Waterproof Tapes Market by Resin (Acrylic, Silicone, Butyl), Substrate Type (Plastic, Metal, Rubber), End-Use Industry (Electrical & Electronics, Automotive, Building & Construction, Healthcare, Packaging) and Region - Global Forecast to 2027

Updated on : August 28, 2025

Waterproof Tapes Market

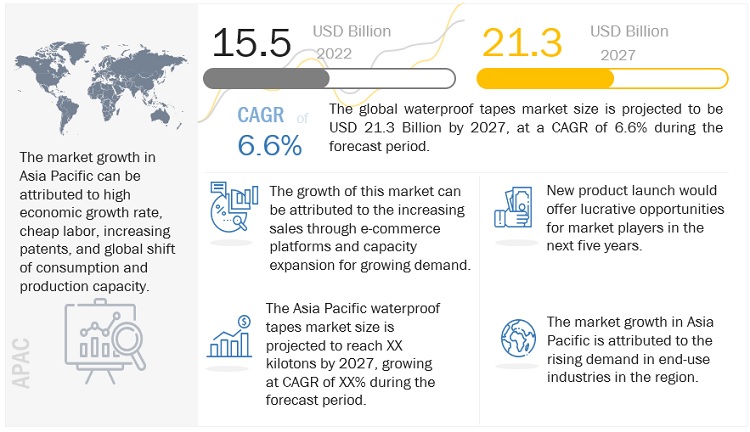

The global waterproof tapes market was valued at USD 15.5 billion in 2022 and is projected to reach USD 21.3 billion by 2027, growing at 6.6% cagr from 2022 to 2027. The healthcare industry, by end-use segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for waterproof tapes.

Attractive Opportunities in the Waterproof Tapes Market

Note: e – estimated, p - projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Waterproof Tapes Market Dynamics

Drivers: Capacity expansion for increasing demand

Capacity expansion is one of the strategies used by many manufacturers to increase business volume. Increasing demand always necessitates elevated production capacity, but it should also be understood in terms of a critical zone of the value chain, which is an investment. As a result, capacity must be defined in terms of process machinery and manpower. Manufacturers generally pursue a "lead capacity strategy," looking for developing countries that will serve as future industrial hubs. Most developing countries have a lot of room for development, construction, and new industrial setup, and waterproof tapes are in high demand due their cost effectiveness and durable nature. Though the initial setup cost is quite high, many manufacturers are opting for production capacity expansion after observing immense market potential and long-term ROI.

Restraints: Impact of COVID and Russia-Ukraine war

The overall waterproof tapes market has been highly impacted due to the COVID crisis. Consequences of the pandemic were faced by all the sectors, construction being one of those impacted badly. The construction sector is considered one of the economic pillars of any country. Due to lack of labor and a hampered supply chain of raw materials, waterproof tapes market saw drastic downward trend in that period. Overall, consumers stopped buying goods, which led to a decrease in demand and hence led the manufacturers to shutting down factories. Several industries suffered tremendous decline due to the economic fluctuations, resulting in a lowering of cost and inventory by the supply side. A similar impact has been seen due to the conditions created by the Russia-Ukraine conflict. The supply has stopped for a few materials, which is hampering the cost of the final product. Many prime leaders of the waterproof tapes market have set up manufacturing in these regions, and thus are heavily affected by the war.

Opportunities: Establishing authenticity through various certification

The integrity of functionality and product durability has been a paramount concern of the consumers and has been a key factor for determining the purchase of these products. Companies rely on clean labels and natural certification, which shows the authenticity of the product. These labels further increase the legitimacy of raw materials used in the final product sourced from an approved entity. Waterproof tape manufacturers are investing in these certification labels which would increase their demand. However, packaging of the end product also plays a vital role while purchasing the product, so in order to highlight these certified norms and also to avoid counterfeiting, manufacturers should also concentrate on packaging.

Challenges: Low product differentiation

Waterproof tapes have limited number of end-use industries, and each of them has different regulations for the use of these tapes. Manufacturers cannot alter the specifications of the product to comply with the regulations. Almost same quality products are being provided to each of the industries by different manufacturers. Therefore, there is no scope for product differentiation in the waterproof tapes market, which is a major challenge for the growth of the market, globally.

Electrical & Electronics application accounted for the largest segment of the waterproof tapes market.

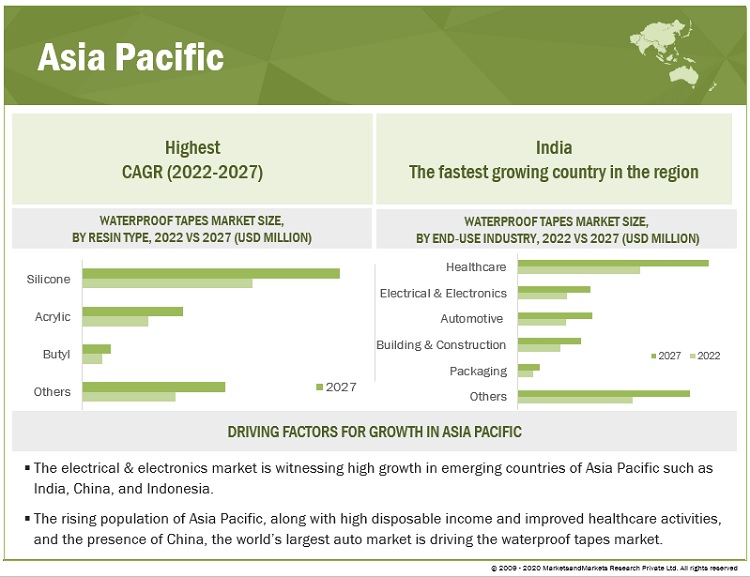

The electrical & electronics market is witnessing high growth in emerging countries of Asia Pacific such as India, China, and Indonesia. Waterproof tapes are used for motor lead insulation, electrical distribution connections, insulating generator coils, electrical conductors, high-voltage cables, bus bar insulations, and jacketing on high-voltage terminations. These high growth application areas will drive the demand for waterproof tapes in the electrical & electronics industry.

Silicone is the fastest resin type segment of the waterproof tapes market.

Silicone resin segment dominated the waterproof tapes market and is the fastest-growing resin type in terms of both value and volume. Silicone resin is preferred because of its superior properties, such as high-water resistance, high heat resistance high peel strength, good adhesion to many substrates, and superior chemical resistance. Typical applications include industrial equipment, automotive interior components, metal furniture, and appliances.

Plastic accounted for the largest substrate type segment of the waterproof tapes market.

Plastic is the largest substrate type segment of waterproof tapes market in terms of both value and volume. The use of waterprrof tapes on plastic substrate helps in reducing cost, time, and waste associated with the use of traditional mechanical fasteners and welding to provide structural integrity to the assemblies. Most of the design assemblies in various industries such as automotive, marine, and aerospace, use waterproof tapes on plastic substrates.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is the fastest-growing waterproof tapes market.

Asia Pacific is the fastest waterproof tapes market in terms of value and volume during the forecast period. The region has witnessed significant economic growth over the last decade.

Waterproof Tapes Market Players

3M (US), Nitto Denko Corporation (Japan), tesa SE (Germany), Johnson & Johnson (US), and Henkel AG & CO. KGAA (Germany) are the key players in the global Waterproof tapes market.

tesa SE is one of the leading manufacturers of adhesive tapes and self-adhesive system solutions for industry retailers and consumers. It operates mainly through two divisions—direct industries and trade markets. The direct industries division is further segmented into automotive, electronic, printing & paper, and building & construction industries. The trade markets segment is further segmented into general industrial markets and consumer and craftsmen. The company sells more than 7,000 products through 61 affiliates in more than 100 countries and has 14 production sites. It is wholly owned by Beiersdorf AG (Germany).

Waterproof Tapes Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2018-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Johnson & Johnson (US), and Henkel AG & CO. KGAA (Germany). A total of 24 players have been covered. |

This research report categorizes the waterproof tapes market based on type, end-use industry, and region.

By Resin Type:

- Acrylic

- Butyl

- Silicone

- Others

By Substrate Type:

- Plastic

- Metal

- Rubber

- Others

By End-Use Industry:

- Electrical & Electronics

- Automotive

- Building & Construction

- Healthcare

- Packaging

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2022, tesa, the international manufacturer of innovative adhesive tapes and self-adhesive system solutions, is launching an assortment of flame-retardant adhesive tapes. The new tape tesa flameXtinct, which is already used successfully in the construction industry, is now also employed in the transport industry and in passenger transport. The special features: In the event of a fire, these new adhesive tapes self-extinguish after a short time, and they are completely halogen-free.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of waterproof tapes?

The global waterproof tapes market is driven by sales through e-commerce platforms gaining rapid momentum.

What are the major applications for waterproof tapes?

The major end-use industries of waterproof tapes are electrical and electronics, automotive, building & construction, healthcare, packaging, and others.

Who are the major manufacturers?

3M (US), Nitto Denko Corporation (Japan), tesa SE (Germany), Johnson & Johnson (US), and Henkel AG & CO. KGAA (Germany) are some of the leading players operating in the global Waterproof tapes market.

Why waterproof tapes are gaining market share?

The growth of this market is attributed to the growing strategic partnership and inorganic approach towards growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 WATERPROOF TAPES MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 WATERPROOF TAPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 WATERPROOF TAPES MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

2.6 RESEARCH LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.8 PRICING ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 1 WATERPROOF TAPES MARKET SNAPSHOT (2022 VS. 2027)

FIGURE 6 SILICONE RESIN TYPE OF WATERPROOF TAPES DOMINATED MARKET IN 2021

FIGURE 7 PLASTIC SUBSTRATE TYPE LED MARKET IN 2021

FIGURE 8 HEALTHCARE END-USE INDUSTRY SEGMENT LED IN 2021

FIGURE 9 ASIA PACIFIC IS LARGEST AND FASTEST-GROWING MARKET FOR WATERPROOF TAPES

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN WATERPROOF TAPES MARKET BETWEEN 2022 AND 2027

FIGURE 10 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES TO MARKET PLAYERS BETWEEN 2022 AND 2027

4.2 WATERPROOF TAPES MARKET, BY RESIN TYPE

FIGURE 11 SILICONE SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

4.3 WATERPROOF TAPES MARKET, BY SUBSTRATE TYPE

FIGURE 12 PLASTIC SUBSTRATE TO LEAD WATERPROOF TAPES MARKET DURING FORECAST PERIOD

4.4 ASIA PACIFIC: WATERPROOF TAPES MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 13 ELECTRICAL & ELECTRONICS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

4.5 WATERPROOF TAPES MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 14 WATERPROOF TAPES MARKET TO REGISTER HIGH CAGR IN DEVELOPING COUNTRIES

4.6 WATERPROOF TAPES MARKET, BY REGION

FIGURE 15 INDIA TO REGISTER HIGHEST CAGR IN WATERPROOF TAPES MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATERPROOF TAPES MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand from electrical & electronics and building & construction industries

5.2.1.2 Capacity expansion for increasing demand

5.2.1.3 Sales through e-commerce platforms gaining rapid momentum

5.2.1.4 Strategic partnership and inorganic approach toward growth

5.2.1.5 Superior properties of waterproof tapes

5.2.2 RESTRAINTS

5.2.2.1 Impact of COVID-19 and Russia-Ukraine war

5.2.2.2 Slow growth of end-use industries in some countries

5.2.3 OPPORTUNITIES

5.2.3.1 Establishing authenticity through various certifications

5.2.3.2 Increase in public-private partnerships in operational markets of end-use industries

5.2.3.3 Growing healthcare industry in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Low product differentiation

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 WATERPROOF TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 WATERPROOFING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP INDUSTRIES (%)

5.4.2 BUYING CRITERIA

FIGURE 19 KEY BUYING CRITERIA FOR WATERPROOF TAPES

TABLE 4 KEY BUYING CRITERIA FOR WATERPROOF TAPES

5.5 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.5.1 INTRODUCTION

5.5.2 TRENDS AND FORECASTS OF GDP

TABLE 5 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), 2020–2027

5.5.3 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION (2020–2021)

5.5.4 TRENDS AND FORECASTS OF CONSTRUCTION INDUSTRY

FIGURE 20 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.6 VALUE CHAIN ANALYSIS

FIGURE 21 WATERPROOF TAPES: VALUE CHAIN ANALYSIS

5.7 AVERAGE PRICING ANALYSIS

FIGURE 22 PRICING ANALYSIS OF WATERPROOF TAPES MARKET, BY REGION, 2021

FIGURE 23 PRICING ANALYSIS OF WATERPROOF TAPES MARKET, BY RESIN TYPE, 2021

FIGURE 24 PRICING ANALYSIS OF WATERPROOF TAPES MARKET, BY SUBSTRATE TYPE, 2021

FIGURE 25 PRICING ANALYSIS OF WATERPROOF TAPES MARKET, BY END-USE INDUSTRY, 2021

5.8 WATERPROOF TAPES ECOSYSTEM AND INTERCONNECTED MARKETS

TABLE 7 WATERPROOF TAPES MARKET: SUPPLY CHAIN

FIGURE 26 ADHESIVE TAPES ECOSYSTEM

5.8.1 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTIONS ON MANUFACTURERS OF WATERPROOF TAPES: YC AND YCC SHIFT

FIGURE 27 WATERPROOF TAPES INDUSTRY: YC AND YCC SHIFT

5.9 TRADE ANALYSIS

TABLE 8 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

TABLE 9 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2017–2022

5.10.3 TOP JURISDICTION

FIGURE 29 PATENTS PUBLISHED BY JURISDICTIONS, 2017–2022

5.10.4 TOP APPLICANTS

FIGURE 30 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017–2022

TABLE 10 RECENT PATENTS BY OWNERS

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY 1:

5.11.2 CASE STUDY 2:

5.11.3 CASE STUDY 3:

5.12 TECHNOLOGY ANALYSIS

5.13 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 11 WATERPROOF TAPES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 WATERPROOF TAPES MARKET, BY RESIN TYPE (Page No. - 96)

6.1 INTRODUCTION

FIGURE 31 SILICONE RESIN TO DOMINATE WATERPROOF TAPES MARKET

TABLE 15 WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 16 WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 17 WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 18 WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

6.2 ACRYLIC

6.2.1 HEAVY DUTY AND LONG-TERM BONDING

TABLE 19 ACRYLIC RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 20 ACRYLIC RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 21 ACRYLIC RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 ACRYLIC RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SILICONE

6.3.1 LARGEST RESIN TYPE IN MARKET

TABLE 23 SILICONE RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 24 SILICONE RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 25 SILICONE RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 SILICONE RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 BUTYL

6.4.1 LOW COST, TOXICITY, AND SURFACE TENSION PROPERTIES

TABLE 27 BUTYL RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 28 BUTYL RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 29 BUTYL RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 BUTYL RESIN-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.5 OTHERS

TABLE 31 OTHER RESINS-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 32 OTHER RESINS-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 33 OTHER RESINS-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 OTHER RESINS-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 WATERPROOF TAPES MARKET, BY SUBSTRATE TYPE (Page No. - 107)

7.1 INTRODUCTION

FIGURE 32 PLASTIC SUBSTRATE SEGMENT TO DOMINATE WATERPROOF TAPES MARKET

TABLE 35 WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 36 WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 37 WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (USD MILLION)

TABLE 38 WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (USD MILLION)

7.2 PLASTIC

7.2.1 LARGEST SUBSTRATE TYPE IN MARKET

TABLE 39 PLASTIC SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 40 PLASTIC SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 41 PLASTIC SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 PLASTIC SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 METAL

7.3.1 AUTOMOTIVE INDUSTRY TO DRIVE MARKET

TABLE 43 METAL SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 44 METAL SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 45 METAL SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 METAL SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 RUBBER

7.4.1 INCREASE IN USE OF RUBBER IN VARIOUS END-USE INDUSTRIES

TABLE 47 RUBBER SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 48 RUBBER SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 49 RUBBER SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 RUBBER SUBSTRATE-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHERS

TABLE 51 OTHER SUBSTRATES-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 52 OTHER SUBSTRATES-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 53 OTHER SUBSTRATES-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 OTHER SUBSTRATES-BASED WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 WATERPROOF TAPES MARKET, BY END-USE INDUSTRY (Page No. - 117)

8.1 INTRODUCTION

FIGURE 33 HEALTHCARE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 55 WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 56 WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 57 WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 58 WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2 AUTOMOTIVE

8.2.1 RISING VEHICLE PRODUCTION

TABLE 59 WATERPROOF TAPES MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 60 WATERPROOF TAPES MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 61 WATERPROOF TAPES MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 WATERPROOF TAPES MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

8.3 HEALTHCARE

8.3.1 FASTEST-GROWING END-USE INDUSTRY IN MARKET

TABLE 63 WATERPROOF TAPES MARKET SIZE IN HEALTHCARE INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 64 WATERPROOF TAPES MARKET SIZE IN HEALTHCARE INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 65 WATERPROOF TAPES MARKET SIZE IN HEALTHCARE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 WATERPROOF TAPES MARKET SIZE IN HEALTHCARE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

8.4 BUILDING & CONSTRUCTION

8.4.1 DEVELOPMENT OF NEW INFRASTRUCTURE IN EMERGING COUNTRIES

TABLE 67 WATERPROOF TAPES MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 68 WATERPROOF TAPES MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 69 WATERPROOF TAPES MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 WATERPROOF TAPES MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

8.5 ELECTRICAL & ELECTRONICS

8.5.1 RISE IN DEMAND FOR ELECTRONIC DEVICES

TABLE 71 WATERPROOF TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 72 WATERPROOF TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 73 WATERPROOF TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 WATERPROOF TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

8.6 PACKAGING

8.6.1 IMPROVED LIFESTYLE AND CHANGING FOOD HABITS

TABLE 75 WATERPROOF TAPES MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 76 WATERPROOF TAPES MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 77 WATERPROOF TAPES MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 WATERPROOF TAPES MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

8.7 OTHERS

TABLE 79 WATERPROOF TAPES MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 80 WATERPROOF TAPES MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 81 WATERPROOF TAPES MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 WATERPROOF TAPES MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

9 WATERPROOF TAPES MARKET, BY REGION (Page No. - 132)

9.1 INTRODUCTION

FIGURE 34 WATERPROOF TAPES MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR

TABLE 83 WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 84 WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 85 WATERPROOF TAPES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 WATERPROOF TAPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: WATERPROOF TAPES MARKET SNAPSHOT

TABLE 87 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 88 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 89 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 92 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 93 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 96 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 97 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 100 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 101 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Rising demand from multiple sectors and continuous investments

9.2.2 JAPAN

9.2.2.1 Growing disposable income and development in healthcare sector

9.2.3 INDIA

9.2.3.1 Availability of resources, rapid economic growth, increasing disposable income, and urbanization

9.2.4 SOUTH KOREA

9.2.4.1 Introduction of new end products

9.2.5 INDONESIA

9.2.5.1 Production plant setups of multiple countries

9.2.6 TAIWAN

9.2.6.1 Investments from diverse foreign investors

9.2.7 VIETNAM

9.2.7.1 Increase in import and export of various products

9.2.8 REST OF ASIA PACIFIC

9.3 EUROPE

FIGURE 36 EUROPE: WATERPROOF TAPES MARKET SNAPSHOT

TABLE 103 EUROPE: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 104 EUROPE: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 105 EUROPE: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 108 EUROPE: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 109 EUROPE: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 110 EUROPE: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 112 EUROPE: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 113 EUROPE: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (USD MILLION)

TABLE 114 EUROPE: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 116 EUROPE: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 117 EUROPE: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 118 EUROPE: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Strategic partnerships with well-established distributors

9.3.2 RUSSIA

9.3.2.1 Government investments in modernizing infrastructure

9.3.3 FRANCE

9.3.3.1 Growth in electronics industry acting as supporting pillar

9.3.4 UK

9.3.4.1 Investments in automotive and packaging sectors

9.3.5 ITALY

9.3.5.1 Government initiatives and growing industrial electronics manufacturing

9.3.6 TURKEY

9.3.6.1 Portfolio diversification and implementation of new technologies

9.3.7 SPAIN

9.3.7.1 Large investments by global manufacturers and adoption of disruptive technologies

9.3.8 REST OF EUROPE

9.4 NORTH AMERICA

FIGURE 37 NORTH AMERICA: WATERPROOF TAPES MARKET SNAPSHOT

TABLE 119 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 120 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 121 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 124 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 125 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 127 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 128 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 129 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (USD MILLION)

TABLE 130 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (USD MILLION)

TABLE 131 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 132 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 133 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 134 NORTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.4.1 US

9.4.1.1 Automotive and healthcare applications are driving demand

9.4.2 CANADA

9.4.2.1 Product line expansion and diversification

9.4.3 MEXICO

9.4.3.1 Favorable trade agreements

9.5 MIDDLE EAST & AFRICA

TABLE 135 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 136 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 137 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 140 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 141 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 144 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 145 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 148 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 149 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Government investments for expansion of production

9.5.2 UAE

9.5.2.1 Growth of various manufacturing industries

9.5.3 SOUTH AFRICA

9.5.3.1 Acquisition of established entities and investment in new assets

9.5.4 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

TABLE 151 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 152 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 153 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 155 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 156 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 157 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 158 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 159 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 160 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 161 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2018–2021 (USD MILLION)

TABLE 162 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY SUBSTRATE TYPE, 2022–2027 (USD MILLION)

TABLE 163 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 164 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 165 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 166 SOUTH AMERICA: WATERPROOF TAPES MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Expansion of production capacity and established distribution channels

9.6.2 ARGENTINA

9.6.2.1 Positive growth outlook from various investments houses

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 184)

10.1 OVERVIEW

TABLE 167 OVERVIEW OF STRATEGIES ADOPTED BY KEY WATERPROOF TAPES PLAYERS (2017–2022)

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PARTICIPANTS

10.2.4 PERVASIVE PLAYERS

FIGURE 38 WATERPROOF TAPES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATERPROOF TAPES MARKET

10.4 SME MATRIX, 2021

10.4.1 RESPONSIVE COMPANIES

10.4.2 PROGRESSIVE COMPANIES

10.4.3 STARTING BLOCKS

10.4.4 DYNAMIC COMPANIES

FIGURE 40 WATERPROOF TAPES MARKET: EMERGING COMPANIES’ COMPETITIVE LEADERSHIP MAPPING, 2021

10.5 COMPETITIVE BENCHMARKING

TABLE 168 WATERPROOF TAPES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 169 WATERPROOF TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

TABLE 170 COMPANY EVALUATION MATRIX: WATERPROOF TAPES

10.6 MARKET SHARE ANALYSIS

FIGURE 41 MARKET SHARE, BY KEY PLAYERS (2021)

TABLE 171 WATERPROOF TAPES MARKET SHARE, BY DEGREE OF COMPETITION, 2021

10.7 MARKET RANKING ANALYSIS

FIGURE 42 MARKET RANKING ANALYSIS, 2021

10.8 REVENUE ANALYSIS

FIGURE 43 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2017–2021

10.9 COMPETITIVE SITUATIONS AND TRENDS

TABLE 172 WATERPROOF TAPES MARKET: PRODUCT LAUNCHES, 2017–2022

TABLE 173 WATERPROOF TAPES MARKET: DEALS, 2017–2022

11 COMPANY PROFILES (Page No. - 198)

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1 MAJOR PLAYERS

11.1.1 3M COMPANY

TABLE 174 3M COMPANY: COMPANY OVERVIEW

FIGURE 44 3M COMPANY: COMPANY SNAPSHOT

TABLE 175 3M COMPANY: DEAL

11.1.2 NITTO DENKO CORPORATION

TABLE 176 NITTO DENKO CORPORATION: COMPANY OVERVIEW

FIGURE 45 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 177 NITTO DENKO CORPORATION: PRODUCT LAUNCH

TABLE 178 NITTO DENKO CORPORATION: DEALS

11.1.3 TESA SE

TABLE 179 TESA SE: COMPANY OVERVIEW

FIGURE 46 TESA SE: COMPANY SNAPSHOT

TABLE 180 TESA SE: PRODUCT LAUNCH

11.1.4 JOHNSON & JOHNSON

TABLE 181 JOHNSON & JOHNSON: COMPANY OVERVIEW

FIGURE 47 JOHNSON & JOHNSON: COMPANY SNAPSHOT

TABLE 182 JOHNSON & JOHNSON: PRODUCT LAUNCH

TABLE 183 JOHNSON & JOHNSON: DEALS

11.1.5 HENKEL AG & CO. KGAA

TABLE 184 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

FIGURE 48 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

TABLE 185 HENKEL AG & CO. KGAA: DEALS

11.1.6 MEDLINE INDUSTRIES, LP

TABLE 186 MEDLINE INDUSTRIES, LP: COMPANY OVERVIEW

TABLE 187 MEDLINE INDUSTRIES, LP: DEALS

11.1.7 FURUKAWA ELECTRIC CO., LTD.

TABLE 188 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

FIGURE 49 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

11.1.8 AVERY DENNISON CORPORATION

TABLE 189 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

FIGURE 50 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 190 AVERY DENNISON CORPORATION: PRODUCT LAUNCH

TABLE 191 AVERY DENNISON CORPORATION: DEALS

11.1.9 SCAPA GROUP PLC

TABLE 192 SCAPA GROUP PLC: COMPANY OVERVIEW

FIGURE 51 SCAPA GROUP PLC: COMPANY SNAPSHOT

TABLE 193 SCAPA GROUP PLC: DEALS

11.1.10 TERAOKA SEISAKUSHO CO., LTD

TABLE 194 TERAOKA SEISAKUSHO CO., LTD.: COMPANY OVERVIEW

FIGURE 52 TERAOKA SEISAKUSHO CO., LTD: COMPANY SNAPSHOT

11.2 OTHER KEY COMPANIES

11.2.1 ASIAN PAINTS LTD

11.2.2 SHURTAPE TECHNOLOGIES LLC

11.2.3 A.B.E. CONSTRUCTION CHEMICALS

11.2.4 TAPESPEC

11.2.5 HESKINS LLC

11.2.6 GEBRÜDER JAEGER GMBH

11.2.7 ADVANCE TAPES INTERNATIONAL

11.2.8 DUKAL LLC

11.2.9 ISOLTEMA GROUP

11.2.10 METALNASTRI SRL

11.2.11 CHOWGULE CONSTRUCTION CHEMICALS

11.2.12 SHANGHAI RICHENG ELECTRONIC

11.2.13 BTM

11.2.14 PERMATEX

11.2.15 PPM INDUSTRIES SPA

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS (Page No. - 252)

12.1 INTRODUCTION

12.2 ADHESIVE TAPES MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 ADHESIVE TAPES MARKET, BY RESIN TYPE

12.2.3.1 Introduction

TABLE 195 ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2018–2026 (USD MILLION)

TABLE 196 ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2018–2026 (MILLION SQUARE METER)

12.2.3.2 Acrylic

12.2.3.3 Silicone

12.2.3.4 Rubber

12.2.3.5 Others

12.2.4 ADHESIVE TAPES MARKET, BY TECHNOLOGY

12.2.4.1 Introduction

TABLE 197 ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 198 ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2018–2026 (MILLION SQUARE METERS)

12.2.4.2 Solvent-Based

12.2.4.3 Hot-Melt

12.2.4.4 Water-Based

12.2.5 ADHESIVE TAPES MARKET, BY BACKING MATERIAL

12.2.5.1 Introduction

TABLE 199 ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2018–2026 (USD MILLION)

TABLE 200 ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2018–2026 (MILLION SQUARE METERS)

12.2.5.2 PolyPropylene (PP)

12.2.5.3 Paper

12.2.5.4 Polyvinyl Chloride (PVC)

12.2.5.5 Others

12.2.6 ADHESIVE TAPES MARKET, BY CATEGORY

12.2.6.1 Introduction

TABLE 201 ADHESIVE TAPES MARKET SIZE, BY CATEGORY, 2018–2026 (USD MILLION)

TABLE 202 ADHESIVE TAPES MARKET SIZE, BY CATEGORY, 2018–2026 (MILLION SQUARE METERS)

12.2.6.2 Commodity adhesive tapes

12.2.6.3 Specialty adhesive tapes

12.2.7 ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

12.2.7.1 Introduction

12.2.7.2 Commodity adhesive tapes

TABLE 203 COMMODITY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 204 COMMODITY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (MILLION SQUARE METERS)

12.2.7.2.1 Packaging

12.2.7.2.2 Masking

12.2.7.2.3 Consumer & Office

12.2.7.3 Specialty adhesive tapes

TABLE 205 SPECIALTY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 206 SPECIALTY ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (MILLION SQUARE METERS)

12.2.7.3.1 Electrical & electronics

12.2.7.3.2 Healthcare

12.2.7.3.3 Automotive

12.2.7.3.4 White goods

12.2.7.3.5 Paper & printing

12.2.7.3.6 Building & construction

12.2.7.3.7 Retail

12.2.7.3.8 Other end-use industries

12.2.8 ADHESIVE TAPES MARKET, BY REGION

12.2.8.1 Introduction

TABLE 207 ADHESIVE TAPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 208 ADHESIVE TAPES MARKET SIZE, BY REGION, 2018–2026 (MILLION SQUARE METERS)

12.2.8.2 North America

12.2.8.3 Europe

12.2.8.4 Asia Pacific

12.2.8.5 South America

12.2.8.6 Middle East & Africa

13 APPENDIX (Page No. - 264)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

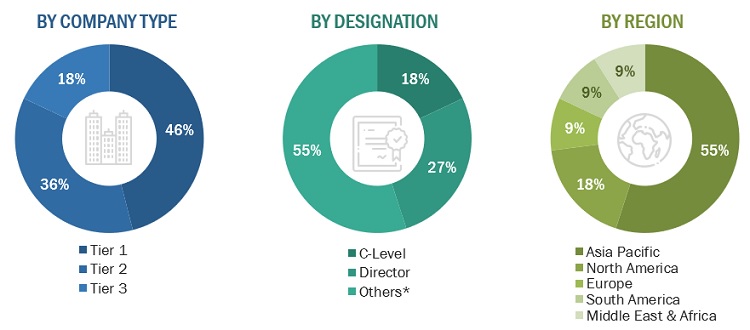

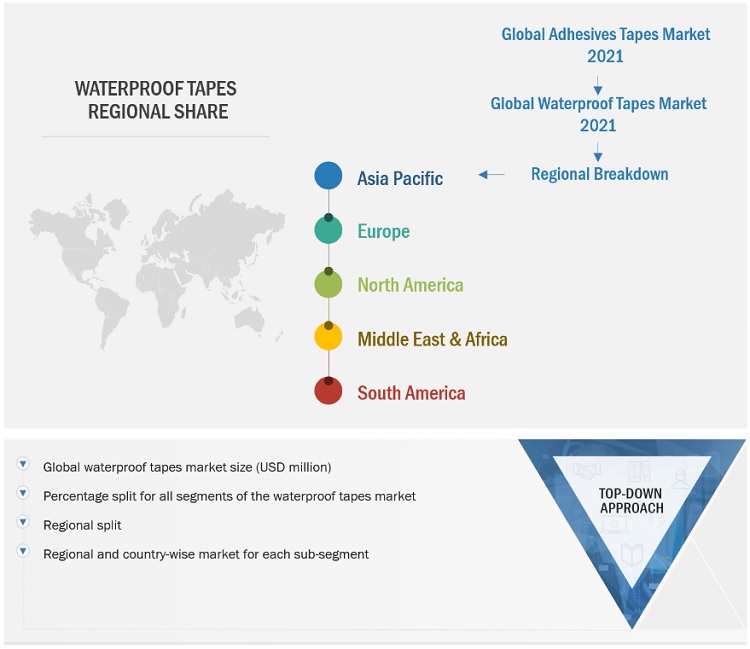

The study involves four major activities in estimating the current market size of waterproof tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The waterproof tapes market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as electrical & electronics, automotive, building & construction, healthcare, packaging, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the waterproof tapes market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Waterproof Tapes Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the waterproof tapes market in terms of value and volume

- To define, describe, and forecast the waterproof tapes market by resin type, substrate type, end-use industry, and region

- To forecast the waterproof tapes market size with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the significant drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets1 with respect to their growth trends, growth prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as acquisitions, new product launches, investments, expansions, joint ventures, and collaborations in the waterproof tapes market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the waterproof tapes market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Waterproof tapes market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Waterproof Tapes Market