3D Projector Market by Technology (DLP, LCD, LCoS), Light Source (Laser, Metal Halide, Hybrid, LED), Brightness, Resolution, Application (Cinema, Education, Business, Events & Large Venues, Home Theater & Gaming) and Region - Global Forecast 2025-2035

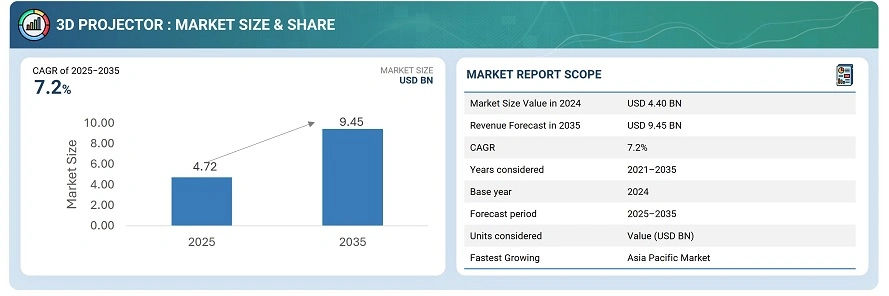

The global 3D projector market was valued at USD 4.40 billion in 2024 and is projected to reach USD 9.45 billion by 2035, growing at a CAGR of 7.2% between 2025 and 2035.

The market is primarily driven by rising adoption of immersive visual experiences across entertainment, education, simulation, and industrial design applications. Technological advancements, including high-lumen output, laser-based projection, 4K and 8K resolution support, and integration with AR/VR ecosystems, are enhancing image quality and precision. Additionally, developments in portable and interactive 3D projectors are expanding their application across classrooms, corporate environments, and public displays. Overall, the market is witnessing heightened competition, with vendors focusing on innovation, energy efficiency, and expanding regional presence to cater to diverse commercial and consumer needs.

3D projectors are advanced display devices designed to project three-dimensional images, creating a sense of depth and realism for viewers. They are widely used in entertainment, education, simulation, and professional visualization applications to deliver immersive visual experiences. 3D projectors operate using technologies such as DLP, LCD, or LCoS and can support active or passive 3D formats. Key features include high brightness, full HD or 4K resolution, wide color gamut, and compatibility with various 3D glasses and content formats. Modern 3D projectors also integrate laser or LED light sources, wireless connectivity, and smart control functions, enhancing performance, energy efficiency, and versatility across both commercial and consumer environments.

Market by Technology

DLP

By technology, Digital Light Processing (DLP) holds the largest share of the 3D projector market, driven by its superior image clarity, high contrast ratio, and low maintenance requirements. DLP projectors are widely adopted across cinemas, education, and corporate environments due to their compact design, color accuracy, and ability to deliver smooth 3D visuals. Their growing integration with laser light sources and 4K resolution capabilities further strengthens their dominance over LCD and LCoS technologies in both commercial and consumer segments.

LCD

The LCD segment is expected to grow at a significant CAGR during the forecast period, driven by its cost-effectiveness, color accuracy, and suitability for large-screen applications. LCD 3D projectors are increasingly adopted in educational institutions, business presentations, and home entertainment systems due to their vibrant image output and energy efficiency. Continuous advancements in panel technology and improved light transmission are further enhancing their performance, supporting wider adoption across emerging markets.

Market by Brightness

2,000–3,999 lumens

By brightness, the 2,000–3,999 lumens segment is expected to hold the largest share of the 3D projector market, owing to its versatility and balanced performance across diverse environments. Projectors in this range deliver clear, vibrant visuals suitable for classrooms, conference rooms, and home entertainment setups without requiring complete darkness. Their affordability, compact design, and compatibility with portable and short-throw models make them a preferred choice for both professional and consumer applications. Additionally, growing demand for energy-efficient and high-quality projection solutions in educational institutions and small businesses continues to drive the dominance of this brightness segment.

4,000–9,999

The 4,000–9,999 lumens segment is expected to grow at a significant CAGR during the forecast period, driven by increasing demand for high-brightness 3D projectors in large venues such as auditoriums, conference halls, and entertainment centers. Projectors in this range deliver powerful, sharp, and vibrant images even in well-lit environments, making them ideal for professional presentations, cinematic experiences, and immersive simulations. Technological advancements, including laser light sources and enhanced cooling systems, are further boosting the adoption of high-lumen 3D projectors across commercial and industrial applications.

Market by Geography

Geographically, the 3D projector market is expanding across North America, Europe, Asia Pacific, and the Rest of the World (ROW), including the Middle East, South America, and Africa. Asia Pacific is expected to grow at the highest CAGR, fueled by rapid urbanization, increasing adoption of advanced educational and corporate technologies, and rising investments in entertainment and simulation infrastructure. The region’s competitive landscape and cost-sensitive consumer base are encouraging vendors to offer innovative yet affordable 3D projection solutions. North America follows, driven by strong demand in corporate, educational, and home entertainment sectors, along with technological advancements such as 4K and laser-based projection. Europe’s growth is supported by increasing integration of 3D projection in museums, cinemas, and professional visualization, while the ROW markets are witnessing rising adoption due to expanding commercial infrastructure, growing entertainment venues, and increased interest in immersive projection technologies.

Market Dynamics

Driver: Adoption of 3D projectors in cinema halls

The adoption of 3D projectors in cinema halls is a key driver for the global 3D projector market, as it enhances the viewing experience by offering immersive and lifelike visuals. With audiences increasingly seeking engaging and interactive entertainment, theaters are investing in high-quality 3D projection systems to attract more visitors and differentiate their offerings. Technological advancements such as laser light sources, 4K resolution, and improved contrast ratios are enabling sharper, brighter, and more realistic 3D images, even in large venues. Additionally, the growing popularity of blockbuster films and franchise releases in 3D format is encouraging cinemas worldwide to upgrade their projection infrastructure, further boosting market demand.

Restraint: Technological constraints with DLP projectors and metal halide light source

DLP projectors face technological limitations that can restrain the growth of the 3D projector market. One common issue is the rainbow effect, where viewers perceive brief flashes of color, potentially affecting the overall visual experience and causing discomfort during extended use. Additionally, projectors using metal halide light sources have shorter lifespans, produce excessive heat, and consume higher amounts of energy compared to modern LED or laser alternatives. These factors lead to increased maintenance requirements and higher operational costs, making such systems less attractive for educational institutions, corporate setups, and entertainment venues. As a result, the adoption of older projection technologies is limited, slowing market growth and encouraging a shift toward more efficient and reliable projection solutions.

Opportunity: Rise in importance of laser-based 3D projectors

The rise in importance of laser-based 3D projectors presents a significant opportunity in the global 3D projector market. Laser projection technology offers higher brightness, superior color accuracy, and longer lifespan compared to traditional lamp-based systems, making it ideal for large venues, professional applications, and immersive experiences. Additionally, laser projectors are more energy-efficient and require lower maintenance, reducing total cost of ownership for educational institutions, corporate environments, and entertainment centers. The growing demand for high-quality visuals in cinemas, museums, and simulation setups is driving the adoption of laser-based 3D projectors. As manufacturers continue to innovate and offer cost-effective laser solutions, this trend is expected to expand market penetration across commercial and consumer segments.

Challenge: High Cost of Advanced 3D Projection Systems

The high cost of advanced 3D projection systems remains a key challenge for the 3D projector market. Premium features such as laser light sources, 4K or higher resolution, and interactive capabilities significantly increase the upfront investment required, making these projectors less accessible for small businesses, educational institutions, and budget-conscious consumers. Additionally, the integration of sophisticated hardware and software for immersive experiences often necessitates specialized installation and maintenance, further adding to total costs. This price barrier can slow adoption rates in emerging markets and limit market growth. Manufacturers must balance technological innovation with affordability to expand their customer base and overcome this challenge.

Future Outlook

Between 2025 and 2035, the 3D projector market is expected to grow substantially as demand for immersive visual experiences expands across entertainment, education, corporate, and industrial applications. Advances in laser and LED projection technologies, higher resolutions, and enhanced color accuracy will elevate image quality and reliability, while integration with interactive and augmented reality systems will broaden application possibilities. Increasing investments in cinemas, simulation centers, educational institutions, and corporate training facilities will further drive adoption. As the market evolves, 3D projectors will play a key role in transforming viewing and learning experiences, supporting innovative content delivery, and enabling more engaging, visually rich environments across both commercial and consumer segments.

Key Market Players

Top 3D projector companies Optoma (Taiwan), Sony Corporation (Japan), Seiko Epson Corporation (Japan), Barco (Belgium) and Vivitek (Taiwan)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in 3D Projector Market

4.2 3D Projector Market, By Technology and Region

4.3 Country-Wise 3D Projector Market Growth Rate

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Adoption of 3D Projectors in Cinema Halls

5.2.1.2 Digitalization in Education Sector

5.2.1.3 Technological Advancements in 3D Projectors

5.2.2 Restraints

5.2.2.1 Technological Constraints With DLP Projectors and Metal Halide Light Source

5.2.3 Opportunities

5.2.3.1 Increasing Use of 3D Projectors for Events, Exhibitions, and Museums

5.2.3.2 Rise in Importance of Laser-Based 3D Projectors

5.2.4 Challenges

5.2.4.1 LED Screens as Substitutes to Projectors

6 3D Projector Market, By Technology (Page No. - 38)

6.1 Introduction

6.2 DLP

6.2.1 High Native Contrast Offered By DLP Projectors Drives the Growth of Market

6.3 LCD

6.3.1 Factors Including Low Power Consumption and Low Maintenance Cost Drives the Growth of Market

6.4 LCOS

6.4.1 Market for LCOS Based 3D Projectors With Laser Light Source to Grow at A Significant Rate

7 3D Projector Market, By Light Source (Page No. - 49)

7.1 Introduction

7.2 Laser

7.2.1 Higher Consistency Brightness, With A Longer Lamp Life Offered By 3D Laser Projector to Drive the Growth of Market

7.3 LED

7.3.1 Market Growth Driven By Increasing Need for Low Maintenance Cost Projectors

7.4 Hybrid

7.4.1 Benefits Offered Including Better Image Quality and Longer Light Source Life to Drive Growth of 3D Projector Market

7.5 Metal Halide

7.5.1 Metal Halide Lamp to Hold Largest Share of 3D Projector Market

7.6 Others

8 3D Projector Market, By Brightness (Page No. - 56)

8.1 Introduction

8.2 Less Than 2,000 Lumens

8.2.1 Market Driven By Applications Like Home Entertainment, Education, and Business

8.3 2,000 to 3,999 Lumens

8.3.1 3D Projectors With Brightness From 2,000 Lumens to 3,999 Lumens to Lead Market

8.4 4,000 to 9,999 Lumens

8.4.1 Market for 3D Projectors Offering 4,000 to 9,999 Lumens Brightness to Grow at A Significant Rate

8.5 10,000 & Above Lumens

8.5.1 Increasing Demand for Higher Lumens 3D Projectors in Events and Large Venues to Drive the Growth of Market

9 3D Projector Market, By Resolution (Page No. - 62)

9.1 Introduction

9.2 VGA

9.2.1 Market Driven By Super Video Graphics Array and Wide Video Graphics Array Projectors

9.3 XGA

9.3.1 Market for DLP Based 3D Projectors Offering XGA Resolution to Grow at A Significant Rate

9.4 HD & Full HD

9.4.1 High Quality Image Displayed By HD & Full HD Resolution 3D Projector Drives the Growth of Market

9.5 4K and Above

9.5.1 Increasing Demand for Better Resolution of Projector to Provide Opportunities for the Market

10 3D Projector Market, By Application (Page No. - 68)

10.1 Introduction

10.2 Cinema

10.2.1 Increasing Adoption of Digital Screens Drives the Growth of Market

10.3 Education

10.3.1 Increasing Interests From End-Users for Interactive Projectors Provides Opportunity for the Market

10.4 Business

10.4.1 DLP Projectors to Lead Market for Business Application

10.5 Home Theater and Gaming

10.5.1 Availability of Low Cost Projectors Provides Opportunity for Home Cinema and Gaming Application

10.6 Events and Large Venues

10.6.1 Increasing Requirements of High Brightness and Quality Images Drives the Growth of Market

10.7 Others

11 Geographic Analysis (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increasing Investments in Education Sector Propels Growth of Market

11.2.2 Canada

11.2.2.1 Cinema and Events Important Applications for 3D Projector Market in Country

11.2.3 Mexico

11.2.3.1 Educational Sector to Contribute Significantly to 3D Projector Market in This Country

11.3 Europe

11.3.1 Germany

11.3.1.1 Emerging Technologies Like Virtual Reality to Provide Opportunity for the Market

11.3.2 UK

11.3.2.1 Events and Exhibition One of the Important Application Areas for UK Market

11.3.3 France

11.3.3.1 Cinema and Events to Play Important Role in 3D Projector Market

11.3.4 Italy

11.3.4.1 Growing Tourism Industry to Provide Opportunity for the Market

11.3.5 Rest of Europe

11.4 APAC

11.4.1 China

11.4.1.1 Rising Number of 3D Movie Screens and Increasing Adoption of Projectors for Home Theatre Application Fuel the Growth of Market

11.4.2 Japan

11.4.2.1 Different Developments Carried Out By Leading Players Play Important Role in 3D Projector Market

11.4.3 India

11.4.3.1 Increasing Adoption of Digital Technologies in Education Sector to Provide Opportunity for the Market

11.4.4 South Korea

11.4.4.1 Adoption of Laser Projectors in Cinema Application to Drive the Growth Market

11.4.5 Rest of APAC

11.5 RoW

11.5.1 Middle East & Africa

11.5.1.1 Increasing Number of Cinema Screens to Provide Significant Growth Opportunities for the Market

11.5.2 South America

11.5.2.1 Events and Cinema are Important Applications for 3D Projector Market

12 Competitive Landscape (Page No. - 95)

12.1 Overview

12.2 Market Ranking Analysis

12.2.1 Product Launches

12.2.2 Agreements, Collaborations, Partnerships, and Contracts

12.2.3 Mergers & Acquisitions

12.2.4 Expansion

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Dynamic Differentiators

12.3.3 Innovators

12.3.4 Emerging Players

13 Company Profile (Page No. - 101)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Introduction

13.2 Key Players

13.2.1 Sony

13.2.2 Optoma

13.2.3 Epson

13.2.4 Barco

13.2.5 Vivitek Corporation

13.2.6 Benq

13.2.7 Christie Digital

13.2.8 Jvckenwood (JVC)

13.2.9 NEC Display Solutions, Ltd.

13.2.10 Panasonic

13.2.11 Viewsonic

13.3 Other Key Players

13.3.1 Acer

13.3.2 Boxlight

13.3.3 Canon

13.3.4 Dell

13.3.5 Digital Projection

13.3.6 Dukane

13.3.7 Infocus

13.3.8 Sim2

13.3.9 Wolf Cinema

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 134)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (64 Tables)

Table 1 3D Projector Market, By Technology, 2015–2024 (USD Million)

Table 2 Market for DLP-Based 3D Projectors, By Resolution, 2015–2024 (USD Million)

Table 3 Market for DLP-Based 3D Projectors, By Light Source, 2015–2024 (USD Million)

Table 4 Market for DLP-Based 3D Projectors, By Application, 2015–2024 (USD Million)

Table 5 Market for DLP-Based 3D Projectors, By Region, 2015–2024 (USD Million)

Table 6 Market for LCD-Based 3D Projectors, By Resolution, 2015–2024 (USD Million)

Table 7 Market for LCD-Based 3D Projector, By Light Source, 2015–2024 (USD Million)

Table 8 Market for LCD-Based 3D Projectors, By Application, 2015–2024 (USD Million)

Table 9 Market for LCD-Based 3D Projectors, By Region, 2015–2024 (USD Million)

Table 10 Market for LCOS-Based 3D Projectors, By Resolution, 2015–2024 (USD Million)

Table 11 Market for LCOS-Based 3D Projectors, By Light Source, 2015–2024 (USD Million)

Table 12 Market for LCOS-Based 3D Projectors, By Application, 2015–2024 (USD Million)

Table 13 Market for LCOS-Based 3D Projectors, By Region, 2015–2024 (USD Million)

Table 14 3D Projector Market, By Light Source, 2015–2024 (USD Million)

Table 15 3D Laser Projector Market, By Technology, 2015–2024 (USD Million)

Table 16 3D Laser Projector Market, By Brightness, 2015–2024 (USD Million)

Table 17 3D Projector With Led Light Source Market, By Technology, 2015–2024 (USD Million)

Table 18 Market for Led Light Source-Based 3D Projector, By Brightness, 2015–2024 (USD Million)

Table 19 Market for Metal Halide-Based 3D Projectors, By Technology, 2015–2024 (USD Million)

Table 20 Market for Metal Halide-Based 3D Projectors, By Brightness, 2015–2024 (USD Million)

Table 21 Market for 3D Projectors Based on Other Light Source, By Brightness, 2015–2024 (USD Million)

Table 22 Market, By Brightness, 2015–2024 (USD Million)

Table 23 Market for Brightness Less Than 2,000 Lumens, By Light Source, 2015–2024 (USD Million)

Table 24 Market for Brightness Ranging From 2,000 to 3,999 Lumens, By Light Source, 2015–2024 (USD Million)

Table 25 Market for Brightness Ranging From 4,000 to 9,999 Lumens, By Light Source, 2015–2024 (USD Million)

Table 26 Market for Brightness of 10,000 and Above Lumens, By Light Source, 2015–2024 (USD Million)

Table 27 Market, By Resolution, 2015–2024 (USD Million)

Table 28 Market for 3D Projector With VGA Resolution, By Technology, 2015–2024 (USD Million)

Table 29 Market for 3D Projectors With XGA Resolution, By Technology, 2015–2024 (USD Million)

Table 30 Market for 3D Projectors With HD & Full HD Resolution, By Technology, 2015–2024 (USD Million)

Table 31 Market for 3D Projectors With 4K and Above Resolution, By Technology, 2015–2024 (USD Million)

Table 32 Market, By Application, 2015–2024 (USD Million)

Table 33 Market for Cinema, By Technology, 2015–2024 (USD Million)

Table 34 DLP-Based Market for Cinema, By Region, 2015–2024 (USD Million)

Table 35 LCOS-Based Market for Cinema, By Region, 2015–2024 (USD Million)

Table 36 Market for Education, By Technology, 2015–2024 (USD Million)

Table 37 DLP-Based Market for Education, By Region, 2015–2024 (USD Million)

Table 38 LCD-Based Market for Education, By Region, 2015–2024 (USD Million)

Table 39 LCOS-Based Market for Education, By Region, 2015–2024 (USD Million)

Table 40 Market for Business, By Technology, 2015–2024 (USD Million)

Table 41 Market for DLP-Based 3D Projectors for Business, By Region, 2015–2024 (USD Million)

Table 42 Market for LCD-Based 3D Projectors for Business, By Region, 2015–2024 (USD Million)

Table 43 Market for LCOS-Based 3D Projectors for Business, By Region, 2015–2024 (USD Million)

Table 44 Market for Home Theater and Gaming, By Technology, 2015–2024 (USD Million)

Table 45 Market for DLP-Based 3D Projectors for Home Theater and Gaming, By Region, 2015–2024 (USD Million)

Table 46 Market for LCD-Based 3D Projectors for Home Theater and Gaming, By Region, 2015–2024 (USD Million)

Table 47 Market for LCOS-Based 3D Projectors for Home Theater and Gaming, By Region, 2015–2024 (USD Million)

Table 48 Market for Events and Large Venues, By Technology, 2015–2024 (USD Million)

Table 49 Market for DLP-Based 3D Projectors for Events and Large Venues, By Region, 2015–2024 (USD Million)

Table 50 Market for LCD-Based 3D Projectors for Events and Large Venues, By Region, 2015–2024 (USD Million)

Table 51 Market for LCOS-Based 3D Projectors for Events and Large Venues, By Region, 2015–2024 (USD Million)

Table 52 Market for Other Applications, By Technology, 2015–2024 (USD Million)

Table 53 Market for DLP-Based 3D Projectors for Other Applications, By Region, 2015–2024 (USD Million)

Table 54 Market for LCD-Based 3D Projectors for Other Applications, By Region, 2015–2024 (USD Million)

Table 55 Market for LCOS-Based 3D Projectors for Other Applications, By Region, 2015–2024 (USD Million)

Table 56 Market, By Region, 2015–2024 (USD Million)

Table 57 Market in North America, By Country, 2015–2024 (USD Million)

Table 58 Market in Europe, By Country, 2015–2024 (USD Million)

Table 59 Market in APAC, By Country, 2015–2024 (USD Million)

Table 60 Market in RoW, By Region, 2015–2024 (USD Million)

Table 61 Product Launch, 2018–2019

Table 62 Agreement, Collaboration, Partnership, and Contract, 2017–2018

Table 63 Mergers & Acquisitions, 2019

Table 64 Expansion, 2018

List of Figures (43 Figures)

Figure 1 3D Projector Market: Research Design

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 3D Projector: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 DLP-Based 3D Projectors to Dominate the Market By 2024

Figure 8 Market for 3D Projector With Laser Light Source to Grow at Highest CAGR During Forecast Period

Figure 9 3D Projectors Offering HD & Full HD Resolution to Hold Largest Size of the Market By 2024

Figure 10 Market for 3D Projector Featuring 10,000 and Above Lumens to Grow at Highest CAGR During Forecast Period

Figure 11 Cinema to Grow at Highest CAGR in Market During Forecast Period

Figure 12 APAC to Account for Largest Share of Market By 2024

Figure 13 Growing Adoption of 3D Projectors in Cinema Theaters Along With Technological Advancement in 3D Projectors to Drive Market for 3D Projectors

Figure 14 DLP Technology and APAC to Hold Largest Share of Market By 2024

Figure 15 Market in China to Grow at Fastest Rate During Forecast Period

Figure 16 Market Dynamics

Figure 17 DLP Technology Based Market to Grow at Highest CAGR During Forecast Period

Figure 18 Market for DLP-Based 3D Projector With Laser Light Source to Grow at Highest CAGR During Forecast Period

Figure 19 3D DLP Projector in APAC to Hold Largest Market Share in 2024

Figure 20 3D Projectors Based on Laser Light Source to Grow at Highest CAGR During Forecast Period

Figure 21 3D Laser Projectors With DLP Technology to Dominate the Market During Forecast Period

Figure 22 Metal Halide-Based 3D Projectors With DLP Technology to Dominate the Market During Forecast Period

Figure 23 3D Projectors With Brightness From 2,000 to 3,999 Lumens to Hold Largest Size of the Market By 2024

Figure 24 3D Projectors With Metal Halide Light Source Offering Brightness Ranging From 2,000 to 3,999 Lumens to Hold Largest Market Size During Forecast Period

Figure 25 Market for 3D Projectors With Resolution of 4K & Above to Grow at Highest CAGR During Forecast Period

Figure 26 Market for DLP-Based 3D Projectors With HD and Full HD Resolution to Dominate the Market During Forecast Period

Figure 27 Market for Cinema Application to Grow at Highest CAGR During the Forecast Period

Figure 28 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 29 North America: Snapshot of 3D Projector Market

Figure 30 US to Dominate Market in North America By 2024

Figure 31 Europe: Snapshot of Market

Figure 32 France to Grow at Highest CAGR in European Market During Forecast Period

Figure 33 APAC: Snapshot of Market

Figure 34 China to Dominate Market in APAC By 2024

Figure 35 South America to Lead Market in RoW During Forecast Period

Figure 36 Organic and Inorganic Strategies Adopted By Companies Operating in Market

Figure 37 Market Player Ranking, 2018

Figure 38 Market (Global) Competitive Leadership Mapping (2018)

Figure 39 Sony: Company Snapshot

Figure 40 Epson: Company Snapshot

Figure 41 Barco: Company Snapshot

Figure 42 Jvckenwood: Company Snapshot

Figure 43 Panasonic: Company Snapshot

The study has involved 4 major activities in estimating the size of the 3D projector market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

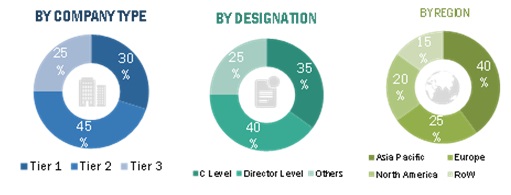

The 3D projector market comprises several stakeholders, such as projector manufacturers, component providers, among others in the supply chain. The demand side of this market includes various cinema, education, business, home theater, events & large venues. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the 3D projector market. These methods have also been used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Players offering various types of projectors are considered; their revenue for 3D projectors has been observed to arrive at global numbers.

- The market has further been narrowed down to obtain the splits for technology, light source, resolution, brightness, and applications.

- Application trends for various regions including North America, Europe, APAC, and Row have been studied to provide further breakdown the market estimation.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the 3D projector market.

Report Objectives

- To describe and forecast the 3D projector market, in terms of value, by technology, resolution, light source, brightness, and application

- To describe and forecast the 3D projector market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with the detailing the competitive landscape for market leaders

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, product launches and developments, and research and development (R&D) in the 3D projector market

- To benchmark players within the market using proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in 3D Projector Market