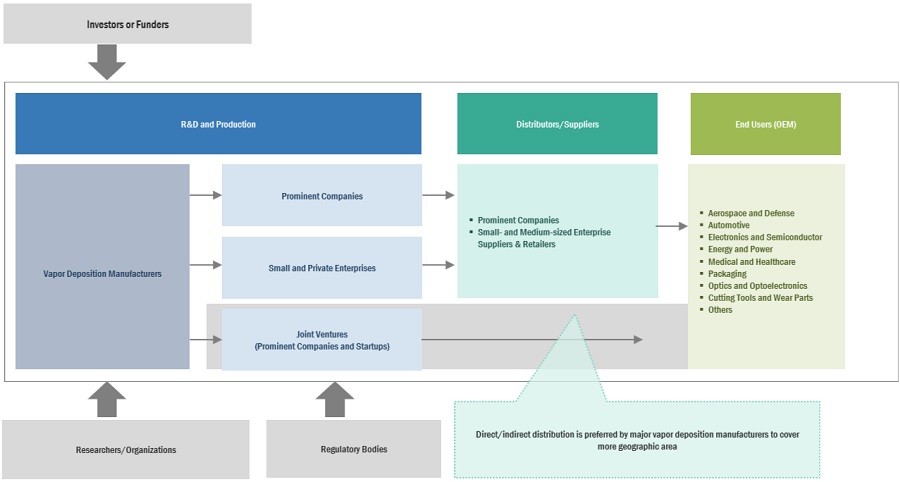

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSES

-

6.5 ECOSYSTEM ANALYSIS

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSTOP COMPANIES/APPLICANTS

-

6.7 TECHNOLOGY ANALYSISCHEMICAL VAPOR DEPOSITION- Inductively coupled plasma-enhanced chemical vapor deposition (ICP-PECVD)- Catalytic Chemical Vapor Deposition (CCVD) for Carbon nanotubes- Pulsed-pressure metal organic CVD- Advancement in atomic layer deposition- Spray pyrolysisPHYSICAL VAPOR DEPOSITION- Ion beam assisted deposition (IBAD)- Magnetron sputtering- Dual source physical vapor deposition- Hybrid vapor deposition

-

6.8 TARIFF AND REGULATORY LANDSCAPETARIFFS

-

6.9 REGULATIONSRESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) DIRECTIVEELECTRONIC WASTE

-

6.10 STANDARDSINTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)OSHA STANDARD

- 6.11 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.13 TRADE ANALYSIS

-

6.14 CASE STUDY ANALYSISITALIAN SMES INVEST IN INNOVATIONNON-CONDUCTIVE COATING FOR DELPHI INJECTORSVSIMPD CASE STUDYAPPLICATION OF ATOMIC LAYER DEPOSITION AND CHEMICAL VAPOR DEPOSITION FOR PEROVSKITE SOLAR CELLS

- 6.15 KEY CONFERENCES & EVENTS

- 6.16 PRICING ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PHYSICAL VAPOR DEPOSITIONGROWING DEMAND IN DECORATIVE, AUTOMOTIVE, AND MEDICAL APPLICATIONS TO DRIVE MARKETCATHODIC ARC DEPOSITIONELECTRON BEAM PVDMAGNETRON SPUTTERING DEPOSITIONOTHERS

-

7.3 CHEMICAL VAPOR DEPOSITIONCVD TO BE LARGER AND FASTER-GROWING TECHNOLOGY DURING FORECAST PERIODLOW PRESSURE CVDATMOSPHERIC PRESSURE CVDPLASMA ENHANCED CVDMETAL ORGANIC CVDOTHERS

- 8.1 INTRODUCTION

-

8.2 ELECTRONICS & SEMICONDUCTORTECHNOLOGICAL ADVANCEMENTS FUELING MARKET FOR VAPOR DEPOSITION

-

8.3 AUTOMOTIVEDEMAND FOR IMPROVED ENGINE EFFICIENCY AND RISE OF ELECTRIC VEHICLES TO DRIVE MARKET

-

8.4 AEROSPACE & DEFENSENEED FOR FUEL-EFFICIENT, RELIABLE MATERIALS LIKE CERAMIC MATRIX COMPOSITES TO DRIVE DEMAND

-

8.5 ENERGY & POWERINCLINATION TOWARD RENEWABLE ENERGY SOURCES TO AUGMENT MARKET GROWTH

-

8.6 MEDICAL & HEALTHCAREAGING POPULATION AND NEED FOR IMPROVED IMPLANT PERFORMANCE TO SUPPORT MARKET GROWTH

-

8.7 PACKAGINGINCREASED AWARENESS AND STRINGENT REGULATIONS ON SUSTAINABLE PACKAGING TO BOOST DEMAND

-

8.8 OPTICS & OPTOELECTRONICSNEED FOR PRECISION IN MINIATURIZATION AND RISE OF IMMERSIVE TECHNOLOGIES TO FUEL DEMAND

-

8.9 CUTTING TOOLS & WEAR PARTSINCREASING DEMAND FOR HIGH-PERFORMANCE AND DURABLE TOOLS TO FUEL ADOPTION OF VAPOR DEPOSITION TECHNOLOGIES

- 8.10 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Growing demand for renewable energy to boost marketCANADA- Government investments to support market growthMEXICO- Government initiative and increasing solar power generation to augment market growth

-

9.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Favorable government initiatives and presence of established automotive and semiconductor sectors to drive marketUK- Robust electronics industry to drive demand for vapor deposition technologiesFRANCE- Growing adoption of advanced components and increasing demand for ICs and transistors to drive demandITALY- Strong growth of semiconductor industry to fuel demand for vapor deposition equipmentRUSSIA- Expanding automotive and semiconductor industries to propel marketREST OF EUROPE

-

9.4 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICSOUTH KOREA- High manufacturing capacity of semiconductors and presence of IDMs to propel demandJAPAN- Robust electronics & semiconductor industry to be major driver of vapor deposition marketCHINA- Favorable government initiatives and availability of inexpensive workforce to drive marketINDIA- Increasing investments in semiconductor industry to boost market growthVIETNAM- Growth in semiconductor industry to fuel demandREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICASAUDI ARABIA- Growth in semiconductor industry and government incentives to propel demandEGYPT- Government initiatives and robust ICT sector to support market growthSOUTH AFRICA- Growing demand for advanced electronics, automotive coatings, and healthcare materials to fuel marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Improved economy and government initiatives to drive marketARGENTINA- Renewable energy initiatives to boost demand for vapor depositionREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 REVENUE ANALYSIS OF KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS

-

10.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

10.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHES

-

11.1 KEY PLAYERSAPPLIED MATERIALS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLAM RESEARCH CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOKYO ELECTRON LIMITED- Business overview- Products/Solutions/Services offered- MnM viewIHI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAIXTRON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOC OERLIKON MANAGEMENT AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASM INTERNATIONAL N.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVOESTALPINE AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewULVAC, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVEECO INSTRUMENTS INC.- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSPLASMA-THERMCVD EQUIPMENT CORPORATIONHEF DURFERRITIMPACT COATINGS ABMUSTANG VACUUM SYSTEMSTECHMETAL, INC.KURT J. LESKER COMPANYJUSUNG ENGINEERING CO., LTD.DENTON VACUUMOXFORD INSTRUMENTSAURORA SCIENTIFIC CORP.INTEVAC, INC.PVD PRODUCTS, INC.CRYSTALLUMEPVDADEKA CORPORATION

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 2 GLOBAL AUTOMOBILE PRODUCTION (UNITS) AND GROWTH, BY COUNTRY

- TABLE 3 INFLATION RATE, AVERAGE CONSUMER PRICES (ANNUAL PERCENT CHANGE)

- TABLE 4 VAPOR DEPOSITION MARKET: KEY STAKEHOLDERS

- TABLE 5 TOTAL NUMBER OF PATENTS IN VAPOR DEPOSITION MARKET

- TABLE 6 LIST OF MAJOR PATENTS IN VAPOR DEPOSITION MARKET

- TABLE 7 ADVANCEMENT IN ALD APPLICATION

- TABLE 8 MOST-FAVORED NATION (MFN) TARIFFS FOR PRODUCTS UNDER HS CODE 848620 EXPORTED BY US

- TABLE 9 VAPOR DEPOSITION MARKET: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN VAPOR DEPOSITION MARKET

- TABLE 11 KEY BUYING CRITERIA IN VAPOR DEPOSITION MARKET

- TABLE 12 MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS WITH EXPORT VALUES FOR MAJOR COUNTRIES, 2022 (USD BILLION)

- TABLE 13 MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS WITH IMPORT VALUES FOR MAJOR COUNTRIES, 2022 (USD BILLION)

- TABLE 14 VAPOR DEPOSITION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 15 VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 16 VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 17 VAPOR DEPOSITION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: VAPOR DEPOSITION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 21 US: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 22 US: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 23 CANADA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 24 CANADA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 25 MEXICO: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 26 MEXICO: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 27 EUROPE: VAPOR DEPOSITION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 29 EUROPE: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 30 GERMANY: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 31 GERMANY: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 32 UK: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 33 UK: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 34 FRANCE: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 35 FRANCE: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 36 ITALY: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 37 ITALY: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 38 RUSSIA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 39 RUSSIA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 40 REST OF EUROPE: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 41 REST OF EUROPE: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: VAPOR DEPOSITION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 45 SOUTH KOREA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 46 SOUTH KOREA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 47 JAPAN: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 48 JAPAN: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 49 CHINA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 50 CHINA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 51 INDIA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 52 INDIA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 53 VIETNAM: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 54 VIETNAM: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 57 MIDDLE EAST & AFRICA: VAPOR DEPOSITION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 MIDDLE EAST & AFRICA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 59 MIDDLE EAST & AFRICA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 60 SAUDI ARABIA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 61 SAUDI ARABIA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 62 EGYPT: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 63 EGYPT: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 64 SOUTH AFRICA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 65 SOUTH AFRICA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 66 REST OF MIDDLE EAST & AFRICA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 67 REST OF MIDDLE EAST & AFRICA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 68 SOUTH AMERICA: VAPOR DEPOSITION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 SOUTH AMERICA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 70 SOUTH AMERICA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 71 BRAZIL: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 72 BRAZIL: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 73 ARGENTINA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 74 ARGENTINA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 75 REST OF SOUTH AMERICA: VAPOR DEPOSITION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 76 REST OF SOUTH AMERICA: VAPOR DEPOSITION MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 77 STRATEGIES ADOPTED BY KEY PLAYERS DURING FORECAST PERIOD

- TABLE 78 VAPOR DEPOSITION MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 79 VAPOR DEPOSITION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 80 VAPOR DEPOSITION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 81 DEALS, 2018–2023

- TABLE 82 PRODUCT LAUNCHES, 2018–2023

- TABLE 83 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- TABLE 84 APPLIED MATERIALS, INC.: DEALS

- TABLE 85 APPLIED MATERIALS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 86 APPLIED MATERIALS, INC.: OTHERS

- TABLE 87 LAM RESEARCH CORPORATION: COMPANY OVERVIEW

- TABLE 88 LAM RESEARCH CORPORATION: DEALS

- TABLE 89 LAM RESEARCH CORPORATION: PRODUCT/SERVICE LAUNCHES

- TABLE 90 LAM RESEARCH CORPORATION: OTHERS

- TABLE 91 TOKYO ELECTRON LIMITED: COMPANY OVERVIEW

- TABLE 92 TOKYO ELECTRON LIMITED: DEALS

- TABLE 93 TOKYO ELECTRON LIMITED: PRODUCT/SERVICE LAUNCHES

- TABLE 94 TOKYO ELECTRON LIMITED: OTHERS

- TABLE 95 IHI CORPORATION: COMPANY OVERVIEW

- TABLE 96 IHI CORPORATION: DEALS

- TABLE 97 IHI CORPORATION: PRODUCT/SERVICE LAUNCHES

- TABLE 98 IHI CORPORATION: OTHERS

- TABLE 99 AIXTRON: COMPANY OVERVIEW

- TABLE 100 AIXTRON: DEALS

- TABLE 101 AIXTRON: PRODUCT/SERVICE LAUNCHES

- TABLE 102 AIXTRON: OTHERS

- TABLE 103 OC OERLIKON MANAGEMENT AG: COMPANY OVERVIEW

- TABLE 104 OC OERLIKON MANAGEMENT AG: DEALS

- TABLE 105 OC OERLIKON MANAGEMENT AG: PRODUCT/SERVICE LAUNCHES

- TABLE 106 OC OERLIKON MANAGEMENT AG: OTHERS

- TABLE 107 ASM INTERNATIONAL N.V.: COMPANY OVERVIEW

- TABLE 108 ASM INTERNATIONAL N.V.: DEALS

- TABLE 109 ASM INTERNATIONAL N.V.: PRODUCT/SERVICE LAUNCHES

- TABLE 110 ASM INTERNATIONAL N.V.: OTHERS

- TABLE 111 VOESTALPINE AG: COMPANY OVERVIEW

- TABLE 112 VOESTALPINE AG: OTHERS

- TABLE 113 ULVAC, INC.: COMPANY OVERVIEW

- TABLE 114 ULVAC, INC.: DEALS

- TABLE 115 ULVAC, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 116 VEECO INSTRUMENTS INC.: COMPANY OVERVIEW

- TABLE 117 VEECO INSTRUMENTS INC.: DEALS

- TABLE 118 VEECO INSTRUMENTS INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 119 PLASMA-THERM: COMPANY OVERVIEW

- TABLE 120 CVD EQUIPMENT CORPORATION: COMPANY OVERVIEW

- TABLE 121 HEF DURFERRIT: COMPANY OVERVIEW

- TABLE 122 IMPACT COATINGS AB: COMPANY OVERVIEW

- TABLE 123 MUSTANG VACUUM SYSTEMS: COMPANY OVERVIEW

- TABLE 124 TECHMETAL, INC.: COMPANY OVERVIEW

- TABLE 125 KURT J. LESKER COMPANY: COMPANY OVERVIEW

- TABLE 126 JUSUNG ENGINEERING CO., LTD.: COMPANY OVERVIEW

- TABLE 127 DENTON VACUUM: COMPANY OVERVIEW

- TABLE 128 OXFORD INSTRUMENTS: COMPANY OVERVIEW

- TABLE 129 AURORA SCIENTIFIC CORP.: COMPANY OVERVIEW

- TABLE 130 INTEVAC, INC.: COMPANY OVERVIEW

- TABLE 131 PVD PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 132 CRYSTALLUMEPVD: COMPANY OVERVIEW

- TABLE 133 ADEKA CORPORATION: COMPANY OVERVIEW

- FIGURE 1 VAPOR DEPOSITION MARKET: RESEARCH DESIGN

- FIGURE 2 VAPOR DEPOSITION MARKET: DATA TRIANGULATION

- FIGURE 3 CVD TECHNOLOGY TO DOMINATE VAPOR DEPOSITION MARKET

- FIGURE 4 ELECTRONICS & SEMICONDUCTOR TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 5 ASIA PACIFIC LED VAPOR DEPOSITION MARKET IN 2022

- FIGURE 6 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR VAPOR DEPOSITION FROM 2023 TO 2028

- FIGURE 7 GERMANY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 SOUTH KOREA LED VAPOR DEPOSITION MARKET IN ASIA PACIFIC

- FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN VAPOR DEPOSITION MARKET

- FIGURE 10 SEMICONDUCTORS MARKET GROWTH, 2008–2022

- FIGURE 11 VAPOR DEPOSITION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 12 MAXIMUM VALUE ADDITION DURING EQUIPMENT MANUFACTURING STAGE

- FIGURE 13 VAPOR DEPOSITION MARKET: SUPPLY CHAIN

- FIGURE 14 REVENUE SHIFT AND NEW REVENUE POCKETS IN VAPOR DEPOSITION MARKET

- FIGURE 15 VAPOR DEPOSITION MARKET: ECOSYSTEM MAPPING

- FIGURE 16 GRANTED PATENTS AND PATENT APPLICATIONS IN VAPOR DEPOSITION MARKET

- FIGURE 17 PATENT PUBLICATION TRENDS (2013–2022)

- FIGURE 18 JURISDICTION ANALYSIS (2013–2022)

- FIGURE 19 TOP COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 21 KEY BUYING CRITERIA IN VAPOR DEPOSITION MARKET

- FIGURE 22 CHEMICAL VAPOR DEPOSITION TO LEAD OVERALL VAPOR DEPOSITION MARKET DURING FORECAST PERIOD

- FIGURE 23 ELECTRONICS & SEMICONDUCTOR SEGMENT TO DOMINATE VAPOR DEPOSITION MARKET DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC TO BE FASTEST-GROWING VAPOR DEPOSITION MARKET

- FIGURE 25 NORTH AMERICA: VAPOR DEPOSITION MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: VAPOR DEPOSITION MARKET SNAPSHOT

- FIGURE 27 REVENUE ANALYSIS OF KEY COMPANIES IN VAPOR DEPOSITION MARKET

- FIGURE 28 VAPOR DEPOSITION MARKET: MARKET SHARE ANALYSIS

- FIGURE 29 VAPOR DEPOSITION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 30 VAPOR DEPOSITION MARKET: STARTUP/SME MATRIX, 2022

- FIGURE 31 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

- FIGURE 32 LAM RESEARCH CORPORATION: COMPANY SNAPSHOT

- FIGURE 33 TOKYO ELECTRON LIMITED: COMPANY SNAPSHOT

- FIGURE 34 IHI CORPORATION: COMPANY SNAPSHOT

- FIGURE 35 AIXTRON: COMPANY SNAPSHOT

- FIGURE 36 OC OERLIKON MANAGEMENT AG: COMPANY SNAPSHOT

- FIGURE 37 ASM INTERNATIONAL N.V.: COMPANY SNAPSHOT

- FIGURE 38 VOESTALPINE AG: COMPANY SNAPSHOT

- FIGURE 39 ULVAC, INC.: COMPANY SNAPSHOT

- FIGURE 40 VEECO INSTRUMENTS INC.: COMPANY SNAPSHOT

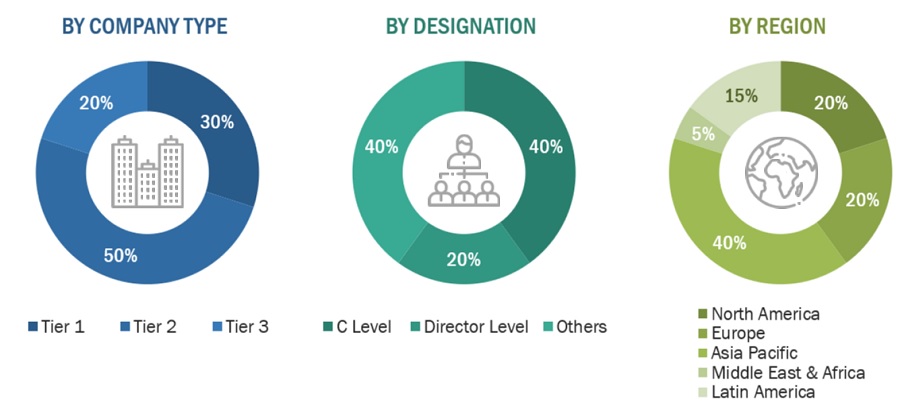

Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource have been used to identify and collect information for this technical, market-oriented, and commercial study of the vapor deposition market. In-depth interviews were conducted with various primary respondents which included key industry participants, subject matter experts (SMEs), C-level executives of key industry players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

The market size of vapor deposition has been estimated based on secondary data available through paid and unpaid sources, and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources.

Primary Research

The vapor deposition market comprises various stakeholders in the supply chain and includes suppliers, manufacturers, and end-product manufacturers. Various primary sources from the supply and demand sides of the vapor deposition market have been interviewed to obtain qualitative and quantitative information. Primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies in the market. Primary sources from the demand side include experts from end-use industries, associations, and institutions involved in the market, and key opinion leaders.

Following is the breakdown of primary respondents—

Notes: *Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The supply-side and demand-side approaches have been extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of annual reports, reviews, vapor deposition associations, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Global Vapor deposition Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Vapor deposition Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market estimation process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Vapor deposition is a specialized manufacturing process within the broader field of thin film deposition. This process is aimed at producing thin films or coatings of various materials on substrates through a controlled vapor-phase reaction. The vapor deposition market is dominated by two key technologies, namely CVD and PVD. These technologies are used for applying a thin coating layer of various precursor materials over the substrate materials in various end-use industries. These precursor materials are typically solid or liquid at room temperature and are converted into a vapor state during the deposition process. These vapors are then directed onto the substrate's surface, where they condense and form a thin, uniform layer with properties such as optical, electrical, or mechanical characteristics.

The term "CVD & PVD technology" encompasses the comprehensive valuation of various components within these technological domains. This valuation includes the collective market size of equipment, precursor materials, and coating services offered by entities operating within these technology sectors.

CVD is a widely used technique for material processing applications in various end-use industries. It is used for application of a thin film of solid materials on a heated surface through a chemical reaction in the vapor phase environment in the CVD reactor. It is mainly used for applying solid thin films on surfaces and for production of high-purity bulk materials and powders, as well as for fabricating composite materials via infiltration technology.

PVD is a technology used for depositing thin layers of high-purity precursor materials, such as titanium, chromium, and aluminum. These precursor materials are deposited by providing heat or bombarding with ions and reacting with the gases and is deposited as thin layer on the substrate material. The applications of PVD technology range from decorative coating to microelectronics and cutting tools. The usage of this technology includes the following three steps:

- Vaporization of the material from a solid source assisted by high-temperature vacuum or gaseous plasma.

- Transportation of the vapor in vacuum or partial vacuum to the substrate surface.

- Condensation onto the substrate to generate thin films.

The vapor deposition market serves diverse industries, including electronics, semiconductors, optoelectronics, aerospace, automotive, medical devices, and renewable energy. It enables the production of high-performance coatings and films that enhance product functionality, durability, and overall performance. As technology advances and the demand for sophisticated materials with tailored properties increases, the vapor deposition market continues to evolve, driving innovations in process efficiency, materials research, and product development

Key stakeholders

- CVD and PVD equipment manufacturers

- CVD and PVD precursor manufacturers

- CVD and PVD equipment suppliers

- End-use industries

- Government and research organizations

Report Objectives

- To define, describe, and forecast the size of the vapor deposition market in terms of value.

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast and analyze the market based on type, product type,straw length, straw diameter, material type and end-use

- To analyze and forecast the market size with respect to five main regions, namely, Asia Pacific, North America, Europe, South America, and Rest of the World, along with their respective key countries

- To analyze competitive developments such as mergers & acquisitions, joint ventures, and investments & expansions in the market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Vapor deposition Market

- Further breakdown of Rest of Europe Vapor deposition Market

- Further breakdown of Rest of South America Vapor deposition Market

- Further breakdown of Rest of Middle East & Africa Vapor deposition Market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Vapor Deposition Market