Computer Vision Market by Component (Hardware (Camera, Frame Grabber, Optics, Processor) and Software (Deep Learning and Traditional Software)), Product (PC Based and Smart Camera Based), Application, Vertical - Global Forecast (2025 - 2035)

Computer Vision Market Overview

The global Computer Vision market was valued at USD 19.78 billion in 2024 and is estimated to reach USD 112.10 billion by 2035, at a CAGR of 17.3% between 2025 and 2035.

Market by Component

North America is expected to hold largest share during forecast period

Key Market Players

Recent Developments

FAQ:

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

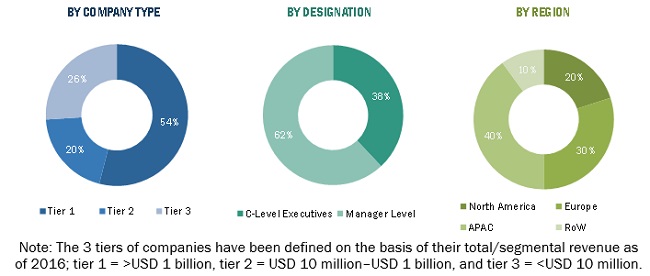

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Computer Vision Market

4.2 Market, By Application (2017–2023)

4.3 Market in APAC, By Country and Vertical

4.4 Market, By Geography (2017)

4.5 Market, By Product and Application

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Need for Quality Inspection and Automation

5.2.1.2 Growing Demand for Vision-Guided Robotic Systems

5.2.1.3 Rising Demand for Application-Specific Computer Vision Systems

5.2.1.4 Increasing Adoption of 3d Computer Vision Systems

5.2.2 Restraints

5.2.2.1 Varying End-User Requirements

5.2.2.2 Lack of Flexible Computer Vision Solutions

5.2.3 Opportunities

5.2.3.1 Growing Adoption of Industrial 4.0

5.2.3.2 Increasing Manufacturing of Hybrid and Electric Cars

5.2.3.3 Government Initiatives to Support Industrial Automation

5.2.3.4 Increasing Demand for Artificial Intelligence (AI) in Computer Vision

5.2.3.4.1 Government Initiatives to Boost AI-Related Technologies

5.2.3.5 Rising Adoption of Computer Vision Systems in Uavs

5.2.4 Challenges

5.2.4.1 Complexity in Integrating Computer Vision Systems

5.2.4.2 Lack of User Awareness About Rapidly Changing Computer Vision Technology

5.3 Value Chain Analysis

5.3.1 R&D

5.3.2 Computer Vision Component Manufacturers

5.3.3 Original Equipment Manufacturers (OEMS)

5.3.4 System Integrators

5.3.5 Resellers and Distributors

5.3.6 End Users

6 Computer Vision Market, By Component (Page No. - 50)

6.1 Introduction

6.2 Hardware

6.2.1 Cameras

6.2.1.1 Interface Standards

6.2.1.1.1 USB 2.0

6.2.1.1.2 USB 3.0

6.2.1.1.3 Camera Link

6.2.1.1.4 Camera Link HS

6.2.1.1.5 Gige

6.2.1.1.6 Others (Coaxpress, EMVA-1288, Genicam)

6.2.1.2 By Frame Rate

6.2.1.2.1 <25 FPS

6.2.1.2.2 25–125 FPS

6.2.1.2.3 More Than 125 FPS

6.2.1.3 By Format

6.2.1.3.1 Line Scan

6.2.1.3.2 Area Scan

6.2.1.4 By Sensor Type

6.2.1.4.1 CMOS

6.2.1.4.2 CCD

6.2.2 Frame Grabbers

6.2.3 Optics

6.2.4 LED Lighting

6.2.5 Processors

6.2.5.1 FPGAS

6.2.5.2 DSPS

6.2.5.3 Microcontrollers and Microprocessors

6.2.5.4 VPUS

6.3 Software

6.3.1 Traditional Computer Vision

6.3.2 Deep Learning

7 Computer Vision Market, By Product (Page No. - 64)

7.1 Introduction

7.2 PC-Based Computer Vision Systems

7.3 Smart Cameras-Based Computer Vision Systems

8 Computer Vision Market, By Application (Page No. - 91)

8.1 Introduction

8.2 Quality Assurance & Inspection

8.3 Positioning & Guidance

8.4 Measurement

8.5 Identification

8.6 Predictive Maintenance

9 Computer Vision Market, By Vertical (Page No. - 95)

9.1 Introduction

9.2 Industrial Vertical

9.2.1 Automotive

9.2.2 Electronics and Semiconductor

9.2.3 Consumer Electronics

9.2.4 Glass

9.2.5 Metals

9.2.6 Wood and Paper

9.2.7 Pharmaceuticals

9.2.8 Food and Packaging

9.2.8.1 Food

9.2.8.2 Packaging

9.2.9 Rubber and Plastics

9.2.10 Printing

9.2.11 Machinery

9.2.12 Solar Panel Manufacturing

9.2.13 Textiles

9.3 Non-Industrial Vertical

9.3.1 Healthcare

9.3.2 Postal and Logistics

9.3.3 Security and Surveillance

9.3.4 Intelligent Transportation Systems

9.3.5 Agriculture

9.3.6 Consumer Electronics

9.3.7 Autonomous and Semi Autonomous Vehicles

9.3.8 Sports and Entertainment

9.3.9 Retail

10 Geographic Analysis (Page No. - 105)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe (RoE)

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of APAC (RoAPAC)

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 116)

11.1 Overview

11.2 Key Players in the Computer Vision Market, 2017

11.3 Competitive Scenario

11.3.1 Product Launches and Developments

11.3.2 Partnerships, Contracts, Collaborations, and Agreements

11.3.3 Mergers & Acquisitions

12 Company Profile (Page No. - 122)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Key Players

12.1.1 Cognex

12.1.2 Basler

12.1.3 Omron

12.1.4 Keyence

12.1.5 National Instruments

12.1.6 Sony

12.1.7 Teledyne Technologies

12.1.8 Texas Instruments

12.1.9 Intel

12.1.10 Baumer Optronic

12.1.11 Jai A/S

12.1.12 Mvtec Software

12.1.13 Isra Vision

12.1.14 Sick

12.1.15 Mediatek

12.1.16 Cadence Design Systems

12.1.17 Ceva

12.1.18 Synopsys

12.1.19 Tordivel As

12.2 Startup-Ecosystem

12.2.1 Ametek

12.2.2 Qualitas Technologies

12.2.3 Sualab

12.2.4 Algolux

12.2.5 Clarifai

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 170)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (65 Tables)

Table 1 Computer Vision Market, By Component, 2015–2023 (USD Billion)

Table 2 Market, By Hardware, 2015–2023 (USD Million)

Table 3 Market for Cameras, in Terms of Value and Volume, 2015–2023

Table 4 Market for Cameras, By Interface Standard, 2015–2023 (USD Million)

Table 5 Market for Cameras, By Frame Rate, 2015–2023 (USD Million)

Table 6 Market for Cameras, By Format, 2015–2023 (USD Million)

Table 7 Market for Cameras, By Sensor Type, 2015–2023 (USD Million)

Table 8 Market, By Processor, 2015–2023 (USD Million)

Table 9 Market, By Software, 2015–2023 (USD Million)

Table 10 Market, By Product, 2015–2023 (USD Billion)

Table 11 Market for PC-Based Computer Vision Systems for Automotive Industry, By Region, 2015–2023 (USD Million)

Table 12 Market for PC-Based Computer Vision Systems for Consumer Electronics Industry, By Region, 2015–2023 (USD Million)

Table 13 Market for PC-Based Computer Vision Systems for Electronics and Semiconductor Industry, By Region, 2015–2023 (USD Million)

Table 14 Market for PC-Based Computer Vision Systems for Printing Industry, By Region, 2015–2023 (USD Million)

Table 15 PC-Based Computer Vision Systems for Metals Industry, By Region, 2015–2023 (USD Million)

Table 16 Market for PC-Based Computer Vision Systems for Wood and Paper Industry, By Region, 2015–2023 (USD Million)

Table 17 Market for PC-Based Computer Vision Systems for Food and Packaging Industry, By Region, 2015–2023 (USD Million)

Table 18 Market for PC-Based Computer Vision Systems for Rubber and Plastics Industry, By Region, 2015–2023 (USD Million)

Table 19 Market for PC-Based Computer Vision Systems for Pharmaceuticals Industry, By Region, 2015–2023 (USD Million)

Table 20 Market for PC-Based Computer Vision Systems for Glass Industry, By Region, 2015–2023 (USD Million)

Table 21 Market for PC-Based Computer Vision Systems for Machinery Industry, By Region, 2015–2023 (USD Million)

Table 22 Market for PC-Based Computer Vision Systems for Solar Panel Manufacturing Industry, By Region, 2015–2023 (USD Million)

Table 23 Market for PC-Based Computer Vision Systems for Textiles Industry, By Region, 2015–2023 (USD Million)

Table 24 Market for PC-Based Computer Vision Systems for Healthcare Industry, By Region, 2015–2023 (USD Million)

Table 25 Market for PC-Based Computer Vision Systems for Postal and Logistics Industry, By Region, 2015–2023 (USD Million)

Table 26 Market for PC-Based Computer Vision Systems for Intelligent Transportation Systems Industry, By Region, 2015–2023 (USD Million)

Table 27 Market for PC-Based Computer Vision Systems for Security and Surveillance Industry, By Region, 2015–2023 (USD Million)

Table 28 Market for PC-Based Computer Vision Systems for Agriculture Industry, By Region, 2015–2023 (USD Million)

Table 29 Market for PC-Based Computer Vision Systems for Sports and Entertainment Industry, By Region, 2015–2023 (USD Million)

Table 30 Market for PC-Based Computer Vision Systems for Retail Industry, By Region, 2015–2023 (USD Million)

Table 31 Market for Smart Camera-Based Computer Vision Systems for Automotive Industry, By Region, 2015–2023 (USD Million)

Table 32 Market for Smart Camera-Based Computer Vision Systems for Consumer Electronics Industry, By Region, 2015–2023 (USD Million)

Table 33 Market for Smart Camera-Based Computer Vision Systems for Electronics and Semiconductor Industry, By Region, 2015–2023 (USD Million)

Table 34 Market for Smart Camera-Based Computer Vision Systems for Printing Industry, By Region, 2015–2023 (USD Million)

Table 35 Market for Smart Camera-Based Computer Vision Systems for Metals Industry, By Region, 2015–2023 (USD Million)

Table 36 Market for Smart Camera-Based Computer Vision Systems for Wood and Paper Industry, By Region, 2015–2023 (USD Million)

Table 37 Market for Smart Camera-Based Computer Vision Systems for Food and Packaging Industry, By Region, 2015–2023 (USD Million)

Table 38 Market for Camera-Based Computer Vision Systems for Rubber and Plastics Industry, By Region, 2015–2023 (USD Million)

Table 39 Market for Smart Camera-Based Computer Vision Systems for Pharmaceuticals Industry, By Region, 2015–2023 (USD Million)

Table 40 Market for Smart Camera-Based Computer Vision Systems for Glass Industry, By Region, 2015–2023 (USD Million)

Table 41 Market for Smart Camera-Based Computer Vision Systems for Machinery Industry, By Region, 2015–2023 (USD Million)

Table 42 Market for Smart Camera-Based Computer Vision Systems for Solar Panel Manufacturing Industry, By Region, 2015–2023 (USD Million)

Table 43 Market for Smart Camera-Based Computer Vision Systems for Textiles Industry, By Region, 2015–2023 (USD Million)

Table 44 Market for Smart Camera-Based Computer Vision Systems for Healthcare Industry, By Region, 2015–2023 (USD Million)

Table 45 Market for Smart Camera-Based Computer Vision Systems for Postal and Logistics Industry, By Region, 2015–2023 (USD Million)

Table 46 Market for Smart Camera-Based Computer Vision Systems for Intelligent Transportation Systems Industry, By Region, 2015–2023 (USD Million)

Table 47 Market for Smart Camera-Based Computer Vision Systems for Security and Surveillance Industry, By Region, 2015–2023 (USD Million)

Table 48 Market for Smart Camera-Based Computer Vision Systems for Agriculture Industry, By Region, 2015–2023 (USD Million)

Table 49 Market for Smart Camera-Based Computer Vision Systems for Non-Industrial Consumer Electronics Industry, By Region, 2015–2023 (USD Million)

Table 50 Market for Smart Camera-Based Computer Vision Systems for Autonomous/Semiautonomous Vehicles Industry, By Region, 2015–2023 (USD Million)

Table 51 Market for Smart Camera-Based Computer Vision Systems for Sports and Entertainment Industry, By Region, 2015–2023 (USD Million)

Table 52 Market for Smart Camera-Based Computer Vision Systems for Retail Industry, By Region, 2015–2023 (USD Million)

Table 53 Computer Vision Market, By Application, 2015–2023 (USD Million)

Table 54 Market, By Vertical, 2015–2023 (USD Billion)

Table 55 ComputMarket, By Industrial Vertical, 2015–2023 (USD Million)

Table 56 Market, By Non-Industrial Vertical, 2015–2023 (USD Million)

Table 57 Market, By Region, 2015–2023 (USD Billion)

Table 58 Market in North America, By Country, 2015–2023 (USD Million)

Table 59 Market in Europe, By Country/Region, 2015–2023 (USD Million)

Table 60 Market in APAC, By Country/Region, 2015–2023 (USD Million)

Table 61 Market in RoW, By Region, 2015–2023 (USD Million)

Table 62 Top 5 Players in the Computer Vision Market, 2017

Table 63 Product Launches and Developments (2015–2017)

Table 64 Partnerships, Collaborations, and Agreements (2015–2017)

Table 65 Mergers & Acquisitions (2015–2017)

List of Figures (53 Figures)

Figure 1 Segmentation of the Computer Vision Market

Figure 2 Computer Vision Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market (2017–2023)

Figure 8 Cameras to Hold the Largest Size of the Computer Vision Market in 2018

Figure 9 Computer Vision Market for Predictive Maintenance Applications to Grow at the Highest CAGR Between 2018 and 2023

Figure 10 Market for Food and Packaging Industry to Grow at the Highest Rate Between 2018 and 2023

Figure 11 Market for Smart Camera-Based Computer Vision Systems to Grow at A Higher CAGR Between 2018 and 2023

Figure 12 APAC to Hold the Largest Share of the Computer Vision Market in 2018

Figure 13 Market to Grow at A Significant Rate Between 2018 and 2023 Owing to the Increasing Adoption of Industrial 4.0 and AI-Integrated Computer Vision Systems

Figure 14 Market for Predictive Maintenance Applications to Grow at the Highest Rate Between 2018 and 2023

Figure 15 Automotive Industry Held the Largest Share of the Computer Vision Market in APAC in 2017

Figure 16 Market in APAC to Grow at the Highest Rate During the Forecast Period

Figure 17 PC-Based Computer Vision Systems Held A Larger Share of the Computer Vision Market for Quality Assurance and Inspection Applications in 2017

Figure 18 Increasing Demand for Quality Inspection and Automation to Drive the Growth of the Computer Vision Market

Figure 19 Growth of Industrial Robotics, in Terms of Shipment, Between 2012 and 2016

Figure 20 Increasing Demand for Hybrid and Electric Vehicles Between 2015 and 2040

Figure 21 Value Chain Analysis: Maximum Value Added During the Component and Equipment Manufacturing and System Integration Stages

Figure 22 Computer Vision Market for Software to Grow at A Higher Rate During the Forecast Period

Figure 23 Camera Link to Hold the Largest Size of the Computer Vision Market for Cameras Throughout the Forecast Period

Figure 24 Computer Vision Market for Area Scan Format-Based Cameras to Grow at A Higher CAGR During the Forecast Period

Figure 25 Smart Camera-Based Computer Vision Systems to Hold A Larger Size of the Computer Vision Market By 2023

Figure 26 Market for PC-Based Computer Vision Systems for Food and Packaging Industry in APAC to Grow at the Highest CAGR During the Forecast Period

Figure 27 Market for PC-Based Computer Vision Systems for Healthcare Industry in APAC to Grow at the Highest CAGR During the Forecast Period

Figure 28 Market for Smart Camera-Based Computer Vision Systems for Automotive Industry in APAC to Grow at the Highest CAGR During the Forecast Period

Figure 29 Market for Smart Camera-Based Computer Vision Systems for Pharmaceuticals Industry in APAC to Grow at the Highest Rate the Forecast Period

Figure 30 Market for Smart Camera-Based Computer Vision Systems for Non-Industrial Consumer Electronics Industry in APAC to Grow at the Highest CAGR During the Forecast Period

Figure 31 Computer Vision Market for Predictive Maintenance Applications to Grow at the Highest CAGR During the Forecast Period

Figure 32 Computer Vision Market for Non-Industrial Vertical to Grow at A Higher CAGR During the Forecast Period

Figure 33 Market for Autonomous and Semi Autonomous Vehicles Industry to Grow at A Highest Rate During the Forecast Period (2018–2023)

Figure 34 Geographic Snapshot of the Global Computer Vision Market (2018–2023)

Figure 35 Snapshot of the Computer Vision Market in North America

Figure 36 Snapshot of the Computer Vision Market in APAC

Figure 37 Product Launches and Developments Emerged as the Key Growth Strategies Adopted By the Companies Between 2015 and 2017

Figure 38 Market Evaluation Framework: Product Launches and Developments Have Fuelled Growth and Innovation Between 2015 and 2017

Figure 39 Cognex: Company Snapshot

Figure 40 Basler: Company Snapshot

Figure 41 Omron: Company Snapshot

Figure 42 Keyence: Company Snapshot

Figure 43 National Instruments: Company Snapshot

Figure 44 Sony: Company Snapshot

Figure 45 Teledyne Technologies: Company Snapshot

Figure 46 Texas Instruments: Company Snapshot

Figure 47 Intel: Company Snapshot

Figure 48 Isra Vision: Company Snapshot

Figure 49 Sick: Company Snapshot

Figure 50 Mediatek: Company Snapshot

Figure 51 Cadence Design Systems: Company Snapshot

Figure 52 Ceva: Company Snapshot

Figure 53 Synopsys: Company Snapshot

The study involved 4 major activities to estimate the current size of the computer vision market. Exhaustive secondary research has been done to collect information on the market, including the peer market and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. The top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation procedures have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study. The secondary sources used for this research study include auto industry organizations (such as OICA), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, press releases, investor presentations of companies, white papers, journals and certified publications, articles from recognized authors, websites, directories, and databases. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated by primary research.

Primary Research

In the primary research process, an extensive primary research has been conducted after understanding and analyzing the computer vision market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews; questionnaires and e-mails have also been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been implemented to estimate and validate the total size of the computer vision market. These methods have also been used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- Key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size in terms of value have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size - using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides across different end-user industries.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional 5 market players

- Country-level break-up for the market based on vertical

Growth opportunities and latent adjacency in Computer Vision Market