AI in Networks Market by Offering (Router & Switches, AI Networking Platform, Management Software, Software Defined Networking), Function (Optimization, Cybersecurity, Predictive Maintenance), Technology (Gen AI, ML, NLP) - Global Forecast to 2029

AI in Networks Market Size Share Industry Growth and Trends

[235 Pages Report] The AI in Networks market size was estimated at USD 10.9 billion in 2024 and is predicted to increase from USD 14.9 billion in 2025 to approximately USD 46.8 billion by 2029, expanding at a CAGR of 33.8% from 2024 to 2029.

The AI in networks market is experiencing high growth driven by increasing adoption of 5G technology, edge computing, IoT and connected devices, and expansion of smart cities. Increasing deployment of 5G networks has led to the vast amount of network data, generated by high bandwidth application such as video streaming and online gaming, driving network operators to integrate AI driven solutions to manage network data and allocate resources to reduce network congestion. Network operators are also integrating AI driven solutions to automate network operations and predictive maintenance, to reduce human dependency and errors, leading to efficient network management. Additionally, as the demand for cloud services is on the rise, there is demand for AI driven network solutions in data centers to optimize network operations. Data center providers are investing heavily towards AI networking solutions to automate and manage network operations, to monitor performance and reduce latency.

AI Impact on the Networks Market

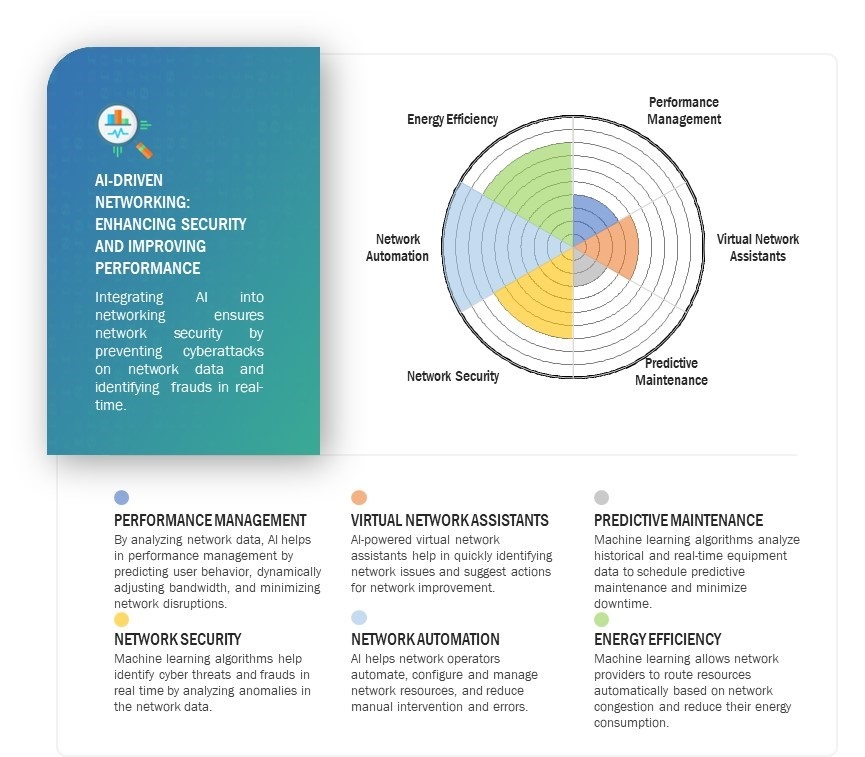

Integrating AI algorithms such as machine learning, Gen AI, and deep learning in networks is becoming increasingly evident as networks become more complex. With the increasing deployment of 5G networks and IoT devices, the demand for advanced networking solutions to manage and automate network operations has grown significantly. AI algorithms help network operators in automation and optimization, network security, predictive maintenance, troubleshooting, performance monitoring, and operational cost reduction.

For instance, machine learning algorithms help identify patterns of cyber threats by analyzing a vast amount of network traffic data to mitigate threats in real-time. These AI-driven security solutions are used for network security, fraud detection, and prevention in areas like billing and subscriber management, helping telecom service providers (TSPs) reduce losses and improve their financial performance.

Attractive opportunities in the AI in networks market

AI in Networks Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

AI in Networks Market Trends & Dynamics

Driver: Rising adoption of 5G technology

The rise in internet and mobile penetration around the globe is driving the demand for 5G technology for high bandwidth applications such as streaming and online gaming services to rise significantly. Network operators invest heavily in developing AI-driven solutions to manage and optimize network traffic. AI in networks allows operators to efficiently perform network management tasks such as traffic routing, resource allocation, and network security. As the 5G technology advances, the demand for cybersecurity solutions will also rise, driving the AI in networks market.

Restraint: Data privacy and security concerns in AI in networks

Integration of artificial intelligence technology in the networking leads to various risks affiliated with collecting, storing, and transmitting network traffic data. AI driven network collect users and network operations data information, creating a high risk environment of privacy breaches, due to the rising cyberthreats. These cyberattacks may lead to unauthorized access to network and user data, disrupting network operations. Additionally, data generated by connected and Iot devices such as smartphones, smart home systems, surveillance system is collected by network, leads to concerns regarding unauthorized surveillance and cyberattacks.

Opportunity: Increasing prevalence of smart city initiatives

Rapid urbanization has led to the exapsnion of smart cities globally. Countries around the world are investing heavily towards smart infrastructure by integrating advanced technologies such as artificial intelligence (AI). For instance, smart city ecosystem consist of various sensors and connected and IoT devices, and to ensure efficient transmission and processing of data generated by these sensor and devices. AI driven network solutions play a vital role in collecting and processing of data, identifying anomalies and equipment failure based on present and historical data, helping network operator to schedule maintenance in advance and reduce downtime.

Challenge: Rapid change in the technology landscape

As the technology landscape evolves rapidly, AI presents a major challenge in the network market. As new technologies appear and current technology evolves, companies in the ecosystem must continuously invest in the research and development of changing market demand and advancements. Additionally, intense competition in the market and pressure to offer innovative solutions further restrict companies from maintaining market leadership. Companies' negligence in identifying the technological shift can result in a decline in market share and revenue.

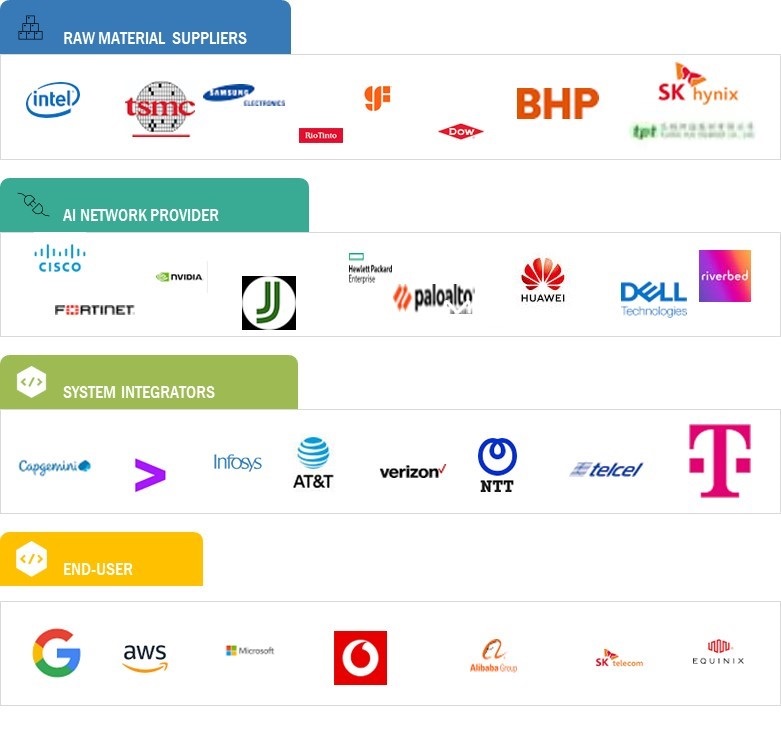

AI in Networks Market Ecosystem

The AI in networks market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include NVIDIA Corporation, Cisco Systems, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Hewlett Packard Enterprise Development LP (US), and Arista Networks, Inc. (US).

Based on the offering, the software in the AI in networks market holds the highest market share during the forecast period.

Software offering is expected to hold the highest share in the AI in networks market during the forecast period. Software solutions in the AI in networks market are highly customized, catering to different requirements of organizations. This includes tailored features, functionalities, and enhanced user interface. Additionally, there is a rise in the demand for cloud-based AI solutions enabling network operators to perform network management tasks from virtually anywhere. This shift towards cloud-based software solutions, reducing physical infrastructure requirements, drives the growth of software offerings.

Based on the technology, AI in the network market for machine learning holds the highest market share during the forecast period.

Machine learning technology in AI in networks market is expected to hold the highest market share during the forecast period. This growth is attributed to its ability in identifying network performance issues and anomalies. Machine learning algorithms help network operators in system monitoring, and identify network anomalies during predictive maintenance, leading to reduced network congestion and efficient resource allocation for high bandwidth networks. The ability to reallocate resources based on network congestion also helps network operators in reducing energy consumption.

Based on the end-use industry, AI in networks for telecom service providers holds the highest market share during the forecast period.

The AI in Networks market for telecom service providers (TSPs) is projected to hold the highest market share during the forecast period. This growth is attributed to the increasing integration of advanced technologies such as AI/ML by network operator to automate and optimize network operations. Telecom operators are integrating AI powered virtual network assistants which helps in quickly identifying network performance issues and suggest actions for network improvement. These virtual assistants reduce the operationsal costs by reducing the human intervention for the network maintenance.

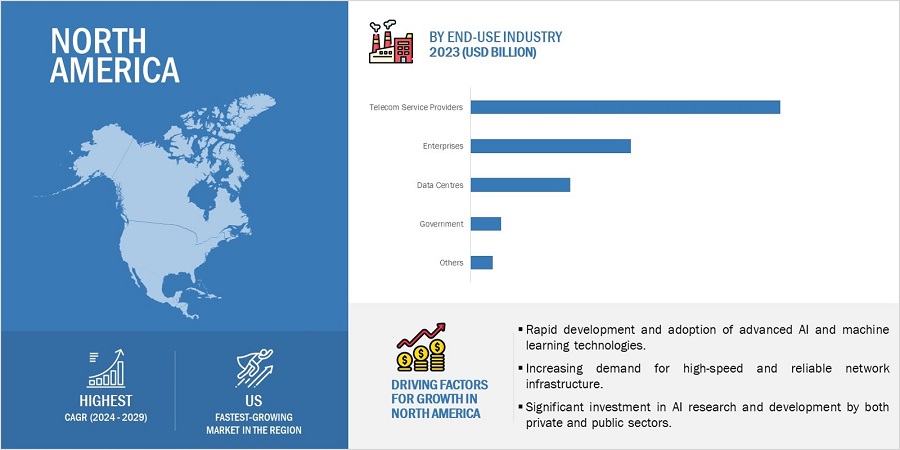

AI in networks market in North America will hold the highest market share during the forecast period.

The AI in networks market for North Ameirca is expected to hold the highest market share during the forecast period. This growth is attributed to the presence of leading AI and network technology companies in the region. These companies are investing heavily towards the advancement of technologies such as AI, 5G, edge computing, due to the high internet penetration rate in the region. The demand for high bandwidth network application such as video streaming and online gaming also on the rise, driving the investments and innovations towards AI driven solutions in network management.

AI in Networks Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies AI in Networks Market - Key Market Players

The AI in networks companies is dominated by players such as

- NVIDIA Corporation (US),

- Cisco Systems, Inc. (US),

- Telefonaktiebolaget LM Ericsson (Sweden),

- Hewlett Packard Enterprise Development LP (US),

- Arista Networks, Inc. (US) and others.

Scope of the AI in Networks Market Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 10.9 billion in 2024 |

| Projected Market Size | USD 46.8 billion by 2029 |

| Market Growth Rate | grow at a CAGR of 33.8% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Offering, By Deployment mode, By Technology, By Network Function, and By End-Use Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include NVIDIA Corporation, Cisco Systems, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Hewlett Packard Enterprise Development LP (US), Arista Networks, Inc. (US), Juniper Networks, Inc. (US), Ciena Corporation (US), Extreme Networks (US), Fujitsu (Japan), Huawei Technologies Co., Ltd. (China), Nokia (Finland). (Total 25 players are profiled) |

AI in Networks Market Highlights

The study categorizes the AI in networks market based on the following segments:

|

Segment |

Subsegment |

|

By Offering |

|

|

By Technology |

|

|

By Deployment Mode |

|

|

By Network Function |

|

|

By End-Use Industry |

|

|

By Region |

|

Recent Developments

- In June 2024, Arista Networks announced the Arista Etherlink AI platforms, designed to deliver optimal network performance for the most demanding AI workloads, including training and inferencing.

- In April 2024, Cisco launched Catalyst 9300 Series Switches. These are Cisco’s lead stackable access platforms for the next-generation enterprise and have been purpose-built to address emerging trends in Security, IoT, Mobility, and Cloud.

- In March 2024, NVIDIA announced a new wave of networking switches, the X800 series, designed for massive-scale AI. NVIDIA X800 switches are end-to-end networking platforms that enable trillion-parameter-scale generative AI essential for new AI infrastructures.

- In January 2024, Juniper Networks announced the industry's first AI-Native Networking Platform, purpose-built to leverage AI to assure the best end-to-end operator and end-user experiences. Juniper’s AI-Native Networking Platform unifies all campus, branch, and data center networking solutions with a common AI engine and Marvis Virtual Network Assistant (VNA).

- In January 2024, Extreme Networks, Inc. announced 4000 Series cloud-managed switches. The new 4000 Series includes the 4120 and 4220 families and extends Extreme’s innovative Universal Switching portfolio. By leveraging ExtremeCloud solutions, the 4000 Series dramatically reduces the time it takes to deploy and manage new switches.

- In June 2023, Cisco launched the Networking Cloud Platform to simplify the management of networking gear through a single, common interface.

- In May 2023, Juniper Networks announced the latest innovation to its award-winning AI-driven enterprise portfolio, the Juniper Mist Access Assurance service. This new service leverages Mist AI and a modern microservices cloud to provide a full suite of network access control (NAC) and policy management functions via the same flexible and simple framework already included in Juniper’s wired access, wireless access, indoor location, SD-WAN, and secure client-to-cloud portfolio.

Frequently Asked Questions (FAQs):

What are the major driving factors and opportunities for the AI in networks market?

Some of the major driving factors for the growth of this market include the Rising adoption of 5G technology, Increased demand for network efficiency, Proliferation of IoT devices, and Increase in data traffic. Moreover, the Rising demand for enhanced analytics, the Increasing prevalence of smart city initiatives, and the rising demand for network automation are critical opportunities for the AI in networks market.

Which region is expected to hold the highest market share?

North America is projected to capture the highest market size in AI networks due to the presence of leading technology companies, advanced technological infrastructure, and significant investments in research and development. Additionally, the early adoption of emerging technologies like AI, Gen AI, and Machine Learning contributes to the robust growth of the AI in networks market in North America, making its position as a dominant player in the global market landscape.

Who are the leading players in the global AI in networks market?

Companies such as NVIDIA Corporation, Cisco Systems, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Hewlett Packard Enterprise Development LP (US), and Arista Networks, Inc. (US) are the leading players in the market.

What are some of the technological advancements in the market?

Network automation and optimization are undergoing a technological revolution due to the increasing adoption of advanced technologies in networks involving AI. The integration of cutting-edge analytics and machine learning algorithms, which provides real-time network insights is on the rise. Companies are increasingly investing in these technologies to automate network management tasks and securing the networks from cyberattacks, reducing the human dependency.

What are some of the macroeconomic facors impacting the AI in networks market?

Macroeconomic factors such as interest rates, inflation, GDP growth, unemployment, and debt will significantly impact the AI in networks market . Government initiatives, enterprise investments, borrowing costs, research and development highly depends on these factors. High inflation leads to increase in interest rates, restricting businesses to minimize spending on AI technology research and development. Reduce in AI investments may lead to delay in the development of AI driven solution affecting the AI in networks market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of 5G technology- Increased demand for network efficiency- Proliferation of IoT devices- Increase in data trafficRESTRAINTS- High implementation costs- Data privacy and security concerns- Complexities in integration of AI in networksOPPORTUNITIES- Rising demand for enhanced analytics- Increasing prevalence of smart city initiatives- Rise in network automation demandCHALLENGES- Rapid changes in technology landscape- Compatibility and interoperability issues

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE OF AI IN NETWORKS OFFERED BY KEY PLAYERS, BY OFFERINGAVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Machine learning algorithms- Natural language processing- Predictive analytics- Edge computingCOMPLEMENTARY TECHNOLOGIES- 5G technology- Internet of Things (IoT)- Cloud computing- Blockchain technologyADJACENT TECHNOLOGIES- Software-defined networking- Network function virtualization- Cybersecurity solutions- Big data analytics

-

5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS DURING 2024–2025

-

5.12 CASE STUDY ANALYSISVODAFONE PARTNERS WITH NOKIA TO ENHANCE ITS NETWORK OPERATIONS THROUGH AI SOLUTIONSAT&T COLLABORATES WITH IBM TO INTEGRATE AI INTO ITS NETWORK MANAGEMENTDEUTSCHE TELEKOM WORKS WITH HUAWEI TO LEVERAGE AI FOR NETWORK AUTOMATION AND MANAGEMENTTELEFÓNICA PARTNERS WITH ERICSSON TO DEPLOY AI SOLUTIONS IN ITS NETWORKORANGE COLLABORATES WITH CISCO TO IMPLEMENT AI IN ITS NETWORK INFRASTRUCTURE

-

5.13 TARIFF AND REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS & REGULATIONS RELATED TO AI IN NETWORKS MARKET

-

5.14 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 AI-DRIVEN ISSUE IDENTIFICATION

- 6.3 IMPROVED WIRELESS PERFORMANCE

- 6.4 AI-ENHANCED ENDPOINT ANALYTICS

- 7.1 INTRODUCTION

-

7.2 ROUTERS AND ETHERNET SWITCHESDATA PROCESSING AND NETWORK OPTIMIZATION – KEY SEGMENT DRIVERS

-

7.3 SOFTWAREEFFICIENT DEPLOYMENT, OPTIMIZATION, AND MANAGEMENT OF AI-DRIVEN NETWORKS TO BOOST SEGMENT- Network Management Software- Network Security Software- Software-defined Networking

-

7.4 AI NETWORKING PLATFORMSINCREASING COMPLEXITY AND SCALE OF MODERN NETWORKS TO DRIVE MARKET

-

7.5 SERVICESIDENTIFICATION OF AI INTEGRATION OPPORTUNITIES – KEY DRIVER

- 8.1 INTRODUCTION

-

8.2 OPTIMIZATIONINTELLIGENT SOLUTIONS FOR ENHANCED PERFORMANCE NETWORKS – KEY DRIVER

-

8.3 CYBERSECURITYINCREASING CYBER THREATS AND NEED TO PROTECT SENSITIVE DATA TO DRIVE MARKET

-

8.4 PREDICTIVE MAINTENANCEDEMAND FOR LOW DOWNTIME AND OPTIMIZED RESOURCE ALLOCATION TO DRIVE MARKET

-

8.5 TROUBLESHOOTINGENHANCED OPERATIONAL EFFICIENCY AND RELIABILITY IN AI NETWORKS – KEY DRIVER

-

8.6 OTHER NETWORK FUNCTIONSINCREASING DATA VOLUMES AND DIVERSE APPLICATIONS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 ON-PREMISESHIGH DEMAND FOR DATA PRIVACY AND SECURITY TO ACCELERATE MARKET GROWTH

-

9.3 CLOUDDEMAND FOR COST-EFFECTIVE NETWORKING SOLUTIONS TO DRIVE SEGMENT

- 10.1 INTRODUCTION

-

10.2 MACHINE LEARNINGENHANCES SECURITY AND ENABLES PREDICTIVE ANALYTICS FOR EFFICIENT RESOURCE ALLOCATION

-

10.3 DEEP LEARNINGENABLES ADVANCED ANOMALY DETECTION AND DECISION-MAKING CAPABILITIES

-

10.4 GENERATIVE AIENABLES AUTONOMOUS NETWORK MANAGEMENT, ENHANCING CYBERSECURITY MEASURES

-

10.5 NATURAL LANGUAGE PROCESSINGENHANCES NETWORK MANAGEMENT AND OPERATIONAL EFFICIENCY

-

10.6 OTHER TECHNOLOGIESENABLE ENHANCED REAL-TIME DATA PROCESSING

- 11.1 INTRODUCTION

-

11.2 TELECOM SERVICE PROVIDERSINCREASING ADOPTION OF 5G NETWORKS TO DRIVE MARKET

-

11.3 ENTERPRISESDEMAND FOR SCALABLE NETWORK MANAGEMENT SOLUTIONS TO DRIVE SEGMENTLARGE ENTERPRISESSMES

-

11.4 DATA CENTERSINCREASING DEMAND FOR CLOUD INFRASTRUCTURE TO BOOST SEGMENT

-

11.5 GOVERNMENTRISE IN AI INFRASTRUCTURE INITIATIVES TO DRIVE MARKET GROWTH

-

11.6 OTHER END USERSDEMAND FOR ENHANCED CYBERSECURITY TO FUEL GROWTH

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Increasing demand for cloud computing and 5G technology to drive marketCANADA- Investments in cybersecurity solutions to drive marketMEXICO- Expansion of data centers to drive demand

-

12.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Increasing investments in 5G infrastructure to provide opportunities for market growthGERMANY- Increasing adoption of AI and cloud computing to boost marketFRANCE- Growing concerns for cybersecurity to accelerate market growthITALY- Increasing initiatives toward digital transformation to drive market growthREST OF EUROPE

-

12.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Growing 5G infrastructure and increasing investment in telecommunication sector to drive market growthJAPAN- Increasing demand for cloud infrastructure to drive market growthSOUTH KOREA- Need for robust network security solutions to present opportunities for playersREST OF ASIA PACIFIC

-

12.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST- GCC Countries- Rest of Middle EastSOUTH AMERICA- Growing investment in 5G infrastructure in Brazil and Colombia to drive marketAFRICA- Increasing internet penetration and government initiatives in region to drive market

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS OF KEY PLAYERS: AI IN NETWORKS MARKET

-

13.4 MARKET SHARE ANALYSIS, 2023KEY PLAYERS: AI IN NETWORKS MARKET, 2023

- 13.5 COMPANY FINANCIAL METRICS

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 BRAND COMPARISON

-

13.8 COMPANY EVALUATION MATRIX, KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT- Offering footprint- Deployment mode footprint- Technology footprint- Network function footprint- End user footprint- Region footprint

-

13.9 COMPANY EVALUATION MATRIX, (STARTUPS/SMES), 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

- 13.10 COMPETITIVE SCENARIO & TRENDS

-

14.1 KEY PLAYERSNVIDIA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO SYSTEMS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELEFONAKTIEBOLAGET LM ERICSSON- Business overview- Products/solutions/services offered- Recent developments- MnM viewHEWLETT PACKARD ENTERPRISE DEVELOPMENT LP- Business overview- Products/solutions/services offered- Recent developments- MnM viewARISTA NETWORKS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJUNIPER NETWORKS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsCIENA CORPORATION- Business overview- Products/solutions/services offered- Recent developmentsEXTREME NETWORKS- Business overview- Products/solutions/services offered- Recent developmentsFUJITSU- Business overview- Products/solutions/services offeredHUAWEI TECHNOLOGIES CO., LTD.- Business overview- Products/solutions/services offeredNOKIA- Business overview- Products/solutions/services offered- Recent developments

-

14.2 OTHER PLAYERSDELL INC.FORWARD NETWORKSFORTINET, INC.ANUTA NETWORKS INTERNATIONAL LLCPALO ALTO NETWORKSNETSCOUTA10 NETWORKS, INC.VERSA NETWORKS, INC.RIVERBED TECHNOLOGYIBMALE INTERNATIONALBLUECAT NETWORKSGIGABIT TECHNOLOGIES PVT. LTD.SOLARWINDS WORLDWIDE, LLCZOHO CORPORATION PVT. LTD.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 AI IN NETWORKS MARKET: RISK ASSESSMENT

- TABLE 2 AVERAGE SELLING PRICE OF AI IN NETWORK OFFERINGS, BY KEY PLAYER (USD)

- TABLE 3 AVERAGE SELLING PRICE OF ROUTERS & ETHERNET SWITCHES, BY REGION (USD)

- TABLE 4 AI IN NETWORKS ECOSYSTEM: COMPANIES AND THEIR ROLE

- TABLE 5 AI IN NETWORKS MARKET: KEY PATENTS: 2020–2023

- TABLE 6 IMPORT DATA FOR HS CODE: 851762, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 851762, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 8 AI IN NETWORKS MARKET: KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 9 MFN TARIFFS FOR HS CODE: 851762-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 10 MFN TARIFFS FOR HS CODE: 851762-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 11 MFN TARIFF FOR HS CODE: 851762-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 STANDARDS & REGULATIONS RELATED TO AI IN NETWORKS MARKET

- TABLE 17 AI IN NETWORKS MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 20 AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 21 AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 22 ROUTERS AND ETHERNET SWITCHES: AI IN NETWORKS MARKET, 2020–2023 (THOUSAND UNITS)

- TABLE 23 ROUTERS AND ETHERNET SWITCHES: AI IN NETWORKS MARKET, 2024–2029 (THOUSAND UNITS)

- TABLE 24 ROUTERS AND ETHERNET SWITCHES: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 25 ROUTERS AND ETHERNET SWITCHES: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 26 ROUTERS AND SWITCHES: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 27 ROUTERS AND SWITCHES: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 28 SOFTWARE: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 29 SOFTWARE: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 30 SOFTWARE: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 31 SOFTWARE: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 32 AI NETWORKING PLATFORMS: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 33 AI NETWORKING PLATFORMS: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 34 AI NETWORKING PLATFORMS: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 35 AI NETWORKING PLATFORMS: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 36 SERVICES: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 37 SERVICES: AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 38 SERVICES: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 39 SERVICES: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 40 AI IN NETWORKS MARKET, BY NETWORK FUNCTION, 2020–2023 (USD MILLION)

- TABLE 41 AI IN NETWORKS MARKET, BY NETWORK FUNCTION, 2024–2029 (USD MILLION)

- TABLE 42 AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 43 AI IN NETWORKS MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 44 ON-PREMISES: AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 45 ON-PREMISES: AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 46 CLOUD: AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 47 CLOUD: AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 48 AI IN NETWORKS MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 49 AI IN NETWORKS MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 50 MACHINE LEARNING: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 51 MACHINE LEARNING: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 52 DEEP LEARNING: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 53 DEEP LEARNING: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 54 GENERATIVE AI: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 GENERATIVE AI: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 NATURAL LANGUAGE PROCESSING: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 57 NATURAL LANGUAGE PROCESSING: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 58 OTHER TECHNOLOGIES: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 59 OTHER TECHNOLOGIES: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 60 AI IN NETWORKS MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 61 AI IN NETWORKS MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 62 TELECOM SERVICE PROVIDERS: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 63 TELECOM SERVICE PROVIDERS: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 64 ENTERPRISES: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 65 ENTERPRISES: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 66 DATA CENTERS: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 67 DATA CENTERS: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 68 GOVERNMENT: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 69 GOVERNMENT: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 70 OTHER END USERS: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 71 OTHER END USERS: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 72 AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: AI IN NETWORKS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: AI IN NETWORKS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: AI IN NETWORKS MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: AI IN NETWORKS MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 82 EUROPE: AI IN NETWORKS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 83 EUROPE: AI IN NETWORKS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 84 EUROPE: AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 85 EUROPE: AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 86 EUROPE: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 87 EUROPE: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 88 EUROPE: AI IN NETWORKS MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 89 EUROPE: AI IN NETWORKS MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: AI IN NETWORKS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: AI IN NETWORKS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 92 ASIA PACIFIC: AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 93 ASIA PACIFIC: AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 94 ASIA PACIFIC: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: AI IN NETWORKS MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: AI IN NETWORKS MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 98 ROW: AI IN NETWORKS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 99 ROW: AI IN NETWORKS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 100 ROW: AI IN NETWORKS MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 101 ROW: AI IN NETWORKS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 102 ROW: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 103 ROW: AI IN NETWORKS MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 104 ROW: AI IN NETWORKS MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 105 ROW: AI IN NETWORKS MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 106 AI IN NETWORKS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES

- TABLE 107 DEGREE OF COMPETITION

- TABLE 108 AI IN NETWORKS MARKT: OFFERING FOOTPRINT

- TABLE 109 AI IN NETWORKS MARKT: DEPLOYMENT MODE FOOTPRINT

- TABLE 110 AI IN NETWORKS MARKT: TECHNOLOGY FOOTPRINT

- TABLE 111 AI IN NETWORKS MARKT: NETWORK FUNCTION FOOTPRINT

- TABLE 112 AI IN NETWORKS MARKT: END USER FOOTPRINT

- TABLE 113 AI IN NETWORKS MARKT: REGION FOOTPRINT

- TABLE 114 AI IN NETWORKS MARKET: KEY STARTUPS

- TABLE 115 AI IN NETWORKS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 116 AI IN NETWORKS MARKET: PRODUCT LAUNCHES, JUNE 2022–JUNE 2024

- TABLE 117 AI IN NETWORKS MARKET: DEALS, JUNE 2022–JUNE 2024

- TABLE 118 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 119 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 NVIDIA CORPORATION: PRODUCT/SERVICE LAUNCHES

- TABLE 121 NVIDIA CORPORATION: DEALS

- TABLE 122 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 123 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 CISCO SYSTEMS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 125 CISCO SYSTEMS, INC.: DEALS

- TABLE 126 TELEFONAKTIEBOLAGET LM ERICSSON: BUSINESS OVERVIEW

- TABLE 127 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCT/SERVICE LAUNCHES

- TABLE 129 TELEFONAKTIEBOLAGET LM ERICSSON: DEALS

- TABLE 130 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: BUSINESS OVERVIEW

- TABLE 131 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 132 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCT/SERVICE LAUNCHES

- TABLE 133 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: DEALS

- TABLE 134 ARISTA NETWORKS, INC.: COMPANY OVERVIEW

- TABLE 135 ARISTA NETWORKS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 ARISTA NETWORKS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 137 JUNIPER NETWORKS, INC.: COMPANY OVERVIEW

- TABLE 138 JUNIPER NETWORKS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 JUNIPER NETWORKS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 140 JUNIPER NETWORKS, INC.: DEALS

- TABLE 141 CIENA CORPORATION: BUSINESS OVERVIEW

- TABLE 142 CIENA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 CIENA CORPORATION: DEALS

- TABLE 144 EXTREME NETWORKS: BUSINESS OVERVIEW

- TABLE 145 EXTREME NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 EXTREME NETWORKS: PRODUCT/SERVICE LAUNCHES

- TABLE 147 FUJITSU: BUSINESS OVERVIEW

- TABLE 148 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 HUAWEI TECHNOLOGIES CO., LTD.: BUSINESS OVERVIEW

- TABLE 150 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 NOKIA: BUSINESS OVERVIEW

- TABLE 152 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 NOKIA: DEALS

- FIGURE 1 AI IN NETWORKS MARKET SEGMENTATION

- FIGURE 2 AI IN NETWORKS MARKET: RESEARCH DESIGN

- FIGURE 3 AI IN NETWORKS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 AI IN NETWORKS MARKET: REVENUE FROM SALES OF AI IN NETWORKS PRODUCTS AND SOLUTIONS

- FIGURE 5 AI IN NETWORKS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 AI IN NETWORKS: TOP-DOWN APPROACH

- FIGURE 7 AI IN NETWORKS MARKET: DATA TRIANGULATION

- FIGURE 8 AI IN NETWORKS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 SOFTWARE OFFERINGS TO HOLD LARGEST SHARE OF AI IN NETWORKS MARKET BY 2029

- FIGURE 10 MACHINE LEARNING TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 AI FOR NETWORK OPTIMIZATION TO COMMAND MARKET DURING FORECAST PERIOD

- FIGURE 12 TELECOM SERVICE PROVIDERS TO BE LARGEST END USERS DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA HELD DOMINANT SHARE OF AI IN NETWORKS MARKET IN 2023

- FIGURE 14 INCREASING DEPLOYMENT OF 5G TECHNOLOGY AND DEMAND FOR CLOUD SERVICES TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 15 CHINA AND TELECOM SERVICE PROVIDERS: KEY SEGMENTS IN ASIA PACIFIC MARKET IN 2024

- FIGURE 16 US TO HOLD LARGEST SHARE OF AI IN NETWORKS MARKET BY 2029

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 18 AI IN NETWORKS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 AI IN NETWORKS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 AI IN NETWORKS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 AI IN NETWORKS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 AI IN NETWORKS MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE OF AI IN NETWORK OFFERINGS BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICE OF AI IN NETWORKS, BY OFFERING

- FIGURE 26 AI IN NETWORKS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 AI IN NETWORKS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 AI IN NETWORKS: DEALS AND FUNDING, 2018–2023

- FIGURE 29 AI IN NETWORKS MARKET: NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 30 IMPORT DATA FOR HS CODE: 851762, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 851762, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS: AI IN NETWORKS MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 35 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 AI MARKET FOR NETWORK OPTIMIZATION TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 37 CLOUD-BASED DEPLOYMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 38 MACHINE LEARNING TECHNOLOGY TO COMMAND MARKET DURING FORECAST PERIOD

- FIGURE 39 RANGE OF AI TECHNOLOGIES IN AI NETWORKS

- FIGURE 40 TELECOM SERVICE PROVIDERS TO HOLD DOMINANT MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA TO DOMINATE AI IN NETWORKS MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: AI IN NETWORKS MARKET SNAPSHOT

- FIGURE 43 EUROPE: AI IN NETWORKS MARKET

- FIGURE 44 ASIA PACIFIC: AI IN NETWORKS MARKET

- FIGURE 45 AI IN NETWORKS MARKET: FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 46 AI IN NETWORKS: MARKET SHARE OF KEY PLAYERS, 2023

- FIGURE 47 COMPANY EV/EBITDA, 2024

- FIGURE 48 COMPANY VALUATION (USD MILLION), 2024

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 AI IN NETWORKS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 51 AI IN NETWORKS MARKET: COMPANY FOOTPRINT

- FIGURE 52 AI IN NETWORKS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 53 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 55 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY SNAPSHOT

- FIGURE 56 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

- FIGURE 57 ARISTA NETWORKS, INC.: COMPANY SNAPSHOT

- FIGURE 58 JUNIPER NETWORKS, INC.: COMPANY SNAPSHOT

- FIGURE 59 CIENA CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 EXTREME NETWORKS: COMPANY SNAPSHOT

- FIGURE 61 FUJITSU: COMPANY SNAPSHOT

- FIGURE 62 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 NOKIA: COMPANY SNAPSHOT

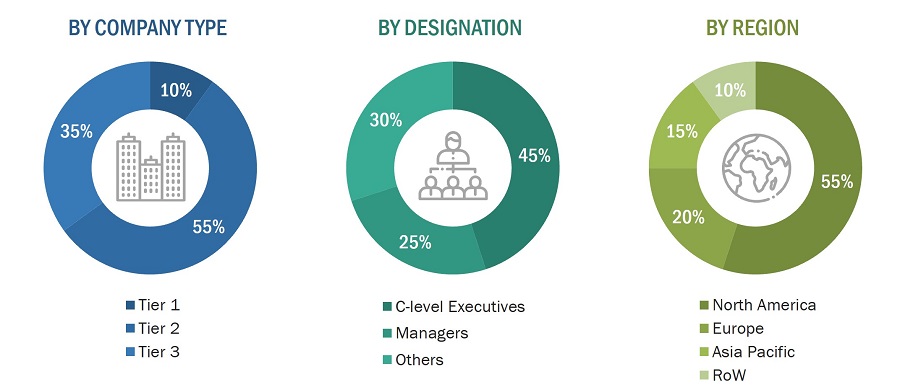

The study involved four major activities in estimating the current size of the AI in networks market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

Web Link |

|

Federal Communications Commission (FCC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

|

|

The AI Association |

|

|

National Security Commission on Artificial Intelligence - NSCAI |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the AI in networks market size and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the AI in networks market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various end-use industries using or expected to implement AI in networks

- Analyzing each end-use sector, along with the significant related companies and AI in networks providers

- Estimating the AI in networks market for end-use industries

- Understanding the demand generated by companies operating across different end-use industries

- Tracking the ongoing and upcoming implementation of projects based on AI in networks technology by end-use industries and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the type of AI in networks products designed and developed vertically, helping analyze the breakdown of the scope of work carried out by each significant company in the AI in networks market

- Arriving at the market estimates by analyzing AI in networks companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the forecasts at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

Each company's market share was estimated to verify the revenue shares used earlier in the top-down approach. This study determined and confirmed the overall parent market size and individual market sizes by using the data triangulation method and validating data through primaries. The data triangulation method is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end-user industries

- Building and developing the information related to the market revenue generated by key AI in network manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of AI in network products in various end-use industries

- Estimating geographic splits using secondary sources based on multiple factors, such as the number of players in a specific country and region, the offering of AI in networks, and the level of solutions offered in end-use industries

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

AI in Networks integrates artificial intelligence technologies within network infrastructure to enhance efficiency, security, and overall performance. By leveraging machine learning, deep learning, and advanced analytics, AI-driven solutions can dynamically manage network traffic, detect and mitigate anomalies, enhance cybersecurity measures, and optimize resource allocation. These capabilities enable real-time responses to network demands, proactive maintenance, and robust protection against cyber threats. AI in Networks is crucial for supporting the increasing complexity and scale of modern network environments, driven by the proliferation of connected devices and the growing demand for high-speed, reliable internet services across various industries.

Key Stakeholders

- Telecommunications Companies

- Network Equipment Manufacturers

- Software Providers

- Cloud Service Providers

- Enterprises and Businesses

- Internet Service Providers (ISPs)

- Data Centers

- Cybersecurity Firms

- Regulatory Bodies and Government Agencies

- Research Institutions and Universities

- Investors and Venture Capitalists

- End-Use Industries

Report Objectives

- To define, describe, and forecast the AI in Networks market by offering, deployment mode, technology, network function, end-use industry, use-case, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets concerning individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the AI in Networks market’s value chain, the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments, such as collaborations, partnerships, product developments, and research & development (R&D), in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the AI in networks market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the AI in networks market.

Growth opportunities and latent adjacency in AI in Networks Market