Aircraft Heat Exchanger Market

Aircraft Heat Exchanger Market by Design (Plate-Fin, Tube-Fin), Application (ECS, Engine, Bleed Air, Avionics/Pod Cooling, Hydraulic Cooling), Medium (Air-to-Air, Air-to-Liquid, Liquid-to-Liquid), Platform, Material, Architecture, Point of Sale and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global aircraft heat exchanger market is estimated at USD 5.28 billion in 2025 and is projected to reach USD 6.45 billion by 2030, registering a CAGR of 4.1% during the forecast period. Market growth is primarily driven by the rising demand for fuel-efficient and lightweight aircraft, increasing air traffic, and ongoing fleet modernization programs. In addition, stringent safety and environmental regulations are compelling OEMs and MRO providers to adopt advanced thermal management systems that enhance reliability, reduce emissions, and ensure compliance across diverse aircraft platforms.

KEY TAKEAWAYS

-

By RegionNorth America is estimated to dominate the aircraft heat exchanger market with a share of 46.1% in 2025.

-

By ApplicationThe environment control systems (ECS) segment accounted for a share of 51.6% in 2024.

-

By ArchitectureThe electric aircraft segment is projected to grow at a CAGR of 15.9% during the forecast period.

-

By MaterialThe aluminum segment is estimated to account for a share of 52.7% of the aircraft heat exchanger market in 2025.

-

By DesignThe plate-fin segment is projected to grow at a CAGR of 4.5% during the forecast period.

-

By MediumThe air-to-air segment accounted for the largest market size in 2024.

-

By Point of SaleThe aftermarket segment accounted for a share of 71.3% in 2024.

-

By PlatformThe advanced air mobility segment is projected to grow at a CAGR of 31.1% during the forecast period.

The aircraft heat exchanger market is expanding steadily as aircraft manufacturers focus on improving thermal efficiency and system performance. Growing use of advanced propulsion systems, electrified components, and lightweight airframes has increased the need for compact and efficient heat exchangers that optimize fuel consumption, control emissions, and maintain reliable temperature balance. Ongoing innovations in materials, additive manufacturing, and integrated design—supported by collaborations between OEMs and specialized suppliers—are transforming the market, driving the development of durable and energy-efficient thermal management solutions for next-generation aircraft.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing demand for advanced, lightweight, and high-efficiency heat exchangers is reshaping the global aircraft heat exchanger market. Increasing aircraft production, rising passenger traffic, and the expansion of military and cargo fleets are driving consistent installation demand across new and existing platforms. Additionally, conventional plate-fin exchangers used for propulsion and environmental control systems are now being complemented by next-generation designs that integrate multiple functions—such as combined fuel, oil, and ECS cooling—into a single unit to improve thermal efficiency and reduce system weight. The aircraft heat exchanger market is witnessing a shift toward lightweight exchangers designed for UAVs and advanced air mobility (AAM) aircraft, driven by the need for compact thermal management in electric and hybrid-electric propulsion systems. Additionally, advancements in additive manufacturing and digital monitoring are enabling the development of IoT-enabled heat exchangers equipped with embedded sensors for predictive maintenance. As stringent emission norms and efficiency standards become central to aircraft design, durable, high-performance heat exchangers made from advanced alloys and composites are increasingly preferred over conventional models, ensuring reliability, thermal stability, and compliance with next-generation aviation requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing fleet sizes and aircraft renewal

-

Tightening fuel efficiency and CO2 requirements

Level

-

Weight pressure drop trade-offs

-

Supply chain constraints in specialty materials and furnace capacity

Level

-

Expansion of additive manufacturing for exchanger cores

-

Adoption of sensorized units and predictive maintenance

Level

-

Detection of internal effects in complex cores

-

Integration within tight, high-load spaces

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Growing fleet sizes and aircraft renewal

Rising investments in fleet modernization and capacity expansion across the commercial and military aviation sectors are driving the demand for advanced heat exchangers. These systems are critical for maintaining fuel efficiency and regulatory compliance while supporting increased aircraft production and MRO activity, directly boosting OEM and aftermarket demand globally.

Weight pressure drop trade-offs

The need for lightweight heat exchangers that maintain high thermal efficiency and low pressure drop presents a major design challenge. Balancing these parameters requires the use of advanced alloys, composite materials, and optimized fin geometries, which can raise manufacturing costs but also push innovation in compact and high-performance exchanger designs.

Adoption of sensorized units and predictive maintenance

The transition toward smart and connected aircraft systems is accelerating the integration of sensorized and IoT-enabled heat exchangers. These systems enable real-time monitoring of temperature, flow rate, and performance metrics, supporting predictive maintenance and reducing operational downtime for operators and MRO providers.

Detection of internal effects in complex cores

Heat exchangers operating in high-temperature and high-pressure environments face challenges such as fouling, leakage, and thermal fatigue, within intricate core structures. Advanced testing, modeling, and diagnostic technologies are being employed to detect internal defects early, ensuring system reliability, thermal stability, and extended operational lifespan.

Aircraft Heat Exchanger: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops lightweight, high-performance heat exchangers for electric propulsion and avionics systems using advanced simulation and brazing technologies | Enhances cooling efficiency and structural durability while reducing weight and ensuring reliable operation in electric aircraft |

|

Designs additively manufactured heat exchangers for battery thermal management in eVTOL and advanced air mobility platforms | Delivers high thermal uniformity and weight reduction, improving battery performance and energy efficiency in electric aircraft |

|

Engineers cryogenic loop heat pipes for thermal control in space and aerospace instrumentation | Ensures stable, passive cooling performance under extreme temperatures and zero-gravity conditions with high reliability |

|

Produces replacement heat exchangers for legacy aircraft through reverse engineering and brazed construction processes | Minimizes aircraft downtime and maintenance costs while ensuring continued operational reliability of aging fleets |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Aircraft heat exchanger manufacturers, service providers, and end users are the key stakeholders in the aircraft heat exchanger market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities serve as the major influencers in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aircraft Heat Exchanger Market, By Application

The environment control systems (ECS) segment dominated the aircraft heat exchanger market in 2024, primarily driven by the growing demand for efficient cabin pressurization and air conditioning systems across commercial and military fleets. Increasing air passenger traffic, emphasis on passenger comfort, and stringent emission norms are driving the integration of advanced ECS units equipped with high-efficiency heat exchangers. Additionally, the engine systems segment is projected to register significant growth during the forecast period, supported by the development of compact, high-performance exchangers for turbofan and hybrid-electric propulsion systems.

Aircraft Heat Exchanger Market, By Design

The plate-fin segment dominated the aircraft heat exchanger market in 2024 due to superior heat transfer efficiency of these exchangers, their compact structure, and their lightweight properties. These exchangers are extensively used in ECS, engine oil cooling, and fuel systems, where they offer high thermal performance under variable operating conditions. Meanwhile, the tube-fin segment continues to serve specialized applications, such as oil and hydraulic cooling, offering durability and reliability under high-pressure environments.

Aircraft Heat Exchanger Market, By Medium

The air-to-air segment accounted for the largest share of the aircraft heat exchanger market in 2024, primarily due to the widespread use of these exchangers in environmental control and engine bleed air systems. On the other hand, the liquid-to-liquid segment is projected to grow at the highest CAGR during the forecast period, driven by increasing adoption in electric and hybrid-electric aircraft. Liquid-to-liquid heat exchangers provide superior cooling efficiency for high-power electronic and propulsion systems, enabling enhanced energy management and system stability.

Aircraft Heat Exchanger Market, By Material

The aluminum segment dominated the aircraft heat exchanger market in 2025, owing to its high thermal conductivity, corrosion resistance, and cost-effectiveness. It remains the preferred material for commercial aircraft due to its lightweight characteristics and ease of fabrication. On the other hand, the titanium segment is anticipated to record the highest growth during the forecast period, driven by its superior strength-to-weight ratio and heat resistance, making it ideal for high-temperature applications in military and high-performance platforms.

Aircraft Heat Exchanger Market, By Point of Sale

The OEM segment is projected to dominate the aircraft heat exchanger market during the forecast period, driven by the increasing number of aircraft deliveries and the integration of advanced heat exchangers into new-generation platforms. Major OEMs such as Airbus, Boeing, and Embraer are increasingly adopting lightweight and high-efficiency exchangers to improve propulsion and environmental performance. On the other hand, the aftermarket segment continues to contribute steadily, supported by regular maintenance, overhaul, and replacement of thermal components across aging fleets.

Aircraft Heat Exchanger Market, By Architecture

The non-electric aircraft segment dominated the aircraft heat exchanger market in 2024, supported by the continued reliance on conventional propulsion systems across commercial, military, and regional aircraft. These systems require robust thermal management components to maintain optimal performance in engines, fuel systems, and auxiliary power units (APUs). On the other hand, the electric aircraft segment is projected to register the highest CAGR of 15.9% during the forecast period, driven by growing investments in electric and hybrid-electric propulsion technologies. The rise of advanced air mobility (AAM) and eVTOL platforms is accelerating the demand for lightweight, compact, and high-efficiency heat exchangers designed for battery and motor cooling applications.

Aircraft Heat Exchanger Market, By Platform

The commercial aviation segment dominated the aircraft heat exchanger market in 2024, primarily due to the increasing production of narrow-body and wide-body aircraft and rising passenger traffic worldwide. Continuous efforts by major OEMs to enhance fuel efficiency and reduce emissions have led to the adoption of next-generation heat exchangers in environmental control and propulsion systems. The advanced air mobility (AAM) segment is projected to grow at the highest CAGR of 31.1% during the forecast period, supported by the commercialization of eVTOL aircraft and electric propulsion technologies that require specialized thermal management solutions. Meanwhile, the military aviation segment continues to present strong demand for rugged and high-performance exchangers capable of withstanding extreme pressure and temperature conditions in combat and transport aircraft.

REGION

Middle East & Africa to be the fastest-growing region in global Satellite Internet Market during forecast period

Asia Pacific is projected to be the fastest-growing market, fueled by massive aircraft deliveries, expanding airline networks, and rising defense procurement across China, India, Japan, and Southeast Asia.

Aircraft Heat Exchanger: COMPANY EVALUATION MATRIX

In the global aircraft heat exchanger market matrix, Honeywell International Inc. (Star) leads with the strongest market share and extensive product footprint, supported by its advanced thermal management systems and plate-fin heat exchangers integrated across commercial, military, and business jet platforms. RTX (Star) follows with a robust portfolio of high-efficiency heat exchangers engineered for propulsion and environmental control systems, ensuring superior performance under demanding thermal loads. Liebherr Group (Star) strengthens its position through Liebherr-Aerospace, offering plate-fin solutions for air management and cabin conditioning applications across regional and wide-body aircraft. Safran SA (Star) further consolidates its footprint by delivering high-performance heat exchangers optimized for fuel and air systems in next-generation propulsion architectures.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 5.22 Billion |

| Revenue Forecast in 2030 | USD 6.45 Billion |

| Growth Rate | CAGR of 4.1% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, Latin America, Africa |

WHAT IS IN IT FOR YOU: Aircraft Heat Exchanger REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on the total addressable market |

RECENT DEVELOPMENTS

- June 2024 : Intergalactic LLC (US) introduced a newly curved configuration of its patented laser-welded microtube heat exchanger, specifically engineered for conformal integration within cylindrical aircraft and engine structures. This innovation aimed to enhance heat transfer performance while reducing overall system weight and footprint, marking a significant advancement within the aerospace thermal management sector.

- November 2024 : Liebherr-Aerospace Toulouse SAS (France) entered into a long-term heat-exchanger maintenance services agreement with Air France Industries KLM Engineering & Maintenance (France/Netherlands). The collaboration covered support for the A320ceo/neo and A220 fleets, reinforcing Liebherr’s strong aftermarket presence and its commitment to lifecycle support for advanced air management and environmental control systems.

- August 2025 : A Honeywell International Inc. (US)-led consortium, in partnership with the UK Government’s Aerospace Technology Institute (ATI) Programme, secured a funding of £14.1 million to accelerate research in additive manufacturing and AI-driven design for next-generation heat exchangers. The initiative focused on improving production efficiency and enhancing thermal performance for future aerospace applications.

- September 2025 : Honeywell International Inc. (US) joined forces with Conflux Technology Ltd. (Australia) under the Hybrid-Electric Regional Aircraft Project to advance additive manufacturing techniques for lightweight heat exchangers. The partnership integrated novel materials and advanced manufacturing processes aimed at supporting the emerging hybrid-electric propulsion ecosystem.

- October 2025 : Conflux Technology Ltd. (Australia) partnered with Airbus SE (France) under the ZEROe hydrogen-electric programme to co-design and supply a new-generation heat exchanger optimized for hydrogen-based propulsion systems. This collaboration underscored the growing shift toward sustainable aviation technologies focused on zero-emission aircraft platforms.

Table of Contents

Methodology

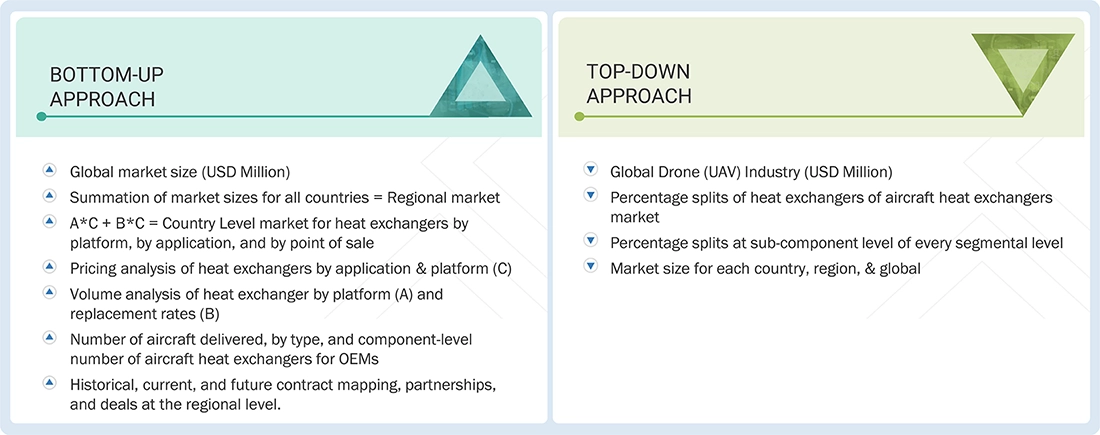

The study involved four major activities in estimating the current size of the aircraft heat exchanger market. Exhaustive secondary research was done to collect information on the aircraft heat exchanger market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analysis was conducted to estimate the overall market size. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the aircraft heat exchanger market.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, including annual reports, press releases, and investor presentations from companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

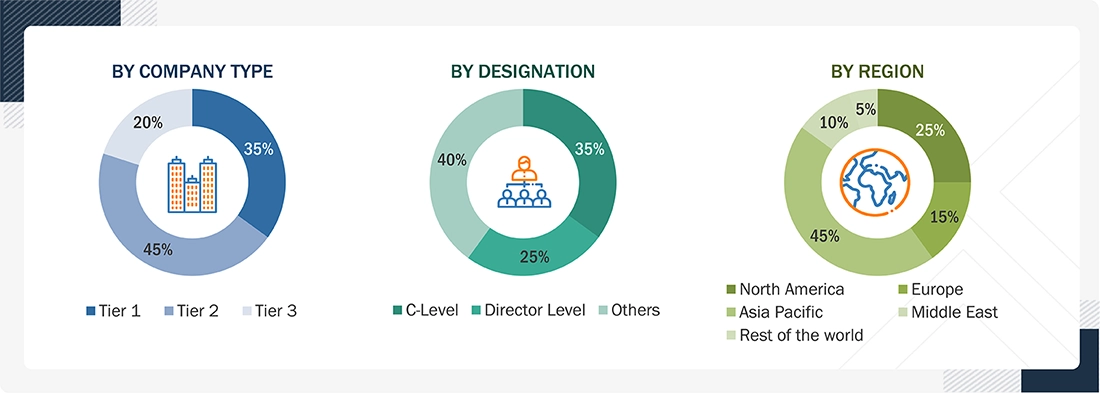

Primary Research

Extensive primary research was conducted after acquiring information regarding the aircraft heat exchanger market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the aircraft heat exchanger market. The research methodology used to estimate the size of the market included the following details:

- Key players in the aircraft heat exchanger market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the aircraft heat exchanger market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Aircraft Heat Exchanger Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

A heat exchanger is a device that enables efficient heat transfer between two or more fluids or between a solid object and a fluid. Heat exchangers are typically made of materials, such as aluminum, carbon steel, copper, stainless steel, and nickel alloys, among others. In aircraft, these exchangers transfer heat from the engine’s oil system to warm cold fuel and prevent the formation of ice from suspended water, which could freeze at high altitudes and cause blockage.

Aircraft heat exchangers also play a crucial role in aircraft environmental control systems, maintaining the required temperature in both the cabin and the flight deck. They are also used to cool hydraulics, auxiliary power units, gearboxes, and various other components.

Key Stakeholders

- Raw Material Suppliers

- Heat Exchanger Manufacturers

- Aircraft System Manufacturers

- System Integrators

- Technology Support Providers

- Distributors and Component Suppliers

- Maintenance, Repair, and Overhaul (MRO) Companies

- Government and Regulatory Agencies

- Research and Development Organizations

Report Objectives

- To define, describe, and forecast the aircraft heat exchanger market based on application, design, medium, material, architecture, point of sale, platform, and region

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading market players

- To provide a detailed competitive landscape of the market, along with a ranking analysis of key players, and an analysis of startup companies in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the electric ship market, along with a market share analysis and revenue analysis of key players

Customization Options

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft heat exchanger market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aircraft heat exchanger market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aircraft Heat Exchanger Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Aircraft Heat Exchanger Market

Damien

Feb, 2019

Global vision of product lines and product types. Main actors sizes and strength/weakness. Drivers for the future. .