White Inorganic Pigments Market by Product Type (Aluminum Silicate, Calcium Silicate, Calcium Carbonate, Silica, Titanium Dioxide, Zinc Oxide), Application and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2026

Updated on : March 20, 2024

White Inorganic Pigments Market

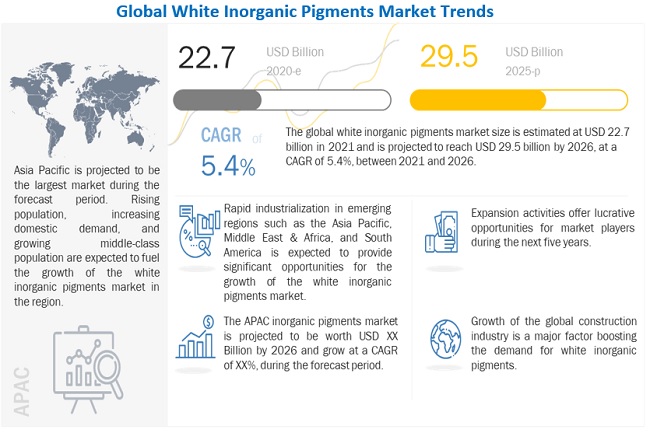

The global white inorganic pigments market was valued at USD 22.7 billion in 2021 and is projected to reach USD 29.5 billion by 2026, growing at 5.4% cagr from 2021 to 2026. Growth in the market can primarily be attributed to the growing involvement of white inorganic pigments in the paints & coatings, adhesives & sealants, plastics, cosmetics, paper, inks, among others. There is a continual demand from the construction, automotive and personal care industry as it helps in attaining high light scattering power, a high degree of hiding power, good tinting strength, a high degree of brightness, a negligible undertone (ideally none), and a high degree of whiteness are all required from white inorganic pigments. These are the key factors driving the demand for white inorganic pigments during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global White Inorganic Pigments Market

The COVID-19 pandemic has significantly impacted the white inorganic pigments industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. The outbreak of the coronavirus disease resulted in the shutdown of approximately 198,000 active dental hospitals and clinics in the US (data as of August 2020). The pigments industry was adversely impacted due to the recession which prevailed after the outbreak of the pandemic. The unexpected fall and uncertainty in the prices of raw material before and after the COVID-19 pandemic has been a worldwide concern for inorganic pigments suppliers and manufacturers. However, there has been a significant increase in the construction and automotive industry after the pandemic. E-commerce retail sales are experiencing a significant spike in numbers. The annual growth in e-commerce trade in Europe is expected to be approximately 20%.

White Inorganic Pigments Market Dynamics

Driver: Growth of global construction sector

The growth of the global construction industry is a major factor boosting the demand for white inorganic pigments. The construction sector includes both, residential and non-residential (including commercial, industrial, and others) infrastructure. According to Price Waterhouse Coopers (PWC) forecast, construction output is expected to grow by 85%, in terms of volume, to reach USD 15.5 trillion by 2030. Three major countries, China, the US, and India, are expected to account for a share of more than 50% of the overall growth of the industry. This growth is attributed to economic recovery in the major economies. Growth is also fueled by globalization, urbanization, rising standards of living, increasing purchasing power parity (PPP), infrastructure development, and increasing need for the construction of megacities in emerging countries. Construction activities are expected to increase two-fold in the emerging markets by 2020. In the Asia Pacific, China and India are the economies which offer high growth opportunities for the construction sector. In other regions such as North America, Europe, the Middle East & Africa, and South America, the need for residential and non-residential construction is high due to the improving standards of living. According to the OECD, annual household disposable income has increased globally for the past six years. The rising disposable income among consumers increases their purchasing power and also the standard of living. These factors drive the demand for interior decoration and home renovation, leading to the increasing demand for decorative paints & coatings, which, in turn, drives the white inorganic pigments market in the construction sector.

Restraint: Stringent regulations related to cadmium- and chromium-based pigments

Cadmium- and chromium-based pigments are hazardous to workers as well as the environment because of their heavy metal content. These heavy metals are harmful to human health and their disposal during the pigment manufacturing process leads to pollution. They need to be processed carefully to ensure that the acid extractable metal levels are controlled. Several Chinese producers have faced challenges pertaining to inadequate treatment facilities and stringent government norms. These factors have led to the closure of major inorganic pigment manufacturing units. Registration, Evaluation, and Authorization of Chemical Substances (REACH) has imposed regulations on the application of these pigments. In Europe, according to Directive 91/338/EEC, the use of cadmium pigments is not permitted in many types of applications. The US-based Environment Protection Agency (EPA) frequently evaluates and bans various pigments that have an adverse impact on animal and human life. Ban on Pigment Violet 29 in 2018 is one such example of the agency’s vigilance. These stringent regulations on the manufacture and application of cadmium- and chromium-based pigments adversely affect the white inorganic pigments market. The regulations can delay or even prevent the launch of new products, increasing the prices of new products.

Opportunity: Rapid industrialization in emerging economies

Rapid industrialization in emerging economies in regions such as the Asia Pacific, the Middle East & Africa, and South America is expected to offer opportunities for the growth of the white inorganic pigments market. Building & construction, automotive, packaging, and textile industries have grown significantly over the years. China, India, Indonesia, Thailand, Saudi Arabia, the UAE, Turkey, Brazil, and Chile have been witnessing rapid growth in key manufacturing sectors. The growth of the manufacturing industry in these countries is further expected to fuel market growth. Government policies in these countries are supporting the growth of industries. In addition, low labor costs, skilled workforces, availability of raw materials, and increasing urbanization have enabled domestic and foreign companies to establish their facilities in these regions. Moreover, the high growth rate of approximately 8% of the plastics industry is projected to increase the consumption of inorganic pigments in these countries. The textiles industry is growing due to the increasing use of fabrics in diverse applications. According to the World Trade Statistical Review, 2018 by the World Trade Organization (WTO), the global market size of textiles was USD 296.1 billion in 2017, and global apparel exports were USD 454.5 billion the same year. Asian countries, especially India, play a crucial role in the global textile industry. India exports most of its apparel to Europe and North America, while China is the largest exporter of apparel at an estimated value of USD 288 billion. This has propelled the demand for white inorganic pigments in fabric printing and offers opportunities for market players.

Challenges: Regulations related to recycling plastics

Plastic recycling is the process of recovering waste plastic and reprocessing the material into useful products. Transparent plastics are preferred in the recycled market, followed by white and colored. Within the colored category, dark-colored plastics have a higher market value than light-colored plastics. EU regulations make it necessary in choosing the correct pigment to meet the legal requirements of the specific application. In some applications, it is mandatory to use a certain grade of pigments, while for others, lower-cost substitutes can be used. For instance, the use of chrome yellow to color a polypropylene beach bat would be illegal if the product is classified as a toy. However, if it were defined as sports equipment, this pigment would be acceptable. Similarly, a nylon molding colored with food-grade cadmium yellow could be used in a food processing product as long as it does not clash with rules on the use of colors in electrical appliances. It is difficult to maintain a balance between cost, regulation mandates, and application needs. Thus, regulations related to plastic recycling is a major challenge faced by inorganic pigment manufacturers as it is tough to customize solutions as per the needs of customers.

Titanium dioxide is the largest product type segment of the white inorganic pigments market

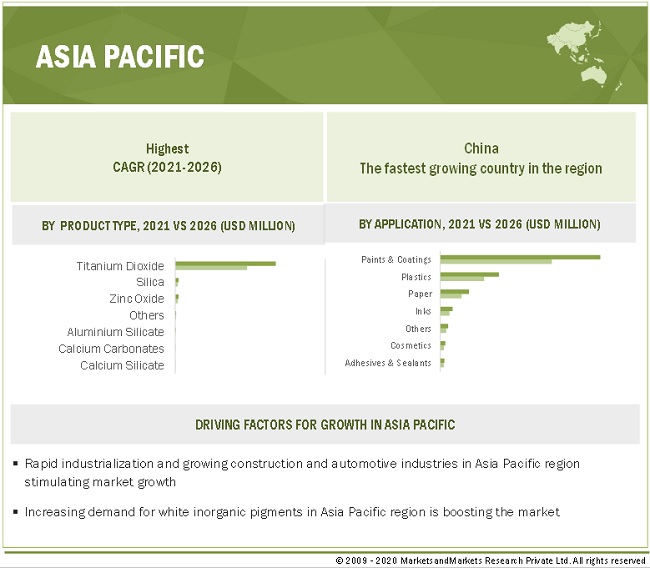

On the basis of product type, the market is segmented into aluminium silicate, calcium silicate, calcium carbonate, silica, titanium dioxide, zinc oxide, and others. The titanium dioxide segment led the product type segment of the market in terms of both value and volume. Titanium dioxide is the most prominent member of the group. Paints with white extender pigments are used to cut costs and improve the qualities of the paint.

Paints & coatings is the largest application segment of the white inorganic pigments market

On the basis of application, the market is segmented into paints & coatings, adhesives & sealants, plastics, cosmetics, paper, inks, and others. The paints & coatings application segment led the market in terms of both value and volume. Paints with white extender pigments are used to cut costs and improve the qualities of the paint. White inorganic pigments, often known as hidden pigments, are pigments that give light scattering qualities to coatings. Because of their relatively high refractive index, they scatter all wavelengths of light, making them seem white to the human eye.

Asia Pacific is the largest market for white inorganic pigments market

The Asia Pacific region is projected to be the largest market, in terms of value. Asia Pacific is also expected to grow at the highest CAGR during the forecast period. Growth in APAC is backed by the efficient demand and supply cycle of the paints & coatings, adhesives & sealants, plastics, cosmetics, paper, inks industry majorly in countries like China, India, and Japan among others. A significant bounce back is expected from the construction and automotive industry and this will drive the market in the area. APAC is also an industrial hub with a significantly large market size. Other factors, such as the increasing consumer goods demand, innovation in electronics and other sectors, etc., are expected to support the growth of this regional market during the forecast period.

Venator Materials PLC (UK), The Chemours Company (US), Tronox Holdings plc (US), LANXESS (Germany), and KRONOS Worldwide, Inc. (US) are key players in white inorganic pigments market.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnections

Key Market Players

Venator Materials PLC (UK), The Chemours Company (US), Tronox Holdings plc (US), LANXESS (Germany), and KRONOS Worldwide, Inc. (US) are the key players operating in the white inorganic pigments market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to white inorganic pigments from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Product Type, Application and Region |

|

Regions |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Venator Materials PLC (UK), The Chemours Company (US), Tronox Holdings plc (US), LANXESS (Germany), and KRONOS Worldwide, Inc. (US) |

This research report categorizes the white inorganic pigments market based on type, application, technology and region.

White Inorganic Pigments Market, By Product Type:

- Aluminium Silicate

- Calcium Silicate

- Calcium Carbonate

- Silica

- Titanium Dioxide

- Zinc Oxide

- Others

White Inorganic Pigments Market, By Application:

- Paints & Coatings

- Adhesives & Sealants

- Plastics

- Cosmetics

- Paper

- Inks

- Others

White Inorganic Pigments Market, By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In July 2021, the Chemours Company started the construction of a mining facility on land leased from Camp Blanding in Clay County, Florida. This project is expected to utilize sustainable mining technology. This expansion has been undertaken to enable Chemours further access to high-quality concentrated deposits of titanium and zircon mineral sands which are used to produce the company’s Ti-Pure brand titanium dioxide (TiO2).

- In May 2020, Tronox Holdings plc signed a definitive agreement to acquire the TiZir Titanium and Iron (TTI) business from Eramet S.A. The TTI facility of TiZir is in Tyssedal, Norway. This is expected to further increase the supply ilmenite for the production of high-grade titanium slag and high-purity pig iron with an annual capacity reaching up to 230,000 tons and 90,000 tons, respectively.

- In November 2019, Venator Materials PLC launched TIOXIDE TR29, a white pigment for low moisture applications and demanding processing conditions. It is designed for plastic applications and can be used to create high TiO2 loading masterbatches.

- In November 2019, the Chemours Company introduced a new low-abrasion grade Ti-Pure titanium dioxide pigment. This new grade is manufactured through the chloride process and specifically designed to improve the performance of printing inks. This new development is expected to help the company meet customer needs in the paper & printing end-use industry.

- In August 2019, the Chemours Company acquired Southern Ionics Minerals, LLC (Florida), a mineral exploration, mining, and manufacturing company. This acquisition is expected to enable access to large, high-value ilmenite ore deposits for the production of TiO2 pigments.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the white inorganic pigments market?

Rise in demand for white inorganic pigments from emerging economies and growing popularity of growing demand from construction, automotive, personal care and electronic sectors are hot bets for the market.

What are the market dynamics for the different product type of white inorganic pigments?

On the basis of product type, the market is segmented into aluminium silicate, calcium silicate, calcium carbonate, silica, titanium dioxide, zinc oxide, and others. The titanium dioxide segment led the product type segment of the market in terms of both value and volume. Titanium dioxide is the most prominent member of the group. Paints with white extender pigments are used to cut costs and improve the qualities of the paint.

What are the market dynamics for the different applications of white inorganic pigments?

On the basis of application, the market is segmented into paints & coatings, adhesives & sealants, plastics, cosmetics, paper, inks, and others. The paints & coatings application segment led the market in terms of both value and volume. Paints with white extender pigments are used to cut costs and improve the qualities of the paint. White inorganic pigments, often known as hidden pigments, are pigments that give light scattering qualities to coatings. Because of their relatively high refractive index, they scatter all wavelengths of light, making them seem white to the human eye.

Who are the major manufacturers of the white inorganic pigments market?

Venator Materials PLC (UK), The Chemours Company (US), Tronox Holdings plc (US), LANXESS (Germany), and KRONOS Worldwide, Inc. (US) are the key players operating in the white inorganic pigments market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Governments worldwide are addressing this issue by imposing strict laws, which results in the white inorganic pigments market being subjected to governance.

What are the effects of COVID-19 on the white inorganic pigments market?

The COVID-19 pandemic has significantly impacted the pigments industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. COVID-19 has had three major effects on the global economy: direct effects on production and demand, supply chain and market disruption, and financial impact on enterprises and financial markets. The market's expansion was hampered by disruptions in supply chain management and products and service transportation. Because to government-imposed lockdowns and curfews across the world, numerous manufacturing and production units were interrupted, resulting in the loss and waste of countless paint pigments. Consumer demand and behavior were also affected by the epidemic. In the midst of the epidemic, consumers avoided buying non-essential items. The pandemic's unclear and unforeseen circumstances slowed the market's expansion. However, the situation has improved since the pandemic, and the worldwide market for white inorganic pigment has rebounded. The market is expected to expand at a rapid pace in the next years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 WHITE INORGANIC PIGMENTS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.3.2 REGIONAL SCOPE

FIGURE 2 WHITE INORGANIC PIGMENTS MARKET, BY REGION

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 3 WHITE INORGANIC PIGMENTS MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE APPROACH

FIGURE 4 WHITE INORGANIC PIGMENTS MARKET: SUPPLY-SIDE APPROACH

2.2.2 DEMAND-SIDE APPROACH - 1

FIGURE 5 WHITE INORGANIC PIGMENTS MARKET: DEMAND-SIDE APPROACH - 1

2.2.3 DEMAND-SIDE APPROACH - 2

FIGURE 6 WHITE INORGANIC PIGMENTS MARKET: DEMAND-SIDE APPROACH - 2

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4.1 SECONDARY DATA

2.4.1.1 Key data from secondary sources

2.4.2 PRIMARY DATA

2.4.2.1 Key data from primary sources

2.4.2.2 Key industry insights

TABLE 2 LIST OF STAKEHOLDERS INVOLVED

2.4.2.3 Breakdown of primary interviews

2.5 ASSUMPTIONS

2.5.1 RISK ASSESSMENT

TABLE 3 LIMITATIONS & ASSOCIATED RISKS

TABLE 4 RISKS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 10 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPP0RTUNITIES

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 11 TITANIUM DIOXIDE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 12 PAINTS & COATINGS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC LED WHITE INORGANIC PIGMENTS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN WHITE INORGANIC PIGMENTS MARKET

FIGURE 14 WHITE INORGANIC PIGMENTS MARKET IN ASIA PACIFIC REGION OFFERS ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

4.2 WHITE INORGANIC PIGMENTS MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

4.3 WHITE INORGANIC PIGMENTS MARKET, BY PRODUCT TYPE

FIGURE 16 TITANIUM DIOXIDE PROJECTED TO BE LARGEST PRODUCT TYPE SEGMENT DURING FORECAST PERIOD

4.4 WHITE INORGANIC PIGMENTS MARKET, BY APPLICATION

FIGURE 17 PAINTS & COATINGS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 WHITE INORGANIC PIGMENTS MARKET: EMERGING VS. MATURE MARKETS

FIGURE 18 INDIA TO EMERGE AS LARGEST LUCRATIVE MARKET BETWEEN 2021 AND 2026

4.6 WHITE INORGANIC PIGMENTS MARKET IN ASIA PACIFIC, 2020

FIGURE 19 CHINA AND PAINTS & COATINGS ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC WHITE INORGANIC PIGMENTS MARKET

4.7 WHITE INORGANIC PIGMENTS MARKET: GLOBAL SNAPSHOT

FIGURE 20 MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WHITE INORGANIC PIGMENTS MARKET

5.1.1 DRIVERS

5.1.1.1 Growth of global construction sector

TABLE 5 HOUSEHOLD DISPOSABLE INCOME, NET ANNUAL GROWTH RATE (%)

5.1.1.2 Increasing significance of esthetics in packaging industry

5.1.1.3 Good optical properties provided by white inorganic pigments

5.1.2 RESTRAINTS

5.1.2.1 Stringent regulations related to cadmium- and chromium-based pigments

TABLE 6 REGULATIONS IN PIGMENTS MARKET

5.1.2.2 Raw material price fluctuations

TABLE 7 IMPORT PRICES OF TITANIUM DIOXIDE (USD/TON)

TABLE 8 EXPORT PRICES OF TITANIUM DIOXIDE (USD/TON)

5.1.3 OPPORTUNITIES

5.1.3.1 Rapid industrialization in emerging economies

5.1.4 CHALLENGES

5.1.4.1 Regulations related to recycling plastics

5.2 MARKET SEGMENTATION

5.2.1 WHITE INORGANIC PIGMENTS MARKET, BY PRODUCT TYPE

5.2.2 WHITE INORGANIC PIGMENTS MARKET, BY APPLICATION

5.2.3 WHITE INORGANIC PIGMENTS MARKET, BY REGION

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.4 MACROECONOMIC INDICATORS

5.4.1 GLOBAL GDP TRENDS AND FORECASTS

TABLE 9 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2019–2026

5.4.2 TRENDS IN PLASTICS INDUSTRY

TABLE 10 DEMAND FOR PLASTICS, BY COUNTRY, 2014–2018 (KILOTON)

5.4.3 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 11 AUTOMOBILE PRODUCTION STATISTICS, BY COUNTRY, 2014–2018, (UNITS)

6 INDUSTRY TRENDS (Page No. - 60)

6.1 VALUE CHAIN

FIGURE 23 VALUE CHAIN ANALYSIS: WHITE INORGANIC PIGMENTS MARKET

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 PORTER’S FIVE FORCES ANALYSIS OF WHITE INORGANIC PIGMENTS

TABLE 12 WHITE INORGANIC PIGMENTS MARKET: PORTER’S FIVE FORCE ANALYSIS

6.2.1 BARGAINING POWER OF BUYERS

6.2.2 BARGAINING POWER OF SUPPLIERS

6.2.3 THREAT OF NEW ENTRANTS

6.2.4 THREAT OF SUBSTITUTES

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 IMPACT OF COVID-19 ON END-USE APPLICATIONS OF WHITE INORGANIC PIGMENTS

6.4 YC-YCC DRIVERS

FIGURE 25 YC-YCC DRIVERS

6.5 SUPPLY CHAIN ANALYSIS

FIGURE 26 WHITE INORGANIC PIGMENTS MARKET: SUPPLY CHAIN

TABLE 13 WHITE INORGANIC PIGMENTS MARKET: ECOSYSTEM

6.5.1 PROMINENT COMPANIES

6.5.2 SMALL & MEDIUM ENTERPRISES

6.6 MARKET MAPPING/ ECOSYSTEM MAP

FIGURE 27 ECOSYSTEM MAP

6.7 TARIFF AND REGULATORY ANALYSIS

6.8 PRICING ANALYSIS

TABLE 14 PRICES OF LEAD PIGMENTS

TABLE 15 PRICES OF TITANIUM DIOXIDE AS PER CHEMI.COM

6.9 TRADE ANALYSIS

TABLE 16 COLORING MATTER: PIGMENTS AND PREPARATIONS BASED ON TITANIUM DIOXIDE, CONTAINING 80% OR MORE BY WEIGHT TITANIUM DIOXIDE CALCULATED ON DRY WEIGHT

FIGURE 28 US IMPORT DATA FOR TITANIUM DIOXIDE | US BILL OF LADING DATABASE

FIGURE 29 US EXPORT DATA FOR TITANIUM DIOXIDE | US TITANIUM DIOXIDE EXPORTS

6.10 TECHNOLOGY ANALYSIS

6.10.1 SULFATE PROCESS

6.10.2 CHLORIDE PROCESS

6.11 CASE STUDY

6.12 PATENT ANALYSIS

6.12.1 INTRODUCTION

6.12.2 METHODOLOGY

6.12.3 DOCUMENT TYPE

FIGURE 30 WHITE INORGANIC PIGMENTS MARKET: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 31 PUBLICATION TRENDS - LAST TEN YEARS

6.12.4 INSIGHTS

6.12.5 LEGAL STATUS OF PATENTS

FIGURE 32 LEGAL STATUS

FIGURE 33 JURISDICTION ANALYSIS

6.12.6 TOP COMPANIES/APPLICANTS

FIGURE 34 TOP APPLICANTS OF WHITE INORGANIC PIGMENTS

6.12.7 LIST OF PATENTS BY KRONOS INT INC

6.12.8 LIST OF PATENTS BY TRONOX LLC

6.12.9 LIST OF PATENTS BY DUPONT

6.12.10 LIST OF TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

6.13 IMPACT OF COVID-19 ON WHITE INORGANIC PIGMENTS MARKET

6.13.1 INTRODUCTION

6.13.2 IMPACT OF COVID-19 ON WHITE INORGANIC PIGMENTS MARKET

6.14 RANGE SCENARIO ANALYSIS

FIGURE 35 RANGE SCENARIO FOR WHITE INORGANIC PIGMENTS MARKET

6.14.1 OPTIMISTIC SCENARIO

6.14.2 PESSIMISTIC SCENARIO

6.14.3 REALISTIC SCENARIO

7 WHITE INORGANIC PIGMENTS MARKET, BY PRODUCT TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 36 TITANIUM DIOXIDE TO LEAD PRODUCT TYPE SEGMENT OF WHITE INORGANIC PIGMENTS MARKET DURING FORECAST PERIOD

TABLE 17 WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 18 WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

7.2 ALUMINUM SILICATE

7.2.1 USE OF ALUMINUM SILICATE AS REPLACEMENT FOR TITANIUM DIOXIDE TO BOOST MARKET

TABLE 19 ALUMINUM SILICATE: WHITE INORGANIC PIGMENTS MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 20 ALUMINUM SILICATE: WHITE INORGANIC PIGMENTS MARKET SIZE BY REGION, 2019–2026 (KILOTON)

7.3 CALCIUM SILICATE

7.3.1 USE IN CONSTRUCTION INDUSTRY TO BOOST MARKET

TABLE 21 CALCIUM SILICATE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 CALCIUM SILICATE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.4 CALCIUM CARBONATE

7.4.1 EXTENSIVE USE AS WHITE INORGANIC PIGMENTS IN PAINTS INDUSTRY TO BOOST MARKET

TABLE 23 CALCIUM CARBONATE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 CALCIUM CARBONATE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.5 SILICA

7.5.1 EXTENDED USE OF WHITE INORGANIC PIGMENTS TO BOOST MARKET

TABLE 25 SILICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 SILICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.6 TITANIUM DIOXIDE

7.6.1 EXTENSIVE USE OF TITANIUM DIOXIDE AS WHITE INORGANIC PIGMENT TO BOOST MARKET DUE TO HIGH DEMAND

TABLE 27 TITANIUM DIOXIDE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 TITANIUM DIOXIDE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.7 ZINC OXIDE

7.7.1 USE OF ZINC OXIDE IN PAINT AND WATERCOLOR INDUSTRIES TO BOOST MARKET

TABLE 29 ZINC OXIDE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 ZINC OXIDE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.8 OTHERS

TABLE 31 OTHERS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 OTHERS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8 WHITE INORGANIC PIGMENTS MARKET, BY APPLICATION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 37 PAINTS & COATINGS APPLICATION SEGMENTS TO LEAD WHITE INORGANIC PIGMENTS MARKET DURING FORECAST PERIOD

TABLE 33 WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTONS)

8.2 PAINTS & COATINGS

8.2.1 PHYSICAL AND CHEMICAL PROPERTIES OF WHITE INORGANIC PIGMENTS UTILIZED IN PAINTS & COATINGS TO BOOST MARKET

TABLE 35 PAINTS & COATINGS: WHITE INORGANIC PIGMENTS MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 36 PAINTS & COATINGS: WHITE INORGANIC PIGMENTS MARKET SIZE BY REGION, 2019–2026 (KILOTON)

8.3 ADHESIVES & SEALANTS

8.3.1 VERSATILITY FOR USE IN VARIOUS INDUSTRIES TO BOOST MARKET

TABLE 37 ADHESIVES & SEALANTS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 ADHESIVES & SEALANTS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.4 PLASTICS

8.4.1 TITANIUM DIOXIDE ENHANCES PROPERTIES OF PLASTICS, BOOSTING MARKET

TABLE 39 PLASTICS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 PLASTICS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.5 COSMETICS

8.5.1 EXTENDED USE OF WHITE INORGANIC PIGMENTS TO BOOST MARKET

TABLE 41 COSMETICS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 COSMETICS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.6 PAPER

8.6.1 TINTING STRENGTH AND OPACITY TO BOOST MARKET APPLICATION IN PAPER INDUSTRY

TABLE 43 PAPER: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 PAPER: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.7 INKS

8.7.1 IDEAL PROTECTION FOR FRAGILE ITEMS TO BOOST MARKET

TABLE 45 INKS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 INKS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.8 OTHERS

8.8.1 COST-EFFECTIVENESS OF WHITE INORGANIC PIGMENTS TO BOOST MARKET

TABLE 47 OTHERS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 OTHERS: WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9 WHITE INORGANIC PIGMENTS MARKET, BY REGION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 38 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 WHITE INORGANIC PIGMENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 51 WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 52 WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 53 WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SNAPSHOT

TABLE 55 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 57 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 58 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 59 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 60 ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2.1 CHINA

9.2.1.1 Increasing demand for paints & coatings from construction industry to fuel market growth

TABLE 61 CHINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 62 CHINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 63 CHINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 64 CHINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICAION, 2019–2026 (KILOTON)

9.2.2 JAPAN

9.2.2.1 Rising demand from automotive industry to accelerate market growth

TABLE 65 JAPAN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODYCT TYPE, 2019–2026 (USD MILLION)

TABLE 66 JAPAN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 67 JAPAN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 JAPAN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2.3 INDIA

9.2.3.1 Growing construction industry and rapid industrialization driving market

TABLE 69 INDIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 70 INDIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 71 INDIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 INDIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Rising consumer demand for eco-friendly packaging

TABLE 73 SOUTH KOREA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 74 SOUTH KOREA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 75 SOUTH KOREA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 SOUTH KOREA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2.5 REST OF ASIA PACIFIC

TABLE 77 REST OF ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 78 REST OF ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 79 REST OF ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 REST OF ASIA PACIFIC: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3 EUROPE

FIGURE 40 EUROPE: WHITE INORGANIC PIGMENTS MARKET SNAPSHOT

TABLE 81 EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 83 EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 84 EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 85 EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 86 EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Market in Germany growing due to strong industrial base

TABLE 87 GERMANY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 88 GERMANY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 89 GERMANY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 GERMANY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.2 FRANCE

9.3.2.1 Growing paints & coatings application expected to boost market

TABLE 91 FRANCE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 92 FRANCE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 93 FRANCE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 FRANCE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.3 UK

9.3.3.1 Growth of construction sector to boost demand for white inorganic pigments

TABLE 95 UK: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 96 UK: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 97 UK: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 UK: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.4 ITALY

9.3.4.1 Construction and packaging industries to drive market

TABLE 99 ITALY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 100 ITALY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 101 ITALY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 102 ITALY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.5 SPAIN

9.3.5.1 Rising demand from electronic and electrical industries to drive market

TABLE 103 SPAIN: WHITE INORGANIC PIGMENTS MARKET SIZE, BYPRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 104 SPAIN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 105 SPAIN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 106 SPAIN: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.6 RUSSIA

9.3.6.1 Automotive and construction sectors expected to drive market

TABLE 107 RUSSIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 108 RUSSIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 109 RUSSIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 110 RUSSIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.3.7 REST OF EUROPE

TABLE 111 REST OF EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 112 REST OF EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 113 REST OF EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 REST OF EUROPE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.4 NORTH AMERICA

FIGURE 41 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SNAPSHOT

TABLE 115 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 117 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 118 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 119 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 120 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODCUT TYPE, 2019–2026 (KILOTON)

TABLE 121 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, TITANIUM DIOXIDE PRODUCT TYPE BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, TITANIUM DIOXIDE PRODUCT TYPE BY APPLICATION, 2019–2026 (KILOTON)

TABLE 123 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, CALCIUM CARBONATE PRODUCT TYPE BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 124 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, CALCIUM CARBONATE PRODUCT TYPE BY APPLICATION, 2019–2026 (KILOTON)

TABLE 125 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, ZINC OXIDE PRODUCT TYPE BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, ZINC OXIDE PRODUCT TYPE BY APPLICATION, 2019–2026 (KILOTON)

TABLE 127 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, SILICA PRODUCT TYPE BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 128 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, SILICA PRODUCT TYPE BY APPLICATION, 2019–2026 (KILOTON)

TABLE 129 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, ALUMINIUM SILICATE PRODUCT TYPE BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 130 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, ALUMINIUM SILICATE PRODUCT TYPE BY APPLICATION, 2019–2026 (KILOTON)

TABLE 131 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, CALCIUM SILICATE PRODUCT TYPE BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 132 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, CALCIUM SILICATE PRODUCT TYPE BY APPLICATION, 2019–2026 (KILOTON)

TABLE 133 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, OTHER PRODUCT TYPES BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 NORTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, OTHER PRODUCT TYPES BY APPLICATION, 2019–2026 (KILOTON)

9.4.1 US

9.4.1.1 Automotive and construction industries expected to drive white inorganic pigments market in US

TABLE 135 US: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 136 US: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 137 US: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 138 US: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.4.2 CANADA

9.4.2.1 Recovery of country’s economy favorable for market growth

TABLE 139 CANADA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 140 CANADA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 141 CANADA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 142 CANADA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.4.3 MEXICO

9.4.3.1 Rising demand for plastics in Mexico expected to fuel consumption of white inorganic pigments

TABLE 143 MEXICO: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 144 MEXICO: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 145 MEXICO: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 146 MEXICO: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.5 SOUTH AMERICA

TABLE 147 SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 148 SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 149 SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 150 SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 151 SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 152 SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.5.1 BRAZIL

9.5.1.1 Due to growing industrial sector, Brazil is a lucrative market for white inorganic pigments

TABLE 153 BRAZIL: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 154 BRAZIL: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 155 BRAZIL: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 156 BRAZIL: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.5.2 ARGENTINA

9.5.2.1 Shrinking economy impacting white inorganic pigments market in Argentina

TABLE 157 ARGENTINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 158 ARGENTINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 159 ARGENTINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 160 ARGENTINA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.5.3 REST OF SOUTH AMERICA

TABLE 161 REST OF SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 162 REST OF SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 163 REST OF SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 164 REST OF SOUTH AMERICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.6 MIDDLE EAST & AFRICA

TABLE 165 MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 167 MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 169 MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.6.1 SAUDI ARABIA

9.6.1.1 Increasing investments in infrastructure expected to spur demand for white inorganic pigments

TABLE 171 SAUDI ARABIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 172 SAUDI ARABIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 173 SAUDI ARABIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 174 SAUDI ARABIA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.6.2 SOUTH AFRICA

9.6.2.1 Increased investments in construction industry boosting market

TABLE 175 SOUTH AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 176 SOUTH AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 177 SOUTH AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 178 SOUTH AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.6.3 UAE

9.6.3.1 Growing infrastructure in UAE expected to drive demand for white inorganic pigments

TABLE 179 UAE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 180 UAE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 181 UAE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 182 UAE: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.6.4 TURKEY

9.6.4.1 Increasing investments in industrial sector expected to lead to growth of white inorganic pigments market

TABLE 183 TURKEY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 184 TURKEY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 185 TURKEY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 186 TURKEY: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

9.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 187 REST OF MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 188 REST OF MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 189 REST OF MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 190 REST OF MIDDLE EAST & AFRICA: WHITE INORGANIC PIGMENTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 164)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 42 COMPANIES ADOPTED ACQUISITIONS AS KEY GROWTH STRATEGY DURING 2017–2021

10.3 MARKET RANKING

FIGURE 43 MARKET RANKING OF KEY PLAYERS, 2020

10.3.1 VENATOR MATERIALS PLC

10.3.2 THE CHEMOURS COMPANY

10.3.3 TRONOX HOLDINGS PLC

10.3.4 LANXESS

10.3.5 KRONOS WORLDWIDE, INC.

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 44 REVENUE ANALYSIS OF KEY COMPANIES IN WHITE INORGANIC PIGMENTS MARKET

10.5 MARKET SHARE ANALYSIS

TABLE 191 WHITE INORGANIC PIGMENTS MARKET: GLOBAL MARKET SHARES OF KEY PLAYERS

FIGURE 45 SHARE OF LEADING COMPANIES IN WHITE INORGANIC PIGMENTS MARKET

TABLE 192 WHITE INORGANIC PIGMENTS MARKET: SHARES OF KEY PLAYERS IN NORTH AMERICA MARKET

FIGURE 46 SHARE OF LEADING COMPANIES IN NORTH AMERICA WHITE INORGANIC PIGMENTS MARKET

10.6 COMPANY EVALUATION QUADRANT

FIGURE 47 COMPETITIVE LEADERSHIP MAPPING: WHITE INORGANIC PIGMENTS MARKET, 2020

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 EMERGING LEADER

10.6.4 PARTICIPANT

10.7 COMPETITIVE BENCHMARKING

10.7.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 48 STRENGTH OF PRODUCT PORTFOLIO

10.7.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 49 BUSINESS STRATEGY EXCELLENCE

TABLE 193 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 194 COMPANY APPLICATION FOOTPRINT

TABLE 195 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 STARTING BLOCKS

10.8.4 DYNAMIC COMPANIES

FIGURE 50 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

10.9 COMPETITIVE SCENARIO AND TRENDS

TABLE 196 WHITE INORGANIC PIGMENTS MARKET: EXPANSION, JANUARY 2017–NOVEMBER 2021

TABLE 197 WHITE INORGANIC PIGMENTS MARKET: MERGERS & ACQUISITIONS, JANUARY 2017–AUGUST 2021

TABLE 198 WHITE INORGANIC PIGMENTS MARKET: NEW PRODUCT DEVELOPMENTS, JANUARY 2017–AUGUST 2021

11 COMPANY PROFILES (Page No. - 179)

11.1 MAJOR PLAYERS

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View)*

11.1.1 THE CHEMOURS COMPANY

TABLE 199 THE CHEMOURS COMPANY: BUSINESS OVERVIEW

FIGURE 51 THE CHEMROUS COMPANY: COMPANY SNAPSHOT

11.1.2 TRONOX HOLDINGS PLC

TABLE 200 TRONOX HOLDINGS PLC: BUSINESS OVERVIEW

FIGURE 52 TRONOX HOLDINGS PLC: COMPANY SNAPSHOT

11.1.3 VENATOR MATERIALS PLC

TABLE 201 VENATOR MATERIALS PLC: BUSINESS OVERVIEW

FIGURE 53 VENATOR MATERIALS PLC: COMPANY SNAPSHOT

11.1.4 KRONOS WORLDWIDE, INC.

TABLE 202 KRONOS WORLDWIDE, INC.: BUSINESS OVERVIEW

FIGURE 54 KRONOS WORLDWIDE, INC.: COMPANY SNAPSHOT

11.1.5 CLARIANT

TABLE 203 CLARIANT: BUSINESS OVERVIEW

FIGURE 55 CLARIANT: COMPANY SNAPSHOT

11.1.6 FERRO CORPORATION

TABLE 204 FERRO CORPORATION: BUSINESS OVERVIEW

FIGURE 56 FERRO CORPORATION: COMPANY SNAPSHOT

11.1.7 BASF SE

TABLE 205 BASF SE: BUSINESS OVERVIEW

FIGURE 57 BASF SE: COMPANY SNAPSHOT

11.1.8 LB GROUP

TABLE 206 LB GROUP: BUSINESS OVERVIEW

FIGURE 58 LB GROUP: COMPANY SNAPSHOT

11.1.9 LANXESS

TABLE 207 LANXESS: BUSINESS OVERVIEW

FIGURE 59 LANXESS: COMPANY SNAPSHOT

11.1.10 VALHI, INC.

TABLE 208 VALHI, INC.: BUSINESS OVERVIEW

FIGURE 60 VALHI, INC.: COMPANY SNAPSHOT

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 ADDITIONAL PLAYERS

11.2.1 CABOT CORPORATION

11.2.2 DCL CORPORATION

11.2.3 DYSTAR

11.2.4 INEOS PIGMENTS

11.2.5 MATAPEL CHEMICALS

11.2.6 NATIONAL INDUSTRIALIZATION COMPANY (TASNEE)

11.2.7 SUDARSHAN CHEMICALS

11.2.8 SUN CHEMICAL

11.2.9 STS GROUP CHEMICALS

11.2.10 LEARKA CZECH REPUBLIC

12 APPENDIX (Page No. - 212)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

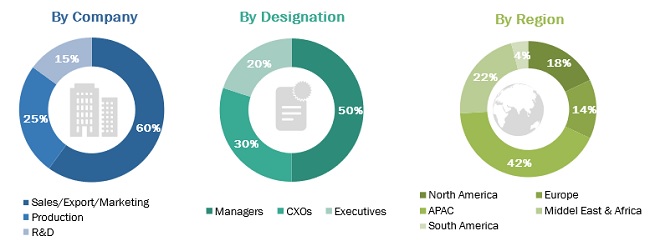

The study involved four major activities in estimating the current market size for the white inorganic pigments market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as automobile, industrial, building & construction companies, and other companies of the customer/end users who are using aluminum cast products were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of white inorganic pigments and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the white inorganic pigments market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global white inorganic pigments market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the white inorganic pigments market based on process and end-use

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in White Inorganic Pigments Market