5G Device Testing Market Size, Share & Industry Trends Analysis Report by Equipment Type (Oscilloscope, Signal Generator, Spectrum Analyzers, Network Analyzers), End User (IDMs & ODMs, Telecom Equipment Manufacturers) and Region - Global Forecast 2028

Updated on : Sep 18, 2024

5G Device Testing Market Size & Growth

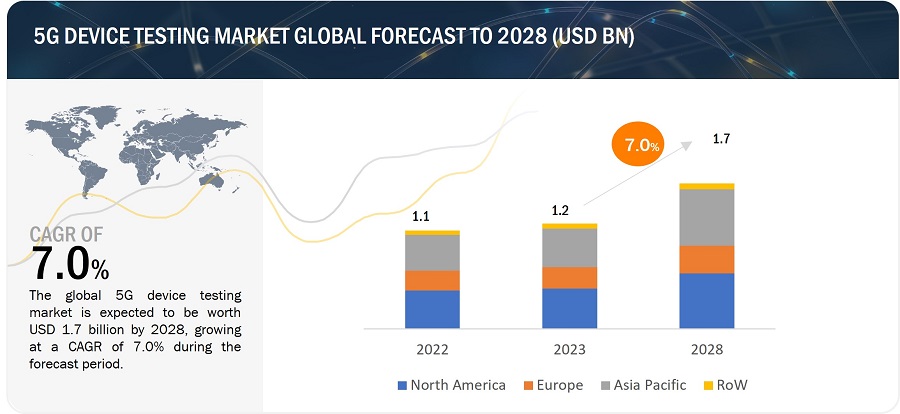

The global 5G device testing market size is projected to reach USD 1.7 billion by 2028, growing at a CAGR of 7.0% during the forecast period. Sizable investment in 5G deployment is one of the key drivers of the market.

5G Device Testing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

5G Device Testing Market Trends:

Requirement for EMI protection and EMC testing of 5G equipment

Although 5G technology and its predecessor share many similarities, there are also significant variations between the two standards that necessitate new testing methods. For instance, 5G equipment will need to be insulated from Electromagnetic Interference (EMI) and tested for Electromagnetic Compatibility (EMC), just like any other telecommunications equipment. Radio frequency (RF) systems, electrical systems, and electronic equipment all suffer from the effects of electromagnetic emissions.

All electronic equipment releases some quantity of electromagnetic radiation because the electricity in a circuit can never be completely contained. This implies that any equipment may be susceptible to the emissions of other electronics and electrical systems as well as having the capacity to produce disruptive electromagnetic fields. Manufacturers are required to demonstrate their compliance with EMI and EMC testing regulations prior to releasing a finished product on the market, in turn creating demand for 5G device testing.

Restraint: High cost of equipment and lack of skilled workforce

The cost of 5G testing equipment is more than just the purchasing price, which is the amount paid for hardware and software at installation. Approximately, 80% of the total IT cost is incurred after the initial purchase. This high cost of technology-related equipment may hamper their adoption and consequently restrain the growth of the 5G device testing industry.

With the adoption of 5G technology, businesses can expect significant increases in component costs in the coming years, which would restrain the growth of the 5G device testing industry. The development, management, and implementation of 5G device testing equipment, which are complex, require a workforce with certain skill sets. The scarcity of a skilled workforce is a more significant challenge in emerging economies as compared to countries, such as the US and Germany. The lack of a skilled workforce in this field may act as a restrain for the growth of the wireless testing market.

Opportunity: Rising demand for 5G network in automobiles, smart cities, and healthcare sector

5G network offers features such as high-speed data transfer rate, low latency, and consistent connectivity-all easily manageable with previous-generation technology. These features are useful across various industries. For instance, in autonomous cars/connected cars, the low latency of 5G networks is critical to implement safety systems and real-time V2V and V2I communications.

In smart cities, there are dense arrays of wireless sensors that enable various services and applications, right from environmental services and pollution monitoring to security surveillance, traffic management, and smart parking. Apparently, 5G infrastructure plays an integral role in meeting various requirements of several connected devices and numerous sensors that are being deployed. Furthermore, in healthcare, 5G networks could become a revolutionary development. For instance, a 5G network can help avail services such as telemedicine and emergency care providers in an emergency situation. The wide adoption of 5G networks in different business segments would further increase opportunities for the 5G device testing industry.

Challenge: Complexity in developing new 5G testing products

5G NR has two types of waveforms: Cyclic-prefix OFDM (CP-OFDM) and Discrete Fourier transform spread OFDM (DFT-S-OFDM). CP-OFDM is for downlink and uplink while DFT-S-OFDM is only for uplink. The generation, distribution, and generation of 5G waveforms across design and test benches presents new issues for researchers and engineers working on 5G device testing. With greater bandwidths than ever before, engineers are working with extremely complicated, standard-compliant uplink and downlink signals.

They comprise various resource distributions, modulation and coding schemes, phase-tracking, sounding, and demodulation data, single-carrier configurations, and contiguous and non-contiguous carrier-aggregated arrangements. Also, these 5G device testing equipment are required to wideband and linear and cover extensive frequency range which is quite complex and cost-intensive. Although the mass-market semiconductor business has not yet investigated this area, RF experts have been working with specialized and expensive test devices for mmWave in sectors such as aerospace and defense. To set up more test benches, engineers require affordable test equipment. Thus, the wide waveforms and extensive frequency ranges in 5G makes development of a universal or multitasking testing very challenging.

5G Device Testing Market Segment Analysis

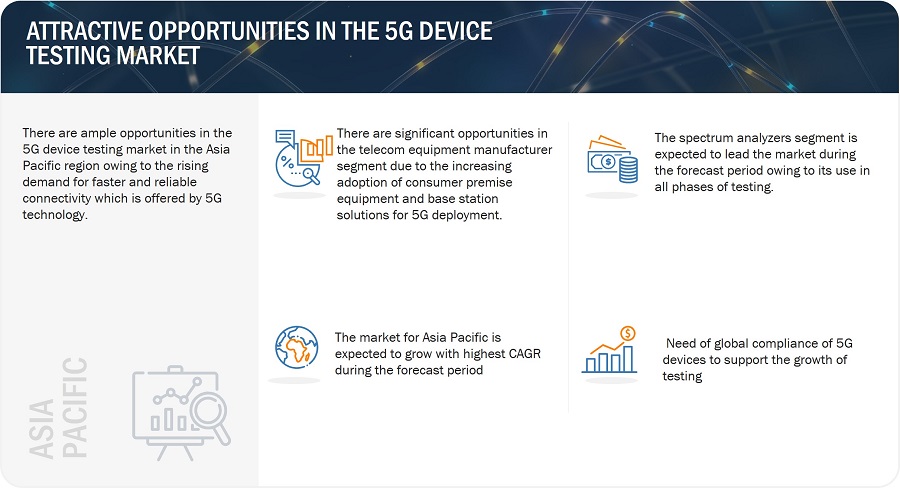

Spectrum Analyzers is expected to contribute the largest market share during the forecast period

A spectrum analyzer is a 5G testing equipment that measures and screens the signal amplitude, which portrays the strength of the signal as it varies within its frequency range and spectrum. In other words, spectrum analyzers portray the spectrum of signal amplitudes on different frequencies. It analyzes if the signal falls under the required range limit. It can be easily connected to wireless devices and analyze electromagnetic signals to fuel segment growth

Telecom equipment manufacturer segment is expected to grow with highest CAGR during the forecast period

5G device testing by telecom equipment manufacturers is used for infrastructure devices such as base stations and consumer premise equipment, such as routers, gateways, switches, transceiver stations, gNodeB (gNB), small cells, and remote radio unit heads, before their deployment for network services.

5G testing is increasingly being used in telecommunications infrastructure. Interconnection testing, conformance testing, interactive voice response (IVR) testing, performance testing, security testing, interoperability testing, protocol testing, and functional and automation testing are carried out in this segment. 5G test equipment manufacturers offer a wide range of products, such as network analyzers, spectrum analyzers, and signal generators, to fulfill the testing requirements of infrastructure providers.

5G Device Testing Market - Regional Analysis

5G Device Testing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top 5G Device Testing Companies - Key Market Players

The 5G Device Testing market is dominated by players such as

- Anritsu (Japan),

- Rohde & Schwarz (Germany),

- Keysight Technologies (US),

- NATIONAL INSTRUMENTS CORP. (US), and

- Teradyne, Inc. (US) are some key players operating in the market.

This research report categorizes

|

Report Metric |

Details |

| Estimated Market Size | USD 1.2 billion in 2023 |

| Projected Market Size | USD 1.7 billion by 2028 |

| 5G Device Testing Market Growth Rate | CAGR of 7.0% |

|

5G Device Testing Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million & Billion |

|

Segments covered |

By equipment type, end user, and region |

|

Regions covered |

North America, Europe, APAC, Middle East, and RoW |

|

Companies covered |

Anritsu (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), NATIONAL INSTRUMENTS CORP. (US), TEKTRONIX, INC. (US), Teradyne, Inc. (US), VIAVI Solutions Inc. (US), Artiza Networks, Inc. (US), EMITE (Spain), and EXFO (Canada) are among the key players operating in the 5G device testing market. |

5G Device Testing Market Highlights

The study categorizes the 5G device testing market based on value, by equipment type and end user at the regional and global levels.

|

Segment |

Subsegment |

|

By Equipment Type |

|

|

By End user |

|

|

By Region |

|

Recent Developments in 5G Device Testing Industry

- In February 2023, Anritsu and Spirent Communications announced a collaboration to work on Open RAN test solutions aiming to strengthen its market position in 5G testing market space.

- In January 2023, Keysight Technologies collaborated with Qualcomm Technologies, Inc. to establish an end-to-end 5G non-terrestrial network (NTN) connection. It aims to accelerate 5G NTN technology to provide affordable broadband connectivity in remote areas.

Frequently Asked Questions (FAQ):

What is the size of the global 5G device testing market?

The global 5G device testing market is expected to be USD 1.2 billion in 2023 and is projected to reach USD 1.7 million by 2028, at a CAGR of 7.0%.

What are the major driving factors and opportunities in the 5G device testing market?

Requirement for EMI protection and EMC testing of 5G equipment, increasing use cases of 5G across various sectors and compatible products, increasing 5G adoption to drive the market demand, and high adoption of smartphones and mobile devices are the key drivers for the market.

Who are the star players in the global 5G device testing market?

Companies such as Anritsu (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), NATIONAL INSTRUMENTS CORP. (US), and Teradyne, Inc. (US) fall under the star category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have effective supply chain strategies. Such advantages give these companies an edge over other companies in the market.

What are the major strategies adopted by the key players?

Product launches and deals such as collaborations, partnerships and agreements are the major strategies adopted by the key players of the 5G device testing market.

Which region contributes to the largest market share in the 5G device testing market during the forecast period?

North America contributes the largest market share in 5G device testing ng market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Requirement for EMI protection and EMC testing of 5G equipment- Increasing use cases of 5G across various sectors and compatible products- Increasing 5G adoption- High adoption of smartphones and mobile devicesRESTRAINTS- Lack of global compliance and standardization in connectivity protocols- High cost of equipment and lack of skilled workforceOPPORTUNITIES- 5G networks in IoT with emergence of cloud services- Rising demand for 5G network in automobiles, smart cities, and healthcare sectorCHALLENGES- Complexity in developing new 5G testing products- Long lead times for overseas qualification tests

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS IMPACTING CUSTOMER BUSINESS

- 5.6 PORTER’S FIVE FORCES ANALYSIS

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 PRICING ANALYSIS

-

5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISCOMPLEMENTARY TECHNOLOGY- 5G FR2 testingADJACENT TECHNOLOGY- Internet of Things (IoT)

-

5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSKEY REGULATIONS- US regulations- EU regulationsSTANDARDS- Distributed Management Task Force (DMTF) Standard- Standards in ITS/C-ITS

-

5.14 TRADE ANALYSIS

- 5.15 TARIFF ANALYSIS

- 6.1 INTRODUCTION

-

6.2 OSCILLOSCOPESDIGITAL OSCILLOSCOPES TO OFFER EASY HORIZONTAL AND VERTICAL SIGNAL ADJUSTMENTS- Case study: Rohde & Schwarz (Germany) and TEKTRONIX, INC. (US) extended their capabilities in 5G testing

-

6.3 SPECTRUM ANALYZERSSPECTRUM ANALYZERS EASILY CONNECT TO WIRELESS DEVICES AND ANALYZE ELECTROMAGNETIC SIGNALS- Case study: Anritsu extended its product offerings for 5G device testing

-

6.4 SIGNAL GENERATORSSIGNAL GENERATORS ALLOW TO OUTPUT SIGNALS WITH VARIOUS FREQUENCIES, AMPLITUDES, AND TIME DURATIONS- Case study: Anritsu launched test solutions supported by signal generators

-

6.5 NETWORK ANALYZERSVNA IS MOST PROMINENT TYPE OF NETWORK ANALYZER

-

6.6 OTHERSOTA TESTERS AND EMI TEST RECEIVERS ARE SOME OTHER FREQUENTLY USED EQUIPMENT- Case study: Keysight Technologies expanded its OTA testing product line

- 7.1 INTRODUCTION

-

7.2 IDMS & ODMSINCREASING DEMAND AT END-OF-LINERISING CONSUMER ELECTRONICS DEMAND TO SUPPORT MARKET GROWTH

-

7.3 TELECOM EQUIPMENT MANUFACTURERSINCREASING DEMAND FOR 5G USERS TO DRIVE TELECOM INFRASTRUCTURE DEPLOYMENT AND TESTINGTELECOM EQUIPMENT TESTING IS COMPETITIVE SEGMENT

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- 5G-to-Next G initiative to create huge market scope for 5G testingCANADA- Rising investments in smart city projects to fuel marketMEXICO- 5G deployment initiatives to drive market

-

8.3 EUROPEEUROPE: RECESSION IMPACTUK- Increasing 5G deployment to drive device testing market- Case study: 5G Testbeds and Trials Programme (5GTT) by UK governmentGERMANY- High adoption rate of 5G connectivity to drive marketFRANCE- Deployment of connected car technologies by renowned car manufacturers to drive marketREST OF EUROPE

-

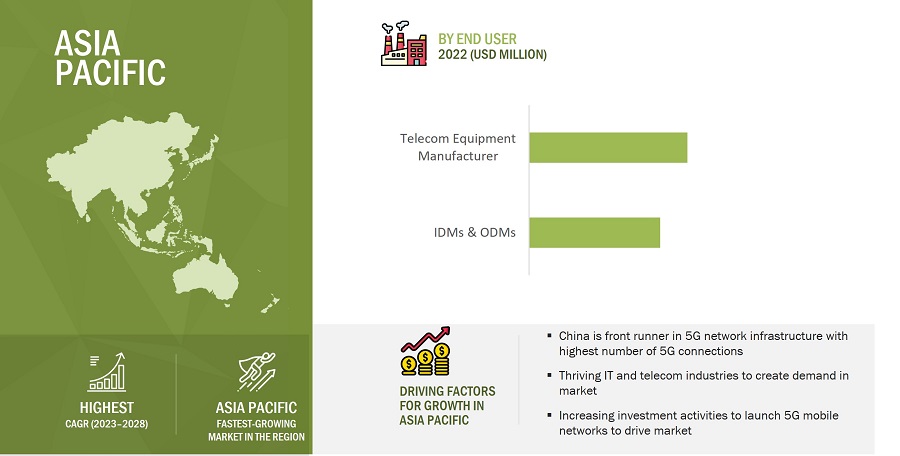

8.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- China is front runner in 5G network infrastructure with highest number of 5G connectionsJAPAN- Thriving IT and telecom industries to create demand in marketSOUTH KOREA- Increasing PPP activities to launch 5G mobile networks to drive marketREST OF ASIA PACIFIC

-

8.5 ROWROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Adoption of 5G device testing equipment by network providers to drive marketSOUTH AMERICA- Rising demand for 5G networks in Brazil, Mexico, Chile, and Argentina to drive 5G device testing market

-

9.1 OVERVIEWOVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- 9.2 5G DEVICE TESTING MARKET: REVENUE ANALYSIS

- 9.3 MARKET SHARE ANALYSIS (2022)

-

9.4 KEY COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.5 COMPETITIVE BENCHMARKING

-

9.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

9.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

10.1 KEY PLAYERSANRITSU- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKEYSIGHT TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewROHDE & SCHWARZ- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTERADYNE INC.- Business overview- Products/Services/Solutions offered- MnM viewNATIONAL INSTRUMENTS CORP.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTEKTRONIX INC.- Business overview- Products/Services/Solutions offeredVIAVI SOLUTIONS INC.- Business overview- Products/Services/Solutions offered- Recent developmentsARTIZA NETWORKS INC.- Business overview- Products/Services/Solutions offered- Recent developmentsEMITE- Business overview- Products/Services/Solutions offered- Recent developmentsEXFO INC.- Business overview- Products/Services/Solutions offered- Recent developmentsMACOM- Business overview- Products/Services/Solutions offeredSPIRENT COMMUNICATIONS- Business overview- Products/Services/Solutions offered- Recent developmentsGL COMMUNICATIONS INC.- Business overview- Products/Services/Solutions offered- Recent developments

-

10.2 OTHER PLAYERSINNOWIRELESS CO., LTD.PCTEL, INC.MARVIN TEST SOLUTIONS, INC.GAO TEK & GAO GROUP INC.NETSCOUTCONSULTIX WIRELESSVALID8.COM INC.SIMNOVUSBUREAU VERITASPOLARIS NETWORKSADVANTEST CORPORATIONVERKOTAN

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 5G DEVICE TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 4 KEY BUYING CRITERIA, BY END USER

- TABLE 5 SELLING PRICE SAMPLES OF 5G DEVICE TESTING EQUIPMENT, BY COMPANY

- TABLE 6 GERMAN FEDERAL NETWORK AGENCY ADOPTED ANRITSU’S BASE STATION SIMULATORS

- TABLE 7 NOKIA BELL LABS SELECTED KEYSIGHT TECHNOLOGIES FOR 5G USE CASE TESTING

- TABLE 8 PATENTS RELATED TO 5G DEVICE TESTING MARKET

- TABLE 9 5G DEVICE TESTING MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SECURITY AND PRIVACY STANDARDS DEVELOPED BY EUROPEAN TELECOMMUNICATION STANDARDS INSTITUTE (ETSI)

- TABLE 15 EXPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 16 IMPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 17 MFN TARIFF IMPOSED BY US ON EXPORTS OF PRODUCTS WITH HS CODE 903040

- TABLE 18 MFN TARIFF IMPOSED BY CHINA ON EXPORTS OF PRODUCTS WITH HS CODE 903040

- TABLE 19 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 20 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 21 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 22 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 23 5G DEVICE TESTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 5G DEVICE TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 26 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 28 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 29 US: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 30 US: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 31 CANADA: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 32 CANADA: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 33 MEXICO: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 34 MEXICO: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 35 5G ACTIVITIES IN EUROPE

- TABLE 36 EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 37 EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 38 EUROPE: 5G DEVICE TESTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 39 EUROPE: 5G DEVICE TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 UK: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 41 UK: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 42 GERMANY: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 43 GERMANY: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 44 FRANCE: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 45 FRANCE: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 46 REST OF EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 47 REST OF EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 CHINA: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 53 CHINA: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 54 JAPAN: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 55 JAPAN: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 56 SOUTH KOREA: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 57 SOUTH KOREA: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 60 ROW: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 61 ROW: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 62 ROW: 5G DEVICE TESTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 ROW: 5G DEVICE TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 MIDDLE EAST & AFRICA: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 66 SOUTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 67 SOUTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 68 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 69 5G DEVICE TESTING MARKET: MARKET SHARE ANALYSIS

- TABLE 70 5G DEVICE TESTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 71 5G DEVICE TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 72 5G DEVICE TESTING MARKET: COMPANY FOOTPRINT

- TABLE 73 5G DEVICE TESTING MARKET: EQUIPMENT TYPE FOOTPRINT

- TABLE 74 5G DEVICE TESTING MARKET: END USER FOOTPRINT

- TABLE 75 5G DEVICE TESTING MARKET: REGION FOOTPRINT

- TABLE 76 5G DEVICE TESTING MARKET: PRODUCT LAUNCHES, SEPTEMBER 2019–FEBRUARY 2023

- TABLE 77 5G DEVICE TESTING MARKET: DEALS, FEBRUARY 2018–FEBRUARY 2023

- TABLE 78 5G DEVICE TESTING MARKET: OTHERS, APRIL 2022–FEBRUARY 2023

- TABLE 79 ANRITSU: COMPANY OVERVIEW

- TABLE 80 ANRITSU: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 81 ANRITSU: PRODUCT LAUNCHES

- TABLE 82 ANRITSU: DEALS

- TABLE 83 ANRITSU: OTHERS

- TABLE 84 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 85 KEYSIGHT TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 86 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 87 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 88 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 89 ROHDE & SCHWARZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 90 ROHDE & SCHWARZ: PRODUCT LAUNCHES

- TABLE 91 ROHDE & SCHWARZ: DEALS

- TABLE 92 ROHDE & SCHWARZ: OTHERS

- TABLE 93 TERADYNE, INC.: COMPANY OVERVIEW

- TABLE 94 TERADYNE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 95 NATIONAL INSTRUMENTS CORP.: COMPANY OVERVIEW

- TABLE 96 NATIONAL INSTRUMENTS CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 97 NATIONAL INSTRUMENTS CORP.: PRODUCT LAUNCHES

- TABLE 98 NATIONAL INSTRUMENTS CORP.: DEALS

- TABLE 99 NATIONAL INSTRUMENTS CORP.: OTHERS

- TABLE 100 TEKTRONIX, INC.: COMPANY OVERVIEW

- TABLE 101 TEKTRONIX INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 102 VIAVI SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 103 VIAVI SOLUTIONS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 104 VIAVI SOLUTIONS INC.: PRODUCT LAUNCHES

- TABLE 105 VIAVI SOLUTIONS INC.: DEALS

- TABLE 106 ARTIZA NETWORKS INC.: COMPANY OVERVIEW

- TABLE 107 ARTIZA NETWORKS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 108 ARTIZA NETWORKS INC.: PRODUCT LAUNCHES

- TABLE 109 ARTIZA NETWORKS: DEALS

- TABLE 110 EMITE: COMPANY OVERVIEW

- TABLE 111 EMITE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 112 EMITE: PRODUCT LAUNCHES

- TABLE 113 EMITE: DEALS

- TABLE 114 EXFO: COMPANY OVERVIEW

- TABLE 115 EXFO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 EXFO: PRODUCT LAUNCHES

- TABLE 117 EXFO: DEALS

- TABLE 118 EXFO: OTHERS

- TABLE 119 MACOM: COMPANY OVERVIEW

- TABLE 120 MACOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 MACOM: DEALS

- TABLE 122 SPIRENT COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 123 SPIRENT COMMUNICATIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 124 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 125 SPIRENT COMMUNICATIONS: DEALS

- TABLE 126 GL COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 127 GL COMMUNICATIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 128 GL COMMUNICATIONS: PRODUCT LAUNCHES

- FIGURE 1 5G DEVICE TESTING MARKET SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- FIGURE 3 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 4 5G DEVICE TESTING MARKET: RESEARCH DESIGN

- FIGURE 5 RESEARCH APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION: RESEARCH METHODOLOGY

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS

- FIGURE 11 5G DEVICE TESTING MARKET, 2019–2028 (USD MILLION)

- FIGURE 12 PROJECTIONS FOR 5G DEVICE TESTING MARKET, 2019–2028 (THOUSAND UNITS)

- FIGURE 13 TELECOM EQUIPMENT MANUFACTURERS SEGMENT HELD LARGEST SHARE OF 5G DEVICE TESTING MARKET, BY END USER, IN 2022

- FIGURE 14 SPECTRUM ANALYZERS SEGMENT TO HOLD LARGEST SHARE OF 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF 5G DEVICE TESTING MARKET IN 2022

- FIGURE 16 GROWING ADOPTION OF 5G DEVICE TESTING DUE TO HIGH INVESTMENTS

- FIGURE 17 OSCILLOSCOPES TO HOLD SECOND-LARGEST MARKET SHARE IN 2023

- FIGURE 18 TELECOM EQUIPMENT MANUFACTURERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 20 SPECTRUM ANALYZERS AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC 5G DEVICE TESTING MARKET IN 2022

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR IN 5G DEVICE TESTING MARKET DURING FORECAST PERIOD

- FIGURE 22 5G DEVICE TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 5G DEVICE TESTING MARKET: IMPACT OF DRIVERS

- FIGURE 24 MOBILE 5G DATA TRAFFIC, 2018–2028 (EB PER MONTH)

- FIGURE 25 GLOBAL MOBILE SUBSCRIPTIONS PER 100 PEOPLE

- FIGURE 26 5G DEVICE TESTING MARKET: IMPACT OF RESTRAINTS

- FIGURE 27 5G DEVICE TESTING MARKET: IMPACT OF OPPORTUNITIES

- FIGURE 28 5G DEVICE TESTING MARKET: IMPACT OF CHALLENGES

- FIGURE 29 5G DEVICE TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 5G DEVICE TESTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 REVENUE SHIFT IN 5G DEVICE TESTING MARKET

- FIGURE 32 5G DEVICE TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 34 KEY BUYING CRITERIA, BY END USER

- FIGURE 35 GLOBAL AVERAGE PRICING TREND OF 5G DEVICE TESTING EQUIPMENT, 2019–2028 (USD)

- FIGURE 36 AVERAGE SELLING PRICE OF 5G DEVICE TESTING, BY EQUIPMENT TYPE

- FIGURE 37 5G DEVICE TESTING MARKET: PATENT ANALYSIS

- FIGURE 38 EXPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 39 IMPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 40 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2023–2028

- FIGURE 41 5G DEVICE TESTING MARKET, BY END USER, 2023–2028

- FIGURE 42 ASIA PACIFIC TO BE NEW HOTSPOT FOR 5G DEVICE TESTING MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: 5G DEVICE TESTING MARKET SNAPSHOT

- FIGURE 44 EUROPE: 5G DEVICE TESTING MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: 5G DEVICE TESTING MARKET SNAPSHOT

- FIGURE 46 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN 5G DEVICE TESTING MARKET

- FIGURE 47 MARKET SHARE ANALYSIS (2022)

- FIGURE 48 5G DEVICE TESTING MARKET (GLOBAL): KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 5G DEVICE TESTING MARKET (GLOBAL): SME EVALUATION QUADRANT, 2022

- FIGURE 50 ANRITSU: COMPANY SNAPSHOT

- FIGURE 51 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 52 TERADYNE INC.: COMPANY SNAPSHOT

- FIGURE 53 NATIONAL INSTRUMENTS CORP.: COMPANY SNAPSHOT

- FIGURE 54 VIAVI SOLUTION INC.: COMPANY SNAPSHOT

- FIGURE 55 MACOM: COMPANY SNAPSHOT

- FIGURE 56 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

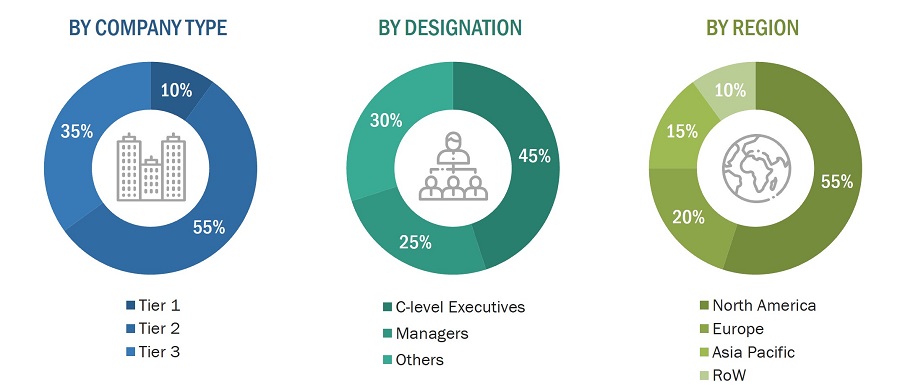

The study involved four major activities in estimating the current size of the 5G device testing market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include technology journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the 5G device testing market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were used to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry experts such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents the overall market size estimation process employed for this study.

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the 5G device testing market from the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market.

- Approach To Derive Market Size Using Demand-Side Analysis

- Identifying devices which are used for 5G testing

- Estimating the market for 5G device testing

- Tracking ongoing and upcoming implementations of 5G device testing in various end users and forecasting the market based on these developments and other critical parameters

- Verifying and crosschecking the estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

5g Device Testing Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Testing for 5G involves more than just confirming the download rates, extremely low latency, and wide-ranging coverage density. Emerging 5G networks' development, deployment, and operational excellence depend heavily on end-to-end test solutions such as oscilloscopes, signal generators, spectrum analyzers, network analyzers, OTA testers, and EMI test receivers. Test solutions are quickly evolving to accommodate complex use cases and significant design developments.

Key Stakeholders

- Raw Material Vendors

- Component and Hardware Providers

- Sensor Providers

- System Integrators

- Original Equipment Manufacturers (OEMs) /Device Manufacturers

- Technology Standard Organizations, Forums, Alliances, and Associations

- Governments, Financial Institutions, and Investment Communities

- Research Organizations

- Analysts and Strategic Business Planners

- Venture Capitalists, Private Equity Firms, and Start-up Companies

Report Objectives

- To define, describe, and forecast the global distributed equipment optic sensors market, in terms of value, based on equipment type and end user

- To forecast the market size, in terms of value, for various segments, with respect to five main regions—North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing the growth of

the distributed equipment optic sensors market (drivers, restraints, opportunities, and industry-specific challenges) - To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for the market stakeholders by identifying high-growth segments of the distributed equipment optic sensors market

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and to provide a detailed competitive landscape for market leaders

- To track and analyze competitive developments such as deals including partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches and other developments in the 5G device testing market.

- To analyze the probable impact of the recession on the market in the future

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Device Testing Market