Carbon Nanotubes (CNT) Market

Carbon Nanotubes (CNT) Market by Type (Single-walled Carbon nanotubes (SWNT), Multi-walled Carbon Nanotubes (MWCNT)), Method, End-use Industry (Electronics & Semiconductors, Energy & Storage, Structural Composites Application), and Region - Global Forecast to 2029

CARBON NANOTUBE MARKET SIZE & SHARE

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis | Updated on : February 09, 2026

The carbon nanotube market is projected to reach USD 2.63 in 2029 from USD 1.31 billion in 2024, at a CAGR of 14.92% from 2024 to 2029. Carbon nanotubes are cylindrical nanostructures composed of rolled graphene sheets, available as single-walled and multi-walled, and are valued for their exceptional electrical conductivity, mechanical strength, and thermal stability. The market is expanding due to rising adoption in lithium-ion batteries, conductive plastics, coatings, electronics, and lightweight composites, particularly driven by growth in electric vehicles, renewable energy storage, and advanced electronics, along with increasing demand for high-performance and lightweight materials across industries.

KEY TAKEAWAYS

-

By RegionAsia Pacific region accounted for the largest share of 39.5% in the carbon nanotube market, for 2023.

-

By TypeThe SWCNT type segment is expected to register the highest CAGR of 16.19%

-

By End-Use IndustryIn the end-use industry segment, the medical sector is projected to grow at the fastest CAGR of 15.43%, between 2024 and 2029.

-

Competitive Landscape - Key PlayersLG Chem, Arkema, Cabot, Nanocyl SA, Resonac Corporation, and Sumitomo Corporation were identified as key players in the global carbon nanotube market, supported by their strong market presence and comprehensive product portfolios.

-

Competitive Landscape - StartupsChasm Advanced Materials Inc, Cheap Tubes, Merck Group, and Ocsial along with other emerging participants, have established firm positions within specialized niche applications, underscoring their potential to develop into future market leaders.

High demand for electronics & semiconductors and rising demand for lightweight & low carbon emitting vehicles in Asia Pacific act as a prominent driver to propel carbon nanotubes market. Multi-walled carbon nanotubes in the Asia Pacific region are expecting a boom and will result in an increasing demand for carbon nanotubes. In contrast to Single-walled carbon nanotubes, Multi-walled carbon nanotubes consist of several layers of graphene sheets rolled into a tube with a diameter a few times larger than that of the Single-walled carbon nanotubes, generally ranging from 2 to 100 nm. Although Multi-walled carbon nanotubes share many of the mechanical and conductive properties demonstrated by Single-walled carbon nanotubes, the layered structure of Multi-walled carbon nanotubes provides them with improved mechanical strength and chemical stability. Composites such as Multi-walled carbon nanotubes are used in applications that require good thermal and mechanical stability, including structural reinforcements, conductive additives in polymers, and heat dissipation materials, as the layers can withstand greater deformation and stress.

CARBON NANOTUBE MARKET TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Megatrends such as electrification, lightweighting, and decarbonization are reshaping the carbon nanotube (CNT) market. Innovation is being driven by advances in scalable CNT production, improved dispersion technologies, and application-specific formulations, enabling wider adoption across industries. Strong growth is supported by rising demand from electric vehicles, energy storage systems, electronics, aerospace, and advanced composites. CNTs are increasingly selected for their exceptional electrical conductivity, high strength-to-weight ratio, durability, and ability to deliver performance at low loadings, while supporting material efficiency, energy efficiency, and compliance with evolving sustainability and performance standards..

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased demand for electronics and semiconductors in Asia Pacific

-

High growth in end-use industries

Level

-

Environmental concerns and health & safety issues

Level

-

Increased penetration in emerging applications

Level

-

Maintaining quality and reducing processing cost

-

Stringent regulatory policies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased demand for electronics and semiconductors in Asia Pacific

Currently, the Asia Pacific region remains the most promising market for carbon nanotubes (CNTs) due to the growing market demand in countries like India, China, and Taiwan. The region is further supported by the growing electronics manufacturing industry, where the production of electronic products is likely to create a higher demand for CNTs. Being superior in their physical characteristics, CNTs find wide application in areas such as conductive films, sensors, and energy storage devices. China is the largest CNTs market in the Asia Pacific. Carbon Nanotubes inhouse production by China remains high, and consequently, the country has more production capability and consumes a large amount of CNTs in diverse industries. The nation leverages on the cost advantages of large-scale production and heavy investments in superior production technologies. In addition, continued growth in the aerospace, autos, rail, wind energy, and infrastructures industries also fuel the demand for CNTs in the country. These industries engage huge government and private investments to establish strong marketplace for CNTs in China

Restraint: Environmental concerns and health & safety issues

Nanomaterials formed by nanoparticles and nano-biotechnological byproducts can be hazardous to health and safety since they are formed from particles at nano-scale. These particles have greater reactivity, toxicity, and mobility than their macro counterparts and are capable of rendering even otherwise innocuous materials dangerous up to a certain scale of application of the respective material. Although the hazards which are identified has been constantly applied in many modern technologies and industries, the current studies of these hazards are rare and limited, which poses a significant risk of exposure to employees and researchers in nanoparticle production and also which are currently used on regular basis. Hazards to human health include lung diseases, cardiovascular diseases, and kidney diseases when working with nanoparticles that are fibrous and easily aerosolized. Among various nanomaterials, carbon nanotubes (CNTs) have been research subjects of increasing concern in terms of their ecological and health threats, leading to escalating government regulations on their manufacture. At the same time, the agglomerates formed by CNTs are recognized as a threat to human life and ecosystems. Research indicates that there is danger of asbestosis like diseases and even cardiovascular diseases through inhalation of CNTs by the human system. Thus, increasing utilization of these materials in industry and scientific work prompts an acute need for the proper safety standards, efficient protective actions, and strict state and government legislation to prevent negative impacts of these materials to the human body and the surrounding environment..

Opportunity: Increased penetration in emerging applications

In many applications of sports equipment and bullet-proof vests, the use of high-performance composite materials is rapidly growing. Carbon nanotubes (CNTs) are considered an essential filler for improving the mechanical properties of these products, especially when incorporated in epoxy resin matrices. The incorporation of CNTs increases the mechanical property of the final product and the stiffness while decreasing the weight of the materials it produces, making the materials lighter and stronger. This combination of properties is particularly desirable for applications where weight matters, as well as high strength and other performance measures, including sports equipment and protective clothing. In addition to reinforcing structures, CNTs are used to enhance chemical and mechanical percolation in polymers. This makes them a preferred material in anti-static packaging since the ability to handle static electricity is a critical parameter in packaging electronics. The capacity of CNTs in making flexible material stronger and 30% lighter makes CNT a great material. It is for this reason that applications of CNTs in structural reinforcement have been made popular by virtue of the CNTs ability to be incorporated within other materials while retaining the native characteristics. Since CNTs possess remarkable mechanical and thermal characteristics, value added industries are in a position to manufacture end products with optimized performance, sturdiness, and utility. Therefore, the adaptability and the effectiveness have made CNTs an essential element in modern and sophisticated composites.

Challenge: Maintaining quality and reducing processing cost

Producing while maintaining quality has been a challenge in the carbon nanotubes (CNT) market as it is complex and resource-intensive for CNT production. High-quality CNTs, particularly single-walled carbon nanotubes (SWCNTs), have advanced synthesis methods such as chemical vapor deposition (CVD) which features expensive catalysts, precise temperature control, and stringent purification processes. More so, ensuring consistency in their properties' purity, conductivity, and mechanical strength complicates their production in a very time-consuming and costly manner. On one edge, industries need cost-effective CNTs for bulk applications in electronics, energy storage, and structural composites. Therefore, affordability and quality are the major challenges these industries face in meeting their requirements. Another broader aspect would be the increasing degree of preference for sustainable ways of manufacturing that usually comes with high investments in initial costs and would involve technological innovations. Scaling up production without modifying the unique properties of CNTs poses a problem due to agglomeration and structural defects that may form during large-scale synthesis. All these point out the delicate balance that the manufacturers must achieve by meeting the cost pressure while keeping, at the same time, high performance and quality demanded by advanced applications. Such a challenge will be solving for wider acceptability of the CNTs across various industrial applications.

CARBON NANOTUBES (CNT) MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrating CNTs into lithium-ion battery cathodes and conductive additives to enhance EV battery performance | Improves electrical conductivity; increases energy density and charging speed; extends battery life and thermal stability |

|

Using multi-walled CNTs (MWCNTs) in lightweight polymer composites for automotive and aerospace components | Enhances mechanical strength and stiffness; enables weight reduction; improves durability and fuel efficiency |

|

Supplying single-wall CNTs (SWCNTs) for conductive plastics and elastomers used in electronics and ESD applications | Achieves high conductivity at low loadings; preserves material flexibility and aesthetics; enables miniaturization |

|

Applying CNTs as conductive fillers in coatings and inks for EMI shielding and antistatic applications | Provides stable and uniform conductivity; improves shielding effectiveness; supports thin and lightweight designs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

A carbon nanotube (CNT) ecosystem is a complicated web, linking the manufacture of both single and multi-walled carbon nanotubes (SWCNTs/MWCNTs) to a wide range of end-use sectors with very different niches. CNTs are extremely flexible due to innate electrical, thermal, and mechanical characteristics which are far superior to the alternatives. Structural composites benefit from higher strength-to-weight ratios, while CNTs play a key role in energy and storage by advancing energy density and charge cycles in next-generation lithium-ion batteries and supercapacitors. In the medical field, CNTs are also used for drug delivery and biosensors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

CARBON NANOTUBE MARKET OUTLOOK & FORECAST (MARKET SEGMENTS)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Carbon Nanotube Market, by Type

Single-wall carbon nanotubes (SWCNTs) accounted for the largest share of the carbon nanotubes market in terms of value in 2023. SWCNTs (diameter of ~1-2 nm) comprise a single cylindrical layer of graphite (or graphene) with uniqueness in structure due to the seamless wrapping of the sheet into a round tube that is capped at the ends. Their small size renders them significantly smaller than multi-walled carbon nanotubes (MWCNTs). SWCNTs substantially outperform traditional materials (e.g. steel and carbon fibres) in terms of material properties. They combine high density, tensile strength, and elastic modulus to operate effectively in high stress environments. These advantages make SWCNTs the material of choice for a multitude of industries, including electronics, aerospace, and energy storage where extreme strength, elasticity, and conduction are required. Consequently, SWCNTs are still top on the list in the CNTs market due to their unique combination of structural and mechanical properties.

Carbon Nanotube Market, by End-use Industry

Structural composites are experiencing significant growth in the carbon nanotubes (CNTs) market due to their exceptional strength-to-weight ratio and enhanced durability. Industries like aerospace and automotive rely on CNT-reinforced composites to create lightweight materials that improve fuel efficiency and performance. The structural composites industry represents a key end-use sector for carbon nanotubes, exploiting their exceptionally strong strength-to-weight ratio, flexibility, and resilience to strengthen composite materials. Carbon nanotubes are being incorporated into either polymer, ceramic, or metallic matrices for improving the mechanical properties like tensile strength. Each of these CNT-enhanced composites find considerable use in the aerospace, automotive, construction, and sporting goods industries, where the performance, fuel efficiency, or durability of high-strength, lightweight materials is crucial. While demand is increasing for materials in advanced industries, CNTs also play a significant role in designing the next generation of composites with better structural integrity and weight savings, meeting industry standards and applications. Major manufacturers in the carbon nanotubes market are heavily investing in investments and expansions across various geographies in order to launch products in untapped markets which ultimately creates new avenues of revenue for them

REGION

Asia Pacific is estimated to be the largest and fastest-growing market for carbon nanotube during the forecast period.

The carbon nanotubes (CNTs) market in the Asia Pacific accounted for the largest market share in 2023 due to the strong industrial base, increased development and production of new and innovative materials, and a massive product requirement from core industries. The region is also producing some of the major electronics manufacturers, which are extensively using CNTs in applications like sensors, transistors, conductive films, etc., in countries such as Japan, South Korea, and China. Additionally, distribution of CNTs in lithium-ion batteries and lightweight materials is rising due surge in China electric automotive manufacturing and other parts of Asia. Further, the region’s significant construction pace especially in the parts of South Asia and India are driving the integration of CNT-reinforced composites due to sustainable & reliable infrastructural development. The cost-effective manufacturing, thriving research ecosystem, and government support in the Asia Pacific have resulted in the increased production and use of CNTs. The region has positioned itself as a leader in CNTs and is anticipated to continue on a similar growth path for the forthcoming years with its constant innovation and industrial digitization.

CARBON NANOTUBES (CNT) MARKET: COMPANY EVALUATION MATRIX

LG Chem is among the top manufacturers of petrochemicals, energy solution materials, and IT & electronic materials across the globe. The company manufactures carbon nanotubes under the Advanced Materials segment and serves semiconductor and circuit board material industries. It also operates through its multiple marketing subsidiaries in the Americas, Europe, and Asia. The company has established R&D networks to provide differentiated products to its customers worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Read More: Carbon Nanotubes Companies

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.15 BN |

| Revenue Forecast in 2030 | USD 2.63 BN |

| Growth Rate | CAGR of 14.92% from 2024−2029 |

| Actual Data | 2019−2029 |

| Base Year | 2023 |

| Forecast Period | 2024−2029 |

| Units Considered | Value (USD Million), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Type: SWCNT, MWCNT End Use Industry: Electronics & Semiconductors, Energy & Storage, Structural Composites Application, Chemical Materials & Polymers, Medical and Others |

| Regional Scope | Asia Pacific, North America, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: CARBON NANOTUBES (CNT) MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-Based Carbon Nanotube Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by end-use sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across industries • Highlight untapped customer clusters for market entry |

| SWCNT future trends, production and key players | • SWCNT future trends • Global & regional production capacity benchmarking | • Regional demand for SWCNT and their pricing analysis to help set up production plant • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- October 2023 : In October 2023, Birla Carbon, a leading manufacturer and supplier of high-quality carbon solutions, announced the completion of its acquisition of Nanocyl SA. This strategic move aimed to expand Birla Carbon’s presence in the energy systems market, particularly in materials critical to lithium-ion battery performance and other conductive applications. The acquisition was seen as a step toward executing Birla Carbon’s sustainability agenda and enhancing its position in emerging energy systems.

- March 2023 : In March 2023, Cabot China Limited (a wholly owned subsidiary of Cabot Corporation) entered into an agreement to purchase Shenzhen Sanshun Nano New Materials Co., Ltd., a leading carbon nanotube (CNT) producer in China, for approximately USD 115 million. This includes liabilities and contingent payments. The acquisition is expected to strengthen Cabot’s market position and formulation capabilities in the high-growth batteries market, especially in China, which is the largest and fastest-growing electric vehicles market in the world.

- Decemeber 2022 : In December 2022, Showa Denko announced plans to increase the production capacity of its vapor-grown carbon fiber (VGCF), a type of CNT used to enhance the electrical conductivity of lithium-ion batteries (LIBs). The expansion aimed to boost annual production capacity by 33%, from 300 to 400 tons, with operations expected to commence in October 2023. This initiative was driven by the rapidly growing demand for LIBs, particularly in electric vehicles (EVs), where VGCF plays a crucial role in improving battery performance and extending lifespan.

- August 2022 : In August 2022, LG Chem announced plans to build the fourth carbon nanotube plant. The new plant will be equipped with the world’s largest single-line carbon nanotube (CNT) production to deliver 20% higher production capacity per capita.

- April 2020 : In April 2020, LG Chem completed the expansion of the CNTs Yeosu plant. This plant has a capacity of 1,200 tons and costs around KRW 65 billion (around USD 54 million).

Table of Contents

Methodology

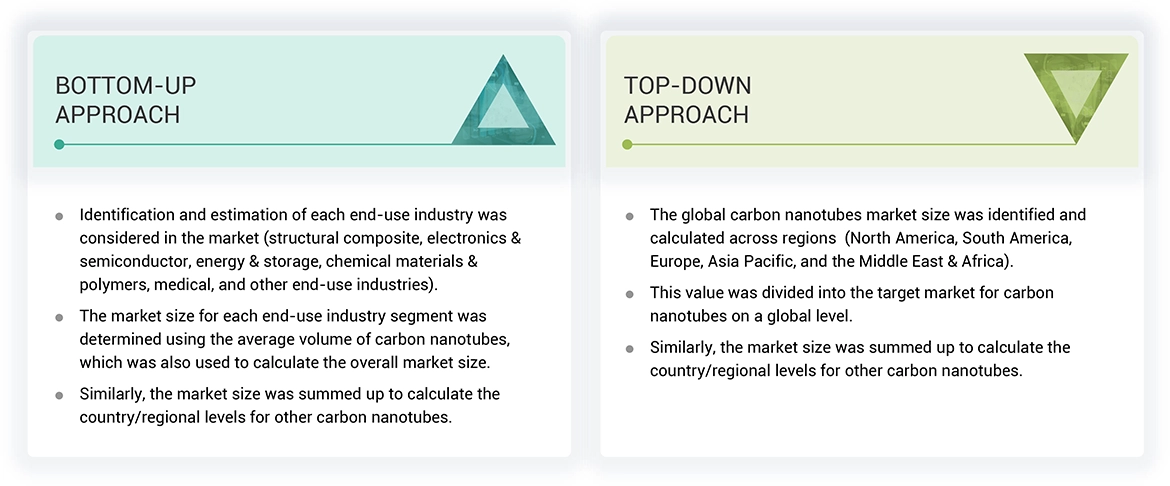

The study involved four major activities in order to estimating the current size of the carbon nanotubes market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including Technology Research Association for Single Wall Carbon Nanotubes (TASC), The Carbon Capture & Storage Association (CCSA), The European Chemical Industry Council (CEFIC), and Producers Association of Carbon Nanotubes in Europe (PACTE).

Primary Research

Extensive primary research was carried out after gathering information about carbon nanotubes market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the carbon nanotubes market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, applications, and region.

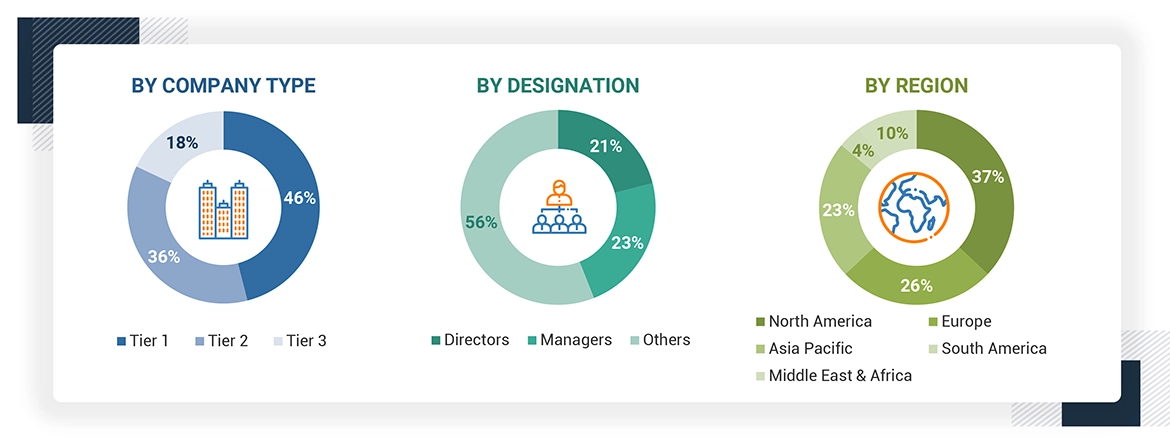

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

| CARBON NANOTUBES MANUFACTURERS | ||

|---|---|---|

| LG Chem | Sumitomo Corporation | |

| Resonac Corporation (Showa Denko K.K.) | Toray International, Inc. | |

| Nanocyl SA | Cabot Corporation | |

| Arkema S.A. | CCheap Tubes, Inc. | |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the carbon nanotubes market. The market sizing of the carbon nanotubes market was undertaken from the demand side. The market size was estimated based on market size for carbon nanotubes in various technology.

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Carbon nanotubes are cylindrical structures made up of hexagonally structure carbon atoms. They have remarkable mechanical, electrical, and thermal characteristics, making them highly useful in a variety of applications across industries. Carbon nanotubes find applications in numerous industries, such as electronics, aerospace, automotive, energy, healthcare, and others. They are used in the production of conductive coatings, batteries, sensors, transistors, displays, composite materials, and many other advanced products.

Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the carbon nanotubes market based on type, application, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the carbon nanotubes market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Carbon Nanotubes (CNT) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Carbon Nanotubes (CNT) Market

Celine

May, 2012

GLOBAL CARBON Query not ClearNOTUBES MARKET AQuery not ClearLYSIS BY APPLICATIONS chapter only.

Erica

Jan, 2015

General information on types, major suppliers, of CNT market.

Bryan

May, 2017

Summary required on carbon nanotube synthesis technology to expand business.

David

Jul, 2019

Require detailed Information about the carbon nanotubes in Li batteries.

Eunji

Jun, 2022

I want to know about the size and technology trend and level of the carbon nanotube market in various countries around the world..

Musnikova

May, 2022

Need a brief overview of carbon nanotubes market tubing industry to help a customer .

Gianluca

Feb, 2014

CNT Market CNT Market .

Marques

Jan, 2019

Wish to get the information of Market data on global energy efficiency sector.

Jordan

Nov, 2016

General information on Carbon Nanotubes (CNT) Market.

raphael

Sep, 2012

General information on Heating elements Actuators, Transparent conductive films, metal/ceramic matrix composites energy storage/harvesting .

Dr.

May, 2019

Information regarding nanocarbon based on applications and markets mainly in batteries.

Talent

Dec, 2019

Interested in getting complete overview of Carbon Nanotubes market.

Talent

Dec, 2019

Overview of the carbon nanotubes market, we wish to invest in manufacturing industry..

Anita

Aug, 2015

Information on the synthesis of carbon nanotubes on a bulk scale and its usage for different applications.

Maxim

Jun, 2019

Please provide Market dynamics, major company profiles and market estimation and forecast for CNT market .

Gareth

Jan, 2014

Market data for global CNT market.