Medical Holography Market by Product (Holographic Display, Microscope, Print, Software), Application (Medical Imaging, Medical Education, Biomedical Research), End User (Medical Schools, Pharmaceutical Companies, Hospitals) - Global Forecast to 2021

The overall medical holography market is expected to grow from USD 163.4 million in 2015 to USD 953.9 million by 2021, at a CAGR of 33.7% from 2016 to 2021. Holography in medical science is mainly used to form 3D images of the human anatomy. Medical 3D holography is used to represent complex 3D structures beneficial for medical imaging, medical research, and medical training & education. The holography products covered in the study include holography displays, holography microscopes, holography prints, holography software, and holoscopes. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Rising adoption of holography products in biomedical research and medical education

- Growing clinical applications of holography

- Emergence of holography as a promising technology in representing complex 3D structures

Restraints

- High computational cost of processing holograms

Opportunities

- Increasing investments in the digital holography market

Challenges

- Technological limitations

- Less effective projection under sunlight

Rising adoption of holography products in biomedical research and medical education drives the growth of the medical holography market.

Holography has emerged as one of the most promising tools for the medical industry. Holographic techniques have extended their applications in life sciences and medical research as well as medical education. The use of holographic imaging and projection has resulted in tremendous changes in the field of biomedical research and medical education and training.

In addition to medical imaging and research, holographic display technology and digital holograms are extensively used in the education industry and hospital teaching. 3D visualization through holography products create an interesting and interactive learning atmosphere as holography helps retain more information compared to other learning techniques. With growing focus on structural biology in medical schools, various market players are focusing on developing holographic prints and holography software to be used for medical teaching and training applications. Companies have developed a 3D kit for medical students and doctors that will help them practice surgeries and dissections without needing real bodies and organs. Echopixel, an emerging player in the medical holography market, launched True3D Viewer, a new generation of medical visualization software. This software converts anatomical data from patients into fully interactive, three-dimensional virtual reality images. With these innovations, medical holography is increasingly being used for healthcare research, hospital teaching, and medical education.

The growing applications of holographic techniques, coupled with their advantages, have encouraged their adoption in research labs, schools and universities, and hospitals across the globe.

The following are the major objectives of the study.

- To define, describe, and forecast the global medical holography market on the basis of product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the medical holography market (drivers, restraints, opportunities, challenges, and industry trends)

- To strategically analyze various segments and subsegments covered in the study with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the medical holography market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in this market and comprehensively analyze their market shares and core competencies

- To forecast the size of the market segments with respect to four main regions (along with countries), namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To track and analyze competitive developments such as mergers and acquisitions; new product developments; and agreements, partnerships, and investments in the medical holography market

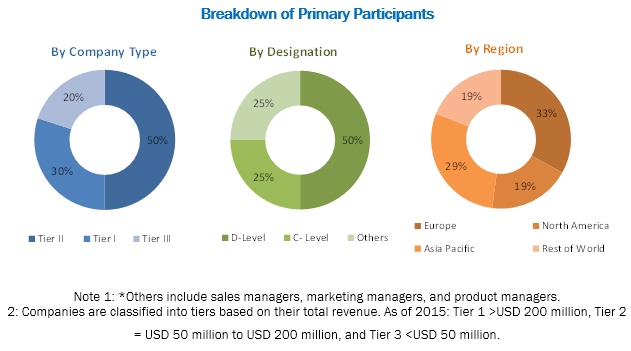

During this research study, major players operating in the medical holography market in various regions have been identified, and their offerings, and regional presence have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key players considered in the analysis of the medical holography market are EchoPixel, Inc. (US), RealView Imaging Ltd. (Israel), Mach7 Technologies Pte. Ltd. (Australia), Ovizio Imaging Systems (Belgium), Holoxica Ltd. (UK), zSpace, Inc. (US), Lyncée Tec (Switzerland), Eon Reality (US), Zebra Imaging (US), Nanolive SA (Switzerland), and Holografika Kft. (Hungary).

Major Market Developments

- In May 2016, Holoxica Limited (UK) launched the world’s first three-dimensional digital hologram image of the human brain fiber pathways. This new brain path imaging helps neurosurgeons and clinicians to identify, diagnose, and treat a wide range of neurological conditions, such as Alzheimer’s, motor neuron disease (MND), stroke, and cancer.

- In November 2015, Zebra Imaging, Inc. (US) acquired Rattan Software (U.S.). This acquisition helped Zebra Imaging to leverage Rattan’s expertise in advanced 3D light -field technology in its upcoming holographic display products.

- In March 2015, EchoPixel (US) launched True 3D Viewer, a real-time, interactive virtual reality system. The product converts anatomical data from patients into fully interactive, three-dimensional virtual reality images. This helped the company to introduce a technologically advanced medical imaging solution in the market space.

Target Audience

- Medical holography companies

- Hospitals and clinics

- Pathological laboratories

- Medical imaging and diagnostic centers

- Research institutes and medical academic institutes

- Government research institutes

- Pharmaceutical and biotechnology companies

- Market research and consulting firms

- Venture capitalists and investors

Report Scope

By Product

- Holographic Displays

- Holography Microscopes

- Holographic Prints

- Holography Software

- Holoscopes

By Application

- Medical Imaging

- Medical Education

- Biomedical Research

By End User

- Academic Medical Centers

- Hospitals and Clinics

- Research Laboratories

- Pharmaceutical and Biotechnology Companies

By Geography

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers

- What are new technologies which the medical holography companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Asia-Pacific medical holography market into Japan, China, India, and others

- Further breakdown of the RoW medical holography market into the Middle East & Africa and Latin America

The overall medical holography market is expected to grow from USD 223.1 million in 2016 to USD 953.9 million by 2021 at a CAGR of 33.7%. Growth in this market can largely be attributed to a number of factors, such as the rising adoption of holography products in biomedical research and medical education, growing clinical applications of holography, and advantages of holography over traditional 2D imaging techniques. However, the high computational cost of processing holograms is restricting the growth of this market to a certain extent.

Although the medical holography market is currently in the embryonic stage, it has the potential to revolutionize the medical imaging industry in the coming years. Medical holography is a powerful tool for molecular imaging in clinical diagnostics and preclinical research in various therapeutic areas. Owing to the potential applications of holography in the field of diagnostic and interventional imaging, considerable research is underway in this industry. In this report, the medical holography market is broadly segmented by product type, application, end user, and region.

On the basis of product, the global medical holography market is segmented into holography software, holography displays, holography microscopes, holography prints, and holoscopes. The holography microscopes are expected to register the highest CAGR during the forecast period. Growth in this product segment can be attributed to the various benefits of these products, including real-time cell imaging for life science and medicine applications.

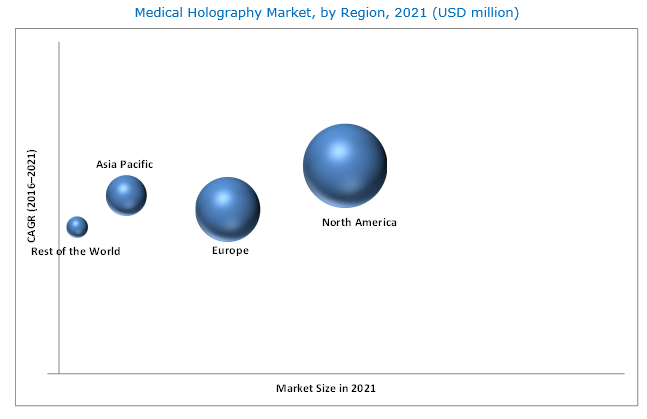

The medical holography market in North America is expected to grow at the highest CAGR during the forecast period. Factors such as increasing demand for noninvasive and radiation-free imaging techniques coupled with the growing geriatric population and increasing number of imaging procedures across the region are driving the growth of regional market.

Biomedical research segment to register highest growth during the forecast period

On the basis of application, the global medical holography market is segmented into medical imaging, biomedical research, and medical education.

Medical Imaging

Medical imaging application segment held the largest share of the global medical holography market in 2015. Medical imaging involves the process of creating visual representations of the interior of a human body for clinical analysis, diagnosis, and medical interventions. The large share of this application segment can be attributed to the advent of digital holograms for medical imaging in hospitals and diagnostic centers. Medical holography is expected to play an important role in medical diagnostic imaging in the near future owing to interactive holographic models that allow more dynamic and cost-effective medical testing and storage of immense quantities of imaging data.

Medical Education

Over the last five years, holography has gained wide acceptance in academic institutions and medical centers for medical education and training applications. Holographic prints are increasingly being used in the field of medical education to teach critical aspects of the human anatomy in a simpler manner. Digital holograms represent complex 3D anatomical structures of the human body and provide users with flexibility to turn a 3D hologram in different dimensions, to build different perspectives of the anatomical structure. This allows students to not only dissect different body systems, but also piece them back together. The increasing adoption of technologically advanced tools in medical teaching is expected to drive greater adoption of holography techniques in the field of medical education in the coming years.

Biomedical Research

The biomedical research segment is expected to grow at the highest rate during the forecast period. Holography microscopes can be used for various applications in biomedical research, such as real-time monitoring of living cells, defect inspection, and noninvasive analysis of fluid tomography. They provide best solutions for performing cell -based assays, such as cytotoxicity assays using living cells. They are used for early drug discovery applications, such as cell death assays for the toxicological profiling of bioactive compounds and identification of cytotoxic agents in cancer research. Apart from the above applications, the digital holography microscopy technology is also used to measure clinically relevant parameters of RBCs, such as hemoglobin content and mean cell volume (MCV) of individual RBCs. Owing to various benefits, such as label-free monitoring of cellular functions and high-resolution, noninvasive, and real-time imaging, medical holography is witnessing an increase in demand in the biomedical research sector.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the major application areas for medical holography technology?

The development of holograms is an extremely cost-intensive process. It takes significant investments in R&D to develop new products that effectively cater to market needs. The high costs associated with research and technology development (which includes product development, system engineering, software development, clinical assessment, and concerned regulatory approvals for the initiation of product manufacturing) increases the cost of the final product. The most expensive component of a digital holographic microscope and digital hologram is the computer that is used to reconstruct images. Various end users, especially academic institutes, cannot afford these high-cost tools, which restricts market growth to some extent. However, with the availability of faster computers for image processing, inexpensive semiconductor lasers, and high-speed CMOS cameras, it would be possible to build holographic microscopes at lower costs in the near future.

Key players in the medical holography market include EchoPixel, Inc. (US), RealView Imaging Ltd. (Israel), Mach7 Technologies Pte. Ltd. (Australia), Ovizio Imaging Systems (Belgium), Holoxica Ltd. (UK), zSpace, Inc. (US), Lyncée Tec (Switzerland), Eon Reality (US), Zebra Imaging (US), Nanolive SA (Switzerland), and Holografika Kft. (Hungary). Some of the key strategies adopted by the market players include new product launches; investments; mergers and acquisitions; and agreements, collaborations, and partnerships.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Approach

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.3.1 Secondary Sources

2.3.1.1 Key Data From Secondary Sources

2.3.2 Primary Sources

2.3.2.1 Key Data From Primary Sources

2.3.2.2 Key Industry Insights

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Medical Holography: Market Overview

4.2 European Market

4.3 Market: Geographic Growth Opportunities

4.4 North America to Dominate the Market During the Forecast Period

4.5 Market, By End User

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Rising Adoption of Holography Products in Biomedical Research and Medical Education

5.2.1.2 Growing Clinical Applications of Holography

5.2.1.3 Emergence of Holography as A Promising Technology in Representing Complex 3D Structures

5.2.2 Market Restraint

5.2.2.1 High Computational Cost of Processing Holograms

5.2.3 Market Opportunity

5.2.3.1 Increasing Investments in the Digital Holography Market

5.2.4 Market Challenges

5.2.4.1 Technological Limitations

5.2.4.2 Less Effective Projection Under Sunlight

6 Industry Insights (Page No. - 39)

6.1 Introduction

6.2 Industry Trends

6.2.1 Market Trends

6.2.1.1 Use of Digital Holographic Microscopy in A Broad Spectrum of Medical Applications

6.2.2 Growing R&D Investments and Funding

6.3 Strategic Benchmarking

6.3.1 Increasing Focus on Agreements, Collaboration, Partnerships, and Acquisition

6.3.2 Value Chain Analysis

7 Medical Holography Market, By Product Type (Page No. - 43)

7.1 Introduction

7.2 Holographic Displays

7.3 Holography Microscopes

7.4 Holographic Prints

7.5 Holography Software

7.6 Holoscopes

8 Medical Holography Market, By Application (Page No. - 51)

8.1 Introduction

8.2 Medical Imaging

8.3 Medical Education

8.4 Biomedical Research

9 Medical Holography Market, By End User (Page No. - 58)

9.1 Introduction

9.2 Academic Medical Centers

9.3 Hospitals and Clinics

9.4 Research Laboratories

9.5 Pharmaceutical and Biotechnology Companies

10 Global Medical Holography Market, By Region (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe (RoE)

10.4 Asia-Pacific

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 Partnerships, Agreements, and Collaborations

11.2.2 New Product Launches

11.2.3 Mergers and Acquisitions

11.2.4 Investments

11.2.5 Other Developments

12 Company Profiles (Page No. - 104)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Zebra Imaging, Inc.

12.2 Realview Imaging Ltd.

12.3 Holoxica Limited

12.4 Echopixel

12.5 EON Reality, Inc.

12.6 Mach7 Technologies Limited

12.7 Zspace, Inc.

12.8 Lyncée Tec SA

12.9 Ovizio Imaging Systems NV/SA

12.10 Nanolive SA

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 117)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Related Reports

List of Tables (76 Tables)

Table 1 Market Drivers: Impact Analysis

Table 2 Market Restraint: Impact Analysis

Table 3 Market Opportunity: Impact Analysis

Table 4 Market Challenges: Impact Analysis

Table 5 Market: Product Portfolio Analysis (2016)

Table 6 Global Market Size, By Product, 2014–2021 (USD Million)

Table 7 Global Market Size, By Country, 2014–2021 (USD Million)

Table 8 Global Holographic Displays Market Size, By Country, 2014–2021 (USD Million)

Table 9 Global Holography Microscopes Market Size, By Country, 2014–2021 (USD Million)

Table 10 Global Holographic Prints Market Size, By Country, 2014–2021 (USD Million)

Table 11 Global Medical Holography Software Market Size, By Country, 2014–2021 (USD Million)

Table 12 Global Holoscopes Market Size, By Country, 2014–2021 (USD Million)

Table 13 Global Market Size, By Application, 2014–2021 (USD Million)

Table 14 Market Size for Medical Imaging, By Country, 2014–2021 (USD Million)

Table 15 Market Size for Medical Education, By Country, 2014–2021 (USD Million)

Table 16 Market Size for Biomedical Research, By Country, 2014–2021 (USD Million)

Table 17 Global Market Size, By End User, 2014-2021 (USD Million)

Table 18 Market Size for Academic Medical Centers, By Country/Region, 2014-2021 (USD Million)

Table 19 Market Size for Hospitals and Clinics, By Country/Region, 2014-2021 (USD Million)

Table 20 Market Size for Research Laboratories, By Country/Region, 2014-2021 (USD Million)

Table 21 Market Size for Pharmaceutical and Biotechnology Companies, By Country/Region, 2014-2021 (USD Million)

Table 22 Market Size, By Region, 2014–2021 (USD Million)

Table 23 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 24 North America: Market Size, By Product, 2014–2021 (USD Million)

Table 25 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 26 North America: Market Size, By End User, 2014–2021 (USD Million)

Table 27 U.S.: Macroeconomic Indicators

Table 28 U.S.: Market Size, By Product, 2014–2021 (USD Million)

Table 29 U.S.: Market Size, By Application, 2014–2021 (USD Million)

Table 30 U.S.: Market Size, By End User, 2014–2021 (USD Million)

Table 31 Canada: Macroeconomic Indicators

Table 32 Canada: Market Size, By Product, 2014–2021 (USD Million)

Table 33 Canada: Market Size, By Application, 2014–2021 (USD Million)

Table 34 Canada: Market Size, By End User, 2014–2021 (USD Million)

Table 35 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 36 Europe: Market Size, By Product, 2014–2021 (USD Million)

Table 37 Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 38 Europe: Market Size, By End User, 2014–2021 (USD Million)

Table 39 Germany: Macroeconomic Indicators

Table 40 Germany: Market Size, By Product, 2014–2021 (USD Million)

Table 41 Germany: Market Size, By Application, 2014–2021(USD Million)

Table 42 Germany: Market Size, By End User, 2014–2021(USD Million)

Table 43 U.K.: Macroeconomic Indicators

Table 44 U.K.: Market Size, By Product, 2014–2021 (USD Million)

Table 45 U.K.: Market Size, By Application, 2014–2021 (USD Million)

Table 46 U.K.: Medical Holography Market Size, By End User, 2014–2021 (USD Million)

Table 47 France: Macroeconomic Indicators

Table 48 France: Medical Holography Market Size, By Product, 2014–2021 (USD Million)

Table 49 France: Medical Holography Market Size, By Application, 2014–2021(USD Million)

Table 50 France: Medical Holography Market Size, By End User, 2014–2021 (USD Million)

Table 51 Italy: Macroeconomic Indicators

Table 52 Italy: Medical Holography Market Size, By Product, 2014–2021 (USD Million)

Table 53 Italy: Medical Holography Market Size, By Application, 2014–2021 (USD Million)

Table 54 Italy: Medical Holography Market Size, By End User, 2014–2021 (USD Million)

Table 55 Spain: Macroeconomic Indicators

Table 56 Spain: Medical Holography Market Size, By Product, 2014–2021 (USD Million)

Table 57 Spain: Medical Holography Market Size, By Application, 2014–2021 (USD Million)

Table 58 Spain: Medical Holography Market Size, By End User, 2014–2021 (USD Million)

Table 59 RoE: Diagnostic Imaging Procedures, By Country & Type (2012)

Table 60 RoE: Macroeconomic Indicators

Table 61 RoE: Medical Holography Market Size, By Product, 2014–2021 (USD Million)

Table 62 RoE: Medical Holography Market Size, By Application, 2014–2021 (USD Million)

Table 63 RoE: Medical Holography Market Size, By End User, 2014–2021(USD Million)

Table 64 Asia-Pacific: Medical Holography Market Size, By Product, 2014–2021(USD Million)

Table 65 Asia-Pacific: Medical Holography Market Size, By Application, 2014–2021 (USD Million)

Table 66 Asia-Pacific: Medical Holography Market Size, By End User, 2014–2021(USD Million)

Table 67 RoW: Macroeconomic Indicators

Table 68 RoW: Medical Holography Market Size, By Product, 2014–2021 (USD Million)

Table 69 RoW: Medical Holography Market Size, By Application, 2014–2021 (USD Million)

Table 70 RoW: Medical Holography Market Size, By End User, 2014–2021 (USD Million)

Table 71 Growth Strategy Matrix (2013–July 2016)

Table 72 Partnerships, Agreements, and Collaborations, 2013–July 2016

Table 73 New Product Launches, 2013–July 2016

Table 74 Mergers and Acquisitions, 2013–July 2016

Table 75 Investments, 2013–July 2016

Table 76 Other Developments, 2013–July 2016

List of Figures (26 Figures)

Figure 1 Medical Holography Market

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Market Data Triangulation Methodology

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Holographic Displays Will Continue to Dominate the Global Medical Holography Products Market During the Forecast Period

Figure 8 The Medical Imaging Application Segment to Dominate the Medical Holography Applications Market During the Forecast Period

Figure 9 Global Medical Holography Market Size, By End User, 2016 vs 2021 (USD Million)

Figure 10 North America Dominated the Global Medical Holography Market in 2015

Figure 11 Growing Use of Holography in Research and Clinical Applications Drives the Growth of the Medical Holography Market

Figure 12 Holographic Display Segment Accounted for the Largest Share of the European Medical Holography Market in 2015

Figure 13 U.S. Commanded More Than One-Third of the Medical Holography Market in 2015

Figure 14 Academic Medical Centers Continue to Dominate the Medical Holography Market in 2021

Figure 15 Rising Adoption of Holography Products in Biomedical Research and Medical Education Todrive the Growth of the Medical Holography Market

Figure 16 Strategic Benchmarking: Major Players Largely Adopted Agreements, Collaborations and Partnerships

Figure 17 Value Chain Analysis: Medical Holography Market

Figure 18 Holographic Displays to Dominate the Market During the Forecast Period

Figure 19 Medical Imaging Segment to Dominate the Medical Holography Market in 2016

Figure 20 Academic Medical Centers Segment to Dominate the Global Medical Holography Market From 2016 to 2021

Figure 21 Geographic Snapshot (2016)

Figure 22 North America: Medical Holography Market Snapshot (2015-2016)

Figure 23 Europe: Medical Holography Market Snapshot (2015-2016)

Figure 24 Asia-Pacific: Medical Holography Market Snapshot (2015-2016)

Figure 25 Partnerships, Agreements, and Collaborations Was the Key Growth Strategy Adopted By Market Players (2013–July 2016)

Figure 26 Battle for Market Share: Agreements, Collaborations, and Partnerships Was the Key Growth Strategy Pursued By Leading Market Players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Holography Market