Vehicles for Disabled Market by Vehicle Type (Adaptive Four-Wheeler, Mobility Scooter), Manufacturer Type (OEM and Third-Party Customization), Entry Mechanism, Entry Configuration, Driving Option, Ownership, and Region - Global Forecast to 2027

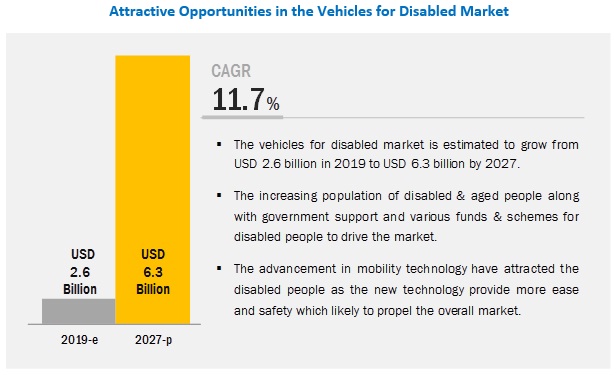

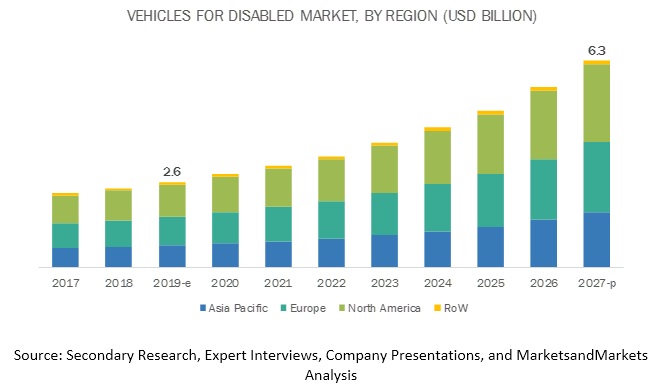

[120 Pages Report] The vehicles for disabled market is projected to reach USD 6.3 billion by 2027 from an estimated USD 2.6 billion in 2019, at a CAGR of 11.7% during the forecast period. Increasing emphasis on providing equality to disabled people in terms of accessibility & mobility solution and improving healthcare infrastructure in developing countries is expected to boost the market.

The market in North America is projected to experience steady growth owing to technological advancement and growing demand of quality & safe healthcare services by the disabled people, while the Asia Pacific market is the fastest-growing market due to the government initiatives and investment in healthcare infrastructure. However, high cost and lack of medical reimbursement act as restraining factors.

Mobility scooter segment is estimated to be the fastest-growing market during the forecast period

The mobility scooter segment is expected to grow fastest among others during the forecast period. Mobility scooters are electric scooters, representing a low-cost way to be able to travel independently, both indoors and outdoors. People with a disability tend to prefer mobility scooters over electric wheelchairs due to better efficiency and less manual effort needed.

Many mobility scooter manufacturers are investing in research & developments to bring a more innovative product to attract disabled people. There have been various advancements to make mobility scooters more efficient. For instance, mobility scooters can move at a speed of 4 to 8 mph, and the seats of these scooters are adjustable according to the height of the person. Factors such as rising government initiatives & schemes, rise in the number of orthopedic diseases, and technological advancement are likely to propel the market of mobility scooter for disabled.

Asia Pacific market is expected to register the fastest growth during the forecast period”

Asia Pacific is expected to witness the fastest growth, followed by Europe and North America during the forecast period. The market growth in the region can also be attributed to the increasing developments in healthcare infrastructure, increasing awareness towards mobility solution along with several initiatives by private organizations as well as governments of the countries.

Japan’s growing aged population and government initiatives are driving the expansion of advanced technology for vehicles made for disabled people in the country. Toyota is leading the market for such vehicles in Japan. The company has invested heavily to develop autonomous vehicles for disabled people.

North America is expected to be the largest market during the forecast period

North America is expected to be the largest market, followed by Europe. The region comprises developed economies such as the US and Canada. The region is the home of many leading players such as Vantage Mobility International, Braunability, Revability, Inc., and Mobility Works.

There are various government and private associations in the US working for disabled people. The association includes Accessible Vans of America (AVA), National Mobility Equipment Dealers Association (NMEDA), National Highway Traffic and Transportation Safety Administration (NHTSA) and Wheelers Accessible Van (WAV) Rentals. Factors such as technological advancements for better fuel efficiency and the advent of electric vehicles for disabled people have, in turn, augmented the demand for such vehicles in this region. Leading car-sharing service providers in major US and Canada are finding ways to exploit the exciting opportunities in the market through the introduction of WAV taxi services.

Key Market Players

The adaptive four-wheeler vehicle for disabled market is led by globally and regionally established players such as Toyota Motor Corporation (Japan), Vantage Mobility International (US), BraunAbility (US), Revability (US), and Mobility Works (US). The mobility scooter vehicle for disabled market is led by globally and regionally established players such as Pride Mobility (US), Sunrise Medical Holdings (Germany), Invacare (US), KYMCO Global (Taiwan), and Amigo Mobility International (US). These companies have strong distribution networks at a global and regional level. In addition, these companies offer an extensive product range in this market. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Units) |

|

Segments covered |

Vehicle Type, Manufacturer Type, Entry Mechanism, Entry Configuration, Driving Option, Ownership |

|

Geographies covered |

Asia Pacific, Europe, North America and RoW (Brazil and Russia) |

|

Companies Covered |

Adaptive Four-Wheeler: Toyota Motor Corporation (Japan), Vantage Mobility International (US), BraunAbility (US), Revability(US), and Mobility Works (US). |

This research report categorizes the given market based on vehicle type, manufacturer type, entry mechanism, entry configuration, driving option, ownership, and region.

Based on vehicle type, it has been segmented as follows:

- Passenger Car

- SUV/MPV

- Pick-up Truck

- Mobility Scooter

Based on Manufacturer type, the given market has been segmented as follows:

- OEM

- Third-Party Customization

Based on Entry Configuration, the market has been segmented as follows:

- Side Entry

- Rear Entry

Based on Entry Mechanism, the market has been segmented as follows:

- Ramp

- Lifting Equipment

Based on Driving Option, the market has been segmented as follows:

- Driving on Swivel Seat

- Driving through Wheelchair

- Driving on Normal Seat

Based on the region, the market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- RoW (Brazil & Russia)

Recent Developments

- In February 2019, Vantage Mobility International company has signed a definitive agreement to acquire Revability which designs and manufactures wheelchair accessible vehicles for commercial and personal use. This move aligns with the company’s commitment to supporting the growth of its retail dealers. By expanding its product portfolio, VMI will enable dealers to offer more choices to consumers with accessible transportation needs. This move also supports VMI’s growth in the commercial market space.

- In January 2019, BraunAbility expanded its product offering to include an additional mobility transportation solution, the BraunAbility® Turny® Evo seat. It is a rotating seat lift which creates an easier and safer way to get in and out of tall vehicles. It is an ideal alternative for anyone with limited mobility, wheelchair users who can transfer into a vehicle seat and caregivers of children, young adults, and older parents.

Critical Questions:

- Vehicles made for disabled people have acquired with other manufacturers for the expansion of their business globally and technology sharing. How will this transform the overall market?

- How will developments in passenger car, SUV/MPV, and mobility scooter by leading manufacturers will change the dynamics of this market?

- The industry is focusing on automated technology. Which are the leading companies who are working on automated technology, and what organic and inorganic strategies have been adopted by them?

- Analysis of your competition that includes major players in this market ecosystem. The major players are adaptive four-wheeler-Toyota Motor Corporation, Vantage Mobility International, Braunability, Revability, Inc., and Mobility Works. For mobility scooter- Pride Mobility, Sunrise Medical, Invacare, Kymco Global, and Amigo Mobility.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1. Markets Covered

1.3.2. Years Considered in the Report

1.4 Currency and Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Secondary Data

2.1.1. Key Secondary Sources

2.1.2. Key Data From Secondary Sources

2.2 Primary Data

2.2.1. Sampling Techniques & Data Collection Methods

2.2.2. Primary Participants

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Segmentation

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

5.3.4. Challenges

6 Industry Trends

6.1 Introduction

6.2 Technology Analysis

6.3 Porters Five Forces

7 Global Vehicle Market for Disabled People, By Manufacturer Type (Volume & Value)

7.1 Introduction

7.2 Oem Manufacturing

7.3 Third Party Customization

8 Global Vehicle Market for Disabled People, By Vehicle Type (Volume & Value)

8.1 Introduction

8.2 Passenger Car

8.3 Mpv/Suv

8.4 Pickup

8.5 Mobility Scooter

9 Global Vehicle Market for Disabled People, By Driving Options (Volume)

9.1 Introduction

9.2 Driving on Swivel Seat

9.3 Driving Through Wheelchair

9.4 Driving on Normal Seat

10 Global Vehicle Market for Disabled People, By Entry Configuration (Volume)

10.1 Introduction

10.2 Side Entry

10.3 Rear Entry

11 Global Vehicle Market for Disabled People, By Entry Mechanism (Volume)

11.1 Introduction

11.2 Ramp

11.3 Lifting Equipment

12 Global Vehicle Market for Disabled People, By Ownership (Volume)

12.1 Introduction

12.2 Rental, Lease & Hire

12.3 Personal Ownership

13 Global Vehicle Market for Disabled People, By Region

13.1 Introduction

13.2 North America

13.3 Europe

13.4 Asia Pacific

13.5 Row (Brazil and Russia)

14 Competitive Landscape

14.1 Overview

14.2 Market Ranking Analysis

14.3 Competitive Scenario

14.4 Competitive Leadership Mapping

14.5 Strength of Product Portfolio

14.6 Business Strategy Excellence

15 Company Profiles

15.1 Adaptive Four-Wheeler

15.1.1 Toyota Motor Corporation

15.1.2 Vantage Mobility International

15.1.3 Braunability

15.1.4 Revability

15.1.5 Mobility Works

15.1.6 AMS Vans

15.1.7 AMF Bruns

15.1.8 Kirchhoff Mobility

15.1.9 Mobility Network Group

15.1.10 Allied Vehicles

15.1.11 United Access

15.1.12 Focaccia Group

15.1.13 GM Coachwork

15.1.14 Gowrings Mobility

15.1.15 Brother Automobility

15.2 Mobility Scooter

15.2.1 Pride Mobility

15.2.2 Sunrise Medical Holdings

15.2.3 Invacare

15.2.4 Afikim Electric Vehicles

15.2.5 Advanced Mobility Products

15.2.6 Hoveround Corporation

15.2.7 Electric Mobility Euro

15.2.8 Tga Mobility

15.2.9 Van Os Medical

15.2.10 Kymco Global

15.2.11 Roma Medical Aids

15.2.12 Amigo Mobility International

15.2.13 Drive Devilbiss Healthcare

15.2.14 Quingo

15.2.15 Golden Technologies

16 Appendix

16.1 Key Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Available Customizations

16.5 Related Reports

16.6 Author Details

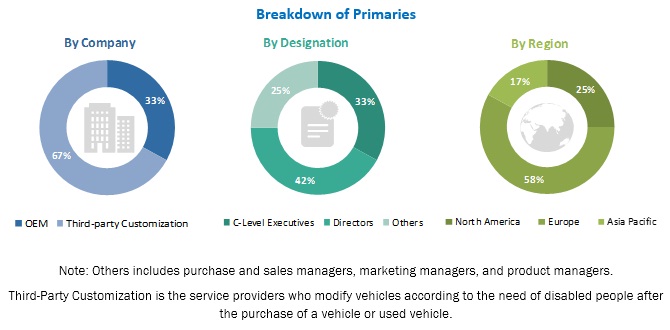

The study involved four major activities in estimating the current market size of the vehicles for disabled market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of Motability Charity in the UK, Japan Automobile Manufacturers Association (JAMA), country-level automotive associations and government organizations for disabled people, and National Mobility Equipment Dealers Association (NMEDA) in the US, National Highway Traffic and Transportation Safety Administration (NHTSA) in the US], mobility solutions for disabled people magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global vehicles for disabled market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs and third-party customization companies (in terms of equipment supply, country-level government associations, dealers and trade associations) and customization service providers across three major regions, namely, Asia Pacific, Europe, and North America. Approximately 25% and 75% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, marketing, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- Value has been determined by taking the average price of the modified vehicle in various region.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the vehicles for disabled market size in terms of value (USD million) and volume (units)

- To define, describe, and forecast the vehicles for disabled market based on vehicle type, manufacturer type, entry mechanism, entry configuration, driving option, ownership and region

- To segment and forecast the market size by vehicle type (passenger cars, SUV/MPV, pick-up truck, and mobility scooter)

- To segment and forecast the market by manufacturer type (OEM manufacturing and third-party customization)

- To segment and forecast the market by entry configuration (side entry and rear entry)

- To segment and forecast the market by entry mechanism (ramp and lifting equipment)

- To segment and forecast the market by driving option (driving by swivel seat, driving through wheelchair and driving on normal seat)

- To segment and forecast the market by ownership (rental, lease & hire and personal ownership)

- To forecast the market size with respect to key regions, namely, North America, Europe, and Asia Pacific

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Mobility Scooter Market, By Tires

- Mobility Scooter Market, By Battery Type

- Vehicles for Disabled Market, at Country level

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Vehicles for Disabled Market

Would be interested in a seeing this market trend report. Not looking to pay for any trends or reports so please no sales calls just wondering what info you have to share. Thank you.