AI In Computer Vision Market Size, Share, Statistics and Industry Growth Analysis Report by Component (Hardware, Software), Function (Training, Inference), Application (Industrial, Non-industrial), End-use Industry (Automotive, Consumer Electronics) and Region - Global Forecast to 2028

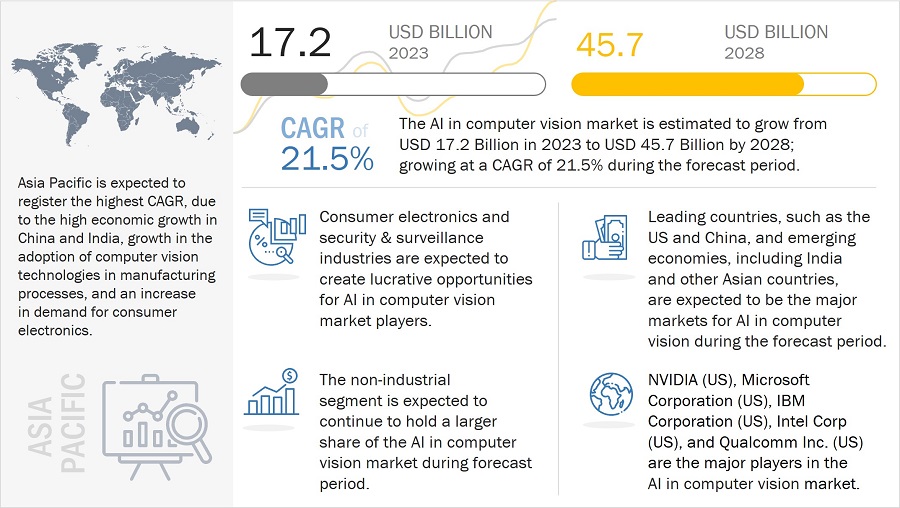

[255 Pages Report] The global AI in Computer Vision Market Size is expected to be valued at USD 17.2 Billion in 2023 and is projected to reach USD 45.7 Billion by 2028; it is expected to grow at a CAGR of 21.5% from 2023 to 2028.

Advancements in deep learning algorithms increased data availability, faster and cheaper computing power, and advancements in hardware technology like GPU and TPU are the driving factors of the AI in computer vision industry. Moreover, the market players are expected to benefit from the government's initiatives aimed at supporting industrial automation and integrating AI into edge devices, creating profitable opportunities for them.

AI In Computer Vision Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

AI in Computer Vision Market Analysis:

The AI in computer vision market is experiencing significant growth, driven by the increasing adoption of AI technologies across various industries such as automotive, healthcare, retail, and security. The market's expansion is supported by advancements in AI algorithms and the integration of deep learning techniques, which enhance the capabilities of computer vision systems in tasks like image recognition, object detection, and facial recognition.

AI in Computer Vision Market Trends:

Several key trends are shaping the AI in computer vision market. There is a notable increase in the use of AI-powered vision systems in autonomous vehicles, where these technologies are critical for navigation, obstacle detection, and safety systems. The healthcare sector is leveraging AI in computer vision for diagnostic imaging and surgical assistance, improving accuracy and patient outcomes. Additionally, the retail industry is adopting AI vision systems for inventory management, customer behavior analysis, and enhanced security measures. The trend towards edge computing is also prominent, allowing real-time processing of visual data directly on devices, reducing latency and improving efficiency.

AI in Computer Vision Market Dynamics:

Driver: Increasing demand for automation and efficiency

Increasing demand for automation and efficiency is one of the key drivers for the AI in computer vision market growth. Automation and efficiency can help businesses save time and resources and improve the accuracy of decision-making processes. This is why many industries are now implementing AI computer vision technologies to automate their processes and enhance efficiency; the manufacturing industry is one example. For instance, factories can use computer vision systems to inspect products and detect defects. This allows them to recognize and address production issues more quickly and effectively, improving efficiency and reducing waste.

Restraint: High cost of acquiring and implementing AI Computer Vision solutions

The high cost of acquiring and implementing AI computer vision solutions is one of the key challenges in the market growth. Developing and deploying AI computer vision systems can be expensive, often requiring specialized hardware, software, and technical expertise. Acquiring and implementing these systems can be significant for organizations new to AI computer vision, including costs for hardware, software licenses, and technical support. Additionally, organizations may need to invest in training and development programs to build their technical expertise in these systems.

Opportunity: Emerging applications of AI Computer Vision in agriculture, logistics, and manufacturing

AI computer vision has numerous emerging applications in several fields, including agriculture, logistics, and manufacturing, which can significantly benefit from the application of this technology. AI computer vision is used in agriculture to automate various processes, such as crop monitoring, yield prediction, and disease identification. AI algorithms can analyze images of crops and provide information on their growth, health, and potential yield. This information can help farmers determine the best methods to care for their crops and improve their products.

Challenge: Maintaining trust and transparency of AI Computer Vision Systems

Maintaining trust and transparency in AI computer vision systems is a critical challenge that the industry is facing. In critical applications such as healthcare and security, the output of AI computer vision systems can have a significant impact on individuals and society. As a result, there is a need to ensure that these systems are reliable, accurate, and transparent in their decision-making processes. One major challenge in maintaining trust and transparency is ensuring that the data used to train AI computer vision systems represents the population it is being applied to. Bias in the training data can lead to biased decisions the system makes, which can result in discrimination or other unintended consequences. Additionally, it is crucial to understand how the system arrived at a particular decision so that its outputs can be validated and potential errors can be corrected.

AI in Computer Vision Market Segmentation:

AI in Computer Vision Market for software to hold the highest market share during the forecast period

AI in computer vision for the software segment is predicted to attain the highest market share during the forecast period. The market for AI platforms has been growing rapidly in recent years, driven by increasing demand for advanced technologies and the growing use of AI in a wide range of industries. Factors driving this growth include the increasing adoption of AI in healthcare, finance, and retail industries, as well as the growing use of AI in emerging technologies such as the Internet of Things (IoT) and edge computing. Additionally, the increasing availability of data, improvements in computing power, and advancements in machine learning algorithms have also contributed to the growth of the AI platform market.

Training function for AI in Computer Vision to hold the highest CAGR from 2023 to 2028

In the context of AI, training is developing an algorithm that can infer a result from data or processes. Training an AI model involves providing the learning algorithm with training data to learn from. The training data must contain the correct answer, known as a target or target attribute. The learning algorithm finds patterns in the training data, maps the input data attributes to the target, and outputs an ML model that captures these patterns. Training is computationally very expensive and is best accelerated with GPUs. The time taken to go through all the training samples can be reduced using GPU compared to CPU, even when using a small dataset.

ML and DL training are used in a wide range of industries to improve performance and efficiency. A few examples of industries that commonly use AI and ML training include healthcare, finance, retail, transportation, manufacturing, agriculture, telecommunication, media, transportation and logistics, public services, and many more.

AI in Computer Vision Market - Regional Analysis:

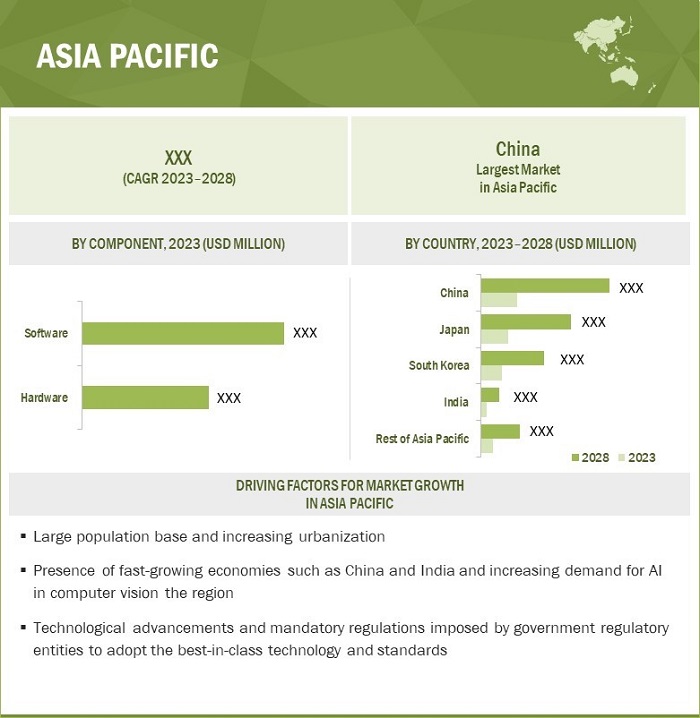

Asia Pacific to hold the highest CAGR during the forecast period

The overall APAC region is home to a few of the fastest-growing and leading industrialized economies, such as China, South Korea, and Japan. It is witnessing dynamic changes in the adoption of recent technologies and advancements across industries. Advancements in AI have attracted investments from the private and public sectors. AI mainly finds its applicability in app-based cab aggregators and digital assistants on smartphones. Many companies are trying to identify untapped areas of commercial applications in this region, which would enable optimal utilization of AI. Public policies on the application of AI have some limitations when compared with the subtle use of AI in startups, as they have combined AI with customer services. With the advent of AI, technologies have also reached a level of maturity where they can analyze like humans in real-time. The rise of AI in computer vision is also expected to drive innovation in the retail, healthcare, and transportation industries.

AI In Computer Vision Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top AI in Computer Vision Companies - Key Market Players

The AI in Computer Vision Companies is dominated by players such as NVIDIA Corporation (US), Intel Corporation (US), Microsoft (US), IBM Corporation (US), Qualcomm Technologies Inc. (US), and others. The study includes an in-depth competitive analysis of these key players in the AI in Computer Vision market with their company profiles, recent developments, and key market strategies.

AI in Computer Vision Industry Overview:

The AI in computer vision industry is characterized by rapid technological advancements and increasing investments from major players. Companies such as Intel, NVIDIA, Google, and Microsoft are at the forefront, driving innovation and expanding the application scope of AI vision systems. The industry is also witnessing a surge in patent filings, indicating a highly competitive landscape focused on technological improvements and new use cases. Regulatory developments and standardization efforts are also playing a crucial role in shaping the industry, ensuring interoperability and addressing ethical concerns related to AI.

AI in Computer Vision Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 17.2 Billion |

|

Projected Market Size in 2028 |

USD 45.7 Billion |

|

Growth Rate |

CAGR of 21.5% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, Function, Application, End-use Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include NVIDIA Corporation (US), Intel Corporation (US), Microsoft (US), IBM Corporation (US), Qualcomm Technologies Inc. (US), Advanced Micro Devices, Inc (US), Alphabet, Inc. (US), Amazon (US), Basler AG (Germany), Hailo (US), and Groq, Inc. (US). (Total 25 players are profiled) |

AI In Computer Vision Market Highlights

The study categorizes AI in the computer vision market based on the following segments:

|

Segment |

Subsegment |

|

AI in the computer vision market, by component |

|

|

AI in the computer vision market, by function |

|

|

AI in the computer vision market, by application |

|

|

AI in the computer vision market, by end-use Industry |

|

|

AI in the computer vision market, By region |

|

Recent Developments

- In January 2023, Microsoft announced the third phase of its long-term partnership with OpenAI through a multiyear, multibillion-dollar investment to accelerate AI breakthroughs to ensure these benefits are broadly shared with the world.

- In January 2023, Visteon and Qualcomm Technologies, Inc. announced that the companies intend to take their technology collaboration one step further by developing a high-performance cockpit domain controller designed to enable global automakers to build next-generation cockpits. The combination of Visteon's SmartCore software and Snapdragon Cockpit Platforms will enable automakers to deliver advanced features & functions in their next-generation cockpits quickly with production programs targeted for 2025.

- In January 2023, IBM collaborated with Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) to formally launch an AI Center of Excellence as part of Abu Dhabi Sustainability Week's World Future Energy Summit. The Center aims to advance collaboration to improve the adoption of AI technology and help drive sustainability.

- In December 2022, Qualcomm Incorporated announced the launch of the Africa Innovation Platform, a suite of mentorship, education, and training programs created to support the development of Africa's emerging technology ecosystem. The platform will provide resources and support for local universities, small-to-medium-sized startups, and grant participants, exposing them to Qualcomm Technologies Inc.'s engineers and its state-of-the-art capabilities suite for mobile platforms and technologies, including 4G, 5G, IoT, AI, and machine learning.

Frequently Asked Questions (FAQ):

What is the market size for AI in the computer vision market?

The global AI in computer vision market is expected to be valued at USD 17,248 million in 2023 and is projected to reach USD 45,688 million by 2028; it is expected to grow at a CAGR of 21.5% from 2023 to 2028.

What are the major driving factors and opportunities in AI in the computer vision market?

Some of the major driving factors for the growth of this market include increasing demand for automation and efficiency, advancements in deep learning and neural network technologies, and the growing impact of AI in machine vision. Moreover, the increasing use of AI computer vision across autonomous vehicles, growing demand for real-time and high-precision visual data analysis, and development of machine learning pertaining to vision technologies create opportunities for market players.

Who are the leading players in the global AI in the computer vision market?

Companies such as NVIDIA Corporation (US), Intel Corporation (US), Microsoft (US), IBM Corporation (US), Qualcomm Technologies Inc. (US), Advanced Micro Devices, Inc (US), Alphabet Inc. (US), Amazon (US), and Basler AG (Germany) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Cognitive robots are equipped with artificial intelligence and computer vision technologies, enabling them to understand and respond to their environment in real-time. They can use visual data to identify objects, detect patterns, and make decisions based on the information they collect. Such robots can also interact with humans and perform various tasks in manufacturing, healthcare, retail, and logistics. Some of the common challenges that these robots face include accuracy, scalability, and cost-effectiveness. Companies are exploring solutions such as deep learning algorithms, computer vision software, and high-resolution cameras to overcome these limitations. As a result, cognitive robots are expected to play an increasingly important role in driving automation and efficiency across various industries.

What is the impact of the global recession on the market?

The demand for components such as AI in computer vision in end-use markets depends primarily on CAPEX by operators/organizations for constructing, rebuilding or upgrading their networking systems. The recession affects the amount of CAPEX spending and the company's sales and profitability; there can be no assurance that existing capital spending will continue or that spending will not decrease during the economic downturn. This will harm the adoption of AI in computer vision equipment such as CPUs, GPUs, ASICs, FPGAs, storage, and memory devices, used in residential and industrial environments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

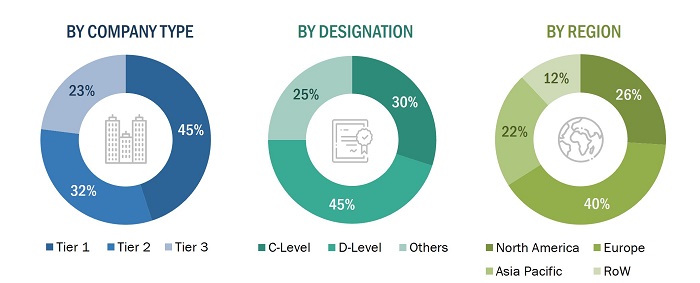

This research study involved extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of AI in the computer vision market. Primary sources were several experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of the value chain of AI in the computer vision ecosystem.

In-depth interviews with various primary respondents, such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, were conducted to obtain and verify critical qualitative and quantitative information to assess future market prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the AI in computer vision market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of AI in the computer vision market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of AI in the computer vision market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various end-user industries using or expected to implement AI in computer vision

- Analyzing each end-user industry and application, along with the major related companies and computer vision hardware and software providers, and identifying service providers for the implementation of AI

- Estimating the AI in the computer vision market for end-user industries

- Understanding the demand generated by companies operating across different end-use applications

- Tracking the ongoing and upcoming implementation of projects based on AI by end-user industries and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of AI technology-based products and services and software designed and developed by end-user industries. This information would help analyze the breakdown of the scope of work carried out by each major company in the AI in the computer vision market

- Arriving at the market estimates by analyzing AI in computer vision companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The bottom-up approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the bottom-up approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end-user industries. Additionally, listing key developments, analyzing updated technology and software in the marketplace, as well as evaluating the market by further splitting it into various AI technologies

- Building and developing the information related to the market revenue generated by key AI in computer vision manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of AI in computer vision products in various end-user industries

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the type of AI in computer vision, and the level of services offered in end-user industries

- Impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall size of the AI in computer vision market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both, demand, and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches

Study Objectives

- To define, describe, and forecast the AI in computer vision market based on component, function, application, and end-use industry

- To forecast the shipment data of AI in computer vision hardware market based on processor types

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on AI in the computer vision market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI In Computer Vision Market