The study used four major activities to estimate the market size of the smart glass. Esxhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the smart glass market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the smart glass market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the Semiconductor Industry Association (SIA), Electronic System Design Alliance (ESD Alliance), Institute of Electrical and Electronics Engineers (IEEE), Taiwan Semiconductor Industry Association (TSIA), European Semiconductor Industry Association (ESIA), and Korea Semiconductor Industry Association (KSIA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the market. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

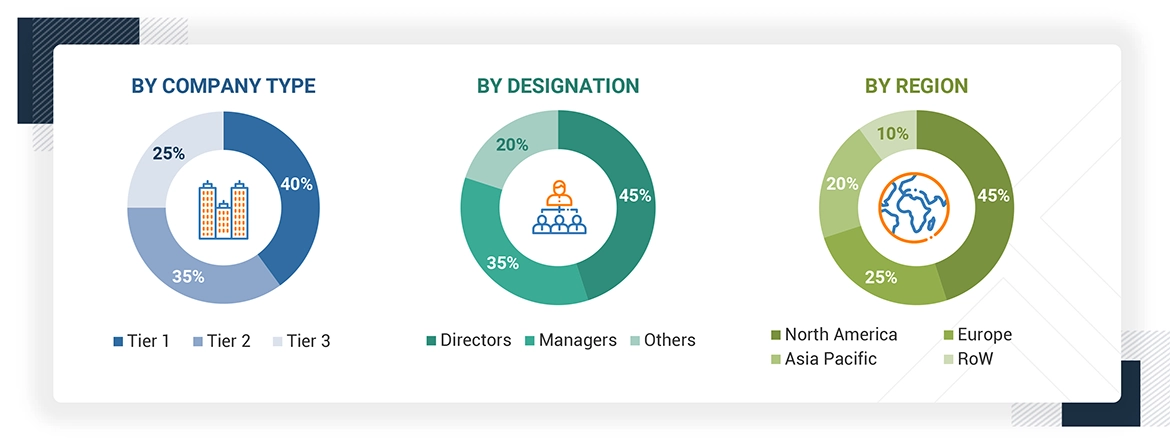

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the smart glass ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the smart glass market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the smart glass market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Smart Glass Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the smart glass market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Smart glass, also known as switchable, dimmable, or magic glass, can adjust the light transmission properties dynamically or statically, depending on the stimuli. The stimuli altering the light transmission properties could be light, voltage, or heat. It does not require electricity to maintain its opacity or change color. The installation of smart glass helps reduce the energy spent on heating, ventilation, and air conditioning (HVAC) and lighting systems and improves the indoor environmental quality of buildings. Electrochromic glass, which can be directly controlled by building occupants, is popular for enhancing occupant comfort, maximizing access to daylight and outdoor views, reducing energy costs, and providing architects with more design freedom.

Key Stakeholders

-

Smart glass manufacturers

-

Building material suppliers

-

Switchable (metal-oxide) film manufacturers

-

Dimmable/smart glass film manufacturers

-

Aerospace and automotive glass industry players

-

Architects and building owners

-

Smart glass-related technology investors

-

Advanced glass and film technology researchers and developers

-

End users

-

Research institutes and organizations

-

Market research and consulting firms

-

Smart glass buyers

-

Smart glass technology providers

Report Objectives

-

To describe and forecast the smart glass market by type, technology, mechanism, control system, end use, and region, in terms of value

-

To describe and forecast the market for various segments across four central regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

-

To strategically analyze the micro markets with regard to the individual growth trends, prospects, and contribution to the market

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To analyze opportunities for stakeholders by identifying high-growth segments in the market

-

To provide a detailed overview of the value chain

-

To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios trade landscape, and case studies pertaining to the market under study

-

To strategically profile key players in the smart glass market and comprehensively analyze their market shares and core competencies

-

To strategically profile the key players and provide a detailed competitive landscape of the market

-

To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with research and development (R&D) in the smart glass market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the smart glass market

Product Analysis

-

Product matrix provides a detailed comparison of the product portfolio of each company in the smart glass market.

Darren

Sep, 2014

Do you have forecasts for the total glass market that would serve as the potential for retrofitting/replacement with Smart Glass?.

vishnu

Dec, 2015

Reasons why photochromic technology has not been incorporated for manufacturing of smart glass? Details such as it's cost, technological short comings, etc. .

kee

Sep, 2014

I want the list of manufacturers of smart glasses in US with their product prices, because I will sale the best one in KSA as representative of best products..

Lisa

Apr, 2017

I came across your report and the segments "Consumer Electronics" and "Power Generation Plant" really caught my eye. What we primarily do is manufacture these glasses for aircraft, vehicles and buildings. If you could explain what goes into consumer electronics and solar power generation, I could have a word with my manager and we could take this ahead. Looking forward to your timely response..

George

Apr, 2016

I am interested in Smart Glasses + Touched, separately. Information for the European and Middle East markets , if there are any import figures / country , and market shares among the producing companies , and any general marketing info's !.

George

Apr, 2016

I am interested in Smart Glasses + Touched, separately. Information for the European and Middle East markets , if there are any import figures / country , and market shares among the producing companies , and any general marketing info's !.

Gerard

Feb, 2017

I'm looking for data on enterprise use of smart glasses, to create a graphic to accompany a Wall Street Journal article..

Aurelio

Dec, 2017

I am only interested in the Automotive sector for smart glass report. So if you could customize it so we could reduce the whole report scope I'd appreciate a new quote, considering the actual price is way over my budget..

Yvonne

Dec, 2014

We have a client who is interested in the smart glass market. He is especially interested in data about installed square meter of facades, installed square meters of glass and installed square meter of smart glass in the following regions: World, Europe, Germany. Further he is interested in the potential of smart glass in the future. We would like to know if the study comprises such data? Furthermore which sources you used to get the data (in general)? Our client likes to purchase a study, but is uncertain about the quality of the data. I would very much appreciate your support. It is possible to get a sample?.

Mike

Oct, 2014

I am interested in penetration and growth rates of the major smart glass players (Sage, View, Gauzy, Scienstry, Pleating) .

CHNG

Jan, 2019

I want to know market trend of using smart glass in 10 years down the road; or any related information about smart glass..

Karen

Jul, 2014

Our company is interested in know more about Smart Glass applications in Aerospace industry, in order to start a pilot trial in our MRO..

Addison

May, 2017

I am interested in knowing the Architecture growth in North America, energy savings, renovation vs new construction. Also, which company has best technology?.

Yasuyuki

Oct, 2019

We are examining the needs of smart glass and the market price. Also, I would like to know why it is expanding in the West and not in Asia..