Acoustic Emission Testing Market by Equipment (Sensors, Amplifiers, Detection Instruments), Service (Inspection, Calibration), Application (Storage Tank, Pipeline, Aging Aircraft, Structural Monitoring, Turbine), and Geography - Global Forecast to 2035

Acoustic Emission Testing Market Overview

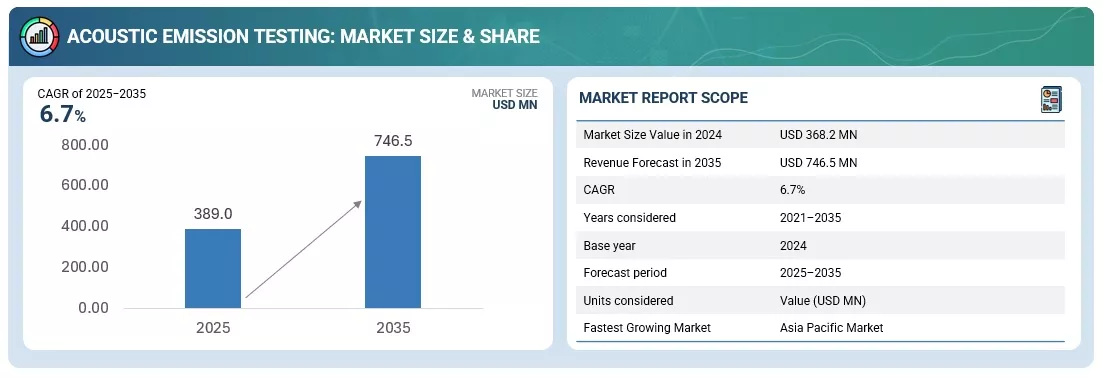

The global acoustic emission testing market was valued at USD 368.2 million in 2024 and is estimated to reach USD 746.5 million by 2035, at a CAGR of 6.7% between 2025 and 2035.

The global acoustic emission testing market is growing rapidly as industries increasingly adopt non destructive testing technologies to ensure structural integrity, detect material defects, and prevent equipment failures. Acoustic emission testing, often referred to as AET, is a passive non destructive evaluation method that detects transient elastic waves generated by the rapid release of energy from localized sources within materials. It is highly effective for monitoring the behavior of materials under stress and identifying cracks, corrosion, or other defects before they result in catastrophic failures. Between 2025 and 2035, the market is expected to experience steady expansion, driven by the growing focus on safety, reliability, and regulatory compliance in industries such as oil and gas, aerospace, energy, manufacturing, and civil infrastructure.

Market Dynamics

The key driver behind the growth of the acoustic emission testing market is the increasing demand for predictive maintenance and real time structural health monitoring across industrial sectors. Traditional inspection methods such as ultrasonic testing or radiography often require system shutdowns and direct access to the test surface. In contrast, acoustic emission testing enables continuous monitoring while equipment remains operational, minimizing downtime and improving efficiency. This makes it particularly valuable for industries where equipment failure can lead to severe economic and safety consequences.

The rising investments in infrastructure development, renewable energy, and aerospace applications are further supporting market growth. Governments and regulatory agencies are implementing stricter safety standards for aging infrastructure, pipelines, and aircraft, which require reliable and efficient testing methods. Acoustic emission testing has become a preferred choice for these applications due to its sensitivity, ability to cover large areas, and potential for remote and automated monitoring.

Technological advancements are also reshaping the market. The integration of digital signal processing, artificial intelligence, and machine learning algorithms in detection systems allows for more accurate interpretation of acoustic signals. Modern systems can differentiate between harmless background noise and genuine defect signals, reducing false alarms and improving detection precision. Additionally, wireless sensors and cloud based data platforms are enabling real time remote monitoring and analysis, which is essential for geographically dispersed industrial assets.

Market Restraints

Despite its advantages, the acoustic emission testing market faces several challenges. One of the major restraints is the complexity of data interpretation. Acoustic signals are influenced by numerous factors such as material properties, geometry, and environmental noise, which can make signal analysis difficult. Skilled technicians and specialized training are required to correctly interpret results, creating a barrier for some industries with limited expertise in this field.

The initial cost of acoustic emission testing equipment is relatively high compared to some traditional inspection methods. This can deter small and medium enterprises from adopting the technology, especially in regions with limited budgets for testing and maintenance. Additionally, environmental factors such as temperature variations and mechanical vibrations can interfere with sensor performance, requiring careful calibration and setup. Regulatory uncertainty and lack of standardized procedures in some emerging markets also hinder adoption.

Market Opportunities

The market presents significant opportunities for innovation and expansion. The increasing emphasis on asset integrity management and structural health monitoring across energy and infrastructure sectors offers fertile ground for growth. Acoustic emission testing is particularly suited for continuous condition monitoring in applications such as wind turbines, bridges, pipelines, and pressure vessels. The ongoing expansion of renewable energy projects, particularly wind and solar farms, is expected to create substantial demand for acoustic emission testing in turbine monitoring and blade inspection.

Another promising opportunity lies in the integration of AET with other non destructive testing methods such as ultrasonic or thermographic inspection. Combining multiple techniques allows for a more comprehensive assessment of material health and defect characterization. The development of advanced sensors capable of operating in extreme environments such as deep sea oil platforms, nuclear plants, or aerospace components will open new market segments.

Digitization and automation trends are expected to revolutionize the industry. The use of cloud platforms, remote monitoring software, and data analytics will enable predictive maintenance strategies that reduce operational costs and prevent unplanned downtime. Companies investing in digital acoustic emission systems with AI powered diagnostics will gain a competitive edge. Moreover, emerging economies with expanding industrial bases present untapped potential as industries modernize and adopt advanced maintenance practices.

Equipment Analysis

The acoustic emission testing market by equipment includes sensors, amplifiers, and detection instruments.

Sensors are the most critical components of acoustic emission systems. They detect the transient elastic waves generated by crack formation, corrosion, or leakage in materials. Sensors convert these mechanical waves into electrical signals that can be analyzed. Piezoelectric sensors are commonly used due to their sensitivity and reliability. Advancements in sensor design have led to the development of broadband and resonant sensors that provide greater accuracy across different frequency ranges. The demand for robust sensors capable of operating in harsh environments such as high pressure pipelines, extreme temperatures, and underwater structures is increasing rapidly.

Amplifiers play a key role in boosting the weak signals captured by sensors to levels that can be effectively processed by detection instruments. They help minimize signal loss and maintain accuracy during long distance signal transmission. The growing use of wireless and portable systems is driving demand for compact and low power amplifiers that maintain high performance in field applications.

Detection instruments form the analytical core of acoustic emission systems. These instruments receive the amplified signals, filter noise, and process data using advanced algorithms. Modern detection instruments are equipped with multi channel data acquisition systems, real time visualization interfaces, and automated defect classification capabilities. The integration of artificial intelligence and digital signal processing enables better detection accuracy and predictive maintenance insights. As industries embrace digital transformation, detection instruments are increasingly being connected to centralized monitoring systems via IoT networks for real time data sharing and analysis.

Service Analysis

The market by service is divided into inspection and calibration.

Inspection services dominate the overall market share as industries rely on acoustic emission testing for periodic and continuous inspection of assets. Inspection services involve deploying AET systems to detect cracks, corrosion, leakage, and fatigue damage in structures such as pipelines, pressure vessels, and aircraft components. Service providers offer both on site testing and remote monitoring capabilities. The growing focus on compliance with safety standards in oil and gas, aerospace, and power generation industries drives consistent demand for inspection services. In addition, industrial operators increasingly outsource these services to specialized providers with advanced equipment and skilled personnel.

Calibration services ensure the accuracy and reliability of acoustic emission systems. Regular calibration of sensors, amplifiers, and detection instruments is essential to maintain precision and consistency in measurements. As the industry evolves, regulatory bodies and end users demand certified calibration to meet international standards. The growth of calibration services is further supported by the increasing complexity of AET systems and the rising need for traceable performance validation. Service providers offering automated calibration systems and cloud based record management are gaining a competitive advantage.

Application Analysis

The acoustic emission testing market serves a diverse range of applications including storage tanks, pipelines, aging aircraft, structural monitoring, and turbines.

Storage tanks require continuous monitoring to prevent leaks and ensure structural integrity, particularly in industries such as oil and gas and chemicals. Acoustic emission testing enables early detection of corrosion, crack propagation, and weld failures in tanks without draining or shutting down operations. The ability to perform in service testing offers significant cost savings and safety benefits.

Pipeline monitoring represents one of the largest applications for acoustic emission testing. Pipelines used in the transport of oil, gas, and water are susceptible to corrosion, cracks, and mechanical damage over time. AET systems can detect leakages and stress accumulation along extensive pipeline networks, enabling operators to perform targeted maintenance and avoid costly failures. The growing demand for energy transportation and the expansion of cross border pipeline projects are major factors boosting adoption in this segment.

The aging aircraft segment also contributes significantly to the market. As many aircraft fleets worldwide continue to operate beyond their original design life, ensuring airframe integrity is crucial. Acoustic emission testing is used to detect fatigue cracks, delamination, and corrosion in aircraft structures without disassembly. The method’s ability to monitor large areas simultaneously and detect subsurface flaws makes it an invaluable tool for aerospace maintenance.

Structural monitoring applications include bridges, buildings, dams, and other civil infrastructure. Acoustic emission systems are increasingly being deployed for continuous structural health monitoring to detect microcracks and assess material degradation. As infrastructure around the world continues to age, governments and private operators are investing in condition based monitoring solutions to prevent catastrophic failures and extend asset life.

Turbine monitoring, particularly in power generation and renewable energy industries, is another key area of application. Acoustic emission testing can identify early signs of fatigue, bearing failure, or blade cracking in turbines, allowing maintenance teams to take preventive action. The rapid expansion of wind energy projects worldwide is expected to significantly drive demand in this segment as operators focus on maximizing uptime and performance of turbine assets.

Regional Analysis

The acoustic emission testing market spans across major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America dominates the global market, driven by strong industrial infrastructure, stringent safety regulations, and early adoption of advanced testing technologies. The United States leads the region due to significant investments in oil and gas, aerospace, and power generation industries. The presence of established service providers and equipment manufacturers further supports regional growth. Increasing demand for predictive maintenance solutions and regulatory compliance will continue to sustain market expansion in North America.

Europe holds a substantial share of the market due to its focus on renewable energy, infrastructure monitoring, and aerospace innovation. Countries such as Germany, the United Kingdom, and France are investing heavily in smart infrastructure projects and adopting advanced non destructive testing methods to ensure safety and reliability. European regulations emphasizing safety in pressure vessels, pipelines, and aircraft structures create a strong demand for acoustic emission testing services.

Asia Pacific is expected to witness the fastest growth between 2025 and 2035. Rapid industrialization, urbanization, and energy sector expansion in countries such as China, India, Japan, and South Korea are key growth drivers. The region’s booming oil and gas, manufacturing, and power generation industries are increasingly adopting AET systems to prevent failures and maintain operational efficiency. Government initiatives promoting industrial safety and infrastructure modernization further support market growth.

Latin America and the Middle East and Africa are emerging markets with rising potential. The growth of oil and gas exploration, mining, and power projects in countries such as Brazil, Mexico, Saudi Arabia, and South Africa is driving adoption. The increasing focus on extending the life of aging infrastructure and pipelines is expected to generate sustained demand for acoustic emission testing in these regions.

Technological Trends

Technological innovation is central to the evolution of the acoustic emission testing market. Developments in digital electronics, data analytics, and connectivity are transforming the way testing is conducted. Wireless and compact sensors are enabling distributed monitoring of large structures, while AI based analytics enhance signal interpretation and anomaly detection. Cloud platforms facilitate centralized data management and remote diagnostics, allowing operators to access real time insights from multiple locations.

The adoption of machine learning models for signal classification and defect prediction is improving the reliability and speed of analysis. Integration of AET with IoT frameworks supports predictive maintenance strategies by correlating acoustic data with other operational parameters. In addition, miniaturization of components and energy efficient designs are expanding the range of applications in compact or mobile assets such as drones or robotic inspection systems.

Competitive Landscape

The acoustic emission testing market is moderately consolidated, with leading players offering comprehensive solutions spanning equipment manufacturing, software development, and testing services. Companies are focusing on innovation, partnerships, and geographic expansion to strengthen their market position. Strategic collaborations with aerospace, energy, and industrial companies are helping providers deliver customized monitoring systems.

Manufacturers are investing in advanced data acquisition systems, AI powered software, and multi sensor platforms to enhance accuracy and efficiency. Service providers are expanding global networks to cater to diverse industry needs and to offer integrated inspection and calibration packages. The growing importance of certification and regulatory compliance is also prompting vendors to align offerings with international standards.

Market Forecast

Between 2025 and 2035, the global acoustic emission testing market is expected to achieve steady growth across all major sectors. The increasing emphasis on predictive maintenance, aging infrastructure management, and sustainable operations will drive demand. Equipment sales will rise as industries invest in digital and automated testing systems, while inspection and calibration services will account for a significant portion of market revenue due to ongoing maintenance needs.

Asia Pacific is expected to lead growth due to industrial expansion, followed by North America and Europe which will continue to adopt advanced technologies for safety compliance and infrastructure modernization. The oil and gas, aerospace, and power generation sectors will remain the dominant end users throughout the forecast period.

Future Outlook

The future of the acoustic emission testing market will be shaped by digital transformation, automation, and global sustainability goals. As industries prioritize operational efficiency and asset longevity, acoustic emission testing will become an integral part of predictive maintenance ecosystems. The convergence of AET with IoT, AI, and cloud computing will redefine the market, enabling intelligent and automated monitoring solutions capable of providing real time insights.

Vendors that focus on technological innovation, user friendly software platforms, and global service reach will be best positioned to capitalize on emerging opportunities. With expanding applications in energy, aerospace, and infrastructure, acoustic emission testing will play an increasingly vital role in ensuring safety, reliability, and cost effectiveness across modern industrial operations.

Key Target Audience in Acoustic Emission Testing Market

- Original equipment manufacturers (OEMs)

- Semiconductor component manufacturers and distributors

- Acoustic emission equipment distributors and suppliers

- Suppliers of related accessories for acoustic emission testing equipment

- Acoustic emission testing service providers

- Research organizations and consulting companies

- Government bodies such as regulatory authorities and policy-makers

- Venture capitalists and private equity firms

- Associations, organizations, and alliances related to acoustic emission testing

Acoustic Emission Testing Market Report Scope

The report categorizes the acoustic emission testing market into the following segments:

Acoustic Emission Testing Market, by Equipment

- Sensors

- Amplifiers

- Detection Instruments

- Calibrators

- Others (Cables, Terminal Blocks, and Connectors)

Acoustic Emission Testing Market, by Service

- Inspection

- Calibration

Acoustic Emission Testing Market, by Application

- Storage tank

- Pipeline

- Aging Aircraft

- Turbine

-

Structural monitoring

- Pressure Vessels

- Bridges

- Concrete Beams

- Others (Tunnels, Dams, and Buildings)

- Nuclear Tank

- Marine

- Tube Trailer

- Advanced Material

Acoustic Emission Testing Market, by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- France

- Germany

- Italy

- Austria

- Switzerland

- Rest of Europe

-

APAC

- China

- India

- Malaysia & Singapore

- Rest of APAC

-

RoW

- Middle East

- Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Acoustic Emission Testing Market Analysis

- Further breakdown of the market on the basis of regions into various countries

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

The key players in the acoustic emission testing market include TUV Rheinland (Germany), MISTRAS (US), TUV Nord (Germany), Parker Hannifin (US), TUV Austria (Austria), General Electric (GE, US), Acoustic Emission Consulting (AEC, US), Vallen Systeme (Germany), KRN Services (US), and Score Atlanta (US). These players have adopted strategies such as partnerships, acquisitions, agreements, expansions, contracts, product launches, and collaborations to achieve growth in the acoustic emission testing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

FAQ

1. What is Acoustic Emission Testing?

Answer:

Acoustic Emission Testing (AET) is a non-destructive testing method that detects transient elastic waves produced by sudden structural changes or defects in materials.

2. What drives the growth of the Acoustic Emission Testing Market?

Answer:

The market is driven by rising demand for structural health monitoring in industries such as oil & gas, aerospace, and power generation.

3. What are the major applications of Acoustic Emission Testing?

Answer:

It is used for leak detection, crack monitoring, pressure vessel testing, and corrosion assessment in critical infrastructure.

4. What advantages does Acoustic Emission Testing offer?

Answer:

AET provides real-time monitoring, early defect detection, and minimal disruption to operations compared to other testing methods.

5. Which industries commonly use Acoustic Emission Testing?

Answer:

Acoustic Emission Testing is widely used in oil & gas, aerospace, manufacturing, power generation, and civil infrastructure industries for preventive maintenance and safety assurance.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Ranking Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Market

4.2 Market, By Equipment

4.3 Market, By Service and Country

4.4 Market, By Application

4.5 Country-Wise Analysis of Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Safety Concerns to Enhance Productivity

5.2.1.2 Increasing Need for Asset Health Monitoring

5.2.1.3 Government Initiatives for Implementation of Ndt Solutions

5.2.2 Restraints

5.2.2.1 High System Cost

5.2.2.2 Lack of Skilled Workforce

5.2.3 Opportunities

5.2.3.1 Advancements in Acoustic Emission Testing

5.2.3.2 Increasing Demand for Acoustic Emission Testing in Power Generation Industry

5.2.3.3 Critical Need to Inspect Aging Infrastructure

5.2.4 Challenges

5.2.4.1 Fluctuating Oil and Gas Prices

5.3 Acoustic Emission Testing Techniques

5.3.1 Introduction

5.3.2 Multichannel Source Location

5.3.3 Computed Source Location

5.3.4 Zone Location and Guard Techniques

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Emerging Trends: Acoustic Emission Testing Equipment Industry

6.3.1 Development of New Materials to Refurbish the Market

6.3.2 Increased Customer Expectations From AET Equipment Manufacturers

6.4 Regulations and Standards Related to Ndt

6.5 Leading Associations for AET

6.5.1 American Society for Nondestructive Testing (ASNT)

6.5.2 British Institute of Non-Destructive Testing (BINDT)

7 Acoustic Emission Testing Market Analysis, By Equipment (Page No. - 48)

7.1 Introduction

7.2 Sensors

7.3 Amplifiers

7.4 Detection Instruments

7.5 Calibrators

7.6 Others

8 Acoustic Emission Testing Market Analysis, By Service (Page No. - 57)

8.1 Introduction

8.2 Inspection

8.3 Calibration

9 Market Analysis, By Application (Page No. - 62)

9.1 Introduction

9.2 Storage Tank

9.3 Pipeline

9.4 Aging Aircraft

9.5 Turbine

9.6 Structural Monitoring

9.6.1 Pressure Vessels

9.6.2 Bridges

9.6.3 Concrete Beams

9.6.4 Others

9.7 Nuclear Tank

9.8 Marine

9.9 Tube Trailer

9.10 Advanced Material

10 Market Analysis, By Geography (Page No. - 80)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Austria

10.3.6 Switzerland

10.3.7 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 India

10.4.3 Malaysia & Singapore

10.4.4 Rest of APAC

10.5 RoW

10.5.1 Middle East

10.5.2 Africa

10.5.3 South America

11 Competitive Landscape (Page No. - 101)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Partnerships, Acquisitions, and Agreements

11.3.2 Expansions and Contracts

11.3.3 Product Launches and Collaborations

12 Company Profile (Page No. - 106)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.1 TUV Rheinland

12.2 TUV Austria

12.3 TUV Nord

12.4 Mistras

12.5 General Electric

12.6 Parker Hannifin

12.7 Acoustic Emission Consulting

12.8 Vallen Systeme

12.9 KRN Services

12.10 Score Atlanta

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 127)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (66 Tables)

Table 1 Acoustic Emission Testing Market, By Equipment, 2015–2023 (USD Million)

Table 2 Market for Sensors, By Application, 2015–2023 (USD Thousand)

Table 3 Market for Sensors, By Region, 2015–2023 (USD Thousand)

Table 4 Market for Amplifiers, By Application, 2015–2023 (USD Thousand)

Table 5 Market for Amplifiers, By Region, 2015–2023 (USD Thousand)

Table 6 Market for Detection Instruments, By Application, 2015–2023 (USD Thousand)

Table 7 Market for Detection Instruments, By Region, 2015–2023 (USD Thousand)

Table 8 Market for Calibrators, By Application, 2015–2023 (USD Thousand)

Table 9 Market for Calibrators, By Region, 2015–2023 (USD Thousand)

Table 10 Market for Others, By Application, 2015–2023 (USD Thousand)

Table 11 Market for Others, By Region, 2015–2023 (USD Thousand)

Table 12 Market, By Service, 2015–2023 (USD Million)

Table 13 Market for Inspection Services, By Application, 2015–2023 (USD Thousand)

Table 14 Market for Inspection Services, By Region, 2015–2023 (USD Million)

Table 15 Market for Calibration Services, By Application, 2015–2023 (USD Thousand)

Table 16 Market for Calibration Services, By Region, 2015–2023 (USD Million)

Table 17 Market, By Application, 2015–2023 (USD Million)

Table 18 Market for Storage Tank, By Equipment, 2015–2023 (USD Thousand)

Table 19 Market for Storage Tank, By Service, 2015–2023 (USD Million)

Table 20 Market for Storage Tank, By Region, 2015–2023 (USD Thousand)

Table 21 Market for Pipeline, By Equipment, 2015–2023 (USD Thousand)

Table 22 Market for Pipeline, By Service, 2015–2023 (USD Million)

Table 23 Market for Pipeline, By Region, 2015–2023 (USD Thousand)

Table 24 Market for Aging Aircraft, By Equipment, 2015–2023 (USD Thousand)

Table 25 Market for Aging Aircraft, By Service, 2015–2023 (USD Million)

Table 26 Market for Aging Aircraft, By Region, 2015–2023 (USD Thousand)

Table 27 Market for Turbine, By Equipment, 2015–2023 (USD Thousand)

Table 28 Market for Turbine, By Service, 2015–2023 (USD Million)

Table 29 Market for Turbine, By Region, 2015–2023 (USD Thousand)

Table 30 Market for Structural Monitoring, By Type, 2015–2023 (USD Million)

Table 31 Market for Structural Monitoring, By Equipment, 2015–2023 (USD Thousand)

Table 32 Market for Structural Monitoring, By Service, 2015–2023 (USD Million)

Table 33 Market for Structural Monitoring, By Region, 2015–2023 (USD Thousand)

Table 34 Market for Nuclear Tank, By Equipment, 2015–2023 (USD Thousand)

Table 35 Market for Nuclear Tank, By Service, 2015–2023 (USD Million)

Table 36 Market for Nuclear Tank, By Region, 2015–2023 (USD Thousand)

Table 37 Market for Marine, By Equipment, 2015–2023 (USD Thousand)

Table 38 Market for Marine, By Service, 2015–2023 (USD Million)

Table 39 Market for Marine, By Region, 2015–2023 (USD Thousand)

Table 40 Market for Tube Trailer, By Equipment, 2015–2023 (USD Thousand)

Table 41 Market for Tube Trailer, By Service, 2015–2023 (USD Million)

Table 42 Market for Tube Trailer, By Region, 2015–2023 (USD Thousand)

Table 43 Market for Advanced Material, By Equipment, 2015–2023 (USD Thousand)

Table 44 Market for Advanced Material, By Service, 2015–2023 (USD Million)

Table 45 Market for Advanced Material, By Region, 2015–2023 (USD Thousand)

Table 46 Market, By Region, 2015–2023 (USD Million)

Table 47 Market in North America, By Equipment, 2015–2023 (USD Thousand)

Table 48 Market in North America, By Service, 2015–2023 (USD Million)

Table 49 Market in North America, By Application, 2015–2023 (USD Thousand)

Table 50 Market in North America, By Country, 2015–2023 (USD Million)

Table 51 Market in Europe, By Equipment, 2015–2023 (USD Thousand)

Table 52 Market in Europe, By Service, 2015–2023 (USD Million)

Table 53 Market in Europe, By Application, 2015–2023 (USD Thousand)

Table 54 Market in Europe, By Country, 2015–2023 (USD Million)

Table 55 Market in APAC, By Equipment, 2015–2023 (USD Thousand)

Table 56 Market in APAC, By Service, 2015–2023 (USD Million)

Table 57 Market in APAC, By Application, 2015–2023 (USD Thousand)

Table 58 Market in APAC, By Country, 2015–2023 (USD Million)

Table 59 Market in RoW, By Equipment, 2015–2023 (USD Thousand)

Table 60 Market in RoW, By Service, 2015–2023 (USD Million)

Table 61 Market in RoW, By Application, 2015–2023 (USD Thousand)

Table 62 Acoustic Emission Testing in RoW, By Region, 2015–2023 (USD Million)

Table 63 Top 5 Players in Market (2017)

Table 64 Recent Partnerships, Acquisitions, and Agreements in Market

Table 65 Recent Expansions and Contracts in Market

Table 66 Recent Product Launches and Collaborations in Market

List of Figures (34 Figures)

Figure 1 Market: Research Design

Figure 2 Process Flow

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market for Sensors to Grow at Highest CAGR Between 2018 and 2023

Figure 8 Inspection Services to Hold Larger Share of Market Between 2018 and 2023

Figure 9 Market for Structural Monitoring to Grow at Highest CAGR Between 2018 and 2023

Figure 10 North America to Hold Largest Share of Market in 2018

Figure 11 Rising Infrastructural Developments Globally Driving Market

Figure 12 Sensors to Dominate Market During Forecast Period

Figure 13 US Held Largest Share of Market in North America in 2017

Figure 14 Market for Structural Monitoring to Grow at Highest CAGR During Forecast Period

Figure 15 Market in Mexico to Grow at Highest CAGR During Forecast Period

Figure 16 Increasing Need for Asset Or Machinery Health Monitoring Drives Market

Figure 17 Value Chain Analysis: Major Value Added During Raw Material Suppliers and Oems Phases of Market

Figure 18 Market for Sensors to Grow at Highest CAGR Between 2018 and 2023

Figure 19 Market for Inspection Services to Grow at Higher CAGR Between 2018 and 2023

Figure 20 Market for Structural Monitoring to Grow at Highest CAGR Between 2018 and 2023

Figure 21 Market for Bridges to Grow at Highest CAGR Between 2018 and 2023

Figure 22 Market: Geographic Snapshot

Figure 23 Overview of AET Market in North America

Figure 24 Overview of AET Market in Europe

Figure 25 Overview of AET Market in APAC

Figure 26 Overview of AET Market in RoW

Figure 27 Key Growth Strategies Adopted By Top Companies Between January 2015 and September 2017

Figure 28 Partnerships, Acquisitions, and Agreements – Key Strategies Adopted By Players Between January 2015 and September 2017

Figure 29 TUV Rheinland: Company Snapshot

Figure 30 TUV Austria: Company Snapshot

Figure 31 TUV Nord: Company Snapshot

Figure 32 Mistras: Company Snapshot

Figure 33 General Electric: Company Snapshot

Figure 34 Parker Hannifin: Company Snapshot

Growth opportunities and latent adjacency in Acoustic Emission Testing Market

Is it possible to have a preformat invoice to proceed with a bank transfer ? What is your address to create a supplier file ?