Aerospace Valves Market by Aircraft Type, End Use (OEM, Aftermarket), Type, Application (Fuel System, Hydraulic System, Environment Control System, Pneumatic System, Lubrication System, Water & Wastewater System) Material, Region (2021-2026)

Update: 02/13/2025

Aerospace Valves Market Size and Share

The Global Aerospace Valves Market Size was valued at USD 11.4 billion in 2021 and is estimated to reach USD 14.0 billion by 2026, growing at a CAGR of 4.1% during the forecast period.

The Aerospace Valves Industry is driven by the increasing demand for aircraft across regions and the need for technologically advanced fluid flow systems in aircraft.

Aerospace Valves Market Forecast to 2026

To know about the assumptions considered for the study, Request for Free Sample Report

Aerospace Valves Market Trends

Drivers: increasing frequency in aerospace valve replacements to drive market growth

Aerospace valves is a component that is constantly being engaged and used across aircraft subsystems. Aerospace valves are required to operate constantly during a flight and this often results in wear and tear of the component. Due to the increase in air traffic across regions, flight hours of fleets have also increased exponentially. The replacement cycle of aerospace valves directly depends on the flight hours an aircraft and the number of days of operation. Aerospace valves also do not undergo repair or maintenance checks and directly are replaced. Hence these factors drive the need for frequent replacement of aerospace valves hence driving the aftermarket size.

Opportunity: Introduction of Internet of Things (IoT) in aerospace valves

New technological advancements in sub systems in aircraft has been leveraging the Internet of Things (IoT) for system operations. Valve manufacturers are looking into adopting IoT architectures to improve and enhance the existing features of control valves to better the performance and reduce maintenance costs over aircraft lifecycles. IoT architectures allow airliners to regularly monitor the health of valves and prevent downtimes or shutdowns. IoT enabled valves will definitely provide valve manufacturers with opportunities as aircraft will get more technologically advanced.

Challenge: Increasing competition from local and unorganized manufacturers

The aerospace valves manufacturers face stiff competition from several local or unorganized suppliers of valves, especially in the aftermarket segment. The aerospace valves market is highly fragmented, as several established as well as local manufacturers operate in this market. The established suppliers might face the risk of losing revenue from the replacement valves, due to the presence of local vendors. The aerospace valves supplied by local companies are often offered at a lesser price as compared to the prices offered by some of the leading manufacturers. Hence, the customers might consider procuring replacement valves from local suppliers. This poses a major challenge for major suppliers as it can result in a loss of market share in the aerospace valves market. This can be especially true for major companies in the US and the UK supplying to some of the developing countries such as China and India where there are hundreds of local valve manufacturers.

Aerospace Valves Market Segment Insights

Environmental control system segment to witnessing largest market share during the forecast period.

The environemntal control system segment is witnessing the alrgest market share during the forecast period. The environmental control system comprises of air supply, thermal control, cabin pressurization, avionics cooling, smoke detection and fire suppression. These functions are integral to ensure passenger and aircraft safety. Aerospace valves are used in all these sub systerms extensievely. With the increasing need for environmental control systems the demand for aerosapce valves increase.

The fixed wing aircraft segment is projected to have the highest revenue during the forecast period

Based on the aircraft type, the fixed wing segment is projected to have the largest market share of the aerospace valves during the forecast period. The increasing passenger traffic across the globe and the increasing requirment for aircraft in civilian and corporate travel and other applications is driving the demand for fixed wing segment.

The OEM segment is projected to witness the highest CAGR during the forecast period

Based on End Use, the OEM segment is expected to grow with highest CAGR for the aerospace valves market during the forecast period. The demand for aircraft is increasing exponentially across regions. The increasing demand for military aircraft due to increasing border tensions are also major factor. With increasing aircraft demand more installation of aerospace valves is expected. This will drive the overall demand of the market.

Aerospace Valves Market Regions

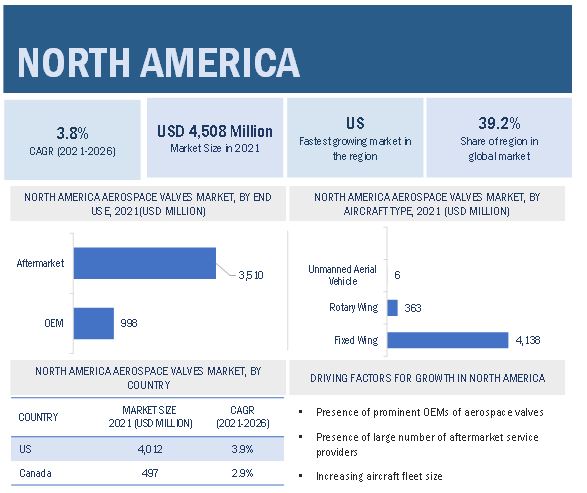

The North America market is projected to contribute the largest market share from 2021 to 2026

North America is projected to be the largest regional share of the aerospace valves market during the forecast period. North America is the headquarters to major valve manufacturers like Honeywell, Triumph, Woodward inc, Collins Aerospace among other major manufacturers. North America also has the presence of the aircraft manufacturers like Beoing, Bombardier and Lockheed Martin Among others. The increasing demand for aircraft and technolgical advancements in valve technolgies are drving the demand in this region.

Aerospace Valves Market by Region

To know about the assumptions considered for the study, download the pdf brochure

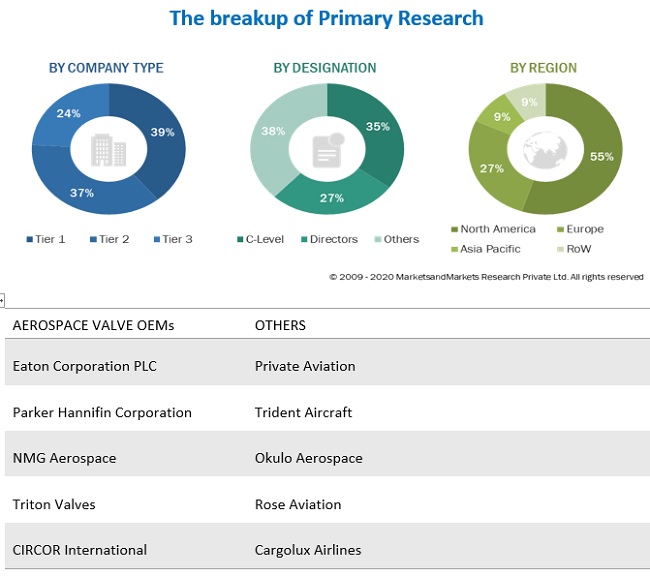

Aerospace Valves Industry Companies: Top Key Market Players

The Aerospace Valves Companies are dominated by globally established players such as

- Eaton Corporation PLC (Ireland)

- Safran (France)

- Woodward, Inc. (US)

- Triumph Group (US)

- Parker Hannifin Corporation (US)

They have great global presence and product portfolio catering to a diverse customer base.

Eaton Corporation PLC provides valves for fuel systems, hydraulic systems, pneumatic systems, and coolants systems. The company has very diverse and broad product portfolio that cater to different applications that spread across wide range of industries including oil & gas, healthcare, food & beverage, etc. Eaton’s valves deliver a competitive advantage in industries across the world.

Safran provides valves for air-conditioning systems, avionics, cargo and cabin environmental control systems. It has multiple valve designs that include air valves, butterfly valves, among others. Safran caters to a wide variety of customers across the aerospace and defense industry.

Woodward Inc. specializes in designing and manufacturing motion control and integrated propulsion systems for the aerospace industry. It offers reliable and cost-effective solutions for its original equipment and end user customers. It also caters to other industries such as oil & gas, power distribution, petrochemicals, and transportation.

Scope of Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 11.4 billion in 2021 |

|

Projected Market Size |

USD 14.0 billion by 2026 |

|

Aerospace Valves Market Growth Rate |

4.1% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Application, By Type, By Material, By Aircraft Type, By End Use |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Companies covered |

Eaton Corporation PLC (Ireland), Safran (France), Woodward, Inc. (US), Triumph Group (US), Parker Hannifin Corporation (US) |

The study categorizes the aerospace valves market based on Application, Type, Material, Aircraft Type, End Use, and Region.

By Type

- Butterfly Valves

- Rotary Valves

- Solenoid Valves

- Flapper-nozzle Valves

- Poppet Valves

- Gate Valves

- Ball Valves

- Others

By Application

- Fuel System

- Hydraulic System

- Environmental Control System

- Pneumatic System

- Lubrication System

- Water & Wastewater System

By Material

- Stainless Steel

- Titanium

- Aluminum

- Others

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

By End Use

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East

- Africa

Aerospace Valves Market Highlights:

Recent Developments

- In 2021, Valcor Engineering Corporation developed Modulating Control Valves (MCV), also known as Proportional Control Valves (PCV), that will perform proportional flow control in avionics cooling systems, pneumatic and hydraulic systems. They are also suitable for controlling aviation fuel flow and Polyalphaolefin (PAO) control.

- In 2020, Marotta Controls developed two distinct valves for Honeybee Robotics’ Pneumatic Sampler. The two custom components, modular solenoid valves and fill & drain valves, will be used in Honeybee’s Pneumatic Sampler.

- In 2019, Crane Co. Partnered with Adient to provide seat actuation systems and electrical integration on its Ascent business class seat which gives superior cabin experience.

- In 2019, Triumph Group had announced that its maintenance, repair, and overhaul business, Triumph Product Support, was awarded a 7-year agreement from Collins Aerospace for repair services on various environmental control system components.

- In 2019, Moog Inc. was awarded contracts for the Primary Flight Control Actuation System, also known as the Electro-Hydrostatic Actuation System, the Leading- Edge Flap Drive System, and the Wingfold Actuation System by Lockheed Martin for the F-35 Lightning II 5th Generation fighter.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aerospace valves market?

Response: The aerospace valves market is expected to grow substantially owing to the increasing global aircraft fleet size, frequent replacement of aerospace valves, and growing demand for Unmanned Aerial Vehicles.

What are the key sustainability strategies adopted by leading players operating in the aerospace valves market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the aerospace valves market. The major players include Eaton Corporation PLC (Ireland), Safran (France), Woodward, Inc. (US), Triumph Group (US), and Parker Hannifin Corporation (US). These players have adopted various strategies, such as agreements, contracts, new product launches, and partnerships, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aerospace valves market?

Response: Some of the major emerging technologies and use cases disrupting the market include additive manufacturing or?,nents for manufacturing aerospace valves.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 62)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AEROSPACE VALVES MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS: AEROSPACE VALVES MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 2 AEROSPACE VALVES MARKET TO GROW AT A HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 67)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET DEFINITION & SCOPE

2.2.2 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

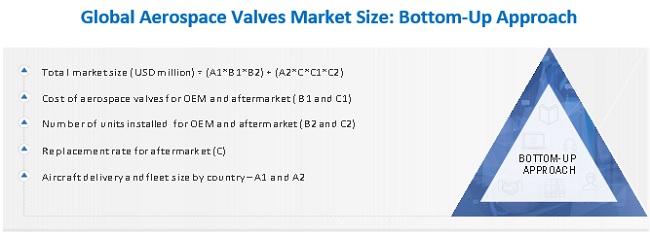

2.3.1 BOTTOM-UP APPROACH

2.3.2 AEROSPACE VALVES MARKET FOR OEM

FIGURE 5 MARKET SIZE CALCULATION FOR OEM

2.3.3 AEROSPACE VALVES AFTERMARKET

FIGURE 6 MARKET SIZE CALCULATION FOR AFTERMARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.4 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION & VALIDATION

FIGURE 9 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 77)

FIGURE 10 ENVIRONMENT CONTROL SYSTEM SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AEROSPACE VALVES MARKET IN 2021

FIGURE 11 AEROSPACE VALVES, BY MATERIAL, 2021

FIGURE 12 AFTERMARKET TO DOMINATE AEROSPACE VALVES MARKET IN 2021

FIGURE 13 MARKET IN EUROPE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 80)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AEROSPACE VALVES MARKET

FIGURE 14 FREQUENT REPLACEMENT OF AEROSPACE VALVES IS EXPECTED TO DRIVE MARKET FROM 2021 TO 2026

4.2 AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE

FIGURE 15 FIXED WING SEGMENT PROJECTED TO LEAD MARKET FROM 2021 TO 2026

4.3 AEROSPACE VALVES MARKET, BY TYPE

FIGURE 16 BUTTERFLY VALVES SEGMENT TO DOMINATE FROM 2021 TO 2026

4.4 AEROSPACE VALVES MARKET, BY COUNTRY

FIGURE 17 FRANCE PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 82)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 AEROSPACE VALVES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in global aircraft fleet size

5.2.1.2 Frequent replacement of aerospace valves

5.2.1.3 Growing demand for unmanned aerial vehicles

5.2.2 RESTRAINTS

5.2.2.1 Increasing electrification of aircraft systems

5.2.2.2 Fluctuating cost of raw materials

5.2.3 OPPORTUNITIES

5.2.3.1 Introduction of Internet of Things (IoT) in aerospace valves

5.2.4 CHALLENGES

5.2.4.1 Improving operational efficiency of aerospace valves

5.3 OPERATIONAL DATA

TABLE 2 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-2038

5.4 COVID-19 IMPACT: RANGE AND SCENARIOS

5.5 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.5.1 RAW MATERIALS

5.5.2 R&D

5.5.3 MANUFACTURING

5.5.4 DISTRIBUTION

5.5.5 END USERS

5.5.6 AFTER-SALE SERVICES

5.6 VOLUME ANALYSIS

TABLE 3 OEM: AEROSPACE VALVES MARKET, BY FIXED WING AND ROTARY WING AIRCRAFT (UNITS)

TABLE 4 AFTERMARKET: AEROSPACE VALVES MARKET, BY FIXED WING AND ROTARY WING AIRCRAFT (UNITS)

5.7 AVERAGE SELLING PRICE

TABLE 5 AVERAGE SELLING PRICE: OEM AEROSPACE VALVES, BY APPLICATION (USD)

TABLE 6 AVERAGE SELLING PRICE: AFTERMARKET AEROSPACE VALVES, BY APPLICATION (USD)

5.8 MARKET ECOSYSTEM MAP

FIGURE 20 AEROSPACE VALVES MARKET ECOSYSTEM

5.8.1 PROMINENT COMPANIES

5.8.2 PRIVATE AND SMALL ENTERPRISES

5.8.3 END USERS

TABLE 7 AEROSPACE VALVES MARKET ECOSYSTEM

5.9 DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 21 AEROSPACE VALVES MARKET: REVENUE SHIFT

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 COMPETITION IN THE INDUSTRY

5.11 TRADE DATA ANALYSIS

TABLE 9 TRADE DATA TABLE FOR AEROSPACE VALVES MARKET

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 THE SAE ARP 490G STANDARD FOR ELECTROHYDRAULIC SERVOVALVES

5.12.2 SAE ARP4763 REGULATION

5.13 CASE STUDIES

5.13.1 CIRCOR INTERNATIONAL, INC. DEVELOPS VALVES FOR CREW EXPLORATION VEHICLE (CEV)

5.13.2 EATON SUPPLIES AEROSPACE VALVES FOR EUROFIGHTER TYPHOON MILITARY AIRCRAFT

5.14 TECHNOLOGY TRENDS

5.14.1 ADDITIVE MANUFACTURING OF AEROSPACE VALVES

6 INDUSTRY TRENDS (Page No. - 98)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 AFTERMARKET SERVICE PROVIDERS

6.2.4 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

FIGURE 23 EMERGING TRENDS IN AEROSPACE VALVES MARKET

6.3.1 SMART VALVES

6.3.2 LIGHTWEIGHT VALVES

6.3.3 POLYETHERETHERKETONE AS A COMPOSITE

6.4 INNOVATION & PATENT ANALYSIS

TABLE 10 INNOVATION AND PATENT REGISTRATIONS

6.5 IMPACT OF MEGATRENDS

7 AEROSPACE VALVES MARKET, BY APPLICATION (Page No. - 104)

7.1 INTRODUCTION

FIGURE 24 ENVIRONMENTAL CONTROL SYSTEM TO LEAD AEROSPACE VALVES MARKET DURING FORECAST PERIOD

TABLE 11 AEROSPACE VALVES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 12 AEROSPACE VALVES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 FUEL SYSTEM

7.2.1 SUCTION VALVES

7.2.2 APU LP VALVES

7.2.3 ENGINE LP VALVES

7.2.4 INLET VALVES

7.2.5 CROSS-FEED VALVES

7.2.6 OTHERS

7.3 HYDRAULIC SYSTEM

7.3.1 FLOW CONTROL VALVES

7.3.2 ISOLATION VALVES

7.3.3 SHUT-OFF VALVES

7.3.4 PRESSURE RELIEF VALVES

7.3.5 PRIORITY VALVES

7.3.6 OTHERS

7.4 ENVIRONMENTAL CONTROL SYSTEM

7.4.1 PACK FLOW CONTROL VALVES

7.4.2 OXYGEN SYSTEM SHUT-OFF VALVES

7.4.3 HOT AIR-PRESSURE REGULATING VALVES

7.4.4 ISOLATION VALVES

7.4.5 TRIM-AIR VALVES

7.5 PNEUMATIC SYSTEM

7.5.1 DRAIN VALVES

7.5.2 RELIEF VALVES

7.5.3 CROSS-BLEED VALVES

7.5.4 APU BLEED VALVES

7.5.5 ENGINE BLEED VALVES

7.5.6 OTHERS

7.6 LUBRICATION SYSTEM

7.6.1 PRESSURE REGULATING VALVES

7.6.2 TEMPERATURE CONTROL VALVES

7.6.3 BYPASS VALVES

7.7 WATER & WASTEWATER SYSTEM

7.7.1 MANUAL SHUT-OFF VALVES

7.7.2 OTHERS

8 AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE (Page No. - 112)

8.1 INTRODUCTION

8.1.1 IMPACT OF COVID-19 ON AIRCRAFT TYPE SEGMENT

8.1.1.1 Most impacted segmenT

8.1.1.2 Least impacted segment

FIGURE 25 FIXED WING SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 13 AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 14 AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.1.2 COMMERCIAL AVIATION

TABLE 15 COMMERCIAL AVIATION: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 16 COMMERCIAL AVIATION: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.1.2.1 Narrow-body Aircraft

8.1.2.2 Wide-body Aircraft

8.1.2.3 Regional Transport Aircraft

8.1.3 BUSINESS & GENERAL AVIATION

TABLE 17 BUSINESS & GENERAL AVIATION: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 18 BUSINESS & GENERAL AVIATION: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.1.3.1 Business Jets

8.1.3.2 Light Aircraft

8.1.4 MILITARY AVIATION

TABLE 19 MILITARY AVIATION: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 20 MILITARY AVIATION: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.1.4.1 Fighter Aircraft

8.1.4.2 Transport Aircraft

8.1.4.3 Special-mission Aircraft

8.2 ROTARY WING

TABLE 21 ROTARY WING: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 22 ROTARY WING: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.2.1 COMMERCIAL HELICOPTERS

8.2.2 MILITARY HELICOPTERS

8.3 UNMANNED AERIAL VEHICLES

TABLE 23 UAV: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 24 UAV: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.3.1 FIXED-WING UAVS

8.3.2 FIXED-WING HYBRID VTOL UAVS

8.3.3 ROTARY-WING UAVS

9 AEROSPACE VALVES MARKET, BY END USE (Page No. - 122)

9.1 INTRODUCTION

9.1.1 IMPACT OF COVID-19 ON END USE SEGMENTS

9.1.1.1 Most impacted segment

9.1.1.2 Least impacted segment

FIGURE 26 OEM SEGMENT TO GROW FASTER DURING FORECAST PERIOD

TABLE 25 AEROSPACE VALVES MARKET, BY END USE, 2017–2020 (USD MILLION)

TABLE 26 AEROSPACE VALVES MARKET, BY END USE, 2021–2026 (USD MILLION)

9.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

9.2.1 INCREASE IN GLOBAL AIRCRAFT FLEET SIZE DRIVES SEGMENT

TABLE 27 FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 28 FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 29 FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 30 FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS &GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 31 FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 32 FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 33 ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 34 ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 35 UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 36 UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

9.3 AFTERMARKET - REPLACEMENT

9.3.1 SHORT REPLACEMENT CYCLE OF AEROSPACE VALVES BOOSTS SEGMENT

TABLE 37 FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 38 FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 39 FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 40 FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 41 FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 42 FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 43 ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 44 ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

10 AEROSPACE VALVES MARKET, BY TYPE (Page No. - 131)

10.1 INTRODUCTION

FIGURE 27 BUTTERFLY VALVES PROJECTED TO COMMAND LARGEST SHARE DURING FORECAST PERIOD

TABLE 45 AEROSPACE VALVES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 46 AEROSPACE VALVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2 BUTTERFLY VALVES

10.3 ROTARY VALVES

10.4 SOLENOID VALVES

10.5 FLAPPER-NOZZLE VALVES

10.6 POPPET VALVES

10.7 GATE VALVES

10.8 BALL VALVES

10.9 OTHERS

11 AEROSPACE VALVES MARKET, BY MATERIAL (Page No. - 135)

11.1 INTRODUCTION

FIGURE 28 STAINLESS STEEL TO BE LARGEST MATERIAL SEGMENT BY 2026

TABLE 47 AEROSPACE VALVES MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 48 AEROSPACE VALVES MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.2 STAINLESS STEEL

11.3 ALUMINUM

11.4 TITANIUM

11.5 OTHERS

12 AEROSPACE VALVES MARKET, BY REGION (Page No. - 139)

12.1 INTRODUCTION

FIGURE 29 AEROSPACE VALVES MARKET: REGIONAL SNAPSHOT

FIGURE 30 AEROSPACE VALVES MARKET: REGIONAL SNAPSHOT

TABLE 49 AEROSPACE VALVES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 AEROSPACE VALVES MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 AEROSPACE VALVES OEM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 AEROSPACE VALVES OEM MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 53 AEROSPACE VALVES AFTERMARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 AEROSPACE VALVES AFTERMARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA AEROSPACE VALVES MARKET SNAPSHOT

12.2.1 PESTLE ANALYSIS

TABLE 55 NORTH AMERICA: AEROSPACE VALVES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: AEROSPACE VALVES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.2.2 OEM MARKET

TABLE 59 NORTH AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.2.3 AFTERMARKET

TABLE 69 NORTH AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.2.4 US

12.2.4.1 Presence of leading aerospace valve manufacturers advantageous to US market

TABLE 77 US: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 78 US: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 79 US: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 80 US: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 81 US: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 82 US: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 83 US: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 84 US: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 85 US: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 86 US: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 87 US: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 88 US: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 89 US: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 90 US: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 91 US: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 92 US: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 93 US: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 94 US: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 95 US: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 96 US: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.2.5 CANADA

12.2.5.1 Investments made in R&D to drive market in Canada

TABLE 97 CANADA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 98 CANADA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 99 CANADA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 100 CANADA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 101 CANADA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 102 CANADA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 103 CANADA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 104 CANADA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 105 CANADA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 106 CANADA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 107 CANADA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 108 CANADA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 109 CANADA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 110 CANADA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 111 CANADA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 112 CANADA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 113 CANADA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 114 CANADA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3 EUROPE

FIGURE 32 EUROPE AEROSPACE VALVES MARKET SNAPSHOT

12.3.1 PESTLE ANALYSIS: EUROPE

TABLE 115 EUROPE: AEROSPACE VALVES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 116 EUROPE: AEROSPACE VALVES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 118 EUROPE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.2 OEM MARKET

TABLE 119 EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 120 EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 122 EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 124 EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 126 EUROPE: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 128 EUROPE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.3 AFTERMARKET

TABLE 129 EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 130 EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 131 EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 132 EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 133 EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 134 EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 136 EUROPE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.4 UK

12.3.4.1 Increase in air travel drives market in UK

TABLE 137 UK: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 138 UK: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 139 UK: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 140 UK: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 141 UK: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 142 UK: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 143 UK: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 144 UK: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 145 UK: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 146 UK: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 147 UK: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 148 UK: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 149 UK: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 150 UK: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Considerable investments in aerospace systems and components drive the French market

TABLE 151 FRANCE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 152 FRANCE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 153 FRANCE: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 154 FRANCE: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 155 FRANCE: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 156 FRANCE: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 157 FRANCE: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 158 FRANCE: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 159 FRANCE: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 160 FRANCE: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 161 FRANCE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 162 FRANCE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 163 FRANCE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 164 FRANCE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 165 FRANCE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 166 FRANCE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 167 FRANCE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 168 FRANCE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 169 FRANCE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 170 FRANCE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.6 GERMANY

12.3.6.1 Market in Germany growing due to investments in aerospace technology and air connectivity

TABLE 171 GERMANY: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 172 GERMANY: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 173 GERMANY: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 174 GERMANY: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 175 GERMANY: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 176 GERMANY: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 177 GERMANY: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 178 GERMANY: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 179 GERMANY: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 180 GERMANY: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 181 GERMANY: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 182 GERMANY: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 183 GERMANY: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 184 GERMANY: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 185 GERMANY: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 186 GERMANY: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.7 ITALY

12.3.7.1 High demand for civil and corporate helicopters to drive market in Italy

TABLE 187 ITALY: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 188 ITALY: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 189 ITALY: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 190 ITALY: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 191 ITALY: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 192 ITALY: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 193 ITALY: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 194 ITALY: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 195 ITALY: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 196 ITALY: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 197 ITALY: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 198 ITALY: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 199 ITALY: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 200 ITALY: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 201 ITALY: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 202 ITALY: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 203 ITALY: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 204 ITALY: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.8 RUSSIA

12.3.8.1 Increase in military budget to manufacture advanced military aircraft boosts market in Russia

TABLE 205 RUSSIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 206 RUSSIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 207 RUSSIA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 208 RUSSIA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 209 RUSSIA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 210 RUSSIA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 211 RUSSIA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 212 RUSSIA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 213 RUSSIA: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 214 RUSSIA: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 215 RUSSIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 216 RUSSIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 217 RUSSIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 218 RUSSIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 219 RUSSIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 220 RUSSIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 221 RUSSIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 222 RUSSIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 223 RUSSIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 224 RUSSIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.3.9 REST OF EUROPE

12.3.9.1 Large number of aerospace valve manufacturers boosts market in Rest of Europe

TABLE 225 REST OF EUROPE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 226 REST OF EUROPE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 227 REST OF EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 228 REST OF EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 229 REST OF EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 230 REST OF EUROPE: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 231 REST OF EUROPE: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 232 REST OF EUROPE: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 233 REST OF EUROPE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 234 REST OF EUROPE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 235 REST OF EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 236 REST OF EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 237 REST OF EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 238 REST OF EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 239 REST OF EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 240 REST OF EUROPE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 241 REST OF EUROPE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 242 REST OF EUROPE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC AEROSPACE VALVES MARKET SNAPSHOT

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 243 ASIA PACIFIC: AEROSPACE VALVES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 244 ASIA PACIFIC: AEROSPACE VALVES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 245 ASIA PACIFIC: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 246 ASIA PACIFIC: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.2 OEM MARKET

TABLE 247 ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 248 ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 249 ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 250 ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 251 ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 252 ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 253 ASIA PACIFIC: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 254 ASIA PACIFIC: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 255 ASIA PACIFIC: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 256 ASIA PACIFIC: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.3 AFTERMARKET

TABLE 257 ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 258 ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 259 ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 260 ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 261 ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 262 ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 263 ASIA PACIFIC: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 264 ASIA PACIFIC: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Increased air travel to drive market in China

TABLE 265 CHINA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 266 CHINA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 267 CHINA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 268 CHINA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 269 CHINA: FIXED WING AEROSPACE VALVES OEM IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 270 CHINA: FIXED WING AEROSPACE VALVES OEM IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 271 CHINA: FIXED WING AEROSPACE VALVES OEM IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 272 CHINA: FIXED WING AEROSPACE VALVES OEM IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 273 CHINA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 274 CHINA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 275 CHINA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 276 CHINA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 277 CHINA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 278 CHINA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 279 CHINA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 280 CHINA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 281 CHINA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 282 CHINA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.5 INDIA

12.4.5.1 Increased commercial and military aircraft to drive market in India

TABLE 283 INDIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 284 INDIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 285 INDIA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 286 INDIA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 287 INDIA: FIXED WING AEROSPACE VALVES OEM IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 288 INDIA: FIXED WING AEROSPACE VALVES OEM IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 289 INDIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 290 INDIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 291 INDIA: ROTARY WING AEROSPACE VALVES OEM, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 292 INDIA: ROTARY WING AEROSPACE VALVES OEM, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 293 INDIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 294 INDIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 295 INDIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 296 INDIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 297 INDIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 298 INDIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 299 INDIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 300 INDIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.6 JAPAN

12.4.6.1 Growth in aviation sector to drive aerospace valves market in Japan

TABLE 301 JAPAN: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 302 JAPAN: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 303 JAPAN: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 304 JAPAN: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 305 JAPAN: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 306 JAPAN: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 307 JAPAN: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 308 ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 309 JAPAN: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 310 JAPAN: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 311 JAPAN: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 312 JAPAN: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 313 JAPAN: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 314 JAPAN: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 315 JAPAN: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 316 JAPAN: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 317 JAPAN: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 318 JAPAN: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.7 AUSTRALIA

12.4.7.1 Market in Australia driven by increase in air traffic and new aircraft deliveries

TABLE 319 AUSTRALIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 320 AUSTRALIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 321 AUSTRALIA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 322 AUSTRALIA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 323 AUSTRALIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 324 AUSTRALIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 325 AUSTRALIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 326 AUSTRALIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 327 AUSTRALIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 328 AUSTRALIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 329 AUSTRALIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 330 AUSTRALIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 331 AUSTRALIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 332 AUSTRALIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.8 SOUTH KOREA

12.4.8.1 Growing passenger traffic to drive South Korean market

TABLE 333 SOUTH KOREA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 334 SOUTH KOREA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 335 SOUTH KOREA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 336 SOUTH KOREA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 337 SOUTH KOREA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 338 SOUTH KOREA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 339 SOUTH KOREA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 340 SOUTH KOREA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 341 SOUTH KOREA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 342 SOUTH KOREA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 343 SOUTH KOREA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 344 SOUTH KOREA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 345 SOUTH KOREA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 346 SOUTH KOREA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.9 REST OF ASIA PACIFIC

12.4.9.1 Replacement of aging aircraft to drive market in Rest of Asia Pacific

TABLE 347 REST OF ASIA PACIFIC: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 348 REST OF ASIA PACIFIC: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 349 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 350 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 351 REST OF ASIA PACIFIC: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 352 REST OF ASIA PACIFIC: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 353 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 354 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 355 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 356 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 357 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 358 REST OF ASIA PACIFIC: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 359 REST OF ASIA PACIFIC: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 360 REST OF ASIA PACIFIC: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5 LATIN AMERICA

12.5.1 PESTLE ANALYSIS

TABLE 361 LATIN AMERICA: AEROSPACE VALVES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 362 LATIN AMERICA: AEROSPACE VALVES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 363 LATIN AMERICA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 364 LATIN AMERICA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.2 OEM MARKET

TABLE 365 LATIN AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 366 LATIN AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 367 LATIN AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 368 LATIN AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 369 LATIN AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 370 LATIN AMERICA: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 371 LATIN AMERICA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 372 LATIN AMERICA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.3 AFTERMARKET

TABLE 373 LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 374 LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 375 LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 376 LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 377 LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 378 LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 379 LATIN AMERICA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 380 LATIN AMERICA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.4 BRAZIL

12.5.4.1 Increase in air passenger traffic to drive Brazilian market

TABLE 381 BRAZIL: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 382 BRAZIL: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 383 BRAZIL: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 384 BRAZIL: FIXED WING AEROSPACE VALVES OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 385 BRAZIL: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 386 BRAZIL: FIXED WING AEROSPACE VALVES OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 387 BRAZIL: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 388 BRAZIL: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 389 BRAZIL: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 390 BRAZIL: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 391 BRAZIL: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 392 BRAZIL: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 393 BRAZIL: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 394 BRAZIL: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 395 BRAZIL: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 396 BRAZIL: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 397 BRAZIL: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 398 BRAZIL: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.5 MEXICO

12.5.5.1 Government use of UAVs for surveillance fuels market in Mexico

TABLE 399 MEXICO: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 400 MEXICO: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 401 MEXICO: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 402 MEXICO: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 403 MEXICO: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 404 MEXICO: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 405 MEXICO: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 406 MEXICO: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 407 MEXICO: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 408 MEXICO: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 409 MEXICO: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 410 MEXICO: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.6 REST OF LATIN AMERICA

12.5.6.1 Increase in aircraft fleet size to drive market in Rest of Latin America

TABLE 411 REST OF LATIN AMERICA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 412 REST OF LATIN AMERICA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 413 REST OF LATIN AMERICA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 414 REST OF LATIN AMERICA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 415 REST OF LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 416 REST OF LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 417 REST OF LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 418 REST OF LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 419 REST OF LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 420 REST OF LATIN AMERICA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 421 REST OF LATIN AMERICA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 422 REST OF LATIN AMERICA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6 MIDDLE EAST

12.6.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 423 MIDDLE EAST: AEROSPACE VALVES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 424 MIDDLE EAST: AEROSPACE VALVES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 425 MIDDLE EAST: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 426 MIDDLE EAST: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.2 OEM MARKET

TABLE 427 MIDDLE EAST: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 428 MIDDLE EAST: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 429 MIDDLE EAST: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 430 MIDDLE EAST: ROTARY WING AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 431 MIDDLE EAST: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 432 MIDDLE EAST: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.3 AFTERMARKET

TABLE 433 MIDDLE EAST: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 434 MIDDLE EAST: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 435 MIDDLE EAST: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 436 MIDDLE EAST: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 437 MIDDLE EAST: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 438 MIDDLE EAST: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 439 MIDDLE EAST: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 440 MIDDLE EAST: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.4 ISRAEL

12.6.4.1 Increased spending on R&D of UAVs for military and commercial applications boosts market in Israel

TABLE 441 ISRAEL: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 442 ISRAEL: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 443 ISRAEL: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 444 ISRAEL: FIXED WING AEROSPACE VALVES OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 445 ISRAEL: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 446 ISRAEL: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 447 ISRAEL: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 448 ISRAEL: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 449 ISRAEL: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 450 ISRAEL: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 451 ISRAEL: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 452 ISRAEL: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 453 ISRAEL: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 454 ISRAEL: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.5 UAE

12.6.5.1 Increasing upgrades of commercial airlines to drive market in UAE

TABLE 455 UAE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 456 UAE: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 457 UAE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 458 UAE: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 459 UAE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 460 UAE: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 461 UAE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 462 UAE: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 463 UAE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 464 UAE: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 465 UAE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 466 UAE: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.6 SAUDI ARABIA

12.6.6.1 High military expenditure to fuel market in Saudi Arabia

TABLE 467 SAUDI ARABIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 468 SAUDI ARABIA: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 469 SAUDI ARABIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 470 SAUDI ARABIA: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 471 SAUDI ARABIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 472 SAUDI ARABIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 473 SAUDI ARABIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 474 SAUDI ARABIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 475 SAUDI ARABIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 476 SAUDI ARABIA: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 477 SAUDI ARABIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 478 SAUDI ARABIA: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.7 TURKEY

12.6.7.1 Turkish market boosted by substantial rise in military spending and development of UAVs

TABLE 479 TURKEY: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 480 TURKEY: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 481 TURKEY: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 482 TURKEY: UAV AEROSPACE VALVES OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 483 TURKEY: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 484 TURKEY: FIXED WING AEROSPACE VALVES AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 485 TURKEY: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 486 TURKEY: ROTARY WING AEROSPACE VALVES AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.8 REST OF MIDDLE EAST

12.6.8.1 Presence of MRO service providers will boost market in Rest of Middle East

TABLE 487 REST OF MIDDLE EAST: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 488 REST OF MIDDLE EAST: AEROSPACE VALVES MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)