VTOL UAV Market by Application (Military, Civil & Commercial, Homeland Security), Type (Multicopter, Helicopter, Hybrid), Size (Large, Medium, Small, Micro), Propulsion, Payloads, Geography - Global Forecast to 2025-2034

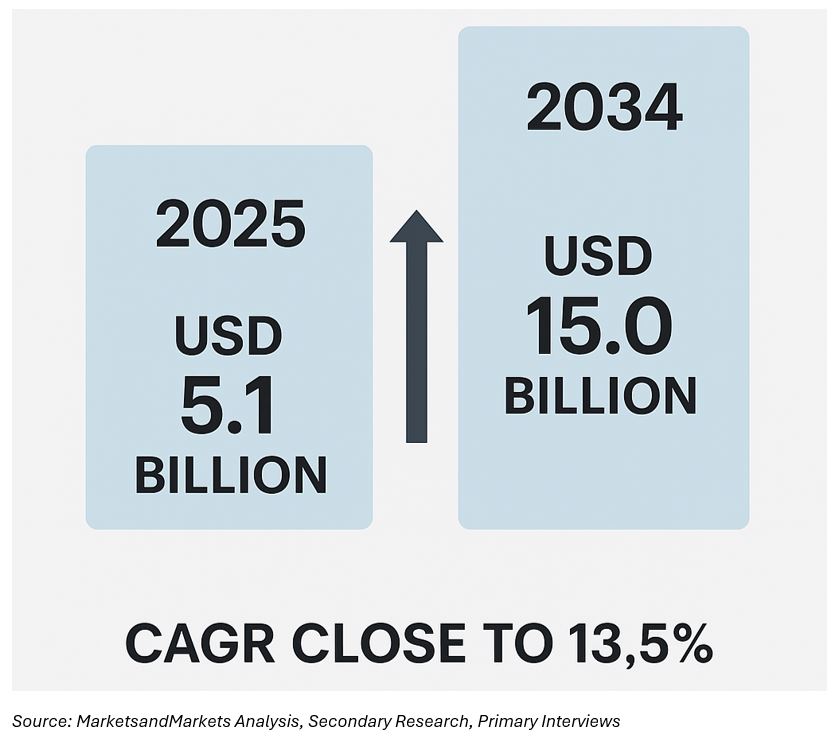

The vertical take-off and landing (VTOL) UAV market is entering a pivotal decade of transformation as flight endurance, hybrid propulsion, and autonomous systems mature simultaneously. In 2025, the market is valued at around USD 5.1 billion and is projected to reach approximately USD 15.0 billion by 2034, representing a compound annual growth rate (CAGR) close to 13.5%. This growth reflects the steady migration of VTOL UAVs from prototype programs to certified operational fleets serving both military and commercial domains.

VTOL UAVs bridge the gap between rotary-wing flexibility and fixed-wing endurance. By combining runway-independent take-off and hover capability with efficient forward-flight performance, these systems are redefining mission economics across inspection, logistics, border surveillance, and tactical intelligence. In recent years, the rapid integration of electric and hybrid-electric propulsion, AI-enabled flight control, and modular payload architectures has expanded their use-cases—from small autonomous reconnaissance aircraft to multi-hour cargo and ISR missions.

The market’s acceleration is also underpinned by favourable regulatory developments. Global aviation authorities are progressively approving BVLOS (Beyond Visual Line of Sight) operations, Remote ID frameworks, and U-space or UTM ecosystems that enable safe integration of drones into civilian airspace. This institutional readiness, combined with steady declines in per-flight-hour cost, is propelling adoption across industrial, governmental, and defense sectors.

Market Dynamics

Key Drivers

- Operational Versatility: VTOL UAVs perform effectively in constrained or unprepared terrains where conventional aircraft are unsuitable. Their dual flight mode allows vertical deployment and fixed-wing cruise without runway dependency.

- Hybrid and Electric Propulsion Maturity: Battery energy density, hydrogen-fuel-cell adoption, and lightweight composites are collectively improving endurance and payload efficiency.

- Autonomy and AI Integration: Advanced autopilot systems, visual-inertial odometry, and on-edge analytics support safer autonomous navigation even in GNSS-denied environments.

- Defence Modernization and ISR Expansion: Militaries are procuring tactical VTOL UAVs for surveillance, target acquisition, and situational awareness in complex battlefields.

- Emerging Commercial Missions: Infrastructure inspection, linear-asset monitoring, and middle-mile logistics are creating new addressable markets for certified VTOL fleets.

Restraints

- Certification complexity and varying airworthiness standards across countries.

- Limited endurance in smaller electric platforms due to current battery chemistry.

- Infrastructure and operator training requirements for larger hybrid UAVs.

Opportunities

- BVLOS corridor deployment and cross-border UTM integration.

- VTOL UAVs for maritime operations, search and rescue, and port logistics.

- Integration with 5G and satellite communication networks for continuous data-link coverage.

Market Segmentation

The VTOL UAV market is segmented as follows:

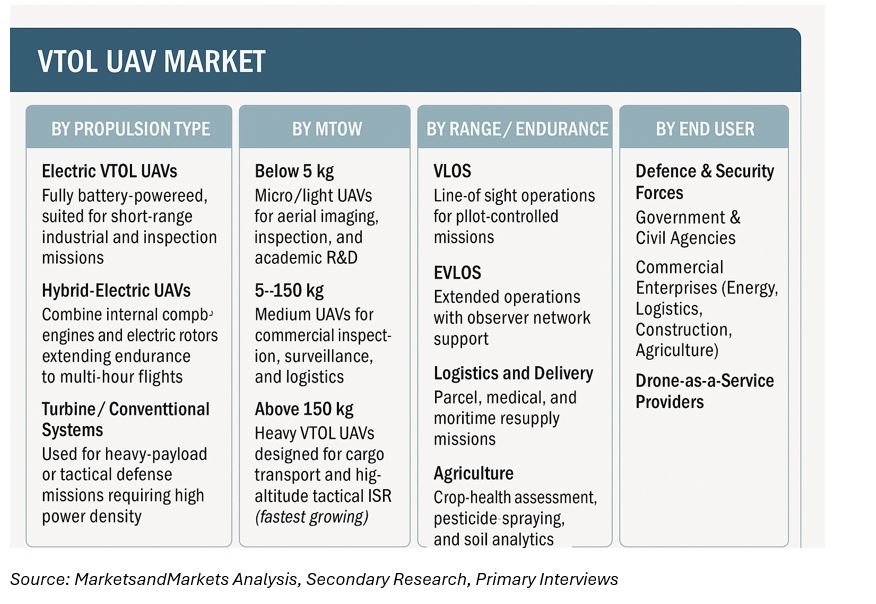

By Propulsion Type

- Electric VTOL UAVs: Fully battery-powered, suited for short-range industrial and inspection missions.

- Hybrid-Electric UAVs: Combine internal combustion engines and electric rotors, extending endurance to multi-hour flights.

- Turbine / Conventional Systems: Used for heavy-payload or tactical defence missions requiring higher power density.

By MTOW (Maximum Take-Off Weight)

- Below 5 kg: Micro/light UAVs for aerial imaging, inspection, and academic R&D.

- 5–150 kg: Medium UAVs for commercial inspection, surveillance, and logistics.

- Above 150 kg: Heavy VTOL UAVs designed for cargo transport and high-altitude tactical ISR.

By Range / Endurance

- VLOS: Line-of-sight operations for pilot-controlled missions.

- EVLOS: Extended operations with observer network support.

- BVLOS: Long-range autonomous missions beyond visual line of sight (fastest-growing category).

By Application

- Defence and ISR: Tactical reconnaissance, surveillance, electronic warfare.

- Commercial Inspection: Power-line, oil & gas, wind turbine, and railway monitoring.

- Logistics and Delivery: Parcel, medical, and maritime resupply missions.

- Agriculture: Crop-health assessment, pesticide spraying, and soil analytics.

- Public Safety: Emergency response, firefighting, disaster management.

By End User

- Defence & Security Forces

- Government & Civil Agencies

- Commercial Enterprises (Energy, Logistics, Construction, Agriculture)

- Drone-as-a-Service Providers

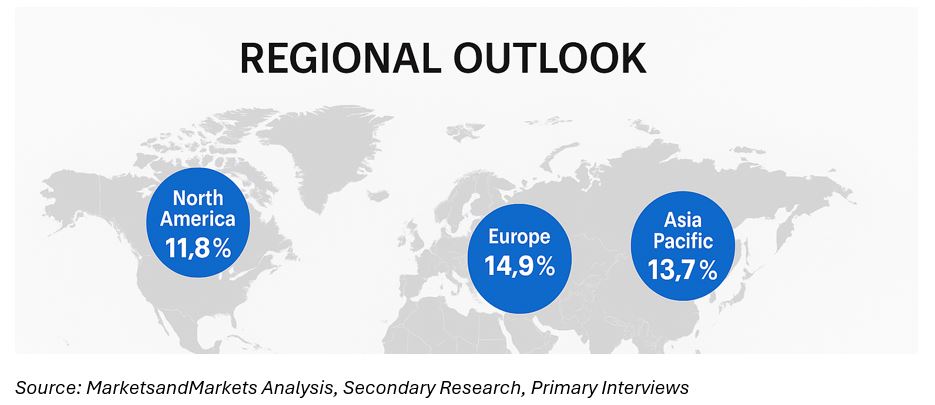

By Region

- North America: Early regulatory maturity and enterprise adoption.

- Europe: Strong R&D base, tilt-rotor technology, and public-safety missions.

- Asia Pacific: Fastest expansion supported by manufacturing clusters in China, South Korea, Japan, and India.

- Middle East & Africa: VTOL UAVs for border control, infrastructure inspection, and port logistics.

- Latin America: Growing adoption for environmental monitoring and precision agriculture.

Technology Landscape

The modern VTOL UAV ecosystem reflects convergence between aerospace design and autonomous robotics.

Recent trends include:

- Tilt-rotor and tilt-wing architectures improving aerodynamic efficiency during transition.

- Distributed-electric propulsion (DEP) and redundant control systems for higher safety assurance.

- Lightweight composite materials enhancing payload-to-mass ratios.

- Onboard compute modules (GPU/TPU) for real-time sensor fusion, object detection, and predictive maintenance analytics.

- Cloud-connected fleet management platforms that unify command, telemetry, and airspace compliance data.

Emerging innovations such as hydrogen-powered VTOLs, solar-assisted lift systems, and tethered-energy variants indicate a shift toward extended endurance and lower operational footprints.

Competitive Landscape

The VTOL UAV industry is moderately consolidated, with a blend of legacy aerospace OEMs, defence primes, and emerging UAV specialists. Leading players include Lockheed Martin, Northrop Grumman, Israel Aerospace Industries (IAI), Schiebel Corporation, Thales Group, AeroVironment, Elbit Systems, Kongsberg, Volocopter, EHang, and Autel Robotics (hybrid R&D entries).

Strategic partnerships are shaping competitive positioning. Defence primes are collaborating with software integrators and propulsion innovators to deliver certified systems for NATO and Asia-Pacific defence tenders. On the commercial side, logistics providers are working with start-ups to develop heavy-lift VTOL cargo platforms optimized for ship-to-shore, offshore energy, and mountain-terrain deliveries.

The market is witnessing an increasing number of Drone-as-a-Service (DaaS) business models where operators own and maintain fleets, offering mission services on subscription or contract basis.

Regulatory and Policy Environment

Global regulatory agencies are accelerating drone-integration frameworks.

- United States: FAA progressing with BVLOS waivers and pilotless certification paths.

- Europe: EASA’s U-space regulation fosters unified traffic management and airspace corridors for commercial VTOL flights.

- India: DGCA and MoCA’s revised Drone Rules and PLI scheme stimulate domestic production.

- Japan & South Korea: Advanced programs in autonomous logistics and emergency UAV corridors.

These regulations are expected to increase operational confidence, insurance uptake, and investment inflows into the VTOL ecosystem.

Sustainability Outlook

Sustainability is increasingly central to UAV procurement and operations. Manufacturers are transitioning toward recyclable composite airframes, battery reuse programs, and low-noise propeller technologies suitable for urban deployment. Hybrid-electric designs offer reduced emissions compared with conventional rotary aircraft, while shared-fleet service models minimize idle capacity. Operators are measuring carbon intensity per flight hour and adopting digital twins to optimize flight plans for lower environmental impact.

Market Outlook (2025–2034)

The VTOL UAV market will continue to demonstrate resilient double-digit growth as technical, regulatory, and commercial ecosystems converge. The next decade will likely see a proliferation of tactical, logistics, and inspection-grade VTOL UAVs, progressively transitioning toward fully autonomous, BVLOS-certified systems. Manufacturers that balance endurance, autonomy, cost efficiency, and sustainability will be best positioned to capture long-term value.

Key Takeaways

- Market size: USD 5.1 billion (2025) → USD 15.0 billion (2034)

- CAGR: ~13.5%

- Fastest-growing region: Asia Pacific

- Top emerging use-cases: Logistics, port operations, tactical ISR

- Major drivers: Hybrid propulsion, autonomy, airspace integration

- Key challenge: Certification and airworthiness standardization

FAQs

1. What defines the VTOL UAV market?

It includes all unmanned aerial vehicles capable of vertical take-off and landing, using electric, hybrid, or turbine propulsion to combine rotary lift with fixed-wing flight efficiency.

2. Which sectors are leading adopters?

Defence, energy & utilities, logistics, and emergency response organizations are primary adopters.

3. What role does BVLOS regulation play?

BVLOS permissions allow long-range autonomous missions, unlocking new applications like infrastructure inspection and medical logistics.

4. How is sustainability achieved in VTOL UAVs?

Through electric propulsion, recyclable materials, battery recovery, and predictive flight planning to reduce emissions.

5. Who are the major players?

Lockheed Martin, Northrop Grumman, IAI, Schiebel, Thales, AeroVironment, Kongsberg, Elbit Systems, Volocopter, and EHang.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization

1.4 Currency & Pricing

1.5 Package Sizes

1.6 Distribution Channel Participants

1.7 Study Limitations

1.8 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Key Data Taken From Secondary Sources

2.1.3 Primary Data

2.1.4 Key Data From Primary Sources

2.1.4.1 Key Industry Insights

2.1.5 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Indicators

2.2.2.1 Increase in Demand of VTOL UAV for Non-Military Application

2.2.3 Supply Side Indicators

2.2.3.1 Supplier Product Coverage

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Break Down and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in VTOL UAV Market

4.2 Market, By Application

4.3 APAC: Market, By Application

4.4 Market, By Region

4.5 Market, By Type

4.6 Market, By Size

4.7 Market, By Propulsion System

4.8 Life Cycle Analysis, By Region (2015-2020)

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Application

5.3.2 By VTOL UAV Type

5.3.3 By Size Type

5.3.4 By Propulsion System

5.3.5 By Payload

5.3.6 By Geography

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing VTOL UAV Applications in Which Flat Land/Runway is Not Available for Ctol/Stol UAV

5.4.1.2 Improving Technical Efficiency and Technological Advancements

5.4.1.3 Fight Against Terrorism

5.4.2 Restraints

5.4.2.1 Strict Airspace Regulations

5.4.2.2 Lack of Skilled and Trained Pilots

5.4.2.3 Less Velocities and Altitude, Limited Set of Applications With Dedicated Payloads

5.4.3 Opportunities

5.4.3.1 Increasing Demand of VTOL UAVs for Several Commercial Applications

5.4.3.2 VTOL UAV for Product Delivery & Logistics

5.4.3.3 Technologies Such as Gnss, Rpas and Persistent Bvlos Makes VTOL Market A Stable Alternative

5.4.4 Challenges

5.4.4.1 Safety and Social Issues Such as Privacy and Nuisance Concerns

5.4.4.2 Competing With Adjacent Field Products

5.4.4.3 Regulatory Policies and Procedural Issues

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Technology Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 VTOL UAV Market, By Application (Page No. - 56)

7.1 Introduction

7.2 Military Application Market

7.2.1 VTOL UAV Market, By ISR Application

7.2.2 Market, By Communication Relay Application

7.2.3 Market, By Border Security & Monitoring Application

7.2.4 Market, By Combat Operations Application

7.3 Civil & Commercial Application Market

7.3.1 Market, By Agriculture Application

7.3.2 Market, By Mapping & Surveying Application

7.3.3 Market, By Oil & Gas Application

7.3.4 Market, By Wildlife Research & Survey Application

7.3.5 Market, By Film & Television Industry Application

7.3.6 Market, By Photography Application

7.4 Homeland Security Application Market

7.4.1 Market, By Search, Rescue & Disaster Management Application Market

7.4.2 Market, By Police Operations Application Market

7.4.3 Market, By Fire Fighting Application Market

7.4.4 Market, By High Traffic Monitoring Application Market

8 VTOL UAV Market, By Type (Page No. - 76)

8.1 Introduction

8.2 Multicopter VTOL UAV

8.3 Helicopter VTOL UAV

8.4 Hybrid VTOL UAV

9 VTOL UAV Market, By Size (Page No. - 81)

9.1 Introduction

9.2 Large Sized VTOL UAV

9.3 Small Sized VTOL UAV

9.4 Medium Sized VTOL UAV

9.5 Micro Sized VTOL UAV

10 VTOL UAV Market, By Propulsion System (Page No. - 89)

10.1 Introduction

10.2 Thermal Propulsion System

10.3 Electrical Propulsion System

10.4 Hybrid Propulsion System

10.5 Solar Propulsion System

11 VTOL UAV Market, By Payload (Page No. - 96)

11.1 Introduction

11.1.1 VTOL UAV Payload Market, By Sensors

12 Global VTOL UAV Market, By Geography (Page No. - 100)

12.1 Introduction

12.2 North America

12.2.1 North America: VTOL UAV Market, By Country

12.2.2 North America: Market, By Application Type

12.2.3 North America: Market, By Military Application

12.2.4 North America: Market, By Civil and Commercial Application

12.2.5 North America: Market, By Homeland Security Application

12.2.6 U.S.

12.2.6.1 U.S.: VTOL UAV Market, By Application Type

12.2.7 Canada

12.2.7.1 Canada: Market, By Application Type

12.3 Europe

12.3.1 Europe: Market, By Country

12.3.2 Europe: Market, By Application Type

12.3.3 Europe: Market, By Military Application

12.3.4 Europe: Market, By Civil and Commercial Application

12.3.5 Europe: Market, By Homeland Security Application

12.3.6 Russia

12.3.6.1 Russia: VTOL UAV Market, By Application Type

12.3.7 U.K.

12.3.7.1 U.K: Market, By Application Type

12.3.8 Germany

12.3.8.1 Germany: Market, By Application Type

12.3.9 France

12.3.9.1 France: Market, By Application Type

12.3.10 Austria

12.3.10.1 Austria: Market, By Application Type

12.4 Asia-Pacific

12.4.1 Asia-Pacific: VTOL UAV Market, By Country

12.4.2 Asia-Pacific: Market, By Application Type

12.4.3 Asia-Pacific: Market, By Military Application

12.4.4 Asia-Pacific: Market, By Civil and Commercial Application

12.4.5 Asia-Pacific: Market, By Homeland Security Application

12.4.6 China

12.4.6.1 China: VTOL UAV Market, By Application Type

12.4.7 Australia

12.4.7.1 Australia: Market, By Application Type

12.4.8 Japan

12.4.8.1 Japan: Market, By Application Type

12.4.9 South Korea

12.4.9.1 South Korea: Market, By Application Type

12.4.10 India

12.4.10.1 India: Market, By Application Type

12.5 Middle East

12.5.1 Middle East: VTOL UAV Market, By Country

12.5.2 Middle East: Market, By Application Type

12.5.3 Middle East: Market, By Military Application

12.5.4 Middle East: Market, By Civil and Commercial Application

12.5.5 Middle East: Market, By Homeland Security Application

12.5.6 Israel

12.5.6.1 Israel: VTOL UAV Market, By Application Type

12.5.7 Saudi Arabia

12.5.7.1 Saudi Arabia: Market, By Application Type

12.5.8 Iran

12.5.8.1 Iran: Market, By Application Type

12.5.9 Turkey

12.5.9.1 Turkey: Market, By Application Type

12.6 Latin America

12.6.1 Latin America: VTOL UAV Market, By Country

12.6.2 Latin America: Market, By Application Type

12.6.3 Latin America: Market, By Military Application

12.6.4 Latin America: Market, By Civil and Commercial Application

12.6.5 Latin America: Market, By Homeland Security Application

12.6.6 Brazil

12.6.6.1 Brazil: VTOL UAV Market, By Application Type

12.6.7 Mexico

12.6.7.1 Mexico: Market, By Application Type

12.6.8 Argentina

12.6.8.1 Argentina: Market, By Application Type

12.7 Africa

12.7.1 Africa: VTOL UAV Market, By Application Type

12.7.2 Africa: Market, By Military Application

12.7.3 Africa: Market, By Civil and Commercial Application

12.7.4 Africa: Market, By Homeland Security Application

13 Competitive Landscape (Page No. - 135)

13.1 Introduction

13.2 Market Share Analysis of Market

13.3 Competitive Situation and Trends

13.3.1 New Product Launches

13.3.2 Mergers & Acquisitions

13.3.3 Partnerships, Collaborations, and Joint Ventures

13.3.4 Long-Term Contracts

14 Company Profiles (Page No. - 144)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Northrop Grumman Corporation

14.3 Dji Innovations

14.4 Lockheed Martin Corporation

14.5 Israel Aerospace Industries Ltd.

14.6 Schiebel Elektronische Gerate GmbH

14.7 Aerovironment, Inc.

14.8 SAAB AB

14.9 Textron Inc.

14.10 The Boeing Company

14.11 Turkish Aerospace Industries, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 168)

15.1 Discussion Guide

15.2 Other Developments

15.2.1 New Product Launches

15.2.2 Mergers & Acquisitions

15.2.3 Partnerships, Collaborations, and Joint Ventures

15.2.4 Contracts

15.3 Introducing RT: Real Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (78 Tables)

Table 1 Increasing Production of VTOL UAV for Non-Military Applications is Driving Growth of the Market

Table 2 Strict Airspace Regulation and Lack of Skilled and Trained Pilots are Limiting Market Progress

Table 3 Increasing Demand of UAV in Emerging Economies for Several Commercial Applications

Table 4 Privacy and Nuisance Concerns and Regulatory Policies and Procedural Issues Pose Challenges to the Market

Table 5 Market, By Application, 2013-2020 (USD Million)

Table 6 Market, By Military Application, 2013-2020 (USD Million)

Table 7 Market, By Civil & Commercial Application, 2013-2020 (USD Million)

Table 8 Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 9 Market Size, By Type, 2013-2020 (USD Million)

Table 10 Multicopter VTOL UAV Market Size, 2013-2020 (Units)

Table 11 Helicopter Market Size 2013-2020 (Units)

Table 12 Hybrid Market Size, 2013-2020 (Units)

Table 13 Market Size, By Size, 2013-2020 (USD Million)

Table 14 Market Volume, By Size, 2013-2020 (Units)

Table 15 Large Size VTOL UAV Market Size, By Type, 2013-2020 (USD Million)

Table 16 Small Size Market Size, By Type, 2013-2020 (USD Million)

Table 17 Medium Size Market Size, By Type, 2013-2020 (USD Million)

Table 18 Micro Size Market Size, By Type, 2013-2020 (USD Million)

Table 19 Market, By Propulsion System, 2013-2020 (USD Million)

Table 20 Market, By Payload, 2013-2020 (USD Million)

Table 21 Market, By Sensors Payload, 2013-2020 (USD Million)

Table 22 Market, By Region, 2013-2020 (USD Million)

Table 23 North America: Market, By Country, 2013-2020 (USD Million)

Table 24 North America: Market, By Application Type, 2013-2020 (USD Million)

Table 25 North America: Market, By Military Application, 2013-2020 (USD Million)

Table 26 North America: Market, By Civil and Commercial Application, 2013-2020 (USD Million)

Table 27 North America: Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 28 U.S.: Market, By Application Type, 2013-2020 (USD Million)

Table 29 Canada: Market, By Application Type, 2013-2020 (USD Million)

Table 30 Europe: Market, By Country, 2013-2020 (USD Million)

Table 31 Europe: Market, By Application Type, 2013-2020 (USD Million)

Table 32 Europe: Market, By Military Application, 2013-2020 (USD Million)

Table 33 Europe: Market, By Civil and Commercial Application, 2013-2020 (USD Million)

Table 34 Europe: Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 35 Russia: VTOL UAV Market, By Application, 2013-2020 (USD Million)

Table 36 U.K: Market, By Application Type, 2013-2020 (USD Million)

Table 37 Germany: Market, By Application Type, 2013-2020 (USD Million)

Table 38 France: Market, By Application Type, 2013-2020 (USD Million)

Table 39 Austria: Market, By Application Type, 2013-2020 (USD Million)

Table 40 Asia-Pacific: Market, By Country, 2013-2020 (USD Million)

Table 41 Asia-Pacific: Market, By Application Type, 2013-2020 (USD Million)

Table 42 Asia-Pacific: Market, By Military Application, 2013-2020 (USD Million)

Table 43 Asia-Pacific: Market, By Civil and Commercial Application, 2013-2020 (USD Million)

Table 44 Asia-Pacific: Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 45 China: Market, By Application Type, 2013-2020 (USD Million)

Table 46 Australia: Market, By Application Type, 2013-2020 (USD Million)

Table 47 Japan: Market, By Application Type, 2013-2020 (USD Million)

Table 48 South Korea: Market, By Application Type, 2013-2020 (USD Million)

Table 49 India: Market, By Application Type, 2013-2020 (USD Million)

Table 50 Middle East: Market, By Country, 2013-2020 (USD Million)

Table 51 Middle East: Market, By Application Type, 2013-2020 (USD Million)

Table 52 Middle East: Market, By Military Application, 2013-2020 (USD Million)

Table 53 Middle East: Market, By Civil and Commercial Application, 2013-2020 (USD Million)

Table 54 Middle East: Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 55 Israel: Market, By Application, 2013-2020 (USD Million)

Table 56 Saudi Arabia: Market, By Application Type, 2013-2020 (USD Million)

Table 57 Iran: Market, By Application Type, 2013-2020 (USD Million)

Table 58 Turkey: Market, By Application Type, 2013-2020 (USD Million)

Table 59 Latin America: Market, By Country, 2013-2020 (USD Million)

Table 60 Latin America: Market, By Application Type, 2013-2020 (USD Million)

Table 61 Latin America: Market, By Military Application, 2013-2020 (USD Million)

Table 62 Latin America: Market, By Civil and Commercial Application, 2013-2020 (USD Million)

Table 63 Latin America: Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 64 Brazil : Market, By Application Type, 2013-2020 (USD Million)

Table 65 Mexico : Market, By Application Type, 2013-2020 (USD Million)

Table 66 Argentina : Market, By Application Type, 2013-2020 (USD Million)

Table 67 Africa: Market, By Application Type, 2013-2020 (USD Million)

Table 68 Africa: Market, By Military Application, 2013-2020 (USD Million)

Table 69 Africa: Market, By Civil and Commercial Application, 2013-2020 (USD Million)

Table 70 Africa: Market, By Homeland Security Application, 2013-2020 (USD Million)

Table 71 New Product Launches, 2011-2015

Table 72 Mergers & Acquisitions, 2011-2015

Table 73 Partnerships, Collaborations, and Joint Ventures, 2011–2015

Table 74 Contracts, 2011-2015

Table 75 New Product Launches, 2011-2015

Table 76 Mergers & Acquisitions, 2011-2015

Table 77 Partnerships, Collaborations, and Joint Ventures, 2011–2015

Table 78 Contracts, 2011-2015

List of Figures (99 Figures)

Figure 1 Market Scope: Market

Figure 2 Study Limitations

Figure 3 Research Design

Figure 4 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 5 VTOL UAV Demand for Non-Military Application, By Incidence

Figure 6 Supplier Product Coverage

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation Methodology

Figure 10 Research Assumptions

Figure 11 Evolution of VTOL UAVs

Figure 12 Market Snapshot (2015 vs 2020): Civil and Commercial Application to Witness the Highest Growth in Next Five Years

Figure 13 Small Size Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 14 Asia-Pacific to Witness Considerable Growth in Market By 2020

Figure 15 U.S. : Highly Prospective Market With Huge Investments

Figure 16 New Product Launches Have Fueled the Growth of Market in Last Four Years

Figure 17 Attractive Opportunities in Market, 2015-2020

Figure 18 Commercial Application Segment is Projected to Grow at the Highest Cagr, 2015-2020

Figure 19 Military Application Segment Expected to Capture the Highest Market Share Within APAC Region in 2015

Figure 20 India is Projected to Grow at the Highest Cagr From 2015 to 2020

Figure 21 Multicopters are Expected to Exhibit Positive Growth By 2020

Figure 22 The Small Size Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 23 Thermal System is Expected to Capture the Highest Market Share By 2020

Figure 24 Asia-Pacific Market to Soon Enter Rapid Growth Phase

Figure 25 Evolution of VTOL UAV

Figure 26 Global Market, By Application

Figure 27 Global VTOL UAV, By Type

Figure 28 Global Market, By Size

Figure 29 Global Market, By Propulsion System

Figure 30 Global Market, By Payload

Figure 31 Global Market, By Geography

Figure 32 Demand for VTOL UAV in Civil & Commercial Sector is Projected to Drive Market

Figure 33 Value Chain Analysis: Market

Figure 34 Supply Chain Analysis: Market

Figure 35 VTOL UAV: Enhanced New Technologies, Sets A Leading Trend in the Market

Figure 36 Porter’s Five Forces Analysis

Figure 37 Porter’s Five Forces Analysis: Factors Degree Summary

Figure 38 Growth in Commercial Application to Push the Demand of VTOL UAVs From 2015 to 2020

Figure 39 High Growth Rate is Expected in VTOL UAV Application Market By 2020

Figure 40 Market, By ISR Application, 2015 vs 2020

Figure 41 Market, By Communication Relay Application, 2015 vs 2020

Figure 42 Market, By Border Security & Monitoring Application, 2015 vs 2020

Figure 43 Market, By Combat Operations Application, 2015 vs 2020

Figure 44 Market, By Agriculture Application, 2015 vs 2020

Figure 45 Market, By Mapping & Surveying Application, 2015 vs 2020

Figure 46 Market, By Oil & Gas Application, 2015 vs 2020

Figure 47 Market, By Wildlife Research & Survey Application, 2015 vs 2020

Figure 48 Market, By Film & Television Industry Application, 2015 vs 2020

Figure 49 Market, By Photography Application, 2015 vs 2020

Figure 50 Market, By Search, Rescue & Disaster Management Application, 2015 vs 2020

Figure 51 Market, By Police Operations Application, 2015 vs 2020

Figure 52 Market, By Fire Fighting Application, 2015 vs 2020

Figure 53 Market, High Traffic Monitoring Application, 2015 vs 2020

Figure 54 Multicopter VTOL UAV Market 2015 vs 2020 (USD Million)

Figure 55 Helicopter VTOL UAV Market 2015 vs 2020 (USD Million)

Figure 56 Hybrid VTOL UAV Market 2015 vs 2020 (USD Million)

Figure 57 Demand for the Micro Sized Drone to Push the Market From 2015 to 2020

Figure 58 VTOL UAVs are Expected to See Steady Growth Until 2020

Figure 59 Large Size VTOL UAV Market, Value vs Volume, 2015 to 2020

Figure 60 Small Size Market, Value vs Volume, 2015 to 2020

Figure 61 Medium Size Market, Value vs Volume, 2015 to 2020

Figure 62 Micro Size Market, Value vs Volume, 2015 to 2020

Figure 63 Hybrid Propulsion System Based Market Projected to Witness Promising Demand in the Near Future

Figure 64 Market, By Propulsion System, 2015 vs 2020

Figure 65 Market, By Thermal Propulsion System, 2013-2020 (USD Million)

Figure 66 Market, By Electrical Propulsion System, 2013-2020 (USD Million)

Figure 67 Market, By Hybrid Propulsion System, 2013-2020 (USD Million)

Figure 68 Market, By Solar Propulsion System, 2013-2020 (USD Million)

Figure 69 ISR Payload Segment of Market is Projected to Be the Potential Growth Pocket By 2020

Figure 70 Market By Sensors Payload, 2015 vs 2020 (USD Million)

Figure 71 North America is Estimated to Account for the Largest Market Share in the Market in 2015

Figure 72 APAC Countries are Projected to Witness Growth in the Market, By Application Type, 2015-2020

Figure 73 North America Snapshot: the U.S. is Expected to Lead the Market, in Terms of Market Share From 2015 to 2020

Figure 74 Europe Snapshot: Russia VTOL UAV Market is Projected to Witness the Fastest Growth From 2015 to 2020

Figure 75 Asia-Pacific Snapshot: China is Projected to Account for the Largest Share in the Fastest Growing Asia-Pacific VTOL UAV Market

Figure 76 Middle East Snapshot: Israel Will Be A Potential Market in the Region From 2015 to 2020

Figure 77 Latin America Snapshot: Brazil is Projected to Hold A Major Market Share in the VTOL UAV in the Region From 2015 to 2020

Figure 78 Africa Snapshot: Military Application is the Leading Segment for the Market in the Region From 2015 to 2020

Figure 79 Companies Adopted New Product Launches as the Key Growth Strategy Between 2011 and 2015

Figure 80 Israel Aerospace Industries Limited Was the Only Company Which Showed Positive Growth Between 2012 and 2014

Figure 81 Market Share Analysis, By Key Player, 2014

Figure 82 Market Share Analysis, By Region, 2014

Figure 83 Market has Witnessed Significant Growth Between 2012 and 2014

Figure 84 New Product Launches are Among the Key Growth Strategies Adopted Between 2011 to 2015

Figure 85 Geographic Revenue Mix of Top Three Market Players, 2014

Figure 86 Northrop Grumman Corporation: Business Overview

Figure 87 SWOT Analysis: Northrop Grumman Corporation

Figure 88 Lockheed Martin Corporation: Business Overview

Figure 89 Lockheed Martin Corporation: SWOT Analysis

Figure 90 Israel Aerospace Industries Ltd.: Business Overview

Figure 91 Israel Aerospace Industries Ltd.: SWOT Analysis

Figure 92 Aerovironment, Inc.: Business Overview

Figure 93 Aerovironment, Inc.: SWOT Analysis

Figure 94 SAAB AB: Business Overview

Figure 95 SAAB AB: SWOT Analysis

Figure 96 Textron Inc.: Business Overview

Figure 97 Textron, Inc.: SWOT Analysis

Figure 98 The Boeing Co. : Business Overview

Figure 99 The Boeing Company: SWOT Analysis

The global VTOL UAV market is projected to witness a high growth in the next five years. The growth of this market is forecast to be driven by the increasing demand of VTOL UAVs in civil & commercial sector. The market is further driven by the demand for 3D mapping, oil & gas pipeline inspection, recreational activities, safety and surveillance. However, the market faces hurdles such as strict airspace regulations and social issues such as privacy and nuisance concern.

The high growth potential in emerging markets and increase in demand for UAVs are anticipated to provide growth opportunities to the players in the VTOL UAV market. However, lack of skilled and trained pilots and stringent regulatory framework are the key challenges for the industry players.

The global VTOL UAV market by application & type has fastest growth for countries in the Asia-Pacific region. The market in the countries, such as Japan and India of the Asia-Pacific region, is projected to grow at a faster pace from 2015 to 2020. The market in these countries is expected grow for military and commercial applications in the next five years.

Major strategic developments are taking place in the field of VTOL UAV, which exhibit high-growth potential in the near future. Dominant market players such as Northrop Grumman Corporation (U.S.), DJI (China), Lockheed Martin Corporation (U.S.) and Israel Aerospace Industries Limited (Israel) introduced several technologically advanced systems, and entered into strategic agreements and partnerships in order to keep pace with the industry trends.

Scope of the Report

This research report categorizes the global VTOL UAV market into the following segments and sub segments:

Global VTOL UAV, by Application

- Military

- Homeland Security

- Civil & Commercial

Global VTOL UAV Market, by Type

- Helicopter

- Multicopter

- Hybrid

Global VTOL UAV Market, by Size

- Large

- Medium

- Small

- Micro

Global VTOL UAV Market, by Payloads

- ISR

- Cameras

- Telemetry

- Sensors

- Autopilot

Global VTOL UAV Market, by Geography

- North America

- Europe

- APAC

- Latin America

- Africa

Growth opportunities and latent adjacency in VTOL UAV Market