Wearable Technology Market Size, Share & Industry 2030

Wearable Technology Market by Product (Smart Watch, Head-mounted Display, Smart Shoes, Smart Vests, Earwear, Exoskeleton, Smart Glasses, Smart Ring, Smart Helmet), Operation (AI-based, Conventional), Type (Active, Passive) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

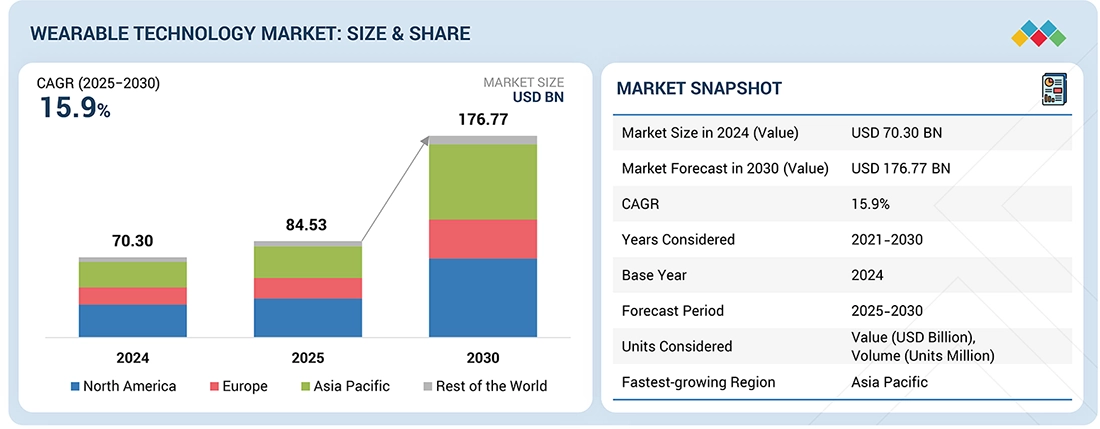

The wearable technology market is projected to reach USD 176.77 billion by 2030 from USD 84.53 billion in 2025, at a CAGR of 15.9% from 2025 to 2030. Wearable technology encompasses electronic devices worn on the body, such as smartwatches, fitness trackers, and smart glasses, that utilize sensors, processors, and wireless connectivity to monitor health metrics, track activity, and deliver real-time notifications. These gadgets enhance daily life by providing biofeedback on fitness, sleep, and vital signs while integrating with smartphones for seamless data syncing and hands-free functionality.

The wearable market is growing steadily as connectivity, sensors, and AI enhance everyday digital experiences. The broader wearables market includes smartwatches, fitness bands, and smart accessories, forming the core of the wearable electronics market. Rising demand for real-time health tracking, mobility, and seamless smartphone integration is driving adoption across the smart wearables market globally.

The wearable fitness technology market continues to lead growth with applications such as activity monitoring, heart-rate tracking, and sleep analysis, strengthening the wearable computing devices market. At the same time, the industrial wearable devices market is expanding in manufacturing, logistics, and construction, where smart helmets, AR glasses, and connected safety devices improve productivity and worker safety.

KEY TAKEAWAYS

-

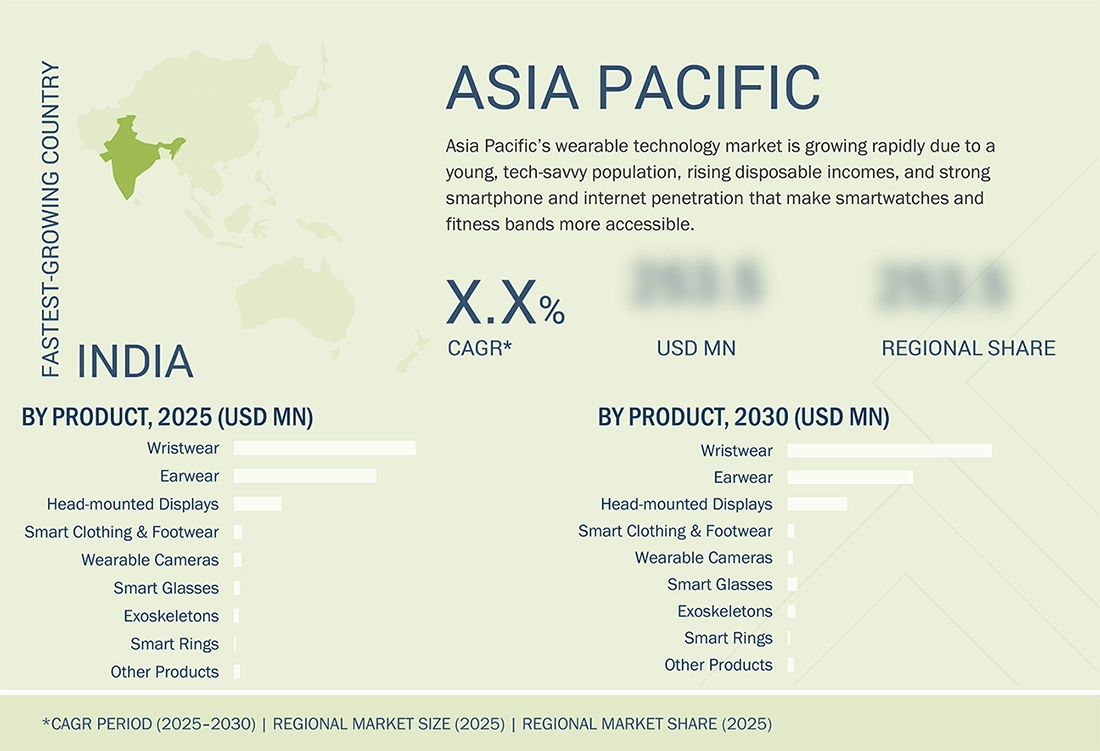

BY REGIONBy region, the Asia Pacific is expected to grow at the highest CAGR of 18.9% during the forecast period.

-

BY PRODUCTBy product, the wristwear segment is expected to register a larger share in 2025.

-

BY TYPEBy type, the non-textile wearables segment is expected to dominate the wearable electronic market during the forecast period.

-

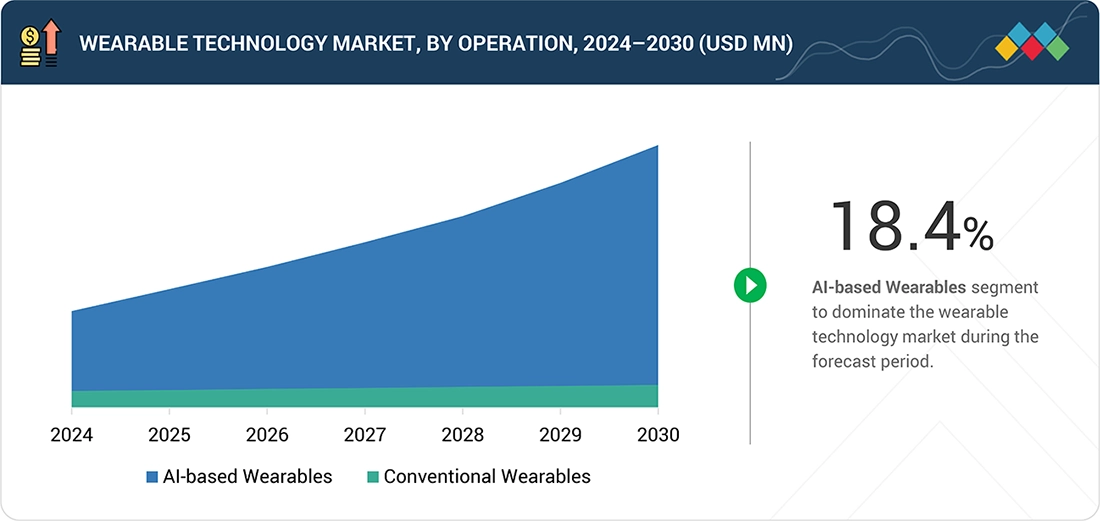

BY OPERATIONBy operation, the AI-based segment is expected to register the highest CAGR of 18.4% over the forecast period.

-

BY APPLICATIONIn 2025, the consumer electronics segment is expected to account for a share of more than 50%.

-

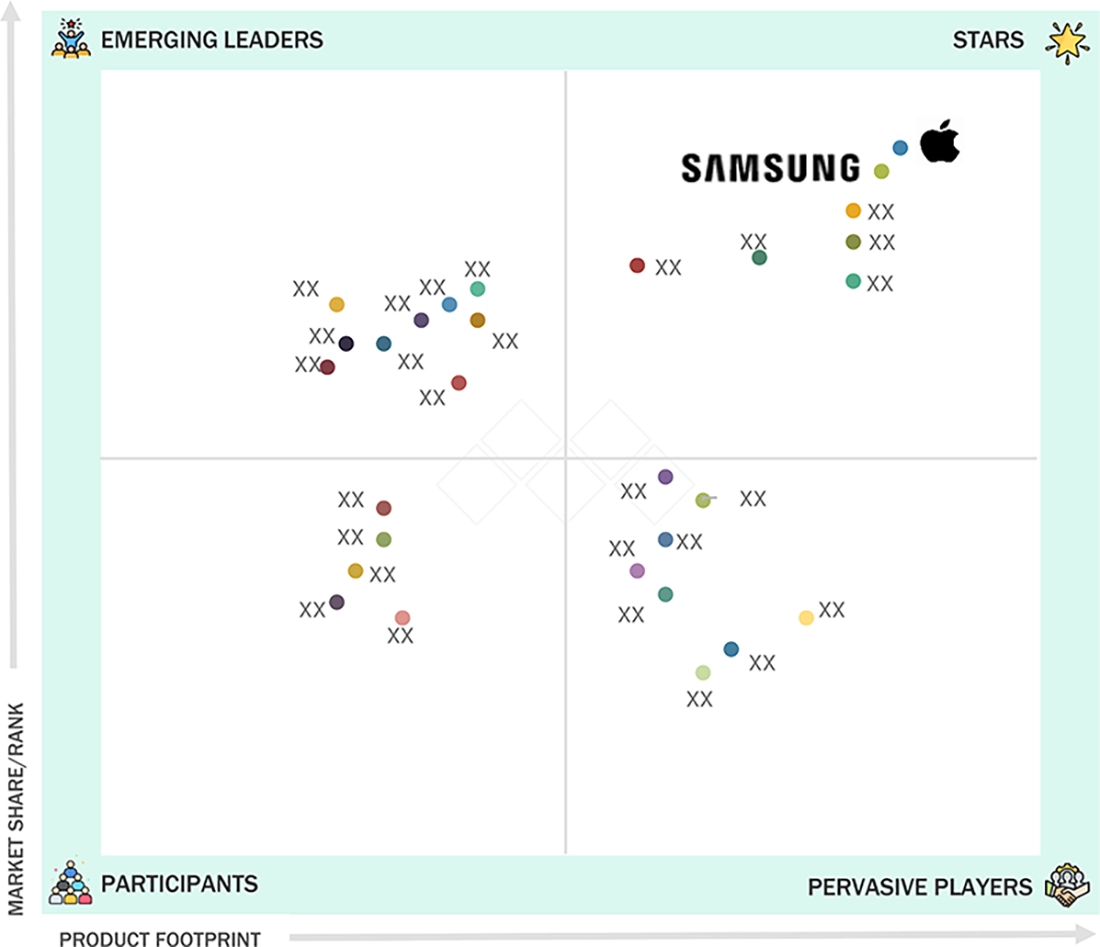

COMPETITIVE LANDSCAPE - KEY PLAYERSApple Inc., Samsung, and Xiaomi were identified as star players in the wearable technology market, given their substantial market share and wide range of product offerings.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESMagic Leap, Inc., Humane Inc., and Bragi, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, highlighting their potential as upcoming market leaders.

The global wearable technology industry is expanding strongly as consumers worldwide adopt smart devices for fitness tracking, health monitoring, communication, and entertainment. Rising chronic health conditions, increasing smartphone and internet penetration, and integration of AI, IoT, and 5G are enabling more advanced, connected, and personalized wearable solutions. Growing adoption across healthcare, sports and fitness, industrial safety, and enterprise productivity use cases further accelerates innovation and long-term market growth.

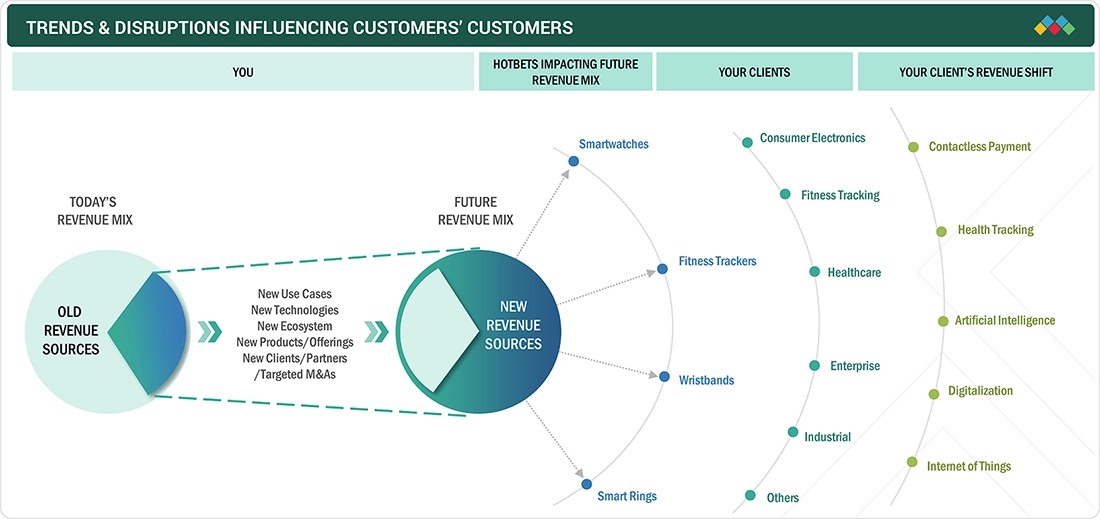

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Across the globe, the rapid adoption of connected wearables, including smartwatches, fitness bands, and smart clothing, is being driven by rising health awareness and an increased emphasis on preventive care. The integration of advanced sensors, AI-driven analytics, and IoT connectivity supports real-time tracking of vital signs, activity levels, and chronic conditions, expanding applications in healthcare, sports, and corporate wellness. Leading technology companies are significantly increasing their R&D investments to deliver more accurate, energy-efficient, and feature-rich devices, further boosting global consumer adoption.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising focus on fitness, wellness, and continuous health tracking

-

Advances in sensors, AI, and 5G enabling smarter, always-connected wearables

Level

-

Premium pricing and subscription models limiting mass adoption

-

Short battery life and comfort issues affecting daily use

Level

-

Growing use of wearables in remote patient monitoring and telehealth

-

Increasing enterprise and industrial adoption for safety and productivity

Level

-

Intensifying data privacy and cybersecurity concerns around health data

-

Fragmented and tightening regulations for medical-grade and consumer devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising focus on fitness, wellness, and continuous health tracking

The rising global focus on fitness, wellness, and continuous health tracking is prompting consumers to adopt wearables that monitor steps, heart rate, sleep quality, and stress levels throughout the day. People are increasingly prioritizing preventative health, using data from smartwatches and fitness bands to manage weight, improve activity levels, and detect early warning signs. Employers and insurers are also promoting wellness programs that incentivize the use of such devices. This is turning wearables into everyday companions rather than niche gadgets.

Restraint: Premium pricing and subscription models limiting mass adoption

Premium smartwatches, AR glasses, and medical-grade wearables often carry high prices due to advanced sensors, processors, and branded ecosystems. For price-sensitive consumers, the upfront cost, plus accessories and subscription services for advanced analytics, can act as a barrier to adoption. Frequent product refresh cycles and rapid feature obsolescence also make buyers hesitant, as devices may need replacement within a few years. As a result, penetration remains lower among lower-income segments despite strong interest in health monitoring.

Opportunity: Growing use of wearables in remote patient monitoring and telehealth

The growing use of wearables in remote patient monitoring and telehealth means that healthcare providers are increasingly relying on connected devices to track patients’ vital signs outside of hospitals. Continuous monitoring of metrics like heart rhythm, blood oxygen, glucose levels, or activity helps clinicians manage chronic diseases more proactively and intervene early when readings deteriorate. Integrating wearable data into telehealth platforms also supports virtual consultations and reduces hospital visits, particularly for elderly or rural populations. This creates a strong new demand segment beyond consumer fitness and supports reimbursable, medically supervised use cases.

Challenge: Intensifying data privacy and cybersecurity concerns around health data

Intensifying data privacy and cybersecurity concerns around health data arises because wearables constantly collect sensitive biometric, location, and lifestyle information. Breaches, insecure apps, or opaque data-sharing practices raise fears about misuse by advertisers, employers, or insurers, and can erode user trust. Regulators in many regions are tightening rules on consent, data storage, cross-border transfers, and security standards for connected health devices. Compliance with these expectations adds cost and complexity for manufacturers, and any high-profile incident can trigger backlash that slows adoption.

WEARABLE TECHNOLOGY MARKET SIZE, SHARE & INDUSTRY 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The Apple Watch is widely used across regions for comprehensive health and fitness tracking, including heart-rate monitoring, ECG, blood oxygen measurement, sleep analysis, and safety features such as fall and crash detection, all integrated with the Apple Health ecosystem and third-party health apps. | Delivers clinically oriented health insights and real-time data that support early detection, chronic disease management, and remote monitoring. At the same time, tight integration with iPhone and services enhances user engagement, adherence, and global scalability. |

|

Samsung Galaxy Watch devices utilize the BioActive sensor to integrate optical heart rate, electrical heart signal, and bioimpedance analysis for ECG, blood pressure, body composition, sleep, and fitness tracking, catering to diverse consumer and preventive health use cases. | Provides users with a holistic picture of cardiovascular health, body composition, and daily activity, supporting preventative wellness and lifestyle coaching, while seamlessly linking with Android phones and Samsung Health improves convenience and reach across developed and emerging markets. |

|

Xiaomi smart bands and smartwatches focus on affordable, feature-rich fitness and health tracking, offering step counting, heart rate monitoring, SpO2 monitoring, sleep/stress tracking, and multi-sport modes with long battery life for mass-market users globally. | Enables cost-conscious consumers in Asia, Europe, and other regions to access core health and activity insights, driving high volumes and ecosystem stickiness through the Mi Fitness app, extended battery life, and aggressive pricing strategies. |

|

Huawei wearables such as the Watch GT series provide multi-system GNSS positioning, advanced running and training guidance, heart-rate and blood-oxygen monitoring, sleep analysis, and long-battery performance, targeting fitness enthusiasts and everyday users. | Offers accurate outdoor sports tracking and continuous health monitoring with strong battery endurance, strengthening Huawei’s ecosystem of phones and services, and appealing to users seeking premium features without premium pricing across global markets. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The wearable technology ecosystem encompasses device OEMs across various categories, including smartwatches, fitness trackers, hearables, AR/VR, smart clothing, and specialized medical wearables, supported by semiconductor and component suppliers that provide sensors, processors, connectivity, and batteries. Cloud and software platforms, app developers, and telecom operators enable data analytics, AI-driven insights, and reliable connectivity across 4G, 5G, and Wi-Fi networks. The ecosystem also includes healthcare providers, insurers, and employers integrating wearables into remote monitoring, wellness programs, and risk-based insurance models, which are shaped by global regulators and data-privacy frameworks that govern the medical-grade use of health data and its protection. Finally, powerful e-commerce platforms, retail chains, and mobile operators’ channels drive mass adoption by making devices accessible and bundled with financing, subscriptions, and digital services in both mature and emerging markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wearable Technology Market, by Product

Globally, wrist-worn devices remain the dominant product category as smartwatches and fitness bands combine health monitoring, notifications, GPS, payments, and entertainment in a compact, familiar form factor. Strong brand portfolios from players such as Apple, Samsung, Xiaomi, and Huawei, along with frequent model refreshes and app ecosystem integration, keep wristwear as the primary gateway into the wearables category for most consumers worldwide.

Wearable Technology Market, by Type

Non-textile wearables are expected to continue leading the global market because products like smartwatches, fitness trackers, hearables, and AR/VR headsets are already mainstream across many regions. These devices provide everyday value in health tracking, communication, audio, and immersive entertainment, and can be scaled and upgraded faster than smart textiles, supporting sustained demand over the forecast period.

Wearable Technology Market, by Operation

AI-enabled wearables are projected to record the fastest growth globally as they evolve from simple tracking devices to intelligent companions delivering personalized coaching and predictive health insights. On-device AI, cloud analytics, and 5G connectivity enable advanced functions such as irregular rhythm detection, sleep and stress scoring, adaptive training plans, and context-aware notifications, which are increasingly adopted by healthcare providers, employers, and sports organizations for remote monitoring and performance management.

Wearable Technology Market, by Application

The consumer electronics segment accounts for the largest share of wearable adoption, with devices primarily purchased for lifestyle, communication, fitness, and entertainment needs. High smartphone penetration, social media influence, and continuous product innovation by global brands position most wearables as multi-purpose companions for everyday use, while medical and enterprise applications are expanding from this large installed base.

REGION

North America is expected to dominate the wearable technology market during the forecast period

North America is expected to dominate the wearable technology market due to its high consumer spending power, strong health and fitness awareness, and rapid adoption of smart devices. The region hosts many leading technology brands that continuously launch advanced smartwatches, fitness trackers, and hearables, supported by mature app and cloud ecosystems. Well-developed telecom infrastructure, high smartphone penetration, and supportive channels such as e-commerce, carrier bundling, and retail chains further accelerate uptake across consumer, enterprise, and healthcare use cases.

WEARABLE TECHNOLOGY MARKET SIZE, SHARE & INDUSTRY 2030: COMPANY EVALUATION MATRIX

In the wearable technology landscape, Apple Inc. (US) and Samsung (South Korea) stand out as leading players, combining strong market reach with broad, feature-rich product lines. Their ecosystems effectively drive adoption among diverse end users, from health and wellness consumers to healthcare organizations and industrial users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Top Wearable Technology Companies

- Apple Inc. (US)

- Samsung (South Korea)

- Xiaomi (China)

- Huawei Technologies Co., Ltd. (China)

- Imagine Marketing Limited (India)

- Garmin Ltd. (US)

- Sony Group Corporation (Japan)

- LG Electronics (South Korea)

- Alphabet Inc. (US)

- Microsoft (US)

- Lenovo (Hong Kong)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 70.30 Billion |

| Market Forecast in 2030 (Value) | USD 176.77 Billion |

| Growth Rate | CAGR of 15.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

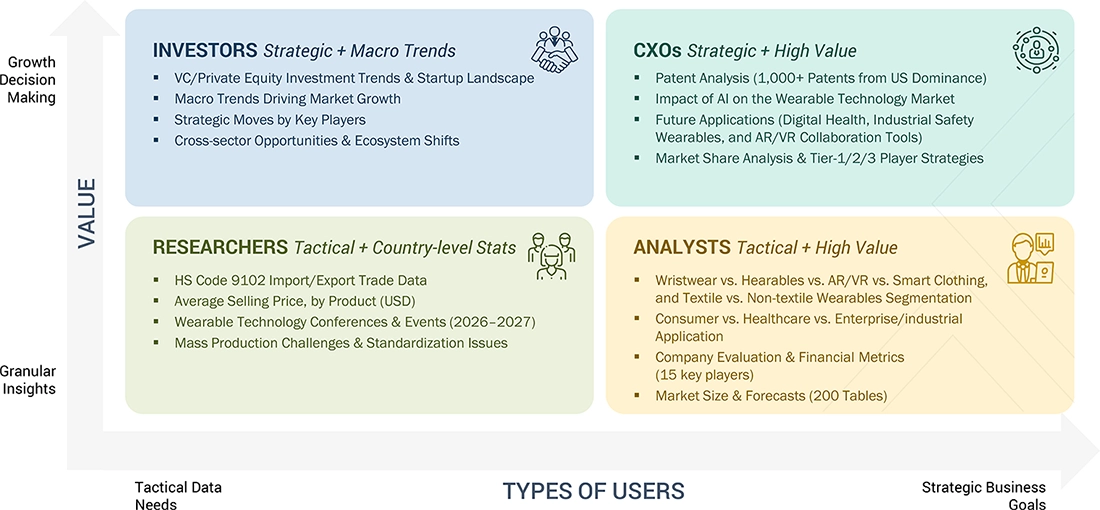

WHAT IS IN IT FOR YOU: WEARABLE TECHNOLOGY MARKET SIZE, SHARE & INDUSTRY 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Middle East telecom operator evaluating bundling wearables with 5G plans |

|

|

| Asia Pacific government agency assessing population-level chronic disease monitoring pilots |

|

|

| Latin America retailer designing omnichannel go-to-market strategy for low-cost fitness bands |

|

|

| Global pharma company exploring wearables for decentralized clinical trials |

|

|

RECENT DEVELOPMENTS

- January 2025 : Sony Corporation launched a PlayStation-themed fitness tracker in China to commemorate PlayStation’s 10th anniversary. Developed in partnership with Xiaomi, the device is based on the Xiaomi Smart Band 9 Pro.

- January 2025 : Oppo confirmed that its upcoming Watch X2 will feature native blood pressure monitoring without the need for an external cuff. This development follows similar innovations by Huawei and Samsung in the health wearables sector. The Watch X2 is expected to debut at Oppo’s Find N5 event in China in February.

- October 2024 : Xiaomi will launch the Xiaomi Watch S4 and Smart Band 9 Pro in China alongside the Xiaomi 15 series and Pad 7 tablet lineup. The new wearables are expected to feature brighter displays and run on HyperOS 2.0, with the Watch S4 including interchangeable bezels and a new intercom mode.

Table of Contents

Methodology

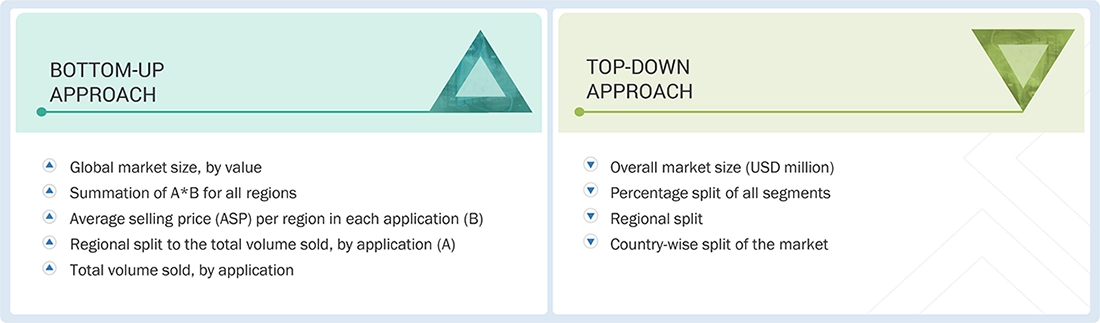

The study employed four major activities to estimate the size of the wearable technology market. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were used to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the wearable technology market. Secondary sources for this research study include corporate filings (annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, and articles by recognized authors, as well as directories and databases. The secondary data was collected and analyzed to determine the overall market size and was further validated through primary research.

List of major secondary sources

|

Source |

Web Link |

|

Consumer Technology Association (CTA) |

https://www.cta.tech/ |

|

Wearable Robotics Association |

https://wearablerobotics.com/ |

|

Universal Mentors Association (UMA) |

https://www.umaconferences.com/ |

|

VR/AR Association |

https://www.thevrara.com/ |

|

Institute of Electrical and Electronics Engineers (IEEE) |

https://www.ieee.org/ |

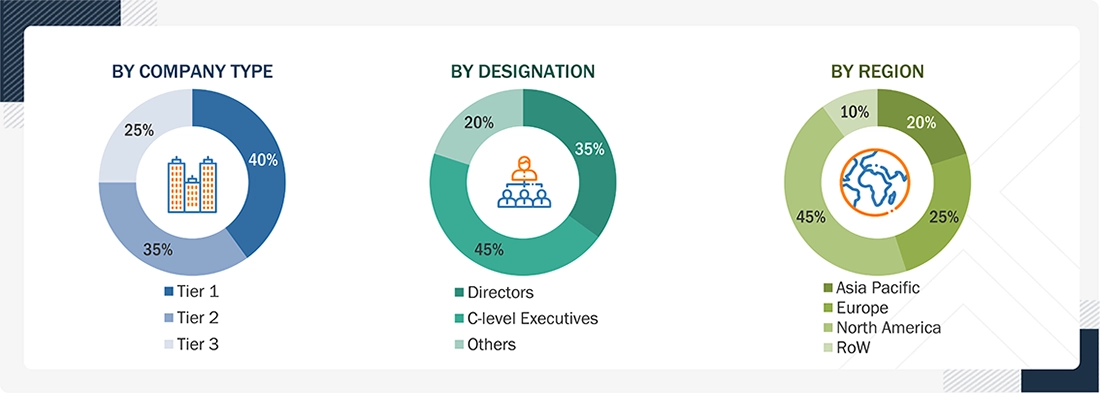

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was conducted to gain a comprehensive understanding of various technologies, types, applications, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end user installation teams using wearable technology offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of wearable technology, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

Note: Other designations include sales managers, marketing managers, and product managers.

The three tiers of the companies have been defined based on their total revenue as of 2023: tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the comprehensive market engineering process, top-down and bottom-up approaches, along with several data triangulation methods, have been employed to estimate and forecast the overall market segments and subsegments outlined in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through a combination of primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis fro MarketsandMarkets and presented in this report. The following figure illustrates the overall process for estimating the market size in this study.

Wearable Technology Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the wearable technology market has been determined using the methods described above, it has been divided into multiple segments and subsegments. Market engineering has been performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides have been studied to triangulate the data. The market size has been validated using both top-down and bottom-up approaches.

Market Definition

Wearable technology refers to electronic devices designed to be worn on the body as accessories, clothing, or implants, enabling continuous monitoring and interaction with the user. These devices collect and analyze data related to health, fitness, location, and daily activities, often connecting with smartphones or other digital platforms. Common examples include smartwatches, fitness trackers, smart glasses, and health-monitoring devices, which enhance convenience, productivity, and personal well-being.

Key Stakeholders

- Wearable technology companies

- Artificial intelligence companies

- Companies in wearable Al ecosystem

- Key service providers

- Software solution providers

- Network providers

- Retail distributors

- Government, financial, research institutions, and investment communities

- Analysts and strategic business planners

- Research and consulting firms

Report Objectives

- To describe and forecast the wearable technology market, by product, type, operation, application, and region, in terms of value

- To describe and forecast the market for various segments across four key regions, namely North America, Europe, Asia Pacific, and RoW, along with their country-level analysis, in terms of value

- To describe and forecast the wearable technology market, by type, in terms of volume

- To strategically analyze micromarkets about individual growth trends, prospects, and contributions to the markets

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To offer a detailed overview of the wearable technology value chain

- To strategically analyze key technologies, average selling price trends, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders, buying criteria, and case studies about the market under study

- To strategically profile key players in the wearable technology market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D, in the wearable technology market

- To analyze the impact of the 2025 US tariff and the implications of AI/Gen AI on the wearable technology market

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wearable Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Wearable Technology Market

sarah

Apr, 2022

Wanted to know the Potential for growth in wearable tech (Apple watch, Fitbit) in US or UK market. .

Maria

Sep, 2022

Interested in South Africa specific Wearable Technology Market information.

Shawal

Sep, 2022

To find out about wearables linked to occupational safety and health..