Veterinary Dental Equipment Market Size, Share & Trends by Product (Dental Equipment, Hand Instruments, Consumables and Adjuvants), Animal Type (Small Companion and Large Animal), End User (Hospitals, Clinics, Academic Institute) & Region - Global Forecast to 2026

Veterinary Dental Equipment Market Size, Share & Trends

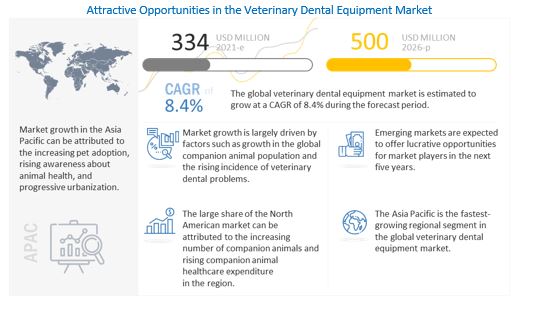

The size of global veterinary dental equipment market in terms of revenue was estimated to be worth $334 million in 2021 and is poised to reach $500 million by 2026, growing at a CAGR of 8.4% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics. Growth in the global companion animal population, rising incidence of veterinary dental problems, and growth in the number of veterinary practitioners and their income levels in developed economies are the primary drivers for the market. However, the increasing cost of pet care is expected to restrain the growth of this market to a certain extent. This problem will be further exacerbated by the low animal health awareness and a shortage of skilled veterinarians in emerging markets.

To know about the assumptions considered for the study, Request for Free Sample Report

Veterinary Dental Equipment Market Dynamics

Driver: Growth in the global companion animal population

Globally, the overall companion animal population and adoption rate have increased significantly. According to a National Pet Owners Survey (2019–2020) conducted by the American Pet Products Association (APPA), an estimated 67% of US households, or about 84.9 million families, owned a pet. Around 63.4 million households owned dogs, 42.7 million owned cats, and 1.6 million owned horses in the US in 2018. The increasing pet population is expected to drive the demand for pet care products and services, which, in turn, will support the growth of dependent markets, such as the market.

Restraint: High pet care and veterinary dental equipment costs

According to petMD, the low-to-medium pet care cost is around USD 250–4,500 in veterinary practices; a high-end procedure costs anywhere between USD 5,000–20,000. Animal dental care costs vary significantly across regions and the degree of dental disease. A simple extraction can cost as little as USD 10–15, while elevated extractions cost more, depending on the work needed to extract the tooth—ranging from USD 25–35. Teeth with multiple roots that may need to be split with a drill can cost up to USD 100 per tooth; a three-rooted tooth could cost between USD 1,000–3,000, depending on the root. Also, dental radiographs add an additional cost of USD 150–200. According to The Mercury News, the prices for dental services can vary greatly and, on average, are USD 55–90 for an oral exam, USD 125–250 for an X-ray procedure, and USD 600–1,200 for anesthesia, cleaning, and extraction procedure.

Opportunity: Untapped emerging markets

Companion animal ownership has grown significantly across the globe. This is particularly evident in the emerging markets across APAC and Latin America due to urbanization and increase in disposable incomes, which have expanded access to animal healthcare and also enabled owners to spend more on pet care. Historically, the adoption of veterinary dental equipment in these countries has been comparatively less than that in developed markets. However, currently, the number of veterinarians in emerging markets is on the rise. Several veterinary practices in developing regions are adopting technologically advanced solutions commonly used by veterinarians in developed economies. With a surge in the companion animal population, growing demand for veterinary dental services from the livestock industry, and the growing companion animal health expenditure, emerging countries across APAC and Latin America are expected to offer significant growth opportunities for players operating in the market.

Challenge: Low animal healthcare awareness in emerging markets

Emerging economies such as India, China, Brazil, and some Southeast Asian countries are home to large companion and farm animal populations. However, animal health expenditure in these countries is relatively lower as compared to developed countries across North America and Europe. This is mainly due to a lack of awareness among pet owners and veterinarians. In addition, animal health expenditure in the farm animals’ segment in these countries is focused on therapeutic treatment only. Veterinary dentistry is not widely used in large-animal practices in these countries.

The equipment segment holds the largest share in veterinary dental equipment industry by product, in the forecast period

The equipment segment accounted for the largest share of the veterinary dental equipment market in the forecast year. The large share of this segment can be attributed to the high cost of dental equipment and the rising income level of veterinarians, which is resulting in the higher adoption of dental equipment.

The dental x ray system segment holds the largest share in the veterinary dental equipment industry, in the forecast period

Dental radiology is an essential diagnostic modality for veterinary dental care. Dental X-ray systems include dental imaging systems, veterinary CBCT scanners, dental CR readers, and X-ray generators. Dental X-rays help distinguish between healthy teeth and abnormal or diseased teeth. During a routine dental exam, a veterinarian may recommend digital dental X-ray procedures to assess the condition of the teeth and gums of animals. Digital dental X-rays can also expose teeth and their surrounding abnormalities like bone tumors, tooth impactions and fractures, and painful lesions or erosions on the surface of the teeth of animals that may otherwise go unnoticed. The cost for implementing dental radiology has been minimal, and new dental X-ray machines (CR systems) are available for around USD 3,000. Digital systems typically cost around USD 6,000–16,000 and are rapidly becoming the standard in veterinary practices as they offer rapid results.

Small companion animals is expected to grow at the highest CAGR in the veterinary dental equipment industry by animal type segment in the forecast period

The increasing prevalence of periodontal diseases in pets is a key factor driving the growth of veterinary dental equipment market segment. According to the American Veterinary Medical Association (AVMA), periodontal diseases affect more than 70% of adult cats and 90% of adult dogs. Early detection and treatment are important as they help prevent the conditions from progressing, which may cause pain or chronic health issues.

Veterinary clinic segment is growing at the highest CAGR in the veterinary dental equipment industry by end users, in the forecast period.

Clinics are the first point of contact for animal owners. Hence, dental instruments in clinics are of prime importance. Clinics are typically equipped with various instruments ranging from small-sized dental hand instruments for equine and companion animals to dental X-ray systems for pets. This helps them support a wide range of clinical specialties.

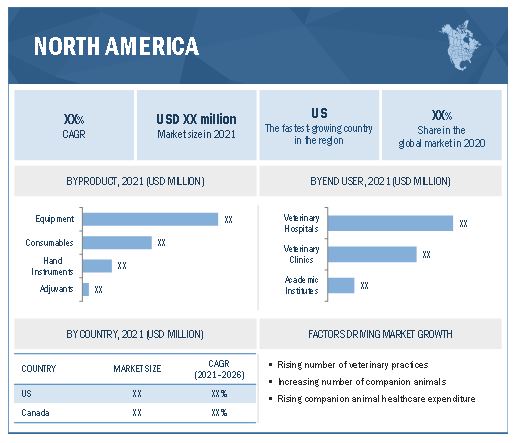

North America accounted for the largest share of the global veterinary dental equipment industry, by region in the forecast period

North America accounted for the largest share of the global veterinary dental equipment market. The rising number of veterinary practices, increasing number of companion animals, and rising companion animal healthcare expenditure are some of the key factors driving the growth of the market in North America.

Key players in the Veterinary dental equipment market are Planmeca Oy (Finland), Midmark Corporation (US), Henry Schein, Inc. (US), Integra LifeSciences Corporation (US), Eickemeyer (Germany), Scil Animal Care(Germany), iM3 (Australia), Dentalaire (US), Dispomed (Canada), MAI Animal Health (US), Acteon Group (UK), TECHNIK Veterinary Ltd. (UK), Cislak Manufacturing (US), and J & J Instruments, Inc. (US), Charles Brungart(US), Covertus Tm(US), Aribex(US), Healthymouth llc(US), MyVet(UK), NewTom(US).

Scope of the Veterinary Dental Equipment Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$334 million |

|

Projected Revenue by 2026 |

$500 million |

|

Revenue Rate |

Poised to grow at a CAGR of 8.4% |

|

Market Driver |

Growth in the global companion animal population |

|

Market Opportunity |

Untapped emerging markets |

The research report categorizes the veterinary dental equipment market to forecast revenue and analyze trends in each of the following submarkets:

By Product

Equipment

- Dental X ray System

- Dental Station

- Electrosurgical Units

- Dental Lasers

- Powered Units

Hand Instrument

- Dental Elevators

- Dental Probes

- Extraction Forceps

- Curette and Scalers

- Retractors

- Dental Luxators

Consumables

- Dental Supplies

- Prophy Products

Adjuvants

By Animal Type

- Small Companion Animal

- Large Animal

By End User

- Veterinary Hospital

- Veterinary Clinics

- Academic Institute

By Region

-

North America North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Recent Developments of Veterinary Dental Equipment Industry

PRODUCT LAUNCHES

|

COMPANY |

Month-Year |

Segment |

Description |

|

MIDMARK CORPORATION |

Mar-21 |

Synthesis Cabinetry |

The company launched a mobile procedure cart |

|

DISPOMED |

May-18 |

Veterinary Dental Units |

The company launched Highdent Quattro Plus |

DEALS

|

COMPANY |

MONTH-YEAR |

DEAL TYPE |

COMPANY 1 |

COMPANY 2 |

DESCRIPTION |

|

HENRY SCHEIN |

Mar-21 |

Acquisition |

Henry Schein (US) |

Stredis Healthcare (US) |

This development was focused on strengthening Henry Schein’s presence in the ambulatory surgery market. |

|

EICKEMEYER |

Feb-18 |

Partnership |

Eickemeyer (Germany) |

Central CPD (UK) |

This development was focused on connecting with veterinary practitioners through professional training programs and promoting the latest medical equipment. |

|

ACTEON GROUP |

Nov-17 |

Acquisition |

Acteon Group (France) |

Prodont-Hollinger (France) |

This development was focused on expanding its range of dental equipment. |

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global veterinary dental equipment market?

The global veterinary dental equipment market boasts a total revenue value of $500 million by 2026.

What is the estimated growth rate (CAGR) of the global veterinary dental equipment market?

The global veterinary dental equipment market has an estimated compound annual growth rate (CAGR) of 8.4% and a revenue size in the region of $334 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 VETERINARY DENTAL EQUIPMENT INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VETERINARY DENTAL EQUIPMENT MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS (GLOBAL MARKET)

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

2.2 VETERINARY DENTAL EQUIPMENT INDUSTRY SIZE ESTIMATION

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 8 REVENUE ANALYSIS OF THE TOP 4 COMPANIES: MARKET (2020)

FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS (GLOBAL MARKET)

FIGURE 10 BOTTOM-UP APPROACH

FIGURE 11 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.4 MARKET RANKING ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

2.7 COVID-19 HEALTH ASSESSMENT

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 13 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 14 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 15 VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 16 VETERINARY DENTAL EQUIPMENT INDUSTRY, BY ANIMAL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 VETERINARY DENTAL EQUIPMENT INDUSTRY, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 18 GEOGRAPHIC SNAPSHOT OF THE VETERINARY DENTAL EQUIPMENT INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 GROWTH POTENTIAL OF THE VETERINARY DENTAL EQUIPMENT INDUSTRY

FIGURE 19 GROWTH IN THE GLOBAL COMPANION ANIMAL POPULATION TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC MARKET

FIGURE 20 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2020

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 CHINA TO REGISTER THE HIGHEST GROWTH IN THE GLOBAL MARKET

4.4 REGIONAL MIX: MARKET (2019–2026)

FIGURE 22 APAC TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 VETERINARY DENTAL EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in the global companion animal population

TABLE 3 PET POPULATION, BY ANIMAL, 2014–2018 (MILLION)

5.2.1.2 Rising incidence of veterinary dental problems

5.2.1.3 Growth in the number of veterinary practitioners and income levels in developed economies

TABLE 4 NUMBER OF VETERINARIANS AND PARA-VETERINARIANS IN DEVELOPED COUNTRIES, 2012–2018

5.2.1.4 Growing demand for pet insurance and increasing pet care expenditure

FIGURE 24 US: PET INDUSTRY EXPENDITURE, 2010–2019

5.2.2 RESTRAINTS

5.2.2.1 High pet care and veterinary dental equipment costs

5.2.3 OPPORTUNITIES

5.2.3.1 Untapped emerging markets

5.2.4 CHALLENGES

5.2.4.1 Low animal healthcare awareness in emerging markets

5.2.4.2 Shortage of veterinarians in emerging markets

6 INDUSTRY INSIGHTS (Page No. - 57)

6.1 TECHNOLOGY ANALYSIS

6.2 PRICING ANALYSIS

TABLE 5 REGIONAL PRICING ANALYSIS OF KEY VETERINARY DIAGNOSTIC IMAGING MODALITIES, 2019 (USD THOUSAND/MILLION)

6.3 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

6.4 ECOSYSTEM MARKET MAP

FIGURE 26 MARKET: ECOSYSTEM MARKET MAP

6.5 SUPPLY CHAIN ANALYSIS

FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7 REGULATORY ANALYSIS

6.8 PATENT ANALYSIS

6.8.1 PATENT PUBLICATION TRENDS FOR VETERINARY DENTAL EQUIPMENT

FIGURE 28 PATENT PUBLICATION TRENDS (2015–2020)

6.9 TRADE ANALYSIS

6.10 IMPACT OF COVID-19 ON THE MARKET

7 VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT (Page No. - 66)

7.1 INTRODUCTION

TABLE 7 VETERINARY DENTAL EQUIPMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

7.2 EQUIPMENT

TABLE 8 DENTAL EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 9 DENTAL EQUIPMENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 DENTAL X-RAY SYSTEMS

TABLE 10 VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2.1.1 Stationary dental X-ray systems

7.2.1.1.1 Stationary units are widely adopted by veterinary practices due to their imaging flexibility

TABLE 11 STATIONARY DENTAL X-RAY SYSTEMS: KEY PRODUCTS

TABLE 12 STATIONARY DENTAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1.2 Mobile dental X-ray systems

7.2.1.2.1 These offer good image quality, enhanced security and comfort for animals, and eliminate the need for transportation

TABLE 13 MOBILE DENTAL X-RAY SYSTEMS: KEY PRODUCTS

TABLE 14 MOBILE DENTAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 ELECTROSURGICAL UNITS

7.2.2.1 The use of electrosurgical techniques can increase practice efficiency and reduce procedure times

TABLE 15 ELECTROSURGICAL UNITS: KEY PRODUCTS

TABLE 16 ELECTROSURGICAL UNITS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3 DENTAL STATIONS

TABLE 17 DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 18 DENTAL STATIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3.1 Mobile cart dental stations

7.2.3.1.1 Mobile cart dental stations accounted for the largest share of the global veterinary dental stations market

TABLE 19 MOBILE CART DENTAL STATIONS: KEY PRODUCTS

TABLE 20 MOBILE CART DENTAL STATIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3.2 Countertop dental stations

7.2.3.2.1 Countertop dental stations are widely used in small veterinary practices where space is scarce

TABLE 21 COUNTERTOP DENTAL STATIONS: KEY PRODUCTS

TABLE 22 COUNTERTOP DENTAL STATIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3.3 Wall-mounted dental stations

7.2.3.3.1 Wall-mounted dental stations are preferred for less consumption of floor space

TABLE 23 WALL-MOUNTED DENTAL STATIONS: KEY PRODUCTS

TABLE 24 WALL-MOUNTED DENTAL STATIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.4 DENTAL LASERS

7.2.4.1 Dental lasers segment is expected to grow at the highest CAGR during the forecast period

TABLE 25 VETERINARY DENTAL LASERS: KEY PRODUCTS

TABLE 26 VETERINARY DENTAL LASERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.5 POWERED UNITS

TABLE 27 DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 28 DENTAL POWERED UNITS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.5.1 Ultrasonic scalers & micromotors

7.2.5.1.1 Ultrasonic scalers & micromotors segment accounted for the largest share of the veterinary dental powered units market

TABLE 29 ULTRASONIC SCALERS: KEY PRODUCTS

TABLE 30 MICROMOTORS: KEY PRODUCTS

TABLE 31 ULTRASONIC SCALERS AND MICROMOTORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.5.2 Dental handpieces

7.2.5.2.1 These offer advantages such as high torque, high speed, better concentric bur movement, and low vibration and noise

TABLE 32 DENTAL HANDPIECES: KEY PRODUCTS

TABLE 33 DENTAL HANDPIECES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 HAND INSTRUMENTS

TABLE 34 DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 DENTAL HAND INSTRUMENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.1 DENTAL ELEVATORS

7.3.1.1 Dental elevators accounted for the largest share of the veterinary dental hand instruments market

TABLE 36 VETERINARY DENTAL ELEVATORS: KEY PRODUCTS

TABLE 37 DENTAL ELEVATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 DENTAL PROBES

7.3.2.1 Dental probes are used in almost all dental problems below the gum line

TABLE 38 VETERINARY DENTAL PROBES: KEY PRODUCTS

TABLE 39 DENTAL PROBES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 EXTRACTION FORCEPS

7.3.3.1 Small breed extraction forceps are commonly used in veterinary dentistry

TABLE 40 VETERINARY EXTRACTION FORCEPS: KEY PRODUCTS

TABLE 41 EXTRACTION FORCEPS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.4 CURETTES & SCALERS

7.3.4.1 Manual scalers in some cases prove to be better for cleaning porcelain and composite restorations

TABLE 42 VETERINARY CURETTES & SCALERS: KEY PRODUCTS

TABLE 43 CURETTES & SCALERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.5 RETRACTORS

7.3.5.1 Retractors provide better access to the oral cavity during dental procedures

TABLE 44 VETERINARY RETRACTORS: KEY PRODUCTS

TABLE 45 RETRACTORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.6 DENTAL LUXATORS

7.3.6.1 Dental luxators are used to loosen teeth prior to extraction

TABLE 46 VETERINARY DENTAL LUXATORS: KEY PRODUCTS

TABLE 47 DENTAL LUXATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.7 OTHER DENTAL HAND INSTRUMENTS

TABLE 48 OTHER DENTAL HAND INSTRUMENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 CONSUMABLES

TABLE 49 DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 DENTAL CONSUMABLES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1 DENTAL SUPPLIES

7.4.1.1 Dental supplies are widely used in varying amounts in veterinary practices and act as auxiliaries for every dental treatment

TABLE 51 VETERINARY DENTAL SUPPLIES: KEY PRODUCTS

TABLE 52 DENTAL SUPPLIES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.2 PROPHY PRODUCTS

7.4.2.1 These are the most commonly used tools for tooth polishing

TABLE 53 VETERINARY PROPHY PRODUCTS: KEY PRODUCTS

TABLE 54 PROPHY PRODUCTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.3 OTHER DENTAL CONSUMABLES

TABLE 55 OTHER DENTAL CONSUMABLES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 ADJUVANTS

7.5.1 IN SPITE OF THEIR SMALL SHARE, ADJUVANTS ARE AN INTEGRAL PART OF EVERY VETERINARY PRACTICE

TABLE 56 DENTAL ADJUVANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 VETERINARY DENTAL EQUIPMENT MARKET, BY ANIMAL TYPE (Page No. - 101)

8.1 INTRODUCTION

TABLE 57 VETERINARY DENTAL EQUIPMENT INDUSTRY, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

8.2 SMALL COMPANION ANIMALS

8.2.1 GROWTH IN COMPANION ANIMAL OWNERSHIP AND RISING DENTAL DISEASE INCIDENCE TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 58 CAT POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 59 DOG POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 60 MARKET FOR SMALL COMPANION ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 LARGE ANIMALS

8.3.1 CONSEQUENCES OF DISEASE OUTBREAKS SUCH AS PRODUCTIVITY LOSSES HAVE SUSTAINED THE DEMAND FOR LARGE ANIMAL DENTAL CARE

TABLE 61 EQUINE POPULATION, BY COUNTRY, 2012–2019 (THOUSAND)

TABLE 62 MARKET FOR LARGE ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

9 VETERINARY DENTAL EQUIPMENT MARKET, BY END USER (Page No. - 107)

9.1 INTRODUCTION

TABLE 63 VETERINARY DENTAL EQUIPMENT INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.2 VETERINARY HOSPITALS

9.2.1 CONSOLIDATION OF VETERINARY HOSPITALS IS A KEY TREND IN THIS MARKET SEGMENT

TABLE 64 MARKET FOR VETERINARY HOSPITALS,BY COUNTRY, 2019–2026 (USD MILLION)

9.3 VETERINARY CLINICS

9.3.1 CLINICS ARE THE FIRST POINT OF CONTACT FOR ANIMAL OWNERS

FIGURE 29 GROWING NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES IN THE US (2012–2018)

TABLE 65 MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 ACADEMIC INSTITUTES

9.4.1 ACADEMIC INSTITUTES PROVIDE HANDS-ON LABORATORY SESSIONS ON THE LATEST RESEARCH IN VETERINARY DENTISTRY

TABLE 66 MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

10 VETERINARY DENTAL EQUIPMENT MARKET, BY REGION (Page No. - 112)

10.1 INTRODUCTION

TABLE 67 VETERINARY DENTAL EQUIPMENT INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 30 EXPECTED GROWTH IN THE NUMBER OF VETERINARIANS IN NORTH AMERICA

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Growing animal health expenditure is a key factor driving the US market

FIGURE 32 US: EXPENDITURE ON VET VISITS

FIGURE 33 US: NUMBER OF VETERINARIANS, 2014–2019

TABLE 78 US: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 79 US: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 US: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 US: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 US: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 US: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 US: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 US: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 86 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising pet health insurance coverage and availability of pet health facilities will support market growth

TABLE 87 CANADA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 88 CANADA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 CANADA: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 CANADA: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 CANADA: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 CANADA: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 CANADA: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 CANADA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 95 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 96 EUROPE: VETERINARY DENTAL EQUIPMENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 97 EUROPE: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 EUROPE: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 EUROPE: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 EUROPE: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 EUROPE: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany dominates the European market for veterinary dental equipment and consumables

TABLE 106 GERMANY: PET POPULATION, 2012–2019 (MILLION)

FIGURE 34 GERMANY: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE, 2015 VS. 2017

TABLE 107 GERMANY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 GERMANY: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 GERMANY: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 GERMANY: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 GERMANY: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 GERMANY: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Increase in pet population and availability of insurance have supported the demand for veterinary dental equipment

TABLE 116 UK: PET POPULATION, 2016–2019 (MILLION)

TABLE 117 UK: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 118 UK: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 UK: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 UK: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 UK: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 UK: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 UK: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 UK: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 125 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 France has among the largest companion animal ownership rates in Europe

TABLE 126 FRANCE: COMPANION ANIMAL POPULATION, 2010–2019 (MILLION)

TABLE 127 FRANCE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 128 FRANCE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 FRANCE: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 FRANCE: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 FRANCE: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 FRANCE: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 FRANCE: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 FRANCE: MARKET, BY ANIMAL TYPE,2019–2026 (USD MILLION)

TABLE 135 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growth in the number of cattle and rising demand for poultry and pork meat have driven the focus on livestock well-being

TABLE 136 ITALY: LARGE ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 137 ITALY: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 138 ITALY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 ITALY: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 ITALY: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 ITALY: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 ITALY: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 ITALY: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 ITALY: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 145 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising companion animal population coupled with a high number of veterinary clinics and vet care expenditure to drive market growth

TABLE 146 SPAIN: LARGE ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 147 SPAIN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 148 SPAIN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 SPAIN: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 SPAIN: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 SPAIN: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 SPAIN: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 SPAIN: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 SPAIN: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 155 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 156 ROE: COMPANION ANIMAL OWNERSHIP, 2018 (MILLION)

TABLE 157 ROE: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 158 ROE: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 ROE: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 ROE: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 ROE: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 ROE: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 163 ROE: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 ROE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 165 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 166 APAC: FOOD-PRODUCING ANIMAL POPULATION, 2010–2018 (MILLION)

FIGURE 35 APAC: MARKET SNAPSHOT

TABLE 167 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 168 APAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 169 APAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 APAC: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 APAC: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 172 APAC: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 173 APAC: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 APAC: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 APAC: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 176 APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Large pool of food-producing animals and growing consumption of animal-derived food products are key market drivers

TABLE 177 CHINA: POPULATION OF FOOD-PRODUCING ANIMALS, 2012–2019 (MILLION)

TABLE 178 CHINA: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 179 CHINA: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 CHINA: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 181 CHINA: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 CHINA: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 183 CHINA: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 CHINA: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 185 CHINA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 186 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Growing adoption of companion animals in Japan to boost market growth

TABLE 187 JAPAN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 188 JAPAN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 JAPAN: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 190 JAPAN: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 JAPAN: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 192 JAPAN: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 JAPAN: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 194 JAPAN: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 195 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Government initiatives to propel the growth of the veterinary dental equipment market in India

TABLE 196 INDIA: FOOD-PRODUCING ANIMAL POPULATION, 2010–2019 (MILLION)

TABLE 197 INDIA: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 198 INDIA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 INDIA: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 200 INDIA: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 INDIA: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 202 INDIA: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 203 INDIA: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 204 INDIA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 205 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 REST OF APAC

TABLE 206 ROAPAC: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 207 ROAPAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 208 ROAPAC: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 209 ROAPAC: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 210 ROAPAC: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 211 ROAPAC: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 212 ROAPAC: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 ROAPAC: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 214 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 BRAZIL, MEXICO, CHILE, AND ARGENTINA ARE THE KEY MARKETS FOR VETERINARY DENTAL INSTRUMENTS IN LATIN AMERICA

TABLE 215 LATIN AMERICA: INCREASE IN THE NUMBER OF VETERINARIANS & VETERINARY PARA-PROFESSIONALS, 2010 VS. 2018

TABLE 216 LATIN AMERICA: VETERINARY DENTAL EQUIPMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 218 LATIN AMERICA: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 219 LATIN AMERICA: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 220 LATIN AMERICA: VETERINARY DENTAL POWERED UNITS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 LATIN AMERICA: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 222 LATIN AMERICA: VETERINARY DENTAL CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING NUMBER OF VETERINARIANS AND PARA-VETERINARIAN PROFESSIONALS IS A KEY FACTOR DRIVING MARKET GROWTH

TABLE 225 MIDDLE EAST: NUMBER OF VETERINARIANS & PARA-VETERINARIANS (2010 VS. 2018)

TABLE 226 MIDDLE EAST & AFRICA: VETERINARY DENTAL EQUIPMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 228 MIDDLE EAST & AFRICA: VETERINARY DENTAL STATIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 229 MIDDLE EAST & AFRICA: VETERINARY DENTAL X-RAY SYSTEMS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 230 MIDDLE EAST & AFRICA: VETERINARY DENTAL POWERED UNITS MARKET,BY TYPE, 2019–2026 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: VETERINARY DENTAL HAND INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 232 MIDDLE EAST & AFRICA: VETERINARY DENTAL CONSUMABLES MARKET,BY TYPE, 2019–2026 (USD MILLION)

TABLE 233 MIDDLE EAST & AFRICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 234 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 184)

11.1 INTRODUCTION

FIGURE 36 KEY MARKET DEVELOPMENTS (JANUARY 2018 TO MAY 2021)

11.2 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 37 REVENUE ANALYSIS: VETERINARY DENTAL EQUIPMENT MARKET (2020)

11.3 MARKET RANKING ANALYSIS

FIGURE 38 MARKET RANKING ANALYSIS, BY KEY PLAYER, 2020

11.4 COMPETITIVE SITUATIONS AND TRENDS

11.4.1 PRODUCT LAUNCHES

TABLE 235 VETERINARY DENTAL EQUIPMENT INDUSTRY: PRODUCT LAUNCHES (JANUARY 2018 TO MAY 2021)

11.4.2 DEALS

TABLE 236 MARKET: DEALS (JANUARY 2018 TO MAY 2021)

11.5 COMPETITIVE BENCHMARKING

TABLE 237 MARKET: PRODUCT PORTFOLIO MATRIX

11.6 COMPANY EVALUATION MATRIX

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 EMERGING COMPANIES

FIGURE 39 VETERINARY DENTAL EQUIPMENT INDUSTRY: GLOBAL COMPANY EVALUATION MATRIX

11.7 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 40 VETERINARY DENTAL EQUIPMENT INDUSTRY: COMPANY EVALUATION MATRIX FOR SMES/START-UPS

12 COMPANY PROFILES (Page No. - 193)

12.1 KEY PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, Competitive analysis, Right-to-Win, MnM View)*

12.1.1 PLANMECA OY

TABLE 238 PLANMECA OY: BUSINESS OVERVIEW

12.1.2 MIDMARK CORPORATION

TABLE 239 MIDMARK CORPORATION: BUSINESS OVERVIEW

12.1.3 HENRY SCHEIN

TABLE 240 HENRY SCHEIN: BUSINESS OVERVIEW

FIGURE 41 HENRY SCHEIN: COMPANY SNAPSHOT (2020)

12.1.4 INTEGRA LIFESCIENCES

TABLE 241 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

FIGURE 42 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2020)

12.1.5 EICKEMEYER

TABLE 242 EICKEMEYER: BUSINESS OVERVIEW

12.1.6 SCIL ANIMAL CARE (HESKA)

TABLE 243 SCIL ANIMAL CARE (HESKA): BUSINESS OVERVIEW

12.1.7 IM3 PTY LTD.

TABLE 244 IM3 PTY LTD.: BUSINESS OVERVIEW

12.1.8 DENTALAIRE

TABLE 245 DENTALAIRE: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 MAI ANIMAL HEALTH

TABLE 246 MAI ANIMAL HEALTH: BUSINESS OVERVIEW

12.2.2 DISPOMED

TABLE 247 DISPOMED: BUSINESS OVERVIEW

12.2.3 J & J INSTRUMENTS, INC.

TABLE 248 J & J INSTRUMENTS: BUSINESS OVERVIEW

12.2.4 TECHNIK VETERINARY

TABLE 249 TECHNIK VETERINARY: BUSINESS OVERVIEW

12.2.5 CHARLES BRUNGART, INC.

TABLE 250 CHARLES BRUNGART: BUSINESS OVERVIEW

12.2.6 CISLAK MANUFACTURING, INC.

TABLE 251 CISLAK MANUFACTURING: BUSINESS OVERVIEW

12.2.7 ACTEON GROUP

TABLE 252 ACTEON GROUP: BUSINESS OVERVIEW

12.2.8 AVANTE HEALTH SOLUTIONS

TABLE 253 AVANTE HEALTH SOLUTIONS: BUSINESS OVERVIEW

12.2.9 COVETRUS TM

TABLE 254 COVETRUS TM: BUSINESS OVERVIEW

12.2.10 ARIBEX

TABLE 255 ARIBEX: BUSINESS OVERVIEW

12.2.11 HEALTHY MOUTH LLC

TABLE 256 HEALTHY MOUTH LLC: BUSINESS OVERVIEW

12.2.12 MYVET IMAGING, INC.

TABLE 257 MYVET IMAGING: BUSINESS OVERVIEW

12.2.13 NEWTOM

TABLE 258 NEWTOM: BUSINESS OVERVIEW

*Details on Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, Competitive analysis, Right-to-Win, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 251)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

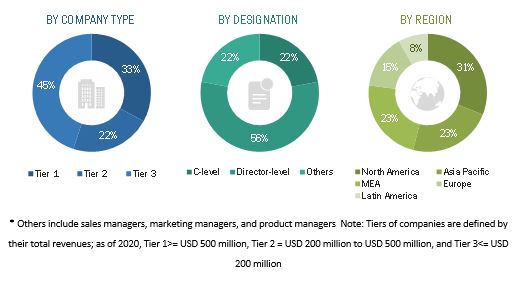

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

Secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary dental equipment market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The veterinary dental equipment market comprises several stakeholders such as Veterinary dental equipment manufacturers and distributors and regulatory organizations. The demand side of this market is characterized by hospitals, clinics, and academic institute.

Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents for veterinary dental equipment market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, by animal type, by end user, and by region).

Data Triangulation

After arriving at the market size, the total veterinary dental equipment market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the veterinary dental equipment market on the basis of product, animal type, end user and region.

- To provide detailed information on the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market segments with respect to North America, Europe, Asia Pacific, latin America and Middle East and Africa.

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, partnerships, acquisitions and other developments in the market.

- To benchmark players within the Veterinary dental equipment market using the Competitive Leadership Mapping framework which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific veterinary dental equipment market into South Korea, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Dental Equipment Market