Distributed Antenna System (DAS) Market Size, Share, Statistics and Industry Growth Analysis by Offering (Component, Services), Coverage (Indoor, Outdoor), Ownership Model, Vertical (Commercial, Public), User Facility Area, Frequency Protocol (Cellular, VHF/UHF), Network Type, Signal Sources and Region - Global Forecast to 2028

Updated on : October 22, 2024

Distributed Antenna System Market Size & Share :

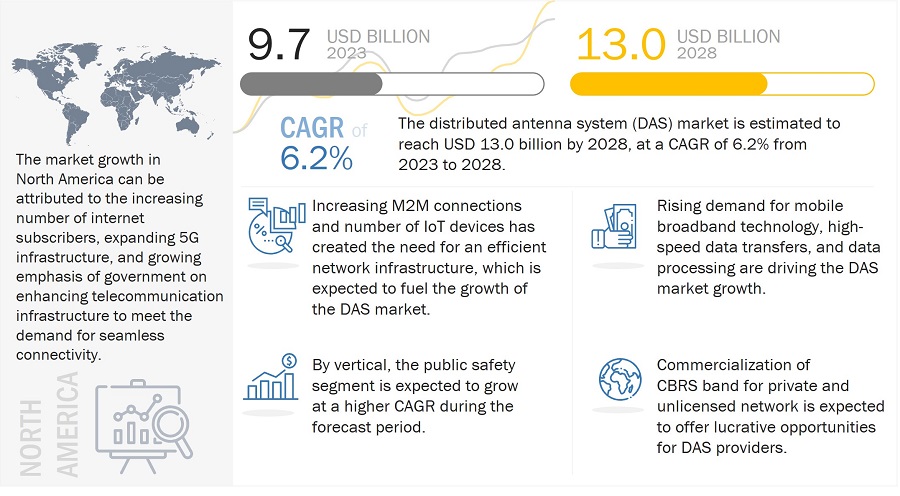

The global Distributed Antenna Systems Market size is projected to grow from USD 9.7 billion in 2023 to USD 13.0 billion by 2028, growing a CAGR of 6.2% during the forecast period 2023 to 2028

The growing mobile data traffic and Growing need for strong and reliable cellular connectivity for Internet of Things (IoT) are expected to propel the DAS market size in the next five years. However, routing backhauling issue associated with DAS networks and complexities associated with installation of DAS are likely to pose challenges for the industry players.

The objective of the report is to define, describe, and forecast the distributed antenna system industry based on offering, coverage, ownership model, vertical, user facility area, frequency protocol, network type, signal sources, and region.

Distributed Antenna System (DAS) Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Distributed Antenna System Market Growth Dynamics

Driver: Rising demand for enhanced network coverage and need to eliminate connectivity gaps in buildings

Mobile device users expect a seamless network for continued connectivity at every location, including stadiums, theaters, malls, railway stations, and airports. Large cell sites and cellular antenna towers deliver wireless reception and transmission across long distances, but dead spots often exist in clusters of buildings or within individual buildings. With their increasing dependence on connectivity, end users cannot afford to have in-building dead zones. DAS alleviate this issue by providing reliable coverage throughout the building.

Although macro cell sites and antennas installed by telecom operators cover most of the venues mentioned above, their coverage is very weak and capacity is low. HetNet solutions, such as small cells, can expand the coverage of mobile networks. However, the deployment process of new cell sites is challenging and costly for mobile operators, and, thus, many operators now prefer DAS to provide seamless connectivity to customers. In addition, DAS aids in ensuring constant communication for end users and emergency responders inside buildings. Also, modern construction processes for many enterprise buildings involve techniques and materials that block wireless communication signal penetration or degrade the quality of received signals. DAS are designed to extend wireless coverage within structures and enable radios and mobile phones to work regardless of their position within the building.

Restraint: Routing backhauling issue associated with DAS networks

The backhaul radio provides a high level of flexibility, as it is claimed that network operators can deploy their DAS anywhere. Although routing backhaul is a problem associated with both DAS and small cell networks, DAS is typically more problematic as each radio head used to broadcast the cellular signal requires routed fiber-optic cables, making the installation process troublesome.

This process can potentially create issues with cable management, as keeping the fiber-optic lines out of sight requires the cables to be carefully routed through the walls and other important structures of the facility. If this process is not conducted correctly, the routing of these cables can adversely affect the facility’s structural integrity, making it unsafe and unfit for visiting patrons.

Opportunities: Increase in commercial spaces across Association of Southeast Asian Nations (ASEAN)

The Association of Southeast Asian Nations (ASEAN) has witnessed a tremendous increase in the number of commercial spaces over the last few years, driven by rapid urbanization and rising middle-class income levels. This also led to the growth in demand for wireless connectivity services in various places such as office and residential buildings, metro stations, subways, airports, and stadiums. According to the World Economic Forum, major Southeast Asian countries, such as Vietnam, Myanmar, and Thailand, have emerged as a low-cost alternative to China for living.

Additionally, the economic growth of the ASEAN region is expected to be beneficial for Singapore as global firms seek to establish their presence in Southeast Asia, with many selecting the country as their regional headquarters. These factors are expected to fuel the requirement for in-building and outdoor wireless services, which would be offered through the deployment of DAS at various sites.

Challenges: Upgradeability issues of existing DAS networks

DAS networks have upgradeability issues when it comes to network advancement. As most carriers are now upgrading to the 5G network, it is more difficult to upgrade an existing DAS network than the upgrade of a comparable small cell network. Typically, small cell networks can be upgraded over the air (OTA) without the need for a technician to visit the cell site. DAS network upgrades, however, may require the replacement of hardware, i.e., base station replacement, making the upgrade process more costly and time-consuming.

Distributed Antenna Systems Market Analysis :

The Distributed Antenna System (DAS) market is analyzed to be growing significantly due to its critical role in addressing the challenges of wireless communication in densely populated and large-scale environments.This growth is driven by the increasing mobile data traffic and the need for better network coverage and capacity. Key industry sectors, such as telecommunications, healthcare, and hospitality, are heavily investing in DAS to improve connectivity and enhance user experience. Furthermore, the regulatory push for improved public safety communication systems is fostering the adoption of DAS in government buildings and transportation hubs. However, the high cost of installation and maintenance, along with the complexity of integrating DAS with existing networks, poses challenges that could impede market growth.

Distributed Antenna System Market Growth :

The Distributed Antenna System (DAS) market is poised for robust growth, fueled by the escalating demand for improved wireless communication and the expansion of mobile networks. The growth trajectory is supported by technological advancements and the increasing penetration of mobile devices, which necessitate reliable and high-performance network infrastructure. The widespread rollout of 5G technology is a major growth driver, as DAS systems are essential for meeting the coverage and capacity requirements of 5G networks, especially in high-density urban areas and large buildings. Additionally, the rise of remote working and digital transformation across industries is boosting the need for efficient indoor network solutions, further accelerating market growth. To capitalize on this growth, industry players are focusing on strategic partnerships, product innovations, and expanding their geographic presence to cater to the rising global demand for DAS solutions.

Distributed Antenna Systems Market Trends:

The Distributed Antenna System (DAS) market is experiencing several noteworthy trends driven by the increasing demand for enhanced mobile connectivity and data transmission. One significant trend is the growing adoption of DAS in large public venues such as stadiums, airports, and convention centers, where ensuring reliable and high-capacity wireless coverage is crucial. Additionally, the rise of smart cities and IoT applications is propelling the deployment of DAS to support the extensive network requirements of these advanced infrastructures. Another trend is the integration of DAS with 5G technology, which aims to deliver ultra-fast internet speeds and low latency. As businesses and consumers seek seamless connectivity, the trend towards indoor DAS installations in commercial buildings and residential complexes is also gaining momentum, enhancing indoor coverage and boosting overall network performance.

Commercial Vertical to acquire significant share in DAS market

The commercial vertical is expected to hold the largest market share during the forecast period. DAS deployments are mainly concentrated in the commercial vertical; this vertical accounted for 87.1% share of the overall market in 2022. Different commercial spaces such as public venues, healthcare organizations, enterprises, and educational institutions are witnessing a high demand for DAS due to the increased mobile data traffic and the number of IoT devices. According to a report published by Ericsson Mobility in 2022, the total mobile data traffic for all devices is expected to increase by four times during the forecast period, reaching ~453 exabytes (EB) per month by 2028.

Service offering to command largest share in DAS market

The service segment accounted for the largest market share in 2022. It is further expected to dominate the market during the forecast period, growing at a higher CAGR between 2023 and 2028. Installation services contribute significantly to the overall growth of the DAS market. Both DAS manufacturers and DAS integrators offer installation services. Major installation services include equipment ordering; cable installation; equipment pre-staging and configuration; installation of the head-end and remote equipment; and coordination with wireless service providers for design approval, rebroadcast agreements, and commissioning (system activation).

Distributed Antenna System Market Regional Analysis:

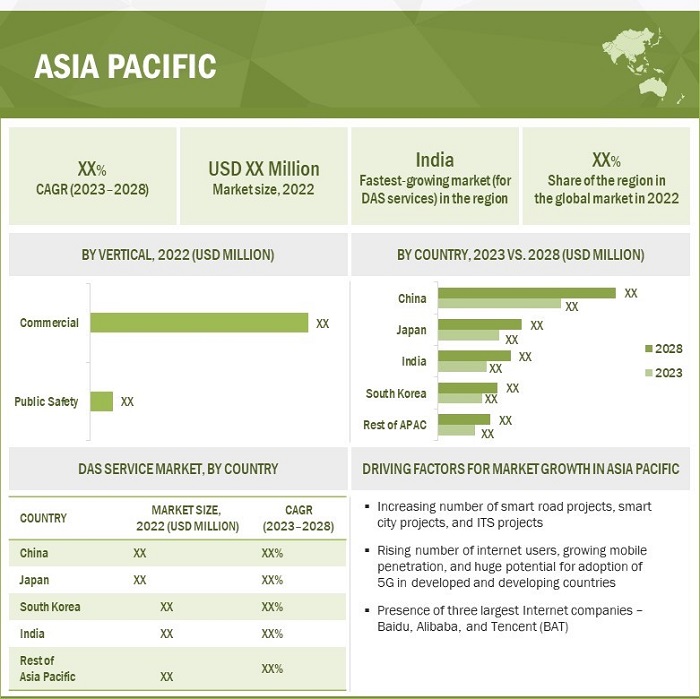

DAS market to witness highest demand from Asia Pacific

China held the largest share of the DAS market size in Asia Pacific for services and components in 2022 and is projected to dominate both markets during the forecast period. Telecom operators and internet providers such as Tencent (China), Baidu (China), and Alibaba (China) continue with various developments in 5G networks in China. The 4G network is still thriving in the Chinese market, and the country, with the world's largest population, had an internet usage rate of 65.2% (912 million) of the total population of 1.4 billion as of January 2021 (DataReportal). As of January 2021, China's mobile web traffic accounted for 61.6% of the total web traffic. With the increasing data traffic, the demand for DAS in China is expected to increase during the forecast period.

The integration of IoT and 5G will help enterprises to manage and scale their IoT businesses from a unified platform. With unprecedented speed and flexibility, 5G transports more data than before, with greater responsiveness and reliability. 5G speeds up cloud services, while AI analyzes and learns from the same data more quickly. AI is required for a fully operational and efficient 5G network. The use of 5G networks allows for the integration of machine learning and AI at the network edge. 5G allows multiple IoT devices to connect at the same time, generating massive amounts of data that must be processed using machine learning and AI. In May 2022, Tencent, the Chinese technology giant, announced an investment of USD 69.9 billion over the next five years in areas ranging from cloud computing to artificial intelligence. It would also back China's push for "new infrastructure," a term used by Beijing to refer to technology areas such as artificial intelligence, next-generation mobile networks of 5G, and transportation infrastructure such as electric cars.

Distributed Antenna System (DAS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Distributed Antenna System Companies - Key Market Players:

Major vendors in the distributed antenna system companies include CommScope (US), Corning (US), PBE Axell (UK), Comba Telecom Systems (China), SOLiD Technologies (US), American Tower (US), AT&T (US), Boingo Wireless (US), Dali Wireless (US), Zinwave (US), Whoop Wireless (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Advanced RF Technologies (ADRF) (US), Galtronics (Canada), Connectivity Wireless (US), Betacom (US), among others.

Distributed Antenna System Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 9.7 billion in 2023 |

| Projected Market Size | USD 13.0 billion by 2028 |

| Growth Rate | At A CAGR of 6.2% |

|

Distributed Antenna Systems Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

CommScope (US), Corning (US), PBE Axell (UK), Comba Telecom Systems (China), SOLiD Technologies (US), American Tower (US), AT&T (US), Boingo Wireless (US), Dali Wireless (US), Zinwave (US), Whoop Wireless (US), HUBER+SUHNER (Switzerland), JMA Wireless (US), Advanced RF Technologies (ADRF) (US), Galtronics (Canada), Connectivity Wireless (US), Betacom (US), among others. |

Distributed Antenna System (DAS) Market Highlights

This report categorizes the DAS market trends based on component, product, application, vertical, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Coverage |

|

|

By Ownership Model |

|

|

By User Facility Area |

|

|

Distributed Antenna System Market Size By Vertical |

|

|

By Frequency Protocol |

|

|

Distributed Antenna Systems Market Size, By Network Type |

|

|

By Signal Source |

|

|

By Region |

|

Recent developments DAS Industry :

- In January 2023, Wilson Electronics acquired Zinwave Communications, a provider of unique, patented ultra-wideband RF over fiber solutions with more than 850 installations in 26 countries. The transaction expanded the total addressable market and opened further opportunities for both organizations internationally.

- In June 2022, Comba Telecom Systems Holdings Limited launched 4G/5G (8TR) Green Integrated Base Station Antenna, which expanded its tower top portfolio to support operators in achieving carbon neutrality targets. To support the low-carbon deployment of 5G networks, Comba Telecom launched a high-end 4G/5G (8TR) integrated Base Station Antenna (BSA), which meets the capacity and coverage requirements, and has become the mainstream tower-top antenna solution for global 5G network construction.

- In December 2022, Boingo Wireless, a leading provider of wireless solutions for the US military, deployed a property-wide Wi-Fi network at the Armed Forces Recreation Center (AFRC) Edelweiss Lodge and Resort located in Germany’s Bavarian Alps. Boingo Wireless designed, installed, and manages the Wi-Fi network throughout the sprawling resort, including rooms, meetings spaces, spa, and restaurants.

- In August 2022, Corning Incorporated expanded manufacturing capacity for optical cables. The new facility is Corning's latest in a series of investments in fiber and cable manufacturing, totaling more than USD 500 million since 2020. These investments, supported by customer commitments, nearly double Corning's ability to serve the US cable market and connect more people and communities.

Frequently Asked Questions (FAQ):

Which are the major companies in the DAS market? What are their primary strategies to strengthen their market presence?

CommScope (US), Corning (US), Comba Telecom Systems (China), SOLiD Technologies (US), American Tower (US), are the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for the Commercial vertical in terms of application?

Healthcare is an commercial vertical with high growth opportunities owing to advancements in the government vertical.

What are the opportunities for new market entrants?

Factors such as increase in commercial spaces across Association of Southeast Asian Nations (ASEAN) and use of distributed antenna system (DAS) technology in Citizens Broadband Radio Service (CBRS) are creating opportunities for the players in the market.

Which offering is expected to drive market growth in the next six years?

Service is expected to remain the major offering driving DAS demand. Installation services contribute significantly to the overall growth of the DAS market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing mobile data traffic- Rising demand for enhanced network coverage and need to eliminate connectivity gaps in buildings- Growing need for strong and reliable cellular connectivity for Internet of Things (IoT)- Growing focus on enhancing spectrum efficiency- Deployment of distributed antenna systems in buildings based on modern and sustainable conceptsRESTRAINTS- High costs associated with DAS network deployment- Routing backhauling issue associated with DAS networksOPPORTUNITIES- Growth in requirement for public safety connectivity- Increase in commercial spaces across Association of Southeast Asian Nations (ASEAN)- Use of distributed antenna system (DAS) technology in Citizens Broadband Radio Service (CBRS)CHALLENGES- Complexities associated with installation of DAS- Upgradeability issues of existing DAS networks

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 PRICING ANALYSISPRICE TREND ANALYSIS FOR DAS DEPLOYMENT

-

5.7 TECHNOLOGY ANALYSISKEY TRENDS IN DISTRIBUTED ANTENNA SYSTEM MARKET- Bring your own device (BYOD) and DAS- Citizen Broadband Radio Networks CBRS and DAS- Small cell and DAS complimenting each other

-

5.8 CASE STUDY ANALYSISCOMMSCOPE SUPPORTS ORANGE CAMEROON TO DELIVER SEAMLESS EXPERIENCE TO SUBSCRIBERS FOR AFCON 2022ACTIVE DAS DEPLOYMENT IN HONG KONGMERCY HOSPITAL INSTALLED CEL-FI’S QUATRA DAS TO IMPROVE INDOOR CELLULAR CONNECTIVITYHATCHER STATION HEALTH CLINIC IMPROVED INDOOR COVERAGE WITH NEW DAS SOLUTIONQUEEN ALIA INTERNATIONAL AIRPORT’S CELLULAR COVERAGE

-

5.9 PATENT ANALYSISLIST OF MAJOR PATENTS

- 5.10 TRADE ANALYSIS AND TARIFF ANALYSIS

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO DISTRIBUTED ANTENNA SYSTEMSSTANDARDS AND REGULATIONS RELATED TO DISTRIBUTED ANTENNA SYSTEMS

- 6.1 INTRODUCTION

-

6.2 COMPONENTANTENNA NODES/RADIO NODES- Omnidirectional antennae and directional antennae most common types of antennae- Antenna nodes/Radio nodes, by type- Antenna nodes/Radio nodes, by technology- Antenna nodes/Radio nodes, by coverage- Antenna nodes/Radio nodes, by configurationHEAD-END UNITS- Help to transport signals received by donor antenna to receiverRADIO UNITS- Receive signals from head-end units and transmit them through antennasBIDIRECTIONAL AMPLIFIERS (BDA)- Used to amplify downlink signals from donor sitesDAS/POINT-OF-INTERFACE (POI) TRAYS- Provide integrated, convenient, and single connection point when using multiple base stations with common DAS systemsOTHERS

-

6.3 SERVICEPRE-SALES SERVICES- Pres-sales services segment accounted for second-largest share of DAS market for services in 2022INSTALLATION SERVICES- Installation services segment to dominate DAS market for services during forecast periodPOST-SALES SERVICES- Post-sales services held smallest share of DAS market for services in 2022

- 7.1 INTRODUCTION

-

7.2 INDOORIDAS ACCOUNT FOR MAJORITY OF DAS DEPLOYMENTACTIVE- Uses active components to distribute signals- Analog- DigitalPASSIVE- No carrier approval required and considerably cheaper than active DASHYBRID- Offers lower signal loss than purely passive systems

-

7.3 OUTDOORUSED TO SERVE OUTDOOR AREAS OF HIGH-DENSITY URBAN AND SUBURBAN ENVIRONMENTS

- 8.1 INTRODUCTION

-

8.2 CARRIER OWNERSHIPCARRIER OWNERSHIP MODEL HELD LARGEST MARKET SHARE IN 2022

-

8.3 NEUTRAL-HOST OWNERSHIPPREFERRED FOR DAS DEPLOYMENTS AT LARGE VENUES, SUCH AS STADIUMS, MALLS, AND AIRPORTS

-

8.4 ENTERPRISE OWNERSHIPSTANDARDIZATION OF 5G TO FAVOR MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 >500 K SQ. FT.>500 K SQ. FT. SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

-

9.3 200–500 K SQ. FT.GROWING ADOPTION OF DAS IN USER FACILITY AREAS OF 200–500 K SQ. FT. TO ENSURE DATA SECURITY AND PRIVACY TO DRIVE MARKET

-

9.4 <200 K SQ. FT.<200 K SQ. FT. SEGMENT TO HOLD SMALLER MARKET SHARE THAN OTHER SEGMENTS DURING FORECAST PERIOD

- 10.1 INTRODUCTION

-

10.2 COMMERCIALPUBLIC VENUES- Use combination of DAS and small cells to offer cellular access to publicHOSPITALITY- Deploys DAS to ensure seamless wireless connectivityHEALTHCARE- Deploys in-building wireless solutions to maximize operational efficiency and improve patient careEDUCATION- Implements CBRS-based private mobile networks to eliminate problem of unreliable coverageENTERPRISE- Uses DAS to extend coverage and capacity for public mobile network connectivityRETAIL- CBRS-based private mobile networks utilized for surveillance and secure staff communicationAIRPORT & TRANSPORTATION- BTS signal sources enable addition of extra capacity in high-occupancy areasINDUSTRIAL- Industry 4.0 to increase deployment of distributed antenna systems in industrial verticalGOVERNMENT- DAS enable effective cellular connectivity, ensure efficient workforce management, and support mission-critical communication services

-

10.3 PUBLIC SAFETYDAS IMPLEMENTATION ENSURES RADIO COMMUNICATION THROUGHOUT BUILDING IN EVENT OF EMERGENCY

- 11.1 INTRODUCTION

-

11.2 CELLULAR5G ROLLOUT TO BOOST DEMAND FOR DISTRIBUTED ANTENNA SYSTEMS FOR CELLULAR FREQUENCY PROTOCOL DURING FORECAST PERIOD

-

11.3 VERY HIGH FREQUENCY/ULTRA-HIGH FREQUENCY (VHF/UHF)INCREASING DEPLOYMENT OF PUBLIC SAFETY NETWORKS TO FUEL DEMAND FOR VHF/UFH DAS

- 11.4 OTHERS

- 12.1 INTRODUCTION

-

12.2 PUBLIC NETWORKSTRINGENT GOVERNMENT REGULATIONS FOR SEAMLESS CELLULAR NETWORK COVERAGE TO BOOST DEMAND FOR DAS

-

12.3 PRIVATE LONG-TERM EVOLUTION (LTE)/CITIZENS BROADBAND RADIO SERVICE (CBRS)PRIVATE LTE/CBRS OFFERS SEPARATE OR PRIVATE WIRELESS NETWORKS FOR BUSINESSES AND GOVERNMENTS FOR DIFFERENT APPLICATIONS

- 13.1 INTRODUCTION

-

13.2 OFF-AIR ANTENNAS (REPEATERS)DAS WITH OFF-AIR SIGNAL SOURCE USED TO EXTEND NETWORK COVERAGE AT EDGES OF NETWORK

-

13.3 ON-SITE BASE TRANSCEIVER STATION (BTS)BTS RESPONSIBLE FOR CONNECTING MOBILE DEVICES TO NETWORK

-

13.4 SMALL CELLSHAVE UNIQUE CAPABILITY TO HANDLE HIGH DATA RATES FOR MOBILE BROADBAND AND IOT

- 14.1 INTRODUCTION

-

14.2 NORTH AMERICAUS- Advent of 5G network and growing use of mobile IoT applications to drive marketCANADA- Increasing demand for high-speed wired and wireless networking services to support market growthMEXICO- Rising demand for 5G technology and increase in internet data traffic to propel market growth

-

14.3 EUROPEUK- Focus on development of 5G infrastructure to drive marketGERMANY- Digital transformation initiatives to fuel demand for DASFRANCE- Presence of several big telecom operators to generate demand for DASNETHERLANDS- LTE-M and NB-IoT cellular developments to propel market growthREST OF EUROPE

-

14.4 ASIA PACIFICCHINA- 5G development initiatives and smart city projects to accelerate marketJAPAN- Increasing number of IoT connections and government initiatives to promote 5G network to induce market growthSOUTH KOREA- Increasing DAS deployments in enterprises to drive marketINDIA- DAS component and DAS service markets in India to grow at highest rate during forecast periodREST OF ASIA PACIFIC

-

14.5 REST OF THE WORLDMIDDLE EAST- Increasing deployment of DAS in public venues and educational institutes to augment market growthAFRICA- Rapid automation in industries and high investments in commercial sector to boost market growth- Country-wise snippetsSOUTH AMERICA- Increasing internet penetration and significant developments in cellular networks to favor market expansionBRAZIL- Strong presence of various DAS players to support market growth

- 15.1 OVERVIEW

-

15.2 KEY PLAYER STRATEGIES/RIGHT TO WINPRODUCT PORTFOLIOREGIONAL FOCUSORGANIC/INORGANIC GROWTH STRATEGIES

- 15.3 MARKET SHARE ANALYSIS, 2021

- 15.4 REVENUE ANALYSIS OF TOP PLAYERS IN DISTRIBUTED ANTENNA SYSTEM MARKET

-

15.5 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

15.6 STARTUPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 15.7 COMPANY FOOTPRINT

-

15.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES & DEVELOPMENTSDEALSOTHERS

-

16.1 KEY PLAYERSCOMMSCOPE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCORNING INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOMBA TELECOM SYSTEMS HOLDINGS LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPBE GROUP- Business overview- Products/Services/Solutions offered- MnM viewSOLID- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAMERICAN TOWER- Business overview- Products/Services/Solutions offeredAT&T- Business overview- Products/Services/Solutions offeredBOINGO WIRELESS, INC.- Business overview- Products/Services/Solutions offeredDALI WIRELESS- Business overview- Products/Services/Solutions offeredZINWAVE- Business overview- Products/Services/Solutions offered- Recent developments

-

16.2 OTHER PLAYERSWHOOP WIRELESSKATHREIN BROADCAST GMBHHUBER+SUHNERBTI WIRELESSJMA WIRELESSWESTELL TECHNOLOGIES, INC.ADVANCED RF TECHNOLOGIES, INC.GALTRONICSCONNECTIVITY WIRELESSBETACOM INC.AIRPLUX TECHNOLOGIES LIMITEDCELLNEX TELECOMVISION TECHNOLOGIESVERIDAS TECHNOLOGIESHARRIS COMMUNICATIONS

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 PRICE OF DIFFERENT COMPONENTS OF DISTRIBUTED ANTENNA SYSTEMS

- TABLE 2 DISTRIBUTED ANTENNA SYSTEM ANTENNA PRICE LIST

- TABLE 3 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 4 LIST OF MAJOR PATENTS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE COMMERCIAL VERTICALS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

- TABLE 8 DISTRIBUTED ANTENNA SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 14 EUROPE: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 15 ASIA PACIFIC: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 16 REST OF THE WORLD: SAFETY STANDARDS FOR DISTRIBUTED ANTENNA SYSTEM MARKET

- TABLE 17 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 18 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 19 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 20 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 21 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2019–2022 (THOUSAND UNITS)

- TABLE 22 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMPONENT, 2023–2028 (THOUSAND UNITS)

- TABLE 23 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 24 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 30 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 31 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019–2022 (USD MILLION)

- TABLE 32 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023–2028 (USD MILLION)

- TABLE 33 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY CONFIGURATION, 2019–2022 (USD MILLION)

- TABLE 34 ANTENNA NODES/RADIO NODES: DISTRIBUTED ANTENNA SYSTEM MARKET, BY CONFIGURATION, 2023–2028 (USD MILLION)

- TABLE 35 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 36 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 37 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019–2022 (USD MILLION)

- TABLE 38 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023–2028 (USD MILLION)

- TABLE 39 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 SERVICE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2019–2022 (USD MILLION)

- TABLE 42 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE, 2023–2028 (USD MILLION)

- TABLE 43 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 INDOOR COVERAGE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 48 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 49 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2019–2022 (USD MILLION)

- TABLE 50 ACTIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2023–2028 (USD MILLION)

- TABLE 51 PASSIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2019–2022 (USD MILLION)

- TABLE 52 PASSIVE: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 INDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 54 INDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 55 HYBRID: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2019–2022(USD MILLION)

- TABLE 56 HYBRID: INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET, BY COMMERCIAL VERTICAL TYPE, 2023–2028 (USD MILLION)

- TABLE 57 OUTDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 OUTDOOR: DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 60 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 61 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 62 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 63 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 64 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 65 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 66 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 67 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 68 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 69 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 70 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR INDOOR COVERAGE, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 71 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2019–2022 (USD MILLION)

- TABLE 72 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET FOR OUTDOOR COVERAGE, BY OWNERSHIP MODEL, 2023–2028 (USD MILLION)

- TABLE 73 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA, 2019–2022 (USD MILLION)

- TABLE 74 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA, 2023–2028 (USD MILLION)

- TABLE 75 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 76 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 77 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 78 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 79 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 80 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 82 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 83 PUBLIC VENUES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 PUBLIC VENUES: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 HOSPITALITY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 HOSPITALITY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 HEALTHCARE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 HEALTHCARE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 EDUCATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 EDUCATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 ENTERPRISE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 ENTERPRISE: DAS MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 RETAIL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 RETAIL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 AIRPORT & TRANSPORTATION: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 INDUSTRIAL: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 GOVERNMENT: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 GOVERNMENT: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 PUBLIC SAFETY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 PUBLIC SAFETY: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 108 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 109 5G FREQUENCY BANDS IN DIFFERENT REGIONS/COUNTRIES

- TABLE 110 CELLULAR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 CELLULAR: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 VHF/UHF: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 VHF/UHF: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 OTHERS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 OTHERS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 117 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 118 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 119 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY FREQUENCY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 120 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE, 2019–2022 (USD MILLION)

- TABLE 121 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 122 PUBLIC NETWORK: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 123 PUBLIC NETWORK: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 PRIVATE LTE/CBRS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 125 PRIVATE LTE/CBRS: DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY NETWORK TYPE, 2019–2022 (USD MILLION)

- TABLE 127 DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 128 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY NETWORK TYPE, 2019–2022 (USD MILLION)

- TABLE 129 DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 130 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE, 2019–2022 (USD MILLION)

- TABLE 131 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE, 2023–2028 (USD MILLION)

- TABLE 132 TYPES OF SMALL CELLS

- TABLE 133 COMPARISON BETWEEN OFF-AIR ANTENNAS, ON-SITE BTS, AND SMALL CELLS

- TABLE 134 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 135 DISTRIBUTED ANTENNA SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 136 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 137 DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 138 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 139 DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 150 EUROPE: DAS COMPONENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 EUROPE: DAS COMPONENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 EUROPE: DAS SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 153 EUROPE: DAS SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 155 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 157 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 159 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DAS COMPONENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DAS COMPONENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DAS SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: DAS SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 170 REST OF THE WORLD: DAS COMPONENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 174 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 175 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 176 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2019–2022 (USD MILLION)

- TABLE 177 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE, BY COMMERCIAL VERTICAL, 2023–2028 (USD MILLION)

- TABLE 178 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 179 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET FOR OUTDOOR COVERAGE, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 180 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DAS MARKET

- TABLE 181 DISTRIBUTED ANTENNA SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 182 COMPANY FOOTPRINT

- TABLE 183 OFFERING FOOTPRINT OF COMPANIES

- TABLE 184 VERTICAL FOOTPRINT OF COMPANIES

- TABLE 185 REGION FOOTPRINT OF COMPANIES

- TABLE 186 DISTRIBUTED ANTENNA SYSTEM MARKET: LIST OF KEY START-UPS/SMES

- TABLE 187 DISTRIBUTED ANTENNA SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 188 DISTRIBUTED ANTENNA SYSTEM MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2019– JANUARY 2023

- TABLE 189 DISTRIBUTED ANTENNA SYSTEM MARKET: DEALS, JANUARY 2019– JANUARY 2023

- TABLE 190 DISTRIBUTED ANTENNA SYSTEM MARKET: OTHERS, JANUARY 2019– JANUARY 2023

- TABLE 191 COMMSCOPE: COMPANY OVERVIEW

- TABLE 192 COMMSCOPE: PRODUCT LAUNCHES

- TABLE 193 COMMSCOPE: DEALS

- TABLE 194 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 195 CORNING INCORPORATED: PRODUCT LAUNCHES

- TABLE 196 CORNING INCORPORATED: DEALS

- TABLE 197 CORNING INCORPORATED: OTHERS

- TABLE 198 COMBA TELECOM SYSTEMS HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 199 COMBA TELECOM SYSTEMS HOLDINGS LTD.: PRODUCT LAUNCHES

- TABLE 200 COMBA TELECOM SYSTEMS HOLDINGS LTD.: DEALS

- TABLE 201 PBE GROUP: COMPANY OVERVIEW

- TABLE 202 SOLID: COMPANY OVERVIEW

- TABLE 203 SOLID: PRODUCT LAUNCHES

- TABLE 204 AMERICAN TOWER: COMPANY OVERVIEW

- TABLE 205 AMERICAN TOWER: DEALS

- TABLE 206 AT&T: COMPANY OVERVIEW

- TABLE 207 BOINGO WIRELESS, INC.: COMPANY OVERVIEW

- TABLE 208 BOINGO WIRELESS, INC.: DEALS

- TABLE 209 DALI WIRELESS: COMPANY OVERVIEW

- TABLE 210 DALI WIRELESS: DEALS

- TABLE 211 ZINWAVE: COMPANY OVERVIEW

- TABLE 212 ZINWAVE: PRODUCT LAUNCHES

- TABLE 213 ZINWAVE: DEALS

- FIGURE 1 DISTRIBUTED ANTENNA SYSTEM MARKET SEGMENTATION

- FIGURE 2 DISTRIBUTED ANTENNA SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 7 MARKET PROJECTIONS FOR DAS MARKET

- FIGURE 8 SERVICE SEGMENT TO HOLD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 9 INDOOR SEGMENT TO HOLD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET IN 2028

- FIGURE 10 NEUTRAL-HOST OWNERSHIP SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 >500 K SQ. FT. SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 12 PUBLIC SAFETY SEGMENT TO GROW AT HIGHER CAGR FROM 2023 TO 2028

- FIGURE 13 NORTH AMERICA HELD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET IN 2022

- FIGURE 14 INCREASING M2M CONNECTIONS AND NUMBER OF IOT DEVICES FUELING GROWTH OF DISTRIBUTED ANTENNA SYSTEM MARKET

- FIGURE 15 SERVICE SEGMENT HELD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET IN 2022

- FIGURE 16 COMMERCIAL VERTICAL AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN DISTRIBUTED ANTENNA SYSTEM MARKET IN 2022

- FIGURE 17 INDIA TO GROW AT HIGHEST RATE IN DISTRIBUTED ANTENNA SYSTEM SERVICE MARKET DURING FORECAST PERIOD

- FIGURE 18 DISTRIBUTED ANTENNA SYSTEM MARKET: DYNAMICS

- FIGURE 19 DISTRIBUTED ANTENNA SYSTEM MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 20 RISE IN GLOBAL MOBILE DATA TRAFFIC FROM 2017 TO 2022

- FIGURE 21 DISTRIBUTED ANTENNA SYSTEM MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 22 DISTRIBUTED ANTENNA SYSTEM MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 23 DISTRIBUTED ANTENNA SYSTEM MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 24 INSTALLATION PROCEDURE FOR DAS OUTLINED BY BUILDING INDUSTRY CONSULTING SERVICE INTERNATIONAL (BICSI)

- FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY WIRELESS CARRIERS AND SYSTEM INTEGRATORS

- FIGURE 26 REVENUE SHIFTS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- FIGURE 27 AVERAGE SELLING PRICE OF MAJOR COMPONENTS OF ACTIVE INDOOR DAS

- FIGURE 28 AVERAGE SELLING PRICE ANALYSIS: MAJOR COMPONENTS OF PASSIVE INDOOR DAS

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- FIGURE 31 IMPORT DATA FOR HS CODE 852910, BY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 32 EXPORT DATA FOR HS CODE 852910, BY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE COMMERCIAL VERTICALS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE COMMERCIAL VERTICALS

- FIGURE 35 PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 36 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OFFERING

- FIGURE 37 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 RADIO UNIT TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 39 CEILING ANTENNA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INSTALLATION SERVICE TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR SERVICES DURING FORECAST PERIOD

- FIGURE 41 DISTRIBUTED ANTENNA SYSTEM MARKET, BY COVERAGE

- FIGURE 42 INDOOR COVERAGE SEGMENT TO HOLD LARGER SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 43 ACTIVE SEGMENT TO HOLD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE DURING FORECAST PERIOD

- FIGURE 44 COMMERCIAL SEGMENT TO REGISTER HIGHER CAGR IN INDOOR DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 45 DISTRIBUTED ANTENNA SYSTEM MARKET, BY OWNERSHIP MODEL

- FIGURE 46 NEUTRAL-HOST OWNERSHIP SEGMENT TO REGISTER HIGHEST CAGR IN DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 47 NEUTRAL-HOST OWNERSHIP SEGMENT TO HOLD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM COMPONENT MARKET FOR INDOOR COVERAGE IN 2028

- FIGURE 48 DISTRIBUTED ANTENNA SYSTEM MARKET, BY USER FACILITY AREA

- FIGURE 49 >500 K SQ. FT. USER FACILITIES TO HOLD LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 50 DISTRIBUTED ANTENNA SYSTEM MARKET, BY VERTICAL

- FIGURE 51 PUBLIC SAFETY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 52 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL

- FIGURE 53 HEALTHCARE TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMMERCIAL VERTICAL DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN PUBLIC VENUES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 55 ASIA PACIFIC DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN HOSPITALITY VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 56 ASIA PACIFIC DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN HEALTHCARE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 ROW DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN EDUCATION VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 58 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN ENTERPRISE VERTICAL DURING FORECAST PERIOD

- FIGURE 59 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN RETAIL VERTICAL DURING FORECAST PERIOD

- FIGURE 60 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN AIRPORT & TRANSPORTATION DURING FORECAST PERIOD

- FIGURE 61 ASIA PACIFIC TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN INDUSTRIAL VERTICAL DURING FORECAST PERIOD

- FIGURE 62 NORTH AMERICA TO CAPTURE LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN GOVERNMENT VERTICAL DURING FORECAST PERIOD

- FIGURE 63 NORTH AMERICA TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET FOR INDOOR COVERAGE IN PUBLIC SAFETY VERTICAL DURING FORECAST PERIOD

- FIGURE 64 DISTRIBUTED ANTENNA SYSTEM MARKET, BY FREQUENCY PROTOCOL

- FIGURE 65 CELLULAR FREQUENCY PROTOCOL TO DOMINATE DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 66 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF CELLULAR DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 67 ASIA PACIFIC VHF/UHF DISTRIBUTED ANTENNA SYSTEM MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 68 NORTH AMERICA TO HOLD LARGEST SHARE OF OTHERS DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 69 DISTRIBUTED ANTENNA SYSTEM MARKET, BY NETWORK TYPE

- FIGURE 70 PUBLIC NETWORK TO ACCOUNT FOR LARGEST SHARE OF DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 71 NORTH AMERICA TO DOMINATE PUBLIC NETWORK DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 72 NORTH AMERICA TO HOLD LARGEST SHARE OF PRIVATE NETWORK DISTRIBUTED ANTENNA SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 73 DISTRIBUTED ANTENNA SYSTEM MARKET, BY SIGNAL SOURCE

- FIGURE 74 DISTRIBUTED ANTENNA SYSTEM MARKET FOR SMALL CELLS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 75 DISTRIBUTED ANTENNA SYSTEM MARKET FOR COMPONENTS, BY COUNTRY

- FIGURE 76 DISTRIBUTED ANTENNA SYSTEM MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 77 NORTH AMERICA: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- FIGURE 78 EUROPE: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- FIGURE 79 ASIA PACIFIC: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- FIGURE 80 REST OF THE WORLD: DISTRIBUTED ANTENNA SYSTEM MARKET SNAPSHOT

- FIGURE 81 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN DISTRIBUTED ANTENNA SYSTEM MARKET

- FIGURE 82 DISTRIBUTED ANTENNA SYSTEM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- FIGURE 83 DISTRIBUTED ANTENNA SYSTEM MARKET (GLOBAL): STARTUPS/SMES EVALUATION QUADRANT, 2021

- FIGURE 84 COMMSCOPE: COMPANY SNAPSHOT

- FIGURE 85 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 86 COMBA TELECOM SYSTEMS HOLDINGS LTD.: COMPANY SNAPSHOT

- FIGURE 87 SOLID: COMPANY SNAPSHOT

- FIGURE 88 AMERICAN TOWER: COMPANY SNAPSHOT

- FIGURE 89 AT&T: COMPANY SNAPSHOT

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the DAS market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the DAS market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the DAS market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, DAS products related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the DAS market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

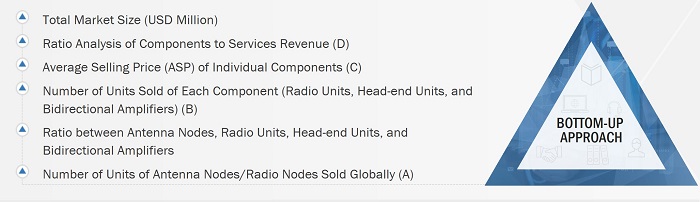

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the DAS market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

DAS Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the DAS market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the DAS market, in terms of value, based on offering, coverage, ownership model, user facility area, signal source, frequency protocol, network type, and vertical

- To describe and forecast the DAS market size, in terms of value, with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the DAS market

- To provide a detailed overview of the supply chain of the DAS ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments in the DAS market, such as acquisitions, product launches, partnerships, expansions, and collaborations

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Distributed Antenna System (DAS) Market

I am interested in purchasing your report on DAS market. Can you share a quotation with me through e-mail?

I was browsing through your ToC on DAS market. Could help me to understand whether the report includes bargaining power of carrier, neutral host, venue owner, stakeholders and their market strategies. Also, could you provide some insights related to rise of venue owners as neutral hosts. Moreover, I would like to understand success of enterprise ownership model. DAS market in Asia, neutral host market in Asia, and types of DAS related services.

I am curious to understand the DAS market for EMEA region. Also, can MnM provide some market insights in terms of technology such as Analog DAS vs Digital DAS?

I am currently researching on telecom industry, I have special interest in emerging technologies and opportunities like DAS and small cell. Could you share some samples with me?

I am interested in the DAS market for the US. I would also like to know how MarketsandMarkets can help us to expand our (Nokia) market share in the country? Can you help us to identify the potentials clients and suggest any strategy?

Could you help me with the scope of your report titled "Distributed Antenna System Market by Offering (Components and Services), Coverage (Indoor and Outdoor), Ownership (Carrier, Neutral-Host, and Enterprise), User Facility, Vertical (Commercial, Public Safety), and Geography - Global Forecast to 2023"? I would like to learn more about the segmentation of this report.

Do you have any report specifically for DAS Public Safety market or can you customize your current study of DAS market? Also, does the scope of your existing report include commercial systems only?

I am interested in purchasing the market research report on DAS. Would it be possible to see some excerpts from the report in the form sample brochure?

We are specifically interested in understanding the US DAS, signal boosters, and small cell market as well as Wi-Fi in enterprise, carrier and public safety segments.

We are looking for DAS market in the US and North America region. We would specifically like to see the market sizing, competitive dynamics/landscape analysis, especially from a commercial sub-sector perspective. We have keen interests in healthcare and hospitality sectors.

We would like to enter into the DAS market in our domestic (South Korea) and international regions. Can MarketsandMarkets help us with a go-to-market strategy?

I am interested in your report as it has comprehensive table of contents and covers entire ecosystem for DAS as compared to other reports that I have found online. Can you provide me some discount?

Can you provide the DAS market analysis for Southeast USA? I am specifically interested in South Carolina, North Carolina,Virginia,Tennesse, Georgia & Flordia.

I am interested in understanding the competitor landscape of you study on DAS. I am looking for the market share of each supplier. Also, what type of DAS solution is the most prevalent and which one will be the most prevalent solution in the future: analogue/digital, Passive, Off-Air DAS/Active DAS, Hybrid DAS, Digital, small cell DAS.

We would like to know if there are companies using DAS for WiFi residential and enterprise solutions, if yes who are these players and what is the size of the market?

Can you share the samples of your report of DAS market? I am specifically interested in market share for public safety vertical in DAS.