5G Market in Aviation by End Use (5G Infrastructure for Aircraft and Airport), Technology (eMBB, FWA, URLLC/MMTC), Communication Infrastructure (Small Cell, DAS), 5G Services (Aircraft Operations, Airport Operations), and Region - Global Forecast to 2035

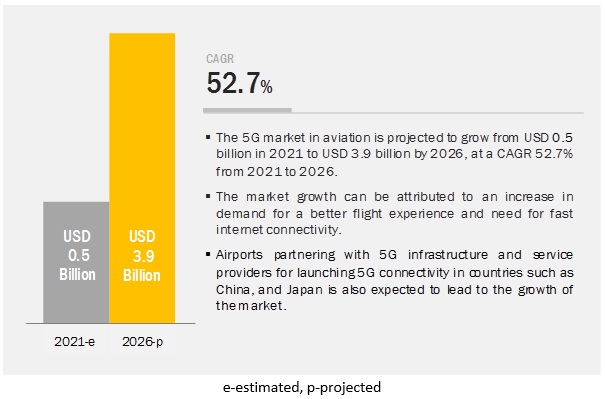

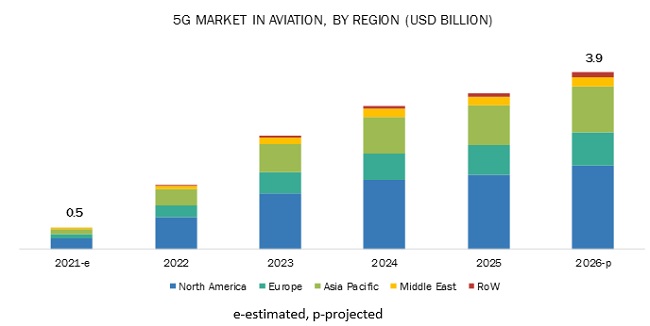

The 5G market in aviation is estimated to be USD 0.5 billion in 2021 and is projected to reach USD 3.9 billion by 2026, at a CAGR of 52.7% from 2021 to 2026. The growing demand for better flight experience and the need for fast internet connectivity at airports and aircraft is expected to drive the market in the coming years.

Market overview:

Based on end-use, 5G infrastructure for airport segment is estimated to account for the largest share of the market in 2021

Based on end-use, 5G infrastructure for airport is estimated to account for the largest share of the overall market in 2021. With the growing establishment of smart connected airports, the demand for the 5G network to support these smart connected airports is also increasing. For instance, London City Airport (UK), in 2018, invested around USD 900,000 for the establishment of the interconnected sensor network and data hub to track the flow of passengers in the airport. With rising air passenger traffic across the world, the installation of 5G will help in enhancing such operations in airports by facilitating ultra-high-speed connectivity, thereby fueling the growth of aviation 5G, across the globe.

Based on technology, the enhanced mobile broadband segment estimated to account for the major market share in 2021

eMBB is an evolution to the existing 4G network and can also be termed as the initial phase of 5G services. Prominent applications involved with eMBB include in-flight entertainment, real-time air traffic alerts, real-time video streaming, games with 3D and 4K resolutions, and high-speed internet access for latent-free cloud access. There is a growing demand for better flight experience, which, in turn, is fueling the demand for eMBB technology used in in-flight 5G connectivity.

Based on application, the aircraft operations segment estimated to account for the major market share in 2021

Based on application, the aircraft operations segment is estimated to account for the major market share in 2021. 5G services for aircraft operations comprise the facilitation of 5G services to airlines. Airlines install 5G infrastructure to enhance the existing Wi-Fi connectivity in their aircraft. They procure a one-time package of 5G network for their aircraft fleet from the vendors operating in the telecom industry. The adoption of 5G network will be higher for international flights as these are long haul flights with a mandatory requirement for Wi-Fi connectivity. Rise in demand for better flight experience and fast internet connection throughout flight journey will fuel growth of 5G services market in aircraft operations.

Based on region, North America is estimated to account for the largest share of the 5G market in aviation in 2021

North America is one of the leading markets for 5G in aviation, in terms of research and development activities in 5G technology for aviation, network design/deployment, and presence of key market players. The region has a high demand for air travel, and there is tremendous growth in air passenger traffic. The rise in passenger traffic is leading to an increase in demand for good internet connectivity in airports as well as aircraft. In addition, the rise of connected aircraft and smart airports in this region is boosting the growth of the regional market. The region is well known for its high adoption rate of new and advanced technologies, including the Internet of Things (IoT), AI, and autonomous/connected aircraft. Qualcomm, Intel, Cisco Systems, and AT&T are some of the major market players based in North America. In 2017, AT&T conducted 5G trials in the US cities of Austin, Waco, Kalamazoo, and South Bend.

Driver: Need for fast internet connectivity

Passengers spend a lot of time at airports. According to a survey by Dufry (Switzerland) in 2018, passengers across the globe spend an average of 180 minutes at airports; this can reach as high as 4 hours when passengers have connecting flights. With many airports being constructed on the outskirts of cities, the unavailability of strong and fast internet connectivity is a major issue faced by travelers. The high-speed and long-range capabilities of 5G is expected to effectually address this issue. In 2018, the International Air Transport Association (Canada) forecast that air passengers across the globe would double to 8.2 billion by 2037. Along with this tremendous growth in air passenger traffic, the demand for fast internet by air passengers will also rise, thereby leading to the growth of the market for 5G in aviation in the coming years

Opportunity: Deployment of flying taxis and delivery drones

While the early adopters of 5G in aviation would be commercial airlines and airports, there will be a huge opportunity for 5G connectivity providers from air taxis/eVTOL (electronic vertical takeoff and landing) aircraft as well as cargo drones/delivery drones. With a rise in demand for quick intercity and intracity transportation, the demand for eVTOL aircraft is expected to increase in the near future. In June 2019, Uber (US) partnered with AT&T (US) to research the applicability of 5G in air taxis.

Challenge: Huge investment involved in developing 5G infrastructure

With regard to the 5G market in aviation, in 2018, Air France (France) anticipated the initial cost of deploying 5G to range between USD 5 million and USD 6 million in aircraft, and between USD 4 million and USD 5 million at airports. The cost of deployment is high, owing to the lack of availability of infrastructure that would support 5G in the current market. For instance, 4G connectivity is provided through a low-band spectrum ranging between a width of 5 to 10 megahertz (MHz). 5G, which is estimated to be 10 times faster than 4G, would require spectrum bands with a width more than 200 MHz. Therefore, the huge investment requirement is one of the major challenges for the 5G market in aviation.

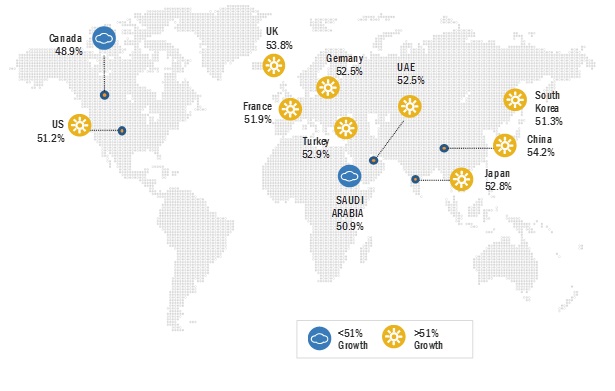

Regional CAGRs of the 5G Market in Aviation

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2026 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

End-Use, Communication Infrastructure, Technology, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, and Rest of the World |

|

Companies Covered |

Ericsson (Sweden), Nokia (Finland), Cisco Systems (US), Panasonic Avionics Corporation (US), Huawei Technologies Co. Ltd. (China), Gogo LLC (US), Global Eagle Entertainment (US), ONEWEB (US), Aeromobile Communications (UK), Smartsky Networks (US), Inseego Corp (US) and Intelsat (US) |

5G Market in Aviation, By End-use

- 5G Infrastructure for Airport

- 5G Infrastructure for Aircraft

5G Market in Aviation, By Communication Infrastructure

- Small cell

- Distributed Antenna System

5G Market in Aviation, By Technology

- Enhanced Mobile Broadband

- Fixed Wireless Access

- Ultra-Reliable Low Latency Communications/ Massive Machine Type Communications

5G Market in Aviation, By Application

- Airport Operations

- Aircraft Operations

5G Market in Aviation, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (RoW)

Key market players in the 5G market in aviation include Ericsson (Sweden), Nokia (Finland), Cisco Systems (US), Panasonic Avionics Corporation (US), Huawei Technologies Co. Ltd. (China), Gogo LLC (US), Global Eagle Entertainment (US), ONEWEB (US), Aeromobile Communications (UK), Smartsky Networks (US), Inseego Corp (US) and Intelsat (US).

Recent Developments:

- In April 2019, the company partnered with TIM (Italy), for installing 5G demo area at Leonardo Da Vinci airport in Rome, Italy, to provide live and virtual guided tour services to passengers at Terminal 3 of the airport.

- In May 2019, Gogo announced that it developed 5G services for the smaller regional jets and business jets. This 5G service provides faster speed to air-to-ground (ATG) for fast communication services.

Critical Questions Addressed by the Report:

- What is the growth perspective of the 5G market in aviation?

- What are the key dynamics and trends governing the market?

- What are the key sustainability strategies adopted by the leading players in the 5G market in aviation?

- What are the new and emerging technologies and use cases disrupting 5G in the aviation industry?

- What are the key applications where 5G services play a significant role in the aviation industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Market Definition & Scope

2.2 Research Approach & Methodology

2.2.1 Bottom-Up Approach

2.2.2 5G Infrastructure for Airport Market Approach

2.2.3 5G Infrastructure for Aircraft Market Approach

2.2.3.1 5G Services Market Approach

2.2.3.1.1 5G Services Market for Aircraft Operations Approach

2.2.3.1.2 5G Services Market for Airport Operations Approach

2.2.4 Bottom-Up Approach

2.2.5 Top-Down Approach

2.3 Triangulation & Validation

2.3.1 Triangulation Through Secondary Research

2.3.2 Triangulation Through Primaries

2.4 Research Assumptions

2.4.1 Market Sizing and Market Forecasting

2.5 Risk Analysis

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in 5G Market in Aviation From 2021 to 2026

4.2 5G Market in Aviation, By End Use

4.3 5G Market in Aviation, By Technology

4.4 5G Market in Aviation, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for A Better Flight Experience

5.2.1.2 Need for Fast Internet Connectivity

5.2.1.3 Use of 5G in IoT

5.2.2 Opportunities

5.2.2.1 Deployment of Flying Taxis and Delivery Drones

5.2.2.2 Increasing Focus on Smart Cabins

5.2.3 Challenges

5.2.3.1 Technology Limitations to Support Consistent High-Speed Connections

5.2.3.2 Difficulty in Sharing Spectrum Bands

5.2.3.3 Huge Investment Involved in Developing 5G Infrastructure

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Adoption of 5G Technology, By Country

6.3 5G in Aviation Use Cases

6.3.1 5G for Air Taxis

6.3.2 5G in Airlines: Gogo 5G

6.3.3 5G in Aerospace Production

6.3.4 5G at Airports

6.3.5 5G Service Robots: Tellu

6.3.6 5G Drones

6.4 5G Direct Air-To-Ground Communications Requirements for Airlines

6.5 Prospective Airlines to Offer 5G In-Flight Network, By Region

7 5G Market in Aviation, By End Use (Page No. - 44)

7.1 Introduction

7.2 5G Infrastructure for Airport

7.2.1 Passenger, Cargo & Baggage

7.2.1.1 Need for Fast Internet-Connected Ground Operators to Send Across Real-Time Data About Baggage and Gates is Expected to Fuel the Growth of 5G Infrastructure for Airport

7.2.2 Air Traffic Control/Air Traffic Management

7.2.2.1 Introduction of Nextgen Air Traffic System is Anticipated to Grow the Demand for 5G Infrastructure for Airport

7.2.3 Communication & Security

7.2.3.1 Rising Demand for Good Voice Communication and High-Speed Internet Connection By Passengers at Airports Will Fuel the Growth of 5G Infrastructure for Airport

7.2.4 Demand for 5G Infrastructure for Airport

7.2.4.1 Rise in Development of Smart Connected Airports is Anticipated to Boost Growth of New Airports Demand for 5G

7.3 5G Infrastructure for Aircraft

7.3.1 Flight Operations

7.3.1.1 Applications of 5G, Such as Fast Data Streaming and Real-Time Health Monitoring, are Expected to Fuel the Growth of 5G Infrastructure for Aircraft

7.3.2 Drone Operations

7.3.2.1 5G is Anticipated to Speed the Acquisition of Real-Time Data of Passenger Drones/Evtol Aircraft/Air Taxis for Ground Station Operators

7.3.3 Demand for 5G Infrastructure for Aircraft

7.3.3.1 Rise in Development of Connected Aircrafts is Expected to Fuel Growth of New Aircrafts Demand for 5G

8 5G Market in Aviation, By Communication Infrastructure (Page No. - 49)

8.1 Introduction

8.2 Small Cells

8.2.1 Improved Capacity and Increased Coverage of 5G Services Through Small Cells are Anticipated to Drive Small Cells Segment

8.3 Distributed Antenna Systems (DAS)

8.3.1 Growing Demand for Continuous On-Connectivity is Expected to Fuel the DAS Segment’s Growth

9 5G Market in Aviation, By Technology (Page No. - 53)

9.1 Introduction

9.2 Massive Machine Type Communications (MMTC) and Ultra-Reliable Low-Latency Communications (URLLC)

9.2.1 Need for A Latent Free 5G Connection is Anticipated to Fuel the Growth of URLLC/MMTC

9.3 Enhanced Mobile Broadband (EMBB)

9.3.1 Demand for In-Flight Entertainment & Real-Time Air Traffic Alerts is Expected to Drive the Growth of EMBB

9.4 Fixed Wireless Access (FWA)

9.4.1 Need to Reduce Last Mile Connectivity Expenditure is Anticipated to Boos the Growth of FWA

10 5G Services Market in Aviation, By Application (Page No. - 56)

10.1 Introduction

10.2 Airport Operations

10.2.1 Need for High-Speed Connectivity By Passengers Waiting in Airports is Anticipated to Fuel the Growth of 5G Services Market in Airport Operations

10.3 Aircraft Operations

10.3.1 Rise in Demand for Better Flight Experience and Fast Internet Connection Throughout Flight Journey Will Fuel Growth of 5G Services Market in Aircraft Operations

11 5G Market in Aviation, By Region (Page No. - 59)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increasing Investment for 5G in Aviation By Key Players in US Such as At&T, T-Mobile, Sprint, Verizon, and Charter

11.2.2 Canada

11.2.2.1 Rise in Testing of 5G Technology By Canadian Telecom Operators

11.3 Europe

11.3.1 UK

11.3.1.1 UK is Ahead in Implementation of 5G Infrastructure at Airports

11.3.2 Germany

11.3.2.1 German Telecom Company Deutsche Telekom (Dt) is Conducting Extensive R&D Activity in the Field of 5G Technology

11.3.3 Spain

11.3.3.1 Orange Sa A French Multinational Telecommunications Corporation, is Expected to Help Spain Deploy 5G Network at Airports and Smart Cities

11.3.4 France

11.3.4.1 France is Focusing on Collaborations With Nokia to Develop 5G Network for Industries Such as Aviation

11.3.5 Turkey

11.3.5.1 Turkey's Largest Telecom Carrier Turkcell Declared Its Intention to Join Hands With Huawei to Build A 5G-Oriented All-Cloud Core Network.

11.3.6 Rest of Europe

11.3.6.1 Increasing Developments of 5G Infrastructure in Rest of European Countries Will Drive the 5G Market

11.4 APAC

11.4.1 China

11.4.1.1 China is Leader in Providing 5G Technologies Due to Presence of 5G Technology Providers Huawei and China Mobile

11.4.2 Japan

11.4.2.1 Rising Focus of Government in Development of 5G Infrastructure at Airports

11.4.3 South Korea

11.4.3.1 Faster Adoption of Technology and Implementation of 5G Enabled Network

11.4.4 India

11.4.4.1 Reliance, Airtel, Bsnl, Samsung and Nokia are Adopting Organic Strategies to Build 5G Network Infrastructure for India

11.4.5 Australia

11.4.5.1 Telstra Australia's Largest Telecommunications Company, Indicated Its Plan to have 200 5G-Ready Sites By 2019 in Australia

11.4.6 Rest of APAC

11.4.6.1 Countries Such as Singapore and Thailand are Closer to the Launch of 5G Network Because of the Active Participation of Government Bodies.

11.5 Middle East

11.5.1 UAE

11.5.1.1 Etisalat Plans to Introduce 5G Network Services in the New Midfield Terminal Building (MTB) of the Abu Dhabi International Airport

11.5.2 Saudi Arabia

11.5.2.1 Saudi Arabia’s Cross-Border City Neom Implemented 5G Network at Its Airport

11.5.3 Rest of Middle East

11.5.3.1 Rising Demand for Good Flight Experience and Faster In-Flight Connectivity in International and Domestic Airlines

11.6 Rest of the World

11.6.1 Latin America

11.6.1.1 The Telecommunication Industry in Latin America Offers 4G Services and has Started Initial Discussions on 5G Technology

11.6.2 Africa

11.6.2.1 Mtn and Vodacom Already Planning to Bring 5G By Partnering With Ericsson and Zte in Africa

12 Competitive Landscape (Page No. - 94)

12.1 Introduction

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Ranking of Key Players, 2020

12.4 Competitive Scenario

12.4.1 New Product Launches

12.4.2 Contracts

12.4.3 Other Strategies

13 Company Profiles (Page No. - 100)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Huawei

13.2 Ericsson

13.3 Nokia Corporation

13.4 Cisco Systems

13.5 Panasonic Avionics Corporation

13.6 Gogo

13.7 Global Eagle Entertainment

13.8 ONEWEB

13.9 Aeromobile Communications

13.10 Smartsky Networks

13.11 Inseego Corp.

13.12 Intelsat

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 125)

14.1 Discussion Guide

14.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.2 Available Customizations

14.3 Related Reports

14.4 Author Details

List of Tables (70 Tables)

Table 1 USD Exchange Rates

Table 2 5G Direct Air-To-Ground Communications (Da2Gc) Kpi Requirements

Table 3 Market in Aviation, By End Use, 2020–2026 (USD Million)

Table 4 5G Infrastructure Market for Airport, By Demand Type, a2020–2026 (USD Million)

Table 5 5G Infrastructure Market for Aircraft, By Demand Type, a2020–2026 (USD Million)

Table 6 Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 7 Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 8 5G Services Market in Aviation, By Application, 2020–2026 (USD Million)

Table 9 Market in Aviation, By Region, 2020–2026 (USD Million)

Table 10 North America Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 11 North America Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 12 North America 5G Services Market in Aviation, By Application, a2020–2026 (USD Million)

Table 13 North America Market in Aviation, By Country, a2020–2026 (USD Million)

Table 14 US Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 15 US Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 16 Canada Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 17 Canada Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 18 Europe Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 19 Europe Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 20 Europe 5G Services Market in Aviation, By Application, a2020–2026 (USD Million)

Table 21 Europe Market in Aviation, By Country, 2020–2026 (USD Million)

Table 22 UK Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 23 UK Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 24 Germany Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 25 Germany Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 26 Spain Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 27 Spain Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 28 France Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 29 France Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 30 Turkey Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 31 Turkey Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 32 Rest of Europe Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 33 Rest of Europe Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 34 APAC Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 35 APAC Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 36 APAC 5G Services Market in Aviation, By Application, a2021–2026 (USD Million)

Table 37 APAC Market in Aviation, By Country, 2020–2026 (USD Million)

Table 38 China Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 39 China Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 40 Japan Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 41 Japan Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 42 South Korea Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 43 South Korea Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 44 India Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 45 India Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 46 Australia Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 47 Australia Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 48 Rest of APAC Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 49 Rest of APAC Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 50 Middle East Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 51 Middle East Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 52 Middle East 5G Services Market in Aviation, By Application, a2021–2026 (USD Million)

Table 53 Middle East Market in Aviation, By Country, 2020–2026 (USD Million)

Table 54 UAE Market in Aviation, By Technology, 2020–2026 (USD Million)

Table 55 UAE Market in Aviation, By Communication Infrastructure, a2020–2026 (USD Million)

Table 56 Saudi Arabia Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 57 Saudi Arabia Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 58 Rest of Middle East Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 59 Rest of Middle East Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 60 Rest of the World 5G Market in Aviation, By Communication Infrastructure, 2020–2026 (USD Million)

Table 61 Rest of the World 5G Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 62 Rest of the World 5G Services Market in Aviation, By Application 2020–2026 (USD Million)

Table 63 Rest of the World 5G Market in Aviation, By Country, a2020–2026 (USD Million)

Table 64 Latin America 5G Market in Aviation, By Technology, a2020–2026 (USD Million)

Table 65 Latin America 5G Market in Aviations, By Communication Infrastructure, 2020–2026 (USD Million)

Table 66 Africa 5G Market in Aviations, By Technology, 2020–2026 (USD Million)

Table 67 Africa 5G Market in Aviations, By Communication Infrastructure, a2020–2026 (USD Million)

Table 68 New Product Launches, 2015–2019

Table 69 Contracts, 2015–2019

Table 70 Other Strategies, 2015–2019

List of Figures (40 Figures)

Figure 1 5G Market in Aviation Segmentation

Figure 2 Research Process Flow

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for the Research Study on the 5G Market in Aviations

Figure 8 Based on End Use, 5G Infrastructure for Airport Segment Estimated to Account for A Larger Share of the 5G Market in Aviations in 2021

Figure 9 Based on Technology, EMBB Segment Projected to Lead the 5G Market in Aviations From 2021 to 2026

Figure 10 Based on Communication Infrastructure, Distributed Antenna System Segment Estimated to Account for A Larger Share of the 5G Market in Aviations in 2021

Figure 11 Growing Demand for Better Flight Experience and Need for Fast Internet Connectivity Across the Globe are Expected to Drive the 5G Market in Aviations

Figure 12 5G Market in Aviations, By End Use, 2021 & 2025

Figure 13 5G Market in Aviations, By Technology

Figure 14 5G Market in Aviations in Asia Pacific Projected to Register the Highest CAGR From 2021 to 2026

Figure 15 Market Dynamics of the 5G Market in Aviations

Figure 16 Adoption of 5G Technology Through 2025, By Country (%)

Figure 17 Prospective Airlines to Offer 5G In-Flight Network

Figure 18 5G Infrastructure for Aircraft Segment Projected to Register A Higher CAGR During the Forecast Period

Figure 19 Small Cells Segment Expected to Grow at A Higher Rate During the Forecast Period

Figure 20 5G Market in Aviations, By Technology, 2021 & 2026 (USD Million)

Figure 21 5G Services Market in Aviation, By Application, 2021 & 2026 (USD Million)

Figure 22 China Estimated to Grow at Highest CAGR During the Forecast Period

Figure 23 North America 5G Market in Aviations Snapshot

Figure 24 Europe 5G Market in Aviations Snapshot

Figure 25 APAC 5G Market in Aviations Snapshot

Figure 26 Key Developments By Leading Players in the 5G Market in Aviations Between 2015 and 2019

Figure 27 5G Market in Aviations Competitive Leadership Mapping, 2020

Figure 28 Market Ranking of Top Players in the 5G Market in Aviations, 2018

Figure 29 Huawei: Company Snapshot

Figure 30 Ericsson: Company Snapshot

Figure 31 Ericsson: SWOT Analysis

Figure 32 Nokia Corporation: Company Snapshot

Figure 33 Nokia Corporation: SWOT Analysis

Figure 34 Cisco Systems: Company Snapshot

Figure 35 Gogo: Company Snapshot

Figure 36 Gogo: SWOT Analysis

Figure 37 Global Eagle Entertainment: Company Snapshot

Figure 38 Global Eagle Entertainment: SWOT Analysis

Figure 39 Inseego Corp.: Company Snapshot

Figure 40 Intelsat: Company Snapshot

The study involved four major activities in estimating the current market size for 5G market in aviation. Exhaustive secondary research was undertaken to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments of 5G market in aviation.

Secondary Research

In 5G market in aviation the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and 5G network and infrastructure databases.

Primary Research

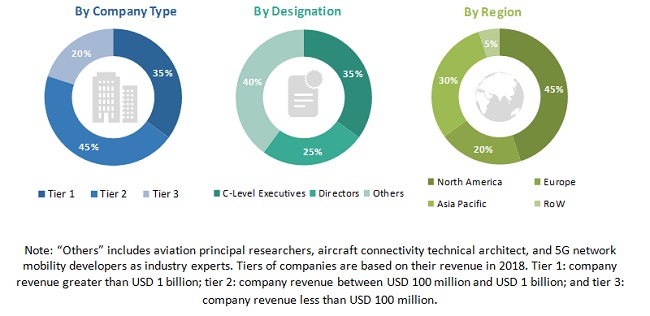

The 5G market in aviation comprises several stakeholders, such as 5G hardware and software suppliers, service providers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by various end-users, such as component manufacturers as well as facility providers and OEMs. The supply side is characterized by technology advancements in 5G in aircraft and airports and the development of 5G infrastructure to be installed at airports and aircraft. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the 5G market in aviation. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the 5G market in the aviation industry.

Report Objectives

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the 5G market in aviation

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, acquisitions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in 5G Market