A2P Messaging Market by Offering (Platforms, Services), Application (Authentication, Promotional & Marketing, CRM), Communication Channel (SMS, Operator IP, Third-party Apps, Fixed Fees), SMS Traffic, End User and Region - Global Forecast to 2029

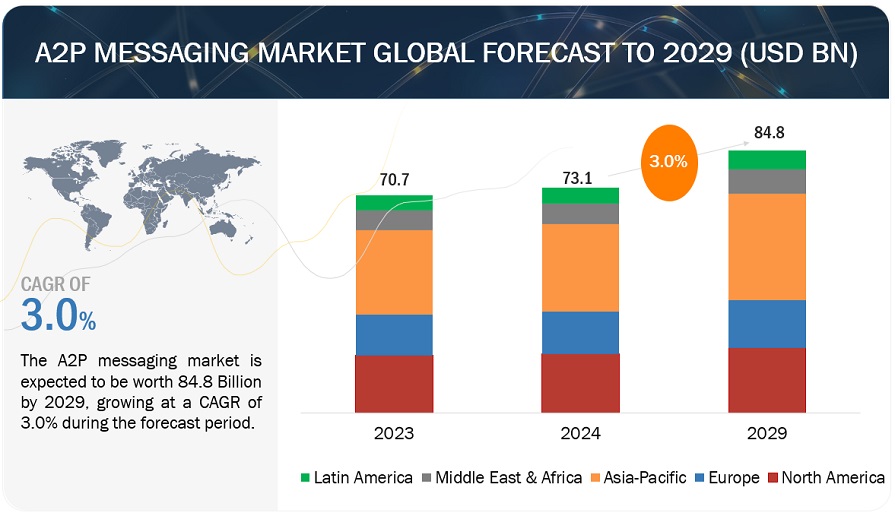

[244 Pages Report] MarketsandMarkets forecasts that the A2P messaging market size is projected to grow from USD 73.1 billion in 2024 to USD 84.8 billion by 2029, at a CAGR of 3.0% during the forecast period. A2P messaging facilitates real-time communication between businesses and customers, allowing for instant delivery of time-sensitive information, updates, and notifications. A2P messaging platforms increasingly support multichannel communication, including SMS, MMS, RCS, and OTT messaging apps, allowing businesses to reach customers through their preferred channels. Also, integration of A2P messaging platforms with Customer Relationship Management (CRM) systems enables businesses to streamline their communication processes, manage customer interactions more effectively, and track engagement metrics.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

A2P messaging market Dynamics

Driver: Growing use of A2P messaging among customer-centric industries

A2P messaging has witnessed large scale implementation in customer-centric industries, such as retail and eCommerce, travel and hospitality, Banking, Financial Services, and Insurance (BFSI), healthcare, and media and entertainment. With the heavy penetration of smartphones across consumers, these industries are embracing the power of A2P messaging to reach their wide base of customers. Since the inception of messaging services, A2P messaging has acted as a reliable and secure communication channel for enterprises to engage with their customers on a larger scale. For instance, in the mobile banking system, application messaging is at the center of the payment system, which helps mobile banking applications to send notifications to their customers, such as instant alerts, transaction details, and One Time Password (OTP) verifications. Mobile banking helps the A2P messaging market grow by deploying application messaging for banking and financial services through SMS aggregators and MNOs. Thus, MNOs and SMS aggregators need to focus on A2P messaging to accommodate the vast revenue coming from the enterprises.

Restraint: Regulatory constraints

Regulatory constraints exert a substantial influence on the A2P (Application-to-Person) messaging market, shaping its operations and strategies. These constraints primarily center around safeguarding consumer privacy, upholding data protection standards, and curbing the proliferation of spam and unsolicited messages. Laws such as the General Data Protection Regulation (GDPR) in Europe and the Telephone Consumer Protection Act (TCPA) in the United States impose stringent requirements on businesses regarding consent, data processing, and message content. Moreover, mobile network operators (MNOs) often enforce their own guidelines, adding another layer of compliance complexity. Service providers must navigate these regulations meticulously to avoid penalties, message blocking, or service termination. Ensuring compliance requires significant investment in technology, infrastructure, and legal expertise.

Opportunity: Rise in application usage

The surge in application usage presents a remarkable opportunity for the A2P (Application-to-Person) messaging market, offering a dynamic platform for businesses to interact with their customers seamlessly. As mobile applications proliferate across diverse sectors, they become pivotal touchpoints for delivering timely notifications, personalized messages, and transactional updates directly to users' devices. This trend reflects a fundamental shift in consumer behavior towards mobile-centric interactions, necessitating robust A2P messaging solutions to meet the growing demand for real-time communication. Integrated into these applications, A2P messaging not only enhances customer engagement but also streamlines transactional processes, such as banking transactions, e-commerce purchases, and service bookings. Moreover, the integration of messaging features within applications further amplifies the role of A2P messaging in facilitating seamless communication between users and businesses. With emerging markets embracing mobile technology at a rapid pace, the opportunities for A2P messaging providers to capitalize on this trend and drive market expansion are abundant.

Challenge: Messaging channel fragmentation

Messaging channel fragmentation presents a formidable challenge within the A2P messaging market, stemming from the diverse array of communication channels available to businesses and consumers alike. This proliferation, ranging from traditional SMS to an array of OTT messaging apps and social media platforms, complicates efforts to maintain a cohesive communication strategy. Businesses must grapple with resource-intensive management, interoperability issues, and the need to ensure consistency across channels while navigating complex regulatory landscapes. Mitigation strategies include prioritizing channels, leveraging integration solutions, and embracing automation and AI for optimization. Looking ahead, collaboration and innovation will be key in addressing these challenges, ensuring businesses can effectively engage with customers across a fragmented messaging landscape while delivering seamless and personalized experiences.

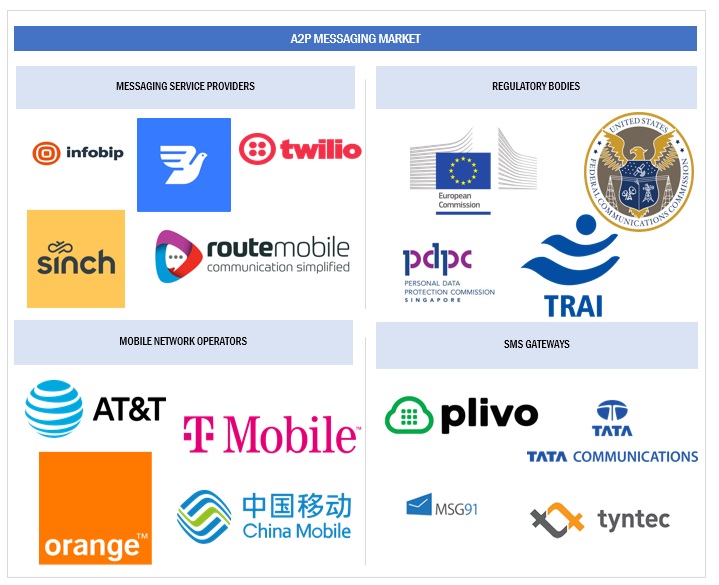

A2P messaging market Ecosystem

Prominent companies in this market have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK), Vonage (US), Orange (France), Comviva (India), Route Mobile (India), BICS (Belgium).

Based on end user, the healthcare segment is expected to grow with the highest CAGR during the forecast period

The global population increase, shifts in lifestyle, and heightened awareness of health-related matters have fueled substantial growth in the healthcare sector. To ensure top-notch service delivery, healthcare providers must engage in effective, personalized communication with their patients. Many healthcare providers have already embraced A2P messaging as a means to disseminate diagnostic test results, appointment reminders, claim statuses, health advice, payment notifications, location inquiries, and to enhance the overall patient experience. A2P messaging solutions are utilized by healthcare enterprises to foster better patient relationships while upholding privacy standards and adhering to HIPAA regulations in the US. These solutions encompass various functionalities such as machine-to-human alerts, pager replacements, wellness notifications, safety training updates, and scheduling communications.

By end user, the BFSI segment to hold the largest market size during the forecast period

Given the rapid expansion of mobile subscriber bases, a significant majority of clients now prefer accessing banking services via their mobile devices. Over recent years, the global mobile banking sector has experienced notable growth. Banks and similar financial entities widely employ A2P messaging services, primarily for dispatching OTPs to validate transactions or authenticate customers for eCommerce dealings. SMS messaging is not only utilized by most financial institutions for informational purposes but also serves as a pivotal tool for confirming transactions through two-factor authentication. Furthermore, A2P messaging finds application in various areas, including fraud prevention, disseminating server monitoring alerts to technicians, updating applications, and issuing payment reminders. Organizations and financial establishments commonly utilize SMS for transmitting access codes and notifications pertinent to specific accounts. Such messages are typically solicited by recipients, serving as a secure means of communication for services requiring two-factor authentication.

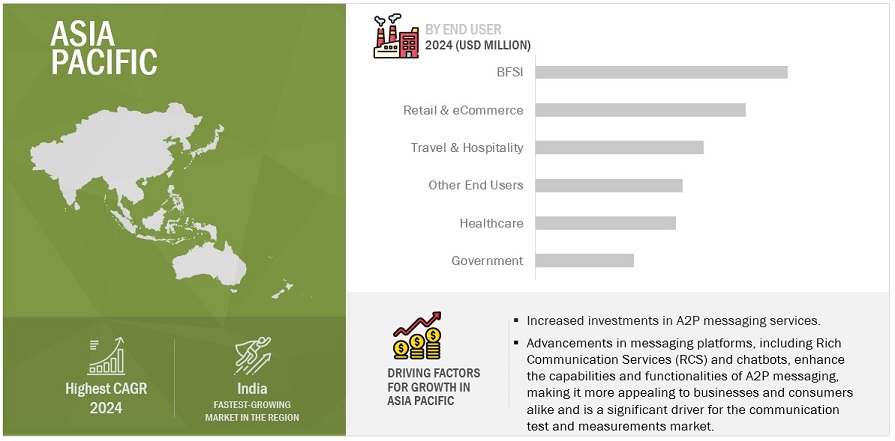

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period

The A2P messaging market in Asia Pacific has been experiencing significant growth and development driven by ongoing digitalization efforts and the evolving needs of businesses to connect with consumers effectively. OTT messaging platforms in Asia Pacific have shifted communication preferences, drawing users away from traditional SMS for personal and business interactions. Businesses now leverage OTT platforms for cost-effective A2P messaging, offering richer content and interactivity to enhance user engagement. However, the increasing competition and fragmentation in the market pose challenges, requiring businesses to navigate multiple platforms and address integration complexities. Despite varying regulatory environments, companies are adapting to compliance requirements while embracing innovations such as AI and chatbots to enhance customer engagement.

Market Players:

The major players in the A2P messaging market are AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the A2P messaging market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering (Platform, Services), Application (Authentication Services, Promotional and Marketing Services, Pushed Content Services, Interactive Messaging Services, Customer Relationship Management Services, Other Applications), Communication Channel (SMS, Operator IP, Third-party Apps, Fixed Fees), SMS traffic (Domestic, International), End User (BFSI, Retail & eCommerce, Government, Healthcare, Travel & Hospitality, Other End Users) and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK), Vonage (US), Orange (France), Comviva (India), Route Mobile (India), BICS (Belgium), Monty Mobile (UK), Tata Communications (India), Syniverse (US), Tyntec (UK), Soprano Design (Australia), Genesys (US), Clickatell (US), CEQUENS (Egypt), MSG91 (India), Plivo (US), Mitto (Switzerland), Bird (Netherlands), Telewhale (Cyprus), EnableX.io (Singapore), TextUs (US), Voxvalley (Singapore) |

This research report categorizes the A2P messaging market based on offering, test solution, type of test, end user, and region.

Based on Offering:

- Platform

- Services

Based on Application:

- Authentication Services

- Promotional and Marketing Services

- Pushed Content Services

- Interactive Messaging Services

- Customer Relationship Management Services

- Other Applications

Based on Communication Channel:

- SMS

- Operator IP

- Third-party Apps

- Fixed Fees

Based on SMS Traffic:

- Domestic

- International

Based on End User:

- BFSI

- Retail & eCommerce

- Government

- Healthcare

- Travel & Hospitality

- Other End Users

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2024, Communications Platform-as-a-Service (CPaaS) solutions firm Sinch India launched its new solution, Sinch Trust, to bring transparency and trustworthiness to business messaging. Sinch Trust addressed critical needs in the Indian SMS market by offering much-needed transparency and reliability and equipping businesses with the tools to capitalize on missed opportunities that turn into potential gains.

- In February 2024, Vonage partnered with KDDI Web Communications to bring Vonage Communications APIs to customers in Japan. With Vonage’s Communications APIs, businesses in Japan would be able to bring new communications capabilities to customers through online calling and two-way messaging and build better connections and deeper engagement. In addition, security could be enhanced with simple, seamless two-factor authentication powered by the Verify API, while Vonage’s conversational commerce application, powered by Jumper.ai, enabled businesses to create AI-powered omnichannel experiences that boost sales and increase customer satisfaction.

- In February 2024, Infobip introduced its Rich Communication Services (RCS) Business Messaging solution to enable MNOs and enterprises to engage with customers and create memorable experiences by delivering rich conversational messages.

- In February 2024, Route Mobile partnered with Billeasy to introduce a first-of-its-kind ticket purchase experience through Rich Communication Services (RCS) Business Messaging for Maha Metro Pune. Through this strategic partnership, users would have the convenience of purchasing Maha Metro Pune e-tickets directly via RCS Messages on phones.

- In November 2023, AT&T introduced AT&T ActiveArmor, offering new text-filtering features for even more protection, blocking spam text messages, and even taking down malicious websites.

Frequently Asked Questions (FAQ):

What is the definition of the A2P messaging market?

A2P (Application-to-Person) messaging refers to the process where an application sends messages to a user, typically through SMS (Short Message Service) but also via other messaging channels, including Over-the-Top (OTT) messaging platforms such as WhatsApp, Telegram, or Facebook Messenger. This type of messaging is used primarily by businesses and organizations to communicate directly with customers for a variety of purposes, such as sending alerts, reminders, promotional content, authentication codes, and transaction confirmations. OTT messaging platforms offer a rich, cost-effective alternative to traditional SMS, allowing for the inclusion of multimedia content, interactive elements, and encryption for privacy.

What is the market size of the A2P messaging market?

The A2P messaging market size is projected to grow USD 73.1 billion in 2024 to USD 84.8 billion by 2029, at a CAGR of 3.0% during the forecast period.

What are the major drivers in the A2P messaging market?

The major drivers of the A2P messaging market are rapid technological advancements, growing number of mobile subscribers to fuel A2P messaging, and growing use of A2P messaging among customer-centric industries.

Who are the key players operating in the A2P messaging market?

The major players in the A2P messaging market are AT&T (US), China Mobile (China), Sinch (Sweden), Twilio (US), Infobip (UK), Vonage (US), Orange (France), Comviva (India), Route Mobile (India), BICS (Belgium), Monty Mobile (UK), Tata Communications (India), Syniverse (US), Tyntec (UK), Soprano Design (Australia), Genesys (US), Clickatell (US), CEQUENS (Egypt), MSG91 (India), Plivo (US), Mitto (Switzerland), Bird (Netherlands), Telewhale (Cyprus), EnableX.io (Singapore), TextUs (US), Voxvalley (Singapore).

What are the opportunities for new market entrants in the A2P messaging market?

The major opportunities of the A2P messaging market are rise in application usage, growing trend of mobile marketing via messaging, and increased adoption of A2P SMS by OTT players to drive revenue for MNOs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

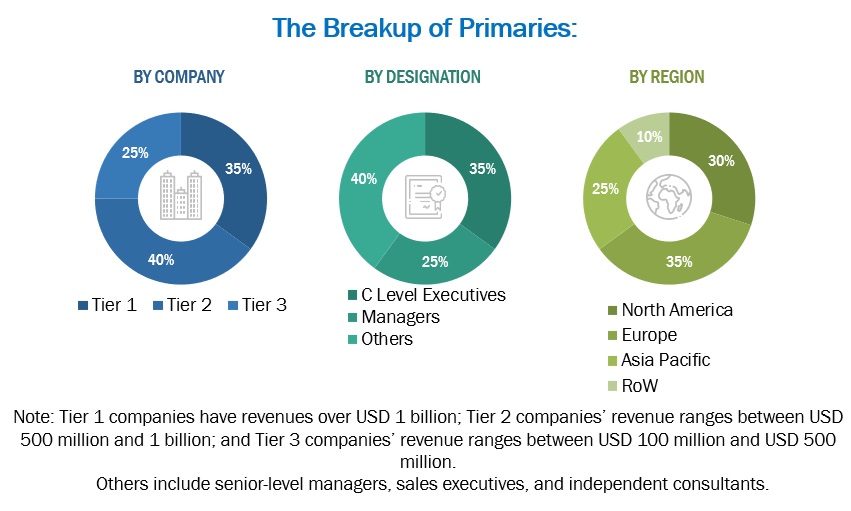

The study involved four major activities in estimating the current size of the global A2P messaging market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total A2P messaging market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the A2P messaging market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Route Mobile |

Senior Manager |

|

Plivo |

VP |

|

Sinch |

Business Executive |

Market Size Estimation

For making market estimates and forecasting the A2P messaging market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global A2P messaging market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the A2P messaging market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

A2P messaging market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

A2P messaging market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

A2P (Application-to-Person) messaging refers to the process where an application sends messages to a user, typically through SMS (Short Message Service) but also via other messaging channels, including Over-the-Top (OTT) messaging platforms such as WhatsApp, Telegram, or Facebook Messenger. This type of messaging is used primarily by businesses and organizations to communicate directly with customers for a variety of purposes, such as sending alerts, reminders, promotional content, authentication codes, and transaction confirmations. OTT messaging platforms offer a rich, cost-effective alternative to traditional SMS, allowing for the inclusion of multimedia content, interactive elements, and encryption for privacy.

Key Stakeholders

- Network infrastructure enablers

- Technology vendors

- Mobile Network Operators (MNOs)

- Communication Service Providers (CSPs)

- System Integrators (SIs)

- A2P platform vendors and software application providers

- Resellers

- Value-added resellers (VARs)

- Compliance regulatory authorities

- Government authorities

- Investment firms

- Cloud service providers

- A2P messaging alliances/groups

- Original Design Manufacturers (ODMs)

- Original Equipment Manufacturers (OEMs)

- Enterprises/businesses

Report Objectives

- To determine, segment, and forecast the global A2P messaging market based on offering, application, communication channel, SMS traffic, end user, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the A2P messaging market.

- To study the complete value chain and related industry segments and perform a value chain analysis of the A2P messaging market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total A2P messaging market.

- To analyze the industry trends, patents, and innovations related to the A2P messaging market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the A2P messaging market.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in A2P Messaging Market

Yet, the popularity of A2P (Application-to-Person) communications has been rising recently, and this trend is probably going to continue, according to trends through 2021. Up until 2021, some of the major themes in A2P messaging include the following: • Increased adoption of Rich Communication Services (RCS) • More personalized messaging • Continued growth in chatbots and AI-powered messaging • Enhanced security and privacy • Integration with other technologies

What are the trends in A2P messaging in 2023?