Waterjet Cutting Machine Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software, Services), Waterjet (Abrasive, Non-Abrasive), Product Type (Micro,3D, Robotic), Industry (Automotive, Aerospace, Food) and Region - Global Growth Driver and Industry Forecast to 2026

Updated on : November 28, 2024

The Waterjet Cutting Machine Market size is experiencing robust demand, driven by its versatility and efficiency across various industries, including manufacturing, aerospace, automotive, and construction. As businesses increasingly prioritize precision cutting and material versatility, the market is projected to witness substantial growth in the coming years. Key trends influencing this growth include advancements in automation and control technologies, which enhance the accuracy and speed of waterjet cutting processes. Additionally, the rising focus on environmentally friendly manufacturing practices is leading to a preference for waterjet cutting, as it produces minimal waste and eliminates harmful emissions associated with traditional cutting methods. Looking ahead, the future of the waterjet cutting machine market appears promising, with ongoing innovations in high-pressure technology and nozzle design set to further improve performance. As industries continue to adopt more efficient and sustainable production methods, the demand for waterjet cutting machines is expected to soar, solidifying their role as a critical tool in modern manufacturing.

Waterjet Cutting Machine Market Size

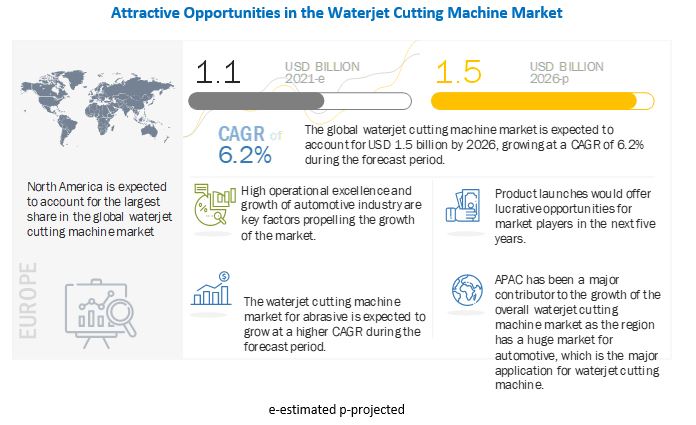

Global waterjet cutting machine market size is projected to reach USD 1.5 billion by 2026, Growing at a CAGR of 6.2% during the forecast period.

The market is driven by rising adoption of waterjet cutting machines across different industries, growing automotive industry, and operational excellence offered by waterjet cutting machine.

Moreover, growing inclination of SMEs towards industrial automation and increasing demand for waterjet cutting machine from industries in APAC are expected to to create high growth opportunities for the market over the forecast period. However, high cost of ownership and development of cost-effective technologies could affect the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Waterjet Cutting Machine Market Trends and Insights

The waterjet cutting machine market is poised for significant growth, driven by the increasing adoption of these machines across various industries. The market is projected to reach USD 1.5 billion by 2026, growing at a CAGR of 6.2% during the forecast period. Key factors contributing to this growth include the rising demand for efficient and versatile cutting solutions, fueled by industrialization and technological advancements. The market is also driven by the growing automotive industry and the increasing trend of process automation across various sectors, particularly in the Asia-Pacific region. Additionally, the introduction of advanced technologies like 3D cutting and multi-axis waterjet cutting is expected to further simplify the cutting process and expand the adoption of waterjet technology across different sectors.

Waterjet Cutting Machine Market Dynamics

How does waterjet cutting machines’ high operational excellence drive its market growth?

The waterjet cutting machine has a range of applications across industries. The waterjet cutting machine is flexible i.e. capable of cutting irregular shapes from any material with exceptional precision and edge quality. The waterjet cutting machine mixed with abrasive can cut almost any shape and thickness which includes bonded laminated materials such as aluminum composite panel and rubber-lined wear plates. Additionally, waterjet is a cold cutting process that eliminates problems caused by heat distortion and hardened edge, which offers an advantage for intricate metal fabrication and products which require additional machining after cutting. Furthermore, the waterjet cutting machine offers immediate high cutting quality ensures a precise result, avoiding an additional finishing process. This significantly accelerates the cutting process and saves time, increasing the overall efficiency.

What is the impact of high cost of ownership of waterjet cutting machine on market?

Waterjet cutting machines industry are capable of cutting materials such as rubber, gaskets, foam, metal, plastics, and composites. However, high energy consumption, sensitivity to environmental conditions, probability of improper selection, poor maintenance, high cost of ownership, and difficulties faced during fabrication are some of the major problems faced during the handling of any equipment. The energy consumed by waterjet cutting machines directly contributes to the operating cost of any company, which makes it a serious issue for the company. Additionally, there are several factors such as water, abrasive, labor, power, parts, and miscellaneous that can affect the hourly running cost of a waterjet cutting machine. Additionally, the advanced control software for waterjet cutting machine adds an extra cost for any company operating a waterjet cutting machine

Which industries and region is expected to create growth opportunities for the market?

Industries such as automotive, food, electronics, and aerospace in emerging markets are registering a high growth rate, which is projected to drive the market for waterjet cutting machines. Automation is considered the largest and fastest-growing segment in the cutting industry as it considerably increases productivity and safety and reduces time, which fuels the demand for waterjet cutting machines. Additionally, the increased population in APAC produces an increased demand for effective mobility.

Many countries across the APAC region stand out as strong competitors in the automotive sector. Countries such as Japan, China, and South Korea have car manufacturing companies.Waterjet cutting machines are likely to have a huge impact on the automotive, aerospace, and electronics industries, as they can be used to cut any materials used in industries.

How is development of cost-effective technologies challenging the market growth?

The waterjet cutting technology can be an expensive one for industries; however, they play an important part in various applications. Sensitivity, selectivity, stability, cost, and portability are the aspects that customers consider while purchasing such equipment. For instance, cutting machines based on waterjet technology are more expensive than machines based on traditional cutting technologies; however, these machines are far better in accuracy and reliability than the traditional ones. These devices are designed to meet requirements such as high sensitivity and selectivity but are highly-priced. Therefore, it remains a challenge to design a cost-effective technology that is affordable for consumers.

Waterjet Cutting Machine Market Segmentation Analysis:

By waterjet segment, Abrasive segment of waterjet cutting machine market to register for largest market in 2027

The abrasive waterjet cutting machines use abrasive materials in the high-pressure waterjet to cut the materials. These machines are used for cutting applications such as glass, metal, stone, and tile cutting. They are used in industries such as aerospace & defense, automotive, and metal fabrication.

By Industry segment, Automotive industry to create highest growth opportunities for the waterjet cutting machine market during the forecast period

The automotive industry is a key consumer of waterjet cutting machines. Waterjet cutting machines in automotive are used for cutting interior and exterior parts of the vehicles such as carpets, door panels, glass, rubbers, and dashboards. The use of waterjet cutting machines improves the flexibility of cutting equipment and enables ease with automation for the automotive industry, which drives the growth of the waterjet cutting machine market for this industry.

To know about the assumptions considered for the study, download the pdf brochure

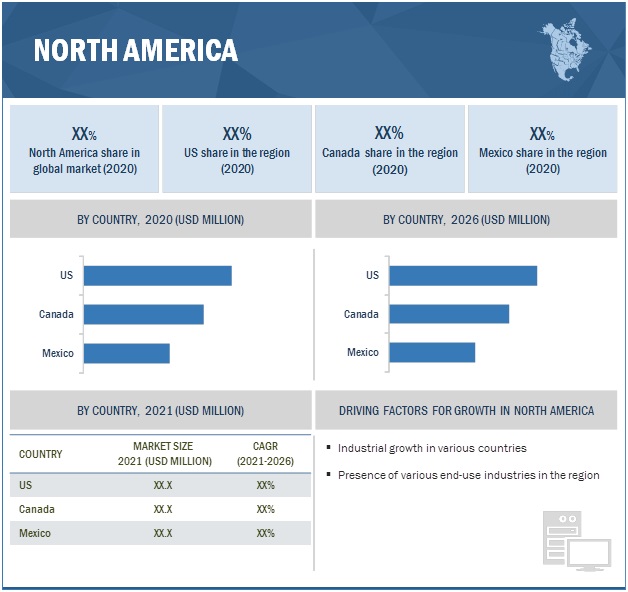

By Region, North America waterjet cutting machine market to account for the largest market share

In North America, the US is the largest market for waterjet cutting machines. The country has witnessed rapid growth in industries such as automotive, electronics, food, and aerospace. The growth in this market can be attributed to the large industrial base and high production capacity of companies in the country. The US is one of the largest automotive markets in the world and is home to several auto manufacturers, which is driving demand for waterjet cutting machines.

The Canadian manufacturing sector is dominated by the presence of a large number of small and medium-sized manufacturers. It has sophisticated infrastructure for various industries such as healthcare, automotive, and aerospace. Canada is one of the leading export economies in the world, with exports including automotive parts, and metals.

Waterjet Cutting Machine Companies - Market Key Players

The waterjet cutting machine companies have implemented various types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market. The major playersin the waterjet cutting machinemarket are :

- Omax (US),

- Flow (US),

- Koike Aronson (US),

- Wardjet (US),

- Dardi (China),

- Lincoln Electric (US),

- Techni Waterjet (Australia),

- KMT (US),

- Colfax (US),

- Waterjet Sweden (Sweden),

- Innovative (India),

- Hornet Cutting System (US),

- Jekran (Malta),

- STM waterjet (Austria),

- International Waterjet Machines (US),

- Waterjet Corporation (Italy),

- Swaterjet (China),

- Foshan Yongshengda Machinery (China),

- Resato (Netherlands),

- Accurl (US),

- LDSA (France),

- Kimtech (Sweden),

- Jet Edge (US),

- Microstep (Slovakia).

The study includes an in-depth competitive analysis of these key players in the waterjet cutting machinemarket with their company profiles, recent developments, and key market strategies.

Waterjet Cutting Machine Market Report Scope:

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 1.1 Billion |

| Projected Market Size | USD 1.5 Billion |

| Growth Rate | 6.2% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Operational excellence offered by waterjet cutting machine |

| Key Market Opportunity | High growth opportunities for the waterjet cutting machine market |

| Largest Growing Region | North America |

| Largest Market Share Segment | Abrasive Segment |

| Highest CAGR Segment | 3D waterjet cutting machine Segment |

| Largest Application Market Share | Automotive Application |

In this report, the overall waterjet cutting machine market has been segmented based on offering, waterjet, product type, industry, and region.

Waterjet Cutting Machine Market By Offerings Segment:

- Hardware

- Software

- Services

Waterjet Cutting Machine Market By Waterjet Segment:

- Abrasive

- Non-abrasive

Waterjet Cutting Machine Market By Product Type Segment:

- 3D

- Micro

- Robotic

Waterjet Cutting Machine Market By Industry Segment:

- Electronics

- Automotive

- Food

- Aerospace

- Metal Fabrication

- Construction

- Others

Waterjet Cutting Machine Market By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments in Waterjet Cutting Machine Industry

- In June 2020, Koike Aronson launched the ShopJet, a new waterjet cutting machine. The machine accommodates a wide range of cutting applications at an accessible cost.

- In April 2020, AXYZ Group added an exclusive 5-axis cutting head to its WARDJet range of waterjet cutting systems. The new system is called Apex-60. The system can cut at angles of up to 60 degrees using a cutting force of 39N and at a maximum speed of 50.8 m/minute.

- In August 2018,Omax expanded its Globalmax pump options with the launch of 10HP pump for GloblaMAX jet machining centers. The pump offers an economical option for an industrial abrasive waterjet and delivers 30,000 psi pressure to the cutting nozzle.

- In September 2018, Flow launched Mach 100, a cost-effective and versatile waterjet solution.

- In September 2018, Koike Aronson, with the help of NUM, developed a 5-axis CNC bevel head for its K-Jet waterjet cutting system. The cutting head is designed to combine ultrafast movement with precision positioning capabilities and is available with pumps up to 60,000-PSI capacity.

Frequently Asked Questions (FAQs):

Who are the top 5 players in the waterjet cutting machine market?

The major vendors operating in the portable projector market include Omax, Flow, Koike Aronson, Wardjet, and Dardi.

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are contract, acquisitions, product launches, and developments.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries..

What are the major applications of waterjet cutting machine?

The major applications of authentication and brand protection are aerospace, automotive, and food.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SNAPSHOT

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 INTRODUCTION

2.2 RESEARCH DESIGN

FIGURE 1 WATERJET CUTTING MACHINE MARKET: RESEARCH DESIGN

2.2.1 SECONDARY AND PRIMARY RESEARCH

2.2.2 SECONDARY DATA

2.2.2.1 Key data from secondary sources

2.2.3 PRIMARY DATA

2.2.3.1 Key data from primary sources

2.2.3.2 Key industry insights

2.2.3.3 Breakdown of primaries

2.2.4 MARKET SIZE ESTIMATION

2.2.5 BOTTOM-UP APPROACH

2.2.5.1 Approach for arriving at market size using bottom-up analysis

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.6 TOP-DOWN APPROACH

2.2.6.1 Approach for arriving at market size using top-down analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 WATERJET CUTTING MACHINE MARKET: SUPPLY-SIDE APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 COVID-19 IMPACT ON MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 ABRASIVE WATERJET CUTTING MACHINES TO ACCOUNT FOR LARGER MARKET SIZE IN 2021

FIGURE 9 3D WATERJET CUTTING MACHINES TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

FIGURE 10 MARKET FOR AUTOMOTIVE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA TO CAPTURE LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 MARKET, 2021–2026

FIGURE 12 ECONOMIC GROWTH AND EXPANSION OF AUTOMOTIVE INDUSTRY TO FUEL GROWTH OF MARKET IN APAC FROM 2021 TO 2026

4.2 MARKET, BY INDUSTRY

FIGURE 13 AUTOMOTIVE TO HOLD LARGEST SIZE OF MARKET IN 2026

4.3 MARKET, BY PRODUCT TYPE

FIGURE 14 3D WATERJET CUTTING MACHINES TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

4.4 MARKET, BY WATERJET

FIGURE 15 ABRASIVE WATERJET CUTTING MACHINES TO CAPTURE LARGER MARKET SIZE IN 2026

4.5 MARKET, BY OFFERING AND REGION

FIGURE 16 HARDWARE AND NORTH AMERICA TO BE LARGEST SHAREHOLDERS OF MARKET IN 2021

4.6 MARKET, BY GEOGRAPHY

FIGURE 17 US ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High operational excellence

5.2.1.2 Rise in adoption of waterjet cutting machines across industries

5.2.1.3 Growth of automotive industry

FIGURE 19 DRIVERS OF MARKET AND THEIR IMPACT

5.2.2 RESTRAINT

5.2.2.1 High ownership cost

FIGURE 20 RESTRAINT OF MARKET AND ITS IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for waterjet cutting machines from industries in APAC

5.2.3.2 Rising adoption of industrial automation in SMEs

FIGURE 21 OPPORTUNITIES FOR MARKET AND THEIR IMPACT

5.2.4 CHALLENGE

5.2.4.1 Development of cost-effective technologies

FIGURE 22 CHALLENGE FOR MARKET AND ITS IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MARKET

5.4 ECOSYSTEM

FIGURE 24 MARKET: ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.5 YC SHIFT

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 IMPACT OF EACH FORCE ON MARKET (2020)

5.7 CASE STUDY

5.7.1 USE CASE 1: JET EDGE HELPED JACQUET TO PROVIDE METAL PARTS WITH HIGHER ACCURACY

5.7.2 USE CASE 2: HYDROCUT HELPED MILACRON TO CUT DOWN REQUIRED SECONDARY PROCESS

5.8 TECHNOLOGY TRENDS

5.8.1 PREDICTIVE MAINTENANCE

5.8.2 DIGITAL TWINS

5.8.3 ROBOTICS

5.8.4 ADVANCED SOFTWARE

5.8.5 ARTIFICIAL INTELLIGENCE

5.9 PRICING ANALYSIS

5.9.1 WATERJET CUTTING MACHINES

TABLE 4 COST PER HOUR FOR ABRASIVE WATERJET CUTTING MACHINES

TABLE 5 COST OF ABRASIVE WATERJET CUTTING MACHINES FOR DIFFERENT DESIGNS

5.10 TRADE ANALYSIS

FIGURE 25 IMPORT DATA OF MACHINE TOOLS, BY COUNTRY, 2017–2020 (USD MILLION)

FIGURE 26 EXPORT DATA OF MACHINE TOOLS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 6 IMPORT OF WATERJET CUTTING MACHINES, BY REGION, 2017–2020 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 27 TOP 10 COMPANIES WITH HIGHEST PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 28 NUMBER OF PATENTS GRANTED PER YEAR OVER LAST 10 YEARS

TABLE 7 TOP PATENT OWNERS (US) IN LAST 10 YEARS

5.12 REGULATORY LANDSCAPE

5.12.1 SAFETY INTEGRITY LEVEL

5.12.2 INDUSTRIAL SAFETY STANDARDS

5.12.3 GENERAL MACHINE TOOLS STANDARDS

6 WATERJET CUTTING MACHINE MARKET, BY APPLICATION (Page No. - 71)

6.1 INTRODUCTION

6.2 GLASS

6.3 METAL

6.4 GASKET

6.5 FOAM

7 WATERJET CUTTING MACHINE MARKET, BY OFFERING (Page No. - 72)

7.1 INTRODUCTION

FIGURE 29 MARKET, BY OFFERING

FIGURE 30 HARDWARE TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

TABLE 8 MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 9 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

7.2.1 HARDWARE TO HOLD LARGEST SIZE OF GLOBAL MARKET IN 2021

7.2.2 PUMPS

7.2.2.1 Direct drive waterjet pumps

7.2.2.2 Hydraulic intensifier waterjet pumps

7.2.2.3 Pressure range

7.2.2.3.1 Pressure range less than 4,200

7.2.2.3.2 Pressure range above 4,200

7.2.3 ACCUMULATORS

7.2.4 CONTROL SYSTEMS

7.2.5 CONTROL VALVES

7.2.6 ABRASIVE DELIVERY SYSTEMS

7.2.7 NOZZLES

7.3 SOFTWARE

7.3.1 USE OF SOFTWARE TO CREATE DEMAND IN COMING YEARS

7.4 SERVICES

7.4.1 MARKET FOR SERVICES TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

8 WATERJET CUTTING MACHINE MARKET, BY WATERJET (Page No. - 77)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY WATERJET

FIGURE 32 ABRASIVE TO ACCOUNT FOR LARGER SIZE OF MARKET IN 2021

TABLE 10 MARKET, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 11 MARKET, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 12 MARKET, 2017–2020 (MILLION UNITS)

TABLE 13 MARKET, 2021–2026 (MILLION UNITS)

8.2 ABRASIVE

8.2.1 3D WATERJET CUTTING MACHINES TO HOLD LARGEST SIZE OF ABRASIVE MARKET IN 2026

TABLE 14 ABRASIVE MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 15 ABRASIVE MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 16 ABRASIVE MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 17 ABRASIVE MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 18 ABRASIVE MARKET FOR ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 ABRASIVE MARKET FOR ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 20 ABRASIVE MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 ABRASIVE MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 ABRASIVE MARKET FOR AEROSPACE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 ABRASIVE MARKET FOR AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

TABLE 24 ABRASIVE MARKET FOR METAL FABRICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 ABRASIVE MARKET FOR METAL FABRICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 ABRASIVE MARKET FOR CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 ABRASIVE MARKET FOR CONSTRUCTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 28 ABRASIVE MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 ABRASIVE MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 MARKET FOR ABRASIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR ABRASIVE, BY REGION, 2021–2026 (USD MILLION)

8.3 NON-ABRASIVE

8.3.1 AUTOMOTIVE INDUSTRY IS MAJOR END USER OF NON-ABRASIVE WATERJET CUTTING MACHINES

TABLE 32 NON-ABRASIVE MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 33 NON-ABRASIVE MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 34 NON-ABRASIVE MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 35 NON-ABRASIVE MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 36 NON-ABRASIVE MARKET FOR ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 NON-ABRASIVE MARKET FOR ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 NON-ABRASIVE MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 NON-ABRASIVE MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 NON-ABRASIVE MARKET FOR AEROSPACE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 NON-ABRASIVE MARKET FOR AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 NON-ABRASIVE MARKET FOR FOOD, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 NON-ABRASIVE MARKET FOR FOOD, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 NON-ABRASIVE MARKET FOR METAL FABRICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 NON-ABRASIVE MARKET FOR METAL FABRICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 NON-ABRASIVE MARKET FOR CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 NON-ABRASIVE MARKET FOR CONSTRUCTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 48 NON-ABRASIVE MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 NON-ABRASIVE MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR NON-ABRASIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MARKET FOR NON-ABRASIVE, BY REGION, 2021–2026 (USD MILLION)

9 WATERJET CUTTING MACHINE MARKET, BY PRODUCT TYPE (Page No. - 94)

9.1 INTRODUCTION

FIGURE 33 MARKET, BY PRODUCT TYPE

FIGURE 34 3D WATERJET CUTTING MACHINES TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

TABLE 52 MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 53 MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

9.2 MICRO WATERJET CUTTING MACHINES

9.2.1 AUTOMOTIVE INDUSTRY HOLDS LARGEST SHARE OF MICRO MARKET

TABLE 54 MICRO MARKET, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 55 MICRO MARKET, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 56 MICRO MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 57 MICRO MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.3 3D WATERJET CUTTING MACHINES

9.3.1 ABRASIVE 3D WATERJET CUTTING MACHINES TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

TABLE 58 3D MARKET, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 59 3D MARKET, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 60 3D MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 61 3D MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.4 ROBOTIC WATERJET CUTTING MACHINES

9.4.1 AUTOMOTIVE INDUSTRY IS MAJOR END USER OF ROBOTIC WATERJET CUTTING MACHINES

TABLE 62 ROBOTIC MARKET, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 63 ROBOTIC MARKET, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 64 ROBOTIC MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 65 ROBOTIC MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

10 WATERJET CUTTING MACHINE MARKET, BY INDUSTRY (Page No. - 102)

10.1 INTRODUCTION

FIGURE 35 MARKET, BY INDUSTRY

FIGURE 36 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

TABLE 66 MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 67 MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

10.2 ELECTRONICS

10.2.1 ADVANCEMENTS IN ELECTRONICS INDUSTRY ENCOURAGE ADOPTION OF WATERJET CUTTING MACHINES TO ENHANCE PRODUCTIVITY

TABLE 68 MARKET FOR ELECTRONICS, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR ELECTRONICS, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR ELECTRONICS, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR ELECTRONICS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 72 MARKET FOR ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

10.3 AUTOMOTIVE

10.3.1 INCREASING INVESTMENTS BY AUTOMOTIVE MANUFACTURERS TO SURGE DEMAND FOR WATERJET CUTTING MACHINES

TABLE 74 MARKET FOR AUTOMOTIVE, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR AUTOMOTIVE, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 76 MARKET FOR AUTOMOTIVE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 77 MARKET FOR AUTOMOTIVE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 78 MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

10.4 AEROSPACE

10.4.1 USE OF WATERJET CUTTING MACHINES FOR CUTTING ENGINE PARTS, BRAKE COMPONENTS, AND AIRCRAFT BODIES TO BOOST MARKET GROWTH

TABLE 80 MARKET FOR AEROSPACE, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 81 MARKET FOR AEROSPACE, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 82 MARKET FOR AEROSPACE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR AEROSPACE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 84 MARKET FOR AEROSPACE, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MARKET FOR AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

10.5 FOOD

10.5.1 INVESTMENTS IN FOOD INDUSTRY ARE EXPECTED TO DRIVE MARKET FOR WATERJET CUTTING MACHINES

TABLE 86 MARKET FOR FOOD, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 87 MARKET FOR FOOD, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 88 MARKET FOR FOOD, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 89 MARKET FOR FOOD, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 90 MARKET FOR FOOD, BY REGION, 2017–2020 (USD MILLION)

TABLE 91 MARKET FOR FOOD, BY REGION, 2021–2026 (USD MILLION)

10.6 METAL FABRICATION

10.6.1 WATERJET CUTTING MACHINES OFFER HIGH PRECISION REQUIRED IN METAL INDUSTRY

TABLE 92 MARKET FOR METAL FABRICATION, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 93 MARKET FOR METAL FABRICATION, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 94 MARKET FOR METAL FABRICATION, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 95 MARKET FOR METAL FABRICATION, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 96 MARKET FOR METAL FABRICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 MARKET FOR METAL FABRICATION, BY REGION, 2021–2026 (USD MILLION)

10.7 CONSTRUCTION

10.7.1 ABRASIVE MARKET FOR CONSTRUCTION INDUSTRY TO HOLD LARGER SIZE FROM 2021 TO 2026

TABLE 98 MARKET FOR CONSTRUCTION, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 99 MARKET FOR CONSTRUCTION, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 100 MARKET FOR CONSTRUCTION, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 101 MARKET FOR CONSTRUCTION, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 102 MARKET FOR CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 103 MARKET FOR CONSTRUCTION, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHERS

TABLE 104 MARKET FOR OTHERS, BY WATERJET, 2017–2020 (USD MILLION)

TABLE 105 MARKET FOR OTHERS, BY WATERJET, 2021–2026 (USD MILLION)

TABLE 106 MARKET FOR OTHERS, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 107 MARKET FOR OTHERS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 108 MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

11 WATERJET CUTTING MACHINE MARKET, GEOGRAPHIC ANALYSIS (Page No. - 120)

11.1 INTRODUCTION

FIGURE 37 MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 38 NORTH AMERICA TO CAPTURE LARGEST SIZE OF MARKET IN 2026

TABLE 110 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 111 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 112 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 US to hold largest market size in North America during forecast period

11.2.2 CANADA

11.2.2.1 Increasing government support for manufacturing to encourage market growth

11.2.3 MEXICO

11.2.3.1 Presence of various industries to create growth opportunity for market

11.3 EUROPE

FIGURE 40 EUROPE: MARKET SNAPSHOT

TABLE 116 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 118 MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 119 MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Increase in vehicle production to drive market

11.3.2 UK

11.3.2.1 Rising demand from food industry to create market growth opportunity

11.3.3 FRANCE

11.3.3.1 Growing aviation industry to boost demand for waterjet cutting machines

11.3.4 REST OF EUROPE

11.4 APAC

FIGURE 41 APAC: MARKET SNAPSHOT

TABLE 120 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Growing automotive industry to boost market growth during forecast period

11.4.2 INDIA

11.4.2.1 Growing manufacturing sector to drive market

11.4.3 JAPAN

11.4.3.1 Increasing growth in automotive industry to propel market growth

11.4.4 SOUTH KOREA

11.4.4.1 Growing automotive industry to create an opportunity for MARKET

11.4.5 REST OF APAC

11.5 REST OF THE WORLD

FIGURE 42 ROW: MARKET SNAPSHOT

TABLE 124 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 126 MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 127 MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Leading emerging economies to account for largest market share of region

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Market in Middle East to grow at significant rate

12 COMPETITIVE LANDSCAPE (Page No. - 138)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

TABLE 128 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS OF MARKET

12.3 MARKET SHARE ANALYSIS, 2020

TABLE 129 MARKET: DEGREE OF COMPETITION

12.4 COMPANY EVALUATION MATRIX

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 43 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.5 STARTUP/SME EVALUATION MATRIX

12.5.1 PROGRESSIVE COMPANY

12.5.2 RESPONSIVE COMPANY

12.5.3 DYNAMIC COMPANY

12.5.4 STARTING BLOCK

FIGURE 44 STARTUP/SME EVALUATION MATRIX

TABLE 130 COMPANY APPLICATION FOOTPRINT

TABLE 131 COMPANY REGION FOOTPRINT

TABLE 132 COMPANY FOOTPRINT

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.7 PRODUCT LAUNCHES

TABLE 133 MARKET: PRODUCT LAUNCHES, MAY 2019–MARCH 2021

12.7.1 DEALS

TABLE 134 MARKET: DEALS, APRIL 2019–JANUARY 2021

13 COMPANY PROFILES (Page No. - 150)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services, Recent Developments, and MnM View)*

13.2.1 COLFAX CORPORATION

TABLE 135 COLFAX: BUSINESS OVERVIEW

FIGURE 45 COLFAX: COMPANY SNAPSHOT

13.2.2 OMAX

TABLE 136 OMAX: BUSINESS OVERVIEW

13.2.3 FLOW INTERNATIONAL

TABLE 137 FLOW INTERNATIONAL: BUSINESS OVERVIEW

13.2.4 KOIKE ARONSON

TABLE 138 KOIKE ARONSON: BUSINESS OVERVIEW

13.2.5 DARDI

TABLE 139 DARDI INTERNATIONAL: BUSINESS OVERVIEW

13.2.6 WARDJET

TABLE 140 WARDJET: BUSINESS OVERVIEW

13.2.7 LINCOLN ELECTRIC

TABLE 141 LINCOLN ELECTRIC: BUSINESS OVERVIEW

FIGURE 46 LINCOLN ELECTRIC: COMPANY SNAPSHOT

13.2.8 TECHNI WATERJET

TABLE 142 TECHNI WATERJET: BUSINESS OVERVIEW

13.2.9 KMT

TABLE 143 KMT: BUSINESS OVERVIEW

13.2.10 WATERJET SWEDEN

TABLE 144 WATERJET SWEDEN: BUSINESS OVERVIEW

13.2.11 A INNOVATIVE INTERNATIONAL

TABLE 145 AINNOVATIVE: BUSINESS OVERVIEW

13.2.12 SEMYX

TABLE 146 SEMYX: BUSINESS OVERVIEW

* Business Overview, Products/Solutions/Services, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.3 OTHER PLAYERS

13.3.1 HORNET CUTTING SYSTEMS

13.3.2 JEKRAN

13.3.3 STM WATERJET

13.3.4 INTERNATIONAL WATERJET MACHINES

13.3.5 WATERJET CORPORATION

13.3.6 SWATERJET

13.3.7 FOSHAN YONGSHENGDA MACHINERY

13.3.8 RESATO INTERNATIONAL

13.3.9 ACCURL

13.3.10 LDSA

13.3.11 KIMTECH

13.3.12 JET EDGE

13.3.13 MICROSTEP

13.3.14 MECANUMERIC

13.3.15 MEYER MICRO WATERJET

14 ADJACENT AND RELATED MARKET (Page No. - 179)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 CNC CONTROLLER MARKET

14.3.1 DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 CNC CONTROLLER MARKET, BY INDUSTRY

TABLE 147 CNC CONTROLLER MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 148 CNC CONTROLLER MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

14.4 AEROSPACE

14.4.1 CRITICAL COMPONENTS REQUIRE CNC MACHINES FOR PRECISE MANUFACTURING

TABLE 149 CNC CONTROLLER MARKET FOR AEROSPACE, BY REGION, 2017–2020 (USD MILLION)

TABLE 150 CNC CONTROLLER MARKET FOR AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

14.5 AUTOMOTIVE

14.5.1 RISING DEMAND FOR MASS PRODUCTION IN AUTOMOTIVE INDUSTRY TO LEAD TO ADOPTION OF CNC MACHINES

TABLE 151 CNC CONTROLLER MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 152 CNC CONTROLLER MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

14.6 MEDICAL DEVICES

14.6.1 NORTH AMERICA DOMINATES MARKET FOR MEDICAL DEVICES, IN TERMS OF SIZE

TABLE 153 CNC CONTROLLER MARKET FOR MEDICAL DEVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 154 CNC CONTROLLER MARKET FOR MEDICAL DEVICES, BY REGION, 2021–2026 (USD MILLION)

14.7 METALS & MINING

14.7.1 RISING DEMAND FOR FABRICATED METAL PARTS TO LEAD TO MARKET GROWTH

TABLE 155 CNC CONTROLLER MARKET FOR METALS & MINING, BY REGION, 2017–2020 (USD MILLION)

TABLE 156 CNC CONTROLLER MARKET FOR METALS & MINING, BY REGION, 2021–2026 (USD MILLION)

14.8 SEMICONDUCTOR & ELECTRONICS

14.8.1 ADOPTION OF CNC MACHINES IN SEMICONDUCTOR & ELECTRONICS IS NEGATIVELY IMPACTED DUE TO COVID-19

TABLE 157 CNC CONTROLLER MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 158 CNC CONTROLLER MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

14.9 OTHERS

TABLE 159 CNC CONTROLLER MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 160 CNC CONTROLLER MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 189)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

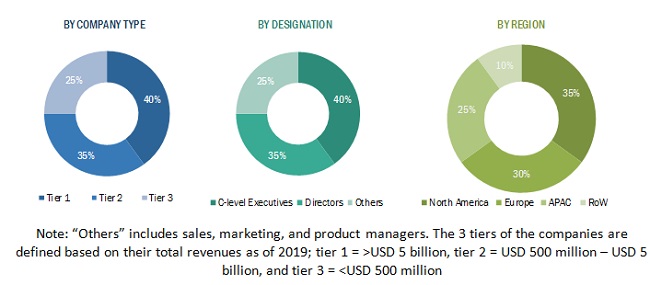

The study involves four major activities for estimating the size of the waterjet cutting machine market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the waterjet cutting machine market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as the Waterjet Technology Association, Indian Machine Tool Manufacturer’s Association, and European Association of the Machine Tool Industries and related Manufacturing Technologies have been used to identify and collect information for an extensive technical and commercial study of the waterjet cutting machine market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the waterjet cutting machine market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the waterjet cutting machine market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the waterjet cutting machine market, in terms of value, segmented by offering, waterjet, product type, and industry

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the COVID-19 impact on the waterjet cutting machine market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To provide a detailed overview of the value chain of the waterjet cutting machine ecosystem

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailed competitive landscape for the market leaders

- To analyze the major growth strategies implemented by the key market player, such as product launch.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Waterjet Cutting Machine Market

Hi, Could I please have a sample/overview of this report to help my student working as an intern at a waterjet company?