Veterinary Monitoring Equipment Market by Type (Vital Signs Monitor, Anesthesia Monitor, ECG Monitor), Target Area (Respiratory diseases, Weight Monitoring), Animal Type (Dogs, Cats, Equines), End User (Veterinary Clinic), Region - Global Forecast to 2025

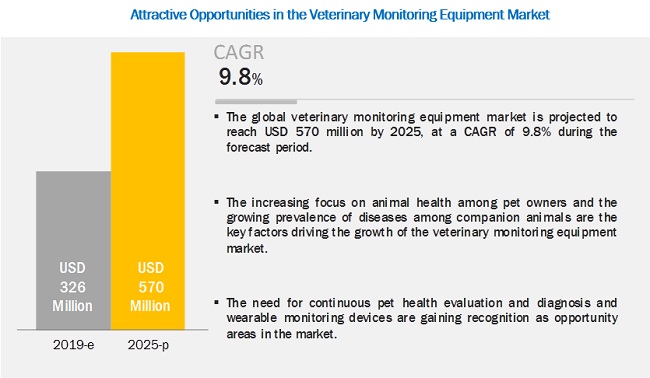

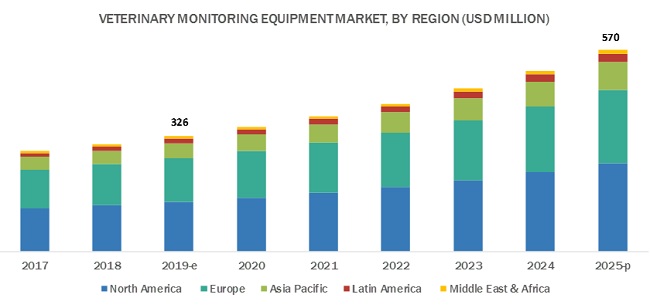

[193 Pages Report] The veterinary monitoring equipment market is projected to reach USD 570 million by 2025 from USD 326 million in 2019, at a CAGR of 9.8%. Growth in this market is driven by the increasing focus on animal health among pet owners, the growing prevalence of diseases among companion animals, the growing companion animal population, rising demand for pet insurance, growing animal health expenditure, and the rising number of veterinary practitioners & income levels in developed economies.

By type, vital sign monitors dominated the veterinary monitoring equipment market in 2018.

Based on type, the veterinary monitoring equipment market has been segmented into vital sign monitors, anesthesia monitors, capnography & oximetry systems, ECG & EKG monitors, MRI systems, and other equipment. The vital sign monitors segment accounted for the largest market share in 2018 due to the increasing focus on companion animal health, coupled with the need for continuous monitoring to prevent serious illnesses, increasing pet care expenditure, and technological advancements (such as the development of wireless monitors).

The weight & temperature monitoring segment accounted for the largest share of the veterinary monitoring equipment market in 2018.

Based on target area, the veterinary monitoring equipment market has been segmented into cardiology, neurology, respiratory disorders, weight & temperature monitoring, multi-parameter monitoring, and other target areas (including dentistry, pain, trauma, gynecology, orthopedics, and ophthalmology). The weight & temperature monitoring segment dominated the market, due to the need for effective weight & temperature monitoring for detecting diseases, monitoring progression and response to treatment, and checking both fluid retention & overload in animals during the assessment of hydration levels.

Small companion animals formed the largest animal type segment of veterinary monitoring equipment in 2018.

Based on animal type, the veterinary monitoring equipment market is segmented into small companion animals, large animals, and other animals (zoo animals, aquatic animals, and exotic animals). In 2018, small companion animals accounted for the largest share of the veterinary monitoring equipment market, due to the increasing adoption of companion animals, increased focus on safety, increased expenditure on animal health & preventive care, aging pet population, and advancements in animal health products.

The APAC market is expected to grow at the highest CAGR during the forecast period.

The market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period. Factors such as the large domesticated animal population, growth in pet adoption, increasing awareness about animal health, growing per capita animal health expenditure (especially in India and China), and the large market for livestock farming are propelling the growth of the APAC market.

Key Market Players

The prominent players in this market are Smiths Group plc. (UK), DRE Veterinary (US), Digicare Biomedical Technology (US), Midmark Corporation (US), Medtronic plc. (Ireland), Bionet America, Inc. (Korea), SonoScape Medical Corporation (China), Hallowell EMC (US), MinXray, Inc. (US), Hallmarq Veterinary Imaging Ltd. (UK), Esaote S.p.A (Italy), Agfa-Gevaert N.V. (Belgium), Nonin Medical, Inc. (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Covetrus, Inc. (US), Vetland Medical Sales & Services LLC (US), Masimo Corporation (US), Burtons Medical Equipment Ltd. (UK), Vetronic Services (UK), and IMV Technologies (France).

The global veterinary monitoring equipment market was dominated by DRE Veterinary in 2018. The company is one of the major veterinary equipment manufacturers. The companys product range helps address a wide range of health conditionsfor both large and small animals. This portfolio includes vital sign monitors, telemetry systems, anesthesia monitors, MRI systems, and others. With its efficient sales specialists and expert biomedical department, the company focuses on offering innovative and durable refurbished equipment to veterinary hospitals, clinics, university programs, zoos, and a host of other animal specialists. The company works with several academic institutes and veterinary hospitals and clinics in North America.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year considered |

2018 |

|

Forecast period |

20192025 |

|

Currency |

USD (Value Estimations) |

|

Segments covered |

Type, Target Area, Animal Type, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa |

|

Companies covered |

Smiths Group plc. (UK), DRE Veterinary (US), Digicare Biomedical Technology (US), Midmark Corporation (US), Medtronic plc. (Ireland), Bionet America, Inc. (Korea), SonoScape Medical Corporation (China), Hallowell EMC (US), MinXray, Inc. (US), Hallmarq Veterinary Imaging Ltd. (UK), Esaote S.p.A (Italy), Agfa-Gevaert N.V. (Belgium), Nonin Medical, Inc. (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Covetrus, Inc. (US), Vetland Medical Sales & Services LLC (US), Masimo Corporation (US), Burtons Medical Equipment Ltd. (UK), Vetronic Services (UK), and IMV Technologies (France) |

The research report categorizes the market into the following segments and subsegments:

Veterinary Monitoring Equipment Market, by Type

- Vital Sign Monitors

- Anesthesia Monitors

- Capnography & Oximetry Systems

- ECG & EKG Monitors

- MRI Systems

- Other Equipment

Veterinary Monitoring Equipment Market, by Target Area

- Cardiology

- Neurology

- Respiratory Disorders

- Weight & Temperature Monitoring

- Multi-parameter Monitoring

- Other Target Areas

Veterinary Monitoring Equipment Market, by Animal Type

- Small Companion Animals

- Dogs

- Cats

- Other Small Animals

- Large Animals

- Equines

- Other Large Animals

- Other Animals

Veterinary Monitoring Equipment Market, by End User

- Veterinary Clinics & Diagnostic Centers

- Veterinary Hospitals

- Research Institutes

Veterinary Monitoring Equipment Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In April 2019, Agfa signed an agreement with Universal Imaging, a multi-modality veterinary provider, to provide high-quality, low-dose imaging in the North American veterinary market. This helped Agfa extend its footprint in the US and Canadian markets for veterinary supplies.

- In December 2018, Henry Schein, Inc. and Vets First Choice underwent a corporate rebranding and changed its name to Covetrus, as a result of the planned spin-off of the Henry Schein Animal Health business and the subsequent merger with Vets First Choice.

- In October 2018, Midmark Corporation (US) opened its new corporate headquarters at Austin Landing, strengthening its position in the healthcare industry in this region.

- In January 2018, Hallmarq Veterinary Imaging, Ltd. (UK), opened its new North American headquarters in West Chicago, to fulfill the rapidly growing standing equine and small animal MRI business in the US and Canada.

- In April 2017, Esaote S.p.A (Italy) inaugurated a new research and production plant for MRI systems in Genoa, Italy.

Critical questions answered in the report:

- How will current technological trends affect the veterinary monitoring equipment market in the long term?

- What are the current growth trends in the veterinary monitoring equipment market for companion animals?

- What are the target areas of the veterinary monitoring equipment market?

- Which regions are likely to grow at the highest CAGR?

- What are the growth strategies being implemented by major market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION APPROACH

2.4 MARKET RANKING ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 VETERINARY MONITORING EQUIPMENT MARKET OVERVIEW

4.2 EUROPEAN VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE

4.3 VETERINARY MONITORING EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

4.4 VETERINARY MONITORING EQUIPMENT MARKET, BY REGION (20172025)

4.5 VETERINARY MONITORING EQUIPMENT MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in the companion animal population

5.2.1.2 Rising demand for pet insurance & growing animal health expenditure

5.2.1.3 Growth in the number of veterinary practitioners and income levels in developed economies

5.2.1.4 Growing prevalence of animal diseases

5.2.2 RESTRAINTS

5.2.2.1 Rising pet care costs

5.2.2.2 Alternatives to animal testing

5.2.3 OPPORTUNITIES

5.2.3.1 Untapped emerging markets

5.2.3.2 Wearable monitoring systems for animals

5.2.4 CHALLENGES

5.2.4.1 Low animal health awareness and inadequate animal testing infrastructure in several countries

5.2.4.2 Shortage of veterinarians in emerging markets

5.2.5 MARKET TRENDS

5.2.5.1 Rising adoption of wearable devices & telemedicine

5.2.5.2 Growing size of veterinary businesses

6 VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE (Page No. - 50)

6.1 INTRODUCTION

6.2 VITAL SIGN MONITORS

6.2.1 WITH INCREASING IMPORTANCE OF CONTINUOUS MONITORING, A NUMBER OF PLAYERS ARE LAUNCHING COST-EFFICIENT AND SMARTER SYSTEMSKEY DRIVERS FOR GROWTH

6.3 CAPNOGRAPHY & OXIMETRY SYSTEMS

6.3.1 TREND OF WEARABLE MONITORS AND DEVELOPMENT OF INNOVATIVE PRODUCTS ARE AIDING MARKET GROWTH

6.4 ANESTHESIA MONITORS

6.4.1 INCREASING MONITORING OF PATIENTS DURING SURGICAL OR INVASIVE PROCEDURES IS DRIVING THE ADOPTION OF ANESTHESIA MONITORS

6.5 ECG & EKG MONITORS

6.5.1 INCREASING PREVALENCE OF CVDS AMONG COMPANION ANIMALS IS LEADING TO THE RISING USE OF ECG & EKG MONITORS

6.6 MAGNETIC RESONANCE IMAGING (MRI) SYSTEMS

6.6.1 EFFICIENT IMAGING OF THE BRAIN AND SPINAL INJURIES IS DRIVING THE DEMAND FOR THESE SYSTEMS IN VETERINARY HOSPITALS

6.7 OTHER VETERINARY MONITORING EQUIPMENT

7 VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA (Page No. - 63)

7.1 INTRODUCTION

7.2 WEIGHT & TEMPERATURE MONITORING

7.2.1 WEARABLE MONITORS FOR WEIGHT & TEMPERATURE MEASUREMENT ARE GAINING WIDE RECOGNITION

7.3 MULTI-PARAMETER MONITORING

7.3.1 USE OF MONITORS IN VARIOUS CRITICAL SETTINGS FOR THERAPEUTIC INTERVENTIONS WILL DRIVE MARKET GROWTH

7.4 CARDIOLOGY

7.4.1 GROWTH IN THE AGING PET POPULATION AND OBESITY HAVE DRIVEN THE PREVALENCE OF CARDIOVASCULAR DISEASES IN ANIMALS

7.5 RESPIRATORY DISORDERS

7.5.1 RISING INCIDENCE OF RESPIRATORY DISORDERS WILL INCREASE THE ADOPTION OF MONITORING EQUIPMENT

7.6 NEUROLOGY

7.6.1 NEED FOR CONTINUOUS MONITORING TO AVOID HEALTH DETERIORATION IS DRIVING THE GROWTH OF THIS SEGMENT

7.7 OTHER TARGET AREAS

8 VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE (Page No. - 73)

8.1 INTRODUCTION

8.2 SMALL COMPANION ANIMALS

8.2.1 DOGS

8.2.1.1 Rising population and the growing adoption of dogs are expected to support market growth

8.2.2 CATS

8.2.2.1 Growing focus on annual checkups is expected to drive market growth

8.2.3 OTHER SMALL COMPANION ANIMALS

8.3 LARGE ANIMALS

8.3.1 EQUINES

8.3.1.1 Increasing awareness and research on equine health are expected to aid market growth

8.3.2 OTHER LARGE ANIMALS

8.4 OTHER ANIMALS

9 VETERINARY MONITORING EQUIPMENT MARKET, BY END USER (Page No. - 86)

9.1 INTRODUCTION

9.2 VETERINARY CLINICS & DIAGNOSTIC CENTERS

9.2.1 VETERINARY CLINICS & DIAGNOSTIC CENTERS ARE THE LARGEST END USERS OF VETERINARY MONITORING EQUIPMENT

9.3 VETERINARY HOSPITALS

9.3.1 INCREASE IN PET CARE EXPENDITURE IS EXPECTED TO STIMULATE THE GROWTH OF THIS SEGMENT

9.4 RESEARCH INSTITUTES

9.4.1 USE OF ANESTHESIA DURING RESEARCH IS INCREASING THE ADOPTION OF MONITORING EQUIPMENT IN RESEARCH INSTITUTES

10 VETERINARY MONITORING EQUIPMENT MARKET, BY REGION (Page No. - 92)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 The US dominates the North American veterinary monitoring equipment market

10.2.2 CANADA

10.2.2.1 Slow economic growth in Canada has severely affected its share in the North American market

10.3 EUROPE

10.3.1 GERMANY

10.3.1.1 Germany is the fastest-growing market for veterinary monitoring equipment in Europe

10.3.2 UK

10.3.2.1 Increasing pet ownership is expected to drive market growth

10.3.3 FRANCE

10.3.3.1 Technological advancements provide attractive growth opportunities for market players to invest in the country

10.3.4 ITALY

10.3.4.1 Need to curb zoonotic diseases in livestock will contribute to the demand for monitoring equipment

10.3.5 SPAIN

10.3.5.1 Increasing animal health expenditure is a major factor driving market growth

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.1.1 China dominates the APAC veterinary monitoring equipment market

10.4.2 JAPAN

10.4.2.1 Rising demand for imported breeds is driving pet adoption in the country

10.4.3 INDIA

10.4.3.1 Rising livestock animal population and growing awareness will contribute to market growth in India

10.4.4 REST OF ASIA PACIFIC

10.5 LATIN AMERICA

10.5.1 GROWING ANIMAL HEALTH AWARENESS & NEED TO MAINTAIN LIVESTOCK HEALTH ARE DRIVING MARKET GROWTH

10.6 MIDDLE EAST & AFRICA

10.6.1 AVAILABILITY OF FUNDING TO PROMOTE ANIMAL HEALTHCARE IN THE REGION IS SUPPORTING MARKET GROWTH

11 COMPETITIVE LANDSCAPE (Page No. - 150)

11.1 OVERVIEW

11.2 MARKET RANKING

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 VISIONARY LEADERS

11.3.2 INNOVATORS

11.3.3 DYNAMIC DIFFERENTIATORS

11.3.4 EMERGING COMPANIES

11.4 COMPETITIVE SITUATION AND TRENDS

11.4.1 EXPANSIONS

11.4.2 OTHER STRATEGIES

12 COMPANY PROFILES (Page No. - 155)

12.1 DRE VETERINARY

12.1.1 BUSINESS OVERVIEW

12.1.2 PRODUCTS OFFERED

12.1.3 COMPETITIVE ANALYSIS

12.2 SMITHS GROUP PLC

12.2.1 BUSINESS OVERVIEW

12.2.2 PRODUCTS OFFERED

12.2.3 COMPETITIVE ANALYSIS

12.3 DIGICARE BIOMEDICAL TECHNOLOGY

12.3.1 BUSINESS OVERVIEW

12.3.2 PRODUCTS OFFERED

12.3.3 COMPETITIVE ANALYSIS

12.4 MIDMARK CORPORATION

12.4.1 BUSINESS OVERVIEW

12.4.2 PRODUCTS OFFERED

12.4.3 RECENT DEVELOPMENTS

12.4.4 COMPETITIVE ANALYSIS

12.5 COVETRUS, INC.

12.5.1 BUSINESS OVERVIEW

12.5.2 PRODUCTS OFFERED

12.5.3 RECENT DEVELOPMENTS

12.5.4 COMPETITIVE ANALYSIS

12.6 MEDTRONIC PLC

12.6.1 BUSINESS OVERVIEW

12.6.2 PRODUCTS OFFERED

12.7 BIONET AMERICA, INC.

12.7.1 BUSINESS OVERVIEW

12.7.2 PRODUCTS OFFERED

12.8 SONOSCAPE MEDICAL CORPORATION

12.8.1 BUSINESS OVERVIEW

12.8.2 PRODUCTS OFFERED

12.9 HALLOWELL EMC

12.9.1 BUSINESS OVERVIEW

12.9.2 PRODUCTS OFFERED

12.10 MINXRAY, INC.

12.10.1 BUSINESS OVERVIEW

12.10.2 PRODUCTS OFFERED

12.11 HALLMARQ VETERINARY IMAGING LTD.

12.11.1 BUSINESS OVERVIEW

12.11.2 PRODUCTS OFFERED

12.11.3 RECENT DEVELOPMENTS

12.12 ESAOTE S.P.A

12.12.1 BUSINESS OVERVIEW

12.12.2 PRODUCTS OFFERED

12.12.3 RECENT DEVELOPMENTS

12.13 AGFA-GEVAERT N.V.

12.13.1 BUSINESS OVERVIEW

12.13.2 PRODUCTS OFFERED

12.13.3 RECENT DEVELOPMENTS

12.14 NONIN MEDICAL INC.

12.14.1 BUSINESS OVERVIEW

12.14.2 PRODUCTS OFFERED

12.15 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

12.15.1 BUSINESS OVERVIEW

12.15.2 PRODUCTS OFFERED

12.16 OTHER MAJOR COMPANIES

12.16.1 VETLAND MEDICAL SALES & SERVICES LLC

12.16.2 MASIMO CORPORATION

12.16.3 BURTONS MEDICAL EQUIPMENT LTD.

12.16.4 VETRONIC SERVICES

12.16.5 IMV TECHNOLOGIES

13 APPENDIX (Page No. - 185)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

LIST OF TABLES (155 TABLES)

TABLE 1 PET POPULATION, BY COUNTRY, 2014 VS. 2016 VS. 2018 (MILLION)

TABLE 2 DEVELOPED ECONOMIES: INCREASE IN THE NUMBER OF VETERINARY PROFESSIONALS (20122017)

TABLE 3 NUMBER OF VETERINARY PROFESSIONALS, BY COUNTRY, 2005 VS. 2014 VS. 2015

TABLE 4 VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 5 VITAL SIGNS MONITORS: KEY PRODUCTS AVAILABLE IN THE MARKET

TABLE 6 VETERINARY VITAL SIGN MONITORS MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 7 CAPNOGRAPHY & OXIMETRY SYSTEMS: KEY PRODUCTS AVAILABLE IN THE MARKET

TABLE 8 VETERINARY CAPNOGRAPHY & OXIMETRY SYSTEMS MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 9 ANESTHESIA MONITORS: KEY PRODUCTS AVAILABLE IN THE MARKET

TABLE 10 VETERINARY ANESTHESIA MONITORS MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 11 VETERINARY ECG & EKG MONITORS MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 12 MRI SYSTEMS: KEY PRODUCTS AVAILABLE IN THE MARKET

TABLE 13 VETERINARY MRI SYSTEMS MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 14 OTHER VETERINARY MONITORING EQUIPMENT MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 15 VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 16 VETERINARY MONITORING EQUIPMENT MARKET FOR WEIGHT & TEMPERATURE MONITORING, BY COUNTRY, 20172025 (USD MILLION)

TABLE 17 VETERINARY MONITORING EQUIPMENT MARKET FOR MULTI-PARAMETER MONITORING, BY COUNTRY, 20172025 (USD MILLION)

TABLE 18 VETERINARY MONITORING EQUIPMENT MARKET FOR CARDIOLOGY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 19 VETERINARY MONITORING EQUIPMENT MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 20 VETERINARY MONITORING EQUIPMENT MARKET FOR NEUROLOGY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 21 VETERINARY MONITORING EQUIPMENT MARKET FOR OTHER TARGET AREAS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 22 VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 23 VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 24 VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 25 VETERINARY MONITORING EQUIPMENT MARKET FOR DOGS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 26 VETERINARY MONITORING EQUIPMENT MARKET FOR CATS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 27 VETERINARY MONITORING EQUIPMENT MARKET FOR OTHER SMALL COMPANION ANIMALS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 28 VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 29 VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 30 VETERINARY MONITORING EQUIPMENT MARKET FOR EQUINES, BY COUNTRY, 20172025 (USD MILLION)

TABLE 31 VETERINARY MONITORING EQUIPMENT MARKET FOR OTHER LARGE ANIMALS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 32 VETERINARY MONITORING EQUIPMENT MARKET FOR OTHER ANIMALS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 33 VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 34 NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES, BY COUNTRY (2012 VS. 2017)

TABLE 35 VETERINARY MONITORING EQUIPMENT MARKET FOR VETERINARY CLINICS & DIAGNOSTIC CENTERS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 36 VETERINARY MONITORING EQUIPMENT MARKET FOR VETERINARY HOSPITALS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 37 VETERINARY MONITORING EQUIPMENT MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 20172025 (USD MILLION)

TABLE 38 VETERINARY MONITORING EQUIPMENT MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 39 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 40 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 41 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 42 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 43 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 44 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 45 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 46 HEALTHCARE EXPENDITURE ON COMPANION ANIMALS (2018)

TABLE 47 US: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 48 US: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 49 US: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 50 US: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 51 US: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 52 US: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 53 CANADA: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 54 CANADA: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 55 CANADA: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 56 CANADA: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 57 CANADA: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 58 CANADA: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 59 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 60 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 61 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 62 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 63 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 64 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 65 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 66 GERMANY: COMPANION ANIMAL POPULATION (MILLION)

TABLE 67 GERMANY: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 68 GERMANY: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 69 GERMANY: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 70 GERMANY: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 71 GERMANY: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 72 GERMANY: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 73 UK: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 74 UK: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 75 UK: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 76 UK: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 77 UK: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 78 UK: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 79 FRANCE: COMPANION ANIMAL POPULATION (MILLION)

TABLE 80 FRANCE: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 81 FRANCE: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 82 FRANCE: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 83 FRANCE: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 84 FRANCE: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 85 FRANCE: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 86 ITALY: LIVESTOCK POPULATION, 2010-2016 (MILLION)

TABLE 87 ITALY: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 88 ITALY: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 89 ITALY: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 90 ITALY: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 91 ITALY: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 92 ITALY: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 93 SPAIN: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 94 SPAIN: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 95 SPAIN: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 96 SPAIN: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 97 SPAIN: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 98 SPAIN: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 99 ROE: COMPANION ANIMAL OWNERSHIP, 2018 (MILLION)

TABLE 100 ROE: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 101 ROE: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 102 ROE: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 103 ROE: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 104 ROE: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 105 ROE: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 106 ASIA PACIFIC: FOOD-PRODUCING ANIMAL POPULATION (20102017) (MILLION)

TABLE 107 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 108 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 109 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 110 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 111 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 112 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 113 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 114 CHINA: FOOD-PRODUCING ANIMAL POPULATION (2010-2016) (MILLION)

TABLE 115 CHINA: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 116 CHINA: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 117 CHINA: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 118 CHINA: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 119 CHINA: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 120 CHINA: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 121 JAPAN: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 122 JAPAN: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 123 JAPAN: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 124 JAPAN: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 125 JAPAN: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 126 JAPAN: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 127 INDIA: FOOD-PRODUCING ANIMAL POPULATION (20102016) (MILLION)

TABLE 128 INDIA: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 129 INDIA: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 130 INDIA: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 131 INDIA: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 132 INDIA: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 133 INDIA: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 134 ROAPAC: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 135 ROAPAC: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 136 ROAPAC: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 137 ROAPAC: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 138 ROAPAC: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 139 ROAPAC: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 140 LATIN AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 141 LATIN AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 142 LATIN AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 143 LATIN AMERICA: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 144 LATIN AMERICA: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 145 LATIN AMERICA: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 146 MIDDLE EAST: NUMBER OF VETERINARIANS AND PARAVETERINARIANS, BY COUNTRY (2016 VS. 2018)

TABLE 147 AFRICA: NUMBER OF VETERINARIANS AND PARAVETERINARIANS, BY COUNTRY (2010 VS. 2010)

TABLE 148 MIDDLE EAST & AFRICA: VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 20172025 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 20172025 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: VETERINARY MONITORING EQUIPMENT MARKET FOR SMALL COMPANION ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: VETERINARY MONITORING EQUIPMENT MARKET FOR LARGE ANIMALS, BY TYPE, 20172025 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 20172025 (USD MILLION)

TABLE 154 EXPANSIONS, 20172019

TABLE 155 OTHER STRATEGIES, 20172019

LIST OF FIGURES (37 FIGURES)

FIGURE 1 VETERINARY MONITORING EQUIPMENT MARKET

FIGURE 2 RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 MARKET SIZE APPROACH

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 DATA TRIANGULATION METHODOLOGY

FIGURE 7 VETERINARY MONITORING EQUIPMENT MARKET, BY TYPE, 2019 VS. 2025 (USD MILLION)

FIGURE 8 VETERINARY MONITORING EQUIPMENT MARKET, BY TARGET AREA, 2019 VS. 2025 (USD MILLION)

FIGURE 9 VETERINARY MONITORING EQUIPMENT MARKET, BY ANIMAL TYPE, 2019 VS. 2025 (USD MILLION)

FIGURE 10 VETERINARY MONITORING EQUIPMENT MARKET, BY END USER, 2019 VS. 2025 (USD MILLION)

FIGURE 11 GEOGRAPHIC ANALYSIS: VETERINARY MONITORING EQUIPMENT MARKET

FIGURE 12 INCREASING FOCUS ON ANIMAL HEALTH IS THE MAJOR FACTOR DRIVING MARKET GROWTH

FIGURE 13 VITAL SIGN MONITORS ACCOUNTED FOR THE LARGEST SHARE OF THE EUROPEAN VETERINARY MONITORING EQUIPMENT MARKET IN 2018

FIGURE 14 MARKET IN CHINA TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 15 NORTH AMERICA WILL CONTINUE TO DOMINATE THE VETERINARY MONITORING EQUIPMENT MARKET TILL 2025

FIGURE 16 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE IN THE FORECAST PERIOD

FIGURE 17 VETERINARY MONITORING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 18 US: PET INDUSTRY EXPENDITURE, 20102018

FIGURE 19 VITAL SIGN MONITORS TO DOMINATE THE VETERINARY MONITORING EQUIPMENT MARKET DURING THE FORECAST PERIOD

FIGURE 20 WEIGHT & TEMPERATURE MONITORING SEGMENT DOMINATES THE VETERINARY MONITORING EQUIPMENT MARKET

FIGURE 21 SMALL COMPANION ANIMALS TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 22 NUMBER OF PRIVATE EQUINE CLINICAL PRACTICES IN THE US, 20092017

FIGURE 23 VETERINARY CLINICS & DIAGNOSTIC CENTERS TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 24 VETERINARY MONITORING EQUIPMENT MARKET: GEOGRAPHIC SNAPSHOT (2018)

FIGURE 25 EXPECTED GROWTH IN THE NUMBER OF VETERINARIANS IN NORTH AMERICA

FIGURE 26 NORTH AMERICA: VETERINARY MONITORING EQUIPMENT MARKET SNAPSHOT

FIGURE 27 US: EXPENDITURE ON VET VISITS

FIGURE 28 NUMBER OF VETERINARIANS IN THE US, 20142018

FIGURE 29 EUROPE: VETERINARY MONITORING EQUIPMENT MARKET SNAPSHOT

FIGURE 30 NUMBER OF PRACTICING VETERINARIANS IN THE UK, 20132016

FIGURE 31 ASIA PACIFIC: VETERINARY MONITORING EQUIPMENT MARKET SNAPSHOT

FIGURE 32 VETERINARY MONITORING EQUIPMENT MARKET RANKING, BY KEY PLAYER, 2018

FIGURE 33 VETERINARY MONITORING EQUIPMENT MARKET: COMPETITIVE LEADERSHIP MAPPING (2018)

FIGURE 34 SMITHS GROUP PLC: COMPANY SNAPSHOT (2019)

FIGURE 35 COVETRUS, INC.: COMPANY SNAPSHOT (2018)

FIGURE 36 MEDTRONIC PLC: COMPANY SNAPSHOT (2019)

FIGURE 37 AGFA-GEVAERT N.V.: COMPANY SNAPSHOT (2018)

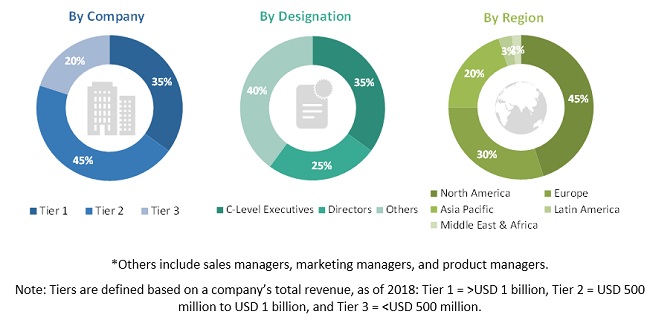

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary monitoring equipment market. It was also used to obtain important information about the key players, market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, sales directors, and related key executives from various key companies and organizations operating in the veterinary monitoring equipment market. The primary sources from the demand side include directors of veterinary hospitals & clinics, veterinary hospital & clinic managers, veterinarians, professors, research scientists, and related key opinion leaders. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, target area, animal type, end user, and region).

Data Triangulation

After arriving at the market size, the veterinary monitoring equipment market was divided into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the global veterinary monitoring equipment market by type, target area, animal type, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall veterinary monitoring equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the veterinary monitoring equipment market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the global veterinary monitoring equipment market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions, new product launches, expansions, collaborations, and R&D activities of the leading players in the veterinary monitoring equipment market

- To benchmark players within the veterinary monitoring equipment market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the market in the Rest of Asia Pacific into South Korea, New Zealand, and others

- Further breakdown of the market in the Rest of Europe into Belgium, Russia, Netherlands, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Monitoring Equipment Market