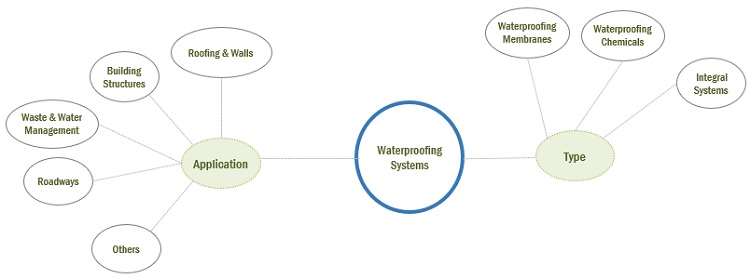

Waterproofing Systems Market by Type (Waterproofing Membranes, Waterproofing Chemicals, Integral Systems), Application (Building Structures, Roofing & Walls, Roadways, Waste & Water Management) and Region - Global Forecast to 2027

Waterproofing Systems Market Analysis

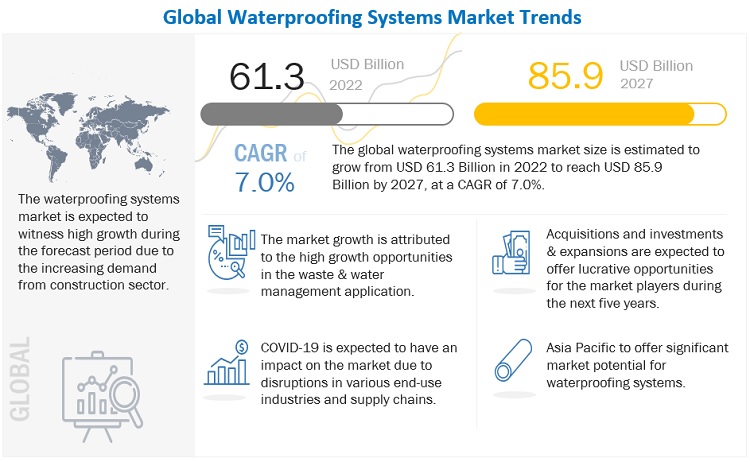

The global waterproofing systems market was valued at USD 61.3 billion in 2022 and is projected to reach USD 85.9 billion by 2027, growing at a cagr 7.0% from 2022 to 2027. Increasing demand for cost-effective and efficient waterproofing systems in construction industry along with growing investment in public infrastructure is driving its market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

During the COVID-19 pandemic every country in the world entered some form of lockdown and this has had a considerable impact on the world’s manufacturing industry. The disruptions in the production and supply chain have had a negative impact on the waterproofing systems market.

The waterproofing systems market is significantly concentrated in Asia Pacific and leading the market in terms of volume. Given that Asia Pacific countries such as China, Japan, India has become virus hotspots in the early outbreak of the COVID-19 pandemic, most of their manufacturing hubs remained under lockdowns to restrict the spread of the virus. Hence, the region underwent an intensive social distancing campaign, further affecting its manufacturing industries.

The COVID-19 pandemic spread through Asia Pacific countries such as China. As a result, Asia Pacific countries including China, Japan, India, and others were sealed to contain the spread of the virus. As a cascading effect of Chinese factories being forced into lockdown, there were supply chain disruptions in manufacturing industries, with exports to the country decreasing by almost 50% in 2020. The pandemic has not only caused production line disruptions and supply-chain stalls but also labor shortages and inactive logistics owing to mass lockdowns by countries across the world.

Waterproofing Systems Market Dynamics

Driver: Growing investment in public infrastructure

Growing investments for the development of commercial buildings, renovation of old infrastructure, growing urbanization, industrialization along with stringent environmental regulations, with regards to industrial and municipal wastewater discharge are some key drivers expected to support revenue growth of global below-grade waterproofing membrane market over the forecast period. In addition, increasing application of waterproofing membranes in industries such as chemical, petroleum, and food & beverage to reduce moisture content, is also expected to stimulate market revenue growth. Corrosion is one of the major issues for oil & gas industry equipment. The industry employs various below-grade waterproofing membranes to prevent moisture-induced corrosion of pipelines, facilities, and resist positive pressure in tanks, bunds, and other water retaining structures. Aforementioned factors are expected to boost market revenue growth.

Restraint: Potential health and environmental issues

At carrying out of the waterproofing works providing protection of land and underground building designs (pipelines, the bases, basements, and others) from impact of water and liquid excited environments, a number of ecologically unsafe materials on the basis of polymers, bitumen imbibition’s and the tars, environment causing a significant damage and to health of people is applied. By production of such works the significant amount of the waste demanding processing in the secondary production or salvaging is formed. All these ecologically hazardous processes have negative impact on a condition of environment, natural resources and health of citizens.

Opportunity: Emergence of environment-friendly waterproofing systems and green buildings

Waterproofing systems are associated with toxicity and VOC content. Sika, Fosroc, Kemper Systems, Pidilite, and other manufacturers provide and have also invested in R&D of solutions that have minimal environmental footprints. Manufacturers are increasingly accrediting their products with green certification for use in sustainable construction projects, such as green roofs and green buildings.

Green roofs are roof structures of any building completely or partially covered with vegetation. They help in the reduction of energy costs and urban heat island effect, removal of harmful air particles, and reduction of stormwater runoff. Green buildings, on the other hand, are energy-efficient buildings. Waterproofing is an important aspect of these building structures. It provides efficient protection from water runoff and weather conditions and provides energy efficiency. In countries such as Germany and the US, green buildings are witnessing high growth owing to regulations pertaining to emissions from buildings and due to the positive impact of these establishments.

Challenge: Volatility in raw material prices

Price and availability of raw materials are major factors that affect the price of the end products. The major challenge for the global waterproofing chemicals market is the oscillating price trends of raw materials, which are fluctuating due to volatile energy prices, as most of the raw materials are petroleum-based. According to BP statistics, in 2018, average oil price increased to USD 71 per barrel from USD 54 per barrel in 2017. Therefore, the fluctuation in oil prices are negatively affecting commercial waterproofing systems market growth. In addition, while applying commercial waterproofing systems such as the bitumen, workers can be exposed to volatile fumes. Extended exposure to these fumes may lead to health issues such as nasal irritation, bronchitis. However, due to the pandemic situation, almost all countries banned both domestic and international travel. This caused a huge drop in the demand for transportation fuel, which affected crude oil prices. The price is further impacted by the geopolitical instability in eastern Europe. Since March 2022, crude oil prices have been above USD 100 per barrel as a consequence of Russia’s invasion of Ukraine.

Waterproofing Systems Market Ecosystem

Source: Secondary Research and MarketsandMarkets Analysis

Waterproofing membranes is the largest and fastest-growing type in the waterproofing systems market during the forecast period.

Waterproofing membranes reduce the ingress of water into a building structure. This segment accounts for the largest share of the overall waterproofing systems market. These membranes are available in two types: sheet membranes and liquid applied membranes. Sheet membranes are more in demand than liquid applied membranes owing to the former’s affordability and ease of operations. Waterproofing membranes are easy to handle and provide efficient waterproofing, a long lifespan to a building structure, and are easily replaceable.

Waste & water management is the fastest-growing application during the forecast period.

Water management includes activities such as waterproofing of large water tanks, sewers, treatment tanks, spillways, channels, inlets, water treatment works, and wastewater treatment utilities. Waterproofing materials such as membrane systems based on polyurea, PU, epoxy, cementitious, and crystalline are utilized in these applications. In water and wastewater treatment plants, waterproofing is applied to pretreatment tanks, primary sedimentation tanks, secondary sedimentation tanks, biological treatment tanks, sludge tanks, tertiary treatment tanks, equalization tanks, operation facilities, and others. Proper waterproofing is required to protect this equipment and establishments from premature damage and provide long-term service life. The high growth of the waterproofing systems market is attributed to the growing water management needs driven by urbanization and industrialization.

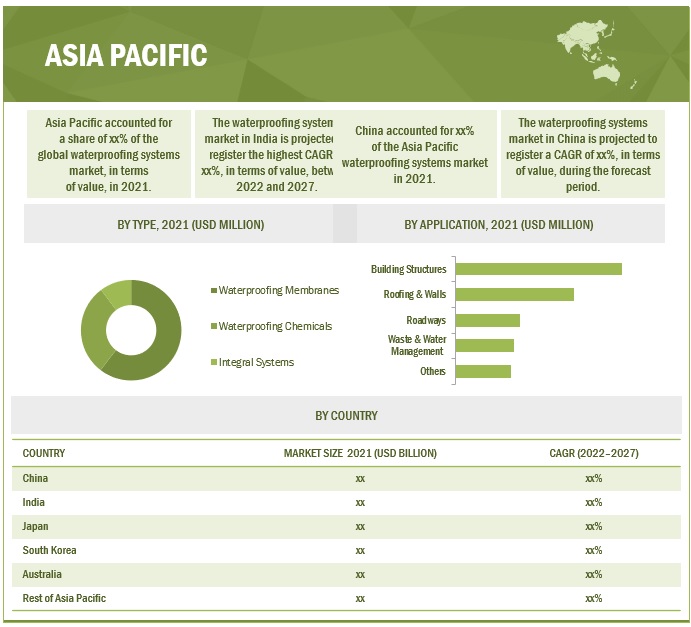

Asia Pacific is the fastest growing region in the waterproofing systems market during the forecast period

The waterproofing systems market is the largest-growing in APAC. The market for waterproofing system in APAC is being driven by factors such as the growing population, rising need for residential buildings, rapid industrialization, and growing urbanization. China is the largest market for waterproofing systems in the region. As the region’s largest manufacture, China is also a significant producer and consumer of commercial waterproofing systems. India and south Korea are projected to grow decent rate during the forecast period.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the global waterproofing systems market include Sika AG (Switzerland), Soprema (France), GCP Applied Technologies (US), Fosroc (UK), Carlisle Construction Company (US), Mapei S.p.A. (Italy), Tremco (US), Pidilite Industries (India), and Henkel Polybit (UAE) among many others.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Waterproofing Systems Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 61.3 billion |

|

Revenue Forecast in 2027 |

USD 85.9 billion |

|

CAGR |

7.0% |

|

Years considered for the study |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Kiloton) and Value (USD Million/Billion) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Sika (Switzerland), Fosroc (UK), GCP Applied Technologies (US), Soprema (France), and Carlisle Construction Materials (US) |

The study categorizes the waterproofing systems market based on type, application, and region.

By Type:

- Waterproofing Membranes

- Waterproofing Chemicals

- Integral Systems

By Application:

- Building Structures

- Roofing & Walls

- Waste & Water Management

- Roadways

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2022, Sika acquired United Gilsonite Laboratories (UGL), a leading manufacturer of primer coating in US. This acquisition is expected to help Sika to improve its presence with major retailers and other building material stores by widening the offering.

- In March 2022, Sika acquired Canada-based Sable Marco Inc., a manufacturer of cementitious products and mortars. It is a complementary acquisition that is expected to improve Sika's access to the retail distribution channel.

- In November 2021, Sika signed an agreement to acquire MBCC Group. It has reinforced a complementary range of product offerings through this acquisition.

- In November 2021, Fosroc launched a new grade of polyurea under the brand name Polyurea WH 100. The new product provides long-lasting waterproofing. This new additional grade further strengthens Fosroc's Polyurea portfolio, catering to all market segments.

Frequently Asked Questions (FAQ):

What is the current size of the global waterproofing systems market?

The global waterproofing systems market is estimated to be USD 61.3 billion in 2022 to reach USD 85.9 billion by 2027, at a CAGR of 7.0% between 2022 and 2027.

What are the factors influencing the growth of waterproofing systems market?

The growth of this market can be attributed to rising demand for waterproofing systems in waste & water management applications.

What is the biggest restraint for waterproofing systems?

The potential health and environmental issues is restraining the growth of the market.

Who are the major manufacturers?

Major manufacturers include Sika AG (Switzerland), Soprema (France), GCP Applied Technologies (US), Fosroc (UK), Carlisle Construction Company (US), Mapei S.p.A. (Italy), Tremco (US), Pidilite Industries (India), and Henkel Polybit (UAE) among many others.

What is the impact of COVID-19 on the overall waterproofing systems market?

The waterproofing systems market is significantly concentrated in Asia Pacific and leading the market in terms of volume. Due to the ongoing pandemic, these industries have been severely affected throughout the world. Manpower shortage, logistical restrictions, material unavailability, and other restrictions have slowed the growth of the industry in a considerable manner.

What will be the growth prospects of the waterproofing systems market?

Emergence of environment-friendly waterproofing systems and green buildings is expected to offer significant growth opportunities to manufacturers of waterproofing systems market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 WATERPROOFING SYSTEMS MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 WATERPROOFING SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 WATERPROOFING SYSTEMS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 WATERPROOFING SYSTEMS MARKET: TOP-DOWN APPROACH

FIGURE 4 WATERPROOFING SYSTEMS MARKET ANALYSIS

2.3 FORECAST NUMBER CALCULATION

2.4 DATA TRIANGULATION

FIGURE 5 WATERPROOFING SYSTEMS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 LIMITATIONS & RISKS ASSOCIATED WITH WATERPROOFING SYSTEMS MARKET

2.6.1 WATERPROOFING SYSTEMS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 6 WATERPROOFING SYSTEMS MARKET ANALYSIS THROUGH SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 7 WATERPROOFING MEMBRANES ACCOUNTED FOR LARGEST SHARE IN 2022

FIGURE 8 BUILDING STRUCTURE ACCOUNTS FOR LARGEST SHARE IN WATERPROOFING SYSTEMS MARKET

FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF GLOBAL WATERPROOFING SYSTEMS MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN WATERPROOFING SYSTEMS MARKET

FIGURE 10 GROWING DEMAND FOR COST-EFFECTIVE AND EFFICIENT WATERPROOFING SYSTEMS TO DRIVE MARKET

4.2 WATERPROOFING SYSTEMS MARKET, BY TYPE

FIGURE 11 WATERPROOFING MEMBRANES TO ACCOUNT FOR LARGEST SHARE OF OVERALL MARKET

4.3 WATERPROOFING SYSTEMS MARKET, BY APPLICATION

FIGURE 12 BUILDING STRUCTURE TO BE LARGEST APPLICATION OF WATERPROOFING SYSTEMS

4.4 WATERPROOFING SYSTEMS MARKET, BY MAJOR COUNTRIES

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 ASIA PACIFIC WATERPROOFING SYSTEMS MARKET, BY APPLICATION AND COUNTRY, 2021

FIGURE 14 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATERPROOFING SYSTEMS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for cost-effective and efficient waterproofing systems in construction industry

5.2.1.2 Growing investment in public infrastructure

TABLE 2 UPCOMING INFRASTRUCTURE PROJECTS

5.2.2 RESTRAINTS

5.2.2.1 Potential health and environmental issues

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of environment-friendly waterproofing systems and green buildings

5.2.3.2 Growing requirement for water management in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Volatility in raw material prices

TABLE 3 KEY RAW MATERIAL PRICES, PERCENTAGE CHANGE (2017-2021)

TABLE 4 KEY PRICE FLUCTUATIONS IDENTIFIED

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 WATERPROOFING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 5 WATERPROOFING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 17 OVERVIEW OF WATERPROOFING SYSTEMS MARKET VALUE CHAIN

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS

5.5 RAW MATERIAL ANALYSIS

5.5.1 POLYURETHANE AND THERMOPLASTIC

5.5.2 CEMENTITIOUS COATING

5.5.3 EPDM RUBBER

5.5.4 BITUMEN AND MASTIC BITUMEN

5.5.5 PVC

5.6 ECOSYSTEM MAPPING

FIGURE 18 WATERPROOFING SYSTEMS MARKET: ECOSYSTEM MAPPING

TABLE 6 WATERPROOFING SYSTEMS MARKET: ROLE IN ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 NANOTECHNOLOGY WATERPROOFING

5.7.2 CRYSTALLINE WATERPROOFING

5.7.3 FLEXIBLE WATERPROOFING MEMBRANE

5.8 PRICING ANALYSIS

5.8.1 AVERAGE SELLING PRICE BASED ON REGION

FIGURE 19 AVERAGE SELLING PRICE, BY REGION (PRICE/KG)

5.8.2 AVERAGE SELLING PRICE BASED ON APPLICATION

TABLE 7 AVERAGE SELLING PRICES, BY APPLICATION (PRICE/KG)

5.8.3 AVERAGE SELLING PRICE BASED ON COMPANY

TABLE 8 AVERAGE SELLING PRICE, BY COMPANY (PRICE/KG)

5.9 TRADE ANALYSIS

5.9.1 IMPORT TRADE ANALYSIS

TABLE 9 REGION-WISE IMPORT (USD THOUSAND)

5.9.2 EXPORT TRADE ANALYSIS

TABLE 10 REGION-WISE EXPORT (USD THOUSAND)

5.10 TARIFF POLICIES/GUIDELINES/REGULATIONS/STANDARDS

5.10.1 IS-3384:1986

5.10.2 AS 4654.2-2009

5.10.3 NATIONAL VOLATILE ORGANIC COMPOUND (VOC) EMISSION STANDARD FOR CONSUMER AND COMMERCIAL PRODUCTS

5.10.4 BS 8102:2009

5.10.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

FIGURE 20 GROWTH OF CONSTRUCTION SECTOR IN EMERGING ECONOMIES INFLUENCING MARKET

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 15 WATERPROOFING SYSTEMS MARKET: LIST OF CONFERENCES & EVENTS

5.13 CASE STUDY ANALYSIS

5.13.1 REMEDIAL TERRACE WATERPROOFING OF DABUR INDIA LIMITED WITH POLYMER MODIFIED BITUMINOUS COATING

5.13.2 CRYSTAL PALACE NATIONAL SPORTS CENTER

5.14 KEY FACTORS AFFECTING BUYING DECISIONS

5.14.1 QUALITY

5.14.2 SERVICE

FIGURE 21 KEY BUYING CRITERIA

5.15 PATENT ANALYSIS

5.15.1 METHODOLOGY

5.15.2 DOCUMENT TYPE

FIGURE 22 TOTAL NUMBER OF PATENTS

FIGURE 23 NUMBER OF PATENTS PUBLISHED IN LAST 10 YEARS

5.15.3 INSIGHTS

5.15.4 LEGAL STATUS OF PATENTS

FIGURE 24 PATENT ANALYSIS, BY LEGAL STATUS

FIGURE 25 TOP JURISDICTION, BY DOCUMENT

5.15.5 TOP COMPANIES/APPLICANTS

FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 16 LIST OF PATENTS BY SIKA AG

TABLE 17 LIST OF PATENTS BY TIANJIN YUSHEN BUILDING WATERPROOF MAT CO. LTD.

TABLE 18 LIST OF PATENTS BY W. R. GRACE & CO.

TABLE 19 LIST OF PATENTS GCP APPLIED TECHNOLOGIES

TABLE 20 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.16 MACROECONOMIC INDICATORS

5.16.1 GLOBAL GDP TRENDS AND CONSTRUCTION INDUSTRY STATISTICS

TABLE 21 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018-2021

TABLE 22 CONSTRUCTION INDUSTRY STATISTICS, BY COUNTRY (USD MILLION)

6 WATERPROOFING SYSTEMS MARKET, BY TYPE (Page No. - 80)

6.1 INTRODUCTION

FIGURE 27 WATERPROOFING MEMBRANES TO BE LARGEST SEGMENT

TABLE 23 WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 24 WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 25 WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

6.2 WATERPROOFING CHEMICALS

6.2.1 BITUMEN

6.2.2 ELASTOMERS

6.2.3 POLYVINYL CHLORIDE (PVC)

6.2.4 THERMOPLASTIC OLEFIN (TPO)

6.2.5 ETHYLENE PROPYLENE DIENE MONOMER (EPDM)

6.3 WATERPROOFING MEMBRANES

6.3.1 PREFORMED MEMBRANES

6.3.2 LIQUID APPLIED MEMBRANES (LAM)

6.3.2.1 Bituminous membranes

6.3.2.2 Elastomeric membranes

6.3.2.3 Cementitious membranes

6.4 INTEGRAL SYSTEMS

6.4.1 CRYSTALLINE WATERPROOFING ADMIXTURES

6.4.2 PORE-BLOCKING WATERPROOFING ADMIXTURES

7 WATERPROOFING SYSTEMS MARKET, BY APPLICATION (Page No. - 87)

7.1 INTRODUCTION

FIGURE 28 BUILDING STRUCTURES TO BE LARGEST APPLICATION

TABLE 27 WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 28 WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027(KILOTON)

TABLE 29 WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 30 WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027(USD MILLION)

7.2 ROOFING & WALLS

7.2.1 INCREASING NEED FOR IMPROVED ENERGY EFFICIENCY FOR ROOFS AND WALLS

7.3 BUILDING STRUCTURES

7.3.1 INCREASING USE IN PROTECTING BELOWGROUND STRUCTURES

7.4 WASTE & WATER MANAGEMENT

7.4.1 RISE IN POPULATION LEADING TO INCREASED REQUIREMENT FOR WASTE MANAGEMENT

7.5 ROADWAYS

7.5.1 INCREASING INFRASTRUCTURAL ACTIVITIES

7.6 OTHERS

8 WATERPROOFING SYSTEMS MARKET, BY REGION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 29 MARKET IN INDIA TO GROW AT HIGHEST CAGR

TABLE 31 WATERPROOFING SYSTEMS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 32 WATERPROOFING SYSTEMS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

TABLE 33 WATERPROOFING SYSTEMS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 WATERPROOFING SYSTEMS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 36 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 37 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 40 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 41 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 44 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 45 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Expanding residential sector

TABLE 47 US: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 48 US: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 49 US: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 US: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Government initiatives in construction sector

TABLE 51 CANADA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 52 CANADA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 53 CANADA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 CANADA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Government’s infrastructure plan

TABLE 55 MEXICO: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 56 MEXICO: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 57 MEXICO: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 58 MEXICO: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SNAPSHOT

TABLE 59 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 60 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 61 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 62 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 64 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 65 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 66 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 68 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 69 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 70 ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Development of prefabricated buildings

TABLE 71 CHINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 72 CHINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 73 CHINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 CHINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.2 INDIA

8.3.2.1 Industrialization and urbanization to drive growth

TABLE 75 INDIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 76 INDIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 77 INDIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 INDIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.3 SOUTH KOREA

8.3.3.1 Government investments to propel market

TABLE 79 SOUTH KOREA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 80 SOUTH KOREA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 81 SOUTH KOREA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 SOUTH KOREA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.4 JAPAN

8.3.4.1 Ongoing construction projects to drive market

TABLE 83 JAPAN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 84 JAPAN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 85 JAPAN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 JAPAN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.5 AUSTRALIA

8.3.5.1 Government funding to support infrastructure projects

TABLE 87 AUSTRALIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 88 AUSTRALIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 89 AUSTRALIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 AUSTRALIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.6 REST OF ASIA PACIFIC

TABLE 91 REST OF ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 92 REST OF ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 93 REST OF ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 94 REST OF ASIA PACIFIC: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4 EUROPE

TABLE 95 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 96 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 97 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 100 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 101 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 104 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 105 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Residential infrastructure to drive market

TABLE 107 GERMANY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 108 GERMANY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 109 GERMANY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 GERMANY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.2 FRANCE

8.4.2.1 Foreign investments to boost construction industry

TABLE 111 FRANCE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 112 FRANCE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 113 FRANCE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 FRANCE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.3 UK

8.4.3.1 Government subsidies to lead to market growth

TABLE 115 UK: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 116 UK: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 117 UK: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 118 UK: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.4 ITALY

8.4.4.1 Restoration and wastewater treatment projects to drive market

TABLE 119 ITALY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 120 ITALY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 121 ITALY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 ITALY: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.5 RUSSIA

8.4.5.1 Government policies to support construction industry

TABLE 123 RUSSIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 124 RUSSIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 125 RUSSIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 RUSSIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.6 SPAIN

8.4.6.1 Investments in infrastructure propelling market

TABLE 127 SPAIN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 128 SPAIN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 129 SPAIN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 SPAIN: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.7 REST OF EUROPE

TABLE 131 REST OF EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 132 REST OF EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 133 REST OF EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 REST OF EUROPE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 135 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 136 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 137 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 140 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 141 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 144 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 145 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Residential construction sector to drive market

TABLE 147 SAUDI ARABIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 148 SAUDI ARABIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 149 SAUDI ARABIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 SAUDI ARABIA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.2 UAE

8.5.2.1 Commercial and residential sectors to fuel market

TABLE 151 UAE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 152 UAE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 153 UAE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 UAE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.3 SOUTH AFRICA

8.5.3.1 Government focus on construction sector

TABLE 155 SOUTH AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 156 SOUTH AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 157 SOUTH AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 158 SOUTH AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 159 REST OF MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 160 REST OF MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 161 REST OF MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 162 REST OF MIDDLE EAST & AFRICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 163 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 164 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 165 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 166 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 167 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 168 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 169 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 172 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 173 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 174 SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Infrastructure and industrial growth to drive market

TABLE 175 BRAZIL: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 176 BRAZIL: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 177 BRAZIL: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 BRAZIL: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Stabilizing economy to boost construction sector

TABLE 179 ARGENTINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 180 ARGENTINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 181 ARGENTINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 182 ARGENTINA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.3 CHILE

8.6.3.1 Government support for infrastructure to attract foreign investments

TABLE 183 CHILE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 184 CHILE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 185 CHILE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 186 CHILE: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.4 REST OF SOUTH AMERICA

TABLE 187 REST OF SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 188 REST OF SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 189 REST OF SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: WATERPROOFING SYSTEMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 158)

9.1 INTRODUCTION

9.2 KEY PLAYER STRATEGIES

TABLE 191 COMPANIES ADOPTED INVESTMENT & EXPANSION AS IMPORTANT DEVELOPMENT STRATEGY

9.3 MARKET EVALUATION MATRIX

TABLE 192 MARKET EVALUATION MATRIX, 2017–2022

9.4 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 193 WATERPROOFING SYSTEM MARKET: REVENUE ANALYSIS

9.5 MARKET RANKING ANALYSIS

FIGURE 32 RANKING OF TOP FIVE PLAYERS IN WATERPROOFING SYSTEM MARKET, 2021

9.6 MARKET SHARE ANALYSIS

FIGURE 33 WATERPROOFING SYSTEM MARKET SHARE, BY COMPANY (2021)

TABLE 194 WATERPROOFING SYSTEM MARKET: DEGREE OF COMPETITION

9.6.1 SIKA

9.6.2 CARLISLE CONSTRUCTION MATERIALS

9.6.3 GCP APPLIED TECHNOLOGIES

9.6.4 SOPREMA

9.6.5 FOSROC

9.7 COMPANY EVALUATION MATRIX

9.7.1 STARS

9.7.2 EMERGING LEADERS

9.7.3 PERVASIVE PLAYERS

9.7.4 PARTICIPANTS

FIGURE 34 WATERPROOFING SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2022

9.7.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATERPROOFING SYSTEMS MARKET

9.7.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN WATERPROOFING SYSTEMS MARKET

9.8 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.8.1 PROGRESSIVE COMPANIES

9.8.2 RESPONSIVE COMPANIES

9.8.3 DYNAMIC COMPANIES

9.8.4 STARTING BLOCKS

FIGURE 37 WATERPROOFING SYSTEM MARKET: START-UPS AND SMES MATRIX, 2021

9.8.5 STRENGTH OF PRODUCT PORTFOLIO (SMES)

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS (SMES) OF TOP PLAYERS IN WATERPROOFING SYSTEMS MARKET

9.8.6 BUSINESS STRATEGY EXCELLENCE (SMES)

FIGURE 39 BUSINESS STRATEGY EXCELLENCE (SMES) OF TOP PLAYERS IN WATERPROOFING SYSTEMS MARKET

9.9 COMPETITIVE BENCHMARKING

TABLE 195 WATERPROOFING SYSTEM MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 196 WATERPROOFING SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

9.9.1 COMPANY OVERALL FOOTPRINT

9.9.2 COMPANY PRODUCT TYPE FOOTPRINT

9.9.3 COMPANY APPLICATION FOOTPRINT

9.9.4 COMPANY REGIONAL FOOTPRINT

9.10 COMPETITIVE SCENARIO

9.10.1 NEW PRODUCT LAUNCH

TABLE 197 NEW PRODUCT LAUNCHES, 2017–2022

9.10.2 DEALS

TABLE 198 DEALS, 2017–2022

9.10.3 OTHER DEVELOPMENTS

TABLE 199 OTHER DEVELOPMENTS, 2017—2022

10 COMPANY PROFILES (Page No. - 183)

10.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM view, Strategic choice made, Right to win, and Weaknesses and competitive threats)*

10.1.1 SIKA AG

TABLE 200 SIKA: COMPANY OVERVIEW

FIGURE 40 SIKA AG: COMPANY SNAPSHOT

TABLE 201 SIKA: PRODUCT OFFERINGS

TABLE 202 SIKA AG: NEW PRODUCT

TABLE 203 SIKA AG: DEALS

TABLE 204 SIKA AG: OTHER DEVELOPMENTS

10.1.2 FOSROC

TABLE 205 FOSROC: COMPANY OVERVIEW

TABLE 206 FOSROC: PRODUCT OFFERINGS

TABLE 207 FOSROC: NEW PRODUCT LAUNCH

TABLE 208 FOSROC: OTHERS

10.1.3 GCP APPLIED TECHNOLOGIES

TABLE 209 GCP APPLIED TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 41 GCP APPLIED TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 210 GCP APPLIED TECHNOLOGIES: PRODUCT OFFERINGS

TABLE 211 GCP APPLIED TECHNOLOGIES: DEALS

TABLE 212 GCP APPLIED TECHNOLOGIES: OTHERS

10.1.4 SOPREMA

TABLE 213 SOPREMA: COMPANY OVERVIEW

TABLE 214 SOPREMA: PRODUCT OFFERINGS

TABLE 215 SOPREMA: DEALS

10.1.5 CARLISLE CONSTRUCTION MATERIALS

TABLE 216 CARLISLE CONSTRUCTION MATERIALS: COMPANY OVERVIEW

FIGURE 42 CARLISLE CONSTRUCTION MATERIALS: COMPANY SNAPSHOT

TABLE 217 CARLISLE CONSTRUCTION MATERIALS: PRODUCT OFFERINGS

TABLE 218 CARLISLE CONSTRUCTION MATERIALS: DEALS

10.1.6 HENKEL POLYBIT INDUSTRIES LTD.

TABLE 219 HENKEL POLYBIT: COMPANY OVERVIEW

TABLE 220 HENKEL POLYBIT: PRODUCT OFFERINGS

10.1.7 MAPEI S.P.A.

TABLE 221 MAPEI S.P.A.: COMPANY OVERVIEW

TABLE 222 MAPEI S.P.A.: PRODUCT OFFERINGS

TABLE 223 MAPEI S.P.A.: DEALS

10.1.8 PIDILITE INDUSTRIES

TABLE 224 PIDILITE INDUSTRIES: COMPANY OVERVIEW

FIGURE 43 PIDILITE INDUSTRIES: COMPANY SNAPSHOT

TABLE 225 PIDILITE INDUSTRIES: PRODUCT OFFERINGS

TABLE 226 PIDILITE INDUSTRIES: NEW PRODUCT LAUNCH

10.1.9 TREMCO (RPM INTERNATIONAL)

TABLE 227 TREMCO: COMPANY OVERVIEW

TABLE 228 TREMCO: PRODUCT OFFERINGS

10.1.10 SAINT-GOBAIN

TABLE 229 SAINT-GOBAIN: COMPANY OVERVIEW

FIGURE 44 SAINT-GOBAIN: COMPANY SNAPSHOT

TABLE 230 SAINT-GOBAIN: PRODUCT OFFERINGS

TABLE 231 SAINT-GOBAIN: DEALS

10.2 OTHER COMPANIES

10.2.1 ALCHIMICA BUILDING CHEMICALS

TABLE 232 ALCHIMICA BUILDING CHEMICALS: COMPANY OVERVIEW

10.2.2 BOSTIK

TABLE 233 BOSTIK: COMPANY OVERVIEW

10.2.3 ELMICH PTE LTD.

TABLE 234 ELMICH PTE LTD.: COMPANY OVERVIEW

10.2.4 FIRESTONE BUILDING PRODUCTS COMPANY LLC.

TABLE 235 FIRESTONE BUILDING PRODUCTS COMPANY: COMPANY OVERVIEW

10.2.5 GAF MATERIAL CORPORATION

TABLE 236 GAF MATERIAL CORPORATION: COMPANY OVERVIEW

10.2.6 GULF MEMBRANE AND COATING INDUSTRIES

TABLE 237 GULF MEMBRANE AND COATING INDUSTRIES: COMPANY OVERVIEW

10.2.7 IKO

TABLE 238 IKO: COMPANY OVERVIEW

10.2.8 JOHNS MANVILLE

TABLE 239 JOHNS MANVILLE: COMPANY OVERVIEW

10.2.9 KEMPER SYSTEM

TABLE 240 KEMPER SYSTEM: COMPANY OVERVIEW

10.2.10 IWL INDIA LIMITED

TABLE 241 IWL INDIA LIMITED: COMPANY OVERVIEW

10.2.11 SIPLAST

TABLE 242 SIPLAST: COMPANY OVERVIEW

10.2.12 STP LIMITED

TABLE 243 STP LIMITED: COMPANY OVERVIEW

10.2.13 THE DOW CHEMICAL COMPANY

TABLE 244 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

10.2.14 KOSTER WATERPROOFING SYSTEM (KOSTER BAUCHEMIE AG)

TABLE 245 KOSTER WATERPROOFING SYSTEM (KOSTER BAUCHEMIE AG): COMPANY OVERVIEW

10.2.15 CONCRETE WATERPROOFING SYSTEM

TABLE 246 CONCRETE WATERPROOFING SYSTEM: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments, MNM view, Strategic choice made, Right to win, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 231)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

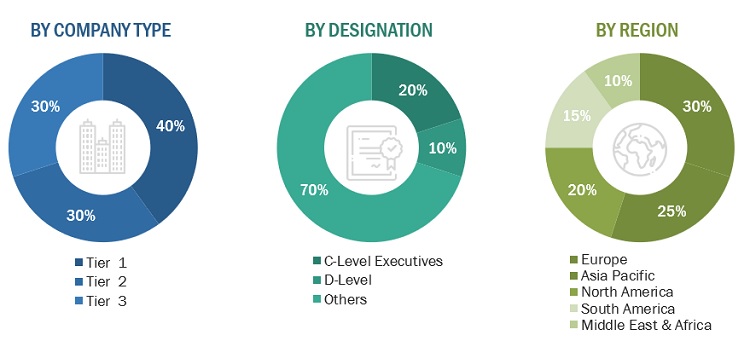

The study involved four major activities in estimating the current market size for waterproofing systems. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary sources referred to for this research study include ceramic industry organizations such as the European Waterproofing Association (EWA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and ceramic associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the waterproofing systems market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (end-users) and supply-side (waterproofing systems manufacturers and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa and South America. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

To know about the assumptions considered for the study, download the pdf brochure

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Global Waterproofing Systems Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of waterproofing systems and their applications.

Objectives of the Study:

- To analyze and forecast the size of the waterproofing systems market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type, application, and region

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Notes: Micromarkets1 are the sub-segments of the Waterproofing systems market included in the report.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report

- Additional country-level analysis of waterproofing systems market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Waterproofing Systems Market