WiMAX Market - TDD/FDD Spectrum Analysis and Global Forecast (2011-2016)

The global WiMAX Equipment market is expected to grow from $1.92 billion in 2011 to $9.21 billion in 2016. This represents a CAGR of 36.83% from 2011 to 2016. Saturation in the existing 3G networks, quest for higher data rates, and the need for spectral efficiency are the prominent factors triggering the demand for global WiMAX deployments.

The inexhaustible need for bandwidth is one of the major drivers of the WiMAX market, not just in the broadband segment, but also in the cellular space. The gradual saturation of 3G networks has given way to the emergence of the 4G market, constituent of LTE and WiMAX. Although LTE is currently being deployed by many cellular operators, there still exists a need to optimize the bandwidth efficiently, to reduce the high operating expenses (OPEX) borne by the operators. Considering the growing customer base demands, deployment of additional resources in terms of bandwidth is necessary, that too, at optimized OPEX. In such a scenario, WiMAX is being considered as an alternate broadband backhaul solution to help operators in offloading their voice and data traffic.

WiMAX (Worldwide Interoperability for Microwave Access) is the fourth generation mobile broadband system defined by the IEEE standard. The WiMAX Forum regulates this technology, while the IEEE monitors its standardization. The global WiMAX market is segmented into equipment, services, and end-user devices market. The services market captures the largest market share in terms of revenue, followed by the equipment market. In order to meet the rising demand for high broadband access, operators are in constant search for high speed network technologies. Enterprises need enhanced efficiency in the existing real-time applications such as video conferencing, while the other users are keen to have television-like experience while browsing through high-bandwidth applications such as YouTube and social networking sites. This rising demand for higher speed with better user experience has compelled operators to go for further enhancements in the broadband space.

The WiMAX market has wide scope in terms of operability as it is capable of operating in both TDD and FDD modes, thereby giving flexibility to the operators. With innovations such as network sharing and hybrid networks budding in the market off late, WiMAX players have immense opportunity; which still remains untapped. TDD is preferred over FDD for WiMAX operations, owing to its flexibility in handling both symmetric and asymmetric broadband traffic. Moreover, TDD saves bandwidth since it uses half the spectrum, as compared to FDD. This, in turn, makes a TDD system cheaper and less complex. As most of the WiMAX traffic comprises asymmetrical data, major WiMAX deployments are being implemented in the TDD mode, thereby facilitating industry players with spectrally efficient alternatives, reducing their OPEX.

Spectrum licensing has various effects on technology; in terms of bandwidth, power, and interference. Since the licensed frequency bands are allocated only to licensees, the interference in these bands is relatively low, thereby benefiting the end-user. In such a scenario, WiMAX operators are at an advantage as they have the flexibility to invest in the licensed bands, thereby being facilitated with superior signal quality.

At the same time, licensed bands are usually expensive as they are auctioned out on a nationwide level. With 5 GHz being a globally recognized unlicensed WiMAX band, medium to small operators find it easier to venture into the license-exempt market as they are not required to compulsorily buy the spectrum, hence providing further flexibility to WiMAX operators.

Scope of the report

This research report segments the global WiMAX market on the basis of equipment, end-user devices, and services. It is further sub-segmented in terms of regions and revenues, giving insights of market trends and applications in each sub segment.

This research report categorizes the global WiMAX market for forecasting the revenue, and analyzing trends in each of the following sub-markets:

On the basis of type and services:

- Fixed

- Mobile

On the basis of equipment:

- Infrastructure

- End-user devices

On the basis of geography:

- North America

- South America

- Europe

- MEA

- Asia-Pacific

Each of the major and micro WiMAX market segments includes detailed analysis of the factors influencing the market, trends and forecasts, and competitive landscape to understand basic market opportunities and growth strategies required to successfully drive the global WiMAX market.

Global WiMAX TDD/FDD Spectrum Analysis and Forecast (2011-2016)

While developing nations are the most potential markets for WiMAX deployments; established economies such as North America stand only second with respect to the same. Even though several regulatory issues and spectrum allocations have not been made globally, WiMAX remains to be on the broadband roadmap for several economies such as APAC, Europe, and MEA.

MarketsandMarkets expects the global WiMAX services market to grow from $3.25 billion in 2010 to $33.65 billion in 2016 at a CAGR of 48.56% from 2011 to 2016. The WiMAX equipment market, on the other hand, is estimated to grow from $1.50 billion in 2010 to $9.21 billion in 2016 at a CAGR of 36.83% for the same period. MarketsandMarkets expects the global WiMAX subscribers to increase from 13.66 million in 2010 to 119.29 million in 2016 at a CAGR of 35.75% from 2011 to 2016. The WiMAX end-user devices shipment market is estimated to grow from 8.34 million in 2010 to 98.73 million in 2016 at a CAGR of 28.28% from 2011 to 2016.

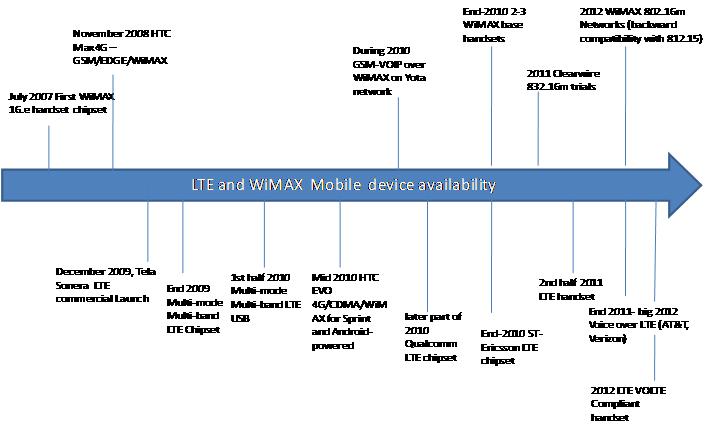

Comparison of WiMAX and LTE on the basis of evolution

The major forces driving the market include rising need for rural connectivity, WiMAX operability on both licensed and unlicensed spectrum among others. On the other hand, negative portrayal of WiMAX is hampering the growth of the overall market.

Licensed bands are usually pricey as they are auctioned out on a nationwide level. With 5 GHz being a globally recognized unlicensed WiMAX band, medium to small operators find it simpler to venture into the license-exempt market as they are not required to buy the spectrum, hence providing further flexibility to WiMAX operators.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 FORECAST ASSUMPTIONS

1.6 RESEARCH METHODOLOGY

2 SUMMARY

3 MARKET OVERVIEW

3.1 DEFINITION

3.2 WIMAX DUPLEXING TECHNIQUES

3.2.1 FDD

3.2.2 TDD

3.3 COMPARISON BETWEEN WI-FI & WIMAX

3.4 COMPARISON BETWEEN LTE & WIMAX

3.5 MARKET DYNAMICS

3.5.1 DRIVERS

3.5.1.1 Rising need for rural connectivity

3.5.1.2 Rising need for broadband connectivity

3.5.1.3 Backhaul solution for bandwidth optimization

3.5.1.4 Operational flexibility

3.5.2 RESTRAINT

3.5.2.1 Shifting focus from WiMAX to LTE: negative portrayal of WiMAX

3.5.3 OPPORTUNITIES

3.5.3.1 Co-existence of LTE & WiMAX: heterogeneous base stations

3.5.3.2 Emerging markets with low broadband penetration

3.6 IMPACT ANALYSIS OF DROS

3.7 WINNING IMPERATIVES

3.7.1.1 Interoperability due to standardization

3.7.1.2 Spectral flexibility

3.8 BURNING ISSUES

3.8.1.1 Spectrum regulatory issues

3.8.1.2 International roaming

3.9 OPPORTUNITY ANALYSIS

3.9.1 BY VERTICALS

3.9.2 BY END-USER DEVICES

3.1 MARKET PRESENCE ANALYSIS

3.11 PATENT ANALYSIS

3.11.1 BY COMPANY

3.11.2 BY GEOGRAPHY

4 WIMAX MARKET TRENDS ANALYSIS

4.1 GLOBAL DEPLOYMENT TRENDS

4.1.1 BY USAGE & ARPU

4.1.2 BY FREQUENCIES

4.2 WIMAX NETWORK ACCESS TYPES

4.2.1 FIXED, PORTABLE & MOBILE ACCESS

4.3 SPECTRUM ANALYSIS

4.3.1 FIXED WIMAX 802.16D

4.3.2 MOBILE WIMAX 802.16E

5 WIMAX MARKET ASSESSMENT

5.1 INSTALLED BASE STATIONS

5.2 WIMAX EQUIPMENT MARKET

5.3 WIMAX END-USER DEVICES MARKET

5.3.1 BY TYPES

5.3.2 BY GEOGRAPHY

5.4 WIMAX SERVICES REVENUE & FORECAST

5.4.1 BY TYPES

5.4.1.1 Fixed

5.4.1.2 Mobile

5.5 SUBSCRIBERS FOR WIMAX

5.5.1 BY TYPES

5.5.1.1 Fixed WiMAX

5.5.1.2 Mobile WiMAX

6 GEOGRAPHICAL ANALYSIS

6.1 NORTH AMERICA

6.1.1 OVERVIEW & TRENDS

6.1.2 MARKET SIZE & FORECAST

6.2 LATIN AMERICA

6.2.1 OVERVIEW & TRENDS

6.2.2 MARKET SIZE & FORECAST

6.3 EUROPE

6.3.1 OVERVIEW & TRENDS

6.3.2 MARKET SIZE & FORECAST

6.4 MIDDLE EAST & AFRICA

6.4.1 OVERVIEW & TRENDS

6.4.2 MARKET SIZE & FORECAST

6.5 ASIA-PACIFIC

6.5.1 OVERVIEW & TRENDS

6.5.2 MARKET SIZE & FORECAST

7 COMPETITIVE LANDSCAPE

7.1 NEW PRODUCT DEVELOPMENTS

7.2 MERGERS & ACQUISITIONS

7.3 PARTNERSHIPS & COLLABORATIONS

8 COMPANY PROFILES

8.1 AIRSPAN NETWORKS INC

8.1.1 OVERVIEW

8.1.2 PRODUCTS & SERVICES

8.1.3 FINANCIALS

8.1.4 STRATEGY

8.1.5 DEVELOPMENTS

8.2 ALVARION LTD

8.2.1 OVERVIEW

8.2.2 PRODUCTS & SERVICES

8.2.3 FINANCIALS

8.2.4 STRATEGY

8.2.5 DEVELOPMENTS

8.3 AVIAT NETWORKS INC

8.3.1 OVERVIEW

8.3.2 PRODUCTS & SERVICES

8.3.3 FINANCIALS

8.3.4 STRATEGY

8.3.5 DEVELOPMENTS

8.4 BHARAT SANCHAR NIGAM LTD

8.4.1 OVERVIEW

8.4.2 PRODUCTS & SERVICES

8.4.3 FINANCIALS

8.4.4 STRATEGY

8.4.5 DEVELOPMENTS

8.5 CLEARWIRE CORPORATION

8.5.1 OVERVIEW

8.5.2 PRODUCTS & SERVICES

8.5.3 FINANCIALS

8.5.4 STRATEGY

8.5.5 DEVELOPMENTS

8.6 COMCAST CORPORATION

8.6.1 OVERVIEW

8.6.2 PRODUCTS & SERVICES

8.6.3 FINANCIALS

8.6.4 STRATEGY

8.6.5 DEVELOPMENTS

8.7 DRAGONWAVE INC

8.7.1 OVERVIEW

8.7.2 PRODUCTS & SERVICES

8.7.3 FINANCIALS

8.7.4 STRATEGY

8.7.5 DEVELOPMENTS

8.8 HUAWEI TECHNOLOGIES CO. LTD

8.8.1 OVERVIEW

8.8.2 PRODUCTS & SERVICES

8.8.3 FINANCIALS

8.8.4 STRATEGY

8.8.5 DEVELOPMENTS

8.9 INTEL CORPORATION

8.9.1 OVERVIEW

8.9.2 PRODUCTS & SERVICES

8.9.3 FINANCIALS

8.9.4 STRATEGY

8.9.5 DEVELOPMENTS

8.10 NOKIA CORPORATION

8.10.1 OVERVIEW

8.10.2 PRODUCTS & SERVICES

8.10.3 FINANCIALS

8.10.4 STRATEGY

8.10.5 DEVELOPMENTS

8.11 REDLINE COMMUNICATIONS GROUP INC

8.11.1 OVERVIEW

8.11.2 PRODUCTS & SERVICES

8.11.3 FINANCIALS

8.11.4 STRATEGY

8.11.5 DEVELOPMENTS

8.12 SAMSUNG ELECTRONICS

8.12.1 OVERVIEW

8.12.2 PRODUCTS & SERVICES

8.12.3 FINANCIALS

8.12.4 STRATEGY

8.12.5 DEVELOPMENTS

8.13 SPRINT NEXTEL CORPORATION

8.13.1 OVERVIEW

8.13.2 PRODUCTS & SERVICES

8.13.3 FINANCIALS

8.13.4 STRATEGY

8.13.5 DEVELOPMENTS

8.14 UQ COMMUNICATIONS INC

8.14.1 OVERVIEW

8.14.2 PRODUCTS & SERVICES

8.14.3 FINANCIALS

8.14.4 STRATEGY

8.14.5 DEVELOPMENTS

8.15 ZTE CORPORATION

8.15.1 OVERVIEW

8.15.2 PRODUCTS & SERVICES

8.15.3 FINANCIALS

8.15.4 STRATEGY

8.15.5 DEVELOPMENTS

APPENDIX

PATENTS

LIST OF TABLES

1 FORECAST ASSUMPTIONS

2 GLOBAL WIMAX MARKET REVENUE, BY TYPES, 2010 2016 ($BILLION)

3 GLOBAL WIMAX END-USER DEVICE SHIPMENTS & SUBSCRIBERS, 2010 2016 (MILLION)

4 COMPARISON BETWEEN WI-FI & WIMAX

5 COMPARISON BETWEEN LTE & WIMAX ON THE BASIS OF FEATURES

6 IMPACT ANALYSIS OF DROS

7 TYPES OF WIMAX NETWORK ACCESS

8 COMPARISON BETWEEN 802.16D & 802.16E

9 FREQUENCY BANDS OF FIXED WIMAX

10 FREQUENCY BANDS OF MOBILE WIMAX

11 INSTALLED BASE STATIONS, BY GEOGRAPHY, 2010 2016 (THOUSAND)

12 GLOBAL WIMAX EQUIPMENT MARKET, 2010 2016 ($BILLION)

13 WIMAX EQUIPMENT MARKET, BY GEOGRAPHY, 2010 2016 ($BILLION)

14 WIMAX EQUIPMENT MARKET, BY GEOGRAPHY, 2011 2016 (Y-O-Y GROWTH RATE)

15 GLOBAL WIMAX END-USER DEVICE SHIPMENTS, BY TYPES, 2010 2016 (MILLION)

16 WIMAX END-USER DEVICE SHIPMENTS, BY GEOGRAPHY, 2010 2016 (MILLION)

17 GLOBAL WIMAX SERVICES MARKET REVENUE, 2010 2016 ($BILLION)

18 GLOBAL WIMAX SERVICES MARKET REVENUE, BY TYPES, 2010 2016 ($BILLION)

19 WIMAX SERVICES MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($BILLION)

20 FIXED WIMAX SERVICES MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($BILLION)

21 MOBILE WIMAX SERVICES MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($BILLION)

22 GLOBAL WIMAX SUBSCRIBERS, BY TYPES, 2010 2016 (MILLION)

23 FIXED WIMAX SUBSCRIBERS, BY GEOGRAPHY, 2010 2016 (MILLION)

24 MOBILE WIMAX SUBSCRIBERS, BY GEOGRAPHY, 2010 2016 (MILLION)

25 NORTH AMERICA: WIMAX SUBSCRIBERS, BY TYPES, 2010 2016 (MILLION)

26 NORTH AMERICA: WIMAX SERVICES MARKET REVENUE, BY TYPES, 2010 2016 ($BILLION)

27 NORTH AMERICA: END-USER DEVICE SHIPMENTS, BY TYPES, 2010 2016 (MILLION)

28 LATIN AMERICA: WIMAX SUBSCRIBERS, BY TYPES, 2010 2016 (MILLION)

29 LATIN AMERICA: WIMAX SERVICES MARKET, BY TYPES, 2010 2016 ($BILLION)

30 LATIN AMERICA: END-USER DEVICE SHIPMENTS MARKET, BY TYPES, 2010 2016 (MILLION)

31 EUROPE: WIMAX SUBSCRIBERS, BY TYPES, 2010 2016 (MILLION)

32 EUROPE: WIMAX SERVICES MARKET, BY TYPES, 2010 2016 ($BILLION)

33 EUROPE: END-USER DEVICE SHIPMENTS, BY TYPES, 2010 2016 (MILLION)

34 MEA: WIMAX SUBSCRIBERS, BY TYPES, 2010 2016 (MILLION)

35 MEA: WIMAX SERVICES MARKET REVENUE, BY TYPES, 2010 2016 ($BILLION)

36 MEA: END-USER DEVICE SHIPMENTS, BY TYPES, 2010 2016 (MILLION)

37 APAC: WIMAX SUBSCRIBERS, BY TYPES, 2010 2016 (MILLION)

38 APAC: WIMAX SERVICES MARKET REVENUE, BY TYPES, 2010 2016 ($BILLION)

39 APAC: END-USER DEVICE SHIPMENTS, BY TYPES, 2010 2016 (MILLION)

40 NEW PRODUCT DEVELOPMENTS, 2008 2011

41 MERGERS & ACQUISITIONS, 2009 2011

42 PARTNERSHIPS & COLLABORATIONS, 2008 2011

43 AIRSPAN NETWORKS: MARKET REVENUE, BY GEOGRAPHY, 2007 2008 ($MILLION)

44 AIRSPAN NETWORKS: MARKET REVENUE, BY PRODUCTS & SERVICES, 2007 2008 ($MILLION)

45 ALVARION: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

46 AVIAT NETWORKS: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

47 BHARAT SANCHAR NIGAM: MARKET REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

48 CLEARWIRE: MARKET REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

49 CLEARWIRE: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

50 COMCAST: MARKET REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

51 DRAGONWAVE: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

52 HUAWEI: MARKET REVENUE, BY BUSINESS SEGMENTS, 2009 2010 ($MILLION)

53 HUAWEI: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

54 INTEL: MARKET REVENUE, BY OPERATING SEGMENTS, 2009 2010 ($MILLION)

55 INTEL: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

56 NOKIA: MARKET REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

57 NOKIA: MARKET REVENUE, BY COUNTRY, 2009 2010 ($MILLION)

58 REDLINE: MARKET REVENUE, BY SEGMENTS, 2010 ($MILLION)

59 REDLINE: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

60 SPRINT NEXTEL: MARKET REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

61 ZTE CORPORATION: MARKET REVENUE, BY PRODUCT SEGMENTS, 2009 2010 ($MILLION)

62 ZTE CORPORATION: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

LIST OF FIGURES

1 WIMAX ARCHITECTURE

2 DATA FLOW IN FDD

3 FDD (FREQUENCY DIVISION DUPLEX)

4 DATA FLOW IN TDD

5 TDD (TIME DIVISION DUPLEX)

6 EVOLUTION OF LTE & WIMAX TECHNOLOGIES

7 GLOBAL BROADBAND SUBSCRIBERS, 2006 2011 (MILLION)

8 WIMAX AS AN ALTERNATE BACKHAUL

9 IEEE STANDARD OF WIMAX

10 CONNECTIONS, BY UTILITY VERTICALS, 2009 2016 (MILLION)

11 OPPORTUNITY ANALYSIS, BY END-USER DEVICES

12 MARKET PRESENCE ANALYSIS, 2008 2011

13 PATENT ANALYSIS, BY COMPANY, 2006 2011 (%)

14 PATENT ANALYSIS, BY GEOGRAPHY, JULY 2006 JULY 2011

15 WIMAX USAGE & ARPU, BY TYPES, 2010

16 WIMAX DEPLOYMENT, BY FREQUENCIES, 2010

17 INSTALLED BASE STATIONS PROPORTIONS & FORECAST, BY GEOGRAPHY, 2011 2016

18 GLOBAL WIMAX EQUIPMENT MARKET TRENDS, BY GEOGRAPHY, 2011 2016

19 WIMAX EQUIPMENT MARKET, PROPORTION & FORECAST, BY GEOGRAPHY, 2011 2016

20 WIMAX END-USER DEVICES MARKET, BY SHIPMENTS, 2010 2015 (MILLION)

21 WIMAX END-USER DEVICE SHIPMENTS PROPORTION & FORECAST, BY TYPES, 2011 2016

22 WIMAX END-USER DEVICE SHIPMENTS PROPORTION & FORECAST, BY GEOGRAPHY, 2011-2016

23 GLOBAL WIMAX SERVICES MARKET PROPORTION & FORECAST, 2011 2016

24 GLOBAL WIMAX SUBSCRIBERS PROPORTION & FORECAST, BY TYPES, 2011 2016

25 FIXED WIMAX SUBSCRIBERS PROPORTION & FORECAST, BY GEOGRAPHY, 2011 2016

26 MOBILE WIMAX SUBSCRIBERS PROPORTION & FORECAST, BY GEOGRAPHY, 2011 2016

27 INTERNET USERS IN APAC, 2011

28 COMPETITIVE LANDSCAPE, BY TYPES, 2008 2011

Growth opportunities and latent adjacency in WiMAX Market