Distribution Automation Market

Distribution Automation Market by Offering (Field Devices, Software, Services), Communication Technology (Wired (Fiber Optic, Ethernet, Powerline Carrier, IP), Wireless), Utility (Public Utilities, Private Utilities), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

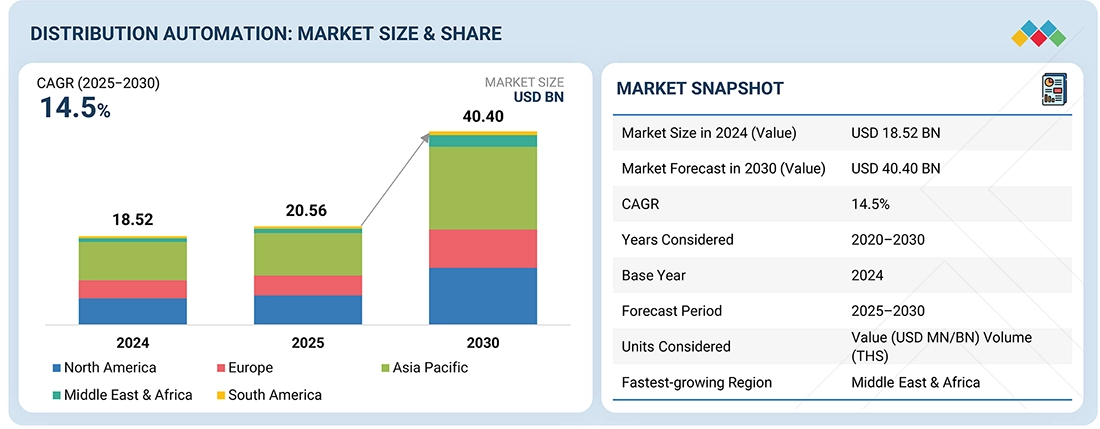

The global distribution automation market is projected to reach USD 40.40 billion by 2030 from USD 20.56 billion in 2025, registering a CAGR of 14.5% during the forecast period. The demand for distribution automation is increasing due to the need for nations to enhance their power grids, individuals' desire for uninterrupted and high-quality power, the growing use of renewable energy, and the advancement of digital communication and control technologies.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific distribution automation market is projected to dominate with a share of 43.0% in 2025.

-

BY OFFERINGBy Offering, field devices are expected to lead the market, registering a CAGR of 14.8% in the forecast period.

-

BY COMMUNICATION TECHNOLOGYBy communication technology, the wireless segment is expected to register a CAGR of 14.8%.

-

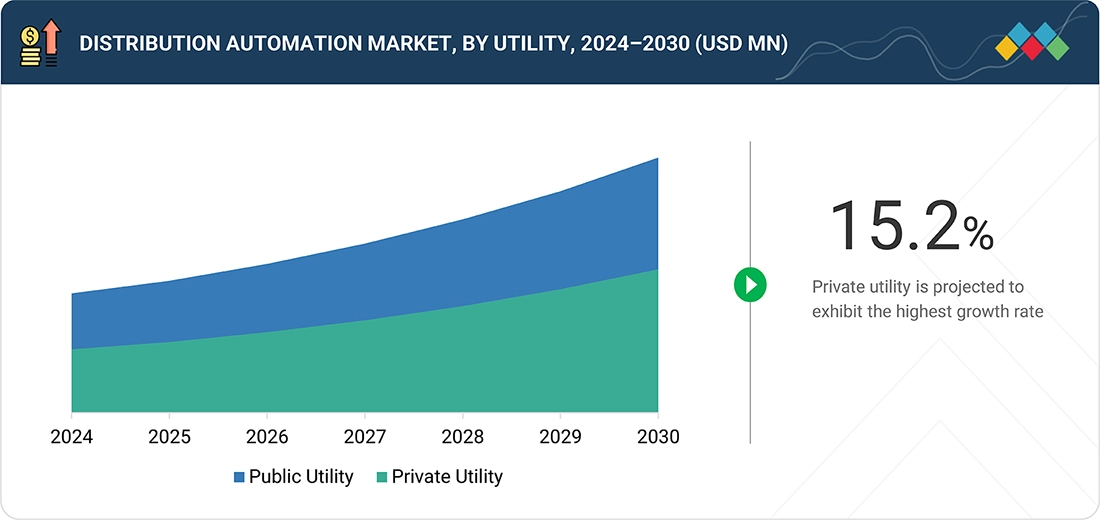

BY UTILITYBy utility, the private is expected to grow fastest in the market, with a share of 15.2% in 2025-2030.

-

COMPETITIVE LANDSCAPEABB (Switzerland), Siemens (Germany), Schneider Electric (France), General Electric (US), and Eaton (Eaton) were identified as Star players in the distribution automation market, focusing on innovation and large-scale smart grid automation solutions.

With the accelerating modernization of power networks, there is increasing potential for Distribution Automation Systems to integrate with smart grid technologies, predictive analytics, and real-time monitoring platforms. Modern systems enable seamless connectivity with IoT devices, digital substations, and cloud-based control solutions, providing a comprehensive platform for efficient operation. Distribution automation that can optimize load management, enhance grid flexibility, and support remote fault detection and restoration is gaining greater importance in the evolving power distribution landscape

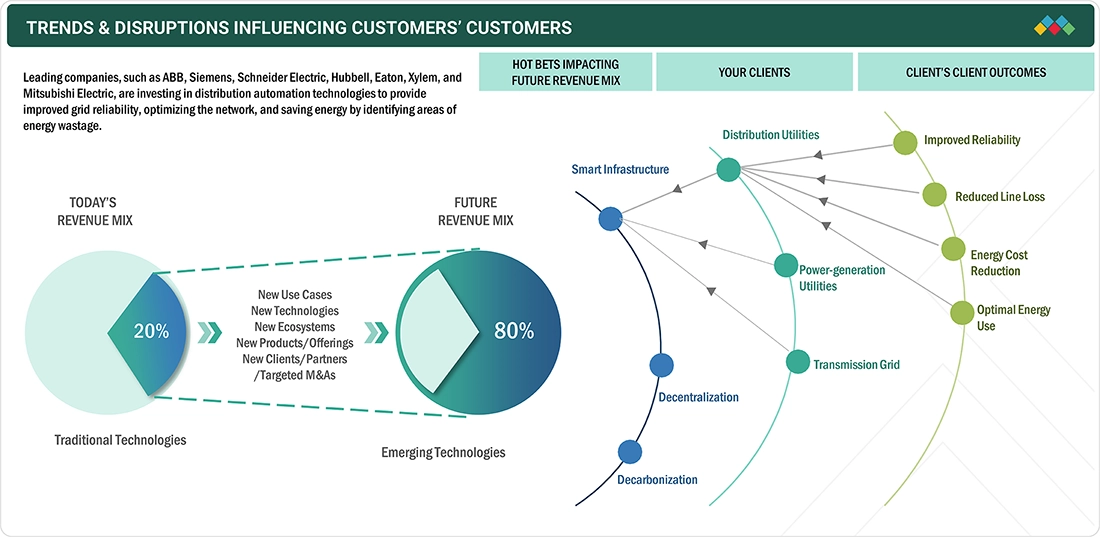

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The distribution automation market is projected to grow at a compound annual growth rate (CAGR) of 14.5% during the forecast period. Leading manufacturers such as ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and GE Vernova (US) are expanding their product and service portfolios across the entire value chain to enhance revenue opportunities. The rising need for a reliable and efficient power supply, along with the growing adoption of smart grid technologies. Increasing investments in grid modernization and renewable energy integration further accelerate market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Reliance on smart grid networks to meet burgeoning energy demand

-

\Government-led initiatives to ensure universal access to electricity

Level

-

High upfront and installation costs

-

Issues in existing switchgear modernization

Level

-

Rapid advancements in AI and& IoT technologies

-

Rising electrification using renewable energy sources

Level

-

Compatibility issues due to lack of standardized communication protocols

-

Increased rate of false data injection attacks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Reliance on smart grid networks to meet burgeoning energy demand

Smart Grids are an important technological approach that addresses issues of aging infrastructure, the increasing demand for energy, and non-renewable sources, such as fossil fuels, which are being overexploited. It incorporates real-time monitoring systems, decision-making algorithms, control systems, forecasting, and optimized algorithms. One of the most significant aspects of smart grids is DA. DA is used for real-time monitoring, control, and management of power distribution grids. DA provides real-time operating information on components in distribution grids, including the state of voltage regulators, capacitor bank controllers, fault detectors, and switches. The operational efficiency of automated smart grids improves, resulting in cost savings that enhance customer satisfaction. Also, environmental impacts would be mitigated while maximizing reliability, resilience, flexibility, and stability. Many key economies have announced investments that they would make to modernize their electricity grids in size and digitalization

Restraint: High upfront and installation costs

The primary reason for restraints in distribution automation is the high upfront investment required for core infrastructure elements, such as SCADA systems and communication networks. It may involve significant capital expenses, as these infrastructures could have secondary functions that utilize existing infrastructure. Acquisition costs include the purchase, installation, testing, and commissioning of various SCADA-compatible medium-voltage power equipment, such as line switches, capacitor banks, and voltage regulators. Additional costs include the installation of new sensors and smart controls to regulate the performance of these components. Significantly, the electric distribution system infrastructure must be significantly altered to prevent overloads and undervoltage during feeder reconfiguration. This includes tying existing radial feeders to backup power sources and reconductoring feeders

Opportunity: Rapid advancements in AI and& IoT technologies

Smart technology, including AI, IoT, and AMRS, promises great prospects in the DA sector. New technologies are important for boosting the efficiency and reliability of DA systems. AI algorithms, combined with IoT sensor data, enable smart cities to analyze large amounts of information efficiently. The IoT devices comprise sensors, processors, and communication networks. They enable utilities to collect, automate, and optimize data for operational efficiency improvements. DA systems are crucial to AL, which supports intelligent verification and monitoring of distribution automation terminals, increasing safety and reliability while decreasing operational costs. Researchers have explored AI-based methods and algorithms for distribution automation terminals.

Challenge: Compatibility issues due to lack of standardized communication protocols

Lack of standardized communication protocols hampers the efficiency, reliability, and interoperability of electrical distribution DA systems. Without these protocols, compatibility issues among vendors hinder seamless system integration. Choosing the right communication infrastructure during deployment is crucial for collecting essential data, considering factors such as transfer frequency, volume, and criticality. Interoperability challenges compromise system reliability, efficiency, and security. A smart grid requires a robust platform aligning power, information, and business flows. The absence of standards makes it difficult to connect devices from various vendors, as open substation automation standards are lacking.

Distribution Automation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

TATA POWER Delhi Distribution Limited Adopts automated solutions to improve efficiency and reduce aggregate technical and commercial losses | TPDD implemented automation in its operations to improve efficiency and reduce losses. The company has established a separate training center, the Center for Power Efficiency in Distribution, which offers training to its employees and other power companies. TPDD has also established the Rithala captive power plant to serve as a backup in the event of breakdowns, particularly for essential services such as hospitals and streetlights. |

|

US DOE grants Chattanooga Electric Power Board contract to deploy smart grid technologies for transformers | Itron’s distribution automation solutions leverage industrial IoT-enabled edge devices to communicate, coordinate, and control equipment across the distribution network in real-time, improving distribution system reliability by reducing outage duration and the number of customers affected. Intelligently connected devices, such as capacitor bank controllers, smart meters, line sensors, and reclosers that leverage peer-to-peer communication, can quickly pinpoint and isolate outages, protecting equipment and helping keep the lights on. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The distribution automation market ecosystem analysis reveals the interconnections/adjacencies that impact the distribution automation market, providing MnM coverage of the market under study. The section highlights the key industries and applications impacting the market under study. Due to the rising need for reliable and efficient power supply, an increasing investment in grid modernization. The growing integration of renewable energy sources is further accelerating the adoption of clean energy to ensure grid stability. Additionally, the focus on minimizing outages and enhancing grid resilience is driving utilities toward advanced automation solutions. The distribution automation ecosystem involves key players operating across different levels. Major Distribution automation manufacturers are ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and GE Vernova (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Distribution Automation Market, By Offering

Offerings include field devices, software, and services. Field devices are expected to grow at the fastest rate during the forecast period due to their unique features and benefits. The need for real-time data exchange and decisions based on data drives the use of field devices. Field devices, like smart transformers and voltage regulators, help improve power distribution and reduce waste. They are also used to make the grid stronger and reduce power outages.

Distribution Automation Market, By Communication Technology

Wired and wireless are the two communication technology segments in this market. The wired market is expanding due to its efficiency and simplicity. When data is transmitted through a wire-based system, it is referred to as wired communication. It primarily consists of fiber optic, Ethernet, powerline carriers, and IP. Fiber optic and Ethernet are the widely used ones for networking in distribution automation. Fiber optic offers greater bandwidth and speed, which aids in high performance, reliability, and greater coverage. Fiber-optic communication is also widely used in substations due to its ability to support high voltages.

REGION

Asia Pacific to be the largest market of Distribution Automation Market

Asia Pacific is expected to have the highest market during the forecast period. The Asia Pacific region holds the largest market share of the global Distribution Automation market. This is due to the fact that these countries have experienced rapid industrialization, urbanization, and a growth in electricity demand in densely populated countries such as China, India, and Japan. Governments in the Asia Pacific area are investing heavily in smart grid technology and renewable energy, which requires upgraded automation technologies to ensure the reliability and efficiency of the grid. The region's emphasis on reducing carbon emissions and improving access to energy in rural areas also translates to a greater application of distribution automation technologies, placing the Asia Pacific at the forefront of this market.

Distribution Automation Market: COMPANY EVALUATION MATRIX

In the distribution automation market matrix, ABB leads with a strong market presence and a wide product portfolio. ABB focuses on acquisitions to further expand its digital energy management offering. This drives the distribution automation adoption across industries like grid management and power generation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.52 Billion |

| Market Forecast in 2030 (Value) | USD 40.40 Billion |

| Growth Rate | CAGR of 14.5% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD MN/BN) Volume (THS) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, South America, Middle East and Africa |

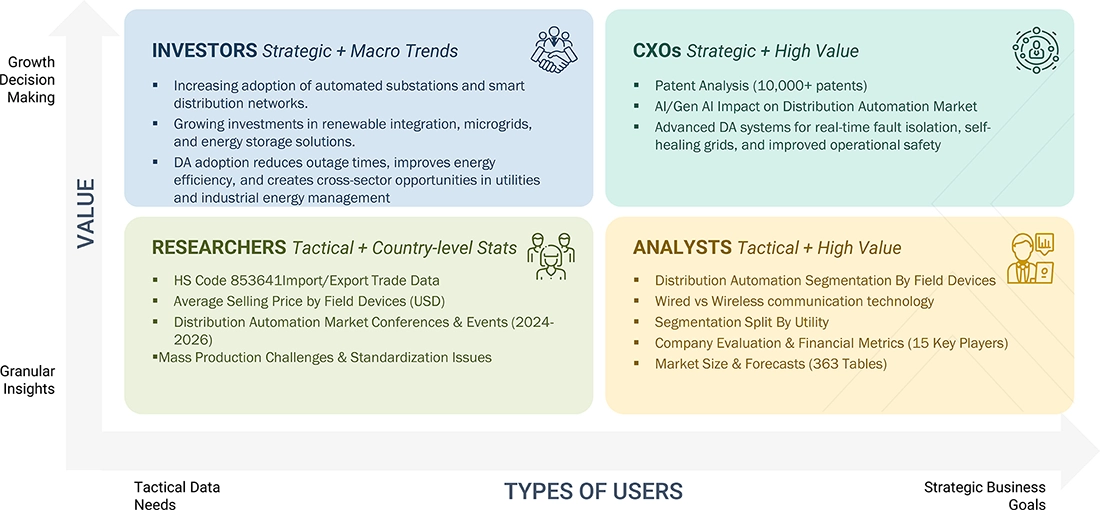

WHAT IS IN IT FOR YOU: Distribution Automation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Distribution of Automation Market by Pricing for Field Device Customization | The average selling price of field devices in a distribution automation system is estimated based on several factors. |

|

| Distribution of Automation Market by Volume for Field Device Customization | Volume data was estimated for field devices |

|

RECENT DEVELOPMENTS

- April 2025 : Schneider Electric invested USD 700 Million to support growing U.S. digitalization, automation, and manufacturing demand, marking the company’s largest single capital expenditure commitment in its 135-year history.

- April 2025 : Toshiba Transmission & Distribution Systems (India) Private Limited (TTDI), a subsidiary of Toshiba Energy Systems & Solutions Corporation (Japan), has signed a Memorandum of Understanding (MoU) with the Government of Telangana (India), to advance Investment in Power Transmission & Distribution Manufacturing investment of USD 66.01 Million (INR 562 crore) in expanding its manufacturing capabilities in the state.

- January 2025 : ABB acquired Sensorfact BV, a fast-growing energy management company headquartered in Utrecht, Netherlands. The acquisition further expands ABB’s digital energy management offering.

- August 2024 : Siemens Smart Infrastructure has introduced the SICAM Enhanced Grid Sensor (EGS), a crucial solution designed to accelerate the energy transition by addressing the key challenge of distribution network transparency for grid operators. With only 22% of urban smart grids classified as mature or advanced, according to the latest Infrastructure Transition Monitor survey, this new solution will play a crucial role in digitalizing distribution grids and enabling operators to achieve complete network visibility.

- August 2024 : In August 2024, Eaton expanded its Montreal Innovation Center, focusing on R&D for the energy transition. After developing cutting-edge software in the region for nearly 40 years, last year, the company announced its Innovation Center, focused on the research and development of distributed energy resources (DER) technologies.

Table of Contents

Methodology

This study involved major activities in estimating the current size of the distribution automation market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved the validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the extensive use of secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, IEA, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global distribution automation market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

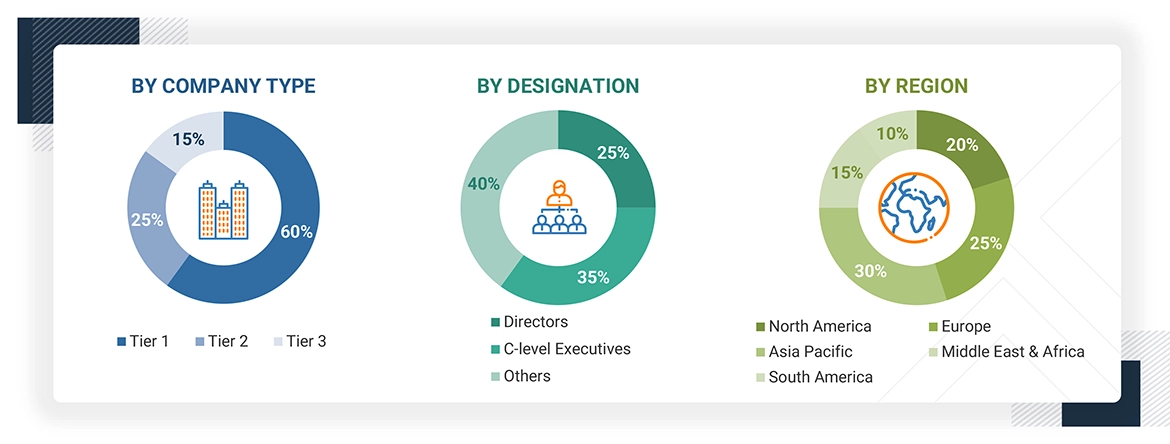

Primary Research

The distribution automation market comprises several stakeholders, such as project developers, exchanges, traders/brokers, auction platforms, and end users/carbon emitters in the supply chain. The demand side of this market is characterized by end users. Moreover, the market growth is also fueled by the growing demand for industrial and utility services. The supply side is characterized by an increase in the number of contracts in the industrial sector and acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

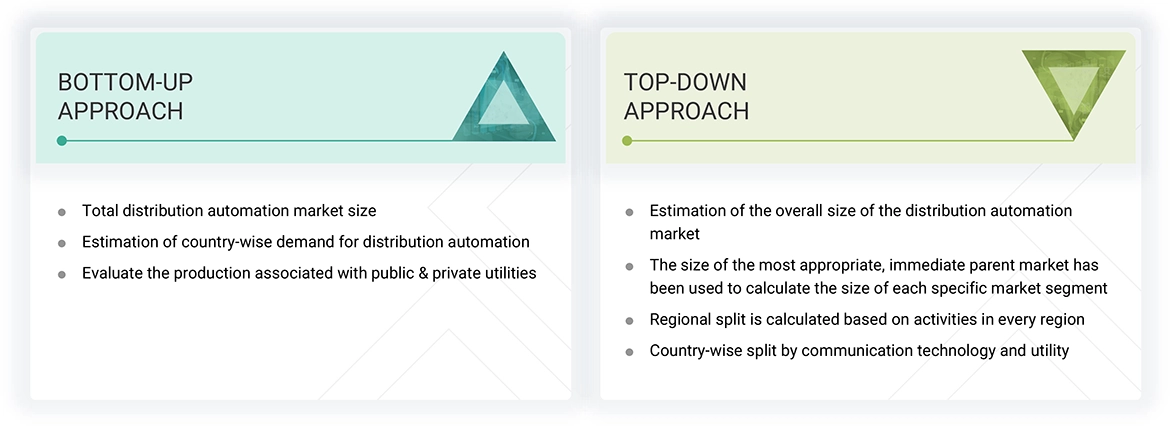

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the distribution automation market. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Distribution Automation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Distribution automation is a key component of modern grid infrastructure as it enables the real-time monitoring and control of distribution assets to maximize grid efficiency and reliability. It uses digital sensors and switches with advanced control and communication technologies to automate feeder switching, voltage monitoring and control, outage management, reactive power management, preventative equipment maintenance for critical substation equipment, and grid integration of distributed energy resources. This helps utilities in collecting and analyzing data to improve the operational efficiency of power distribution systems.

The distribution automation market refers to the year-on-year investments in distribution automation across the five main regions, namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Stakeholders

- Field device manufacturers

- Public and private electric utilities

- Distribution companies (DISCOMS)

- Energy & power sector consulting companies

- Government & research organizations

- Independent power producers

- Investment banks

- Electrical equipment associations

- Network and communication service providers

- Support and maintenance service providers

- Smart grid players

Report Objectives

- To describe and forecast the distribution automation market based on offering, communication technology, utility, and region in terms of value

- To describe and forecast the market for five key regions: Asia Pacific, North America, Europe, South America, and the Middle East & Africa, along with their country-level market sizes in terms of value

- To forecast the distribution automation market by offering and region, in terms of volume

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market map, ecosystem analysis, tariffs and regulations, pricing analysis, patent analysis, case study analysis, impact of 2025 US tariff, impact of generative AI & AI on distribution automation market, global macroeconomic outlook, technology analysis, key conferences and events, trade analysis, Porter’s Five Forces analysis, key stakeholders and buying criteria, and regulatory analysis of the distribution automation market

- To analyze opportunities for stakeholders and draw a competitive landscape of the distribution automation market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players with respect to product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, product launches, partnerships, and joint ventures & collaborations, in the distribution automation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the distribution automation market, by country

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the current size of the distribution automation market?

The current market size of the global distribution automation market is USD 18.52 billion in 2024.

What are the major drivers for the distribution automation market?

Government policies promoting energy efficiency and grid modernization, especially in developing regions, support market growth.

Which is likely to be the largest regional distribution automation market during the forecast period?

The Asia Pacific region is estimated to be the largest regional market during the forecast period.

Which is the faster-growing segment, by communication technology, in the distribution automation market during the forecast period?

The wireless communication technology segment is estimated to be the faster-growing segment.

What can be restraints for the distribution automation market growth?

High initial investment cost is one of the key restraints for the market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Distribution Automation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Distribution Automation Market