Aerospace & Defense Elastomers Market by Type (EPDM, Fluoroelastomers, Silicone Elastomers), Application (O-Rings & Gaskets, Seals, Profiles, Hoses), and Region (North America, Europe, South America, Rest of the World) - Global Forecast to 2022

[103 Pages Report] aerospace & defense elastomers market was valued at USD 51.5 Million in 2016 and is projected to reach USD 70.8 Million by 2022, at a CAGR of 5.5% during the forecast period from 2017 to 2022. The growth of the aerospace & defense elastomers market across the globe can be attributed to the increasing demand for new aircraft in emerging economies such as India and China, among others. In addition, the increased rate of replacement of the existing aircraft with new ones is another major factor driving the growth of the aerospace & defense elastomers market across the globe.

The base year considered for this study on the aerospace & defense elastomers market is 2016 and the forecast period is from 2017 to 2022.

Objectives of the Report:

The report aims at estimating the size and future growth potential of the aerospace & defense elastomers market. The aerospace & defense elastomers market has been segmented based on type, application, and region. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022. The report provides detailed information regarding major factors influencing the growth of the aerospace & defense elastomers market. It also analyzes opportunities in the market for the stakeholders and provides the detailed competitive landscape for the market leaders. Additionally, the report also profiles the key players operating in the aerospace & defense elastomers market and comprehensively analyzes their core competencies.

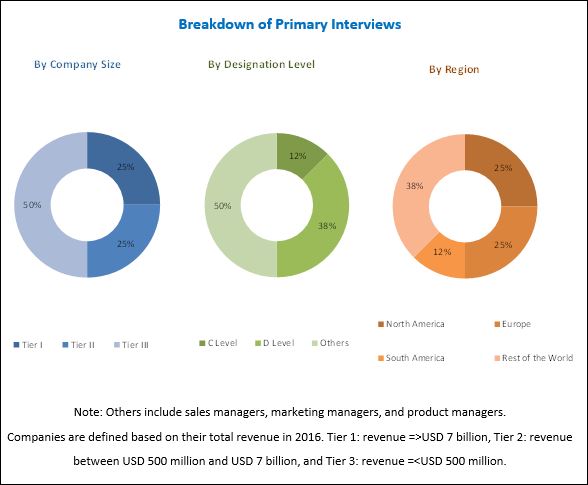

Both, top-down and bottom-up approaches were used to estimate and forecast the size of the aerospace & defense elastomers market and estimate the size of various other dependent submarkets. This research study involved the extensive use of secondary sources, directories, and databases such as Bloomberg BusinessWeek and Factiva to collect information useful for this technical, market-oriented, and commercial study of the aerospace & defense elastomers market. In-depth interviews with various primary respondents were conducted to verify critical qualitative and quantitative information as well as to assess future growth prospects of the aerospace & defense elastomers market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the aerospace & defense elastomers market includes manufacturers of aerospace & defense elastomers such as Trelleborg (Sweden), Shin-Etsu Chemical (Japan), Dow Corning (US), Greene, Tweed (US), Chemours (US), Wacker Chemie (Germany), Momentive (US), Saint-Gobain (France), and Solvay (Belgium), among others.

Key Target Audience:

- Manufacturers of Aerospace & Defense Elastomers

- Traders, Distributors, and Suppliers of Aerospace & Defense Elastomers

- Regional Manufacturers’ Associations and General Aerospace & Defense Elastomers Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

“The study answers several questions for stakeholders, primarily which market segments to focus in the next two to five years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the aerospace & defense elastomers market based on type, application, and region.

Aerospace & Defense Elastomers Market, by Type:

- Ethylene Propylene Diene Monomer (EPDM)

- Silicone Elastomers

- Fluoroelastomers

Aerospace & Defense Elastomers Market, by Application:

- O-Rings & Gaskets

- Seals

- Profiles

- Hoses

Aerospace & Defense Elastomers Market, by Region:

- North America

- Europe

- South America

- Rest of the World

The market has been further analyzed based on key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of the companies. The following customization options are available for the report:

Regional Analysis:

- A country-level analysis of the aerospace & defense elastomers market

Company Information:

- A detailed analysis and profiling of additional market players

The aerospace & defense elastomers market is projected to grow from USD 54.3 million in 2017 to USD 70.8 million by 2022, at a CAGR of 5.5% from 2017 to 2022. The growth of the aerospace & defense elastomers market across the globe can be attributed to the increasing consumption of aerospace & defense elastomers in the aviation industry of emerging economies such as India and China. In addition, the replacement of the existing aircraft by new aircraft is also expected to drive the growth of the aerospace & defense elastomers market across the globe.

Aerospace & defense elastomers are used in O-Rings & gaskets, seals, profiles, and hoses. Among applications, the O-rings & gaskets segment is projected to lead the aerospace & defense elastomers market between 2017 and 2022 in terms of volume. The growth of this segment of the market can be attributed to the increasing use of O-rings & gaskets in the static sealing applications, wherein simple, economical, and leak-proof performance is required.

O-rings can be manufactured using various types of aerospace elastomers and are available in all internationally recognized standard sizes. Gaskets are used to completely plug the empty space between two surfaces. The type of elastomers used for manufacturing gaskets depends on a broad range of variables such as working temperature range that gaskets have to withstand, their mechanical properties, and chemical resistance offered by them to acids.

Based on type, the fluoroelastomers segment accounted for the largest share of the aerospace & defense elastomers market in 2017, in terms of value. The growth of this segment of the market can be attributed to the excellent resistance to heat and weathering offered by fluoroelastomers as well as their extraordinary sealing and mechanical properties. Thus, fluoroelastomers are increasingly being used in aircraft engines and fuel handling systems, thereby leading to their growing demand from the aviation industry.

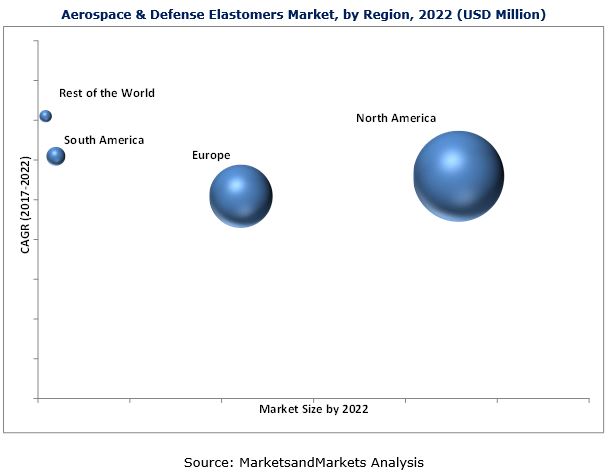

The aerospace & defense elastomers market has been studied in North America, Europe, South America, and Rest of the World. The North American region was the largest market for aerospace & defense elastomers market is 2017, in terms of volume and value, and is expected to remain the largest market by 2022. The growth of the North America aerospace & defense elastomers market can be attributed to the upgradation and expansion of the existing aviation infrastructure in countries such as the US. The Rest of the World aerospace & defense elastomers market is projected to grow at the highest CAGR between 2017 and 2022, in terms of value and volume. The increasing demand for aerospace & defense elastomers for assembling different components of aircraft in Rest of the World is expected to drive the growth of the Rest of the World aerospace & defense elastomers market during the forecast period.

The highly cyclical nature of the aerospace industry poses a key challenge for the growth of the aerospace & defense elastomers market. The main reasons for this cyclical nature of the aerospace industry are the fluctuations in demand for commercial aircraft and irregular defense spending of developed countries. Apart from that, the general health of the airline industry also affects the sales of commercial aircraft across the globe. Moreover, as the aerospace industry is vulnerable to the fluctuating global situations, it also adversely impacts the growth of the aerospace & defense elastomers market across the globe.

The key players operating in the aerospace & defense elastomers market include Trelleborg (Sweden), Shin-Etsu Chemical (Japan), Dow Corning (US), Greene, Tweed (US), Chemours (US), Wacker Chemie (Germany), Momentive (US), Saint-Gobain (France), and Solvay (Belgium), among others. These companies are expected to venture into new markets to widen their customer base and strengthen their market presence. Other manufacturers of aerospace & defense elastomers include Esterline (US), Fralock (US), Chenguang Fluoro & Silicone Elastomers (China), Holland Shielding (Netherlands), Jonal Laboratories (US), Polymod Technologies (US), Rogers Corporation (US), Seal Science (US), Specialised Polymer Engineering (UK), Specialty Silicone Products (US), Unimatec (Japan), and Zeon Chemicals (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Aerospace & Defense Elastomers Market Overview, 2017 vs 2022

4.2 Market of Aerospace & Defense Elastomers, By Application

4.3 Market of Aerospace & Defense Elastomers, By Region

4.4 Market of Aerospace & Defense Elastomers, By Application and Country

4.5 Aerospace & Defense Elastomers Market Attractiveness

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Sustained Technological Advancement

5.2.1.2 Replacement of Aging Aircraft

5.2.2 Restraints

5.2.2.1 Stagnant Western Markets

5.2.3 Opportunities

5.2.3.1 Manufacturing Optimization Through New Technologies

5.2.4 Challenges

5.2.4.1 Major Manufacturers are Demanding Cost Reductions

5.2.4.2 Highly Cyclical Nature of the Aerospace Industry

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Growth Rate Forecast of Major Economies

6 Aerospace & Defense Elastomers Market, By Type (Page No. - 38)

6.1 Introduction

6.2 EPDM

6.3 Fluoroelastomers

6.4 Silicone Elastomers

6.5 Others

7 Aerospace & Defense Elastomers Market, By Application (Page No. - 41)

7.1 Introduction

7.2 O-Rings & Gaskets

7.3 Seals

7.4 Profiles

7.5 Hoses

7.6 Others

8 Aerospace & Defense Elastomers Market, By Region (Page No. - 44)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.3 Europe

8.3.1 France

8.3.2 Italy

8.3.3 Austria

8.3.4 Switzerland

8.3.5 Germany

8.4 South America

8.4.1 Brazil

8.5 RoW

8.5.1 China

8.5.2 India

8.5.3 New Zealand

9 Competitive Landscape (Page No. - 67)

9.1 Overview

9.2 Market Ranking of Key Players

9.3 Competitive Situations & Trends

9.4 Contracts, Expansions, Agreements, & Investments

9.5 Partnerships & Joint Ventures

9.6 New Product Launches

10 Company Profiles (Page No. - 72)

10.1 Trelleborg

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 SWOT Analysis

10.1.4 MnM View

10.2 Shin-Etsu Chemical

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 SWOT Analysis

10.2.5 MnM View

10.3 DOW Corning

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 SWOT Analysis

10.3.4 MnM View

10.4 Greene, Tweed

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 SWOT Analysis

10.4.4 Recent Developments

10.4.5 MnM View

10.5 Chemours

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 SWOT Analysis

10.5.4 Recent Developments

10.5.5 MnM View

10.6 Wacker Chemie AG

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.6.4 SWOT Analysis

10.6.5 MnM View

10.7 Momentive Performance Materials Inc.

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 SWOT Analysis

10.7.4 MnM View

10.8 Saint-Gobain

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 SWOT Analysis

10.8.4 MnM View

10.9 Solvay

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 SWOT Analysis

10.9.4 Recent Developments

10.9.5 MnM View

10.10 Lanxess

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 SWOT Analysis

10.10.4 Recent Developments

10.10.5 MnM View

10.11 Other Companies

10.11.1 3M

10.11.2 Chenguang Fluoro & Silicone Elastomers Co.,Ltd

10.11.3 Esterline

10.11.4 Holland Shielding

10.11.5 Jonal Laboratories, Inc

10.11.6 Polymod Technologies

10.11.7 Quantum Silicones

10.11.8 Rogers Corporation

10.11.9 Seal Science, Inc

10.11.10 Specialised Polymer Engineering

10.11.11 Specialty Silicone Products

10.11.12 Technetics

10.11.13 TRP Polymer Solutions Limited.

10.11.14 Unimatec

10.11.15 Zeon Chemicals

11 Appendix (Page No. - 95)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Related Reports

11.6 Author Details

List of Tables (48 Tables)

Table 1 Trends and Forecast of Real GDP Growth Rates Between 2017 and 2022

Table 2 Market Size, By Type, 2015–2022 (USD Million)

Table 3 Market Size, By Type, 2015–2022 (Ton)

Table 4 Market Size, By Application, 2015–2022 (USD Million)

Table 5 Market Size, By Application, 2015–2022 (Ton)

Table 6 Market Size, By Region, 2015–2022 (USD Million)

Table 7 Market Size, By Region, 2015–2022 (Ton)

Table 8 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 9 North America: Market Size, By Country, 2015–2022 (Ton)

Table 10 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 11 North America: Market Size, By Application, 2015–2022 (Ton)

Table 12 US: Market Size, By Application, 2015–2022 (USD Million)

Table 13 US: Market Size, By Application, 2015–2022 (Ton)

Table 14 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 15 Canada: Market Size, By Application, 2015–2022 (Ton)

Table 16 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 17 Europe: Market Size, By Country, 2015–2022 (Ton)

Table 18 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 19 Europe: Market Size, By Application, 2015–2022 (Ton)

Table 20 France: Market Size, By Application, 2015–2022 (USD Million)

Table 21 France: Market Size, By Application, 2015–2022 (Ton)

Table 22 Italy: Market Size, By Application, 2015–2022 (USD Million)

Table 23 Italy: Market Size, By Application, 2015–2022 (Ton)

Table 24 Austria: Market Size, By Application, 2015–2022 (USD Million)

Table 25 Austria: Market Size, By Application, 2015–2022 (Ton)

Table 26 Switzerland: Market Size, By Application, 2015–2022 (USD Million)

Table 27 Switzerland: Market Size, By Application, 2015–2022 (Ton)

Table 28 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 29 Germany: Market Size, By Application, 2015–2022 (Ton)

Table 30 South America: Market Size, By Country, 2015–2022 (USD Million)

Table 31 South America: Market Size, By Country, 2015–2022 (Ton)

Table 32 South America: Market Size, By Application, 2015–2022 (USD Million)

Table 33 South America Market Size, By Application, 2015–2022 (Ton)

Table 34 Brazil: Market Size, By Application, 2015–2022 (USD Million)

Table 35 Brazil: Market Size, By Application, 2015–2022 (Ton)

Table 36 RoW: Market of Aerospace & Defense Elastomers, By Country, 2015–2022 (USD Million)

Table 37 RoW: Market of Aerospace & Defense Elastomers, By Country, 2015–2022 (Ton)

Table 38 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 39 RoW: Market Size, By Application, 2015–2022 (Ton)

Table 40 China: Market Size, By Application, 2015–2022 (USD Million)

Table 41 China: Market Size, By Application, 2015–2022 (Ton)

Table 42 India: Market Size, By Application, 2015–2022 (USD Million)

Table 43 India: Market Size, By Application, 2015–2022 (Ton)

Table 44 New Zealand: Market Size, By Application, 2015–2022 (USD Million)

Table 45 New Zealand: Market Size, By Application, 2015–2022 (Ton)

Table 46 Contracts, Expansions, Agreements, & Investments, 2015–2017

Table 47 Partnerships & Joint Ventures, 2015–2017

Table 48 New Product Launches, 2015–2017

List of Figures (24 Figures)

Figure 1 Aerospace & Defense Elastomers Market: Research Design

Figure 2 Fluoroelastomers to Be the Largest Type Between 2017 and 2022

Figure 3 O-Rings & Gaskets to Be the Largest Application of Aerospace & Defense Elastomers Between 2017 and 2022

Figure 4 RoW to Be the Fastest-Growing Market of Aerospace & Defense Elastomers Between 2017 and 2022

Figure 5 North America Was the Largest Market of Aerospace & Defense Elastomers in 2016

Figure 6 Market of Aerospace & Defense Elastomers to Witness Moderate Growth Between 2017 and 2022

Figure 7 O-Rings & Gaskets to Be the Largest Market During Forecast Period

Figure 8 RoW to Register Highest CAGR During Forecast Period

Figure 9 US Accounted for Largest Market Share in 2016

Figure 10 RoW to Be Fastest-Growing Market Between 2017 and 2022

Figure 11 Factors Governing Market of Aerospace & Defense Elastomers

Figure 12 Porter’s Five Forces Analysis: Aerospace & Defense Elastomers Market

Figure 13 China, India, and Brazil are Emerging as New Hotspots

Figure 14 North America: Aerospace & Defense Elastomers Market Snapshot

Figure 15 RoW: Aerospace & Defense Elastomers Market Snapshot

Figure 16 Companies Adopted Contracts, Expansions, & Agreements, and Partnerships & Joint Ventures as the Key Strategies Between 2015 and 2017

Figure 17 Trelleborg: Company Snapshot

Figure 18 Shin-Etsu Chemical: Company Snapshot

Figure 19 Chemours: Company Snapshot

Figure 20 Wacker Chemie AG: Company Snapshot

Figure 21 Momentive Performance Materials Inc.: Company Snapshot

Figure 22 Saint-Gobain: Company Snapshot

Figure 23 Solvay: Company Snapshot

Figure 24 Lanxess: Company Snapshot

Growth opportunities and latent adjacency in Aerospace & Defense Elastomers Market