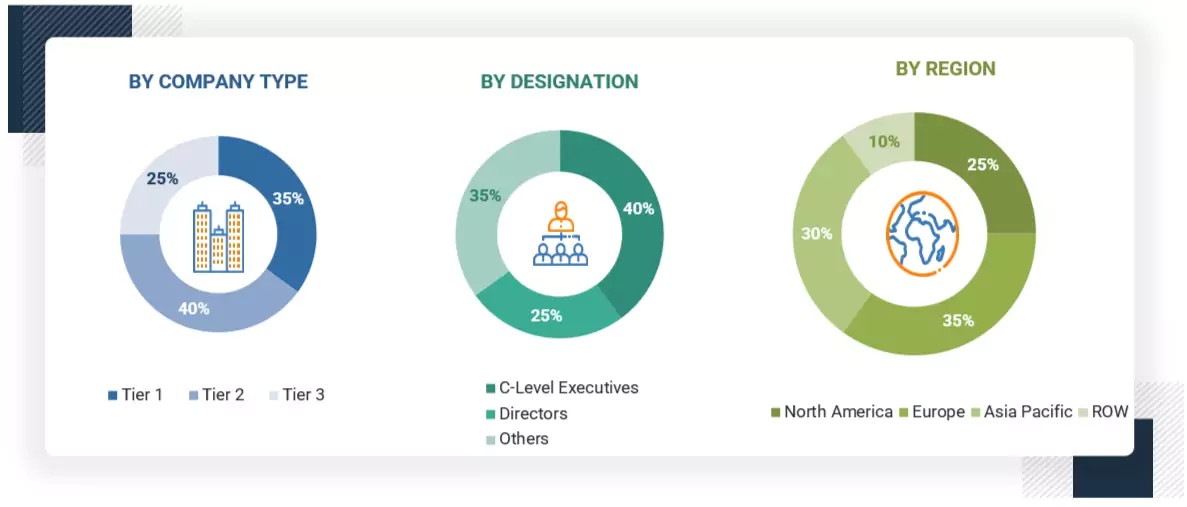

This research study on the smart city platforms market involved extensive secondary sources, directories, and several journals, databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the smart city platforms market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with different primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants. Primary sources were mainly industry experts from the core and related industries, preferred smart city platforms providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess growth prospects. The following figure highlights the market research methodology applied to make the smart city platforms market report.

Secondary Research

The market size of companies offering smart city platforms was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals and related magazines. Smart city platforms' spending in various countries was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify key players, market classification, and segmentation according to offerings of major players; industry trends related to offering, deployment, application, and regions; and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing smart city platforms solutions and services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information. Primary research was conducted to identify the segmentation, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range between

USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the smart city platforms market. The first approach involved estimating the market size by summing up the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following:

-

We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

-

Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

-

We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Smart City Platforms Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities' supply and demand sides.

Market Definition

Smart city platforms offer a middleware operational capacity that allows the integration of various software and hardware and several communication protocols. A smart city platform, in simple terms, binds multiple products, processes, systems, and people, bringing together a unified ‘system of systems' to deliver a holistic view of the city’s overall performance and functions. Powered by AI and IoT technologies, these platforms allow cities to transform, grow, and adapt to the evolving needs of a city.

Stakeholders

-

National/State governments

-

Municipal authorities

-

Real estate developers

-

Information technology (IT) solution providers

-

Platform providers

-

System integrators

-

Telecom service providers

-

Networking solution providers

-

Utility companies

-

Transportation service providers

-

Independent software vendors (ISVs)

-

Network equipment providers

-

Communication service providers (CSPs)

Report Objectives

-

To define, describe, and forecast the smart city platforms market in terms of value

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To forecast the market by offering, deployment, application, and region

-

To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

-

To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

-

To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

-

The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis as per Feasibility

-

Further breakup of the smart city platforms market

Company Information

-

Detailed analysis and profiling of five additional market players

Growth opportunities and latent adjacency in Smart City Platforms Market