Aircraft Micro Turbine Engines Market by Engine Type (Turboshaft, Turbojet, Turboprop), End Use (OEM, Aftermarket), Platform (General Aviation, Commercial Aviation, Military Aviation, Others), Horsepower, Fuel Type and Region - Global Forecast to 2030

Update: 11/05/2024

Aircraft Micro Turbine Engines are small, lightweight jet engines typically used for unmanned aerial vehicles (UAVs), light aircraft, and auxiliary power units. These engines are valued for their compact design, high power-to-weight ratio, and ability to operate at high speeds and altitudes. Unlike traditional piston engines, micro turbine engines operate by compressing air, mixing it with fuel, and igniting the mixture to produce thrust, making them efficient for specific aerial applications. They are also noted for lower maintenance due to fewer moving parts and simpler designs. As the UAV market expands, micro turbine engines are gaining traction, especially in surveillance, reconnaissance, and hobbyist sectors, where efficiency, durability, and performance are critical. Technological advancements are further improving fuel efficiency, noise reduction, and power output, broadening their potential applications in both military and commercial aviation markets.

Aircraft Micro Turbine Engines Size & Growth

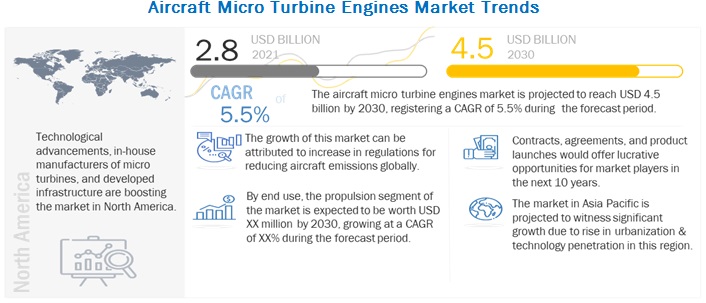

The Global Aircraft Micro Turbine Engines Market Size was valued at USD 2.8 billion in 2021 and is estimated to reach USD 4.5 billion by 2030, growing at a CAGR of 5.5% during the forecast period.

The Aircraft Micro Turbine Engines Industry exhibits lucrative growth potential during the forecast period primarily due to the inherent operational benefits of micro turbine engines, including low operating and maintenance costs of micro turbine engines and the introduction of new generation hybrid architecture in aircraft. Nevertheless, the emergence of hybrid electric power generation technology and the development of distributed power generation systems are anticipated to open several growth opportunities for aircraft micro turbine engine manufacturers during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Aircraft Micro Turbine Engines Market

The COVID-19 pandemic and resultant lockdowns have adversely impacted the aviation industry. According to the International Air Transport Association (IATA), over 2 billion people take aircraft as their mode of transportation every year. Due to the outbreak of COVID-19, the year 2020 witnessed over 60% loss in global air traffic, which bought the aviation industry to a standstill.

Several companies have already implemented policies to restrict non-essential travel to protect their employees. Remote and flexible working arrangements have been considered, and supply chains have become highly sophisticated and vital to the competitiveness of many companies. Their interlinked, global nature also makes them increasingly vulnerable to a range of risks, with more potential points of failure and less margin of error for absorbing delays and disruptions.

The outbreak of COVID-19 has moderately impacted the aircraft micro turbine engines market on the supply side. This impact is due to the delays in order deliveries because of large-scale disruptions in the supply chain in affected countries. Some companies across non-hotspot countries have resumed partial operations in line with government safety guidelines. Their production is slow due to labor shortage and inadequate supply of components from other suppliers and subsidiaries. New supply chain technologies are emerging, significantly improving visibility across the end-to-end supply chain, and supporting more supply chain agility and resiliency without the traditional overhead associated with risk management techniques.

Aircraft Micro Turbine Engines Trends

Driver: Introduction of New Generation Hybrid Architecture in Aircraft

Though the aviation sector is gearing towards electrification, the current generation of electric power sources cannot store enough charge for long-distance flights. The Li-ion technology has fully matured, and the average energy density enhancement has fallen to below five percent with each annual iteration. This has encouraged several researchers and battery companies to seek the next breakthrough battery chemistry, such as Sodium-ion (Na-ion), Lithium-metal (Li-metal), Lithium-Sulphur (Li-S), or Zinc-air (Zn-air), to achieve or overtake the energy density of 9.6kWh/L offered by aviation fuel. The maximum charge capacity of the current generation of Li-ion batteries is 250Wh/kg. In contrast, short-range electric aircraft demand battery packs specific energies of 750-2,000 Wh/kg, which translates into 6-17% of the jet fuel energy content, depending on aircraft size and range. Fully electric aircraft can travel around 200 km per charge with the current battery technology. Thus, limited travel distance and charge capacity are major factors hindering the growth of a fully electric aircraft.

Hybrid aircraft elevate this constraint by installing electric power generating equipment such as micro turbines to propel the aircraft when extra power is needed or when the batteries are depleted. Micro turbine engines are a hybrid power source for small aerial vehicles such as UAVs and VTOLs. The growing emphasis on reducing aircraft emissions and maintaining on-flight power generating capacity is expected to drive the market growth for micro turbine engines during the forecast period.

Restraints: High Overall Temperature of Systems Restricts Adoption

The inlet temperature of the turbine needs to be fairly high to obtain high power output in aircraft micro turbines. The high temperature at the inlet leads to a higher overall temperature of the entire engine body under a small scale of engines. This situation with high temperature gets even worse by the rising temperature of the exhaust gases. Although, the exhaust gas temperatures can be controlled by reusing the increased heat to increase the power output further. Specialized cooling methods need to be adopted to use micro turbine engines in aircraft. Due to the increased mechanization involved, adoption of this technology can possibly be low. Hence, it could hinder the growth of the aircraft micro turbine engines market.

Opportunities: Development of Distributed Power Generation Systems

As per NASA, distributed electric propulsion (DEP) technology is based on the premise that closely integrating the propulsion system with the airframe and distributing multiple motors across the wing will increase efficiency, lower operating costs, and increase safety. The DEP utilizes propulsors that can be placed, sized, and operated with greater flexibility to leverage the synergistic benefits of aero-propulsive coupling and provide improved performance over more traditional designs. Besides, careful integration of electrically driven propulsors for boundary-layer ingestion improves propulsive efficiency. The placement and configuration of propulsors can also be used to mitigate the trailing vortex system of a lifting surface or leverage an increase in dynamic pressure across blown surfaces for increased lift performance.

The inherent design potential of DEPs and the benefits of implementing such technology have fostered R&D on a global scale. For instance, as of July 2021, Electra.aero (US) was working on a new project funded by NASA to advance sustainable aviation for urban and regional air markets using electrified aircraft with ultra-short takeoff and landing capabilities. Electra is developing a blown lift technology that redirects air to generate a very high lift using DEP. Thus, electric power systems fuel the demand for decentralization through the deployment and use of distributed power technologies. However, due to the current commercial and technical maturity, micro turbines have lower efficacy and require high CAPEX than reciprocating engines and gas turbines. Additional technology development and commercial progress are envisioned before rendering micro turbines a more competitive option for distributed power applications.

Challenges: Reliability of Micro Turbine Engines in Harsh Environments

Extremely skillful and knowledgeable operators are required to ensure the efficient working of micro turbine engines. Improper operation can be potentially dangerous for the aircraft and even cause power generation failure. Similarly, various cables used for operations must be robust enough to operate in harsh environments as they are exposed to extreme temperatures, chemicals, and extensive flexing. Hence, designing a reliable micro turbine engine that can withstand harsh environments is a major challenge for OEMs.

Aircraft Micro Turbine Engines Segments

Based on Installation, the Aftermarket Segment of the Aircraft Micro Turbine Engines Market is Estimated to Account for the Largest Market Share in 2021

Based on installation, the aftermarket segment is expected to dominate the market share in 2021. The aftermarket segment of the aircraft micro turbine engines market is limited to the replacement of auxiliary power units (APUs) once its service life expires. Since the aftermarket segment mainly replaces micro turbines on old aircraft, the research excludes platforms such as light aircraft, military UAVs, and advanced air mobility (cargo drones and air taxis). Micro turbine engine manufacturers are the sole source of APU replacement. The aftermarket for micro turbine engines of light aircraft, military UAVs, and advanced air mobility aircraft is futuristic as many of these products are yet to be commercialized. However, the continuous advancements in micro turbine engine technology are expected to drive the growth of the aftermarket segment.

Based on End-Use, the Auxiliary Power Segment is Estimated to Account for the Largest Market Share From 2021 to 2030

Based on end-use, the auxiliary power segment is expected to dominate the market share during the forecast period (2021 to 2030). There are ongoing research activities undertaken on an aircraft architecture wherein a micro turbine engine is used for auxiliary power. Micro turbine engines with power ratings between 5 HP and 500 HP are expected to find applications as auxiliary power units in civil aviation by cutting off the operating costs of light aircraft and business jets. The use of microturbines for auxiliary power would increase onboard electric power generation and reduce emissions. The anatomy of a microturbine is similar to a gas turbine used in an aircraft comprising compressor, combustor, turbine, alternator, recuperator, and generator. For small-scale power generation, microturbines for propulsion in aircraft offer many advantages over other technologies, including lesser moving parts, compatible size, lighter weight, better efficiency, lower emissions, and waste fuel utilization. These systems also allow recovery of waste heat, leading to efficiencies greater than 80%.

Based on Platform, the Advanced Air Mobility Segment is Estimated to Exhibit the Fastest Growth in the Aircraft Micro Turbine Engines Market From 2021 to 2030

Based on platform, the advanced air mobility segment is expected to witness the fastest growth during the forecast period (2021 to 2030). The unprecedented growth in urban population is envisioned to promote the development of hybrid air taxis and unmanned cargo delivery systems. Presently, several companies are focusing on the development of air taxis that are expected to be commercialized in the coming years. Air taxis can be piloted manually or flown autonomously and have the capability to take off and land vertically, making it easier for them to land in crowded locations in cities. For instance, Rolls- Royce (US) announced the development of a comprehensive hybrid aerospace turbine engine that is expected to pave the way for experimental flights on aircraft after 2021. The development includes a prototype of the APUS i-5 aircraft to demonstrate the commercial applications of hybrid-electric technology. The system could be used across a wide range of transport platforms, including VTOLs, to enable distributed electric propulsion in aircraft.

Hybrid architecture is being preferred for power powering intercity travel and cargo deliveries. With the establishment of a viable Beyond Visual Line of Operations (BVLOS) regulatory framework, the adoption of drones for point-to-point delivery of cargo and passengers is envisioned to increase. Japan is one of the few countries to have tested large UAVs for use in freight transport. Swiss Post and Swiss WorldCargo (Switzerland) are currently experimenting with drones for air freight solutions. Plans for commercial drones for freight have recently been announced by many companies, including Deutsche Post (DHL)(Germany), Zookal, Inc. (an Australian textbook service), and Amazon, Inc (US).

Aircraft Micro Turbine Engines Regions

The European Market is Projected to Contribute the Largest Share in 2021 in the Aircraft Micro Turbine Engines Market

Based on region, Europe is expected to lead the aircraft micro turbine engines market in 2021. The demand for stealth and durable aerial vehicles for use in military operations in Europe is expected to rise soon. Key players operating in the European market are entering into agreements and collaborations to develop technologies and platforms that can expand the applicability of aerial vehicles in border and coastal patrolling and homeland security. The UK government has permitted more than 130 private companies to fly UAVs in civilian airspace, while France has approved limited UAV operations for homeland security activities. The demand for compact and efficient propulsion systems to operate military drones will drive the aircraft micro turbine engines market. The rise in the number of development programs for electric aircraft, the development of aerial vehicles with advanced technologies, and the growth in air traffic are the major factors expected to add up to the growth of the market in this region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Micro Turbine Companies: Top Key Market Players

The Aircraft Micro Turbine Engines Market is dominated by a handful of established players, mainly due to the high technical expertise required to design the high-performance components of a micro turbine engine. The Aircraft Micro Turbine Companies are dominated by globally established players such as:

- Raytheon Technologies Corporation (US)

- Honeywell International Inc. (US)

- Kratos Defense & Security Solutions Inc. (US)

- Safran SA (France)

- UAV Turbines Inc. (US)

Major focus was given to the contracts and new product development due to the changing requirements of end-user industries globally.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 2.8 billion in 2021 |

|

Projected Market Size |

USD 4.5 billion by 2030 |

|

Growth Rate (CAGR) |

5.5% |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By installation, by end use, by platform, by horsepower, by engine type, by fuel type, and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Raytheon Technologies Corporation (US), Honeywell International Inc. (US), Kratos Defense & Security Solutions Inc. (US), Safran SA (France), and UAV Turbines Inc. (US) are some of the major players of aircraft micro turbine engines market. (17 Companies) |

The study categorizes the aircraft micro turbine engines market based on installation, end use, platform, horsepower, engine type, fuel type, and region.

By Installation

- Original Equipment Manufacturers

- Aftermarket

By End Use

- Propulsion

- Auxiliary Power

By Platform

-

General Aviation

- Light Aircraft

- Business Jets

- Commercial Aviation

-

Military Aviation

- Military Aircraft

- Military Drones

-

Advanced Air Mobility

- Air Taxis

- Cargo Drones

By Horsepower

- Below 50 HP

- 50 to 100 HP

- 100 to 200 HP

- Greater than 200 HP

By Engine Type

- Turbojet Micro Turbine Engines Market

- Turboshaft Micro Turbine Engines Market

- Turboprop Micro Turbine Engines Market

By Fuel Type

- Jet Fuel

- Multi Fuel

By Region

- North America

- Europe

- Asia Pacific

-

Rest of the World

- Middle East

- Latin America

Recent Developments

- In August 2021, the PBS Group launched the TJ80M, which is a small sub-sonic jet engine specially designed for UAVs and disposable aircraft. This engine has major upgrades and provides an excellent thrust-to-weight ratio.

- In February 2020, UAV Turbines Inc. launched a portable Micro Turbogenerator System 1.0, which meets the requirements of ground power and auxiliary power system. MTS 1.0 can provide on-demand electrical power ranging from 3 kW to 40 kW.

- In December 2019, UAV Turbines Inc. developed the Monarch Hybrid Range Extender (HREX), a microturbine-powered generator capable of extending the range of Unmanned Aircraft System (UAS).

Frequently Asked Questions (FAQ):

Which Are the Major Companies in the Aircraft Micro Turbine Engines Market? What Are Their Major Strategies to Strengthen Their Market Presence?

Some of the key players in the aircraft micro turbine engines market are key players in the market include Raytheon Technologies Corporation (US), Honeywell International Inc. (US), Kratos Defense & Security Solutions Inc. (US), Safran SA (France), and UAV Turbines Inc. (US), among others. Innovation through development of new products, solutions, and services was the major strategy adopted by these companies to strengthen their market presence.

What Are the Drivers and Opportunities for the Aircraft Micro Turbine Engines Market?

The growth of the aircraft micro turbine engines market can be mainly attributed to the growing development and adoption of compact and auxiliary power generation systems for aircraft. Nevertheless, the emergence of hybrid electric power generation technology and the development of distributed power generation systems are anticipated to open several growth opportunities for aircraft micro turbine engine manufacturers during the forecast period.

Which Region is Expected to Grow at the Highest Rate in the Next Five Years?

The market in North America is projected to grow at the highest CAGR of from 2021 to 2030, showcasing strong demand for such equipment in the region. The US is projected to be the major contributor to the regional share of the aircraft micro turbine engines market, driven by large investments for the development of electric and hybrid-electric aircraft and the emergence of several startups supporting the evolution of micro turbine engines in aviation industry.

Which Platform is Expected to Significantly Lead in the Coming Years?

The demand from the advanced air mobility sector is envisioned to be significant during the forecast period as the unprecedented growth in urban population is envisioned to promote the development of hybrid air taxis and unmanned cargo delivery systems.

Which Are the Key Technology Trends Prevailing in the Aircraft Micro Turbine Engines Market?

The advent of disruptive technologies, such as 3D printing and additive manufacturing is expected to boost performance for applications where design has not been optimized yet, such as, in microturbines, cost restrictions have forbidden manufacturing tricky features that enhance performance. Furthermore, the development of fuel agnostic micro gas turbine engines is also envisioned to drive the adoption of such systems as the fleet operators would be able to use natural gas for local operation or diesel to extend the range or outside areas with natural gas infrastructure.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

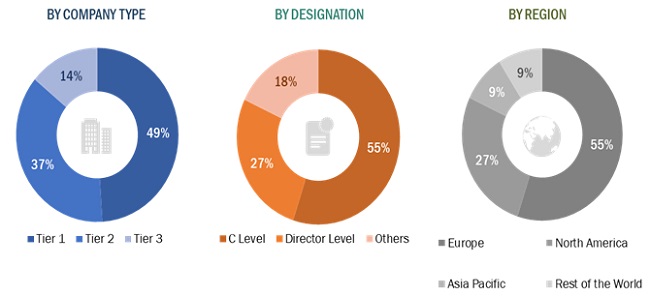

This research study on the aircraft micro turbine engines market involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources considered included industry experts, suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the aircraft micro turbine engines market as well as to assess prospects in the market.

Secondary Research

The ranking analysis of companies in the aircraft micro turbine engines market was determined using secondary data from paid and unpaid sources and by analyzing the product excellence of major companies operating in the market. These companies were rated based on the development and quality of their products. These data points were further validated by primary sources.

Secondary sources for this research study included financial statements of companies offering aircraft micro turbine engines and various trade, business, and professional associations, etc. Secondary data was collected and analyzed to arrive at the overall size of the aircraft micro turbine engines market, which were validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the aircraft micro turbine engines market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across all five major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

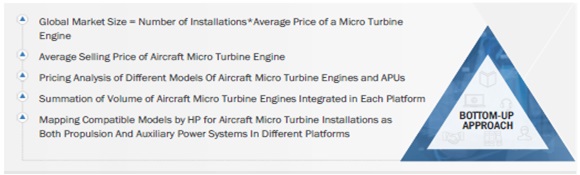

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the aircraft micro turbine engines market size. The research methodology used to estimate the size of the market includes the following details.

Secondary research identified key players in the aircraft micro turbine engines market, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with leaders such as chief executive officers, directors, and marketing executives of leading companies operating in the market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the aircraft micro turbine engines market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Aircraft Micro Turbine Engines Market Size: Top-Down Approach

Aircraft Micro Turbine Engines Market Size: Bottom-Up Approach

Data Triangulation

The data obtained from the processes explained above was verified and validated using the triangulation method to complete the market engineering process. The triangulation process was carried out for country-wise market estimations in terms of value. The following visually represents the data triangulation methodology used to validate and verify the information to arrive at the estimates.

Report Objectives

- To define, describe, and forecast the size of the aircraft micro turbine engines market based on solutions, verticals, technology, connectivity, frequency, platform, and region.

- To forecast the size of the various segments of the aircraft micro turbine engines market based on five regions—North America, Europe, Asia Pacific, and Rest of the World—along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Aircraft Micro Turbine Engines Market

Profiling of additional market players (up to 5)

Product Analysis

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aircraft Micro Turbine Engines Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Micro Turbine Engines Market