Waterproofing Membranes Market by Raw Material, Type (Liquid Applied, Sheet Based), Usage (New Construction, Refurbishment), Application (Building Structure, Roofing, Roadways, Waste & Water Management, Walls), and Region- Global Forecast to 2025

Waterproofing Membranes Market Analysis

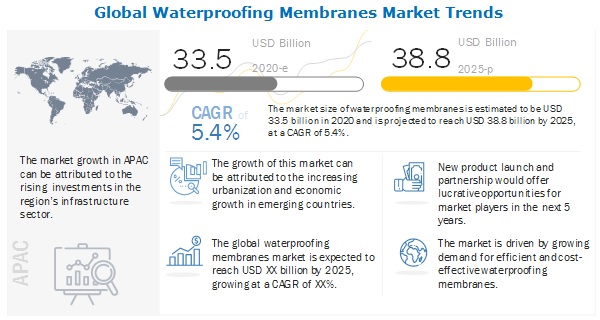

The global waterproofing membranes market was valued at USD 33.5 billion in 2020 and is projected to reach USD 38.8 billion by 2025, growing at 5.4% cagr during the forecast period. The growing demand for waterproofing membrane is due to the economic development, increasing urbanization and industrialization in emerging econmoies. Additionally, increasing investments to build infrastrcture is also driving the consumption of waterproofing membranes.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Waterproofing Membranes Market

The waterproofing membranes are used mainly in the construction industry. COVID-19 has severely impacted this industry.

- The lockdown in various countries and logistical restrictions have adversely impacted the construction industry. Supply chain disruptions, workforce unavailability, logistical restrictions, limited availability of components, demand drop, low company liquidity, and shutdown of manufacturing due to lockdown in various countries have adversely affected the industry. Raw material suppliers and other related businesses are forced to re-evaluate their strategies to cater to this industry during this crisis period.

- Residential and commercial construction has come to a grinding halt owing to the pandemic. Waterproofing membranes demand from this sector is expected to be low to the medium during this crisis period. Some major issues would be a delay in order shipments, supply chain restriction, manpower & equipment shortage, and material shortage. Post conclusion of this crisis, the market is expected to revive, and demand is likely to increase for the waterproofing membranes market.

- The demand for construction activities has increased in the healthcare sector, owing to the pandemic. A rise in demand for new hospitals and care institutions have provided some stability to the construction sector thus driving the waterproofing membranes market

Waterproofing Membranes Market Dynamics

Driver: Urbanization, economic growth, and infrastructural developments

Infrastructure is the vehicle for transforming low- and middle-income countries into emerging or developing ones. Rapid urbanization in emerging economies and continued urbanization in advanced economies are the major drivers of infrastructure spending. A rise in infrastructure spending includes the creation of a huge demand for private and public sector infrastructural developments, such as power stations, electricity grids, water supply and treatment plants, roads, railways, airports, bridges, telecommunications networks, schools, and hospitals. The building & construction industry requires high-performance materials that are strong, lightweight, high-performance, durable, and versatile. The quality and performance of building materials need to be extremely consistent; as a result, the demand for waterproofing membranes is increasing for infrastructural development. The increasing population in emerging regions, especially in APAC, and the need for improved infrastructure, are expected to drive the global consumption of waterproofing membranes. The global population was around 7.7 billion in 2019, with APAC having approximately 60% of the total population. Close to 80% of the global population resides in developing countries where there is an increasing demand for residential housing and urban infrastructure. According to the United Nations, the global population is expected to reach 8.5 billion by 2030 and 9.7 billion by 2050, which will further necessitate the construction of housing, commercial hubs, roads, and waste & water management facilities. There is a huge scope for developing and improving the quality of infrastructure in China, Brazil, India, SEA, Russia, and other developing economies. The consumption of waterproofing membranes is expected to increase as these membranes play a key role in improving the overall quality and durability of infrastructure.

Restrain: Potential health and environmental issues

The use of waterproofing chemicals or membranes poses environmental and human health risks. Waterproofing membranes, when used in spray form, can be dangerous for the user and also the workers in the vicinity. These chemicals might contain fluorinated compounds, which, when entering the respiratory system, can cause chemical pneumonitis, lung trauma, and other respiratory problems. Similarly, while applying bitumen-based membranes, workers can be exposed to volatile fumes. Extended exposure to these fumes may lead to health issues, such as nasal irritation or bronchitis. In addition, employees with extended lengths of employment have exhibited more nasal, pharyngeal symptoms. Although there is a shifting trend toward synthetic membranes, bitumen still accounts for a significant share among other waterproofing membranes. This means a large section of workers in the roofing industries, especially in emerging economies, are vulnerable. The presence of solvents, diluents, and others in waterproofing membranes also harms the environment by releasing toxic fumes and VOCs in the atmosphere. However, the use of respirators, protective clothing, and eco-friendly alternatives can be used to mitigate these factors.

Opportunity: Rising interest in green roofs to boost demand for waterproofing membranes

Waterproofing membranes have some disadvantages, such as toxicity and VOC content. Manufacturers such as Sika, Fosroc, and Tremco provide and have also invested in R&D of solutions, which have minimal impact on the environment. Manufacturers are increasingly accrediting their products with green certification for use in sustainable construction projects that include green roofs and green buildings. Green roofs are roof structures of any building that are completely or partially covered with vegetation. Green roofs offer a reduction in energy costs, urban heat island effect, and stormwater runoff, and the removal of harmful air particles. Green buildings, on the other hand, are buildings that are energy-efficient and environmentally responsible throughout a building’s life cycle. Waterproofing is important for these building structures as they provide efficient protection from water runoff and weather conditions, and also provide energy efficiency. In countries, such as Germany and the US, green buildings are witnessing high growth owing to regulations pertaining to emissions from buildings, and also due to the positive impact of these establishments.

Challenge: Volatility in raw material prices

The raw materials used for manufacturing waterproofing membranes are extracted primarily from crude oil. Waterproofing membranes based on PVC, PU, acrylic, and bitumen are all derived from petroleum sources. Crude oil is one of the important sources of energy that contributed to 27.3% of the global primary energy consumption in 2015, according to the BP Statistical Review of Energy. The average crude oil spot price reached USD 52 per barrel at the end of December 2016 from a low of USD 29.8 per barrel at the end of January 2016. Crude oil price is very much on a recovery path and stabilized in the range of USD 55-60 per barrel in 2017. However, due to the current pandemic situation, almost all countries have banned both domestic and international travel. This has caused a huge drop in the demand for transportation fuel, which has further affected crude oil prices. However, oil prices are expected to rise owing to renewed demand from China. Due to the fluctuating crude oil prices, the prices of raw materials of waterproofing membranes are also affected.

Liquid-applied membrane type segment to register the fastest growth during the forecast period.

Waterproofing membranes reduce the ingress of water in a building structure. The liquid-applied membranes segment accounts for the larger share in the global waterproofing membranes market. The demand for these membranes is rising rapidly, owing to their environment-friendly properties and easy applicability. Liquid waterproofing membranes are easy to handle and replace, and provide efficient waterproofing and longer lifespan of a building structure.

New construction to be the largest consumer of waterproofing membranes

Based on usage, the waterproofing membranes market is segmented into new construction and refurbishment. The new construction segment accounted for the larger market share in 2019. The growth can be attributed to the regulations for new construction, infrastructural developments, industrialization, and urbanization in emerging economies.

Building structure to be the largest consumer of waterproofing membranes.

Building structures are areas excluding roofs and walls such as balconies, basements, foundations, retaining walls, storage rooms, belowground constructions, and others. Building structures are often exposed to stresses such as water exposure, water stresses, groundwater chemical exposures, unequal static forces, temperature variations, biological influences, and others. Waterproofing of these structures provide effective and long term protection form these exposures and ensure efficient protection of building structures.

APAC is projected to be the fastest growing waterproofing membranes market during the forecast period.

The waterproofing membranes market in APAC is projected to register the highest CAGR during the forecast period. The building structures market in APAC is driven by the growing construction industry, increased consumer spending, and strong economic growth.

The recent COVID-19 pandemic is expected to impact the global construction industry. COVID-19 led the construction industry into an unknown operating environment, globally. Government restrictions on the number of people that can gather at one particular place, severely impacted the industry. E.g., the US construction industry relies heavily on imports for materials such as steel, copper, aluminum, stone, and fixtures, especially from China. Logistical constraints, manpower shortages, and government restrictions have forced many of these suppliers of raw materials to close down, hence, disrupting construction activities in the US. Similarly, economies such as China, India, and others are also facing the brunt of the Covid-19 pandemic.

Waterproofing Membranes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 33.5 billion |

|

Revenue Forecast in 2025 |

USD 38.8 billion |

|

CAGR |

5.4% |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Billion) , Volume (Million Square Meter) |

|

Segments |

Raw Material, Type, Usage, Application, and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa. |

|

Companies |

Total of 10 major players covered: |

This research report categorizes the waterproofing membranes market based on type, application, and region.

Based on Raw Material:

- Modified Bitumen

- PVC

- TPO

- Acrylic

- Polyurea

- Polyurethane

- Others

Based on Type:

- Liquid-applied Membranes

- Sheet-based Membranes

Based on Usage:

- Refurbishment

- New construction

Based on the application:

- Building Structures

- Roofing

- Walls

- Roadways

- Waste & water management

- Others

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Waterproofing Membranes Market Players

The key players profiled in this report include Sika (Switzerland), Tremco (US), BASF (Germany), Soprema (France), GCP applied technologies (US), Fosroc (UK), Mapei (Italy), Carlisle Construction Company (US), Johns Manville (US), and Renolit (Germany). These companies have adopted various organic as well as inorganic growth strategies between 2017 and 2020 to enhance their regional presence and meet the growing demand for waterproofing membranes from emerging economies.

Recent Developments

- In March 2020, Sika put into operation a new production facility for the SikaProof structural waterproofing membrane, at Sarnen, Switzerland. This investment in the expansion will boost manufacturing efficiency and enable the company to serve the rapidly growing market.

- In February 2019, Tremco has launched a new product under the brand name POWERply Endure Membranes. These membranes can be installed in a variety of hot and cold adhesives and form exceptionally durable, waterproof roofs when paired with POWERply Endure BIO Adhesive.

- In May 2018, GCP Applied Technologies has acquired UK .based R.I.W. Limited, a supplier of waterproofing products for USD 30 million. The company provides products for commercial and residential construction applications. This deal expanded GCP Applied Technologies' penetration of waterproofing projects in the UK.

Frequently Asked Questions (FAQ):

What is the current size of the global waterproofing membranes market?

Global waterproofing membranes market size is estimated at USD 33.5 billion in 2020 and is projected to reach USD 38.8 billion by 2025, at a CAGR of 5.4%.

Several countries in Europe and North America have introduced regulations to use environmentally friendly products that do not harm the environment. Hence, various research is being conducted to use environmentally friendly products.

Who are the winners in the global waterproofing membranes market?

Who are the winners in the global waterproofing membranes market?

Companies such as Sika (Switzerland), Tremco (US), BASF (Germany), Soprema (France), GCP applied technologies (US), Fosroc (UK), Mapei (Italy), Carlisle Companies (US), Johns Manville (US), and Renolit (Germany) falls under the winner’s category. These companies cater to the requirements of their customers by providing customized products. Such advantages give these companies an edge over other companies that are component providers.

What is the COVID-19 impact on waterproofing membranes manufacturers?

Industry experts believe that COVID-19 could affect construction activities globally. In Southern Europe, building activity is expected to contract by 60% - 70%. Overall, GDP is expected to shrink by 3.0%, as per the International Monetary Fund (IMF). However, the demand is expected to rise post-pandemic, owing to measures including flexibilization, resizing, operational excellence, digitization, and investments in R&D.

What are some of the drivers in the market?

The increasing demand for cost-effective and efficient waterproofing membranes and positive impact of urbanization, industrialization, and economic growth are the driving factors for the waterproofing membranes market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 WATERPROOFING MEMBRANES MARKET – FORECAST TO 2025

1.4 MARKET SCOPE

1.4.1 WATERPROOFING MEMBRANES MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.3.1 WATERPROOFING MEMBRANES MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN WATERPROOFING MEMBRANES MARKET

4.2 WATERPROOFING MEMBRANES MARKET, BY TYPE

4.3 WATERPROOFING MEMBRANES MARKET, BY USAGE

4.4 WATERPROOFING MEMBRANES MARKET, BY APPLICATION

4.5 WATERPROOFING MEMBRANES MARKET, BY MAJOR COUNTRIES

4.6 APAC WATERPROOFING MEMBRANES MARKET, BY APPLICATION AND COUNTRY, 2019

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Urbanization, economic growth, and infrastructural developments

5.2.1.2 Growing demand for cost-effective and efficient waterproofing membranes

5.2.2 RESTRAINTS

5.2.2.1 Potential health and environmental issues

5.2.3 OPPORTUNITIES

5.2.3.1 Rising interest in green roofs to boost demand for waterproofing membranes

5.2.3.2 Awareness about potential water crisis encouraging the implementation of water management programs

5.2.4 CHALLENGES

5.2.4.1 Volatility in raw material prices

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN OF WATERPROOFING MEMBRANES

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS

5.4.4 END USERS

5.5 IMPACT OF COVID-19 ON WATERPROOFING MEMBRANES MARKET

5.5.1 COVID-19

5.5.2 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

5.5.3 IMPACT ON APPLICATION AND END-USE INDUSTRY SEGMENTS

5.6 MACROECONOMIC INDICATORS

5.6.1 GLOBAL GDP TRENDS AND CONSTRUCTION INDUSTRY STATISTICS

5.7 CASE STUDY ANALYSIS

6 WATERPROOFING MEMBRANES MARKET, BY RAW MATERIAL (Page No. - 52)

6.1 INTRODUCTION

6.2 MODIFIED BITUMEN

6.2.1 STYRENE-BUTADIENE-STYRENE (SBS)

6.2.2 ATACTIC POLYPROPYLENE (APP)

6.3 PVC

6.4 EPDM

6.5 TPO

6.6 ACRYLIC

6.7 POLYUREA

6.8 POLYURETHANE

6.9 OTHERS

6.9.1 PMMA

6.9.2 EVA

6.9.3 PE

6.9.3.1 HDPE

6.9.3.2 LDPE

7 WATERPROOFING MEMBRANES MARKET, BY TYPE (Page No. - 56)

7.1 INTRODUCTION

7.2 LIQUID-APPLIED MEMBRANES

7.2.1 HIGH FLEXIBILITY AND SIMPLE APPLICATION TO BOOST DEMAND FOR THESE MEMBRANES

7.2.2 BITUMINOUS MEMBRANES

7.2.3 ELASTOMERIC MEMBRANES

7.2.4 ACRYLIC MEMBRANES

7.2.5 POLYURETHANE MEMBRANES

7.2.6 PMMA MEMBRANES

7.2.7 CEMENTITIOUS MEMBRANES

7.3 SHEET-BASED/ PRE-FORMED MEMBRANES

7.3.1 REQUIREMENT FOR ROOFING, BASEMENT, AND FOUNDATION PROTECTION TO DRIVE THE MARKET

8 WATERPROOFING MEMBRANES MARKET, BY USAGE (Page No. - 61)

8.1 INTRODUCTION

8.2 NEW CONSTRUCTION

8.2.1 INFRASTRUCTURAL DEVELOPMENTS IN EMERGING ECONOMIES TO BOOST CONSUMPTION IN THIS SEGMENT

8.3 REFURBISHMENT

8.3.1 AGING INFRASTRUCTURE TO ENCOURAGE REFURBISHMENT

9 WATERPROOFING MEMBRANES MARKET, BY APPLICATION (Page No. - 65)

9.1 INTRODUCTION

9.2 ROOFING

9.2.1 BENEFITS PROVIDED BY GREEN ROOFING EXHIBIT HUGE UNTAPPED OPPORTUNITIES FOR MARKET GROWTH

9.3 WALLS

9.3.1 NECESSITY OF PROTECTION FROM WEATHER CONDITIONS TO BOOST THE MARKET

9.4 BUILDING STRUCTURE

9.4.1 REQUIREMENT FOR BELOW-GROUND STRUCTURE PROTECTION TO PROPEL THE MARKET

9.4.2 COMMERCIAL

9.4.3 RESIDENTIAL

9.5 WASTE & WATER MANAGEMENT

9.5.1 WASTE MANAGEMENT/ LANDFILLS

9.5.1.1 Population growth to propel waste management activities

9.5.2 WATER MANAGEMENT

9.5.2.1 Rising need for water management activities to drive the market

9.6 ROADWAYS

9.6.1 INCREASING INFRASTRUCTURAL ACTIVITIES TO DRIVE THE MARKET

9.6.2 BRIDGES

9.6.3 HIGHWAYS

9.6.4 TUNNELS/ TUNNEL LINERS

9.7 OTHERS

9.7.1 MINING

9.7.2 AGRICULTURAL

9.7.3 INDUSTRIAL

10 WATERPROOFING MEMBRANES MARKET, BY REGION (Page No. - 71)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 Expanding residential sector to fuel the market

10.2.2 CANADA

10.2.2.1 Government initiatives for theconstruction sector to be the governing factors for the market

10.2.3 MEXICO

10.2.3.1 Government’s infrastructure plan to boost the market

10.3 APAC

10.3.1 CHINA

10.3.1.1 Development of prefabricated buildings to influence the market

10.3.2 INDIA

10.3.2.1 Industrialization and urbanization to drive the market

10.3.3 SOUTH KOREA

10.3.3.1 Government investments to propel the market

10.3.4 JAPAN

10.3.4.1 Ongoing construction projects to drive the waterproofing membranes market

10.3.5 AUSTRALIA

10.3.5.1 Government relief funds to support infrastructure projects

10.3.6 SINGAPORE

10.3.6.1 Public sector investments to drive the market

10.3.7 PHILIPPINES

10.3.7.1 Government initiatives to increase demand during the forecast period

10.3.8 MALAYSIA

10.3.8.1 Lucrative opportunities in the waterproofing membranes market

10.3.9 INDONESIA

10.3.9.1 Rapid growth of the residential sector to propel the waterproofing membranes market

10.3.10 VIETNAM

10.3.10.1 Construction industry growth driving the waterproofing membranes market

10.3.11 THAILAND

10.3.11.1 Infrastructural developments to boost demand

10.3.12 REST OF APAC

10.4 EUROPE

10.4.1 GERMANY

10.4.1.1 Residential infrastructure to drive the waterproofing membranes market

10.4.2 FRANCE

10.4.2.1 Foreign investments to boost construction industry growth

10.4.3 UK

10.4.3.1 Government subsidies to influence the growth of the waterproofing membranes market

10.4.4 ITALY

10.4.4.1 Restoration and wastewater treatment projects to drive the market

10.4.5 RUSSIA

10.4.5.1 Government policies to support the construction industry

10.4.6 SPAIN

10.4.6.1 Investment in infrastructure influencing the waterproofing membranes market

10.4.7 HOLLAND

10.4.7.1 Government initiatives for infrastructural developments to boost consumption

10.4.8 REST OF EUROPE

10.5 MIDDLE EAST & AFRICA

10.5.1 SAUDI ARABIA

10.5.1.1 Increase in construction activities to propel the market

10.5.2 UAE

10.5.2.1 Growing commercial and residential sector to fuel the market

10.5.3 KUWAIT

10.5.3.1 Improved government focus on the construction sector to boost demand

10.5.4 QATAR

10.5.4.1 Construction sector to spur market growth

10.5.5 SOUTH AFRICA

10.5.5.1 Improved government focus on the construction sector to boost demand

10.5.6 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.1.1 Growing infrastructure and rapid industrial growth to drive the construction industry

10.6.2 ARGENTINA

10.6.2.1 Stabilizing economy to boost construction sector

10.6.3 CHILE

10.6.3.1 Government funds to support infrastructural projects and attract foreign investments

10.6.4 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 129)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE, 2019

11.4 MARKET RANKING

11.4.1 SIKA

11.4.2 TREMCO

11.4.3 CARLISLE COMPANIES

11.4.4 GCP APPLIED TECHNOLOGIES

11.4.5 SOPREMA GROUP

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

11.6 COMPANY EVALUATION MATRIX, 2019

11.7 STRENGTH OF PRODUCT PORTFOLIO

11.8 BUSINESS STRATEGY EXCELLENCE

11.9 WINNERS VS TAIL ENDERS

11.9.1 WINNERS

11.9.2 TAIL ENDERS

11.10 KEY MARKET DEVELOPMENTS

11.10.1 INVESTMENT & EXPANSION

11.10.2 MERGER & ACQUISITION

11.10.3 NEW PRODUCT/TECHNOLOGY LAUNCH

11.10.4 AGREEMENT & PARTNERSHIP

12 COMPANY PROFILE (Page No. - 142)

12.1 SIKA

12.1.1 BUSINESS OVERVIEW

12.1.2 PRODUCTS OFFERED

12.1.3 RECENT DEVELOPMENTS

12.1.4 SWOT ANALYSIS

12.1.5 CURRENT FOCUS AND STRATEGIES

12.1.6 RIGHT TO WIN

12.1.7 THREAT FROM COMPETITION

12.2 TREMCO (RPM INTERNATIONAL)

12.2.1 BUSINESS OVERVIEW

12.2.2 PRODUCTS OFFERED

12.2.3 RECENT DEVELOPMENTS

12.2.4 SWOT ANALYSIS

12.2.5 CURRENT FOCUS AND STRATEGIES

12.2.6 RIGHT TO WIN

12.3 GCP APPLIED TECHNOLOGIES

12.3.1 BUSINESS OVERVIEW

12.3.2 PRODUCTS OFFERED

12.3.3 RECENT DEVELOPMENTS

12.3.4 SWOT ANALYSIS

12.3.5 CURRENT FOCUS AND STRATEGIES

12.3.6 THREAT FROM COMPETITORS

12.3.7 RIGHT TO WIN

12.4 CARLISLE COMPANIES

12.4.1 BUSINESS OVERVIEW

12.4.2 PRODUCTS OFFERED

12.4.3 RECENT DEVELOPMENTS

12.4.4 CURRENT FOCUS AND STRATEGIES

12.4.5 THREAT FROM COMPETITORS

12.4.6 RIGHT TO WIN

12.5 SOPREMA GROUP

12.5.1 BUSINESS OVERVIEW

12.5.2 PRODUCTS OFFERED

12.5.3 RECENT DEVELOPMENTS

12.5.4 SWOT ANALYSIS

12.5.5 CURRENT FOCUS AND STRATEGIES

12.5.6 THREAT FROM COMPETITION

12.5.7 RIGHT TO WIN

12.6 JOHNS MANVILLE

12.6.1 BUSINESS OVERVIEW

12.6.2 PRODUCTS OFFERED

12.6.3 RECENT DEVELOPMENTS

12.6.4 MNM VIEW

12.7 RENOLIT

12.7.1 BUSINESS OVERVIEW

12.7.2 PRODUCTS OFFERED

12.7.3 RECENT DEVELOPMENTS

12.7.4 MNM VIEW

12.8 BASF SE

12.8.1 BUSINESS OVERVIEW

12.8.2 PRODUCTS OFFERED

12.8.3 RECENT DEVELOPMENTS

12.8.4 MNM VIEW

12.9 FOSROC

12.9.1 BUSINESS OVERVIEW

12.9.2 PRODUCTS OFFERED

12.9.3 RECENT DEVELOPMENTS

12.9.4 MNM VIEW

12.10 MAPEI

12.10.1 BUSINESS OVERVIEW

12.10.2 PRODUCTS OFFERED

12.10.3 RECENT DEVELOPMENTS

12.10.4 MNM VIEW

12.11 OTHER COMPANIES

12.11.1 CHRYSO

12.11.2 ELMICH

12.11.3 SAINT-GOBAIN WEBER

12.11.4 PIDILITE

12.11.5 THE DOW CHEMICAL COMPANY

12.11.6 ALCHIMICA BUILDING CHEMICALS

12.11.7 FIRESTONE BUILDING PRODUCTS COMPANY LLC.

12.11.8 PAUL BAUDER

12.11.9 GAF

12.11.10 SCHLUTER MEMBRANES

12.11.11 HENKEL POLYBIT INDUSTRIES LTD.

12.11.12 IKO

12.11.13 COPERNIT

12.11.14 ISOMAT

12.11.15 SIPLAST

12.11.16 HENRY COMPANY

13 ADJACENT/RELATED MARKETS (Page No. - 175)

13.1 INTRODUCTION

13.2 LIMITATION

13.3 MARKET ECOSYSTEM AND INTERCONNECTED MARKET

13.4 ROOFING

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 ROOFING MARKET, BY TYPE

13.4.3.1 Materials

13.4.3.2 Chemicals

13.4.4 ROOFING MARKET, BY APPLICATION

13.4.1 RESIDENTIAL

13.4.2 COMMERCIAL

13.4.3 NON RESIDENTIAL

13.4.4 OTHERS

13.4.5 ROOFING MARKET, BY REGION

13.4.5.1 North America

13.4.5.2 Europe

13.4.5.3 APAC

13.4.5.4 South America

13.4.5.5 Middle East & Africa

14 APPENDIX (Page No. - 182)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (124 Tables)

TABLE 1 WATERPROOFING MEMBRANES MARKET: INCLUSIONS & EXCLUSIONS

TABLE 2 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018-2021

TABLE 3 INDUSTRY (INCLUDING CONSTRUCTION) VALUE ADDED (CURRENT USD) STATISTICS, BY COUNTRY, 2018 (USD MILLION)

TABLE 4 WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 5 WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 6 WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 7 WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (USD MILLION)

TABLE 8 WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 9 WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 10 WATERPROOFING MEMBRANES MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 11 WATERPROOFING MEMBRANES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 13 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 15 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 16 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 17 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (USD MILLION)

TABLE 18 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 19 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 20 US: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 21 US: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 22 CANADA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 23 CANADA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 24 MEXICO: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 25 MEXICO: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 26 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 27 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 29 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 30 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 31 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (USD MILLION)

TABLE 32 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 33 APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 34 CHINA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 35 CHINA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 36 INDIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 ((MILLION SQUARE METER)

TABLE 37 INDIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 38 SOUTH KOREA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 39 SOUTH KOREA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 40 JAPAN: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 41 JAPAN: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 42 AUSTRALIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 43 AUSTRALIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 44 SINGAPORE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 45 SINGAPORE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 PHILIPPINES: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 47 PHILIPPINES: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 MALAYSIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 49 MALAYSIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 INDONESIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 51 INDONESIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 VIETNAM: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 53 VIETNAM: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 THAILAND: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 55 THAILAND: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 REST OF APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 57 REST OF APAC: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 59 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 61 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 63 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 65 EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 66 GERMANY: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 67 GERMANY: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 FRANCE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 69 FRANCE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 UK: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 71 UK: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 ITALY: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 73 ITALY: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 RUSSIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 75 RUSSIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 76 SPAIN: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 77 SPAIN: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 78 HOLLAND: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 79 HOLLAND: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 REST OF EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 81 REST OF EUROPE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 83 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 84 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 85 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 87 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 88 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 89 MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 SAUDI ARABIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 91 SAUDI ARABIA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 UAE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 93 UAE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 94 KUWAIT: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 95 KUWAIT: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 96 QATAR: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 97 QATAR: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 98 SOUTH AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 99 SOUTH AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 REST OF MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 101 REST OF MIDDLE EAST & AFRICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 103 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 104 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 105 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (MILLION SQUARE METER)

TABLE 107 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY USAGE, 2018–2025 (USD MILLION)

TABLE 108 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 109 SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION )

TABLE 110 BRAZIL: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 111 BRAZIL: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION )

TABLE 112 ARGENTINA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 113 ARGENTINA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION )

TABLE 114 CHILE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 115 CHILE: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION )

TABLE 116 REST OF SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 117 REST OF SOUTH AMERICA: WATERPROOFING MEMBRANES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION )

TABLE 118 INVESTMENT & EXPANSION, 2017–2020

TABLE 119 MERGER & ACQUISITION, 2017-2020

TABLE 120 NEW PRODUCT/TECHNOLOGY LAUNCH, 2017-2020

TABLE 121 AGREEMENT & PARTNERSHIP 2017-2020

TABLE 122 ROOFING MARKET SIZE, BY TYPE, 2014–2026 (USD BILLION)

TABLE 123 ROOFING MARKET SIZE, BY APPLICATION, 2014–2026 (USD BILLION)

TABLE 124 ROOFING MARKET SIZE, BY REGION, 2014–2026 (USD BILLION)

LIST OF FIGURES (40 Figures)

FIGURE 1 WATERPROOFING MEMBRANES MARKET: RESEARCH DESIGN

FIGURE 2 WATERPROOFING MEMBRANES MARKET: BOTTOM-UP APPROACH

FIGURE 3 WATERPROOFING MEMBRANES MARKET: TOP-DOWN APPROACH

FIGURE 4 WATERPROOFING MEMBRANES MARKET: DATA TRIANGULATION

FIGURE 5 WATERPROOFING MEMBRANES MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 6 WATERPROOFING MEMBRANES MARKET ANALYSIS

FIGURE 7 LIQUID-APPLIED MEMBRANES ACCOUNTED FOR LARGER SHARE IN 2019

FIGURE 8 NEW CONSTRUCTION SEGMENT ACCOUNTED FOR LARGER SHARE IN THE WATERPROOFING MEMBRANES MARKET IN 2019

FIGURE 9 BUILDING STRUCTURE ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 10 APAC WAS THE LARGEST WATERPROOFING MEMBRANES MARKET IN 2019

FIGURE 11 URBANIZATION, INVESTMENT FOR INFRASTRUCTURAL DEVELOPMENT, AND ECONOMIC GROWTH TO DRIVE THE MARKET

FIGURE 12 LIQUID-APPLIED MEMBRANES TO BE THE LARGER TYPE OF WATERPROOFING MEMBRANES

FIGURE 13 NEW CONSTRUCTION TO BE THE LARGER SEGMENT OF THE MARKET

FIGURE 14 BUILDING STRUCTURE TO BE THE LARGEST APPLICATION OF WATERPROOFING MEMBRANES

FIGURE 15 INDIA TO RECORD HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 BUILDING STRUCTURE AND CHINA ACCOUNTED FOR LARGEST SHARES

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATERPROOFING MEMBRANES MARKET

FIGURE 18 WATERPROOFING MEMBRANES MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 OVERVIEW OF WATERPROOFING MEMBRANES VALUE CHAIN

FIGURE 20 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

FIGURE 21 LIQUID-APPLIED MEMBRANES TO BE THE LARGER TYPE

FIGURE 22 NEW CONSTRUCTION TO BE THE LARGER SEGMENT OF THE MARKET

FIGURE 23 BUILDING STRUCTURE TO BE THE LARGEST APPLICATION OF WATERPROOFING MEMBRANES

FIGURE 24 WATERPROOFING MEMBRANES MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

FIGURE 25 NORTH AMERICA: WATERPROOFING MEMBRANES MARKET SNAPSHOT

FIGURE 26 APAC: WATERPROOFING MEMBRANES MARKET SNAPSHOT

FIGURE 27 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY DURING 2017-2020

FIGURE 28 SIKA LED WATERPROOFING MEMBRANES MARKET IN 2019

FIGURE 29 MARKET RANKING OF KEY PLAYERS

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATERPROOFING MEMBRANES MARKET

FIGURE 31 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN WATERPROOFING MEMBRANES MARKET

FIGURE 32 SIKA AG: COMPANY SNAPSHOT

FIGURE 33 SIKA AG: SWOT ANALYSIS

FIGURE 34 TREMCO: SWOT ANALYSIS

FIGURE 35 GCP APPLIED TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 36 GCP APPLIED TECHNOLOGIES: SWOT ANALYSIS

FIGURE 37 CARLISLE: COMPANY SNAPSHOT

FIGURE 38 SOPREMA: SWOT ANALYSIS

FIGURE 39 BASF SE: COMPANY SNAPSHOT

FIGURE 40 MAPEI: COMPANY SNAPSHOT

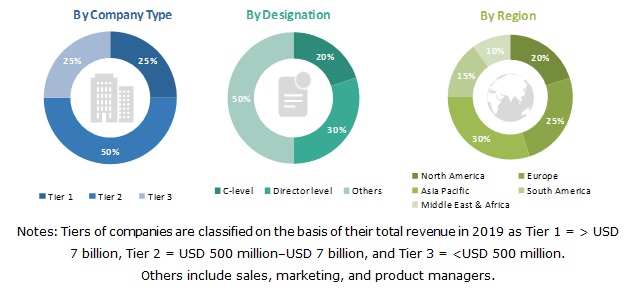

The study involves four major activities in estimating the current market size of waterproofing membranes. Extensive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; and databases.

Primary Research

The waterproofing membranes market comprises several stakeholders, such as raw material suppliers, manufacturers, and distributors of waterproofing membranes, industry associations, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of major construction companies, whereas the supply side consists of waterproofing system manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary interviews

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the waterproofing membranes market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define and analyze the waterproofing membranes market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, usage, application, and region

- To forecast the size of the market with respect to five regions; Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as new product launch, investment & expansion, merger & acquisition and partnership & agreement.

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies, along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC waterproofing membranes market

Company Information:

- Detailed analysis and profiles of additional market players.

Growth opportunities and latent adjacency in Waterproofing Membranes Market