Wireless Gas Detection Market Size, Share, Industry Growth, Trends & Analysis by Technology (Wi-Fi, Bluetooth, Cellular, License-Free Ism Band), Offering (Hardware (Detectors/ Sensors, Gateways, Monitors and Controllers), Software, Services), Application, and Geography

Updated on : July 19 , 2023

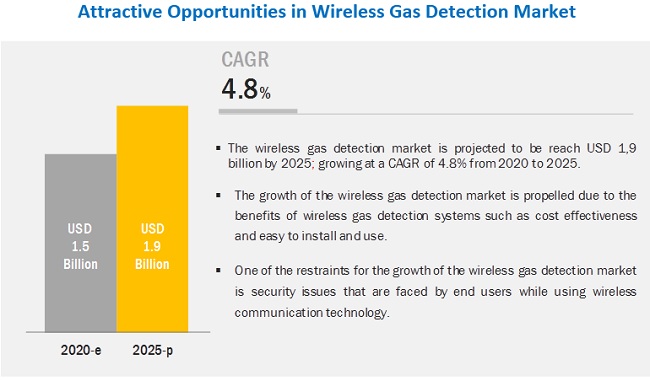

[174 Pages Report] The wireless gas detection market Size, Share, Industry Growth, Trends & Analysis is estimated to grow from USD 1.5 billion in 2020 to USD 1.9 billion by 2025; it is expected to grow at a CAGR of 4.8%. The cost-effectiveness, increased safety, and portability of wireless gas detection devices and the time- and money-saving easy installation of wireless gas detection systems are the key factors driving the growth of the wireless gas detection market.

Market for oil & gas end-user industry to hold largest share during forecast period

The market for oil & gas accounted for the largest size in 2019. In the oil & gas industry, gas detection is required for various applications such as confined space entry, emergency response, fence line monitoring, fracking, leak detection, plant shutdown, and worker exposure. Refining facilities involve the use of lubricating oil, wax, and fuel products such as jet fuel gasoline and diesel, all of which pose a health hazard for workers. Moreover, workers in the oil & gas industry are exposed to hazardous substances such as carbon monoxide, hydrogen sulfide, ammonia, methane, and chlorides, which are released during the process of oil extraction.

Market for industrial safety application to hold largest share during forecast period

The industrial safety application is estimated to account for the largest share of the overall wireless gas detection market in 2019. As safety is a top priority in most industries, a wide range of safety equipment are installed in these industries. Industrial chemicals and gases are prone to leaks and spills; their mismanagement can harm employees or workers, as well as manufacturing facilities, and disrupt production schedules. Wireless gas detection systems embedded with man-down alarms and GPS signals alert operators before an incident occurs and alert workers in advance. The various applications of wireless gas detection solutions in industrial safety include emergency response, fence line monitoring, leak detection, plant shutdown, and incident response.

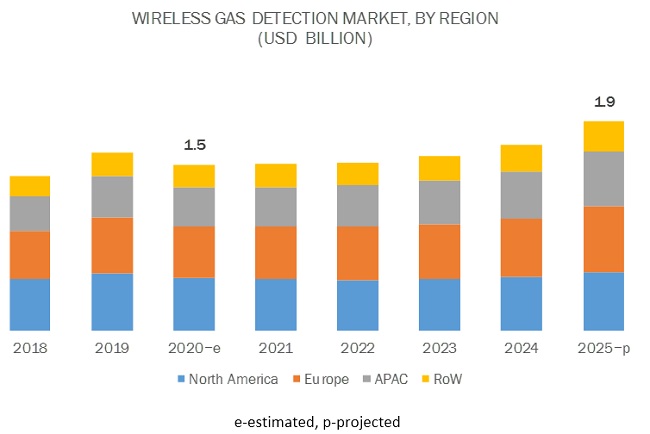

Market in North America to hold largest share in 2025

In terms of value, North America led the wireless gas detection market in 2019, accounting for the largest share of the overall wireless gas detection market, by region. In the recent years, the wireless gas detection market has witnessed significant growth in oil & gas and chemicals industries in North America. This growth is attributed to the increasing need for the security and safety of workers working in environments where they are constantly exposed to toxic gases. Moreover, the growing need to prevent industrial accidents caused by undetected gas leakage, and the increasing pressure from insurance companies for ensuring safety are encouraging industries to install wireless gas monitors.

Key Market Players

Honeywell International (US), DRÄGERWERK (Germany), Yokogawa Electric corporation (Japan), MSA Safety (US), Agilent Technologies (US), Teledyne Gas and Flame Detection (US), Siemens (Germany), United Electric Control (US), Sensidyne (US), Pem-tech (US), Airtest Technologies (Canada), Crowcon Detection Instruments (UK), Otis Instruments (US), Tek Troniks (UK), Emerson Electric (US), Ambetronics Engineering (India), GDS Corp (US), Bacharach (US), Onebee (India), and Gastronics (US) are a few major companies dominating the wireless gas detection market.

Honeywell International (US) innovates and develops technologies that address challenges pertaining to energy, safety, security, productivity, and global urbanization. The company owns a strong brand name and holds a high position in industries such as aerospace, semiconductors, and industrial manufacturing that have been huge drivers for the company’s organic growth across various industries.

Drägerwerk (Germany) is one of the major players in the fields of medical and safety technologies globally. The company’s offices are currently present in more than 190 countries and it offers a diversified range of products and solutions for portable gas detection. The company offers services in more than 40 countries. For the growth of its business and to strengthen its customer base, the company focuses on product launches, developments, and partnerships as key strategies. For instance, in 2015, the company acquired GasSecure AS (Norway) to manage research and development operations for wireless technology and innovative gas detection technologies. The company has established its development and production facilities across various regions including Germany, the UK, Sweden, the Netherlands, China, the Czech Republic, South Africa, Brazil, and the US.

Yokogaw Electric Corporation (Japan) is one of the major players that offers products and solutions in the areas of measurement, control, and information technologies. The company holds a strong position in Japan and has 13 subsidiaries and one affiliate in Japan. Additionally, it owns 75 subsidiaries and two affiliates outside Japan. The company operates through three business segments, namely, Industrial Automation and Control; Test and Measurement, and Aviation and Other. Yokogawa offers wireless gateways and controllers for various industries such as oil & gas, chemicals, natural gas, power, iron and steel, pulp & paper, and pharmaceuticals. The long-term agreement of GasSecure AS (Norway) and Yokogawa has been made to develop a wireless gas detection system to meet their customers’ requirements.

Wireless gas detection market Report Scope :

|

Report Metric |

Details |

| stimated Market Size | USD 1.5 Billion in 2020 |

| Projected Market Size |

USD 1.9 Billion by 2025 |

| Growth Rate | At CAGR of 4.8% |

|

Market size available for years |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units |

Value (USD) |

|

Segments covered |

End-user industry, offering, application, technology, and Geography |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Honeywell International, DRÄGERWERK, Yokogawa Electric corporation, MSA Safety, Agilent Technologies, Teledyne Gas and Flame Detection, Siemens, United Electric Control, Sensidyne, Pem-tech, Airtest Technologies, Crowcon Detection Instruments, Otis Instruments, Tek Troniks,, Emerson Electric, Ambetronics Engineering, GDS Corp, Bacharach, Onebee, and Gastronics |

This report categorizes the wireless gas detection market by end-user industry, application, offering, technology, and geography.

By End-user industry:

- Oil & Gas

- Chemicals and Petrochemicals

- Utilities and Power Generation

- Mining and Metals

- Water and Wastewater Treatment Plants

- Commercial Buildings and Public Facilities

- Government and Military

- Discrete Manufacturing Industries

- Others

By Application:

- Industrial Safety

- National Safety and Military Security

- Environmental Safety

By Offering:

- Hardware

- Software

- Services

By Technology:

- Wi-fi

- Bluetooth

- License-free ISM band

- Cellular technology

- Others

Geographic Analysis

-

North America

- US

- Canada

- Rest of North America

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- South Korea

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East

- Africa

- Latin America

Recent Developments

- In March 2020, United Electric Controls announced that its Vanguard WirelessHART gas detector is now HART Registered. The HART communication protocol digital communications technology deployed in process industries has more than 40 million field instruments supporting HART technology worldwide. The FieldComm Group owns the HART specifications and provides specification development and training, as well as device registration.

- In August 2019, Teledyne Technologies announced that it has successfully completed the acquisition of the gas and flame detection business of 3M for USD 230 million in cash.

- In May 2019, MSA Safety Incorporated has completed its acquisition of Sierra Monitor Corporation, a provider of fixed gas and flame detection (FGFD) instruments and the Industrial Internet of Things (IIoT) solutions. Typical end-user industries of Sierra Monitor technology include wastewater treatment facilities, light manufacturing, transportation infrastructures, and HVAC applications.

Key Questions Addressed in the Report

- How big is the opportunity for the wireless gas detection market? How the rising adoption of wireless gas detection products can help grasp this opportunity?

- Which are the recent industry trends that can be implemented to generate additional revenue streams?

- Who are the major players operating in the wireless gas detection market? Which companies are the front runners?

- With the rise in demand for wireless gas detection products from various end-user industries, what are the opportunities for players now and for those planning to enter various stages of the value chain?

- How will the increasing adoption of wireless gas detection products across the oil & gas end-user segment impact the growth rate of the overall market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 SCOPE

1.3.1 GEOGRAPHIC ANALYSIS

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.1.2 Breakdown of primaries

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTION

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN WIRELESS GAS DETECTION MARKET, 2020–2025 (USD MILLION)

4.2 WIRELESS GAS DETECTION MARKET, BY END-USER INDUSTRY AND COUNTRY (2019)

4.3 WIRELESS GAS DETECTION MARKET, BY OFFERING

4.4 WIRELESS GAS DETECTION MARKET, BY APPLICATION

4.5 WIRELESS GAS DETECTION MARKET, BY END-USER INDUSTRY IN 2019

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Cost-effectiveness, increased safety, and portability of wireless gas detection devices

5.2.1.2 Real-time detection, dependability, and feasibility of wireless detection systems to monitor industrial plants from remote locations

5.2.1.3 Time- and money-saving easy installation of wireless gas detection systems

5.2.1.4 Increased adoption of Industrial Internet of Things technology in manufacturing

5.2.1.5 Increased need for wireless detection systems due to growing focus on environment safety

5.2.2 RESTRAINTS

5.2.2.1 Data security and privacy issues related to wireless communication devices

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of wireless gas monitoring systems in oil and gas drilling and exploration activities

5.2.4 CHALLENGES

5.2.4.1 Difficulty in execution and planning of oil and gas projects due to outbreak of COVID-19, which, in turn, would decrease demand for wireless gas detectors

5.2.4.2 Issues such as complexity and difficulty in following constantly changing standards faced by wireless gas detection system designers

6 INDUSTRY TRENDS (Page No. - 44)

6.1 INTRODUCTION

6.2 COMPARATIVE ANALYSIS OF WIRED AND WIRELESS GAS DETECTION SYSTEMS

6.3 VALUE CHAIN ANALYSIS

6.4 REGULATORY AGENCIES

6.4.1 REGULATORY AGENCIES

6.4.2 CERTIFICATIONS

6.4.3 COMMUNICATION PROTOCOLS

7 WIRELESS GAS DETECTION MARKET, BY WIRELESS TECHNOLOGY (Page No. - 48)

7.1 INTRODUCTION

7.2 WIRELESS FIDELITY TECHNOLOGY

7.2.1 GAS DETECTION DEVICES WITH WI-FI TECHNOLOGY SUPPORT TWO MODES OF NETWORKING, NAMELY, AD-HOC AND INFRASTRUCTURE

7.3 BLUETOOTH TECHNOLOGY

7.3.1 BLUETOOTH TECHNOLOGY IS USED IN INDUSTRY AUTOMATION, AS WELL AS IN MANUFACTURING INDUSTRIES, COMMERCIAL BUILDINGS, AND PROCESSING INDUSTRIES

7.4 CELLULAR TECHNOLOGY

7.4.1 CELLULAR TECHNOLOGY USES RADIO FREQUENCIES THROUGHOUT AREA, WHICH IS TO BE MONITORED, WITH MINIMAL INTERFERENCE TO SERVE LARGE NUMBERS OF SIMULTANEOUS DATA COMMUNICATION

7.5 LICENSE-FREE ISM BAND

7.5.1 LICENSE-FREE ISM BAND TECHNOLOGY IS MOSTLY USED FOR FIRE, HAZMAT, AND LAW ENFORCEMENT AND IS ALSO USED BY REMOTE-CONTROLLED CONSUMER DEVICES AND HOME-AUTOMATION PRODUCTS

7.6 OTHERS

7.6.1 WIRELESSHART

7.6.2 NEAR-FIELD COMMUNICATION

8 WIRELESS GAS DETECTION MARKET, BY OFFERING (Page No. - 57)

8.1 INTRODUCTION

8.2 HARDWARE

8.2.1 HARDWARE IS COMBINATION OF VARIOUS COMPONENTS INCLUDING SENSORS/DETECTORS, WIRELESS GATEWAYS, AND ROUTERS AMONG OTHERS

8.2.2 SENSORS/DETECTORS

8.2.2.1 Catalytic sensors

8.2.2.2 Infrared sensors

8.2.2.3 Photoionization detectors

8.2.2.4 Electrochemical sensors

8.2.2.5 Metal-oxide-semiconductor sensors

8.2.2.6 Multiple sensors/detectors

8.2.3 WIRELESS GATEWAYS/WIRELESS ROUTERS

8.2.4 WIRELESS GAS MONITORS AND CONTROLLERS

8.2.5 WIRELESS TRANSMITTERS AND REPEATERS

8.2.6 ACCESSORIES

8.3 SOFTWARE

8.3.1 SOFTWARE IS REQUIRED TO CONVERT DATA INTO MEANINGFUL INFORMATION TO PROVIDE GREATER VISIBILITY AND CONTROL TO SAFETY MANAGERS AND OPERATORS

8.4 SERVICES

8.4.1 POST-SALES SERVICES ARE NECESSARY FOR RELIABLE AND LONG-TERM FUNCTIONING OF WIRELESS GAS DETECTION DEVICES

9 WIRELESS GAS DETECTION MARKET, BY APPLICATION (Page No. - 71)

9.1 INTRODUCTION

9.2 INDUSTRIAL SAFETY

9.2.1 WIRELESS GAS DETECTION SYSTEMS EMBEDDED WITH MAN-DOWN ALARMS AND GPS SIGNALS ALERT OPERATORS BEFORE INCIDENTS OCCUR

9.2.2 DISCRETE INDUSTRIES

9.2.3 PROCESS INDUSTRIES

9.3 NATIONAL SECURITY AND MILITARY SAFETY

9.3.1 MOST OF WIRELESS PHOTOIONIZATION DETECTORS ARE USED BY MILITARY PERSONNEL IN DAY-TO-DAY HAZMAT APPLICATIONS

9.4 ENVIRONMENTAL SAFETY

9.4.1 ENVIRONMENTAL SAFETY APPLICATIONS OF WIRELESS GAS DETECTION SOLUTIONS INCLUDE HAZARDOUS WASTE MONITORING, SOIL REMEDIATION, AND INDOOR AIR QUALITY MONITORING

10 WIRELESS GAS DETECTION MARKET, BY END-USER INDUSTRY (Page No. - 78)

10.1 INTRODUCTION

10.2 OIL & GAS

10.2.1 IN OIL & GAS INDUSTRY, GAS DETECTION IS REQUIRED FOR VARIOUS APPLICATIONS SUCH AS CONFINED SPACE ENTRY, EMERGENCY RESPONSE, FENCE LINE MONITORING, TRACKING, LEAK DETECTION, PLANT SHUTDOWN, AND WORKER EXPOSURE

10.3 CHEMICALS & PETROCHEMICALS

10.3.1 IN CHEMICALS AND PETROCHEMICALS INDUSTRIES, WIRELESS GAS DETECTORS ARE USED IN TANK FARMS WHERE GASES ARE COMPRESSED AND LIQUEFIED

10.4 UTILITIES AND POWER GENERATION

10.4.1 WIRELESS GAS DETECTION PLAYS VITAL ROLE IN MAINTAINING HYDROGEN PURITY LEVEL FOR BOTH PLANT SAFETY AND ECONOMIC REASONS

10.5 MINING AND METALS

10.5.1 IN MINING INDUSTRY, WIRELESS GAS DETECTION IS REQUIRED TO PROTECT, MONITOR, AND ASSESS MINING OPERATIONS IN HARSH AND HAZARDOUS CONDITIONS

10.6 WATER AND WASTEWATER TREATMENT PLANTS

10.6.1 WASTEWATER FROM RESIDENTIAL BUILDINGS, BUSINESSES, AND INDUSTRIES IS POTENTIALLY DANGEROUS TO HUMANS AND ENVIRONMENT BECAUSE OF ITS TOXICITY, FLAMMABILITY, CORROSIVENESS, AND CHEMICAL REACTIVITY

10.7 COMMERCIAL BUILDINGS AND PUBLIC FACILITIES

10.7.1 IN COMMERCIAL BUILDINGS, WIRELESS GAS DETECTION PRODUCTS SAFEGUARD BUILDING OCCUPANTS AND ASSETS, MANAGE ENERGY CONSUMPTION, PROMOTE GREEN BUILDING PRACTICES, AND IMPROVE INDOOR AIR QUALITY

10.8 GOVERNMENT AND MILITARY

10.8.1 NATIONAL SECURITY IN TERMS OF ENVIRONMENTAL AND PUBLIC SAFETY IS MAJOR CONCERN ACROSS FEDERAL, STATE, AND LOCAL GOVERNMENTS WORLDWIDE

10.9 DISCRETE MANUFACTURING INDUSTRIES

10.9.1 WIRELESS GAS DETECTION IS NECESSARY FOR DETECTION, MONITORING, AND CONTROL OF CARRIER GASES, CLEANING GASES, AND TOXIC GASES IN DISCRETE MANUFACTURING INDUSTRIES

10.10 OTHERS

10.10.1 PAPER & PULP

10.10.2 AGRICULTURE

10.10.3 MARINE

11 FIXED GAS DETECTION EQUIPMENT MARKET (Page No. - 99)

12 GEOGRAPHIC ANALYSIS (Page No. - 101)

12.1 INTRODUCTION

12.2 NORTH AMERICA

12.2.1 US

12.2.1.1 US, being largest oil producer in North America, has high adoption rate of wireless gas detection solutions

12.2.2 CANADA

12.2.2.1 Presence of chemicals and petrochemicals industries in Canada leads to wide adoption of wireless gas detection solutions

12.2.3 REST OF NORTH AMERICA

12.3 EUROPE

12.3.1 UK

12.3.1.1 Upcoming oil & gas projects will provide opportunities for wireless gas detection in country

12.3.2 GERMANY

12.3.2.1 Strong presence of discrete manufacturing industries such as automobile will provide opportunities for wireless gas detection products in country

12.3.3 FRANCE

12.3.3.1 Oil service industries have huge presence in France

12.3.4 REST OF EUROPE

12.4 APAC

12.4.1 CHINA

12.4.1.1 China has taken various initiatives for air pollutant emission reduction and is also making efforts to reduce greenhouse gas emissions to overcome problem of winter haze

12.4.2 JAPAN

12.4.2.1 Development of new applications and innovations in wireless gas detection market is creating huge opportunities for growth of market

12.4.3 INDIA

12.4.3.1 India is among largest contributors of greenhouse gas emissions, which has adverse effects on environment

12.4.4 SOUTH KOREA

12.4.4.1 South Korea has strong presence of discrete manufacturing industries, which will provide opportunities for wireless gas detection market

12.4.5 REST OF APAC

12.5 ROW

12.5.1 MIDDLE EAST

12.5.1.1 Wireless gas detection market is expected to witness rapid growth in oil-rich countries in Middle East due to need for industrial safety equipment with highly robust and reliable infrastructure

12.5.2 AFRICA

12.5.2.1 Countries such as Algeria, Nigeria, and Libya are expected to show growth in market

12.5.3 LATIN AMERICA

12.5.3.1 Increase in investments for environmental safety in domestic oil & gas industries would increase demand for wireless gas detection solutions in near future

13 COMPETITIVE LANDSCAPE (Page No. - 130)

13.1 INTRODUCTION

13.2 MARKET RANKING ANALYSIS: WIRELESS GAS DETECTION MARKET

13.3 COMPETITIVE LEADERSHIP MAPPING

13.3.1 VISIONARY LEADERS

13.3.2 DYNAMIC DIFFERENTIATORS

13.3.3 INNOVATORS

13.3.4 EMERGING COMPANIES

13.4 STRENGTH OF PRODUCT PORTFOLIO (25 COMPANIES)

13.5 BUSINESS STRATEGY EXCELLENCE (25 COMPANIES)

13.6 COMPETITIVE SCENARIO

13.6.1 PRODUCT LAUNCHES AND DEVELOPMENTS

13.6.2 ACQUISITIONS

13.6.3 PARTNERSHIPS, COLLABORATIONS, ALLIANCES, AND JOINT VENTURES

14 COMPANY PROFILE S (Page No. - 139)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

14.2.1 HONEYWELL INTERNATIONAL INC.

14.2.2 DRÄGERWERK AG & CO. KGAA

14.2.3 YOKOGAWA ELECTRIC CORPORATION

14.2.4 SIEMENS

14.2.5 MSA SAFETY INCORPORATED

14.2.6 AGILENT TECHNOLOGIES INC.

14.2.7 UNITED ELECTRIC CONTROL

14.2.8 SENSIDYNE, LP

14.2.9 TELEDYNE GAS & FLAME DETECTION

14.2.10 PEM-TECH, INC.

14.2.11 AIRTEST TECHNOLOGIES INC.

14.2.12 CROWCON DETECTION INSTRUMENTS LTD.

14.2.13 OTIS INSTRUMENTS, INC.

14.2.14 TEK TRONIKS LTD

14.2.15 EMERSON ELECTRIC

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14.3 RIGHT TO WIN

14.4 OTHER COMPANIES

14.4.1 AMBETRONICS ENGINEERS PVT. LTD.

14.4.2 GDS CORP

14.4.3 BACHARACH

14.4.4 ONEBEE

14.4.5 GASTRONICS

15 APPENDIX (Page No. - 168)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (103 TABLES)

TABLE 1 INCIDENCES OF OIL AND GAS LEAKS

TABLE 2 WIRELESS GAS DETECTION MARKET, BY WIRELESS TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 3 WIRELESS GAS DETECTION MARKET FOR WI-FI TECHNOLOGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 4 WIRELESS GAS DETECTION MARKET FOR BLUETOOTH TECHNOLOGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 5 WIRELESS GAS DETECTION MARKET FOR CELLULAR/GPS TECHNOLOGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 6 WIRELESS GAS DETECTION MARKET FOR LICENSE-FREE ISM BAND TECHNOLOGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 7 WIRELESS GAS DETECTION MARKET FOR OTHER WIRELESS TECHNOLOGIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 8 WIRELESS GAS DETECTION MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 9 WIRELESS GAS DETECTION MARKET FOR HARDWARE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 10 WIRELESS GAS DETECTION MARKET FOR WIRELESS DETECTORS/ SENSORS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 11 WIRELESS GAS DETECTION MARKET FOR HARDWARE, BY REGION, 2017–2025 (USD MILLION)

TABLE 12 WIRELESS GAS DETECTION MARKET FOR HARDWARE IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 13 WIRELESS GAS DETECTION MARKET FOR HARDWARE IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 14 WIRELESS GAS DETECTION MARKET FOR HARDWARE IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 15 WIRELESS GAS DETECTION MARKET FOR HARDWARE IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 16 WIRELESS GAS DETECTION MARKET FOR SOFTWARE, BY REGION, 2017–2025 (USD MILLION)

TABLE 17 WIRELESS GAS DETECTION MARKET FOR SOFTWARE IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 18 WIRELESS GAS DETECTION MARKET FOR SOFTWARE IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 19 WIRELESS GAS DETECTION MARKET FOR SOFTWARE IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 20 WIRELESS GAS DETECTION MARKET FOR SOFTWARE IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 21 WIRELESS GAS DETECTION MARKET FOR SERVICES, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 WIRELESS GAS DETECTION MARKET FOR SERVICES IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 23 WIRELESS GAS DETECTION MARKET FOR SERVICES IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 24 WIRELESS GAS DETECTION MARKET FOR SERVICES IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 25 WIRELESS GAS DETECTION MARKET FOR SERVICES IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 26 WIRELESS GAS DETECTION MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 27 WIRELESS GAS DETECTION MARKET FOR INDUSTRIAL SAFETY APPLICATION, BY SUBAPPLICATION, 2017–2025 (USD MILLION)

TABLE 28 WIRELESS GAS DETECTION MARKET FOR INDUSTRIAL SAFETY APPLICATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 29 WIRELESS GAS DETECTION MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 30 WIRELESS GAS DETECTION MARKET FOR PROCESS INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 31 WIRELESS GAS DETECTION MARKET FOR NATIONAL SECURITY AND MILITARY SAFETY, BY REGION, 2017–2025 (USD MILLION)

TABLE 32 WIRELESS GAS DETECTION MARKET FOR ENVIRONMENTAL SAFETY APPLICATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 33 WIRELESS GAS DETECTION MARKET, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 34 WIRELESS GAS DETECTION MARKET FOR OIL & GAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 35 WIRELESS GAS DETECTION MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 36 WIRELESS GAS DETECTION MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 37 WIRELESS GAS DETECTION MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 38 WIRELESS GAS DETECTION MARKET FOR OIL & GAS IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 39 A FEW UPCOMING EPC PROJECTS THAT WILL PROVIDE OPPORTUNITIES TO MARKET

TABLE 40 WIRELESS GAS DETECTION MARKET FOR CHEMICALS & PETROCHEMICALS, BY REGION, 2017–2025 (USD MILLION)

TABLE 41 WIRELESS GAS DETECTION MARKET FOR CHEMICALS & PETROCHEMICALS IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 42 WIRELESS GAS DETECTION MARKET FOR CHEMICALS & PETROCHEMICALS IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 43 WIRELESS GAS DETECTION MARKET FOR CHEMICALS & PETROCHEMICALS IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 44 WIRELESS GAS DETECTION MARKET FOR CHEMICALS & PETROCHEMICALS IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 45 WIRELESS GAS DETECTION MARKET FOR UTILITIES AND POWER GENERATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 46 WIRELESS GAS DETECTION MARKET FOR MINING AND METALS, BY REGION, 2017–2025 (USD MILLION)

TABLE 47 WIRELESS GAS DETECTION MARKET FOR MINING AND METALS IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 48 WIRELESS GAS DETECTION MARKET FOR MINING AND METALS IN EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 49 WIRELESS GAS DETECTION MARKET FOR MINING AND METALS IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 50 WIRELESS GAS DETECTION MARKET FOR MINING AND METALS IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 51 WIRELESS GAS DETECTION MARKET FOR WATER AND WASTEWATER TREATMENT PLANTS, BY REGION, 2017–2025 (USD MILLION)

TABLE 52 WIRELESS GAS DETECTION MARKET FOR COMMERCIAL BUILDINGS AND PUBLIC FACILITIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 53 WIRELESS GAS DETECTION MARKET FOR COMMERCIAL BUILDINGS AND PUBLIC FACILITIES IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 54 WIRELESS GAS DETECTION MARKET FOR COMMERCIAL BUILDINGS AND PUBLIC FACILITIES IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 55 WIRELESS GAS DETECTION MARKET FOR COMMERCIAL BUILDINGS AND PUBLIC FACILITIES IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 56 WIRELESS GAS DETECTION MARKET FOR COMMERCIAL BUILDINGS AND PUBLIC FACILITIES IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 57 WIRELESS GAS DETECTION MARKET FOR GOVERNMENT AND MILITARY, BY REGION, 2017–2025 (USD MILLION)

TABLE 58 WIRELESS GAS DETECTION MARKET FOR DISCRETE MANUFACTURING INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 59 WIRELESS GAS DETECTION MARKET FOR DISCRETE MANUFACTURING INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 60 WIRELESS GAS DETECTION MARKET FOR DISCRETE MANUFACTURING INDUSTRIES IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 61 WIRELESS GAS DETECTION MARKET FOR DISCRETE MANUFACTURING INDUSTRIES IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 62 WIRELESS GAS DETECTION MARKET FOR DISCRETE MANUFACTURING INDUSTRIES IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 63 WIRELESS GAS DETECTION MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 64 FIXED GAS DETECTION EQUIPMENT MARKET REVENUE, 2017–2025 (USD MILLION)

TABLE 65 WIRELESS GAS DETECTION MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 66 WIRELESS GAS DETECTION MARKET IN NORTH AMERICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 67 WIRELESS GAS DETECTION MARKET IN NORTH AMERICA, BY WIRELESS TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 68 WIRELESS GAS DETECTION MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 69 WIRELESS GAS DETECTION MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 70 WIRELESS GAS DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 71 WIRELESS GAS DETECTION MARKET IN US, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 72 WIRELESS GAS DETECTION MARKET IN CANADA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 73 WIRELESS GAS DETECTION MARKET IN REST OF NORTH AMERICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 74 WIRELESS GAS DETECTION MARKET IN EUROPE, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 75 WIRELESS GAS DETECTION MARKET IN EUROPE, BY WIRELESS TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 76 WIRELESS GAS DETECTION MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 77 WIRELESS GAS DETECTION MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 78 WIRELESS GAS DETECTION MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 79 WIRELESS GAS DETECTION MARKET IN UK, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 80 WIRELESS GAS DETECTION MARKET IN GERMANY, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 81 WIRELESS GAS DETECTION MARKET IN FRANCE, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 82 WIRELESS GAS DETECTION MARKET IN REST OF EUROPE, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 83 WIRELESS GAS DETECTION MARKET IN APAC, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 84 WIRELESS GAS DETECTION MARKET IN APAC, BY WIRELESS TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 85 WIRELESS GAS DETECTION MARKET IN APAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 86 WIRELESS GAS DETECTION MARKET IN APAC, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 87 WIRELESS GAS DETECTION MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 88 WIRELESS GAS DETECTION MARKET IN CHINA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 89 WIRELESS GAS DETECTION MARKET IN JAPAN, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 90 WIRELESS GAS DETECTION MARKET IN INDIA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 91 WIRELESS GAS DETECTION MARKET IN SOUTH KOREA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 92 WIRELESS GAS DETECTION MARKET IN REST OF APAC, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 93 WIRELESS GAS DETECTION MARKET IN ROW, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 94 WIRELESS GAS DETECTION MARKET IN ROW, BY WIRELESS TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 95 WIRELESS GAS DETECTION MARKET IN ROW, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 96 WIRELESS GAS DETECTION MARKET IN ROW, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 97 WIRELESS GAS DETECTION MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 98 WIRELESS GAS DETECTION MARKET IN MIDDLE EAST, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 99 WIRELESS GAS DETECTION MARKET IN AFRICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 100 WIRELESS GAS DETECTION MARKET IN LATIN AMERICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 101 PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2020

TABLE 102 ACQUISITIONS, 2019

TABLE 103 PARTNERSHIPS, COLLABORATIONS, ALLIANCES, AND JOINT VENTURES, 2017–2020

LIST OF FIGURES (46 FIGURES)

FIGURE 1 WIRELESS GAS DETECTION MARKET SEGMENTATION

FIGURE 2 WIRELESS GAS DETECTION MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 DATA TRIANGULATION

FIGURE 6 WIRELESS GAS DETECTION MARKET, 2017–2025 (USD MILLION)

FIGURE 7 WIRELESS GAS DETECTION SYSTEMS ENABLED WITH WI-FI TECHNOLOGY EXPECTED TO WITNESS LARGEST MARKET SHARE IN 2025

FIGURE 8 HARDWARE TO ACCOUNT FOR LARGEST SHARE OF WIRELESS GAS DETECTION MARKET IN 2025

FIGURE 9 OIL & GAS END-USER INDUSTRY TO DOMINATE WIRELESS GAS DETECTION MARKET, IN TERMS OF SIZE, IN 2025

FIGURE 10 NORTH AMERICA HELD LARGEST SHARE OF WIRELESS GAS DETECTION MARKET IN 2019

FIGURE 11 ATTRACTIVE GROWTH OPPORTUNITIES IN WIRELESS GAS DETECTION MARKET

FIGURE 12 WIRELESS GAS DETECTION MARKET IN US HELD LARGEST SHARE IN 2019

FIGURE 13 MARKET FOR HARDWARE SEGMENT HELD LARGEST SHARE IN 2019

FIGURE 14 INDUSTRIAL SAFETY APPLICATION HELD LARGEST MARKET SHARE IN 2019

FIGURE 15 OIL & GAS HELD LARGEST SHARE OF WIRELESS GAS DETECTION MARKET IN 2019

FIGURE 16 WIRELESS GAS DETECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17 WIRELESS GAS DETECTION MARKET DRIVERS AND THEIR IMPACT

FIGURE 18 WIRELESS GAS DETECTION MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 19 WIRELESS GAS DETECTION MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 20 WIRELESS GAS DETECTION MARKET CHALLENGES AND THEIR IMPACT

FIGURE 21 VALUE CHAIN ANALYSIS: WIRELESS GAS DETECTION

FIGURE 22 WIRELESS GAS DETECTION MARKET, BY WIRELESS TECHNOLOGY

FIGURE 23 WI-FI TECHNOLOGY TO CONTINUE TO DOMINATE WIRELESS GAS DETECTION MARKET DURING FORECAST PERIOD

FIGURE 24 WIRELESS GAS DETECTION MARKET SEGMENTATION, BY OFFERING

FIGURE 25 SERVICES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 26 INDUSTRIAL SAFETY APPLICATION IS EXPECTED TO HOLD LARGEST SHARE OF WIRELESS GAS DETECTION MARKET IN 2025

FIGURE 27 OIL & GAS INDUSTRY IS EXPECTED TO LEAD WIRELESS GAS DETECTION MARKET IN 2025

FIGURE 28 WIRELESS GAS DETECTION MARKET SEGMENTATION, BY GEOGRAPHY

FIGURE 29 APAC TO WITNESS HIGHEST GROWTH RATE IN WIRELESS GAS DETECTION MARKET DURING FORECAST PERIOD

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 31 EUROPE: MARKET SNAPSHOT

FIGURE 32 APAC: MARKET SNAPSHOT

FIGURE 33 ROW: MARKET SNAPSHOT

FIGURE 34 MAJOR PLAYERS IN WIRELESS GAS DETECTION MARKET ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

FIGURE 35 TOP 5 COMPANIES IN WIRELESS GAS DETECTION MARKET

FIGURE 36 WIRELESS GAS DETECTION MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 37 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE GLOBAL WIRELESS GAS DETECTION MARKET

FIGURE 38 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE GLOBAL WIRELESS GAS DETECTION MARKET

FIGURE 39 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 40 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 41 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 42 SIEMENS: COMPANY SNAPSHOT

FIGURE 43 MSA SAFETY INCORPORATED: COMPANY SNAPSHOT

FIGURE 44 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 45 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 46 EMERSON ELECTRIC: COMPANY SNAPSHOT

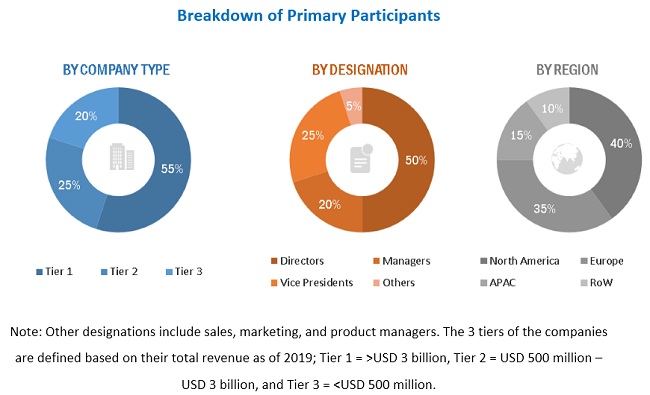

The study involved 4 major activities in estimating the current size of the wireless gas detection market. Exhaustive secondary research has been conducted to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the wireless gas detection market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, APAC, and RoW. Approximately 20% and 80% of primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the wireless gas detection market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) about the wireless gas detection market.

Data Triangulation

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To describe and forecast the wireless gas detection market, in terms of value and volume, by offering, end-user industry, application, and technology

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To provide a detailed overview of value chain analysis in the wireless gas detection ecosystem

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the wireless gas detection market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product developments, expansions, mergers, and research & development in the wireless gas detection market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Wireless Gas Detection Market