Traction Inverter Market Propulsion Type (BEV, HEV, and PHEV), Output Power Type (<=130 kW and >130 kW), Technology Type (IGBT and MOSFET), Semiconductor Materials Type (GaN, Si, and SiC), by Vehicle Type (PC and CV), and Region - Global Forecast to 2025

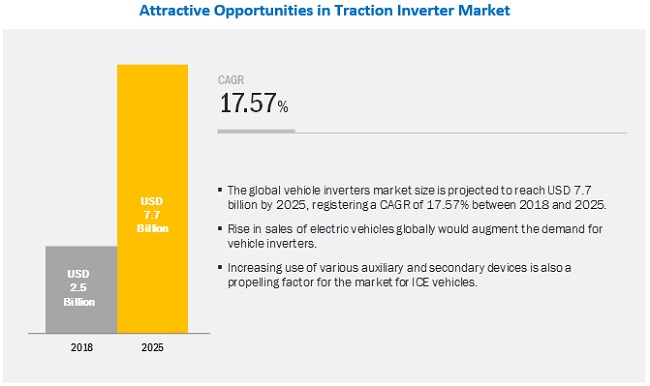

[160 Pages Report] The global traction inverter market is projected to grow at a CAGR of 17.57% during the forecast period, to reach USD 7.7 billion by 2025 from an estimated USD 2.5 billion in 2018. The automobile industry has witnessed a continuous increase in the integration of various electronic devices in the vehicles. The rising demand for reducing carbon emissions has led to huge innovations and R&D efforts from OEMs and automotive suppliers for the development of components (battery and inverters) and compliance with government regulations. Moreover, the overall weight of the vehicles has increased due to the integration of various electronic features in electric vehicles. The awareness among the consumers, OEMs, and various suppliers along with a push from the government will boost the demand for traction inverter in the market.

BEV segment is estimated to account for the largest market size during the forecast period.

BEV segment is estimated to be the largest market for traction inverter market in 2018. The increasing purchasing power of customers and the growing demand for eco-friendly vehicles in emerging and developed countries have contributed to the growth of the market for BEV vehicles. Also, the growing stringency of mandates related to emissions and favorable government policies in several countries has inflated the demand for vehicle inverters.

Commercial vehicles segment for ICE vehicles is estimated to account for the largest market size during the forecast period.

The increasing use of various auxiliary and secondary devices (such as television sets and coffee makers) during official travel by commercial vehicle drivers has driven the growth of vehicle inverters in the commercial vehicle segment. Also, the Traction Inverter Market has witnessed a rising number of innovations due to the growing demand for driver safety and comfort features that increase the durability of the automobile. With the increasing use of various handheld devices (mobile charger, gaming console etc.) and household appliances in vehicles, the demand for vehicle inverters has witnessed an increasing trend in the commercial vehicle segment of ICE vehicles.

IGBT-based vehicle inverters are estimated to account for the largest market size during the forecast period.

The IGBT is a three terminal (gate, collector, and emitter) full-controlled switch. Its gate/control signal takes place between the gate and emitter and its switch terminals are the drain and emitter. IGBT-based vehicle inverters can withstand high voltages as the newer version of electric vehicles needs to have higher output capacity. The IGBT market is projected to grow due to the growing demand for electric vehicles that require high power efficiency and faster switching capabilities. Thus, driving the growth for IGBT-based Traction Inverter Market globally.

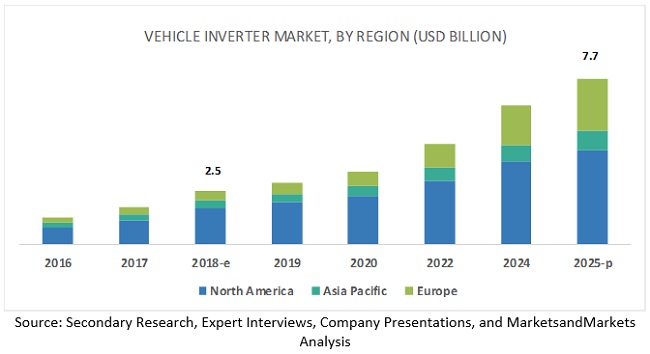

Asia Pacific region is estimated to account for the largest market size during the forecast period.

The Asia Pacific region has emerged as a hub for automobile production and is estimated to be the largest market for vehicle inverters during the forecast period. The growing purchasing power of consumers has triggered the demand for automobiles in the region. Cost advantages for OEMs, low automobile penetration levels, and increased vehicle production offer attractive market opportunities for automobile manufacturers and automotive component suppliers. Also, due to the availability of cheap labor and low production cost, many major OEMs have launched production plants in the region or joined hands with major domestic vehicle manufacturers. The Asia Pacific region is home to key electric vehicles manufacturers such as BYD Auto (China), SAIC Motor (China), and Geely (China). Moreover, it is also home to key suppliers of vehicle inverters such as Denso (Japan), Mitsubishi Electric Corporation (Japan), and Hitachi (Japan).

Key market players

The global traction inverter market is dominated by major players such as Denso (Japan), Delphi Technologies (UK), Continental AG (Germany), Robert Bosch GmbH (Germany), and Mitsubishi Electric Corporation (Japan). These companies have strong distribution networks at the global level. In addition, these companies offer an extensive range of products for electric vehicles. The key strategies adopted by these companies to sustain their market position are new product developments, partnerships, and expansions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2025 |

|

Forecast units |

Value (USD) and Volume (’000 Units) |

|

Segments covered |

Propulsion Type, Output Power, Semiconductor Materials Type, Technology (Power Module), Vehicle Type, and Region |

|

Geographies covered |

North America, Asia Pacific, and Europe |

|

Companies covered |

Denso (Japan), Delphi Technologies (UK), Continental AG (Germany), Robert Bosch GmbH (Germany), and Mitsubishi Electric Corporation (Japan). Total 20 major players covered. |

This research report categorizes the traction inverter market based on propulsion type, output power, semiconductor materials type, technology type (power module), vehicle type, and region.

On the basis of Propulsion Type, the market has been segmented as follows:

- BEV

- HEV

- PHEV

On the basis of output power type, the market has been segmented as follows:

- <= 130 kW

- > 130 kW

On the basis of Semiconductor Materials Type, the market has been segmented as follows:

- Gallium Nitride (GaN)

- Silicon (Si)

- Silicon Nitride (SiC)

On the basis of Technology Type (power module), the market has been segmented as follows:

- IGBT

- MOSFET

On the basis of Vehicle Type for ICE vehicles, the market has been segmented as follows:

- Passenger Cars

- Commercial Vehicles

On the basis of Tegion, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Netherlands

- Norway

- Sweden

- UK

Recent developments

- In October 2018, Valeo Siemens eAutomotive, a joint venture between suppliers Valeo and Siemens, opened a factory in the east China city of Changshu to expand output of high-voltage components for electrified vehicles in China. The plant has 2 production lines for inverters and 1 for electric motors.

- In September 2018, Hitachi, Ltd. announced the development of an original energy saving power semiconductor structure, TED-MOS, using next-generation Silicon Carbide (SiC) material that contributes to saving energy in Electric Vehicles (EVs). This power semiconductor is a new device using a fin-structured trench MOSFET based on the conventional DMOS-FET, a SiC transistor of power semiconductor. Using this new device, an energy saving of 50% was confirmed. Hitachi intends to apply this device in motor drive inverters, which are a core component of EVs to increase energy efficiency.

- In September 2018, Delphi Technologies electrification solutions will be developed and manufactured in every region, with new facilities currently being built in Poland and China. Once operational, the Polish facility, located at Blonie, will manufacture DC-DC converters, inverters, and control units.

- In February 2018, Delphi Technologies, PLC launched the first combined inverter and DC/DC converter (CIDD) in the Chinese market. For automakers, these components create a more efficient and cost-effective solution delivering higher power density, integrated into a smaller and lighter package.

- In January 2018, Delphi Technologies PLC invested in PolyCharge America, Inc., a start-up established to commercialize a new capacitor technology. This technology helps to make high-power inverters smaller, lighter, and more tolerant to high temperatures.

Critical Questions:

- How will electric vehicle sales trend impact the Traction Inverter Market in the long term?

- How will the industry cope with the challenge of compactness and light weight components for traction inverters?

- What is the impact of government regulations and policies on the Traction Inverter Market?

- What are the upcoming trends in the Traction Inverter Market? What impact would they make post 2020?

- What are the key strategies adopted by the top players to increase their revenue?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Traction Inverter Market

4.2 Market, By Region

4.3 Market, By Country

4.4 Market, By Output Power

4.5 Market, By Technology (Power Module)

4.6 Market, By Propulsion Type

4.7 Market, By Semiconductor Materials Type

4.8 Market, By Vehicle Type

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Sales of Electric Vehicles Globally

5.2.1.2 Surge in the use of Various Handheld and Household Devices in Vehicles

5.2.1.3 Usage of Navigation Devices and Smartphones By Cab Aggregators, Car Rental, and Fleet Management Service Providers

5.2.2 Restraints

5.2.2.1 Lower Utilization of Battery Power for Necessary Vehicle Applications

5.2.2.2 Complex Design and Integration Process for Advanced Applications

5.2.2.3 Functional Safety Requirements

5.2.3 Opportunities

5.2.3.1 Development of High Power Density Inverters

5.2.3.2 Demand for Combined Inverter and DC/DC Converter

5.2.4 Challenges

5.2.4.1 Increase in the Overall Weight of the Vehicle and More Space Consumption By the Inverter

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Technology Overview

6.2.1 Development of Multilevel Inverters for EV Applications

6.2.2 New Semiconductor Materials: Silicon Carbide and Gallium Nitride

6.2.2.1 Silicon Carbide (SIC)

6.2.2.2 Gallium Nitride (GAN)

6.2.3 Emergence of Advanced Vehicle Inverters in Electric Vehicles

6.3 Regulatory Overview

6.4 Value Chain Analysis

7 Traction Inverter Market, By Propulsion Type (Page No. - 59)

7.1 Introduction

7.2 Research Methodology

7.3 Battery Electric Vehicle (BEV)

7.3.1 Increase in Sales of BEV Will Boost the Market of Vehicle Inverters Globally

7.4 Hybrid Electric Vehicle (HEV)

7.4.1 Rise in Usage of Fully Hybrid Vehicles Will Fuel the Market of Vehicle Inverters

7.5 Plug-In Hybrid Electric Vehicle (PHEV)

7.5.1 Better Charging Infrastructure Will Directly Propel the Traction Inverter Market

7.6 Key Industry Insights

8 Traction Inverter Market, By Technology Type (Power Module) (Page No. - 68)

8.1 Introduction

8.2 Research Methodology

8.3 IGBT

8.3.1 IGBT Provides Faster Switching Capabilities and Suitable for High Power Applications

8.4 Mosfet

8.4.1 Mosfet has the Advantages of Higher Commutation Speed and Greater Efficiency During Operation at Low Voltages

8.5 Key Industry Insights

9 Traction Inverter Market, By Semiconductor Materials Type (Page No. - 74)

9.1 Introduction

9.2 Research Methodology

9.3 Gallium Nitride

9.3.1 Gallium Nitride Specialized Semiconductor Usually Used in Optical Electronics

9.4 Silicon

9.4.1 Silicon Devices Supports High Frequency Switching Applications

9.5 Silicon Carbide

9.5.1 Silicon Carbide Materials Provide Greater Thermal Management Flexibility

9.6 Key Industry Insights

10 Traction Inverter Market, By Output Power (Page No. - 81)

10.1 Introduction

10.2 Research Methodology

10.3 <= 130kw

10.3.1 Suitable for Fwd or Rwd Wheel Drive Vehicles

10.4 > 130 KW

10.4.1 Best Suited for Awd Wheel Drive Vehicles

10.5 Key Industry Insights

11 Traction Inverter Market, By Vehicle Type (Page No. - 86)

11.1 Introduction

11.2 Research Methodology

11.3 Passenger Cars

11.3.1 Vehicle Inverters Find Application in Lower Power Usage Devices in Passenger Cars

11.4 Commercial Vehicles

11.4.1 Vehicle Inverters Enable the Usage of Household Electric Appliances in Commercial Vehicles

11.5 Key Industry Insights

12 Traction Inverter Market, By Region (Page No. - 92)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.1.1 Incentives and Subsidy Will Push the Growth of Electric Vehicles in China

12.2.2 India

12.2.2.1 Favorable Government Policies Will Foster the Growth of the Electric Vehicle Industry

12.2.3 Japan

12.2.3.1 Major Oems Operating in Japan Will Foster the Market for Electric Vehicles

12.2.4 South Korea

12.2.4.1 Rise in Sales of HEV and BEV Vehicles is Boosting the Market for Vehicle Inverters in South Korea

12.3 North America

12.3.1 Canada

12.3.1.1 Government Initiatives for the Development of Electric Vehicle Infrastructure Will Foster the Growth of Electric Vehicles in Canada

12.3.2 Mexico

12.3.2.1 Cheap Labor Cost is Fueling the Growth of the Automotive Industry in Mexico

12.3.3 US

12.3.3.1 Strict Emission Norms and Huge Expenditure on the Development of Electric Vehicles are Driving the Development of Vehicle Inverters in the US Market

12.4 Europe

12.4.1 France

12.4.1.1 Rising Number of HEVs and PHEVs in France is Boosting the Market for Vehicle Inverters

12.4.2 Germany

12.4.2.1 High Focus on Reducing Carbon Emissions is Driving the Market for Electric Vehicles in Germany

12.4.3 Netherlands

12.4.3.1 Netherlands has the Highest Adoption of Electric Vehicles Driven By Government Incentives

12.4.4 Norway

12.4.4.1 Various Tax Exemption for Electric Vehicles Such as Road Tax, Purchase Tax, Registration Tax, Import Tax, and Annual Tax is Boosting the E-Mobility

12.4.5 Sweden

12.4.5.1 Strong Electric Vehicle Infrastructure

12.4.6 UK

12.4.6.1 UK is Among the Largest Markets for Electric Vehicles in the Europe Region

13 Competitive Landscape (Page No. - 115)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Situations & Trends

13.3.1 New Product Developments

13.3.2 Expansions

13.3.3 Partnerships/Supply Contracts/Collaborations/ Joint Ventures/Agreements/Mergers & Acquisitions

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

14 Company Profiles (Page No. - 125)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Denso

14.2 Delphi Technologies

14.3 Continental AG

14.4 Robert Bosch GmbH

14.5 Mitsubishi Electric Corporation

14.6 Hitachi

14.7 Valeo

14.8 Fuji Electric

14.9 Lear Corporation

14.10 Toshiba

14.11 Additional Company Profiles

14.11.1 Toyota Industries

14.11.2 Calsonic Kansei

14.11.3 Sensata Technologies

14.11.4 Samlex Europe

14.11.5 Metric Mind Corporation

14.11.6 Xantrex

14.11.7 Aims Power Compacts

14.11.8 Stanley Black & Decker

14.11.9 Bestek Corp

14.11.10 Energizer

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 153)

15.1 Insights From Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.4.1 Traction Inverter Market, By Output Power, By Value

15.5 Related Reports

15.6 Author Details

List of Tables (65 Tables)

Table 1 Currency Exchange Rates (WRT USD)

Table 2 Traction Inverter Market Size, By Propulsion Type, 2016–2025 (‘000 Units)

Table 3 Traction Inverter Market Size, By Propulsion Type, 2016–2025 (USD Million)

Table 4 Battery Electric Vehicle: Traction Inverter Market Size, By Region, 2016–2025 (‘000 Units)

Table 5 Battery Electric Vehicle: Traction Inverter Market Size, By Region, 2016–2025 (USD Million)

Table 6 Hybrid Electric Vehicle: Traction Inverter Market Size, By Region, 2016–2025 (’000 Units)

Table 7 Hybrid Electric Vehicle: Traction Inverter Market Size, By Region, 2016–2025 (USD Million)

Table 8 Plug-In Hybrid Electric Vehicle: Traction Inverter Market Size, By Region, 2016–2025 (’000 Units)

Table 9 Plug-In Hybrid Electric Vehicle: Market Size, By Region, 2016–2025 (USD Million)

Table 10 Traction Inverter Market Size, By Technology Type, 2016–2025 (000’ Units)

Table 11 Traction Inverter Market Size, By Technology Type, 2016–2025 (USD Million)

Table 12 IGBT: Market Size, By Region, 2016–2025 (000’ Units)

Table 13 IGBT: Market Size, By Region, 2016–2025 (USD Million)

Table 14 Mosfet: Traction Inverter Market Size, By Region, 2016–2025 (000’ Units)

Table 15 Mosfet: Market Size, By Region, 2016–2025 (USD Million)

Table 16 Market Size, By Semiconductor Materials Type, 2016–2025 (USD Million)

Table 17 Gallium Nitride: Market Size, By Region, 2016–2025 (USD Million)

Table 18 Silicon: Market Size, By Region, 2016–2025 (USD Million)

Table 19 Silicon Carbide: Market Size, By Region, 2016–2025 (USD Million)

Table 20 Market Size, By Output Power, 2016–2025 (000’ Units)

Table 21 <= 130kw: Market Size, By Region, 2016–2025 (000’ Units)

Table 22 > 130 KW: Market Size, By Region, 2016–2025 (000’ Units)

Table 23 Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 24 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 25 Passenger Cars: Market, By Region, 2016–2025 (’000 Units)

Table 26 Passenger Cars: Market, By Region, 2016–2025 (USD Million)

Table 27 Commercial Vehicles: Market, By Region, 2016–2025 (’000 Units)

Table 28 Commercial Vehicles: Market, By Region, 2016–2025 (USD Million)

Table 29 Market, By Region, 2016–2025 (‘000 Units)

Table 30 Market, By Region, 2016–2025 (USD Million)

Table 31 Asia Pacific: Market, By Country, 2016–2025 (‘000 Units)

Table 32 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 33 China: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 34 China: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 35 India: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 36 India: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 37 Japan: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 38 Japan: Traction Inverter Market, By Propulsion Type, 2016–2025 (USD Million)

Table 39 South Korea: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 40 South Korea: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 41 North America: Market, By Country, 2016–2025 (‘000 Units)

Table 42 North America: Market, By Country, 2016–2025 (USD Million)

Table 43 Canada: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 44 Canada: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 45 Mexico: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 46 Mexico: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 47 US: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 48 US: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 49 Europe: Market, By Country, 2016–2025 (‘000 Units)

Table 50 Europe: Market, By Country, 2016–2025 (USD Million)

Table 51 France: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 52 France: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 53 Germany: Market, By Propulsion Type, 2016–2025 (‘000 Units)

Table 54 Germany: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 55 Netherlands: Market, By Propulsion Type, 2016–2025 ('000 Units)

Table 56 Netherlands: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 57 Norway: Market, By Propulsion Type, 2016–2025 ('000 Units)

Table 58 Norway: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 59 Sweden: Market, By Propulsion Type, 2016–2025 ('000 Units)

Table 60 Sweden: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 61 UK: Market, By Propulsion Type, 2016–2025 ('000 Units)

Table 62 UK: Market, By Propulsion Type, 2016–2025 (USD Million)

Table 63 New Product Developments, 2015–2018

Table 64 Expansions, 2015–2018

Table 65 Partnerships/Supply Contracts/Collaborations/Joint Ventures/ Agreements/Mergers & Acquisitions, 2015–2018

List of Figures (60 Figures)

Figure 1 Traction Inverter Market Segmentation

Figure 2 Market Segmentation, By Region

Figure 3 Research Design

Figure 4 Research Methodology Model

Figure 5 Breakdown of Primary Interviews

Figure 6 Global Market Size: Bottom-Up Approach

Figure 7 Global Market Size: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Vehcile Inverters Market: Market Dynamics

Figure 10 Mosfet Based Vehcile Inverter By Technology Type is Expected to Witness the Fastest Growth in the Market, 2018 Vs. 2025 (USD Million)

Figure 11 SIC (Silicon Carbide) is Expected to Have the Fastest Growth in the Market By 2025 (USD Million)

Figure 12 Market: Market Size

Figure 13 Technological Advancements and the Growth of Electric Vehicles are Expected to Drive the Market

Figure 14 Asia Pacific is Estimated to be the Largest Market, By Value

Figure 15 Chinese Market is Expected to Witness the Highest Growth During the Forecast Period (By Value)

Figure 16 >130 KW Segement is Projected to Have the Largest Market Share in 2025, By Volume

Figure 17 IGBT-Based Vehicle Inverters is Estimated to Dominate the Market, By Value

Figure 18 BEVS are Projected to Dominate the Market, By Value

Figure 19 Si Materials are Projected to Dominate the Market, By Value

Figure 20 Commercial Vehicles are Projected to Dominate the Market, By Value

Figure 21 Traction Inverter Market: Market Dynamics

Figure 22 Sales of Electric Vehicles

Figure 23 Usage of Inverters in EV/HEV

Figure 24 Powertrain Architecture of Electric Vehicle

Figure 25 Hitachi’s Future Inverter Development Plan

Figure 26 2012 Nissan Leaf Inverter Weight Distribution

Figure 27 Usage of Inverters to Power Various Devices

Figure 28 Advantages of Multilevel Inverters

Figure 29 Power Comparison of Silicon Power Semiconductor Vs. Silicon Carbide Power Semiconductor

Figure 30 Silicon Carbide Vs. Gallium Nitride

Figure 31 Hitachi’s Vehicle Inverter Evolution

Figure 32 Hitachi: Comparison of Maximum Current Ratios

Figure 33 Value Chain Analysis: Market

Figure 34 Market, By Propulsion Type, 2018 vs 2025 (USD Million)

Figure 35 Market, By Technology Type, 2018 Vs. 2025 (USD Million)

Figure 36 Market, By Semiconductor Materials Type, 2018 Vs. 2025 (USD Million)

Figure 37 Market, By Output Power, 2018 Vs. 2025 (‘000 Units)

Figure 38 Market, By Vehicle Type, 2018 Vs. 2025 (USD Million)

Figure 39 Asia Pacific is Estimated to Hold the Largest Market Share In

Figure 40 Asia Pacific: Market Snapshot

Figure 41 North America: Vehicle Invereters Market Snapshot

Figure 42 Europe: Market Snapshot, By Country, 2018 Vs. 2025 (USD Million)

Figure 43 Key Developments By Leading Players in the Market for 2015–2018

Figure 44 Continental Lead the Market in 2017

Figure 45 Competitive Leadership Mapping: Market, 2018

Figure 46 Company Snapshot: Denso

Figure 47 SWOT Analysis: Denso

Figure 48 Company Snapshot: Delphi Technologies

Figure 49 SWOT Analysis: Delphi Technologies

Figure 50 Company Snapshot: Continental AG

Figure 51 SWOT Analysis: Continental AG

Figure 52 Company Snapshot: Robert Bosch GmbH

Figure 53 SWOT Analysis: Robert Bosch GmbH

Figure 54 Company Snapshot: Mitsubishi Electric Corporation

Figure 55 SWOT Analysis: Mitsubishi Electric Corporation

Figure 56 Company Snapshot: Hitachi

Figure 57 Company Snapshot: Valeo

Figure 58 Company Snapshot: Fuji Electric

Figure 59 Company Snapshot: Lear Corporation

Figure 60 Company Snapshot: Toshiba

The study involved 4 major activities in estimating the current market size of traction inverters. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, automobile OEMs, Electric Vehicle Association of Asia Pacific (EVAAP), country-level electric vehicle automotive associations and trade organizations, and the Department of Transportation (DOT)], automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global traction inverter Market.

Primary Research

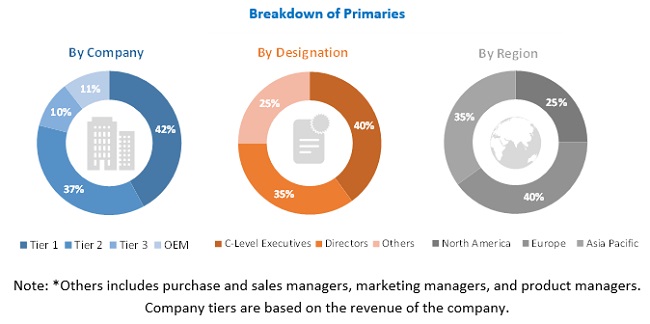

Extensive primary research has been conducted after acquiring an understanding of the traction inverter market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across 3 major regions, namely, North America, Europe, and Asia Pacific. Approximately 40% and 60% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the traction inverter Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand- and supply-sides.

Report Objectives

- To analyze and forecast (2018 to 2025) the size of the traction inverter market, in terms of volume (’000 units) and value (USD million), to segment the Market and forecast its size, by volume and value, and on the basis of region (Asia Pacific, Europe, and North America)

- To provide a detailed analysis of various factors influencing the global market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment the market and forecast its size, by volume and value, based on propulsion type (battery electric vehicles, hybrid electric vehicles, and plug-in hybrid vehicles)

- To segment and forecast the size of the market, in terms of volume, based on output power (<=130 kW and >130 kW)

- To segment and forecast the size of the market, in terms of volume and value, based on power module (IGBT and MOSFET)

- To segment and forecast the size of the market, in terms of value, based on semiconductor materials type (gallium nitride, silicon, and silicon carbide)

- To segment and forecast the size of the market for ICE vehicles, in terms of volume and value, based on vehicle type (passenger cars and commercial vehicles)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

- To segment and forecast the global market size, in terms of volume (’000 units) and value (USD Million)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Traction Inverter Market, By Output Power, By Value

-

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Traction Inverter Market