Agriculture Drones Market by Offering (Hardware, Software and Services), Components, Payload Capacity, Medium-weight drones, Heavy-weight drones, Farming Environment, Application, Farm Produce, Range, Farm Size and Region - Global Forecast to 2028

Agriculture Drones Market Analysis & Report Summary, 2028

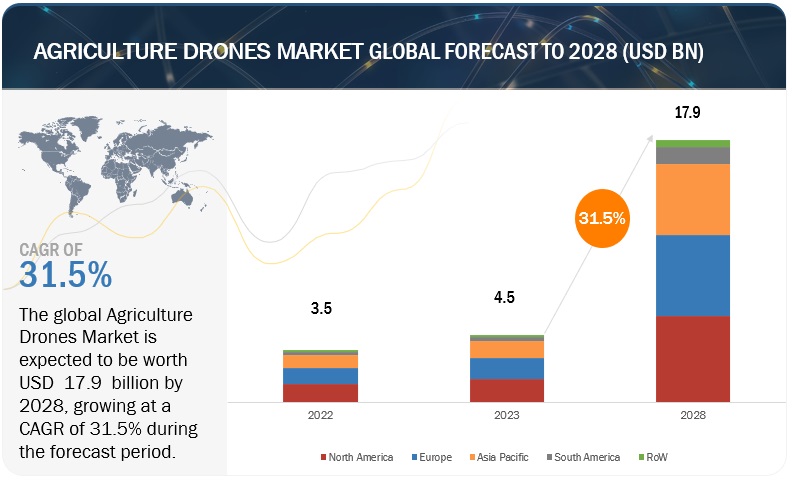

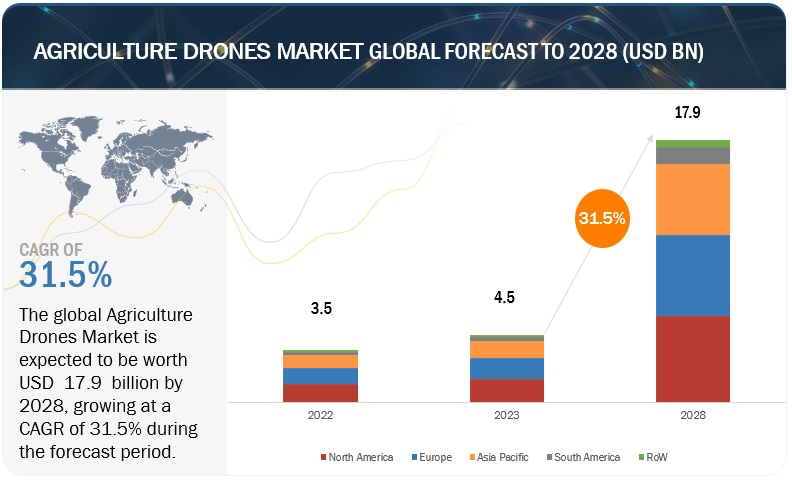

The agriculture drones market size is predicted to grow at a CAGR of 31.5% between 2023 and 2028, reaching a value of $17.9 billion by 2028 from a projection of $4.5 billion in 2023. Drone technologies are quickly revolutionizing the agricultural sector owing to the recent evolutions in this technology and the Federal Aviation Administration (FAA) regulations, and thereby bringing drones into mainstream farming. With the global population projected to reach over 9 billion by 2050, the consumption of agriculture products is expected to increase by 70%, a figure complicated by unpredictable weather patterns and natural disasters.

Agriculture drones are unmanned aerial vehicles (UAVs) that are used in various applications of agriculture, such as precision farming, livestock farming, smart greenhouse, precision fish farming, horticulture, and forestry. Drones in agriculture can simply be a low-cost aerial camera platform, equipped with an autopilot using GPS and sensors for collecting relevant data. They can be compared to a regular point-and-shoot camera for visible images; in addition to the functions served by a regular camera—providing some information about plant growth, coverage, and so on—a multispectral sensor expands the utility of the drone-based technique and allows farmers to see things that cannot be seen in the visible spectrum, such as moisture content in the soil, plant health, stress levels, and fruits.

To know about the assumptions considered for the study, Request for Free Sample Report

Agriculture Drones Market Dynamics

Driver: Availability of software solutions for field survey and data analytics

Software in drones acts as an interface for mediating the interaction between user and aircraft, and aircraft and its hardware. Similar to smartphones and tablet systems, choosing the wrong software platform for any drone can result in high switching costs if one needs to change the software in the future. Drone software is categorized as open source and proprietary software. Open-source software is distributed under a variety of licensing terms; almost anyone can modify the software to add capabilities that are not envisaged by its originators. Hence, it is preferred over proprietary software.

PX4 is one of the top open-source, auto-piloting software packages available from Pixhawk (Switzerland) in the agriculture drone sector. It is a piece of software that allows drones and other unmanned vehicles to fly. The software offers drone developers a versatile set of tools for sharing technology and creating customized solutions for drone applications. Farm surveying plays an important role in precision farming, along with proper analysis of field data collected by drones.

Trimble Inc. (US) and DroneDeploy (US) are the leading software solution providers in the agriculture drones market. In April 2019, Precision Hawk launched PrecisionAnalytics. With PrecisionAnalytics, the user can apply the latest generation of AI to aerial data collected by agriculture drones, thereby automating analysis, streamlining reporting, and accelerating work.

Restraint: Security and safety concerns associated with civil and commercial application of drones

Commercial drones have been successfully integrated into civilian airspace, although they need authorization from the concerned regulatory bodies before use. As UAVs/drones operate remotely or autonomously, manufacturers need to ensure that their drones operate within limits and do not affect the environment. They should also be able to demonstrate that their drones do not affect other manned aircraft as well as lives on the ground. In both of the above-mentioned cases, there is a possibility of hacking the flight control systems of UAVs and taking control of their operations.

For instance, in July 2012, a team from the Texas University successfully demonstrated the capability of taking control of a UAV with the use of GPS spoofing devices, which cost only ~USD 1,000 per unit; this enabled it to disrupt operations of the UAV and send it off course. UAV manufacturers need to ensure that the control systems of UAVs cannot be hacked easily to make them safe for civil and commercial applications. Thus, issues with the safety and security of UAVs may result in government agencies banning their use in civil and commercial applications, thereby hindering the growth of the global agriculture drones market.

Opportunity: Exemptions by US Federal Aviation Administration for use of agriculture drones

According to the Federal Aviation Administration (FAA), the regulatory body for commercial drone operations in the US), viewing a field with a drone to determine whether crops need water when they are grown for personal use does not require FAA authorization; however, FAA authorization is needed for using drones for the same purpose in commercial farming. Previously, the only viable avenue for authorizing the use of commercial drones was the FAA’s Section 333 exemption process. This process was put in place by the FAA Modernization and Reform Act of 2012 and required the regulator to determine if a certain drone will operate safely in the national airspace system.

To know about the assumptions considered for the study, download the pdf brochure

The application process took ~120 days, although this timeline varied depending on the planned use and whether other applicants have been approved for similar exemptions using similar aircraft in the past. Altitude, speed, and general flight specifications for the drone operations, along with the type of drone the applicant wills to fly, are the main parameters considered by the FAA while issuing an exemption. Till September 2015, FAA had issued more than 1,400 exemptions, and ~130 of them were specifically issued for precision agricultural purposes. In January 2015, Empire Unmanned became the first company in the US to receive an FAA exemption for flying UAVs for commercial agricultural uses in agriculture drones market.

Recently, The introduction of the FAA's Small UAS Rule (Part 107) has significantly influenced the utilization of drones in various sectors, including agriculture. Specifically targeting the agricultural industry, these regulations provide guidelines and specifications for farmers and ranchers to employ drones for remote sensing activities on their farms and ranches. Moreover, other applications are being developed, including, but not limited to, expanded flights beyond current limits (distance between ground operator and UAVs and possible applications of insecticides and fungicides in fields). For agriculture, in Part 107 rule, a waiver allowing operations beyond the visual line-of-sight (BVLOS) of the operator allows pilots to capture more area in a single deployment, compared to the area taken while flying a drone within line-of-sight. While the process of securing a waiver may seem complex, there are resources available to help navigate the process.

Challenges in the Agriculture Drones Market: Management of data collected by agriculture drones

Drone’s data is collected in raw format; it is processed by context, relevance, and priority, and it is then presented in a manner that can be useful in decision-making. Precision farming regularly produces high volumes of important data pertaining to mapping, variable rate seeding, soil testing, yield monitoring, and historical crop rotation. The proper storage and management of data are important in precision farming as its success relies entirely on the data gathered for assessing farm conditions. Data management is key to making smart farm management decisions and improving farm operations.

The management of data collected by drones is a major challenge faced by users as it requires expertise and knowledge. Also, many adopters of precision farming technologies do not know how to analyze their precision data. The adoption rate of agriculture drones could be boosted by providing easy data management solutions to farmers. However, to utilize it better, efforts should also be made to standardize the data format of precision agriculture processes.

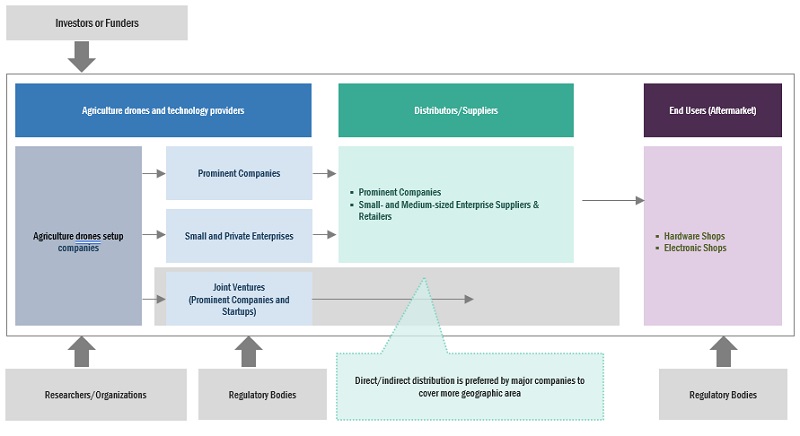

Agriculture Drones Market Ecosystem

The agriculture drone market is home to prominent companies that are well-established, financially stable manufacturers. These companies have a long-standing presence in the market and offer a diverse range of products. They are equipped with state-of-the-art technologies and boast strong global sales and marketing networks. Prominent companies in this market include DJI (China), PrecisionHawk (US), Trimble Inc. (US), Parrot Drones (France), AeroVironment, Inc. (US), Yamaha Motor Co., Ltd. (Japan), AgEagle Aerial Systems, Inc. (US), DroneDeploy (US), 3DR (US), and Sentera Inc. (US) SlantRange (US), Sentera Inc. (US), ATMOS UAV (Netherlands), Delair (France), and Nileworks Inc. (Japan).

Based on drone type, fixed wing drone is estimated to account for the largest share of the agriculture drones market

The advantages of fixed wing drones include maximum flying time, long-distance coverage, and high speed. Fixed wing drones have more efficient aerodynamics and better payload capacity and endurance than other drones, making them ideal for carrying multiple onboard sensors (multispectral camera, thermal imaging, and LIDAR, among others). They are used for aerial surveys and mapping over large areas such as fields and farms, which makes their use suitable in precision agriculture.

In November 2018, Delair (France) launched a new drone platform, the Delair UX11 Ag, specifically optimized for the agriculture industry. The new version of the Delair UX11 fixed-wing UAV builds upon the successful foundation of its predecessor. It offers a combination of long-range and beyond-visual line of sight (BVLOS) flight operations, providing increased productivity. At the same time, it incorporates highly accurate survey-grade mapping and plant data collection capabilities—all in an easy-to-use platform—to enable a new level of decision agriculture. Fixed wing drones are designed for professionals and priced comparatively higher than rotary blade drones. Some leading manufacturers in agricultural drones market of fixed wing drones include senseFly, Trimble UAS (Belgium), and AgeEagle.

The Software and Services segment is projected to witness the highest CAGR during the forecast period.

Good agriculture practice needs monitoring of farms and crops at regular intervals. Storing data after every flight helps farmers or agronomists analyze the health of crops and farmland necessities such as water or fertilizers. The data management software can record, share, and manage data such as who operates which drone, which pilots are operating drones for specific projects, flight logs and routes, and project management.

The software can manage flight plans and documents, store photos and videos, and handle all types of records such as weather conditions during each flight, model specifications of the drones flown, flight hours of individual pilots, and repair and maintenance updates. The potential benefits of using data management software include real-time data collection and high-resolution imagery of farmland. Trimble Navigation is one of the key players in the agriculture drones market offering software products and services for yield monitoring, water management, and farm survey.

Based on component, controller system is expected to drive the segment.

A drone controller, also known as a transmitter, is used by a pilot to fly and control the drone. In most cases, radio signals are used in the controllers to communicate with the drones or quadcopters. A flight controller is the nerve center of a drone. There are various drone control systems, from GPS-enabled autopilot systems flown via two-way telemetry links to basic stabilization systems using hobby-grade radio control hardware.

Advancements in drone controllers began with remote-controlled helicopters. Historically, remote-controlled planes were controlled directly with the help of the pilot’s radio. Tail rotors were added to helicopters; a helicopter uses its tail (or anti-torque) rotor to counteract the torque of the main rotor, attempting to spin the entire body of the helicopter. It works efficiently when the helicopter is hovering, but as the pilot throttles up, the torque increases, causing the entire helicopter to do a pirouette or two, until the torque levels out again. This effect may cause accidents of remote-controlled helicopters. To overcome this, gyroscopes were introduced, which were heavy brass-spinning weights tilted in response to the helicopter’s motion. A hall-effect sensor would detect that tilt and command the tail rotor to counteract the helicopter’s rotation. Also, these mechanical gyroscopes were replaced by solid-state micro-electro-mechanical systems (MEMS).

The present controller systems comprise several sensors, such as GPS, barometric pressure sensors, and airspeed sensors. The major contributors to the flight calculations are the gyros, coupled with accelerometers. The DJI Naza controller is a preeminent commercial controller system offered by DJI.

The Asia Pacific market is projected to contribute the largest share of the agriculture drones market.

APAC is among the prospective markets for agriculture drones. APAC has large farmlands and a high population growth rate. APAC has a huge regional spread with countries such as China, Japan, India, Australia, New Zealand, and the Rest of APAC. In APAC, the adoption of agriculture drones is driven by factors such as the rising food demand, the need to improve yields despite limited resources, and the growing necessity to protect crops from unpredictable weather conditions.

China is developing innovative technologies for drones with a prime aim to manufacture them at the lowest possible cost. China Aerospace Science and Technology Corporation (CASC) is developing a medium-range drone called CH-4; the company has also shown interest in short-range drones. China plans to launch drones in several of its provinces for surveying and information security missions. Beijing Wisewell Avionics Science and Technology Company, Nanjing Research Institute on Simulation Technique, and the Beijing University of Aeronautics and Astronautics are a few of the organizations involved in the development of drones in China.

The rapid development of the Chinese agricultural machinery industry is predominantly attributed to its favorable economy and agricultural activities. Moreover, the political support and investment in agriculture by the government is playing a crucial role in the development of the agriculture drones market in this country. As a result, the demand for agricultural drones is continuously increasing, facilitating the use of precision farming devices by farmers. Many of the players have been establishing agriculture drone service network in China to cope with the growing demand for agriculture drones from farmers and agronomists.

Top Companies in the Agriculture Drones Market

The key players in this include DJI (China), PrecisionHawk (US), Trimble Inc. (US), Parrot Drones (France), AeroVironment, Inc. (US), Yamaha Motor Co., Ltd. (Japan), AgEagle Aerial Systems, Inc. (US), DroneDeploy (US), 3DR (US), and Sentera Inc. (US) SlantRange (US), Sentera Inc. (US), ATMOS UAV (Netherlands), Delair (France), and Nileworks Inc. (Japan).

These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Agriculture Drones Market Report

|

Report Metric |

Details |

|

Market size valuation in 2023 |

USD 4.5 billion |

|

Market size prediction in 2028 |

USD 17.9 billion |

|

Progress rate |

CAGR of 31.5% |

|

Segments covered |

Range, Offering, Component, Offering, Farm Size, Farm produce, Farming environment and Application |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

|

|

Largest Growing Regions |

Asia Pacific (APAC) |

Agriculture Drones Market Report Segmentation

This research report categorizes the market based on Range, Offering, Component, Offering, Farm Size, Farm produce, Farming environment and Application

|

Segment |

Subsegment |

|

Based on offering |

|

|

Based on component |

|

|

Based on the payload capacity |

|

|

Based on the farming equipment |

|

|

Agriculture Drones Market Based on the farm produce |

|

|

Based on the range |

|

|

Based on the farm size |

|

|

Based on the application |

|

|

Based on the region |

|

Recent Developments in the Agriculture Drones Market

- In March 2023, PrecisionHawk and Field merged to bring advanced geospatial data analysis solutions to the US infrastructure and energy sectors. With Field's expertise in digital reality services and a shared mission of creating a sustainable future, the partnership aims to provide world-class infrastructure management solutions across the US, Europe, and beyond, using AI and machine learning.

- In 2020, DJI introduces the AGRAS T20 smart spraying drone. The DJI AGRAS T20 spraying drone is built to operate in the most difficult settings. It has autonomous flight planning and terrain-sensing radar, as well as a long flying time, a large cargo capacity, and off-grid power choices.

- In 2021, PrecisionHawk has partnered with Wake Technical Community College to offer hands-on unmanned aircraft system (UAS) pilot training for FAA Part 107 certified pilots. This training aims to equip pilots with the necessary skills to effectively fly and utilize drones in various industries such as utilities, agriculture, and construction. The program addresses the need for experienced pilots in the growing drone industry, as many certified professionals lack practical experience in real-life drone operations.

Frequently Asked Questions (FAQ):

What are the drivers for the growth of the Agriculture Drones market?

The drivers for the growth of the agriculture drone market include the increasing pressure on the global food supply due to a growing world population, a surge in venture funding for agriculture drone development, and the availability of software solutions for field surveys and data analytics.

Which are the major companies in the agriculture drones market? What are their major strategies to strengthen their market presence?

The key players in agriculture drones market include DJI(China), PrecisionHawk (US), Trimble Inc. (US), Parrot Drones (France), AeroVironment, Inc. (US), Yamaha Motor Co., Ltd. (Japan), AgEagle Aerial Systems, Inc. (US), DroneDeploy (US), 3DR (US), and Sentera Inc. (US) SlantRange (US), Sentera Inc. (US), ATMOS UAV (Netherlands), Delair (France), and Nileworks Inc. (Japan). The companies operating in the agriculture drone market are strategically expanding their presence through agreements and collaborations. They have established a strong foothold in North America, Asia Pacific, and Europe, with manufacturing facilities and robust distribution networks across these regions.

Which region is expected to hold the highest share in the agriculture drones market?

The Asia Pacific market is projected to contribute the largest share of the agricultural drones market.

Which are the key technology trends prevailing in the agriculture drones market?

DJI has recently launched DJI Terra, a software tool that converts drone data into digital 3D models and maps for simplified analysis and decision-making. This tool is designed to assist businesses and organizations using DJI drone technology in capturing, visualizing, and analyzing aerial images for various applications in sectors such as public safety, construction, infrastructure, agriculture, and film industries. PrecisionHawk launched the BVLOS-enabled, multi-rotor drone platform. First, to market, the drone incorporates industry-leading technology to automatically identify all cooperative and non-cooperative aircraft within a radius of 10 km, ensuring airspace deconfliction well before the potential confrontation. The platform was designed on the basis of findings and recommendations in the FAA Pathfinder Report, which serves as a blueprint for enterprises to conduct BVLOS drone operations.

What is the total CAGR expected to be recorded for the agriculture drones market during 2023-2028?

The market is expected to record a CAGR of 31.5% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

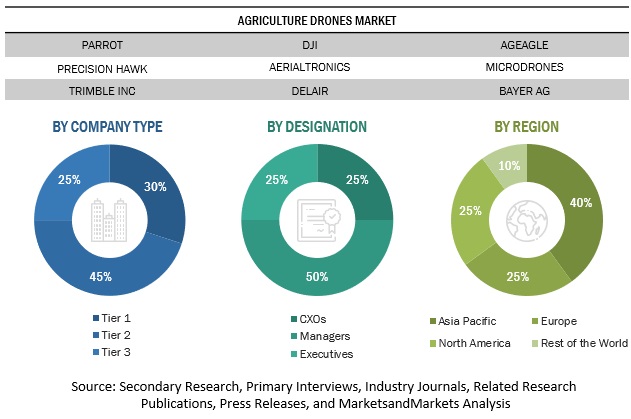

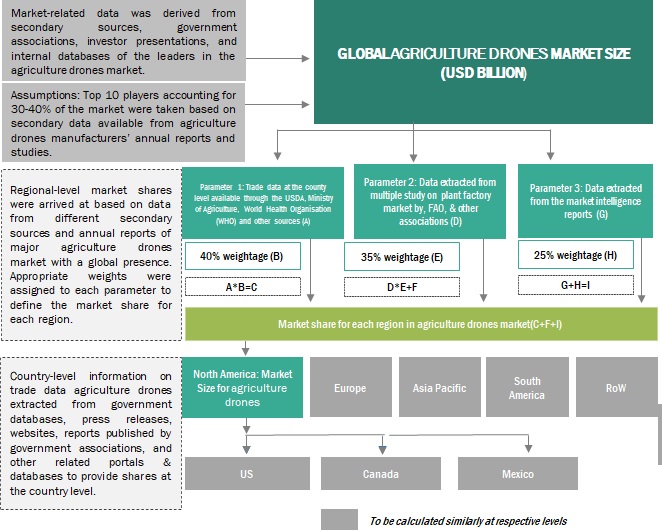

The study involved four major activities in estimating the current size of the agriculture drones market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The agriculture drones market includes several stakeholders in the supply chain, including raw material suppliers, technology and service providers, and regulatory organizations. The demand side of the market is characterized by the manufacturing companies and startups. Key technology and service providers and suppliers of raw materials characterize the supply side.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the insect repellents sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in agriculture drone market.

To know about the assumptions considered for the study, download the pdf brochure

Agriculture Drones Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent markets—the smart agriculture market and precision farming market—were considered to validate further the market details of agricultural drones market.

-

Bottom-up approach:

- The market size was analyzed based on the share of each offering of agriculture drones and growing system at regional and country levels. Thus, the global market was estimated with a bottom-up approach at the country level.

- Other factors include demand for agriculture drones produced through different growing systems across various facility types; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Agriculture Drones Market Size: Bottom-Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. This approach was employed to determine the overall size of the market in particular regions. Its share in the market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

Global agriculture drones market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

- In the market, related secondary sources such as US Department of Agriculture (USDA) Ministry of Agriculture, Forestry and Fisheries (MAFF), World Health Organisation (WHO) Annual Reports of all major players were considered to arrive at the global market size.

- The global number for agriculture drones arrived after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, area harvested, product launches, and global regulations for agriculture drones Market in the last four years was used to arrive at the country-wise market size. CAGR estimation of offering and application segments was used and then validated from primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to estimate the overall insect repellent active ingredients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the Federal Aviation Administration (FAA) of the United States, an authoritative regulatory body for aviation, the definition of UAV is as follows:

"Unmanned Aircraft System (UAS) - An unmanned aircraft and the equipment necessary for the safe and efficient operation of that aircraft. This includes all system components from the operator control station(s) and data links to the aircraft."

Key Stakeholders in the Agriculture Drones Market

- Agriculture Equipment Component Suppliers

- Electronics Component and Device Manufacturers

- Original Equipment Manufacturers (OEMs)

- Product Manufacturers

- Agriculture Component and Device Suppliers and Distributors

- Software, Service, and Technology Providers

- Standardization and Testing Firms

- Government Bodies such as Regulatory Authorities and Policymakers

- Associations, Organizations, Forums, and Alliances Related to Semiconductor and Automotive Industries

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Agri-food Buyers

Agriculture Drones Market Report Objectives

Market Intelligence

- Determining and projecting the size of the Market based on offering, application, farm size, farm produce, farming environment, payload capacity, component and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the Agriculture Drones Market

Competitive Intelligence

- Identifying and profiling the key market players in the Market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the Agriculture Drones Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe agriculture drones market, by key country

- Further breakdown of the Rest of Asia Pacific market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of the market

Growth opportunities and latent adjacency in Agriculture Drones Market

Which players are dominating this market, and what are the strategies used by them to strengthen their position in this market.

I would like to know more about the agriculture drone market, mainly about it worldwide revenue and Brazil applications.

Working on a project for client. Kindly share sample information for the study. If they like the segmentation and analysis, we have a high chance to purchase as well. Share your best price as well.

We are a start-up firm provides sensors for smart farming applications. I would like to understand the market dynamics, players and acquisitions in this area.

Is the report involves the information about the use of drones, how it can be handle, how it help generate the rental revenue, what are the charges for the same.

Is the report provides in detail market sizing in India. What are the key application areas in this country. Is there any government initiatives taken by Indian government, mentioned in the report? Looking for the same

Looking for projections for the commercial drone industry, Currently seeking $350,000 to begin manufacturing a hybrid UAV ( fixed wing / Tilt Multirotor )

We are UAV surveying company having fixed wing, and hexa-drone systems with RGB/multi-spectral, thermal, and hyperspectral camera/sensors. We are exploring marketing over agriculture areas in the province of Ontario. So is it possible to schedule call to know more about this report study.

What is the EV/Revenue of this sector in 2020?

Exploring the drones technologies for Agricultural purposes.

Hello Could you tell me where I can find the data that shows Corteva as having the largest Agricultural Drone fleet in the World and comparable data to who is the 2nd and 3rd biggest?

I need to know size of the market for drones used in agriculture. The information gained from the report will not be used for any other purpose than study.

Dear Sir, we would like to know more information about the drones used in agriculture to apply insecticide and pesticide application.

Hello. Could you let me know the size of the agriculture drone market in the USA and Europe? And also the drone application proportion in agriculture. Thank you very much.

Who are the customers or end user for Agriculture Drones. How it will helpful for crop consultants, big multinational companies, or others