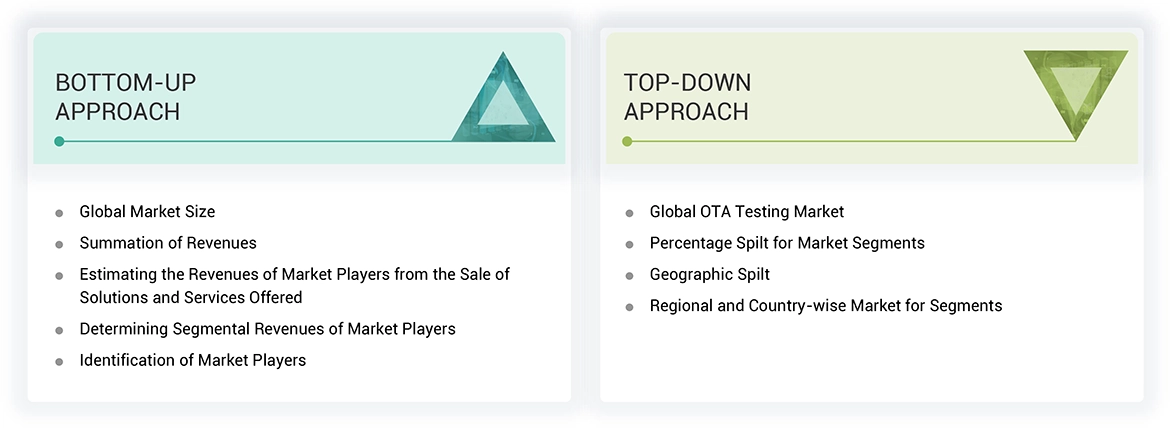

The research study involved 4 major activities in estimating the size of the OTA testing market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the OTA testing market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

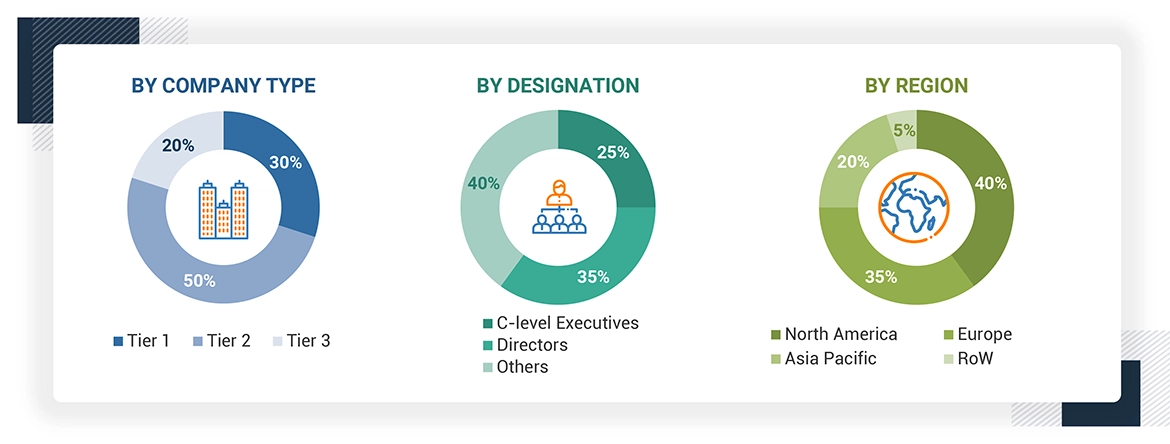

Extensive primary research has been conducted after understanding the OTA testing market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the OTA testing and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

-

Identifying different stakeholders in the OTA testing market that influence the entire market, along with participants across the supply chain

-

Analyzing major manufacturers and service providers in the OTA testing market and studying their solutions and service portfolios

-

Analyzing trends related to the adoption of OTA testing solutions and services

-

Tracking recent and upcoming market developments, including investments, R&D activities, solution and service launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to identify the adoption trends of OTA testing solutions and services

-

Segmenting the overall market into various other market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall OTA testing market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

OTA testing is basically a methodology that considers the performance of a wireless device about the performance of its antenna transmitting and receiving signals in the air. The main parameters for this test include Total Isotropic Sensitivity and Total Radiated Power. The TIS refers to the total sensitivity of an antenna to receive signals from every direction so that it can ensure that communication is okay in different scenarios, and it is tested inside anechoic chambers under different environmental conditions. Total Radiated Power-TRP measures antenna performance with regard to sending out signals, ensuring that the antenna does not exceed the maximum radiated power limits and works well in real-life environments.

The segments of the OTA Testing market based on offerings include test chambers (anechoic chambers), antenna testing solutions, and software, along with comprehensive testing and certification services. The technology segment includes cellular networks, inclusive of 5G, LTE, UMTS, GSM, CDMA, WiFi, and Bluetooth. The end-user segment is quite diversified and includes applications such as consumer smartphones, laptops, tablets, wearables, others, automotive & transportation systems, industrial applications, smart cities infrastructure, and emerging use cases. Each of these segments requires precise OTA testing against performance standards and regulations.

Key Stakeholders

-

Raw Material Suppliers

-

Test Equipment Manufacturers

-

Service Providers

-

Device Manufacturers

-

Network Operators

-

Research and Development Organizations

-

Government and Regulatory Bodies

-

Industry Associations

-

System Integrators

-

Component Suppliers

-

Certification Bodies

Report Objectives

-

To define, describe, and forecast the OTA testing market in terms of value on the basis of offering, technology, end users, and region.

-

To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

-

To define, describe, and forecast test chamber and antenna testing solutions in OTA testing market in terms of volume

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the OTA testing market

-

To study the complete value chain and related industry segments for the OTA testing market

-

To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze trends and disruptions; pricing trends; investment and funding scenario; patents and innovations; trade data (export and import data); regulatory environment; Porter's five forces analysis; case studies; key stakeholders & buying criteria; technology trends; the market ecosystem; and key conferences and events related to the OTA testing market.

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

-

To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders.

-

To analyze competitive developments such as solution and service launches/developments, expansions, acquisitions, partnerships, collaborations, agreements, and research and development (R&D) activities carried out by players in the OTA testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Country-wise Information:

-

Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

-

Company Information:

-

Detailed analysis and profiling of additional market players (up to five)

thesmaz

Apr, 2021

Need details about companies using OTA Testing (5G & 4G).