EMI Shielding Market Size, Share and Trends

EMI Shielding Market by Type (Narrowband EMI, Broadband EMI), Method (Radiation, Conduction), Material (Coatings & Paints, Polymers, Elastomers, Metal Shielding, EMI/EMC Filters, EMI Tapes & Laminates), Frequency (Low, High) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

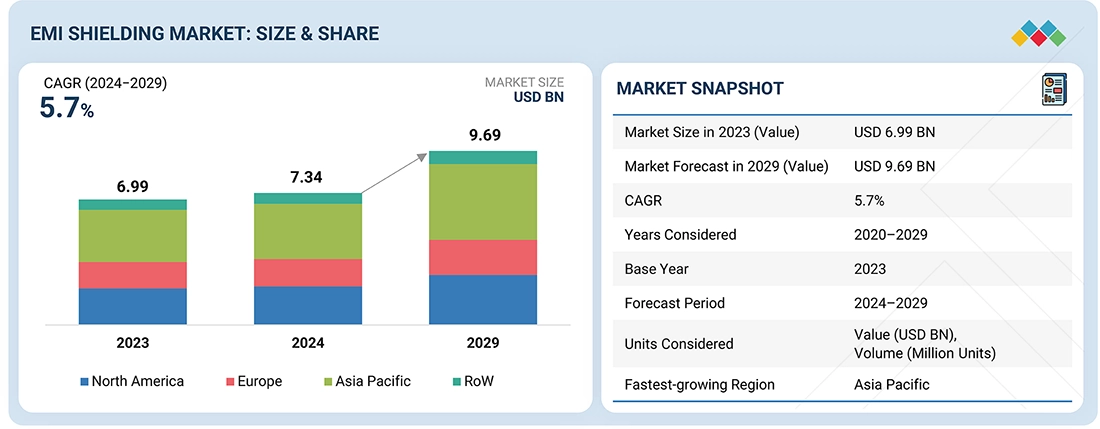

The EMI Shielding market is projected to reach USD 9.69 billion by 2029 from USD 7.34 billion in 2024, at a CAGR of 5.7% from 2024 to 2029. The growth of the EMI shielding market is driven by the rapid proliferation of high-frequency electronics especially 5G, IoT, EVs, and miniaturized consumer devices which increases the risk of electromagnetic interference.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific EMI Shielding Market market dominated with a share of 41.6% in 2023.

-

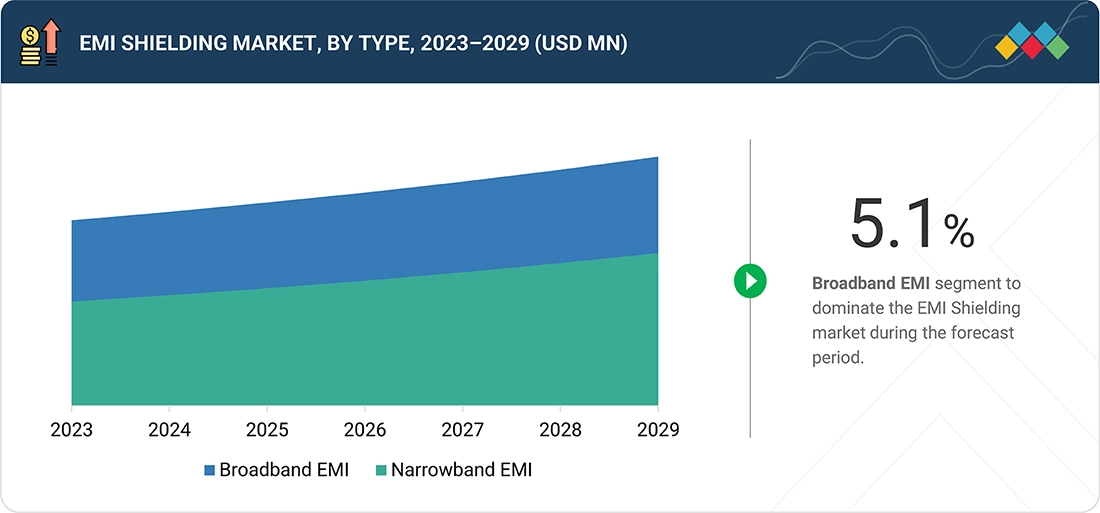

By OfferingsBy offerings, the narrowband EMI segment is expected to register the highest CAGR of 6.7%.

-

By MethodBy method, the conduction segment is projected to grow at the fastest rate from 2024 to 2029.

-

By MaterialBy material, the conductive coatings & paints segment is expected to dominate the market.

-

By IndustryBy industry, the automotive segment will grow the fastest during the forecast period.

-

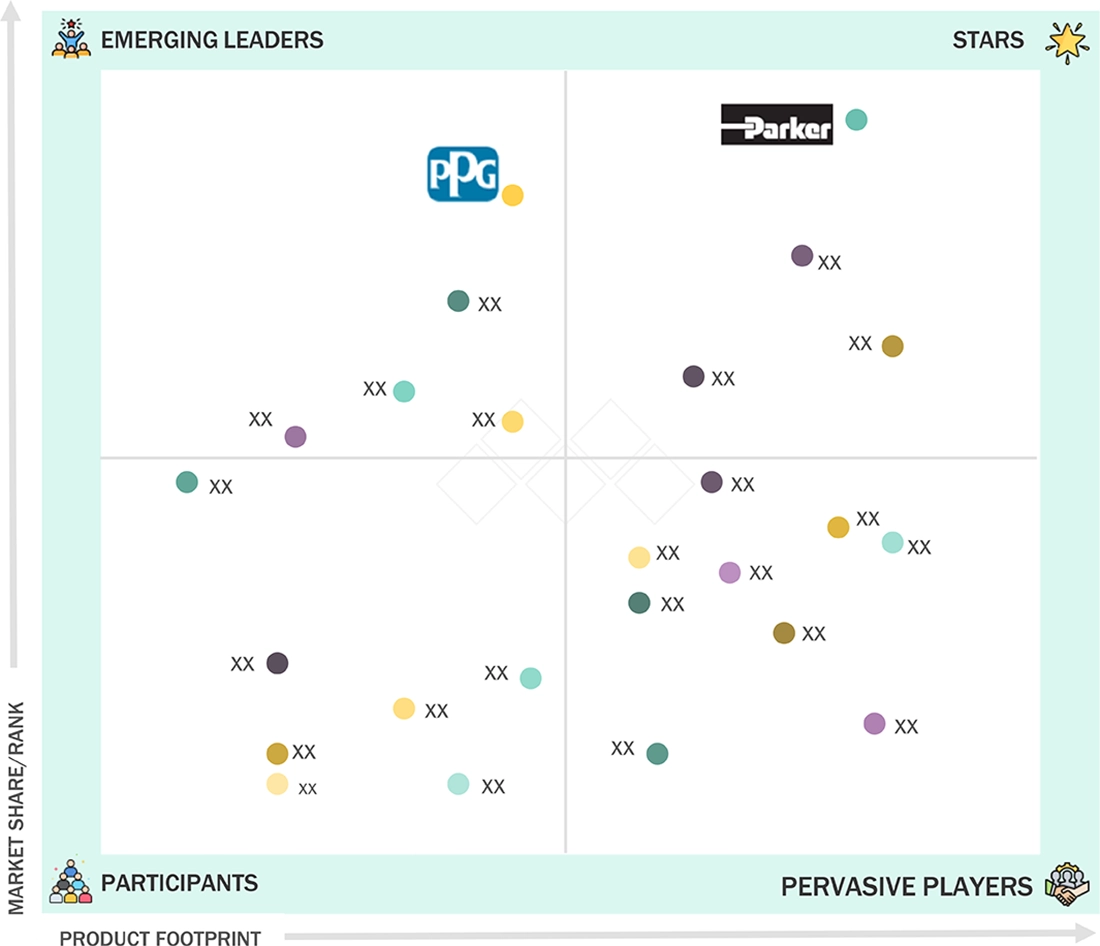

Competitive LandscapeParker Hannifin Corp, 3M, Laird Performance Materials, Leader Tech, were identified as some of the star players in the EMI Shielding market (global), given their strong market share and product footprint.

-

Competitive LandscapeCoatex Industries, Shielding Solutions, East Coast Shielding, Nitrium Co Ltd., Graphenest, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The EMI shielding market is witnessing steady growth driven by the rapid proliferation of electronic devices across automotive, consumer electronics, telecom, and industrial equipment, which increases the risk of electromagnetic interference in densely packed circuits. As devices become smaller and faster, the need for reliable shielding materials intensifies to ensure signal integrity and device safety. Additionally, stringent global EMC regulations are compelling manufacturers to integrate advanced shielding solutions, further accelerating market adoption.

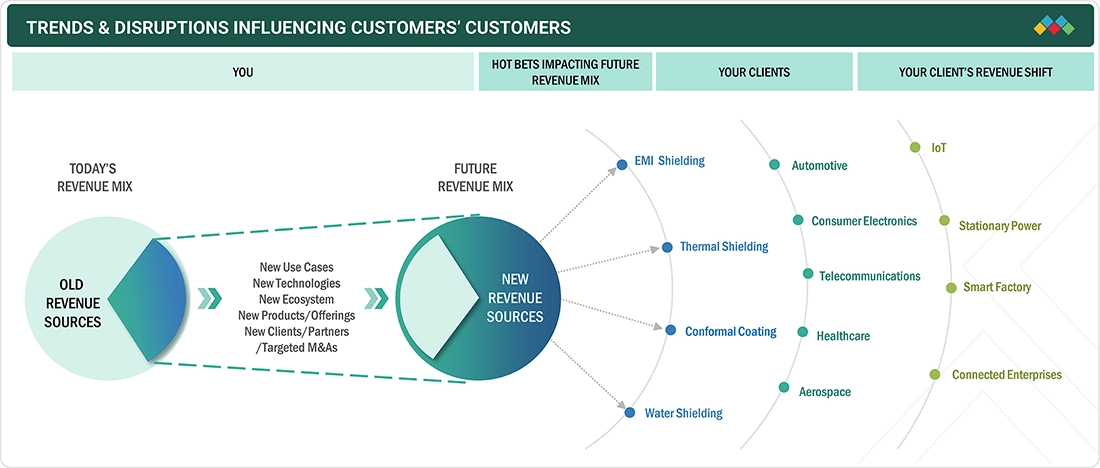

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The EMI shielding market is experiencing significant shifts driven by the rapid evolution of electronics and communication technologies. A key trend is the growing use of lightweight and flexible shielding materials, including conductive polymers and nanocomposites, to support compact, high-density devices. The rollout of 5G networks and high-frequency electronics is also pushing manufacturers toward advanced shielding coatings and materials that can handle higher signal speeds and tighter EMC requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for high-speed and high-frequency devices

-

Enforcement of stringent regulations to prevent electronic equipment malfunctions

Level

-

Environmental hazards and high costs of EMI shielding metals

-

Low effectiveness of traditional EMI shielding materials.

Level

-

Shifting preference toward electric vehicles to mitigate carbon emissions.

-

Growing adoption of digital healthcare solutions.

Level

-

High complexity in reducing electromagnetic interference in miniaturized devices.

-

Ensuring long-term durability and corrosion resistance of shielding materials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for high-speed and high-frequency devices.

The rising demand for high-speed and high-frequency devices is a major driver for the EMI shielding market, as faster data transmission and higher operating frequencies increase the risk of electromagnetic interference. Modern applications such as 5G smartphones, automotive radar, advanced computing, and IoT devices require precise signal integrity, making effective shielding essential. As electronic systems become more powerful and compact, manufacturers are compelled to adopt advanced shielding materials and designs to ensure performance reliability and regulatory compliance..

Restraint: Environmental hazards and high costs of EMI shielding metals.

Environmental hazards and the high cost of EMI shielding metals act as a significant restraint on the market. Metals such as copper, nickel, and aluminum offer strong shielding performance but come with high extraction, processing, and manufacturing costs, making solutions expensive for large-scale or price-sensitive applications. Additionally, metal production and disposal pose environmental concerns, including energy-intensive mining, carbon emissions, and waste generation, pushing manufacturers to search for alternatives. These factors collectively slow adoption and limit the use of traditional metal-based EMI shielding in some industries.

Opportunity: Shifting preference toward electric vehicles to mitigate carbon emissions.

The shifting preference toward electric vehicles to mitigate carbon emissions presents a strong opportunity for the EMI shielding market. EVs rely heavily on high-power electronics, battery management systems, inverters, onboard chargers, and advanced communication modules—each of which is highly susceptible to electromagnetic interference. As EV adoption accelerates, the need for reliable shielding solutions to ensure safety, signal integrity, and smooth operation of critical electronic components increases substantially. This growing demand positions EMI shielding materials and technologies as essential enablers in the global transition to cleaner mobility.

Challenge: High complexity in reducing electromagnetic interference in miniaturized devices.

Reducing electromagnetic interference in miniaturized devices is a major challenge because shrinking form factors leave very little space for traditional shielding materials or physical separation of components. As more functions are packed into compact devices, the density of high-speed circuits increases, amplifying the risk of interference between components. Designers must balance performance, thermal management, and space constraints, making it difficult to integrate effective EMI shielding without impacting device size, weight, or efficiency.

EMI SHIELDING MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of conductive elastomers and EMI shielding gaskets for aerospace electronic enclosures and avionic systems. | Ensures reliable signal integrity, prevents electromagnetic leakage, and enhances aircraft electronics safety and performance. |

|

Use of conductive and anti-static coatings for EMI shielding in aircraft cabins, radomes, and cockpit displays. | Lightweight coating-based shielding, improved system reliability, and protection against high-frequency interference. |

|

EMI shielding tapes, films, and absorbers used in high-density aerospace electronics, communication modules, and navigation systems. | High shielding effectiveness, reduced interference, enhanced performance of sensitive flight-control and communication electronics. |

|

Conductive adhesives, sealants, and thermal interface materials for EMI shielding in aircraft power systems and onboard electronics. | Enables miniaturized design, improves heat dissipation, and provides stable electrical connectivity for critical components.. |

|

EMI shielding materials such as conductive foams, gaskets, and board-level shields in UAVs, satellites, and military avionics. | Lightweight shielding, enhanced stealth and electronic protection, improved performance in harsh and high-frequency environments. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of EMI shielding includes raw material suppliers, manufacturers, distributors, and end users. Raw material suppliers provide essential inputs such as metals, conductive polymers, and nanomaterials used in shielding products. Manufacturers convert these materials into shielding tapes, coatings, gaskets, foams, and enclosures tailored for various applications. Distributors enable smooth supply-chain movement by supplying these shielding solutions to regional markets and industry-specific customers. Finally, end users including automotive, aerospace, consumer electronics, telecom, and industrial sectors integrate these shielding products into devices and systems to ensure reliable performance and electromagnetic compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

EMI Shielding Market, By Type

Broadband EMI shielding is dominating because modern electronic systems operate across wide frequency ranges, creating complex interference patterns that require shielding solutions capable of blocking multiple frequencies at once. As devices like 5G equipment, EV electronics, advanced medical devices, and high-speed computing systems become more multifunctional, they generate and encounter EMI across broad spectra. Broadband shielding offers versatile, high-performance protection, reducing the need for multiple specialized materials and ensuring consistent signal integrity in dense, high-frequency environments—making it the preferred choice for most industries.

EMI Shielding Market, By Material

Conductive coatings and paints dominate the EMI shielding market because they provide an effective, lightweight, and cost-efficient shielding solution that can be easily applied to complex shapes and compact electronic enclosures. They enable uniform coverage without adding bulk, making them ideal for miniaturized devices, automotive components, and aerospace systems where space and weight are critical. Additionally, their compatibility with high-volume manufacturing and ability to deliver strong shielding performance across wide frequency ranges make them the preferred choice for many OEMs.

EMI Shielding Market, By Industry

Consumer electronics dominate the EMI shielding market because they contain densely packed high-speed circuits that generate significant electromagnetic interference, making shielding essential to ensure device performance and safety. The rapid growth of smartphones, tablets, wearables, smart TVs, gaming consoles, and IoT devices has massively increased the volume of electronics requiring EMI protection. Additionally, trends like device miniaturization, 5G integration, and wireless connectivity further raise EMI risks, pushing manufacturers to adopt advanced shielding materials—driving the segment’s overall market leadership.

REGION

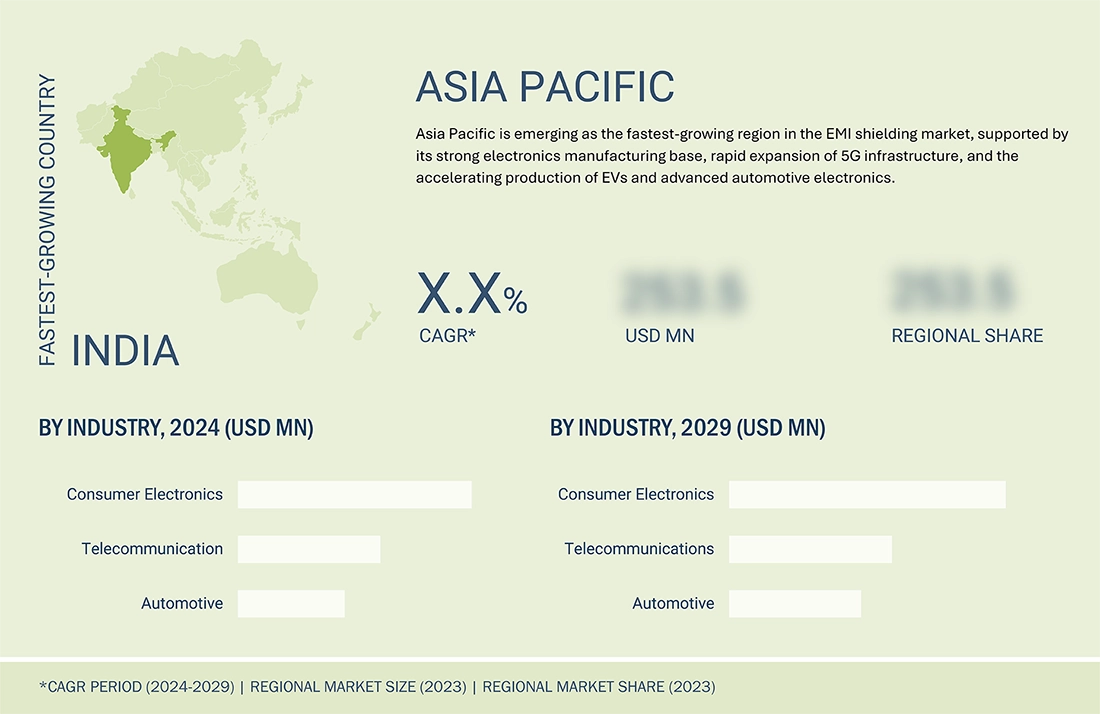

Asia Pacific to be fastest-growing region in global EMI Shielding market during forecast period

Asia Pacific is growing the fastest in the EMI shielding market because the region is the global hub for electronics manufacturing, with countries like China, South Korea, Japan, and Taiwan producing smartphones, PCs, automotive electronics, and telecom equipment at massive scale. Rapid expansion of 5G infrastructure, electric vehicles, and industrial automation is further increasing the need for advanced EMI protection. Additionally, strong government support for semiconductor production and the presence of major OEMs and EMS companies accelerate adoption of shielding materials, making Asia Pacific the fastest-growing region.

EMI SHIELDING MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In the EMI shielding market matrix, Parker Hannifin (Star) leads with a strong market presence and a comprehensive portfolio of conductive elastomers, gaskets, and shielding materials widely adopted across aerospace, automotive, and high-reliability industrial applications. Its scale, advanced material technologies, and deep integration into mission-critical electronics reinforce its dominant position. PPG Industries (Emerging Leader) is rapidly gaining traction with its innovative conductive coatings, anti-static paints, and lightweight shielding solutions tailored for next-generation electronics and aerospace platforms. While Parker Hannifin continues to lead through its broad product footprint and proven performance, PPG Industries demonstrates strong potential to move toward the leaders’ quadrant as demand rises for coating-based EMI shielding that supports miniaturization, weight reduction, and complex geometries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Parker Hannifin Corp (US)

- PPG Industries Inc (US)

- 3M (US)

- Henkel AG & CO. KGAA, (Germany)

- Laird Technologies, Inc. (US)

- Leader Tech Inc. (US)

- MG Chemical (Canada)

- Nolato AB (Sweden)

- Tech Etch In (US)

- RTP Company (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 6.99 Billion |

| Market Forecast in 2029 (Value) | USD 9.69 Billion |

| Growth Rate | CAGR of 5.7% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

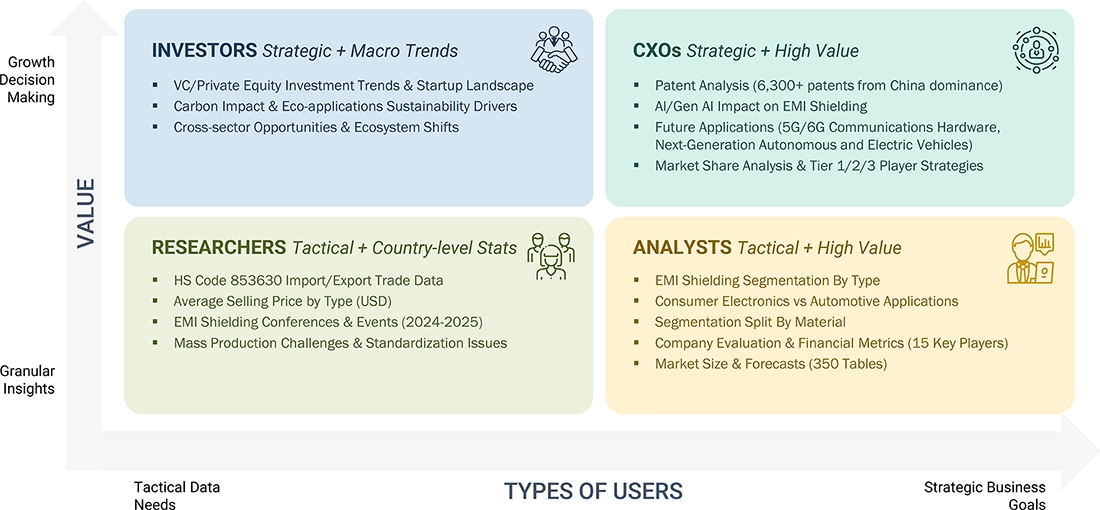

WHAT IS IN IT FOR YOU: EMI SHIELDING MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Electronics OEM |

|

|

| Automotive Tier-1 Supplier (EV/ADAS) |

|

|

| Telecom Equipment Manufacturer (5G/6G) |

|

|

| Aerospace & Defense Contractor |

|

|

RECENT DEVELOPMENTS

- August 2024 : PPG announced the completion of upgrades to expand production capacity at its Yen Phong industrial coatings plant in B?c Ninh province, Vietnam.

- May 2024 : 3M has announced a USD 67 million, 90,000-square-foot expansion at its Valley, Nebraska facility, aimed at increasing manufacturing capacity. This investment adds new production lines, equipment, and a warehouse, enabling 3M to better and more quickly meet customer demand for its personal safety products

- Septmber 2023 : Henkel introduced the multifunctional EMI thermal gap pad without silicone. The Bergquist Gap Pad TGP EMI4000 is a silicone-free substance that combines high thermal conductivity (4W/mK) with EMI shielding capabilities, effective up to 77 GHz frequencies

Table of Contents

Methodology

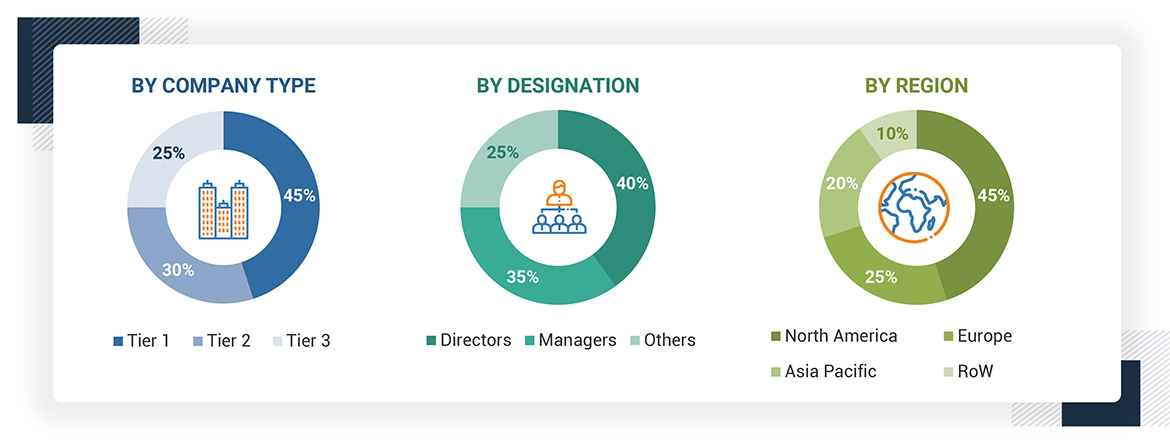

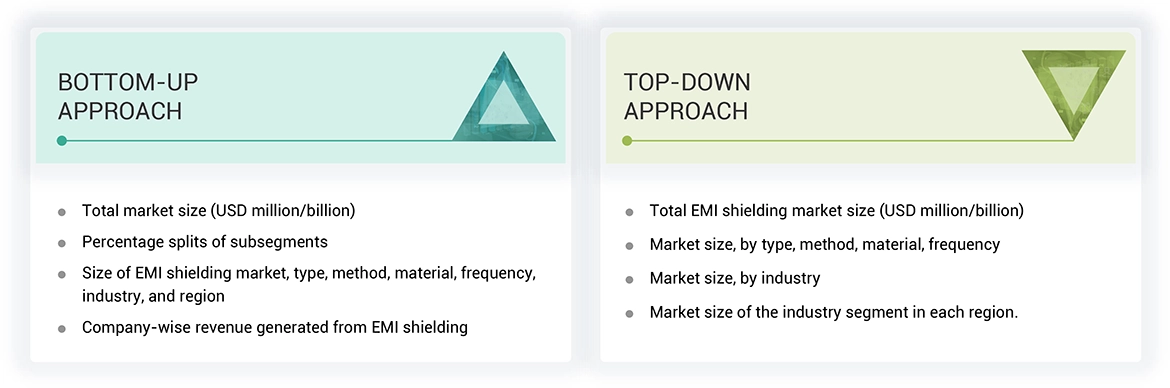

The study used four major activities to estimate the market size of the EMI shielding. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the EMI shielding market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the EMI shielding market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the Semiconductor Industry Association (SIA), Electronic System Design Alliance (ESD Alliance), Institute of Electrical and Electronics Engineers (IEEE), Taiwan Semiconductor Industry Association (TSIA), European Semiconductor Industry Association (ESIA), and Korea Semiconductor Industry Association (KSIA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the EMI shielding market. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the EMI shielding ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the EMI shielding market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the EMI shielding market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

EMI Shielding Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the EMI shielding market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Electromagnetic Interference (EMI) shielding is a protective measure implemented to minimize or control the impact of electromagnetic interference on electronic devices and systems. EMI shielding involves the use of various materials and techniques to prevent unwanted electromagnetic signals from disrupting the normal functioning of electronic components. EMI shielding solutions, including tapes and laminates, conductive coatings & paints, metal shielding, conductive polymers, and EMI filters, are used across various industries to protect electronics from electromagnetic interference.

The EMI shielding ecosystem encompasses manufacturers and distributors of EMI shielding products and solutions. The EMI shielding market is diverse, with more than 25 companies vying for positions and striving to expand their market shares across the value chain. Anticipated growth in the market in the upcoming years is attributed to the escalating demand for consumer electronics that necessitate EMI shielding.

Key Stakeholders

- EMI Shielding Solution Suppliers

- EMI Shielding Component Suppliers

- EMI Shielding Regulatory Bodies

- EMI Testing Companies

- Semiconductor Component Manufacturers

- Advanced Chemical Material Suppliers

- Analysts and Strategic Business Planners

- End Users who want to know more about EMI Shielding and the Latest Technology Developments in this Market

Report Objectives

- To describe and forecast the EMI shielding market by type, method, material, frequency, industry and region, in terms of value

- To describe and forecast the market for various segments across four central regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To strategically analyze the micro markets with regard to the individual growth trends, prospects, and contribution to the market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the value chain

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios trade landscape, and case studies pertaining to the market under study

- To strategically profile key players in the EMI shielding market and comprehensively analyze their market shares and core competencies

- To strategically profile the key players and provide a detailed competitive landscape of the market

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with research and development (R&D) in the EMI shielding market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the EMI shielding market

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company in the EMI shielding market.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the EMI Shielding Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in EMI Shielding Market

Shannigrahi

Jul, 2022

I am more interested to know the frequency band to be adopted in 5G devices, the current state-of-the art EMI shielding, and the current pain point if any together with the list of MNCs involved in this and the overall market size.Also, Can you please share a bit more on the EMI shielding value chain? Does your full report contain information on the value chain in terms of OEM/manufacturers, EMS/Sub-cons, component makers/assemblers, module assemblers?.